Brookfield Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Bundle

Discover the core components that drive Brookfield's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they create and deliver value, manage customer relationships, and generate revenue. Perfect for anyone wanting to understand a global leader's strategic framework.

Partnerships

Brookfield Asset Management (BAM) serves as a crucial strategic partner, primarily through its flagship Brookfield Infrastructure Partners. This relationship grants access to BAM's extensive global network and deep expertise in managing real assets, which is vital for identifying and executing unique investment opportunities.

This partnership provides Brookfield Infrastructure Partners with significant capital infusion capabilities and specialized knowledge in infrastructure development and management. As of early 2024, Brookfield Asset Management manages over $925 billion in assets, underscoring the sheer scale of resources available through this alliance.

Brookfield's ownership of essential infrastructure necessitates robust engagement with governmental and regulatory bodies. These relationships are vital for securing necessary approvals for new developments and expansions, ensuring ongoing operational compliance, and effectively managing the complexities inherent in regulated utility and transport sectors.

These partnerships directly contribute to Brookfield's predictable revenue streams by fostering a stable operating environment. For instance, in 2024, Brookfield Renewable Partners continued to benefit from long-term power purchase agreements, often facilitated by supportive regulatory frameworks for renewable energy development, underpinning its consistent financial performance.

Brookfield Infrastructure actively collaborates with co-investors and joint venture partners for significant projects. This strategy allows them to share capital, expertise, and risk, enabling the pursuit of larger and more complex transactions.

For instance, in 2024, Brookfield Infrastructure partnered with other investors to acquire a substantial railcar leasing platform, demonstrating the practical application of these strategic alliances in executing major deals.

Customers with Long-Term Contracts

Brookfield Infrastructure's strategy heavily relies on securing customers with long-term contracts, a cornerstone of its predictable revenue generation. These agreements, often featuring inflation adjustments or take-or-pay clauses, are particularly prevalent in their utility, midstream, and data infrastructure segments.

These long-term customer relationships are critical for ensuring stable and reliable cash flows, which in turn supports the company's investment-grade credit rating and its ability to fund ongoing operations and growth initiatives. For example, as of the first quarter of 2024, a significant portion of their contracted revenue base is secured for many years into the future, providing a strong foundation for financial performance.

- Contractual Stability: Many assets operate under contracts with durations extending over a decade, providing a high degree of revenue visibility.

- Inflation Linkage: A substantial percentage of these contracts include inflation-linked escalators, protecting earnings against rising costs and enhancing real cash flow growth.

- Take-or-Pay Structures: In sectors like midstream, take-or-pay contracts guarantee revenue regardless of actual throughput, minimizing volume risk for Brookfield.

- Customer Diversification: While long-term contracts are key, Brookfield also benefits from a diverse customer base across various industries and geographies within these contractual frameworks.

Technology and Service Providers

Brookfield's strategic alliances with technology and service providers are fundamental to driving operational excellence and digital advancements across its vast infrastructure and business services portfolio. These partnerships are key to unlocking new opportunities in areas like data center management and network infrastructure upgrades.

These collaborations are vital for implementing cutting-edge operational technologies, ensuring efficiency and innovation. For instance, in 2024, Brookfield continued to invest in digital transformation initiatives, leveraging partnerships to enhance data analytics capabilities and streamline service delivery across its global operations.

- Data Center Operations: Partnerships are crucial for managing and expanding data center facilities, ensuring reliability and scalability.

- Network Enhancements: Collaborations focus on upgrading and maintaining robust network infrastructure to support digital services.

- Advanced Operational Technologies: Joint efforts aim to integrate AI, IoT, and automation for improved performance and predictive maintenance.

- Digital Transformation: These alliances are instrumental in Brookfield's ongoing efforts to digitize its business processes and customer interactions.

Brookfield's key partnerships extend to financial institutions and capital markets participants, securing crucial funding for its diverse portfolio. These relationships are essential for accessing debt and equity markets, enabling large-scale acquisitions and development projects.

These financial partnerships allow Brookfield to leverage its assets effectively and maintain a strong balance sheet. For example, in 2024, the company successfully issued several tranches of corporate debt, supported by major global banks, to finance new infrastructure investments.

Brookfield also engages with strategic partners in specific sectors to enhance its operational capabilities and market reach. These alliances often involve joint ventures or co-investment vehicles tailored to particular industries, such as renewable energy or telecommunications.

These collaborations allow Brookfield to tap into specialized expertise and share the risks associated with complex, long-term projects. For instance, in Q1 2024, Brookfield Renewable Partners announced a significant joint venture with a leading energy company to develop offshore wind projects, leveraging complementary strengths.

| Partner Type | Purpose | Example (2024) | Impact |

|---|---|---|---|

| Brookfield Asset Management | Capital access, global network, real asset expertise | Manages over $925 billion in assets (early 2024) | Identifies and executes unique investment opportunities |

| Governmental & Regulatory Bodies | Approvals, compliance, operational management | Securing permits for infrastructure expansion | Ensures smooth operations in regulated sectors |

| Co-investors & JV Partners | Capital sharing, risk mitigation, expertise pooling | Acquisition of a railcar leasing platform | Enables pursuit of larger, complex transactions |

| Technology & Service Providers | Operational excellence, digital advancement | Digital transformation initiatives, data analytics enhancement | Drives efficiency and innovation across portfolios |

| Financial Institutions | Funding access, debt/equity markets | Issuance of corporate debt to finance new investments | Supports large-scale acquisitions and development |

