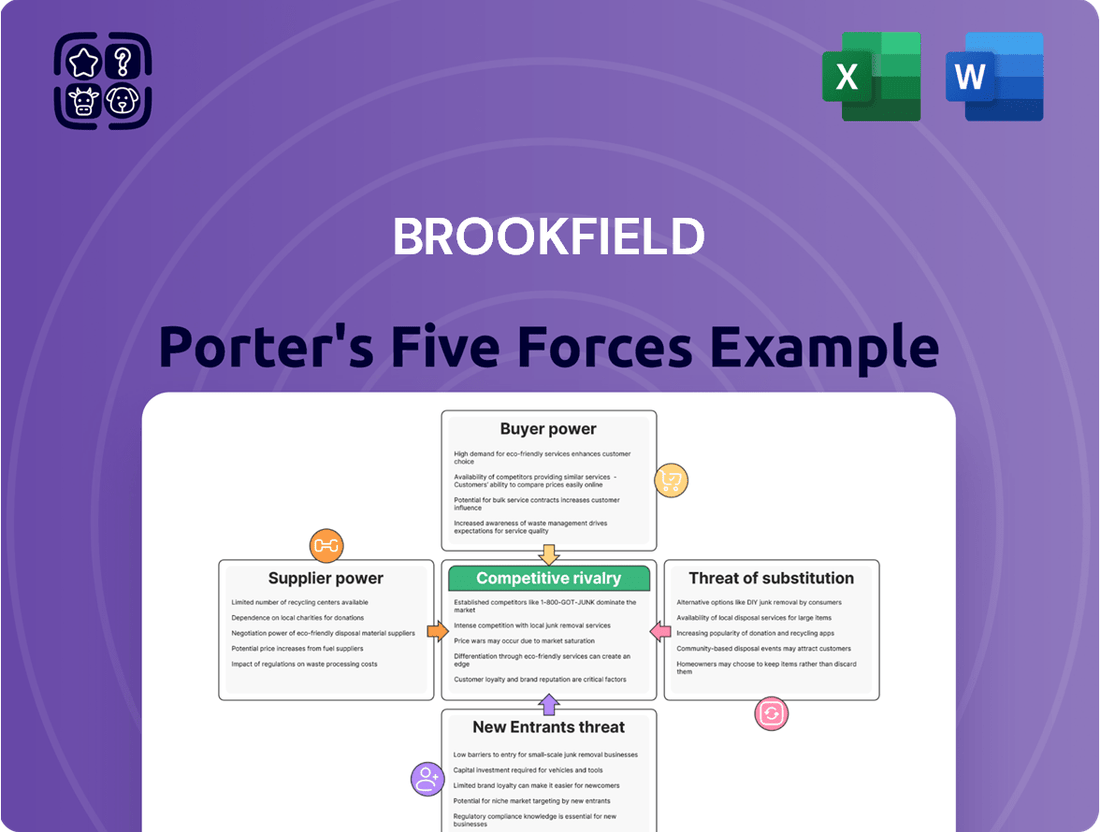

Brookfield Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Bundle

Brookfield's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers and suppliers to the ever-present threat of new entrants and substitute products. Understanding these dynamics is crucial for any strategic decision-making.

The complete report reveals the real forces shaping Brookfield’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Brookfield Infrastructure Partners' reliance on specialized, critical components for its essential infrastructure assets can sometimes lead to a limited pool of qualified suppliers. This scarcity, particularly for highly specialized equipment and technology, can grant these suppliers a degree of bargaining power. For instance, the complex nature of advanced data center cooling systems or specialized subsea cable laying equipment means only a few manufacturers possess the necessary expertise and production capabilities.

Brookfield Asset Management's emphasis on long-life assets and predictable cash flows often leads to supplier relationships structured around long-term contracts. These enduring agreements can significantly dampen a supplier's individual bargaining leverage by guaranteeing consistent demand and often locking in pricing, thereby stabilizing input costs for Brookfield.

For instance, in 2024, Brookfield's infrastructure segment, a major area for long-term asset ownership, continued to benefit from such contractual arrangements. These partnerships ensure a steady supply of essential components for their renewable energy projects and utility operations, insulating them from the price volatility that can affect shorter-term arrangements.

