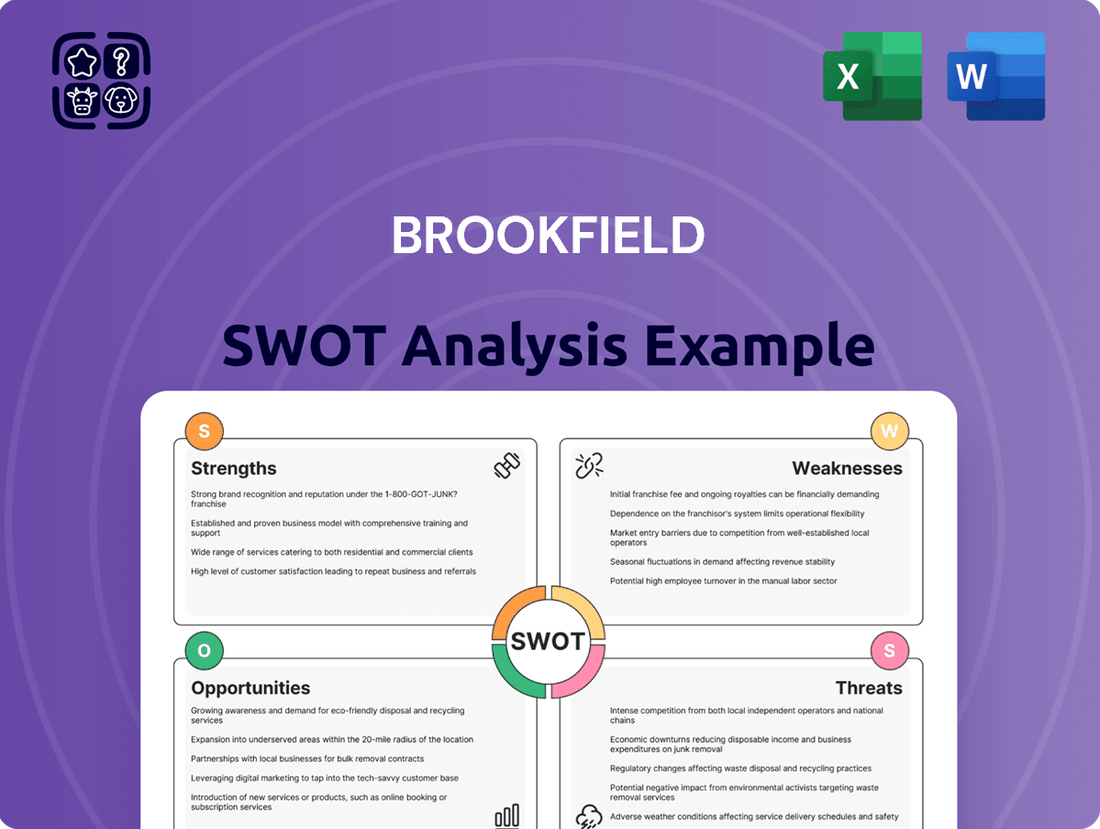

Brookfield SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Bundle

Brookfield's impressive diversification across real estate, infrastructure, and renewable power presents significant strengths, but understanding the nuanced opportunities and potential threats requires a deeper dive. Our comprehensive SWOT analysis unpacks these elements, offering a clear roadmap for strategic advantage.

Want to fully grasp Brookfield's market position and future trajectory? Purchase our complete SWOT analysis to reveal actionable insights, expert commentary, and a professionally formatted report designed to inform your investment or strategic decisions.

Strengths

Brookfield Infrastructure Partners boasts a highly diversified global asset portfolio, encompassing utilities, transport, midstream, and data infrastructure across North and South America, Asia Pacific, and Europe. This extensive geographic spread, as of early 2024, provides a significant buffer against localized economic downturns or regulatory shifts, ensuring more consistent revenue streams. Such diversification allows Brookfield to tap into growth in various regions while reducing overall portfolio volatility.

Brookfield's strength lies in its strategic focus on acquiring and operating top-tier assets that consistently produce reliable and predictable cash flows. This approach is a cornerstone of its financial stability.

A significant portion of these assets are secured by long-term contracts and agreements tied to inflation. This structure offers a robust defense against increasing expenses and economic volatility, ensuring a steady income stream.

