Brookfield Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Bundle

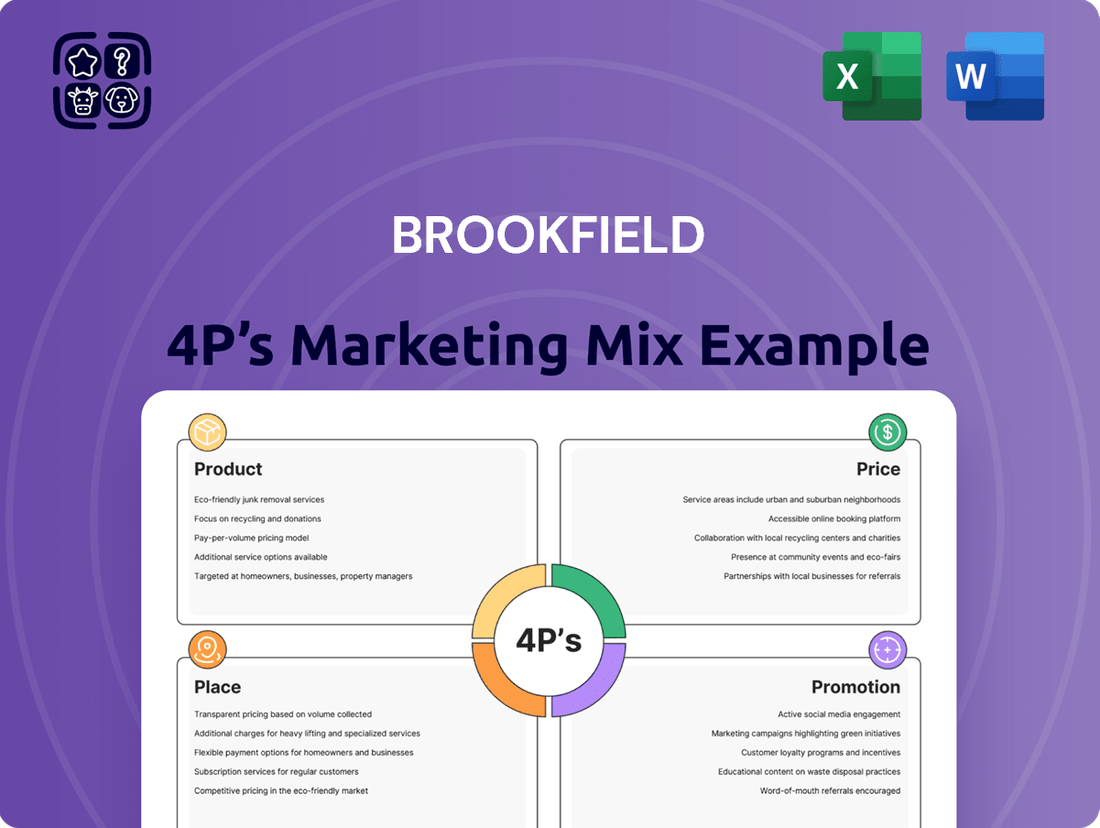

Uncover the strategic brilliance behind Brookfield's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve deep into their product innovation, pricing strategies, distribution channels, and promotional campaigns to reveal what truly drives their success.

Go beyond the surface-level understanding and gain actionable insights into how Brookfield effectively leverages each element of the marketing mix. This detailed analysis is your key to unlocking their competitive advantage.

Save valuable time and resources. Our professionally crafted, editable report provides a ready-made framework for understanding Brookfield's marketing prowess, perfect for students, professionals, and consultants seeking strategic depth.

Product

Brookfield Infrastructure Partners boasts a diverse portfolio of essential infrastructure assets, spanning utilities, transport, midstream, and data sectors. This breadth ensures resilience and access to various growth opportunities.

These assets are fundamental to global economic activity, generating stable and predictable cash flows. For example, as of Q1 2024, Brookfield Infrastructure reported a 10% increase in Funds From Operations (FFO) per unit year-over-year, highlighting the consistent performance of its infrastructure holdings.

