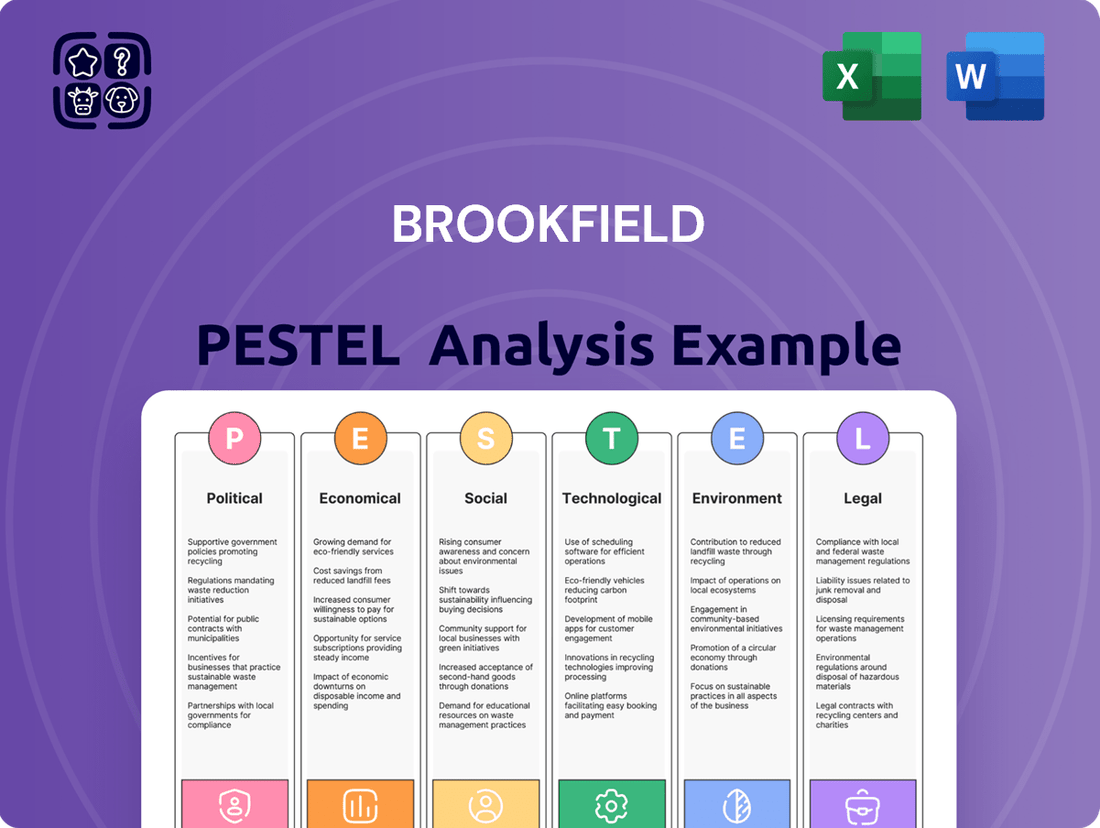

Brookfield PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Brookfield's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to navigate market complexities and identify emerging opportunities. Download the full report to gain actionable intelligence and sharpen your competitive edge.

Political factors

Governments globally are prioritizing infrastructure upgrades, spurred by aging systems, economic development goals, and climate resilience efforts. This surge in spending creates substantial opportunities for infrastructure companies.

The U.S. Infrastructure Investment and Jobs Act (IIJA) is a prime example, injecting billions into critical sectors like transportation, utilities, and broadband. This legislation is expected to support over 40,000 projects and foster significant job creation through 2025, directly benefiting entities like Brookfield Infrastructure Partners.

Political stability and clear regulatory environments are paramount for substantial infrastructure investments. Brookfield Infrastructure Partners prioritizes regions with strong legal systems and a demonstrated need for private capital in developing essential infrastructure.

While Europe is reinforcing its sustainability agenda with initiatives like the Corporate Sustainability Reporting Directive (CSRD), which came into effect for large EU companies in January 2024, the United States is experiencing policy shifts that could influence investment structures.

Brookfield's global portfolio, valued at approximately $100 billion as of early 2024, is strategically positioned to navigate these varying political landscapes, seeking opportunities in countries that offer predictable policy frameworks for long-term asset development.

Global geopolitical tensions and evolving trade policies present a complex landscape for the infrastructure sector. These shifts can create uncertainty, impacting investment decisions and project timelines across the industry.

