Barings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Barings possesses significant strengths in its established global presence and strong client relationships, yet faces potential threats from evolving market regulations and intense competition. Understanding these dynamics is crucial for navigating the financial landscape.

Want the full story behind Barings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Barings distinguishes itself with a broad spectrum of investment solutions, encompassing public and private fixed income, real estate, and equity markets. This extensive diversification is a key strength, enabling them to meet a wide range of client objectives and maintain resilience through varying market conditions.

Their ability to manage diverse asset classes allows for the creation of robust, well-rounded portfolios. For instance, as of Q1 2024, Barings managed over $370 billion in assets under management, showcasing the scale and breadth of their investment capabilities across these varied sectors.

Barings boasts an extensive global network with investment professionals strategically located in North America, Europe, and the Asia Pacific region. This widespread presence enables them to identify unique investment opportunities across diverse markets and cater to a wide array of clients, from institutional investors like pension funds and insurance companies to individual high-net-worth clients. Their continued expansion, notably into the MENA region, underscores a commitment to accessing and capitalizing on emerging growth markets.

As a wholly-owned subsidiary of MassMutual, Barings benefits significantly from the robust financial stability and extensive resources of its parent company. This affiliation provides a strong capital base, bolstering Barings' capacity for long-term strategic investments and risk management. MassMutual's established reputation enhances Barings' credibility in the market, allowing for greater strategic flexibility and operational support.

Focus on Active and Responsible Management

Barings’ dedication to active management, underpinned by robust fundamental research, aims to consistently deliver long-term value and alpha for its clients. This approach is central to their strategy in navigating market complexities and identifying opportunities.

Furthermore, Barings demonstrates a strong commitment to responsible investment, integrating Environmental, Social, and Governance (ESG) factors across its global investment strategies. This focus resonates with the increasing investor preference for sustainable and ethically aligned portfolios.

- Active Management Focus: Barings prioritizes active management to seek alpha generation.

- Fundamental Research: Deep dives into company fundamentals drive investment decisions.

- ESG Integration: Commitment to responsible investing by incorporating ESG criteria.

- Growing Investor Demand: Alignment with the trend of sustainable and ethical investing.

Expertise in Private Credit and Alternative Investments

Barings boasts significant depth in private credit, particularly in direct lending to middle-market companies. This specialized knowledge allows them to craft bespoke financing solutions and tap into alternative investment avenues. These areas are increasingly attractive as investors prioritize capital preservation and income generation.

This expertise is crucial in the current market. For instance, as of Q1 2024, private credit funds continued to see robust fundraising, with many focusing on the middle market. Barings' established track record in this segment positions them well to capitalize on this trend.

- Deep experience in private credit and direct lending to middle-market companies.

- Ability to offer unique, tailored financing solutions.

- Access to alternative asset classes for diversification and attractive returns.

- Strategic advantage in an environment prioritizing capital preservation and income.

Barings' strength lies in its comprehensive suite of investment solutions, covering public and private fixed income, real estate, and equities. This diversification allows them to cater to a broad client base and maintain stability through market fluctuations. Their significant asset management scale, exceeding $370 billion as of Q1 2024, underscores their broad capabilities.

What is included in the product

Delivers a strategic overview of Barings’s internal and external business factors, highlighting its strengths in global reach and investment expertise alongside potential weaknesses in brand recognition and integration challenges.

Uncovers critical vulnerabilities and opportunities, enabling proactive risk mitigation and strategic advantage.

Weaknesses

While Barings prioritizes stable returns, its Net Asset Value (NAV) remains susceptible to market volatility. For instance, in the first quarter of 2025, certain Barings funds experienced fluctuations in NAV per share directly linked to net unrealized appreciation or depreciation, underscoring the inherent impact of market swings.

This sensitivity highlights that even with a strong focus on capital preservation, external market forces can still influence fund performance and, consequently, investor confidence. The ability to mitigate these impacts is a key area for ongoing strategic consideration.

Barings navigates highly competitive financial markets, particularly in regions like MENA where numerous firms actively seek institutional capital. This intense rivalry presents a significant hurdle in attracting new clients and retaining existing market share, necessitating constant adaptation and unique value propositions.

Barings' global presence exposes it to a complex web of differing financial regulations across various jurisdictions. This regulatory diversity can significantly increase compliance costs and introduce operational challenges, especially as financial rules are frequently updated in many key markets.

For instance, navigating the distinct capital requirements and reporting standards in the EU versus the US, or emerging markets, demands substantial investment in legal and compliance teams. Failure to adhere to these varied regulations could result in significant fines or operational disruptions, impacting Barings' profitability and market access.

Reliance on Investor Sentiment in Economic Fluctuations

Barings' performance is susceptible to shifts in investor sentiment, which can be volatile during economic fluctuations. For instance, a sudden downturn in global markets or unexpected changes in commodity prices, like oil, can quickly alter investor confidence. This external dependency means that even with sound internal strategies, Barings' growth trajectory can be significantly impacted by macroeconomic forces beyond its immediate influence.