Brookfield Infrastructure's strategic diversification across utilities, transport, midstream, and data sectors, coupled with its extensive global footprint, significantly diminishes its reliance on any single supplier or geographical market. This broad operational base empowers Brookfield to negotiate from a position of strength, as it can readily shift sourcing or operations to alternative regions or sectors if supplier terms become unfavorable.

For instance, in 2024, Brookfield Infrastructure's asset base spanned over 150 million customer connections across its various segments, with a substantial portion of its revenue generated outside of North America, highlighting its global reach. This geographic and sectoral spread directly curtails the bargaining power of individual suppliers, as they face a reduced ability to exert pressure due to Brookfield's capacity to tap into a wider array of alternative sourcing options.

In-house Expertise and Operational Capabilities

Brookfield's commitment to operational improvements highlights its significant in-house expertise. This internal capability allows them to perform certain functions, like specialized engineering or maintenance, which directly lessens their dependence on outside suppliers for these critical services. For instance, in 2024, Brookfield reported a substantial increase in capital expenditure dedicated to enhancing its operational efficiency across its diverse portfolio, suggesting a strategic move towards greater self-sufficiency in key areas.

This robust internal capacity empowers Brookfield to negotiate from a stronger position with external suppliers. By having the option to bring services in-house, they can more effectively challenge supplier pricing and terms, thereby reducing the bargaining power of those suppliers. This strategic advantage is crucial in managing costs and ensuring the seamless execution of their projects, a core tenet of their value enhancement strategy.

- Reduced Supplier Dependence: Brookfield's internal operational and engineering teams handle critical functions, lessening reliance on external providers.

- Enhanced Negotiation Leverage: The ability to perform tasks internally strengthens Brookfield's position when negotiating with suppliers for services they do outsource.

- Cost Management: In-house capabilities contribute to better cost control by reducing the need for potentially higher-priced external services.

- Operational Efficiency: This expertise directly supports Brookfield's strategy of driving value through continuous operational improvements across its assets.

Regulatory Environment and Standardized Equipment

In regulated utility and transport sectors, prescribed equipment and operational standards significantly influence supplier bargaining power. These stringent requirements often mean a broader range of suppliers can meet the necessary criteria, diluting the leverage of any individual provider.

For instance, in the US electricity sector, the Federal Energy Regulatory Commission (FERC) sets standards for grid reliability and equipment. This encourages a competitive supplier landscape. In 2024, the market for grid modernization equipment, including advanced sensors and control systems, saw numerous vendors vying for contracts, with prices often reflecting this competitive pressure rather than supplier-specific dominance.

- Standardization Limits Supplier Leverage: Prescribed technical and safety standards in regulated industries like utilities create a larger pool of qualified suppliers.

- Increased Competition: This broad supplier base fosters competition, preventing any single supplier from dictating terms or prices.

- Reduced Dependence: Utilities can more easily switch between approved suppliers, reducing their reliance on any one entity.

- Impact on Pricing: The competitive environment generally leads to more favorable pricing for the purchasing utility.

Brookfield's bargaining power with suppliers is generally strong due to its scale, diversification, and in-house capabilities. While specialized components can create supplier leverage, Brookfield mitigates this through long-term contracts and its global operational reach. The company's commitment to operational improvements and its internal expertise further reduce dependence on external providers, enhancing its negotiation position and cost management.

| Factor | Brookfield's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Scale and Diversification | Extensive global asset base across multiple sectors. | Lowers reliance on any single supplier; enables sourcing alternatives. |

| In-house Expertise | Significant engineering and operational capabilities. | Reduces need for external services, strengthening negotiation leverage. |

| Long-term Contracts | Secures supply and stabilizes pricing for essential components. | Dampens supplier ability to dictate terms due to guaranteed demand. |

| Specialized Components | Reliance on niche, high-tech equipment (e.g., data center cooling). | Can grant limited leverage to a few highly specialized suppliers. |

| Regulated Markets | Standardized requirements in utilities and transport. | Broadens supplier pool, increasing competition and reducing individual leverage. |

What is included in the product

Analyzes the competitive intensity within Brookfield's operating environments, examining threats from new entrants, substitute products, supplier and buyer power, and rivalry among existing competitors.