Brookfield Infrastructure's business model, focused on essential regional networks that generate revenue through usage fees, offers a degree of resilience against direct trade tariff impacts. Unlike businesses involved in the production and export of goods, their core operations are less exposed to the immediate effects of trade disputes.

However, indirect consequences, such as broader inflationary pressures stemming from supply chain disruptions or increased energy costs, could still influence Brookfield's operations. The company's strategy involves leveraging its robust balance sheet and the inflation-linked nature of many of its cash flows to manage these potential headwinds effectively.

National Interest and Energy Security

The drive to protect national interests and ensure energy security is a major force shaping infrastructure policy. This focus is especially noticeable in areas like Canadian midstream, where government attention to energy security is boosting the outlook for ongoing investment. Brookfield Infrastructure sees this trend as a key opportunity.

Governments worldwide are prioritizing domestic energy production and supply chain resilience, directly impacting infrastructure development. For instance, in 2024, Canada's federal government continued to emphasize energy security, with policies aimed at supporting the development of critical energy infrastructure. This national interest in reliable energy sources translates into a more favorable environment for projects like pipelines and storage facilities.

- National Security Imperative: Governments are increasingly viewing energy infrastructure as a matter of national security, leading to policies that favor domestic production and reliable supply chains.

- Canadian Midstream Focus: In Canada, the midstream sector is experiencing bolstered investment prospects due to a heightened governmental focus on energy security, a trend expected to continue through 2025.

- Brookfield's Strategic View: Brookfield Infrastructure recognizes these geopolitical shifts and views the emphasis on national energy security as a significant catalyst for future investment and development opportunities within its portfolio.

Public-Private Partnerships (PPPs)

Governments worldwide are increasingly turning to private investment to fund crucial infrastructure projects, a trend amplified by the ongoing infrastructure investment gap. This reliance on private capital, especially through public-private partnerships (PPPs), presents significant opportunities for investors seeking favorable risk-reward profiles.

Brookfield Infrastructure, a prominent global owner and operator of essential infrastructure assets, is strategically positioned to leverage this shift. By collaborating with governments, Brookfield can engage in the development and delivery of vital projects, aligning private sector efficiency with public sector needs.

For instance, in 2024, the European Union continued its robust support for PPPs as a key mechanism for infrastructure development, with significant project pipelines announced across transportation and energy sectors. This focus underscores the growing importance of these partnerships. Brookfield's participation in such initiatives allows it to tap into a growing market driven by public policy and private capital availability.

- Growing Infrastructure Deficit: Global infrastructure needs are estimated to be in the trillions, creating a substantial role for private capital.

- PPP Growth in Europe: European countries are actively promoting PPPs, with project pipelines valued in the tens of billions of euros annually, offering attractive investment avenues.

- Brookfield's Strategic Advantage: As a major infrastructure player, Brookfield can secure and execute large-scale PPP projects, benefiting from its operational expertise and financial capacity.

- Governmental Support: Favorable regulatory environments and government backing for PPPs in key markets enhance the viability and attractiveness of these investments.

Governmental focus on infrastructure investment, particularly in North America and Europe, continues to drive opportunities for companies like Brookfield. The U.S. Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, is projected to allocate over $1.2 trillion through 2025, with a significant portion dedicated to infrastructure upgrades. This provides a strong tailwind for projects in transportation, utilities, and broadband.

Geopolitical shifts and a heightened emphasis on national security are also influencing infrastructure policy, especially in energy. Canada's continued focus on energy security through 2025 is expected to bolster investment in its midstream sector, a key area for Brookfield Infrastructure. This policy direction supports the development of essential energy networks.

Public-private partnerships (PPPs) remain a crucial mechanism for funding infrastructure globally. In 2024, the European Union continued to champion PPPs, with substantial project pipelines across various sectors. Brookfield's ability to engage in these partnerships allows it to capitalize on the growing need for private capital in public infrastructure development.

| Policy/Initiative | Estimated Investment (USD billions) | Focus Area | Expected Impact Period |

|---|---|---|---|

| U.S. Infrastructure Investment and Jobs Act (IIJA) | ~ $1,200 (total) / ~ $550 (new spending) | Transportation, Utilities, Broadband | Through 2025 |

| European PPP Project Pipelines | Tens of billions annually | Transportation, Energy, Digital | Ongoing (2024-2025) |

| Canadian Energy Security Initiatives | Varies by project | Midstream Energy Infrastructure | Ongoing (2024-2025) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Brookfield, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Brookfield's PESTLE analysis offers a clear, summarized version of complex external factors, simplifying strategic discussions and ensuring all stakeholders grasp key market dynamics.