The company strategically targets high-quality, long-life assets that form the backbone of modern society. This focus on foundational infrastructure, such as regulated utilities and critical transportation networks, provides a reliable revenue base.

Brookfield Infrastructure's product is fundamentally built on regulated and contracted revenue streams. This focus is a cornerstone of their strategy, ensuring a predictable and stable income base. For instance, a significant portion of their revenue in 2023 came from assets with long-term contracts, providing a reliable cash flow. This stability is a key differentiator for investors seeking dependable returns in the infrastructure sector.

These regulated and contracted revenues, often tied to essential services, offer a high degree of visibility into future earnings. Brookfield actively seeks out and develops assets, such as utilities and toll roads, where pricing and demand are often predetermined or regulated. This approach minimizes exposure to market volatility, a critical factor for maintaining consistent financial performance and investor confidence.

Brookfield Infrastructure doesn't just buy infrastructure; it actively improves it. This means making existing assets work better and investing in new projects to grow their capacity and services. This focus on operational enhancement is key to their strategy.

A prime example of this is their commitment to organic growth. In the first quarter of 2025 alone, Brookfield commissioned over $1 billion worth of projects from their capital backlog. This directly translates to increased value and expanded offerings for their customers.

Global Reach and Diversification

Brookfield Infrastructure’s product portfolio is a testament to its global reach, spanning North and South America, Asia Pacific, and Europe. This deliberate geographical diversification is key to mitigating concentration risk, allowing the company to tap into varied economic cycles and growth opportunities across the globe. For instance, as of early 2024, Brookfield Infrastructure's operations included significant investments in utilities in North America, toll roads in South America, and telecommunications infrastructure in Asia Pacific, showcasing the breadth of their global offerings.

This extensive geographic footprint is a core element of their strategy, enabling them to capitalize on diverse market dynamics. By operating across continents, Brookfield Infrastructure can balance regional economic slowdowns with growth in other areas, ensuring a more stable and resilient revenue stream. Their presence is not just about scale, but about strategic positioning in key growth markets.

- Geographic Diversification: Operations across North America, South America, Asia Pacific, and Europe.

- Risk Mitigation: Reduces concentration risk by not relying on a single region's economic performance.

- Growth Opportunities: Access to diverse economic cycles and emerging market growth.

- Operational Breadth: Demonstrates a wide range of infrastructure assets managed globally.

Focus on Digitalization and Decarbonization

Brookfield Infrastructure is actively investing in digitalization and decarbonization to future-proof its business. This strategic focus is evident in its significant capital allocation towards data centers and fiber optic networks, crucial components of the digital economy. For instance, in 2024, Brookfield Infrastructure continued its expansion in data center capacity, aiming to meet the surging demand driven by cloud computing and AI.

The company is also a major player in the energy transition, investing in renewable energy generation and transmission infrastructure. This aligns with global efforts to reduce carbon emissions and build a more sustainable future. By 2025, Brookfield anticipates its decarbonization-focused assets to represent an even larger portion of its portfolio, reflecting strong market tailwinds.

- Digital Infrastructure Growth: Brookfield's investments in data centers and fiber optic networks are designed to capitalize on the increasing demand for digital services.

- Energy Transition Focus: The company is expanding its portfolio of renewable energy assets, including wind and solar power, to support global decarbonization efforts.

- Strategic Alignment: These investments directly address two of the most significant macro trends shaping the global economy in 2024 and beyond.

- Portfolio Relevance: By prioritizing digitalization and decarbonization, Brookfield ensures its infrastructure assets remain essential and capable of delivering long-term growth.

Brookfield Infrastructure's product is its globally diversified portfolio of essential, long-life assets. These assets, including utilities, transport, midstream, and data infrastructure, are crucial for modern economies. The company focuses on regulated and contracted revenue streams, ensuring stable cash flows and minimizing market volatility.