Instantly visualize competitive intensity with a dynamic, color-coded threat matrix, making it easy to pinpoint and address key industry pressures.

Customers Bargaining Power

Brookfield Infrastructure's revenue streams are heavily influenced by regulated assets and long-term contracts, which significantly curbs customer bargaining power. For instance, in 2024, a substantial portion of its earnings before interest, taxes, depreciation, and amortization (EBITDA) was derived from these stable sources, insulating it from direct price negotiations with individual end-users.

The regulated nature of its utility businesses means that pricing is determined by regulatory bodies, not by customer demand. Similarly, its infrastructure assets, such as toll roads and pipelines, operate under long-term agreements with fixed or inflation-adjusted tariffs. This structure provides Brookfield Infrastructure with predictable cash flows and limits the ability of any single customer to demand lower prices or better terms.

Customers of essential infrastructure services like electricity and water often face significant hurdles when trying to switch providers. These services are deeply integrated into our daily lives, making it nearly impossible to opt for a different supplier without substantial disruption or cost. For instance, in many regions, a single utility company manages the entire infrastructure, leaving consumers with no practical alternatives.

This lack of viable choices severely limits the bargaining power of these customers. Imagine trying to switch your electricity provider when the same company owns the power lines and the generation facilities; it's simply not feasible for most individuals or businesses. In 2024, the continued reliance on established, often monopolistic, infrastructure networks underscores this reality, reinforcing the low bargaining power of customers in these sectors.

The bargaining power of customers is often diminished when the customer base is highly fragmented. For many of Brookfield's infrastructure assets, such as residential utilities or toll roads, the users are numerous individuals, making it difficult for them to organize and collectively negotiate terms.

While large industrial or commercial clients might possess greater leverage, the sheer volume of dispersed individual customers limits their ability to exert significant pressure on a large infrastructure provider like Brookfield. This fragmentation means that no single customer, or even a small group, can substantially impact pricing or service conditions.

For instance, in the regulated utility sector, customer price sensitivity exists, but the regulatory framework and the essential nature of the service, coupled with millions of individual users, prevent any meaningful collective bargaining that could impact Brookfield's revenue streams significantly.

Critical Nature of Services Provided

The critical nature of services provided by Brookfield Infrastructure significantly dampens customer bargaining power. These services, essential for daily life and economic operations, often face inelastic demand. For instance, in 2024, Brookfield Infrastructure's regulated utility assets, like electricity transmission and distribution networks, are fundamental to economic activity, making customers highly reliant on continuous service delivery. This reliance means customers prioritize service continuity and reliability over minor price fluctuations, limiting their leverage to negotiate lower prices.

Customers' focus on reliability rather than cost for essential infrastructure means they have less ability to bargain down prices. Brookfield's infrastructure assets, such as telecommunications towers and data centers, are vital for modern commerce and communication. In 2024, the demand for these services remains robust, with businesses and individuals unwilling to risk service disruptions by demanding lower rates that could compromise maintenance and upgrades. This dynamic inherently reduces the bargaining power of these customer segments.

- Essential Services: Brookfield Infrastructure provides services critical to daily life and economic activity, such as utilities and communications.

- Inelastic Demand: The indispensable nature of these services leads to demand that is not highly sensitive to price changes.

- Prioritization of Reliability: Customers value consistent and dependable service over cost savings, reducing their ability to negotiate.

- Limited Price Sensitivity: In 2024, the essentiality of Brookfield's infrastructure means customers are less likely to exert significant bargaining pressure based on price alone.

Inflation Indexation and Volume-Based Contracts

Brookfield's contracts, especially in utilities and transport, often feature inflation indexation. This means that as inflation rises, the prices for their services automatically adjust upwards. For instance, in 2024, many infrastructure contracts are designed to reflect the prevailing inflation rates, ensuring Brookfield's revenue keeps pace with rising operational costs and doesn't erode due to general price increases.

Furthermore, volume-based contracts are a key strategy to manage customer bargaining power. If customers use more of Brookfield's services, the company benefits from increased revenue. This structure incentivizes higher usage and can offset any attempts by individual customers to negotiate lower per-unit prices, particularly in energy distribution or toll road operations where higher traffic volumes translate directly to greater income.