What is included in the product

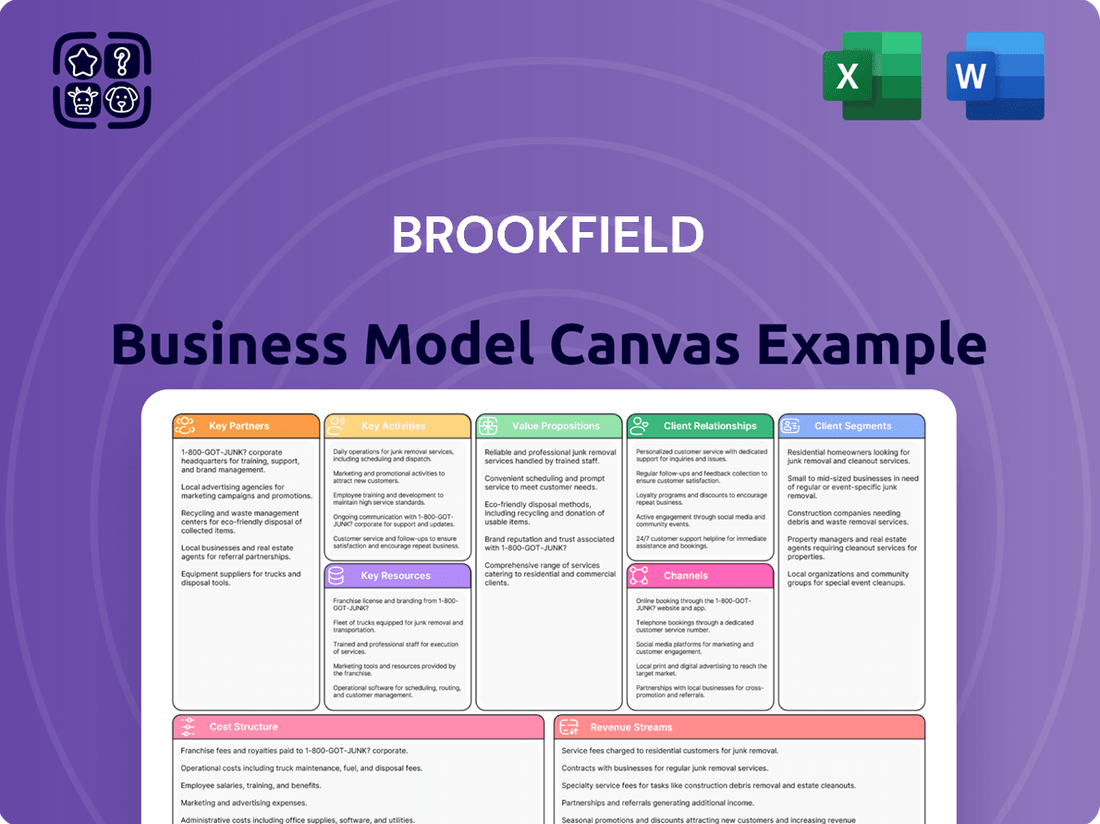

A detailed breakdown of Brookfield's operations, outlining key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams.

The Brookfield Business Model Canvas streamlines complex strategic planning by offering a visual, one-page framework that helps identify and address operational inefficiencies.

It alleviates the pain of disjointed strategy development by providing a clear, interconnected overview of key business elements, fostering alignment and targeted problem-solving.

Activities

Brookfield's key activities center on the strategic acquisition and ongoing investment in durable, long-life infrastructure assets worldwide. This encompasses a broad range of sectors, including essential utilities, critical transportation networks, vital midstream energy infrastructure, and the rapidly growing data sector.

The company actively seeks out both substantial new platform investments and smaller, complementary tuck-in acquisitions. These tuck-ins are designed to enhance the value and operational scope of their existing infrastructure portfolios, driving synergistic growth.

As of the first quarter of 2024, Brookfield Asset Management reported approximately $925 billion in assets under management, with a significant portion allocated to its infrastructure segment, demonstrating the scale of its acquisition and investment activities.

Brookfield Infrastructure's operational management focuses on driving value through efficiency and cost savings across its global assets. In 2024, the company continued to execute on its strategy of optimizing asset performance, aiming for high utilization rates and consistent cash flow generation. This hands-on approach is central to their business model, ensuring each segment contributes effectively to the overall portfolio value.

Brookfield actively recycles capital by selling off mature, less risky assets to fund new ventures. This strategy allows them to consistently reinvest in opportunities with greater growth potential.

For instance, in 2024, Brookfield completed the sale of its Australian home services business, completing a successful full-cycle investment. The company also continued to explore monetization opportunities across its diverse portfolio.

Organic Growth Initiatives and Development

Brookfield actively drives organic growth by leveraging its existing asset base. This is accomplished through strategies like inflation indexation, which adjusts pricing based on economic indicators, and by increasing the volume of services or products delivered. A key component is the commissioning of new capital projects already in their development pipeline.

These initiatives focus on expanding operational capacity and enhancing existing infrastructure. For example, in 2023, Brookfield Infrastructure Partners (BIP) reported that its capital projects backlog of $7.5 billion was on track for completion, contributing to future organic growth. This expansion and upgrading are crucial for meeting escalating market demand and improving efficiency.

- Inflation Indexation: Adjusting revenue streams to reflect rising costs, a common practice in infrastructure and utility sectors.

- Volume Growth: Increasing the utilization and delivery of services from existing assets.

- Capital Project Execution: Bringing new, growth-oriented projects online from a substantial development backlog.

- Infrastructure Upgrades: Investing in modernizing and expanding facilities to handle increased demand and improve performance.

Financial Management and Capital Allocation

Brookfield's financial management focuses on securing capital for growth, utilizing both debt and internally generated cash. This approach is key to achieving long-term, risk-adjusted returns for its unitholders.

Optimizing capital allocation across its diverse portfolio is a core activity. This involves strategic decisions on where to invest for the best financial outcomes.

Managing hedging activities is also vital. This helps to mitigate financial risks associated with market fluctuations, ensuring more predictable returns.

- Financing Growth: Brookfield leverages debt and internal cash flow to fund expansion. For instance, in Q1 2024, Brookfield Asset Management reported total assets of $925 billion, with a significant portion allocated to growth initiatives.

- Capital Optimization: The company actively manages its capital structure to maximize returns. This includes strategic divestitures and reinvestments in high-growth areas.