The predictability of these cash flows directly fuels Brookfield's ability to deliver consistent dividend growth and provides the financial flexibility needed for smart capital allocation, reinforcing its position as a dependable investment.

Brookfield Infrastructure's proven capital recycling strategy is a significant strength. They excel at selling mature assets at favorable prices and reinvesting that capital into promising new ventures, effectively fueling their growth without heavy reliance on outside funding. This approach ensures their portfolio remains dynamic and value-generating.

This 'buy, enhance, sell, and reinvest' model allows for continuous portfolio optimization and value enhancement. For instance, in 2025, Brookfield Infrastructure achieved a record $2.4 billion in sale proceeds, while simultaneously deploying $1.3 billion into new investments, demonstrating the efficacy of their strategy.

Strong Organic Growth and Development Pipeline

Brookfield Asset Management exhibits strong organic growth, driven by its existing operations and a substantial capital backlog. This is further bolstered by a robust pipeline of new investment opportunities, which are crucial for expanding its Funds From Operations (FFO). The company is actively pursuing strategic acquisitions that complement its core businesses and is focused on the timely commissioning of new projects to fuel this growth.

The infrastructure segment, in particular, is projected to achieve impressive organic growth. Brookfield anticipates a yearly increase of 6-9% within this portfolio. This growth is a direct result of its ongoing development initiatives and the successful integration of acquired assets, contributing to a more predictable and expanding revenue stream.

- Robust Organic Growth: Brookfield's existing businesses are showing healthy expansion.

- Significant Capital Backlog: A substantial amount of capital is committed to ongoing and future projects.

- Deep Development Pipeline: Numerous new investment opportunities are being cultivated.

- FFO Enhancement: Organic growth, strategic acquisitions, and project commissioning directly boost Funds From Operations.

Experienced Management and Access to Brookfield Ecosystem

Brookfield Infrastructure Partners benefits significantly from its seasoned management team, which possesses a strong history of success in infrastructure investment and operational management. This deep expertise is crucial for navigating the complexities of the global infrastructure market.

The company's integration within the broader Brookfield ecosystem is a key strategic advantage. This affiliation grants access to an extensive network, facilitating the origination of compelling investment opportunities. For instance, Brookfield Asset Management, the parent entity, managed approximately $850 billion in assets as of Q1 2024, showcasing the scale of resources and reach available.

This ecosystem also allows Brookfield Infrastructure to participate in Brookfield-sponsored consortiums. Such collaborations enhance its capacity to identify, pursue, and execute large-scale, intricate transactions on a global scale, often securing advantageous terms and de-risking major projects.

- Experienced Leadership: Management team with a demonstrated track record in infrastructure.

- Extensive Network: Access to Brookfield's vast global network for deal origination.

- Synergistic Opportunities: Ability to participate in consortiums for large-scale projects.

- Global Execution Capability: Enhanced capacity to manage complex international transactions.

Brookfield's diversified global asset base, spanning utilities, transport, midstream, and data infrastructure across key continents, provides resilience against regional economic downturns. This geographic spread, coupled with a focus on high-quality, inflation-linked assets under long-term contracts, ensures stable and predictable cash flows, supporting consistent dividend growth.

The company's adept capital recycling strategy, exemplified by a record $2.4 billion in sale proceeds in 2025 against $1.3 billion in new investments, fuels continuous portfolio enhancement and growth. Furthermore, Brookfield's infrastructure segment is targeted for 6-9% annual organic growth, driven by development initiatives and asset integration.

Brookfield benefits from a seasoned management team with deep expertise in infrastructure investment and operations, alongside significant strategic advantages derived from its integration within the broader Brookfield ecosystem, which manages approximately $850 billion in assets as of Q1 2024.

What is included in the product

Analyzes Brookfield’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines strategic assessment by identifying key strengths and weaknesses, alleviating the pain of unfocused planning.

Weaknesses

Brookfield Infrastructure has historically operated with substantial debt levels, reflected in a notable debt-to-equity ratio. This financial leverage, while common in infrastructure, amplifies financial risk, especially in an environment of increasing interest rates. For instance, as of the first quarter of 2024, the company's consolidated debt stood at approximately $25 billion, highlighting the significant capital structure it manages.

