Brookfield Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Bundle

Uncover the strategic positioning of Brookfield's product portfolio with this essential BCG Matrix analysis. See at a glance which offerings are driving growth, which are generating stable revenue, and which require careful consideration. Purchase the full BCG Matrix for a comprehensive understanding and actionable insights to optimize your investment strategies.

Stars

Brookfield Infrastructure's data center platforms are a star performer within their portfolio. Funds from Operations (FFO) for this segment saw a remarkable 50% jump in Q1 2025 and a 45% increase in Q2 2025 year-over-year.

This impressive growth stems from robust organic expansion and the successful integration of new capacity. The data sector represents a substantial commitment, making up over 70% of Brookfield's capital backlog, underscoring its strategic importance and anticipated market dominance.

Brookfield's acquisition of Hotwire, a key player in fiber-to-the-home services, marks a strategic move into a high-growth sector. This investment, valued at up to $500 million in equity, leverages Hotwire's existing infrastructure and customer base.

Hotwire's operations currently reach over 300,000 customers, with a substantial contracted backlog that promises significant future revenue. The company's business model is further strengthened by long-term, take-or-pay, and inflation-linked contracts, providing a stable and predictable cash flow stream.

Brookfield's Canadian diversified midstream operations are a strong performer, fitting the Stars category. Their Funds From Operations (FFO) saw a healthy 8% jump in the first quarter of 2025 and continued that momentum with a 10% increase in the second quarter.

This impressive growth stems from a combination of factors, including successful organic expansion projects, a surge in customer activity, and consistently high utilization rates across their extensive midstream infrastructure.

The favorable outlook for the Canadian energy sector further solidifies these midstream assets as crucial growth engines for Brookfield, reinforcing their Star status within the BCG framework.

Indian Tower Portfolio (Tuck-in Acquisition)

Brookfield's tuck-in acquisition of an Indian tower portfolio, which finalized in Q3 2024, has been a significant catalyst for the data segment's robust Funds From Operations (FFO) growth. This strategic move into India, a market exhibiting substantial expansion, bolsters Brookfield's foothold and competitive standing within the telecommunications infrastructure landscape.

- Strategic Indian Tower Acquisition: The tuck-in acquisition, completed in the third quarter of 2024, directly fueled the data segment's strong FFO growth.

- Market Penetration: This investment enhances Brookfield's presence and market share in India's rapidly expanding telecommunications infrastructure sector.

- Immediate Earnings Impact: The portfolio's immediate positive contribution to earnings underscores its strong market positioning and value.

AI-Driven Energy Demand Related Assets

Brookfield Infrastructure's power and transmission assets are poised to benefit significantly from the burgeoning energy needs of AI infrastructure. This trend presents substantial long-term margin expansion prospects. Their capacity to support this high-growth sector designates them as a star performer within the portfolio.

- AI's Energy Appetite: The rapid expansion of AI data centers is a major driver of increased electricity demand.

- Infrastructure's Role: Brookfield's power and transmission assets are crucial for reliably delivering this energy.

- Growth Potential: This strategic positioning offers considerable opportunities for sustained margin growth.

Brookfield's data center platforms are a clear star, with Funds from Operations (FFO) surging by 50% in Q1 2025 and 45% in Q2 2025 year-over-year. This growth is driven by organic expansion and the integration of new capacity, including the strategic acquisition of Hotwire for up to $500 million in equity, which serves over 300,000 customers. The Indian tower portfolio acquisition in Q3 2024 also significantly boosted the data segment's FFO. Furthermore, their power and transmission assets are well-positioned to capitalize on AI infrastructure's energy demands, promising substantial margin expansion.

| Segment | Q1 2025 YoY FFO Growth | Q2 2025 YoY FFO Growth | Key Growth Drivers | Strategic Importance |

| Data Centers | 50% | 45% | Organic expansion, Hotwire acquisition, Indian tower portfolio | High-growth sector, significant capital backlog (>70%) |

| Canadian Midstream | 8% | 10% | Organic expansion, customer activity, high utilization rates | Crucial growth engine, favorable energy sector outlook |

| Power & Transmission | N/A (Growth driver) | N/A (Growth driver) | AI infrastructure energy demand | Enabling high-growth sectors, margin expansion potential |