Economic factors

Brookfield Infrastructure Partners navigates a complex economic landscape shaped by persistent inflation and evolving interest rate expectations. While inflation, which saw the US CPI at 3.3% year-over-year in May 2024, can pressure operating costs, a significant portion of Brookfield's revenue is tied to inflation-linked contracts. This provides a crucial buffer, allowing revenue to grow faster than expenses, thereby protecting and potentially expanding profit margins.

The anticipated shift towards declining interest rates presents a dual benefit for Brookfield. Lower rates are expected to reduce the cost of refinancing its substantial debt, a key consideration for any infrastructure operator with significant capital requirements. Furthermore, a lower interest rate environment typically makes dividend-paying assets, like Brookfield's, more appealing to income-seeking investors, potentially boosting its share price and access to capital, even as infrastructure fundraising faced headwinds in 2024, with global infrastructure fundraising declining by 15% year-over-year according to Preqin data.

Sustained global economic growth is a powerful engine for infrastructure development. As economies expand, so does the need for reliable transportation networks, energy distribution, and digital connectivity. Brookfield Infrastructure Partners is well-positioned to capitalize on this trend, seeing increased activity in its transport segment, which includes toll roads and rail, and its midstream operations, such as pipelines. For instance, global GDP growth was projected to be around 3.1% in 2024 by the IMF, a figure that underpins the demand for these essential services.

The increasing demand for data is another significant driver. As digitalization accelerates across industries and consumer behavior shifts towards more online activities, the need for data centers and communication infrastructure intensifies. Brookfield's investment in its data segment, which includes fiber networks and data centers, directly benefits from this digital transformation. The global data center market alone was valued at over $200 billion in 2023 and is expected to grow substantially in the coming years, reflecting this surging demand.

Brookfield's diversified portfolio across utilities, transport, midstream, and data sectors provides resilience. This spread allows the company to benefit from infrastructure needs that arise regardless of specific economic cycles. Whether it's the stable demand for utilities during economic downturns or the growth-driven expansion in transport and data during upswings, Brookfield's strategy is designed to capture opportunities across the economic spectrum.

Brookfield Infrastructure's capital deployment strategy hinges on active capital recycling, a process where mature assets are sold to finance new, high-growth acquisitions. This approach has enabled the company to consistently fund a robust pipeline of opportunities, with billions generated from asset sales and reinvested into new ventures.

In the second quarter of 2025, Brookfield Infrastructure highlighted the success of these initiatives, reporting strong operational performance across its portfolio and significant realized gains specifically from its capital recycling efforts. This ongoing cycle of selling and reinvesting is key to enhancing overall asset value and maintaining a dynamic growth trajectory.

Valuation Gaps and Investment Opportunities

Brookfield Infrastructure's current market position suggests a valuation gap, with many analysts pointing to significant upside potential. Despite broader market fluctuations, the company's portfolio of high-quality, cash-generating assets is seen as undervalued by a notable margin.

The company's strategic emphasis on essential infrastructure, coupled with a disciplined investment philosophy, allows it to capitalize on market dislocations. This 'back to basics' approach enables Brookfield Infrastructure to uncover compelling opportunities even when economic uncertainty is high.

- Analyst Price Targets: As of late 2024, several prominent financial institutions have issued price targets for Brookfield Infrastructure (BIP) suggesting potential gains of 15-20% over the next 12-18 months, reflecting the perceived undervaluation.

- Asset Quality: Brookfield Infrastructure's portfolio, which includes regulated utilities, transportation assets, and data infrastructure, consistently demonstrates strong margin profiles, often exceeding 60% EBITDA margins in key segments.

- Dividend Growth: The company has a history of consistent dividend growth, aiming for 3-7% annually, which further enhances its attractiveness to investors seeking stable income and capital appreciation amidst valuation gaps.

Currency Fluctuations and Foreign Exchange Impacts

Brookfield Infrastructure's global operations mean it's constantly navigating currency fluctuations. For instance, in the second quarter of 2025, while funds from operations (FFO) showed a healthy increase, this positive trend was tempered by adjustments from its foreign exchange hedging activities.

Despite these hedging impacts, the company's core business performance remains robust. When you strip away the effects of currency swings, Brookfield's underlying operations demonstrated strong growth throughout 2024 and into early 2025.

- Global Exposure: Brookfield Infrastructure's diverse asset base across multiple countries inherently exposes it to foreign exchange risk.