The increased cost of borrowing due to rising interest rates poses a challenge for servicing existing debt and funding new projects. While Brookfield often finances assets at the individual project level, reducing direct recourse to the parent company, the overall leverage remains a key consideration for investors assessing financial stability and growth prospects.

Brookfield's financial performance in 2024 and early 2025 has highlighted some weaknesses, notably a low interest coverage ratio. This metric, which indicates how easily a company can pay its interest expenses from its operating income, has been a point of concern. For instance, while specific figures fluctuate, a ratio dipping below 2x can signal potential financial strain.

Compounding this, the company has also seen relatively thin net profit margins. Despite robust revenue growth, these margins, often in the low single digits for some of its segments, can restrict the amount of profit available for reinvestment or shareholder returns. This can make it harder to weather economic downturns or fund ambitious growth initiatives.

Brookfield Infrastructure's significant global footprint, while a strength, also exposes it to the vagaries of regulatory shifts and economic downturns across numerous jurisdictions. For instance, changes in energy pricing regulations or infrastructure spending policies in countries like Australia or Brazil could directly affect its revenue streams and operational costs.

The company's reliance on stable, long-term contracts provides some buffer, but sustained economic contractions in major operating regions, such as North America or Europe, could still lead to reduced demand for its services or pressure on tariff structures. This inherent sensitivity to macroeconomic conditions and evolving policy landscapes remains a key vulnerability.

Volatility in Stock Performance

Brookfield's stock has shown a tendency for higher volatility than the general market, often reflected in its beta value. For instance, during periods of market stress in late 2023 and early 2024, Brookfield's share price experienced more pronounced fluctuations than many benchmark indices. This heightened volatility can translate into more significant price swings, potentially affecting investor confidence and short-term gains.

While this can be manageable for investors with a long-term outlook and a higher tolerance for risk, it presents a notable concern for those with shorter investment timelines or a more conservative approach to risk. The unpredictability of these price movements can make it challenging for some investors to maintain their desired allocation or to enter and exit positions at favorable price points.

- Higher Beta: Brookfield's beta, a measure of its stock's volatility relative to the market, has often been observed to be above 1, indicating greater sensitivity to market movements.

- Short-Term Price Swings: Investors with shorter horizons may find the amplified price fluctuations challenging to navigate, potentially impacting their immediate returns.

- Investor Sentiment Impact: Significant price drops, even if temporary, can negatively influence investor sentiment, leading to further selling pressure.

Impact of Foreign Exchange Fluctuations

Brookfield's extensive international presence means that currency exchange rate volatility can still pose a challenge. Even with hedging strategies in place, significant adverse movements in foreign currencies could impact its Funds from Operations (FFO) and overall financial performance. For instance, if a substantial portion of its revenue is generated in currencies that weaken against the U.S. dollar, this could reduce the translated value of those earnings.

While Brookfield aims to mitigate these risks, the sheer scale of its global operations means that not all foreign currency exposures can be perfectly hedged. The company reported that as of December 31, 2023, its net debt exposure to foreign currency fluctuations was approximately $12.1 billion, highlighting the potential impact of currency shifts on its balance sheet and earnings.

- Currency Volatility Impact: Foreign exchange rate fluctuations can negatively affect Brookfield's Funds from Operations (FFO) and financial results due to its global operations.

- Hedging Limitations: Despite hedging efforts, adverse currency movements can still create headwinds for a significant portion of cash flows not fully covered.

- U.S. Dollar Exposure: While a large part of cash flows are hedged or in U.S. dollars, the remaining unhedged portions are susceptible to currency depreciation.

- Financial Statement Translation: Changes in exchange rates can alter the reported value of assets, liabilities, and income generated in foreign currencies, impacting consolidated financial statements.

Brookfield's significant debt levels, while typical for infrastructure, present a weakness due to rising interest rates. As of Q1 2024, its consolidated debt was around $25 billion, making it sensitive to borrowing costs. This leverage can impact its ability to service debt and fund new projects, especially with a reported low interest coverage ratio in early 2024, which can signal financial strain.