- Inflation Indexation: Contracts are adjusted based on inflation, protecting revenue streams.

- Volume-Based Contracts: Increased customer usage directly boosts revenue.

- Mitigation of Price Pressure: These contract structures limit the ability of customers to force down prices.

- Revenue Stability: The combination provides a more predictable and stable income for Brookfield.

The bargaining power of Brookfield Infrastructure's customers is notably low due to the essential nature of its services and the structure of its contracts. Customers often have limited alternatives for critical services like utilities, and the high cost or disruption associated with switching providers significantly reduces their leverage.

In 2024, Brookfield's extensive network of regulated utilities and long-term contracts for assets like toll roads and pipelines lock in customers. For example, many of its revenue streams are derived from contracts with fixed, inflation-adjusted tariffs, meaning individual customers cannot easily negotiate lower prices. This limited price sensitivity, coupled with the essentiality of the services, ensures customers prioritize reliability over cost, further diminishing their bargaining power.

| Factor | Impact on Customer Bargaining Power | Brookfield's Mitigation Strategy |

|---|---|---|

| Essentiality of Services | Low | Provides critical utilities, communications, and transport services with inelastic demand. |

| Switching Costs | High | Customers face significant disruption and expense to change providers for integrated infrastructure. |

| Contractual Agreements | Low | Long-term contracts with inflation indexation and fixed tariffs limit price negotiation. |

| Customer Fragmentation | Low | Large base of individual residential and commercial users makes collective bargaining difficult. |

What You See Is What You Get

Brookfield Porter's Five Forces Analysis

This preview showcases the complete Brookfield Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally prepared strategic tool.

Rivalry Among Competitors

The infrastructure sector demands massive upfront investment, often in the billions, for projects like power plants or toll roads. For instance, a new nuclear power plant can cost upwards of $25 billion, making it nearly impossible for smaller firms to compete. This capital intensity, coupled with extensive licensing and environmental approvals, significantly restricts the number of new entrants, thereby lowering direct competitive rivalry among established players.

While Brookfield Infrastructure Partners has a global reach, the infrastructure sector itself often operates with significant regional or national nuances. This is largely due to varied regulatory frameworks and the unique characteristics of existing infrastructure in different areas, leading to a more fragmented competitive environment in specific geographies. For instance, the transportation infrastructure market in North America might see intense rivalry among a handful of major players, distinct from the competitive dynamics in European energy transmission.

Brookfield Infrastructure faces intense competition from other substantial, well-funded players in the infrastructure sector. These rivals include other infrastructure funds, large pension funds, and major utility companies, creating a landscape with a limited number of powerful participants rather than a widely dispersed market.

Key competitors such as Black Hills, Sempra Energy, AES, Enbridge, and NextEra Energy Partners actively vie for similar assets and projects. For instance, in 2024, NextEra Energy Partners reported significant capital expenditures, demonstrating its ongoing investment and competitive drive within the renewable energy infrastructure space.

Strategic Focus on Value Enhancement and Capital Recycling

Brookfield's competitive advantage is significantly bolstered by its strategic focus on value enhancement and capital recycling. This involves acquiring quality assets, improving their performance through operational expertise, and then selling these mature assets to finance new, growth-oriented investments. This dynamic approach to portfolio management sets Brookfield apart from rivals with more passive investment strategies.

This strategy allows Brookfield to consistently generate returns and maintain a competitive edge. For instance, in 2023, Brookfield Asset Management reported deploying approximately $20 billion in new capital, a testament to its active capital recycling. This proactive management of its asset base ensures it remains nimble and well-positioned for future opportunities.

- Value Enhancement: Brookfield actively improves asset performance, increasing their market value.

- Capital Recycling: Mature, lower-growth assets are sold to fund new, higher-return investments.

- Competitive Distinction: This active management contrasts with less dynamic strategies of some competitors.

- Financial Impact: In 2023, Brookfield deployed around $20 billion in new capital, highlighting its active approach.