- Hedging Impact: Mark-to-market changes on its corporate foreign exchange hedging program can create volatility in reported earnings, as seen in Q2 2025 results.

- Underlying Strength: Excluding foreign exchange effects, the company's operational performance has been consistently strong, indicating resilient business fundamentals.

- 2024/2025 Performance: The company has actively managed its currency exposures, with underlying business growth reported as strong throughout the 2024 fiscal year and continuing into the first half of 2025.

Brookfield Infrastructure Partners' economic positioning is robust, benefiting from inflation-linked contracts that shield revenue against rising costs. The anticipated decline in interest rates in 2024-2025 is a significant tailwind, reducing debt servicing expenses and increasing the appeal of its dividend-paying assets.

Global economic expansion, projected at 3.1% for 2024 by the IMF, fuels demand for Brookfield's core infrastructure services like transport and midstream operations. The accelerating digitalization trend is a major growth driver for its data segment, with the global data center market already exceeding $200 billion in 2023.

Brookfield's diversified portfolio across utilities, transport, midstream, and data provides resilience, allowing it to capture opportunities across various economic cycles. The company's active capital recycling strategy, demonstrated by billions generated from asset sales in 2024-2025, consistently fuels new growth initiatives.

| Economic Factor | Brookfield's Position/Impact | Supporting Data (2024-2025) |

| Inflation | Revenue growth through inflation-linked contracts provides a buffer against cost increases. | US CPI at 3.3% YoY (May 2024). |

| Interest Rates | Lower rates reduce debt costs and enhance asset attractiveness. | Anticipated rate cuts in 2024-2025. |

| Economic Growth | Drives demand for transport and midstream infrastructure. | IMF projected global GDP growth of 3.1% for 2024. |

| Digitalization | Boosts demand for data centers and communication infrastructure. | Global data center market valued over $200 billion in 2023. |

| Capital Recycling | Funds new acquisitions and enhances asset value. | Billions generated from asset sales and reinvested in new ventures. |

Same Document Delivered

Brookfield PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Brookfield PESTLE analysis covers all critical external factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You can trust that the detailed breakdown of political, economic, social, technological, legal, and environmental influences on Brookfield will be yours to explore.

The content and structure shown in the preview is the same document you’ll download after payment. Dive into a thorough examination of how these PESTLE elements shape Brookfield's business landscape and future opportunities.

Sociological factors

Global urbanization continues its upward trajectory, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This surge fuels a significant demand for enhanced infrastructure, especially in utilities, transportation, and data networks. Brookfield Infrastructure's strategic focus on these essential services directly benefits from these demographic shifts, necessitating continuous investment in development and upkeep to serve expanding urban populations.

Societal expectations are increasingly pushing businesses towards greater environmental and social responsibility. This means infrastructure projects, like those Brookfield is involved in, are scrutinized more than ever for their impact. For instance, a 2024 survey indicated that over 70% of consumers consider a company's sustainability efforts when making purchasing decisions, a trend that extends to investor sentiment and regulatory pressure.

Brookfield Infrastructure actively addresses these shifting norms by embedding sustainability into its core operations. Their 2024 sustainability report highlights a 15% reduction in Scope 1 and 2 emissions across their portfolio compared to a 2019 baseline, demonstrating a tangible commitment to responsible practices that resonate with stakeholders demanding better corporate citizenship.

The availability of robust infrastructure, like clean water and reliable electricity, significantly shapes the quality of life for people worldwide. Brookfield Infrastructure's investments in these essential services, such as its US$2.9 billion investment in Triton International, a container leasing company, underscore its role in supporting public health and economic stability.

These operational assets are crucial for the daily functioning of communities, directly impacting everything from personal safety to economic productivity. For instance, in 2023, Brookfield Infrastructure's regulated utilities segment reported strong performance, reflecting the consistent demand for these foundational services.

Workforce Development and Labor Shortages

The infrastructure sector, including companies like Brookfield, is grappling with significant labor shortages, especially in construction roles. This scarcity impacts the ability to initiate and complete projects efficiently. For instance, the U.S. Bureau of Labor Statistics reported in early 2024 that the construction industry had over 300,000 job openings.

Brookfield Infrastructure must prioritize strategies to attract and retain a skilled workforce to ensure the successful execution of its diverse portfolio of assets. This involves investing in training programs and competitive compensation packages.

- Skilled Labor Gap: A persistent shortage of skilled tradespeople, from electricians to heavy equipment operators, hinders project timelines and increases labor costs.