This product strategy is further enhanced by a commitment to organic growth and strategic investments in digitalization and decarbonization. For example, in Q1 2025, Brookfield commissioned over $1 billion in projects from its backlog, directly increasing asset value and service offerings.

The company's product is characterized by its geographic diversification across North America, South America, Asia Pacific, and Europe, mitigating risk and capturing diverse growth opportunities. This broad operational base, coupled with a focus on future-proofing through digital and green infrastructure, positions Brookfield's product as a resilient and forward-looking investment.

| Asset Type | Key Characteristics | Revenue Stability Driver | 2024/2025 Growth Focus |

|---|---|---|---|

| Utilities | Regulated, essential services | Regulatory frameworks, long-term contracts | Decarbonization investments, grid modernization |

| Transport | Toll roads, ports, rail | Usage-based fees, long-term concessions | Capacity expansion, efficiency upgrades |

| Midstream | Pipelines, storage | Long-term transportation and storage contracts | Expansion of existing networks, new project development |

| Data | Data centers, fiber optic networks | Long-term leases, high demand growth | Digitalization, AI-driven capacity expansion |

What is included in the product

This analysis provides a comprehensive breakdown of Brookfield's Product, Price, Place, and Promotion strategies, offering a deep dive into their marketing positioning.

It's designed for professionals seeking a grounded understanding of Brookfield's actual brand practices and competitive context.

Streamlines complex marketing strategies into a clear, actionable framework, removing the confusion of the 4Ps.

Provides a concise, visual summary of Brookfield's marketing approach, alleviating the burden of deciphering dense reports.

Place

Brookfield Infrastructure's strategy for 'place' centers on direct ownership and active operation of its diverse infrastructure assets. This hands-on management approach provides granular control over asset performance, enabling them to optimize operations and drive value creation. They function as owner-operators, not passive investors, ensuring efficient service delivery across their global portfolio.

Brookfield's extensive portfolio of essential infrastructure assets is strategically positioned across North America, South America, Asia Pacific, and Europe. This global footprint ensures proximity to high-demand markets and robust economic activity.

This widespread geographical distribution, encompassing critical infrastructure like utilities, renewable power, and transportation, optimizes Brookfield's market reach and operational efficiency. For instance, as of early 2024, Brookfield Renewable Partners had over 7,000 operating assets across these key regions, generating consistent cash flows.

Brookfield's 'place' strategy is defined by its extensive presence across a variety of essential sectors. This includes utilities, transportation infrastructure, midstream energy, and data infrastructure. Such diversification allows Brookfield to serve critical economic functions, reaching a wide array of industries and consumer demands.

This multi-sector footprint significantly broadens Brookfield's market access, making it less susceptible to downturns in any single industry. For instance, as of early 2025, Brookfield's renewable power segment continues to expand its global utility operations, while its infrastructure arm actively manages vital transportation networks, demonstrating this embedded economic presence.

Capital Recycling for Optimal Allocation

Brookfield Infrastructure strategically employs capital recycling as a core element of its 'Place' strategy within the marketing mix. This involves divesting mature, lower-growth assets to fund investments in newer ventures offering superior returns. This dynamic allocation ensures capital is consistently directed towards opportunities with the most significant growth potential, thereby boosting overall portfolio performance.

In 2025, Brookfield Infrastructure demonstrated this commitment by successfully generating approximately $2.4 billion in proceeds from asset sales. This significant capital infusion fuels their ability to pursue and acquire assets that align with their forward-looking growth objectives.

- Active Divestment: Brookfield Infrastructure consistently sells mature assets to free up capital.

- Reinvestment Strategy: Proceeds are redeployed into new, higher-return infrastructure projects.

- 2025 Proceeds: The company realized $2.4 billion from asset sales in the fiscal year 2025.

- Portfolio Optimization: This process continuously enhances the 'Place' of capital for optimal performance.

Digital and Physical Infrastructure Integration

Brookfield's 'place' strategy now heavily features the seamless integration of its physical and digital infrastructure. This means their vast portfolio of traditional assets, like real estate and infrastructure projects, is increasingly complemented by a robust digital backbone. For instance, their investments in fiber optic networks and data centers are crucial for delivering services across both physical locations and online platforms.