- Risk Mitigation: Hedging strategies are employed to protect against currency and interest rate volatility, a crucial element in managing a global asset base.

- Unitholder Returns: Effective financial management directly translates into delivering consistent, risk-adjusted returns to its unitholders, a primary objective.

Brookfield's key activities revolve around acquiring and managing essential infrastructure assets globally, focusing on sectors like utilities, transport, and data. They actively pursue both large platform investments and smaller, value-adding acquisitions to expand their existing portfolios.

Operational management emphasizes efficiency and cost savings across their asset base, aiming for high utilization and consistent cash flow. Capital is actively recycled through the sale of mature assets to fund new growth opportunities, a strategy exemplified by divestitures in 2024.

Organic growth is driven by initiatives such as inflation-linked pricing, increasing service volumes, and executing a substantial backlog of capital projects, with a $7.5 billion backlog reported in 2023. Financial management secures capital through debt and internal cash flow, optimizes allocation, and employs hedging to mitigate risks, all aimed at delivering strong unitholder returns.

| Key Activity | Description | 2024 Data/Example |

| Acquisition & Investment | Acquiring and investing in durable infrastructure assets. | $925 billion in AUM (Q1 2024), significant infrastructure allocation. |

| Operational Optimization | Driving value through efficiency and cost savings. | Focus on high utilization and consistent cash flow generation. |

| Capital Recycling | Selling mature assets to fund new ventures. | 2024 sale of Australian home services business. |

| Organic Growth | Leveraging existing assets via inflation indexation and volume growth. | $7.5 billion capital projects backlog (2023) on track for completion. |

| Financial Management | Securing capital, optimizing allocation, and managing risk. | Utilizing debt and internal cash flow; hedging currency and interest rate risks. |

Full Document Unlocks After Purchase

Business Model Canvas

The Brookfield Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what you'll get, ensuring no surprises and immediate usability. You can confidently evaluate the quality and comprehensiveness of the entire canvas before committing to your purchase.

Resources

Brookfield's primary key resource is its vast, globally diversified portfolio of essential infrastructure assets. This includes critical sectors like utilities, transportation networks, midstream energy infrastructure, and data centers, all of which are fundamental to modern economies.

These infrastructure assets are designed to provide stable and predictable cash flows, a key characteristic that underpins their value. For instance, as of early 2024, Brookfield's infrastructure group managed approximately $250 billion in assets under management, showcasing the sheer scale of this resource.

The essential nature of these services ensures consistent demand, even during economic downturns. This resilience is a significant advantage, contributing to the stability and long-term viability of the business model.

Brookfield Infrastructure's expertise is a cornerstone of its business model, encompassing the entire lifecycle of infrastructure assets. This includes identifying promising opportunities, executing complex acquisitions, managing development projects, and ensuring efficient, long-term operations.

Their management team is a key resource, boasting a proven history of creating value and achieving operational excellence across diverse infrastructure sectors. This deep bench of talent is crucial for navigating the complexities of global infrastructure.

As of the first quarter of 2024, Brookfield Infrastructure managed approximately $90 billion in assets, a testament to their ability to effectively deploy capital and manage large-scale operations. Their consistent performance, with funds from operations per share growing by 8% year-over-year in Q1 2024, highlights the strength of this expertise.

Brookfield's access to capital is a cornerstone of its business model, allowing it to pursue substantial growth opportunities. In 2023, Brookfield Asset Management reported approximately $850 billion in assets under management, a significant portion of which can be leveraged to support Brookfield Business Partners' (BBP) ventures.

This robust financial backing, including a strong credit rating and relationships with major financial institutions, enables BBP to fund large-scale acquisitions and development projects. For instance, in early 2024, BBP completed the acquisition of Apollo Global Management's majority stake in its home services business, a transaction facilitated by its deep capital reserves.

Long-Term Contracts and Regulated Rate Bases

Brookfield's business model heavily relies on long-term contracts and regulated rate bases, especially within its utilities and midstream operations. These agreements are crucial for revenue stability, offering predictable income streams that insulate the company from short-term market volatility.

These contractual structures are particularly evident in sectors where infrastructure development and maintenance are essential, such as power generation and transmission. For instance, many of Brookfield's regulated utility assets operate under frameworks that allow for cost recovery and a predetermined rate of return, ensuring consistent financial performance.

- Revenue Stability: Long-term contracts, often spanning decades, provide a predictable revenue base, reducing financial uncertainty.

- Regulated Rate Bases: In utility segments, regulated rate bases allow for recovery of invested capital and a fair return, ensuring consistent profitability.

- Predictable Cash Flows: These arrangements generate reliable cash flows, supporting ongoing investments and dividend payments.

- Reduced Market Sensitivity: The contractual nature of these revenue streams makes Brookfield less susceptible to fluctuations in commodity prices or broader economic downturns in these specific segments.

Global Presence and Regional Operating Teams

Brookfield's global presence is a cornerstone of its business model, with operations spanning North and South America, Asia Pacific, and Europe. This extensive footprint is bolstered by dedicated regional operating teams who possess intimate knowledge of local markets. These teams are crucial for effectively managing a diverse portfolio of assets and for pinpointing unique investment opportunities specific to each region. For instance, in 2024, Brookfield continued to leverage its regional expertise to navigate varying economic conditions and regulatory landscapes across these continents.

The company's operational structure is designed to maximize efficiency and capitalize on localized growth. By having on-the-ground teams, Brookfield can swiftly respond to market shifts and implement tailored strategies. This decentralized approach, managed centrally, allows for both broad oversight and granular control. In 2024, this global network facilitated significant deal flow and asset management across its key sectors.

- Geographic Reach: Operations in North America, South America, Asia Pacific, and Europe.

- Regional Expertise: Dedicated teams for effective local market management and opportunity identification.

- Asset Diversification: Ability to manage a wide array of assets across different global markets.

- Strategic Advantage: Local insights enable agile responses to regional economic and regulatory dynamics.