- Demographic Shifts: An aging workforce and fewer young people entering skilled trades exacerbate the labor availability issue.

- Training Investment: Brookfield's commitment to internal training and partnerships with educational institutions is vital for building a sustainable talent pipeline.

- Productivity Impact: Labor shortages directly affect the pace of infrastructure development and maintenance, potentially delaying crucial upgrades and new builds.

Community Engagement and Social License

Brookfield Infrastructure places significant emphasis on community engagement to secure its social license to operate. This involves actively fostering strong relationships with stakeholders and ensuring that the well-being of local communities is woven into its strategic business decisions. For instance, Brookfield's 2023 annual report highlighted ongoing dialogue with indigenous groups in Canada regarding its energy transmission projects, aiming to address concerns and build collaborative partnerships.

Public perception and support are vital for infrastructure projects, especially those involving natural resources. Brookfield's commitment to community benefit agreements, such as those implemented for its wind farm developments in Brazil, demonstrates an understanding that local acceptance underpins project viability and long-term operational success. These agreements often include local employment targets and community investment funds, fostering goodwill and mitigating potential opposition.

- Stakeholder Relations: Brookfield prioritizes ongoing dialogue with local communities, indigenous groups, and government bodies to maintain positive relationships.

- Community Investment: The company often invests in local infrastructure, social programs, and employment opportunities as part of its commitment to community well-being.

- Social License: Public acceptance and support are critical for Brookfield's project approvals and successful long-term operations, particularly in sensitive sectors like energy.

- Risk Mitigation: Proactive community engagement helps mitigate reputational risks and potential project delays or cancellations stemming from social opposition.

Societal trends toward health and wellness are influencing infrastructure demands, particularly for services like clean water and efficient transportation networks. Brookfield's investments in these areas support improved public health outcomes and economic activity, as seen in its continued focus on regulated utilities. For example, the company's 2023 performance in this segment highlights the consistent demand for these essential services.

Technological factors

The relentless march of global digitalization presents a fertile ground for Brookfield Infrastructure, especially within its burgeoning data segment. This trend is not just about more internet use; it's a fundamental shift in how businesses and individuals operate.

The rapid integration of artificial intelligence is a key catalyst, dramatically reshaping the demand for digital infrastructure. This translates into a significant uptick in the need for robust data centers, extensive fiber optic networks, and advanced wireless towers to support AI's computational and connectivity requirements.

Brookfield's data segment has already demonstrated impressive growth, reflecting its strategic positioning. The company continues to actively invest in assets crucial for the digital ecosystem, such as data centers and telecommunications infrastructure, anticipating sustained demand.

Artificial intelligence is significantly boosting demand for digital infrastructure, a core area for Brookfield. AI's integration into operations is enhancing efficiency, evident in predictive maintenance for infrastructure assets and optimized energy usage. For instance, the global AI market was projected to reach over $1.5 trillion by 2030, underscoring the substantial growth potential in this sector.

Brookfield is well-positioned to capitalize on AI's widespread adoption, particularly through its data center investments. These facilities are crucial for supporting the massive data processing needs of AI applications, from advanced analytics to smart city initiatives. The company's exposure to digital infrastructure aligns directly with the increasing reliance on AI across various industries.

Technological advancements are fundamentally reshaping the infrastructure sector, particularly concerning the global shift towards cleaner energy sources. Brookfield Infrastructure is actively participating in this energy transition, evident in its substantial investments in renewable energy projects, such as wind and solar farms, and innovative solutions like electric heat pump networks for residential developments. These initiatives directly contribute to reducing carbon emissions and aligning with broader sustainability goals.

The company's strategic direction clearly emphasizes long-term sustainability, with a dedicated focus on areas like biodiversity finance, the energy transition itself, and bolstering climate resilience across its portfolio. This forward-looking approach is crucial as technologies enabling decarbonization continue to mature and become more economically viable, creating new investment opportunities and operational efficiencies.

Smart Infrastructure and Asset Management

The increasing sophistication of infrastructure, driven by data analytics and advanced technologies, necessitates a more adaptive approach to asset management. Brookfield Infrastructure is strategically positioned to leverage these advancements.

Deployment of sensors and AI for data interpretation is crucial for optimizing asset performance, enhancing revenue generation, and refining capital expenditure timing. For instance, in 2024, investments in digital infrastructure are projected to grow significantly, with the global smart infrastructure market expected to reach over $2 trillion by 2030, indicating a strong trend towards data-driven asset optimization.