This dual-pronged approach ensures Brookfield can meet market demands wherever customers are, whether it's through a physical presence or a digital touchpoint. By leveraging advanced digital channels alongside conventional ones, they enhance accessibility and convenience for their diverse client base.

Examples of this integration include:

- Data Center Expansion: Brookfield has been actively expanding its data center footprint, recognizing the growing demand for digital infrastructure. In 2024, they continued to invest in key markets, aiming to provide reliable and scalable data storage and processing capabilities.

- Fiber Network Development: Investments in high-speed fiber optic networks are fundamental to their digital strategy, enabling faster and more efficient data transmission for their managed properties and services.

- Omnichannel Service Delivery: Customers can interact with Brookfield's offerings through both physical touchpoints at their properties and sophisticated digital platforms for leasing, management, and customer service.

Brookfield's 'Place' strategy emphasizes its global reach and strategic positioning of essential infrastructure assets. This includes utilities, renewable power, transportation, and data infrastructure across North America, South America, Asia Pacific, and Europe. Their active ownership model ensures operational efficiency and value creation. For example, in early 2025, Brookfield's renewable power segment continued its expansion, complementing its transportation network operations.

| Region | Key Sectors | Asset Count (Early 2024) | Strategic Focus |

|---|---|---|---|

| North America | Utilities, Renewables, Transportation | Thousands | Market proximity, robust economic activity |

| South America | Utilities, Renewables | Thousands | Growth markets, essential services |

| Asia Pacific | Renewables, Data Infrastructure | Thousands | High demand, digital integration |

| Europe | Utilities, Transportation, Renewables | Thousands | Diversified operations, capital recycling |

What You See Is What You Get

Brookfield 4P's Marketing Mix Analysis

The preview you see here is the exact Brookfield 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This ensures you know precisely what you're getting, with no hidden surprises or altered content. It's a complete and ready-to-use resource, allowing you to confidently apply its insights to your marketing strategies.

Promotion

Brookfield Infrastructure's promotional efforts focus on investor relations and clear financial reporting to reach financially savvy individuals. This involves regular updates like quarterly earnings calls and annual reports detailing their financial health and future plans.

These communications, including SEC filings, are crucial for showcasing Brookfield's performance and strategic direction. For instance, in their Q1 2024 results, they reported Funds From Operations per share of $0.95, demonstrating operational strength.

The company prioritizes transparency, providing detailed financial statements and operational updates. This commitment to open communication builds trust with investors and analysts, underpinning their market positioning.

Brookfield's strategic communications on value creation, a key element of its promotional strategy within the 4Ps framework, consistently highlights its core approach: acquiring premium assets, optimizing operations, and strategically recycling capital. This narrative is meticulously disseminated through various channels, including press releases and investor presentations, underscoring a disciplined investment philosophy.

For instance, Brookfield's 2024 investor day presentations detailed their continued focus on deploying capital into sectors like renewable power and infrastructure, areas they believe offer strong long-term growth potential and inflation protection. Their asset recycling strategy, a cornerstone of their value creation, saw them complete significant divestitures in 2023, allowing for reinvestment into higher-yielding opportunities.

Management commentary throughout 2024 has reinforced this message, often referencing the company's ability to generate outsized returns through operational improvements and strategic repositioning of their vast portfolio. This consistent messaging aims to build investor confidence in their ability to navigate market complexities and deliver sustainable, long-term value.

Brookfield Infrastructure actively cultivates relationships with financial analysts, aiming for sustained positive coverage. As of early 2024, the company consistently receives attention from numerous sell-side analysts, with many maintaining buy or outperform ratings, underscoring market confidence in its strategy.

This analyst engagement serves as a crucial promotional tool, validating Brookfield Infrastructure's operational performance and growth prospects to a wide audience of investors. Such recognition helps to solidify its valuation and attract further capital, a key component of its market positioning.