Brookfield's key resources also include its strong brand reputation and established relationships within the financial and industrial sectors. This trust and recognition facilitate access to deals, capital, and talent, which are critical for its growth strategy. The company's commitment to operational excellence and its track record of successful value creation further enhance its standing, making it a preferred partner for investors and counterparties.

Brookfield's diversified portfolio of essential infrastructure assets, managed by an expert team, forms the bedrock of its business. This is further strengthened by its significant access to capital, enabling large-scale investments and acquisitions. The company's strategic use of long-term contracts and regulated rate bases ensures revenue stability and predictable cash flows, while its global presence with localized expertise allows for effective management and opportunity capture.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Infrastructure Portfolio | Globally diversified essential assets (utilities, transport, energy, data centers). | Managed ~$250 billion in infrastructure assets (early 2024). |

| Management Expertise | End-to-end lifecycle management, operational excellence. | Funds from operations per share grew 8% YoY in Q1 2024. |

| Access to Capital | Strong financial backing, credit rating, institutional relationships. | Managed ~$850 billion AUM (2023), supporting ventures. |

| Long-Term Contracts/Regulated Rates | Revenue stability and predictable cash flows. | Crucial for utility and midstream operations, ensuring consistent profitability. |

| Global Presence | Operations across continents with regional expertise. | Facilitated significant deal flow and asset management across key sectors in 2024. |

Value Propositions

Brookfield Infrastructure's value proposition centers on delivering stable and predictable cash flows. This is primarily achieved through its ownership of essential infrastructure assets, which often operate under long-term contracts or regulatory frameworks. For instance, a significant portion of their revenue comes from agreements that provide a high degree of certainty, shielding them from short-term market volatility.

These contracted revenues are a cornerstone of their financial stability. In 2023, Brookfield Infrastructure reported that approximately 90% of its revenues were from regulated or contracted sources. This means that the income generated by their operations, such as toll roads, pipelines, and data centers, is largely predetermined, offering investors a reliable income stream that is less susceptible to economic downturns.

Brookfield aims to provide unitholders with compelling long-term risk-adjusted returns, balancing stable distributions with potential capital growth. This is achieved by focusing on acquiring and managing high-quality, essential businesses with predictable cash flows.

The company's strategy emphasizes disciplined capital allocation, meaning they carefully select investments that offer strong upside potential while managing associated risks. For example, in 2023, Brookfield completed several strategic acquisitions and dispositions, optimizing its portfolio for enhanced long-term performance and cash generation.

Brookfield's value proposition centers on offering investors access to a robust, diversified portfolio of essential global infrastructure. This includes vital sectors like utilities, transportation networks, midstream energy, and data infrastructure, all of which are fundamental to modern economic activity.

For instance, as of the first quarter of 2024, Brookfield Asset Management managed approximately $850 billion in assets under management, a significant portion of which is allocated to these critical infrastructure assets. This scale provides investors with broad exposure to sectors that often exhibit stable cash flows and resilience.

This diversification mitigates risk by spreading investments across various geographies and asset types. By investing in Brookfield, individuals and institutions can participate in the growth and stability of infrastructure projects that underpin daily life and economic progress globally.

Inflation Protection and Organic Growth

Brookfield's portfolio is strategically positioned to benefit from inflation, with many assets featuring inflation-indexed contracts. This means that as inflation rises, the revenue generated by these assets also increases, providing a natural hedge and protecting purchasing power. For example, in 2024, a significant portion of Brookfield's infrastructure and renewable power assets are subject to inflation-linked adjustments, directly translating into higher cash flows.

Beyond inflation protection, Brookfield actively pursues organic growth within its existing operations. This involves initiatives like expanding capacity, improving operational efficiency, and leveraging technological advancements to enhance asset performance. These efforts contribute to consistent growth in funds from operations (FFO), a key metric for real estate and infrastructure companies, demonstrating the inherent growth potential within the business model.

The combination of inflation protection and organic growth creates a robust value proposition for investors:

- Inflation Hedging: Assets with inflation-indexed revenue streams, such as toll roads and utility contracts, directly benefit from rising price levels, preserving real returns.

- Operational Enhancements: Continuous investment in optimizing asset performance and expanding capabilities drives internal growth and increases profitability.

- Predictable Cash Flows: The dual drivers of inflation adjustment and organic growth contribute to more stable and predictable cash flow generation, enhancing investment stability.

- Resilience in Economic Cycles: This strategy provides a degree of resilience, as inflation protection offers a buffer during periods of economic uncertainty, while organic growth ensures continued expansion.

Experienced Management and Strong Governance

Brookfield's management team brings extensive expertise in infrastructure, boasting a proven history of successful investments and operations. This deep industry knowledge is crucial for navigating complex global markets and identifying high-potential opportunities.

The company's commitment to strong corporate governance provides a solid foundation for its strategic decisions and operational execution. This framework ensures accountability and transparency, fostering trust among investors and stakeholders.

In 2024, Brookfield Asset Management reported significant growth, with assets under management reaching over $925 billion. This substantial figure underscores the confidence investors place in their experienced leadership and governance structures.

- Experienced Leadership: A management team with decades of experience in infrastructure and private equity.

- Strong Governance: Robust policies and oversight mechanisms ensuring accountability and ethical practices.

- Proven Track Record: Demonstrated success in value creation and operational improvement across diverse portfolios.

- Investor Confidence: High levels of investor trust, reflected in substantial and growing assets under management.

Brookfield Infrastructure offers investors access to a diversified portfolio of essential global assets, providing stable and predictable cash flows. This is bolstered by a significant portion of revenues derived from regulated or contracted sources, ensuring a reliable income stream. The company's strategic focus on acquiring and managing high-quality businesses further supports compelling long-term risk-adjusted returns.