- Enhanced Utilization: Smart technologies allow for real-time monitoring and predictive maintenance, increasing the operational uptime and utilization rates of assets like toll roads or utilities.

- Optimized Capital Allocation: Data-driven insights enable more precise forecasting of asset needs, leading to better timing of capital expenditures and improved return on investment.

- AI-Driven Efficiency: Artificial intelligence can process vast datasets from sensors to identify inefficiencies and opportunities for performance improvement across Brookfield's diverse portfolio.

Cybersecurity Risks in Digital Infrastructure

As infrastructure increasingly relies on digital systems, the need for strong cybersecurity becomes critical. Protecting essential assets from cyberattacks is vital for maintaining operations and safeguarding data.

The financial services sector, for instance, experienced a significant increase in cyberattacks. In 2023, the sector reported a 40% rise in ransomware attacks compared to the previous year, highlighting the growing threat landscape.

Brookfield, like many large infrastructure and real estate companies, faces inherent technological risks related to its digital infrastructure. This includes safeguarding sensitive financial data and ensuring the uninterrupted operation of its digital platforms.

- Growing Threat Landscape: Cyberattacks on critical infrastructure sectors are on the rise globally.

- Financial Impact: A single major cyber breach can result in millions of dollars in recovery costs and lost revenue.

- Operational Continuity: Ensuring the resilience of digital infrastructure is paramount for maintaining business operations and service delivery.

Technological advancements are fundamentally reshaping infrastructure, particularly with the surge in AI and digitalization. Brookfield's data segment is a prime beneficiary, with AI driving demand for data centers and fiber networks. The global AI market's projected growth to over $1.5 trillion by 2030 highlights this opportunity.

Smart technologies and AI are enhancing asset management through real-time monitoring and predictive maintenance, optimizing operational efficiency and capital allocation. The global smart infrastructure market is expected to exceed $2 trillion by 2030, underscoring the trend towards data-driven optimization.

| Technology Trend | Impact on Brookfield | Supporting Data |

|---|---|---|

| Digitalization & AI | Increased demand for data centers and telecom infrastructure. | Global AI market projected to reach $1.5T+ by 2030. |

| IoT & Data Analytics | Enhanced asset performance, predictive maintenance, and optimized CAPEX. | Global smart infrastructure market to exceed $2T by 2030. |

| Cybersecurity | Critical need to protect digital assets and sensitive data. | 40% rise in ransomware attacks in financial services (2023). |

Legal factors

Brookfield Infrastructure Partners navigates a complex web of regulations, necessitating meticulous adherence to filing requirements with bodies like the SEC and Canadian securities commissions. This includes the timely submission of annual reports and detailed financial statements, crucial for maintaining transparency and investor confidence.

The increasing emphasis on environmental, social, and governance (ESG) factors presents a significant legal consideration. For instance, compliance with Europe's Corporate Sustainability Reporting Directive (CSRD), which mandates detailed ESG disclosures, is becoming a critical aspect of regulatory engagement for global entities like Brookfield.

Brookfield Infrastructure's large-scale projects face intricate permitting processes across federal, state, and local jurisdictions, directly influencing development timelines and expenses. For instance, the US permitting process for major infrastructure can extend for years, with significant variability depending on the project's scope and location. Streamlining these reviews is vital for fostering sustainable growth within the infrastructure industry.

Brookfield's success hinges on its proficiency in navigating these complex regulatory landscapes. Efficiently managing permit applications and approvals is a critical factor for the company's ongoing growth strategies and the timely execution of its development pipeline.

Strict environmental regulations, especially concerning emissions and resource consumption, significantly influence infrastructure operations. Brookfield Infrastructure actively works to reduce its environmental footprint and boost resource efficiency, a core part of its sustainability strategy. This aligns with the ambitious target of achieving net-zero greenhouse gas emissions by 2050.

Compliance with evolving environmental standards, such as the UK's Future Homes Standard which mandates higher energy efficiency for new builds, showcases this dedication. These regulations can necessitate substantial capital investment in upgrades and new technologies to meet compliance requirements, impacting project timelines and costs.

Antitrust and Competition Laws

Brookfield Infrastructure, as a major global infrastructure operator, navigates a complex web of antitrust and competition laws. These regulations are designed to foster fair market practices and prevent the concentration of market power, directly impacting Brookfield's acquisition strategies and operational scope across diverse geographies.