Diversified Portfolio Mitigates Sector-Specific Rivalry

Brookfield Infrastructure's diversified portfolio across utilities, transport, midstream, and data significantly dampens the impact of intense rivalry within any single sector. This broad operational base allows for a more resilient financial performance, as strength in one segment can effectively counterbalance competitive headwinds in another. For instance, in 2024, while certain transportation assets might face increased competition, the stable, regulated returns from its utility operations provide a buffer, contributing to overall portfolio stability and continued growth. This strategic diversification is a key element in managing competitive rivalry.

The company's strategic approach to diversification provides a tangible advantage in navigating competitive landscapes. By spreading investments across distinct industries, Brookfield Infrastructure is less susceptible to the cyclical downturns or heightened competitive pressures that can plague a single sector. This approach ensures that even if one area experiences intensified rivalry, the overall business remains robust. For example, a strong performance in their regulated utilities segment in 2024, characterized by consistent cash flows, helped offset the more volatile competitive environment faced by some of their toll road assets.

- Sector Diversification: Brookfield Infrastructure operates in utilities, transport, midstream, and data, reducing reliance on any one sector.

- Risk Mitigation: Strong performance in one segment can offset competitive pressures in another, enhancing overall stability.

- 2024 Performance Example: Robust utility returns in 2024 provided a cushion against competitive pressures in other areas like transportation.

- Strategic Advantage: Diversification allows the company to manage competitive rivalry more effectively across its diverse asset base.

Competitive rivalry within the infrastructure sector is characterized by a limited number of large, well-capitalized players. These include major infrastructure funds, pension funds, and utility companies, all vying for significant assets. For instance, in 2024, companies like NextEra Energy Partners are actively investing in renewable infrastructure, demonstrating the intense competition for growth opportunities.

Brookfield Infrastructure's strategy of value enhancement and capital recycling, such as deploying approximately $20 billion in new capital in 2023, helps it maintain a competitive edge against rivals with more passive approaches. Furthermore, its diversification across utilities, transport, midstream, and data sectors mitigates the impact of intense rivalry in any single segment. For example, strong utility performance in 2024 provided stability against competitive pressures in other areas.

| Key Competitors | 2024 Focus/Activity Example | Competitive Impact |

|---|---|---|

| NextEra Energy Partners | Significant capital expenditure in renewables | Intensifies competition for renewable assets |

| Sempra Energy | Ongoing investments in energy infrastructure | Vies for regulated utility and energy transition projects |

| Enbridge | Expansion in midstream and renewable energy | Direct competition in energy transportation and transition |

| AES Corporation | Focus on renewable energy development and decarbonization | Competes for renewable generation and storage projects |

SSubstitutes Threaten

For many of Brookfield Infrastructure's core assets, like electricity transmission networks, vital pipelines, and key toll roads, direct substitutes are scarce. These are essential services that communities and businesses rely on daily, making it difficult for customers to switch to an alternative. For instance, the need for reliable power distribution or the transport of goods via pipelines isn't easily met by another type of infrastructure.

This scarcity means the threat of customers finding and switching to a direct substitute is considerably low. Consider the data center industry; while cloud services offer alternatives for data storage, the physical infrastructure of data centers remains a critical, often irreplaceable, component for many enterprises. This inherent stickiness of core infrastructure services significantly dampens the threat of substitution.

While direct substitutes for Brookfield's core infrastructure assets are scarce, emerging technological advancements pose a potential long-term threat. For instance, the rapid growth of renewable energy sources and decentralized power generation could diminish the reliance on traditional electricity transmission infrastructure. In 2024, global renewable energy capacity additions reached a record high, underscoring this evolving landscape.

Similarly, innovations in communication technologies might impact the demand for existing fiber optic networks, although Brookfield's strategic investments in data infrastructure, including data centers, aim to capitalize on these trends. The continuous evolution of digital infrastructure necessitates ongoing adaptation to remain competitive against potential technological obsolescence.

The threat of substitutes in sectors like energy and transportation could emerge from a growing trend towards decentralized solutions. For example, the rise of localized power generation, such as rooftop solar, and alternative mobility options might lessen dependence on traditional, large-scale infrastructure.