What You See Is What You Get

Brookfield SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The relentless surge in global demand for data infrastructure, fueled by the widespread adoption of artificial intelligence (AI) and ongoing digitalization, creates a substantial growth avenue for Brookfield Infrastructure's data segment. This trend is particularly evident in the increasing need for robust data centers and extensive cellular tower networks, areas where Brookfield has been strategically investing through acquisitions to secure its market position.

Brookfield's proactive approach to expanding its data infrastructure portfolio, including investments in power and transmission assets specifically designed to support AI-driven computing needs, positions it to benefit from this expanding market. The company's focus on these critical digital backbone components underscores its strategy to capitalize on the foundational requirements of the digital economy.

Brookfield Infrastructure is strategically targeting the United States for significant capital investment, recognizing its robust demand for large-scale infrastructure projects. This focus is driven by the nation's ongoing need for modernization across various sectors.

The company is actively pursuing opportunities in emerging economies, where the demand for new infrastructure is particularly high, ensuring a steady stream of potential acquisitions and development projects. This global approach diversifies its portfolio and capitalizes on growth trends.

Persistent inflation, while a concern, can actually benefit Brookfield Infrastructure. Many of its infrastructure assets, like toll roads and utilities, have contracts that are directly tied to inflation. This means as prices rise, so does the revenue generated by these assets, often allowing revenue growth to outpace rising operating costs. For example, in Q1 2024, Brookfield Infrastructure reported that approximately 70% of its revenues were subject to inflation linkage, providing a natural hedge.

Looking ahead to 2025, anticipated reductions in interest rates present a significant opportunity. Lower interest rates directly translate to reduced borrowing costs for Brookfield, which carries substantial debt to finance its global portfolio of infrastructure assets. This can improve profitability and free up capital for reinvestment or shareholder returns. Furthermore, a lower interest rate environment makes Brookfield's attractive dividend yield, which stood at around 5.2% as of early 2024, even more compelling for income-seeking investors, potentially driving up its stock valuation.

Further Capital Recycling and Reinvestment

Brookfield's established capital recycling program presents a significant opportunity. This strategy, which involves divesting mature assets to fund new, higher-return investments, continues to be a key driver for value creation.

With a robust pipeline of potential acquisitions, Brookfield can consistently optimize its portfolio and boost overall returns. The company anticipates generating between $5-6 billion from asset sales in the upcoming two years, fueling further strategic reinvestment.

- Capital Recycling: Brookfield's proven ability to sell mature assets to fund new ventures.

- Value Creation: This strategy is expected to unlock substantial value through ongoing portfolio optimization.

- Acquisition Pipeline: A strong pipeline of opportunities supports continuous reinvestment and growth.

- Projected Asset Sales: Brookfield aims to generate $5-6 billion from asset sales over the next two years.

Strategic Partnerships and Consortiums

Brookfield Infrastructure can forge strategic alliances and join consortiums, especially leveraging its connection to the broader Brookfield Asset Management ecosystem. This allows participation in significant, intricate acquisitions that might be too large for a single entity. For instance, in 2024, Brookfield Asset Management successfully closed its largest infrastructure fund to date, Brookfield Infrastructure Fund V, with $10 billion in commitments, demonstrating the scale of capital available for such ventures.

These collaborations enable Brookfield Infrastructure to pursue larger, more ambitious projects and effectively spread investment risk across multiple partners. Such consortiums provide access to a wider array of investment opportunities, including those that might otherwise be out of reach due to size or complexity. This approach is particularly valuable in sectors requiring substantial capital deployment, such as renewable energy or large-scale transportation networks.

Key benefits include:

- Access to Larger Deals: Enables participation in acquisitions exceeding individual capacity.

- Risk Diversification: Spreads financial exposure across multiple partners.

- Enhanced Capabilities: Combines expertise and resources for complex projects.

- Broader Opportunity Set: Unlocks investments not otherwise accessible.

Brookfield Infrastructure's strategic focus on data infrastructure, driven by AI and digitalization, positions it for significant growth in 2024-2025. Investments in data centers and cellular towers, crucial for the digital economy, are key. The company's expansion into emerging markets and targeted investments in the U.S. further bolster its growth prospects.