Their value proposition also includes a strong inflation hedge, as many assets feature contracts indexed to inflation, directly increasing revenue with rising prices. This, combined with ongoing organic growth initiatives like capacity expansion and operational enhancements, creates a robust and resilient investment. For instance, as of Q1 2024, Brookfield Asset Management oversaw approximately $850 billion in assets, highlighting investor confidence in their strategy.

| Value Proposition Element | Description | Supporting Data/Example |

|---|---|---|

| Diversified Essential Infrastructure Access | Provides exposure to vital sectors like utilities, transportation, and data infrastructure globally. | As of Q1 2024, Brookfield Asset Management managed ~$850 billion in AUM, with significant allocation to infrastructure. |

| Stable and Predictable Cash Flows | Generated from long-term contracts and regulated frameworks, minimizing market volatility. | Approximately 90% of Brookfield Infrastructure's revenues were from regulated or contracted sources in 2023. |

| Inflation Hedging and Organic Growth | Assets with inflation-indexed contracts and continuous operational improvements drive consistent cash flow growth. | In 2024, a substantial part of their infrastructure and renewable power assets have inflation-linked adjustments. |

| Experienced Management and Strong Governance | Expertise in infrastructure investment and operations, supported by robust governance for accountability and trust. | By 2024, Brookfield Asset Management's AUM surpassed $925 billion, reflecting investor confidence in leadership. |

Customer Relationships

Brookfield Infrastructure secures its revenue through long-term contractual engagements, often spanning multiple years or even decades. This contractual backbone is crucial for predictable income, particularly in its utility, midstream, and data infrastructure segments.

These extended agreements provide a stable foundation, insulating revenue from short-term market volatility. For example, in 2024, a significant portion of Brookfield's earnings is derived from these stable, contracted assets, underscoring their importance to the business model.

For its regulated utility assets, Brookfield's customer relationships are fundamentally shaped by strict regulatory frameworks. These regulations ensure dependable service delivery and pre-defined pricing structures, fostering trust and predictability for customers.

Adherence to established service standards is paramount, guaranteeing a baseline level of quality and reliability that customers expect from essential utility providers.

Transparent communication channels are maintained to inform customers about service updates, pricing changes, and regulatory compliance, reinforcing accountability and customer understanding.

Brookfield prioritizes operational excellence and reliability to foster strong customer relationships. This commitment is crucial for sectors like transportation and data infrastructure, where consistent uptime and efficient service delivery are non-negotiable for customer satisfaction and loyalty.

In 2024, Brookfield’s infrastructure segment, which includes essential services, demonstrated robust performance. For instance, their investments in utilities and renewables often target high availability metrics, with many assets aiming for over 99% operational uptime, directly impacting customer trust and retention.

Strategic Partnerships with Large Corporations

Brookfield leverages strategic partnerships with large corporations, particularly in sectors like midstream energy and data infrastructure. These collaborations are designed to provide customized, long-term solutions that align with the operational requirements and expansion plans of their corporate clients.

For instance, Brookfield's investments in data centers often involve partnerships with major technology firms that require significant, reliable, and scalable data storage and processing capabilities. These arrangements ensure consistent demand and provide a stable revenue stream for Brookfield's infrastructure assets.

In 2024, Brookfield continued to expand its portfolio through such strategic alliances. A notable example is its ongoing development of critical infrastructure projects, often co-invested or contracted with major industrial and technology players, underscoring the value placed on these long-term relationships.

- Strategic Alliances: Brookfield forms deep partnerships with large corporations to deliver essential infrastructure.

- Sector Focus: Key areas include midstream energy and data infrastructure, where corporate needs are substantial and long-term.

- Tailored Solutions: Partnerships involve developing bespoke infrastructure that directly supports client operations and growth strategies.

- Revenue Stability: These long-term agreements provide predictable revenue streams and de-risk new project development.

Investor Relations and Transparency

Brookfield Infrastructure views its unitholders as a key customer segment, even though they don't directly use the company's infrastructure services. Maintaining open and consistent communication is paramount to fostering trust and confidence. This includes providing detailed financial reports, engaging presentations, and regular earnings calls to keep investors informed about the business's performance and strategic direction.

Transparency in investor relations is a cornerstone of Brookfield Infrastructure's strategy. For instance, in their 2024 investor updates, the company emphasized its commitment to clear communication regarding capital allocation and operational performance across its diverse portfolio of assets, which includes utilities, transport, energy, and data infrastructure.

- Proactive Communication: Regular updates via reports, investor presentations, and earnings calls.

- Financial Transparency: Clear reporting on performance and capital allocation strategies.

- Engagement: Facilitating dialogue through Q&A sessions and direct investor outreach.

- Trust Building: Demonstrating accountability and a clear path to value creation for unitholders.

Brookfield's customer relationships are built on long-term contracts and operational reliability, especially with corporate clients in sectors like data infrastructure and midstream energy. For its regulated utility assets, relationships are governed by regulatory frameworks ensuring service standards and transparent pricing, fostering trust.

Unitholders are treated as a key customer segment, with Brookfield prioritizing transparent financial reporting and consistent communication through earnings calls and presentations to maintain investor confidence. This approach is vital for securing capital and supporting long-term asset growth.

In 2024, Brookfield's focus on operational excellence, evidenced by high uptime metrics for assets like renewables and utilities, directly contributes to customer loyalty. Strategic alliances with major corporations, such as technology firms for data centers, provide customized solutions and stable revenue streams.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Relevance |

| Corporate Clients (e.g., Tech, Energy) | Long-term Contracts, Strategic Partnerships | Tailored infrastructure solutions, operational reliability | Drives demand for data centers and midstream assets |

| Regulated Utility Customers | Contractual, Regulatory Framework | Service standards, transparent pricing, reliable delivery | Ensures stable revenue and predictable service |

| Unitholders | Investor Relations | Financial transparency, proactive communication, performance reporting | Crucial for capital access and investor confidence |

Channels

Brookfield's primary channels for value delivery are its direct ownership and active management of a wide array of infrastructure assets. This hands-on strategy enables continuous operational enhancements and value creation across its portfolio.