However, Brookfield's substantial investments in centralized infrastructure, like extensive power grids and transportation networks, often provide significant economies of scale and operational efficiencies. In 2024, renewable energy capacity additions continued to grow, with solar photovoltaic leading the charge, but the integration and stability challenges of highly decentralized systems still favor large, integrated networks for many core functions.

Regulatory Frameworks and High Barriers to Entry for Substitutes

The threat of substitutes in infrastructure is significantly diminished by stringent regulatory frameworks. For instance, in the energy sector, new technologies aiming to replace traditional power generation face extensive environmental impact assessments and permitting processes, often taking years to navigate. This regulatory labyrinth, coupled with the massive capital required for compliance and infrastructure development, acts as a formidable barrier.

Consider the telecommunications industry; the rollout of 6G technology, a potential substitute for current 5G infrastructure, will undoubtedly be subject to rigorous spectrum allocation, security, and interoperability regulations. In 2024, the global telecommunications equipment market, while vast, saw significant investment in existing 5G infrastructure, indicating a slower pace for disruptive substitute technologies due to these regulatory and capital demands.

- High Capital Requirements: Establishing substitute infrastructure often demands billions in upfront investment, far exceeding what many new entrants can secure.

- Lengthy Regulatory Approval Processes: Obtaining necessary permits and approvals for new infrastructure can take 5-10 years or more in many developed economies.

- Established Network Effects: Existing infrastructure benefits from established user bases and economies of scale, making it difficult for substitutes to compete on price or accessibility.

- Technological Maturity: Current infrastructure technologies are highly refined and optimized, presenting a moving target for emerging substitutes to match in terms of reliability and cost-effectiveness.

Brookfield's Adaptation and Investment in Emerging Infrastructure

Brookfield Infrastructure is actively investing in areas like data centers and fiber networks, anticipating future infrastructure demands. This forward-thinking approach helps them stay ahead of potential substitutes by ensuring their services remain critical.

The company's positive outlook on the energy sector, fueled by the push for energy diversification and the significant electricity needs of AI, further solidifies its position. For instance, Brookfield Infrastructure's recent capital deployment highlights a strategic focus on these growth areas, aiming to capture evolving market opportunities.

- Data Center Growth: Brookfield Infrastructure is expanding its data center portfolio, recognizing the surge in demand driven by cloud computing and AI.

- Fiber Network Expansion: Investments in fiber optic networks are crucial for supporting increased data transmission, a key area for Brookfield.

- Energy Sector Investment: The company sees strong potential in energy infrastructure, particularly in supporting renewable energy sources and the growing demand for electricity.

- AI's Impact: Brookfield acknowledges the substantial electricity demand generated by AI technologies, positioning them to benefit from this trend.

For many of Brookfield Infrastructure's core assets, like electricity transmission networks and vital pipelines, direct substitutes are scarce, making the threat of customers switching considerably low. While emerging technologies like decentralized power generation pose a long-term challenge, the high capital requirements, lengthy regulatory approval processes, and established network effects of current infrastructure create significant barriers for substitutes. Brookfield's strategic investments in areas like data centers and fiber networks aim to capitalize on evolving demands, further solidifying their competitive position against potential disruptions.

Entrants Threaten

Entering the infrastructure sector, especially to compete with established players like Brookfield Infrastructure, demands substantial financial resources. The sheer scale of investment needed for acquiring or developing assets such as toll roads, pipelines, or renewable energy projects presents a significant hurdle for newcomers.

For instance, a single major infrastructure project can easily run into billions of dollars. In 2024, the average cost for developing a new large-scale renewable energy project, like a wind farm, often exceeds $1 billion, making it a daunting proposition for entities without deep pockets.

This high capital requirement acts as a strong deterrent, effectively limiting the number of potential new entrants capable of mounting a credible challenge in this capital-intensive industry.

The infrastructure sector, particularly for large-scale projects, is burdened by extensive regulatory hurdles. For instance, in 2024, the average time for obtaining major construction permits in the US could stretch over a year, involving multiple federal, state, and local agencies. This complex web of requirements, including environmental impact assessments and safety certifications, acts as a significant barrier, deterring many potential new entrants who lack the capital and expertise to navigate these protracted processes.

Brookfield Infrastructure, as an established player, leverages extensive existing networks and significant economies of scale. This infrastructure giant reported revenues of approximately $15.2 billion in 2023, a testament to its operational reach.