Threats

While the market anticipates potential rate reductions, a prolonged environment of high interest rates or unforeseen hikes could significantly increase Brookfield Infrastructure's borrowing expenses. For instance, if benchmark rates remain elevated throughout 2024 and into 2025, the cost of servicing Brookfield's substantial debt, which stood at approximately $70 billion as of the end of Q1 2024, would climb. This escalation in financing costs directly impacts profitability and diminishes the capital available for crucial activities like increasing investor distributions and funding new growth initiatives.

The global infrastructure market is experiencing fierce competition, with major players like Brookfield Asset Management constantly facing bids from other large institutional investors and specialized infrastructure funds. This heightened rivalry for prime assets, such as renewable energy projects or digital infrastructure, is pushing acquisition prices higher. For instance, in 2024, the average valuation multiples for operational renewable energy assets have seen an uptick compared to previous years, making it more challenging to secure deals at attractive entry points.

Brookfield Infrastructure faces significant threats from diverse and changing regulatory landscapes across its global operations. Fluctuations in government policies, stricter regulations, or political unrest in key markets can disrupt operations and diminish asset values. For instance, in 2024, ongoing discussions around infrastructure spending and potential changes to energy transition regulations in North America and Europe could affect Brookfield's energy transmission and renewable power segments.

The company's extensive portfolio, spanning sectors like utilities, transport, and data infrastructure, makes it susceptible to sector-specific regulatory shifts. For example, evolving environmental regulations impacting carbon emissions or the approval timelines for large-scale transport projects, such as potential mergers or acquisitions in its rail operations, could create operational hurdles and financial uncertainty. This complexity demands constant vigilance and adaptation to maintain compliance and mitigate potential negative impacts on its financial performance.

Global Economic Slowdowns or Recessions

Brookfield Asset Management, despite its broad diversification, faces a significant threat from global economic slowdowns or recessions. Such downturns can dampen demand across various sectors, notably impacting its transport and midstream operations. For instance, a global GDP contraction, as seen in potential forecasts for late 2024 or early 2025, could directly translate to reduced cargo volumes and energy transportation needs.

While Brookfield's core infrastructure assets, like utilities and renewable power, typically exhibit resilience even during economic contractions, prolonged periods of reduced economic activity will inevitably affect overall revenue streams. For example, lower consumer spending during a recession can indirectly impact infrastructure usage, leading to decreased toll road revenues or energy consumption.

Specific impacts could include:

- Reduced demand for logistics and transportation services, affecting Brookfield's infrastructure and real estate segments.

- Lower energy consumption and pricing volatility impacting revenues from its energy and infrastructure businesses.

- Decreased capital availability and higher borrowing costs making it more challenging to finance new projects or refinance existing debt.

Operational and Integration Risks of Acquisitions

Brookfield Infrastructure's aggressive acquisition strategy, while a growth driver, carries significant operational and integration risks. The process of merging new businesses into existing operations can uncover unforeseen complexities. For instance, in 2023, Brookfield Infrastructure reported that integration costs for certain acquisitions exceeded initial projections, impacting the immediate profitability of those deals.

Failure to achieve the anticipated synergies from these acquisitions poses a material threat. These synergies, often projected to boost earnings and operational efficiency, might not materialize as planned due to cultural clashes, IT system incompatibilities, or market shifts post-acquisition. The company must diligently manage these integration challenges to safeguard its financial performance and shareholder value.

- Integration Costs: Acquisitions can incur higher-than-anticipated integration expenses, potentially eroding projected returns.

- Synergy Realization: The failure to achieve expected synergies from newly acquired assets directly impacts financial performance.

- Operational Disruptions: Unforeseen operational challenges within acquired businesses can disrupt service delivery and profitability.

Brookfield Infrastructure faces significant threats from increasing competition for quality assets, which can drive up acquisition prices and reduce potential returns. Furthermore, evolving regulatory environments across its diverse global operations present risks, as policy changes or political instability can disrupt operations and impact asset values. Economic slowdowns are also a concern, potentially reducing demand for services and increasing borrowing costs, while the inherent risks associated with integrating acquired businesses could lead to higher-than-expected costs and unrealized synergies.

SWOT Analysis Data Sources

This Brookfield SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert analyses of the global real estate and infrastructure sectors.