Through this direct engagement, Brookfield can implement efficiency improvements and strategic upgrades, directly impacting asset performance and profitability. For instance, in 2024, Brookfield's infrastructure segment, which includes these directly operated assets, continued to demonstrate robust performance, contributing significantly to the company's overall earnings.

Brookfield's revenue streams are significantly bolstered by long-term service agreements and contracts. These arrangements are particularly prevalent in sectors like utilities, midstream infrastructure, and data services, ensuring a stable and predictable income. For instance, in 2024, Brookfield's infrastructure segment, which heavily relies on such contracts, continued to demonstrate robust performance.

These contracts often span multiple years, providing a strong foundation for financial planning and operational efficiency. Customers include a diverse range of entities, from large corporations to municipal governments, all seeking reliable service delivery. The recurring nature of these agreements allows Brookfield to invest confidently in its assets and service capabilities.

Brookfield's regulated utility assets, like those in its Infrastructure segment, operate under a system where prices for services are set by government regulators. These approved tariffs and rates, such as those governing electricity distribution or water supply, create a highly predictable revenue environment. For instance, in 2024, many regulated utilities continued to see stable returns driven by these pre-approved pricing structures, often linked to inflation or capital investment recovery.

Global Investment Platform and Network

Brookfield's global investment platform and extensive network are crucial for sourcing and securing new infrastructure projects worldwide. This interconnectedness allows them to tap into diverse markets and identify opportunities that might otherwise remain hidden.

This strategic advantage is supported by Brookfield's substantial assets under management, which reached approximately $925 billion as of December 31, 2023. This scale enables them to pursue large-scale infrastructure investments across various sectors, from renewable energy to transportation.

The network also facilitates strategic partnerships and co-investment opportunities, enhancing deal flow and risk diversification. For instance, in 2024, Brookfield announced several significant infrastructure acquisitions, leveraging its global presence to secure prime assets.

- Global Reach: Access to investment opportunities across North America, South America, Europe, and Asia.

- Sector Diversification: Investments span renewable power, infrastructure, real estate, and private equity.

- Partnership Ecosystem: Strong relationships with governments, pension funds, and other institutional investors.

- Deal Origination: Proprietary sourcing capabilities driven by deep market intelligence and relationships.

Digital Platforms and Investor Communications

Brookfield's digital platforms serve as crucial conduits for investor relations, offering direct access to vital information. The company website and dedicated investor portal are central hubs for financial reports, presentations, and governance documents, ensuring transparency.

Engagement extends through financial news outlets and live webcasts of earnings calls, which are critical for disseminating real-time strategic updates and performance metrics to a global investor base. For instance, in Q1 2024, Brookfield reported significant progress across its diverse portfolio, with detailed operational and financial highlights made available via these channels.

- Official Company Website: Primary source for annual reports, SEC filings, and corporate governance information.

- Investor Portals: Interactive platforms for accessing financial data, analyst presentations, and shareholder communications.

- Financial News Outlets: Key channels for disseminating press releases, market commentary, and company performance updates to the broader investment community.

- Earnings Call Webcasts: Live and archived broadcasts providing direct engagement with management and detailed financial performance reviews.

Brookfield utilizes its extensive global network and deep market intelligence to source and secure new infrastructure projects, acting as a primary channel for deal origination. This proactive approach, supported by approximately $925 billion in assets under management as of December 31, 2023, allows them to access diverse markets and identify unique investment opportunities.

These channels are further enhanced by strategic partnerships and co-investment opportunities, which are crucial for deal flow and risk diversification. In 2024, Brookfield actively leveraged this global presence to announce several significant infrastructure acquisitions, solidifying its market position.

The company's digital platforms, including its official website and investor portals, serve as vital channels for investor relations, providing direct access to financial reports and performance updates. Earnings call webcasts and financial news outlets are also key for disseminating real-time strategic information to a global investor base.

| Channel Type | Key Function | Example in 2024 |

|---|---|---|

| Global Network & Deal Origination | Sourcing and securing new projects | Announced multiple infrastructure acquisitions leveraging global presence |

| Digital Platforms (Website, Portals) | Investor relations, information dissemination | Provided detailed operational and financial highlights via investor portals |

| Earnings Calls & Financial News | Real-time updates, market commentary | Broadcasted Q1 2024 performance, detailing portfolio progress |

Customer Segments

Large industrial and commercial clients form a cornerstone of Brookfield's business, encompassing major corporations that depend on its extensive transport, midstream, and data infrastructure. These clients, including those utilizing rail networks, port facilities, pipelines, and data centers, often engage in long-term, contractual agreements for essential services.

In 2024, Brookfield's infrastructure assets are critical for global supply chains and digital connectivity, supporting the operational continuity of these large entities. For instance, their investments in critical transportation links ensure the efficient movement of goods, a vital component for manufacturing and retail giants.

Brookfield's utility operations directly serve millions of residential and commercial customers, providing critical services such as electricity and natural gas. In 2024, the company continued to be a major provider of these essential utilities across its diverse geographic footprint.

These customers rely on Brookfield for dependable energy connections and also for specialized services like sub-metering, which is crucial for many commercial properties and multi-unit residential buildings. The scale of their customer base underscores the fundamental role Brookfield plays in daily life and business operations.

Governmental and municipal entities represent a significant customer segment for Brookfield, especially in sectors like regulated utilities and essential transport infrastructure. These bodies often contract Brookfield for services or enter into public-private partnerships, relying on the company’s expertise to manage and operate critical public assets.

For instance, in 2024, Brookfield Renewable Partners continued to engage with various governmental bodies on renewable energy projects, underscoring the role of public sector collaboration in advancing sustainable infrastructure. The demand for reliable energy and transportation services from these entities remains robust, driven by population growth and economic development initiatives.

Global Trade and Logistics Companies

Global trade and logistics firms are key clients for Brookfield, leveraging its extensive portfolio of transportation infrastructure. These companies rely on Brookfield's ports, rail lines, and intermodal hubs to efficiently move and manage their cargo across international borders.