New entrants face a formidable barrier in replicating Brookfield's cost structures and widespread operational capabilities. Achieving comparable efficiency and market penetration from day one is a substantial challenge, impacting their ability to compete effectively on price or service quality.

Long Payback Periods and Risk Aversion

The lengthy payback periods inherent in infrastructure projects act as a significant barrier, deterring potential new entrants. These investments often require decades to recoup initial capital, a timeframe that can be unappealing to firms prioritizing shorter investment horizons.

Risk aversion plays a crucial role here. New companies may be hesitant to commit substantial upfront capital to projects with such extended timelines, especially if they lack the established track record and deep pockets of incumbents to weather market volatility or unforeseen delays.

- Long-Term Commitment: Infrastructure projects, like a new toll road or a renewable energy plant, can have payback periods exceeding 20-30 years.

- Capital Intensity: The sheer volume of capital required upfront for these ventures is immense, often running into billions of dollars, which is a substantial hurdle for new players.

- Risk Tolerance: Many new entrants are more comfortable with investments that offer returns within 5-10 years, making the long-term nature of infrastructure less attractive.

Brookfield's Acquisition and Capital Recycling Strategy

Brookfield's proactive capital recycling strategy, which involves acquiring premium, long-duration assets and reinvesting proceeds into emerging sectors, significantly raises the barrier for new entrants. For instance, in 2024, Brookfield continued its aggressive deployment of capital, with significant investments in renewable energy and data centers, areas demanding substantial upfront investment and expertise. This continuous portfolio enhancement and focus on high-growth segments effectively fortifies Brookfield's market dominance and deters potential new competitors.

Brookfield's approach to capital recycling directly impacts the threat of new entrants by creating formidable scale and operational efficiencies. By continuously optimizing its asset base and strategically divesting mature assets to fund growth in areas like digital infrastructure, Brookfield solidifies its competitive moat. This dynamic strategy ensures that new players face an already established and well-capitalized incumbent, making market entry considerably more challenging.

- Scale Advantage: Brookfield’s extensive capital base, demonstrated by its over $850 billion in assets under management as of early 2024, allows it to undertake large-scale acquisitions that are beyond the reach of most new entrants.

- Sector Focus: By concentrating on sectors like renewable power and infrastructure, where significant upfront capital is required, Brookfield creates a high barrier to entry.

- Operational Expertise: Brookfield's long history and proven track record in managing complex, long-life assets provide an operational advantage that new firms would struggle to replicate quickly.

- Capital Access: Brookfield’s established relationships with institutional investors and its ability to access diverse funding sources give it a distinct advantage in securing the necessary capital for new ventures.

The threat of new entrants into the infrastructure sector, particularly when competing with giants like Brookfield Infrastructure, is significantly mitigated by the immense capital requirements. For instance, developing a new large-scale renewable energy project in 2024 often cost over $1 billion, a substantial barrier for most potential newcomers.

Furthermore, navigating the complex regulatory landscape, which in 2024 could mean over a year for major US construction permits, demands specialized expertise and resources that new firms may lack. Brookfield's established scale, evidenced by its $15.2 billion in 2023 revenues, and its efficient cost structures are also difficult for new entrants to replicate quickly.

The long payback periods, often 20-30 years for infrastructure assets, coupled with Brookfield's aggressive capital recycling and focus on high-growth segments like digital infrastructure, further solidify its market position and deter new competition.

| Barrier | Description | Example Data (2024/2023) |

| Capital Intensity | High upfront investment needed for asset acquisition/development. | New large-scale renewable energy project cost: >$1 billion. |

| Regulatory Hurdles | Complex and time-consuming approval processes. | Average US major construction permit time: >1 year. |

| Economies of Scale & Expertise | Established players have lower costs and proven operational capabilities. | Brookfield Infrastructure 2023 Revenue: ~$15.2 billion. |

| Long Payback Periods | Extended time for investment returns deters risk-averse entrants. | Typical infrastructure asset payback: 20-30 years. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages proprietary market research, industry expert interviews, and publicly available financial data from companies and regulatory bodies to provide a comprehensive view of competitive dynamics.