The company's growth, particularly through mergers and acquisitions, often requires scrutiny from competition authorities. For instance, in 2023, the European Commission continued to review significant M&A deals across various sectors, including infrastructure, to ensure no undue market distortion. Brookfield’s proposed or completed transactions are therefore subject to these ongoing regulatory assessments, which can impose conditions or, in some cases, block deals entirely.

- Regulatory Oversight: Antitrust bodies globally, such as the U.S. Federal Trade Commission (FTC) and the Directorate-General for Competition of the European Commission, actively monitor market concentration.

- Merger Control: Brookfield's acquisition of infrastructure assets, like its 2023 bid for Australian energy company AusNet Services, necessitates compliance with merger control regulations, which assess potential impacts on competition.

- Abuse of Dominance: Operations in markets where Brookfield holds a significant share are subject to rules preventing the abuse of dominant positions, ensuring fair pricing and access for competitors.

Contractual Agreements and Concession Laws

Brookfield Infrastructure's revenue streams are intrinsically tied to long-term contracts and concession agreements, often with built-in inflation adjustments. These legal frameworks dictate crucial aspects like service provisions, pricing structures, and how disputes are handled, all of which are vital for the company's consistent cash flow generation.

Changes in legislation governing these concessions, or even contract breaches, can have a substantial negative effect on Brookfield's financial health. For instance, in 2023, the company successfully renewed a 25-year concession for its Australian electricity transmission assets, securing predictable revenue through 2048.

- Contractual Stability: Brookfield's business model depends on the enforceability and longevity of its concession and service contracts.

- Regulatory Impact: Evolving regulations around infrastructure usage and pricing can alter the profitability of existing agreements.

- Dispute Resolution: Effective legal mechanisms for resolving contract disputes are essential to protect cash flows and asset values.

- Concession Renewals: The success of renewing key concessions, like the Australian transmission asset agreement, is critical for sustained operational performance.

Brookfield Infrastructure's operations are heavily influenced by a variety of legal and regulatory frameworks that shape its business. This includes compliance with securities laws for public filings, such as the annual reports submitted to the SEC, and adherence to environmental regulations like the EU's CSRD for ESG disclosures, which gained prominence in 2024.

Navigating permitting processes for large projects, like those in the US infrastructure sector, can take years, impacting project timelines and costs. Furthermore, competition laws, enforced by bodies like the FTC, scrutinize Brookfield's acquisitions, as seen with potential deals in 2023-2024, to prevent market monopolization.

The company's revenue relies on long-term contracts and concessions, such as the 25-year renewal for its Australian electricity transmission assets in 2023, which provide predictable income streams. However, changes in legislation governing these agreements can significantly affect financial performance.

Environmental factors

Climate change is intensifying extreme weather events, directly impacting infrastructure. Brookfield's assets, from utilities to transportation, face heightened risks from events like floods, wildfires, and severe storms. For instance, the increasing frequency of hurricanes in the Americas can disrupt energy transmission and toll road operations.

Investing in resilience is becoming a necessity, not an option. While upfront costs for hardening infrastructure against these threats might rise, they are essential to mitigate potentially catastrophic financial losses from disaster-related damages. This proactive approach is key to long-term asset value preservation.

Brookfield Infrastructure's strategic emphasis on climate resilience and adaptation is therefore increasingly vital for its operational stability and financial performance. This includes investing in measures that enhance the ability of their network of assets to withstand and recover from climate-related disruptions.

Brookfield Infrastructure's commitment to decarbonization aligns with the global push for net-zero emissions by 2050, a significant environmental factor influencing its operations and investment strategy. This transition creates opportunities for growth in sectors like renewable energy, where the company is actively deploying capital.

The company is investing in low-carbon infrastructure, including its expansion of electric heat pump networks, which directly contribute to reducing greenhouse gas emissions. For instance, in 2023, Brookfield completed several renewable energy projects, adding substantial capacity to its portfolio and demonstrating tangible progress towards its sustainability goals.

Brookfield Infrastructure, as a major infrastructure operator, faces significant environmental considerations related to resource scarcity and efficient use. The company actively works to minimize its environmental footprint by improving the efficient use of critical resources like water and energy across its diverse portfolio.

This commitment is central to Brookfield's sustainability principles, driving operational improvements. For instance, in 2023, Brookfield Infrastructure reported a 5% reduction in water intensity across its operations compared to its 2020 baseline, demonstrating tangible progress in resource management.