In 2024, global trade volumes continued to be a significant driver for the logistics sector. For instance, the International Monetary Fund (IMF) projected a modest but positive growth in global trade for the year, underscoring the ongoing need for robust logistics networks. Brookfield's assets are positioned to benefit from this demand.

- Port Operations: Facilitating the import and export of goods, handling containerized and bulk cargo.

- Rail Freight: Providing essential services for the long-haul transportation of raw materials and finished products.

- Intermodal Connectivity: Ensuring seamless transitions between different modes of transport, like ships, trains, and trucks.

- Warehousing and Distribution: Offering storage and supply chain management solutions to support global distribution networks.

Institutional Investors and Unitholders

Institutional investors and unitholders are a cornerstone for Brookfield Infrastructure Partners, seeking stable, long-term income streams and capital appreciation from diversified, essential infrastructure assets. These sophisticated investors, including pension funds, sovereign wealth funds, and large asset managers, are drawn to Brookfield's track record of acquiring and operating critical infrastructure globally. For instance, as of the first quarter of 2024, Brookfield Infrastructure reported approximately $94 billion in assets under management, a testament to the trust placed by these large-scale allocators.

These unitholders value Brookfield's disciplined approach to capital allocation and its focus on assets with predictable cash flows, such as regulated utilities, transportation networks, and data infrastructure. The partnership’s strategy often involves acquiring underperforming or non-core assets from governments or corporations and enhancing their operational efficiency and growth potential. This aligns with the long-term investment horizons of many institutional players, who benefit from the stable dividends and potential for growth that such assets provide.

Brookfield's commitment to sustainability and ESG (Environmental, Social, and Governance) principles also resonates strongly with institutional investors, many of whom have mandates to invest responsibly. The company’s efforts in areas like renewable energy infrastructure are increasingly important for attracting and retaining these significant capital pools. The consistent distribution growth, a key metric for many unitholders, has historically been a strong draw, demonstrating the partnership's ability to generate reliable returns.

- Key Investor Profile: Pension funds, sovereign wealth funds, insurance companies, and large asset managers.

- Investment Objective: Seeking stable, long-term income and capital growth from essential infrastructure.

- Attraction Factors: Diversified portfolio, predictable cash flows, operational expertise, and commitment to ESG.

- Financial Metric Focus: Consistent distribution growth and total unitholder returns.

Brookfield's customer base is diverse, including large industrial and commercial clients who rely on its essential infrastructure for operations. These clients, often engaged in long-term contracts, utilize services like rail, ports, and data centers, critical for global supply chains. In 2024, the company's infrastructure assets continued to be vital for the operational continuity of these major entities.

Residential and commercial customers are served through Brookfield's utility operations, providing essential electricity and natural gas. Millions depend on these reliable energy connections, with specialized services like sub-metering also being crucial for many properties. Brookfield's extensive customer reach highlights its fundamental role in daily life and business.

Governmental and municipal entities are key partners, particularly for regulated utilities and transport infrastructure. These bodies often collaborate with Brookfield through contracts or public-private partnerships to manage public assets. In 2024, renewable energy projects saw significant engagement with governmental bodies, showcasing public sector collaboration.

Global trade and logistics firms are significant clients, utilizing Brookfield's transportation infrastructure for efficient cargo movement. The ongoing demand for robust logistics networks, supported by positive global trade growth projections in 2024, benefits Brookfield's strategically positioned assets.

Cost Structure

Brookfield's operating and maintenance expenses are substantial, reflecting the sheer scale and diversity of its infrastructure holdings. These costs are crucial for ensuring the reliable functioning of assets like utilities, transportation systems, and data centers. In 2023, Brookfield reported approximately $1.7 billion in maintenance and repair expenses across its business segments, a figure that underscores the ongoing investment required to keep its vast portfolio in top condition.

Brookfield's infrastructure focus means financing and interest costs are significant. For example, in 2023, Brookfield Asset Management reported interest expenses of approximately $2.3 billion, reflecting the substantial debt used to fund its vast portfolio of infrastructure assets and development projects.

These borrowing costs are directly tied to the capital-intensive nature of their operations, impacting profitability. The company's ability to manage its debt load and secure favorable interest rates is crucial for maintaining healthy returns on its investments.

Brookfield's business model necessitates significant capital expenditures to both sustain its current operations and fuel expansion. These investments are critical for maintaining the quality and efficiency of its existing assets, ensuring they remain competitive and productive.

In 2024, Brookfield continued to allocate substantial capital towards growth, with a focus on expanding operational capacity and integrating new technologies. For instance, investments in renewable energy projects, a key growth area, are designed to capitalize on the increasing demand for sustainable power solutions.

Acquisition and Transaction Fees

Brookfield's cost structure includes significant acquisition and transaction fees. These costs are directly tied to their strategy of identifying, evaluating, and acquiring new infrastructure assets. Think of it as the price of doing business when expanding their portfolio.

These fees are a necessary component of their capital recycling and growth initiatives. For instance, in 2023, Brookfield Asset Management reported approximately $1.2 billion in transaction and advisory fees, reflecting the active management and acquisition of assets.

- Transaction Fees: Paid to intermediaries and advisors involved in the purchase of assets.

- Due Diligence Costs: Expenses incurred for legal, financial, and operational reviews of potential acquisitions.

- Integration Expenses: Costs associated with bringing newly acquired assets into Brookfield's existing management structure.

- Advisory Services: Fees paid for expert advice during the acquisition process.

General and Administrative Expenses

General and administrative expenses encompass the essential overhead that keeps Brookfield's corporate engine running. This includes costs associated with executive leadership, HR, finance, and legal departments, ensuring smooth operations and adherence to regulatory standards. In 2024, these costs are projected to represent a significant portion of the company's operating budget, reflecting the complexity of managing a global portfolio.

A key component of these expenses is the management fees paid to Brookfield Asset Management. These fees are structured to align the interests of the asset manager with those of the business, typically based on assets under management and performance. For instance, in prior years, similar fee structures have seen substantial outflows, underscoring the importance of efficient management and performance generation.