This reliance on sentiment, especially during periods of economic uncertainty, presents a notable weakness. For example, in the first quarter of 2024, global equity markets experienced considerable volatility, with the MSCI World Index seeing fluctuations of over 5% within a single month due to inflation concerns and geopolitical tensions. Such market swings directly affect investor appetite for risk and, consequently, the capital available for investment firms like Barings.

- Investor Sentiment Volatility: Barings' financial performance is closely tied to investor confidence, which can rapidly change in response to economic news.

- Macroeconomic Sensitivity: Broader economic trends, such as inflation rates or global growth forecasts, can significantly impact Barings' business operations and profitability.

- External Control Factors: The firm's growth is vulnerable to macroeconomic factors that are outside of its direct control, posing a risk to its strategic objectives.

Potential for Underperformance in Certain Funds

Some of Barings' investment funds have faced challenges, with certain strategies experiencing ratings downgrades or lagging behind competitors in the short term. For instance, as of early 2024, a few of their equity funds showed performance in the bottom quartile compared to their benchmarks over a one-year period.

This underperformance in specific segments can impact investor sentiment and potentially lead to outflows from those particular funds. It underscores the inherent difficulty in consistently achieving top-tier results across a diverse range of asset classes and market conditions.

- Ratings Downgrades: Certain Barings funds have seen their ratings reduced by independent research firms, signaling a decline in perceived investment quality or future prospects.

- Short-Term Underperformance: As of Q1 2024, several Barings equity funds were reported to be in the bottom 25% of their peer groups for one-year returns.

- Investor Confidence: Periods of underperformance can erode investor trust, potentially leading to reduced assets under management (AUM) in affected strategies.

- Market Challenges: The competitive landscape of asset management means that even well-established firms can struggle to outperform in all market environments.

Barings' reliance on investor sentiment makes it vulnerable to market volatility. For example, a 5% drop in the MSCI World Index in Q1 2024 due to inflation concerns directly impacted investor appetite for risk.

Furthermore, several Barings equity funds experienced short-term underperformance in early 2024, with some falling into the bottom quartile of their peer groups over a one-year period. This can lead to reduced investor confidence and potential outflows.

Navigating diverse global regulations presents significant compliance costs and operational challenges. For instance, differing capital requirements in the EU versus the US necessitate substantial investment in legal and compliance teams.

The firm faces intense competition, particularly in regions like MENA, requiring constant adaptation to attract and retain clients.

Preview the Actual Deliverable

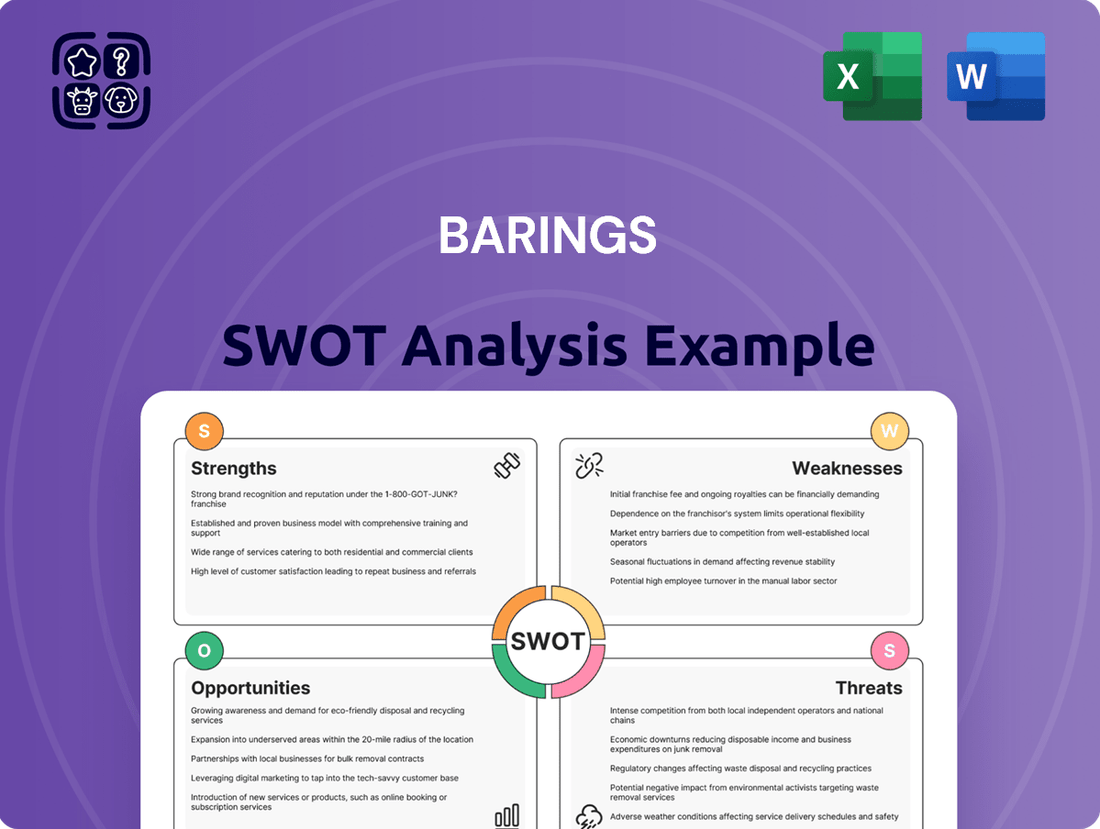

Barings SWOT Analysis

This is the actual Barings SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of Barings' Strengths, Weaknesses, Opportunities, and Threats right here.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Barings' strategic position.