What is included in the product

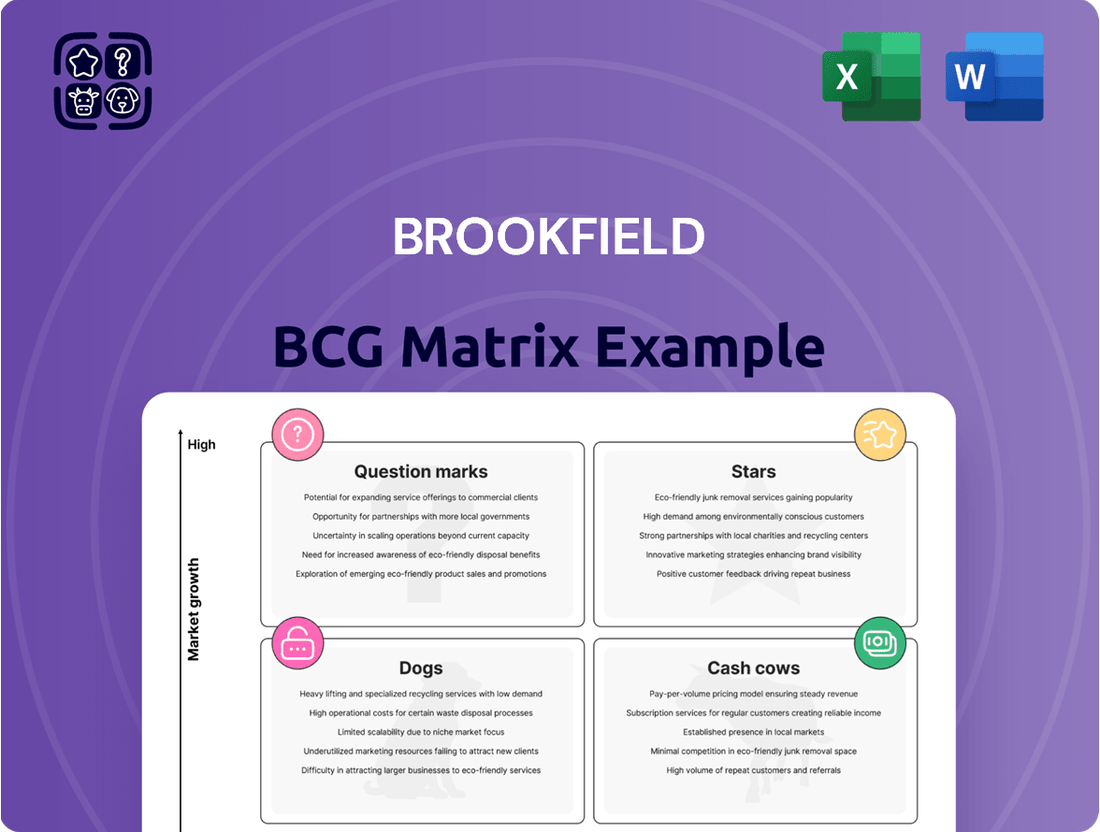

This overview details Brookfield's product portfolio across the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

A clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

The regulated utilities segment within Brookfield Asset Management's (Brookfield) portfolio is a prime example of a Cash Cow. These assets consistently deliver robust and predictable cash flows, with Funds From Operations (FFO) showing a slight increase year-over-year. For instance, in 2024, Brookfield's utilities business demonstrated this stability, benefiting from the predictable revenue streams inherent in regulated markets.

This resilience is further bolstered by inflation indexation clauses within their regulatory frameworks and ongoing capital investments that expand their rate base. These factors ensure that the segment's performance remains strong and dependable, even in fluctuating economic conditions. The regulated nature of these operations inherently provides a significant competitive moat and supports healthy profit margins, making them a core component of Brookfield's stable earnings.

Brookfield's acquisition of Colonial Pipeline for $9 billion in 2024 positions it as a significant cash cow. This deal secured the largest refined products pipeline system in the U.S., a critical piece of infrastructure.

Colonial Pipeline's strong utilization and dominant market position ensure exceptionally stable and predictable cash flows. This reliability is a hallmark of a true cash cow, offering consistent returns.

The asset is projected to deliver attractive mid-teen cash returns, reinforcing its status as a core holding for Brookfield. Its high market share and essential service solidify its role as a dependable income generator.

Brookfield's global intermodal logistics operations are a prime example of a cash cow. These operations consistently achieve nearly 99% asset utilization, showcasing their efficiency and strong market demand. This high operational capacity directly translates into a stable and predictable contribution to Brookfield's transport segment's Funds From Operations (FFO).