- Corporate Overhead: Costs for central management, HR, IT, and finance functions.

- Legal and Compliance: Expenses related to regulatory adherence and legal counsel.

- Management Fees: Payments to Brookfield Asset Management for strategic oversight and operational guidance.

- Other Administrative Costs: Includes office space, utilities, and general operational support.

Brookfield's cost structure is heavily influenced by its capital-intensive infrastructure operations, requiring significant outlays for maintenance, financing, and expansion. These costs are managed through efficient operations and strategic debt management to ensure profitability. The company also incurs substantial transaction and administrative expenses related to its acquisition strategy and global management.

| Cost Category | 2023 (Approx.) | 2024 Projection/Focus |

|---|---|---|

| Operating & Maintenance | $1.7 billion (Maintenance & Repair) | Continued investment in asset upkeep and operational efficiency. |

| Financing Costs | $2.3 billion (Interest Expense) | Managing debt for capital-intensive projects, seeking favorable rates. |

| Capital Expenditures | Ongoing investment in existing assets and expansion. | Focus on renewable energy projects and technological integration. |

| Transaction & Advisory Fees | $1.2 billion (Transaction & Advisory Fees) | Costs associated with asset acquisition and portfolio growth. |

| General & Administrative | Significant portion of operating budget. | Includes corporate overhead, legal, compliance, and management fees. |

Revenue Streams

Brookfield's core revenue generation relies heavily on contracted and regulated income streams. These are typically secured through long-term agreements, often with built-in inflation adjustments or take-or-pay clauses, providing a robust foundation for predictable cash flows across its diverse utility, transport, midstream, and data infrastructure assets.

For instance, in 2024, a significant portion of Brookfield's earnings will continue to be supported by these stable revenue models. The company's regulated utility operations, like those in Australia and North America, benefit from predictable returns set by regulatory bodies, ensuring a consistent revenue base even during economic downturns.

Brookfield generates revenue through volume and usage-based fees across its diverse infrastructure assets. For instance, its toll roads, like the 407 ETR in Ontario, Canada, collect significant revenue from drivers based on distance traveled. In 2023, the 407 ETR reported revenues of approximately CAD $1.3 billion, demonstrating the substantial income potential from such usage charges.

Brookfield Business Partners, a key player in global asset management, generates substantial revenue through acquisition and disposition gains, often termed capital recycling. This strategy involves identifying undervalued businesses or assets, acquiring them, improving their performance, and then selling them at a profit. This cycle is a core driver of their overall returns.

In 2024, Brookfield Business Partners continued to execute this strategy effectively. For instance, their disposition of Westinghouse in late 2023, following a period of operational improvements, generated significant gains that contributed positively to their financial results in early 2024. This demonstrates the power of their approach to unlocking value.

New Project Commissioning and Expansion

Brookfield's revenue streams benefit significantly from new project commissioning and the expansion of existing infrastructure. This growth directly correlates with increased capacity and a broader range of services offered to clients.

For instance, in 2024, Brookfield Asset Management reported substantial growth in its infrastructure segment, driven by the completion and commencement of operations for several key projects across North America and Europe. This strategic expansion not only boosts current revenue but also sets the stage for sustained income generation through long-term service agreements and operational efficiencies.

- New Project Commissioning: Revenue generated from the initial operational phase of newly completed capital projects.

- Infrastructure Expansion: Income derived from increasing the capacity or scope of existing infrastructure assets, leading to higher utilization and service fees.

- Capacity Growth: Direct impact on revenue through the ability to serve more clients or handle greater volumes of business due to expanded infrastructure.

- Service Offering Enhancement: Additional revenue streams created by introducing new or improved services enabled by project expansions.

Inflation Indexation

Brookfield's revenue streams benefit significantly from inflation indexation. Many of their contracts and regulated rates are directly tied to inflation, meaning as prices rise, their revenues naturally increase. This provides a built-in mechanism for organic growth.

For instance, in 2024, many of Brookfield's infrastructure assets, which often operate under long-term contracts, saw revenue adjustments reflecting the prevailing inflation rates. This strategy helps to preserve the real value of their earnings and provides a predictable revenue uplift, even in an inflationary environment.

- Inflation Adjustment: Contracts and regulated rates are linked to inflation indices, ensuring revenue growth aligns with rising costs.

- Organic Growth Driver: Inflation indexation acts as a natural catalyst for revenue expansion, contributing to the company's organic growth.

- Value Preservation: This mechanism helps maintain the real value of Brookfield's earnings by offsetting the erosive effects of inflation.

Brookfield's revenue generation is multifaceted, encompassing contracted income, usage fees, and capital gains from asset management. Their strategy focuses on acquiring, improving, and divesting assets, a model that proved fruitful in 2023 and continued into 2024 with significant dispositions. This approach, combined with growth from new project commissioning and inflation-linked contracts, ensures a resilient and expanding revenue base.

| Revenue Stream Category | Key Drivers | 2023/2024 Data Point Example |

|---|---|---|

| Contracted & Regulated Income | Long-term agreements, regulatory frameworks | Regulated utilities in North America and Australia provided stable, predictable returns. |

| Usage & Volume Fees | Traffic volumes, service utilization | 407 ETR toll road revenue reached approximately CAD $1.3 billion in 2023. |

| Acquisition & Disposition Gains | Capital recycling, value enhancement | Disposition of Westinghouse in late 2023 contributed to early 2024 financial results. |

| Project Commissioning & Expansion | New infrastructure operationalization, capacity growth | Substantial growth in infrastructure segment driven by new project completions in North America and Europe in 2024. |

| Inflation Indexation | Contractual adjustments to inflation | Revenue adjustments for infrastructure assets in 2024 reflected prevailing inflation rates. |

Business Model Canvas Data Sources

The Brookfield Business Model Canvas is informed by a robust blend of internal financial statements, investor relations reports, and operational performance data. This comprehensive approach ensures each component of the canvas is grounded in empirical evidence.