Sustainability Reporting and ESG Integration

Brookfield actively promotes its dedication to sustainability and ESG principles, showcasing this commitment as a core element of its marketing. Their comprehensive sustainability reports, which detail their environmental stewardship, social responsibility, and governance practices, are designed to resonate with the increasing number of investors prioritizing responsible investment opportunities. For instance, in their 2023 reporting, Brookfield highlighted a 25% reduction in Scope 1 and 2 greenhouse gas emissions intensity across their operations compared to their 2019 baseline, a key metric for ESG-focused investors.

These reports serve as a transparent communication channel, offering tangible data on their progress and impact. This focus on ESG integration not only aligns with evolving investor expectations but also strengthens Brookfield's brand reputation as a forward-thinking and responsible corporate citizen. The company's 2024 outlook continues to emphasize renewable energy investments, with a stated goal of deploying an additional $10 billion in clean energy projects by the end of 2025.

Brookfield's strategy in this area includes:

- Publishing detailed annual sustainability reports outlining progress against ESG targets.

- Integrating ESG metrics into investment decisions and portfolio management.

- Communicating ESG achievements through investor relations and public outreach.

- Setting ambitious environmental targets such as achieving net-zero emissions by 2050.

Targeted Investor Day Events

Brookfield Infrastructure actively engages in targeted investor day events, often in conjunction with other Brookfield entities. These gatherings are crucial for fostering direct dialogue with both existing and potential investors, providing in-depth looks at their operational performance, strategic direction, and forward-looking projections.

These events serve as a vital channel for transparency and relationship building. For instance, during 2024, Brookfield Infrastructure has been actively communicating its progress on key growth initiatives, such as expanding its communications infrastructure portfolio and investing in renewable energy assets. These discussions often highlight the company's robust free cash flow generation, which is a key metric for investors.

- Direct Engagement: Facilitates one-on-one interactions with investors, addressing specific queries and concerns.

- Strategic Insights: Offers detailed presentations on business strategy, capital allocation, and growth opportunities.

- Performance Updates: Provides granular data on operational performance and financial results, often exceeding the information available in standard quarterly reports.

- Future Outlook: Articulates the company's vision and plans for future development and market positioning.

Brookfield Infrastructure's promotional strategy centers on transparent financial reporting and investor relations, utilizing investor days and analyst engagement to communicate performance and strategy. Their commitment to ESG principles is also a key promotional pillar, highlighted through detailed sustainability reports and ambitious environmental targets, such as their 2024 outlook emphasizing significant clean energy investments.

This multi-faceted approach aims to build investor confidence and attract capital by showcasing operational strength, strategic capital allocation, and a forward-looking commitment to sustainability. For example, their 2023 sustainability report showed a 25% reduction in GHG emissions intensity, a key metric for ESG-focused investors.

| Promotional Activity | Key Focus | 2024/2025 Data Point |

|---|---|---|

| Investor Relations & Financial Reporting | Transparency, operational performance, future plans | Q1 2024 FFO per share: $0.95 |

| Analyst Engagement | Validating strategy and growth prospects | Sustained positive coverage from sell-side analysts |

| Sustainability & ESG Communication | Responsible investment, environmental stewardship | Goal to deploy $10 billion in clean energy by end of 2025 |

| Investor Days | Direct dialogue, strategic insights, performance updates | Detailed progress on communications infrastructure and renewable energy expansion |

Price

Brookfield Infrastructure's pricing strategy, and by extension its valuation for investors, leans heavily on the predictable cash flows derived from its contracted and regulated assets. This stability is crucial for attracting investors seeking reliable income streams over the long term.

For instance, in 2023, approximately 90% of Brookfield Infrastructure's Adjusted EBITDA was generated from regulated or contracted sources, highlighting the dependable nature of its revenue. This predictable revenue base allows for robust valuation models, including Discounted Cash Flow (DCF) analyses, which are fundamental for investor decision-making.