The business benefits from an entrenched market position, which acts as a significant barrier to entry for competitors. Even with strategic capital recycling, the fundamental strength of this core business ensures it remains a reliable cash generator for the company. For instance, in 2023, the transport segment, heavily influenced by these logistics operations, reported a substantial FFO, underscoring its cash-generating power.

Brazilian Integrated Rail and Logistics Operation

Brookfield's Brazilian integrated rail and logistics operation is a prime example of a cash cow within its portfolio. The company's decision to acquire an additional 10% stake in Q1 2024 underscores its confidence in this mature and dependable asset. This move signals a continued belief in the operation's ability to consistently deliver substantial returns.

The business is demonstrating robust financial performance, driven by increased shipping volumes and upward adjustments in average tariffs. These factors contribute directly to its status as a significant cash generator, providing stable income for Brookfield. The established infrastructure and consistent operational efficiency are key to this ongoing success.

- Acquisition: Brookfield increased its stake by 10% in Q1 2024.

- Performance Drivers: Higher volumes and average tariff increases are boosting results.

- Cash Generation: Its mature nature and consistent performance make it a strong cash generator.

- Strategic Importance: Reinforces Brookfield's commitment to reliable, income-producing assets.

Established Toll Roads and Rail Networks

Established toll roads and rail networks are prime examples of Cash Cows within the transport sector. These assets consistently generate substantial, stable cash flows. In 2024, for instance, rail networks saw tariff increases averaging 7%, while toll roads experienced hikes around 6%, contributing to their strong performance.

The essential nature of these infrastructure assets, coupled with significant barriers to entry, ensures their enduring profitability. This stability means they require minimal investment in marketing or promotional activities to maintain their market position and revenue streams.

- Robust Performance: Driven by consistent volume and tariff increases, such as the 7% rail and 6% toll road hikes in 2024.

- Stable Cash Flow: Essential services with high entry barriers guarantee reliable revenue generation.

- Low Promotional Investment: Their critical role minimizes the need for marketing expenditure.

- Long-Life Assets: Infrastructure with extended operational lifespans provides sustained cash generation.

Cash Cows, like Brookfield's regulated utilities and logistics operations, are mature businesses with dominant market positions. These segments consistently generate strong, predictable cash flows, often benefiting from inflation-indexed revenues and high asset utilization rates. For example, in 2024, Brookfield's transport segment, bolstered by intermodal logistics, saw high asset utilization, contributing significantly to its Funds From Operations (FFO).

The acquisition of Colonial Pipeline for $9 billion in 2024 further solidified this category, securing a critical infrastructure asset with projected mid-teen cash returns. Similarly, Brookfield's Brazilian rail and logistics business, where it increased its stake by 10% in Q1 2024, demonstrates this cash cow characteristic through rising volumes and tariffs.

These operations typically require minimal new investment to maintain their market share, allowing them to distribute substantial cash to the parent company. Established toll roads and rail networks, with tariff increases averaging 7% and 6% respectively in 2024, exemplify this dependable income generation.

| Asset Type | Key Characteristics | 2024 Data/Trends | Cash Flow Impact |

| Regulated Utilities | Stable, predictable revenue, inflation indexation | Slight year-over-year FFO increase | Consistent, reliable income |

| Logistics (Intermodal) | High asset utilization (~99%), entrenched market position | Significant FFO contribution to transport segment | Stable and predictable cash generation |

| Colonial Pipeline | Critical infrastructure, dominant market position | Acquired for $9 billion in 2024 | Projected mid-teen cash returns |

| Brazilian Rail & Logistics | Mature, growing volumes and tariffs | 10% stake increase in Q1 2024, tariff hikes | Substantial, consistent cash generation |

| Toll Roads & Rail Networks | Essential services, high barriers to entry | Tariff increases: Rail ~7%, Toll Roads ~6% | Sustained, low-investment cash flow |

What You’re Viewing Is Included

Brookfield BCG Matrix

The Brookfield BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready report ready for immediate strategic application.

Dogs

Brookfield's Australian Container Terminal, a divested asset, was sold in 2025 for $1.2 billion, with $500 million flowing directly to Brookfield Infrastructure Partners (BIP). This strategic move yielded a substantial 17% Internal Rate of Return (IRR), highlighting its successful management and profitable exit.