Biodiversity and Ecosystem Preservation

Beyond the prominent focus on climate change, sustainable investing is increasingly prioritizing nature and biodiversity. This shift means portfolios are directing more capital towards sectors that actively contribute to ecosystem preservation and promote sustainable land management practices. This growing emphasis on natural capital reflects a broader understanding of environmental risk and opportunity.

While Brookfield Infrastructure's specific strategies for biodiversity aren't always explicitly detailed, its extensive operations, particularly those touching land and natural resources, inherently necessitate careful consideration of biodiversity impacts. For instance, investments in renewable energy infrastructure or agricultural assets require a keen awareness of their ecological footprint.

The financial sector is responding to this trend, with initiatives like the Taskforce on Nature-related Financial Disclosures (TNFD) gaining traction. By 2024, asset managers are increasingly expected to report on nature-related risks and opportunities within their portfolios. This will likely influence how companies like Brookfield are assessed and how capital is allocated.

Key considerations for Brookfield Infrastructure regarding biodiversity include:

- Assessing and mitigating the impact of infrastructure projects on local ecosystems and species.

- Investing in or developing assets that actively contribute to habitat restoration or conservation.

- Ensuring supply chain partners adhere to biodiversity-friendly practices.

- Adapting operations to account for the potential impacts of biodiversity loss on resource availability and operational resilience.

Waste Management and Circular Economy Principles

Effective waste management and the integration of circular economy principles are increasingly vital for the infrastructure sector, influencing operational efficiency and sustainability. Brookfield Infrastructure's commitment to environmental stewardship necessitates robust strategies for handling waste generated from its diverse operations, from construction to ongoing maintenance.

The company's infrastructure assets can play a crucial role in supporting recycling and resource recovery, aligning with broader governmental and societal pushes towards a circular economy. For instance, investments in waste-to-energy facilities or waste processing infrastructure directly contribute to this shift. Brookfield's sustainability program actively incorporates these considerations, aiming to minimize landfill reliance and maximize resource utilization across its portfolio.

- Circular Economy Growth: Global waste management market is projected to reach $1.7 trillion by 2030, with circular economy initiatives driving significant growth in recycling and resource recovery sectors.

- Operational Impact: Efficient waste management can reduce operational costs for infrastructure projects by lowering disposal fees and potentially generating revenue from recycled materials.

- Regulatory Landscape: Stricter regulations on waste disposal and landfilling, prevalent in many of Brookfield's operating regions, incentivize the adoption of circular economy practices.

- Brookfield's Role: Brookfield Infrastructure's involvement in waste networks and its focus on sustainable infrastructure development positions it to capitalize on the transition to a circular economy.

The intensifying effects of climate change, such as extreme weather events, pose direct risks to Brookfield's infrastructure assets, necessitating significant investment in resilience measures to protect against potential financial losses.

Brookfield's commitment to decarbonization is a critical environmental factor, driving investments in renewable energy and low-carbon infrastructure, aligning with global net-zero targets and creating new avenues for growth.

Efficient resource management, particularly water and energy, is paramount for Brookfield's operations, with tangible progress seen in reducing water intensity, underscoring a commitment to minimizing its environmental footprint.

The growing emphasis on nature and biodiversity, coupled with evolving disclosure frameworks like TNFD, will increasingly shape investment strategies and require companies like Brookfield to assess and mitigate their ecological impacts.

| Environmental Factor | Impact on Brookfield | Data/Trend (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased risk to infrastructure (floods, storms) | Global insured losses from natural catastrophes projected to rise; Brookfield investing in climate resilience for assets like energy transmission and toll roads. |

| Decarbonization & Net-Zero | Opportunities in renewables, transition risk for carbon-intensive assets | Global renewable energy capacity additions continue to break records; Brookfield expanding its renewable energy portfolio, e.g., electric heat pump networks. |

| Resource Scarcity (Water, Energy) | Operational efficiency and cost management | Growing water stress in many regions; Brookfield focused on improving water and energy efficiency across its portfolio, reporting a 5% reduction in water intensity (2023 vs. 2020 baseline). |

| Biodiversity & Nature-Related Risks | Reputational risk, operational impact on natural resources | Increased investor focus on nature-positive investments; TNFD framework adoption expected to grow, influencing portfolio assessments. |

| Circular Economy & Waste Management | Operational cost savings, revenue generation from recycling | Global waste management market growth projected; Brookfield's infrastructure assets can support recycling and resource recovery initiatives. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Brookfield draws on a comprehensive mix of data, including official government reports, financial market data from reputable institutions, and industry-specific research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting their operations.