For investors, Brookfield Infrastructure’s distribution growth and dividend yield are key pricing factors. The company has a history of raising its distributions, which attracts those seeking income. Brookfield aims for 5-9% annual distribution growth.

Brookfield's capital recycling strategy directly influences its perceived 'price' by showcasing its skill in generating strong returns from asset disposals. For example, in 2023, Brookfield Asset Management completed over $20 billion in asset sales, demonstrating their ability to exit mature investments at opportune moments.

This disciplined approach to selling assets at attractive multiples and redeploying that capital into new, higher-yielding ventures boosts the overall portfolio value. This active management enhances the attractiveness of Brookfield's units for investors, indirectly supporting its market valuation.

Inflation-Linked Revenue Adjustments

Brookfield Infrastructure's revenue stream benefits significantly from inflation-linked contracts across many of its assets. This mechanism allows for automatic adjustments to revenues, directly correlating with inflation rates, which is a key component of their pricing strategy within the 4Ps framework.

This feature acts as a natural hedge against increasing operational costs, thereby protecting and potentially enhancing profit margins. For investors, this translates to a more stable and predictable return profile, bolstering the perceived value of their holdings.

- Inflation Pass-Through: Approximately 70% of Brookfield Infrastructure's revenues are linked to inflation, providing a robust hedge.

- Revenue Stability: This linkage helps maintain real revenue growth even during periods of elevated inflation.

- Margin Protection: By adjusting revenues with inflation, the company protects its margins from being eroded by rising expenses.

Analyst Targets and Market Valuation

The market price for Brookfield Infrastructure Partners L.P. (BIP) units is significantly shaped by analyst sentiment and their forward-looking price targets. These targets reflect analysts' assessments of the company's performance and growth prospects, directly impacting investor perception and valuation.

As of late 2024, the consensus analyst price target for BIP units hovers in the range of $41 to $46.50. This range indicates a generally positive outlook among market watchers, suggesting potential upside from current trading levels.

- Analyst Price Targets: Average target range of $41-$46.50 for BIP units.

- Market Sentiment: Analyst forecasts influence investor perception and demand.

- Valuation Impact: Price targets contribute to the perceived intrinsic value of BIP.

- Potential Upside: Targets suggest opportunities for capital appreciation for investors.

Brookfield Infrastructure's pricing strategy is deeply intertwined with its ability to generate stable, inflation-protected cash flows and deliver consistent distribution growth. The market price for its units reflects investor confidence in these predictable revenue streams, often supported by regulated or contracted assets where approximately 90% of Adjusted EBITDA was derived from such sources in 2023.

The company's commitment to a 5-9% annual distribution growth target is a key driver for income-focused investors, directly influencing the perceived value and 'price' of its units. Furthermore, its active capital recycling, exemplified by over $20 billion in asset sales completed by Brookfield Asset Management in 2023, demonstrates a strategy to enhance overall portfolio value and investor returns.

The pricing of Brookfield Infrastructure's units is also significantly influenced by analyst sentiment and forward-looking price targets. As of late 2024, these targets generally range from $41 to $46.50, indicating a positive market outlook and potential for capital appreciation.

| Key Pricing Influences | Data Point | Impact on Price |

| Revenue Stability (Regulated/Contracted) | ~90% of 2023 Adj. EBITDA | Enhances investor confidence and valuation stability. |

| Distribution Growth Target | 5-9% annually | Attracts income investors, supporting unit price. |

| Capital Recycling Activity | >$20B asset sales (2023) | Demonstrates value creation, boosting perceived worth. |

| Inflation-Linked Revenue | ~70% of revenues | Provides a natural hedge, protecting margins and predictability. |

| Analyst Price Targets (Late 2024) | $41 - $46.50 | Influences market sentiment and potential upside. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for Brookfield leverages a comprehensive blend of proprietary market intelligence, official company disclosures, and extensive industry research. We meticulously gather data on product portfolios, pricing strategies, distribution networks, and promotional activities from reliable sources including financial reports, investor relations materials, and trade publications.