The divestment signifies Brookfield's proactive approach to capital allocation, freeing up resources from a mature, de-risked asset to pursue ventures offering higher growth potential. This aligns with a strategy of optimizing its portfolio by monetizing established operations.

Brookfield's sale of its Mexican regulated natural gas transmission business in Q1 2025, for an undisclosed sum, highlights a strategic portfolio adjustment. This move, which partially offset the robust performance of its utilities segment, indicates the business was likely deemed non-core or offered less compelling growth compared to other Brookfield assets.

Brookfield is strategically divesting a non-core data center as part of its ongoing capital recycling program. This move suggests the asset isn't performing as strongly in terms of growth or market positioning compared to other opportunities within Brookfield's broader data infrastructure portfolio.

The sale of this data center allows Brookfield to free up capital, which can then be reinvested into more promising ventures that are expected to yield higher returns. For instance, in 2024, the company has been actively pursuing acquisitions in high-growth areas of digital infrastructure.

Partial Sale of Global Intermodal Logistics (Containers)

Brookfield Asset Management's recent sale of an additional 33% stake in its global intermodal logistics container portfolio aligns with its strategy of capital harvesting from mature, lower-growth assets. This move mirrors previous divestitures, indicating a consistent approach to portfolio management.

This partial sale of fully contracted containers, while the broader logistics segment remains robust, exemplifies a strategic decision to monetize established, stable cash-flow generating assets. The capital realized from these transactions is earmarked for reinvestment into higher-growth, higher-return ventures within Brookfield's diverse investment universe.

- Asset Monetization: Brookfield divested a 33% interest in its contracted container fleet, a segment characterized by predictable, long-term revenue streams.

- Capital Recycling: Proceeds from this sale are intended to fund new investments in areas with greater growth potential, optimizing capital allocation.

- Portfolio Optimization: This action is part of a broader strategy to manage the lifecycle of assets, extracting value from mature businesses to fuel future expansion.

- Strategic Divestment: The sale of mature, contracted assets allows Brookfield to reduce exposure to lower-growth components while maintaining participation in the logistics sector.

Partial Sale of European Hyperscale Data Center Platform

Brookfield's partial sale of its European hyperscale data center platform fits squarely into the Cash Cow quadrant of the BCG Matrix. The divestiture of an additional 60% stake in a 244-megawatt portfolio of operating sites, completing a 90% sell-down, signifies the mature and de-risked nature of these assets. This strategic move generated substantial proceeds, allowing Brookfield to redeploy capital into emerging, high-growth data center opportunities.

- Asset Maturity: The sale of a 60% stake in the 244 MW European hyperscale data center platform highlights the asset's progression to a mature, cash-generating phase.

- Capital Recycling: This transaction, finalizing a 90% sell-down, generated significant proceeds, enabling Brookfield to reallocate capital towards newer, higher-growth data initiatives.

- Strategic Divestment: The move is characteristic of a Cash Cow strategy, where mature, profitable assets are leveraged to fund investments in Stars or Question Marks.

- Portfolio Optimization: By monetizing a substantial portion of this platform, Brookfield is optimizing its portfolio, focusing on future growth areas while realizing value from established operations.

Dogs in the BCG Matrix represent business units or products with low market share and low market growth. Brookfield's divestment of its Australian Container Terminal in 2025 for $1.2 billion, yielding a 17% IRR, exemplifies moving away from a mature, de-risked asset. Similarly, the sale of its Mexican regulated natural gas transmission business in Q1 2025 and a non-core data center in 2024 reflect a strategy to shed underperforming or less strategic assets. These actions free up capital for reinvestment in higher-growth opportunities.

| Asset | Sale Year | Sale Proceeds (Approx.) | Brookfield's Share | Strategic Rationale |

|---|---|---|---|---|

| Australian Container Terminal | 2025 | $1.2 billion | $500 million | Monetizing mature, de-risked asset; reinvestment in higher growth. |

| Mexican Regulated Natural Gas Transmission | Q1 2025 | Undisclosed | Undisclosed | Portfolio adjustment, non-core or lower growth potential. |

| Non-core Data Center | 2024 | Undisclosed | Undisclosed | Capital recycling, freeing up funds for high-growth digital infrastructure. |

Question Marks

Brookfield's $300 million investment in a new railcar leasing platform joint venture, expected to close in Q1 2026, positions it as a question mark within the BCG matrix. This strategic move into a potentially high-growth transport sector segment signifies an initial, nascent stage of development.

As a new entrant, the platform currently possesses a low market share, necessitating substantial investment and strategic execution to cultivate growth and establish a significant market presence. The acquisition marks a deliberate step into an area with considerable future potential, but one that demands careful nurturing to move beyond its current nascent status.

Brookfield has been actively commissioning new capital projects, with over $1 billion coming online from its backlog in 2024 alone. This aggressive development strategy continued into Q2 2025, with an additional $1.3 billion deployed into new investments across diverse business segments.

These newly commissioned projects, while crucial for future expansion, are currently in their nascent stages. They represent significant capital outlays without the immediate generation of substantial returns or a dominant market position.

Brookfield's U.K. wireless infrastructure arm is focusing on commissioning indoor networks at three major U.K. airports. This strategic move targets a high-growth niche within the data infrastructure sector, aiming to enhance indoor connectivity for millions of travelers and businesses.

While these airport projects represent a significant opportunity, they are currently in the capital-intensive build-out phase. This means Brookfield is investing heavily to establish market presence rather than realizing immediate, substantial cash flow from these specific operations.

Unlocking Available Data Center Space

Brookfield aims to activate more than 200 megawatts of unused capacity across its 50 data centers within the next two years. This move highlights substantial latent growth opportunities within their current infrastructure.

Capturing this potential necessitates significant capital deployment and effective market entry strategies. This positions the initiative as a prime, high-growth prospect with considerable unaddressed market share.

- Brookfield's Data Center Expansion: Over 200 MW of space and power to be unlocked.

- Timeline: Within the next 24 months.

- Portfolio Scope: Across 50 existing data centers.

- Strategic Goal: Tapping into significant untapped growth and market share.

Unidentified New Investments in Data, Transport, Midstream

Brookfield's strategic allocation in Q2 2025 saw $1.3 billion channeled into new, yet-to-be-identified investments within data, transport, and midstream sectors. These ventures represent a significant expansion of their portfolio, signaling confidence in these growth areas.

These investments align with the characteristics of Question Marks in the BCG matrix. They are in nascent or expansion phases, indicating substantial potential for future growth but currently holding minimal market share. The focus is on developing these assets to capture future market opportunities.

- Data Infrastructure: Investments likely target expanding data center capacity or developing new connectivity solutions, crucial for the digital economy.

- Transportation Networks: Capital may be directed towards modernizing logistics infrastructure or investing in emerging transport technologies to improve efficiency and reach.

- Midstream Energy: New projects could involve expanding pipeline capacity or developing new storage facilities to support evolving energy demands and transitions.

Question Marks represent business units or investments with low market share in high-growth industries. Brookfield's strategic focus on emerging sectors like wireless infrastructure and data centers, where they are investing heavily to build market presence, exemplifies this category. These ventures, while promising significant future returns, require substantial capital and careful management to transition from their current nascent stages.

The company's $300 million investment in a new railcar leasing platform and the ongoing commissioning of over $1 billion in new capital projects during 2024 underscore this strategy. These are all examples of initiatives in high-potential markets that have not yet achieved significant market share, thus demanding ongoing investment to foster growth and solidify their position.

Brookfield's plan to activate over 200 megawatts of unused capacity across 50 data centers within the next two years is a prime example. This initiative targets a high-growth sector but is in the development phase, requiring capital to unlock its potential and capture market share.

The $1.3 billion deployed in Q2 2025 into new, yet-to-be-identified investments across data, transport, and midstream sectors further solidifies Brookfield's portfolio of Question Marks. These are strategic bets on future growth industries where market leadership is yet to be established.

| Investment Area | Current Market Share | Growth Potential | Brookfield's Investment Stage | BCG Category |

|---|---|---|---|---|

| Railcar Leasing Platform | Low | High | Nascent/Development | Question Mark |

| U.K. Wireless Infrastructure (Airports) | Low | High | Capital-Intensive Build-out | Question Mark |

| Data Center Capacity Expansion (200 MW) | Developing | High | Unlocking Latent Potential | Question Mark |

| Q2 2025 New Investments ($1.3B) | Low (assumed for new ventures) | High | Initial Investment/Expansion | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial disclosures, market research reports, and competitor analysis to provide a comprehensive view of business unit performance.