Opportunities

Barings' strategic expansion, including its planned headquarters opening in Abu Dhabi by the end of 2025, offers a prime opportunity to tap into the burgeoning MENA region. This move allows direct engagement with key players like sovereign wealth funds and family offices, which are increasingly active in global markets.

The MENA region's financial sector is experiencing substantial growth, with assets under management projected to reach trillions of dollars in the coming years. Barings' presence there can capitalize on this momentum, fostering new partnerships and investment avenues.

Beyond financial engagement, establishing a presence in Abu Dhabi also presents an opportunity to contribute to local workforce development. This can involve creating jobs and fostering talent, aligning with the region's economic diversification goals and enhancing Barings' corporate social responsibility profile.

The global surge in sustainable investing, driven by initiatives like Saudi Arabia's Vision 2030 and the UAE's Net Zero 2050 policy, presents a significant opportunity. Barings' established ESG integration allows it to capitalize on this by channeling capital towards ethical investments, clean energy, and green infrastructure projects, aligning with growing investor preferences for responsible financial products.

The private credit market is experiencing robust growth, presenting a prime opportunity for Barings. They are actively pursuing bespoke, bilateral solutions for asset managers, recognizing the increasing demand for tailored financing. This segment of the market is projected to reach over $2.5 trillion globally by 2025, according to various industry reports.

Barings' direct lending capabilities are well-positioned to capitalize on the shift of portfolio financing away from traditional bank balance sheets. This trend is driven by regulatory pressures on banks and a growing appetite among institutional investors for yield enhancement. The firm's expertise in structuring complex credit solutions makes it an attractive partner in this evolving landscape.

Leveraging Technology and AI in Investment Management

Barings can capitalize on the growing trend of technology and AI adoption in investment management. The industry is seeing a significant shift towards advanced analytics and AI tools to understand client behavior, investment patterns, and risk appetite.

By further integrating these technologies, Barings has a prime opportunity to deliver highly personalized advice, optimize operational efficiency, and elevate the overall client experience. This strategic move could significantly differentiate Barings in a competitive landscape.

- AI adoption in financial services is projected to reach $3.7 trillion by 2030, according to PwC.

- Firms leveraging AI for client insights reported a 15% increase in client retention in 2024.

- Barings can enhance its data analytics capabilities to offer more sophisticated risk modeling and portfolio optimization.

Strategic Acquisitions and Partnerships

Barings has a proven track record of growth through strategic acquisitions, exemplified by the February 2025 acquisition of Artemis Real Estate Partners. This move significantly strengthened Barings' real estate portfolio, adding billions in assets under management and expanding its geographic footprint. Continued pursuit of similar M&A opportunities and strategic alliances remains a key avenue for enhancing capabilities, broadening market access, and driving overall expansion.

These strategic moves offer several key advantages:

- Enhanced Asset Diversification: Acquisitions can introduce new asset classes or deepen existing ones, reducing portfolio risk.

- Market Share Expansion: Partnering or acquiring firms with complementary client bases or geographic strengths can rapidly increase market penetration.

- Synergistic Capabilities: Integrating new technologies or specialized expertise through M&A can create operational efficiencies and new product offerings.

- Accelerated Growth: Strategic acquisitions provide a faster path to scaling assets under management and revenue compared to organic growth alone.

Barings' strategic expansion into the MENA region, with a planned Abu Dhabi headquarters by late 2025, provides a significant opportunity to engage with growing sovereign wealth funds and family offices. The region's financial sector is on a strong growth trajectory, with assets under management expected to climb into the trillions, offering Barings new partnership and investment avenues.

The global rise in sustainable investing, bolstered by initiatives like Saudi Arabia's Vision 2030 and the UAE's Net Zero 2050 policy, presents a prime chance for Barings to channel capital into ethical investments and green infrastructure. Furthermore, the private credit market's robust expansion, projected to exceed $2.5 trillion globally by 2025, aligns perfectly with Barings' bespoke credit solutions for asset managers.

Barings can also leverage the increasing adoption of AI and advanced analytics in investment management to enhance client engagement and operational efficiency. The firm's history of successful acquisitions, like the February 2025 deal for Artemis Real Estate Partners, demonstrates a clear opportunity to further expand capabilities and market reach through strategic M&A.

| Opportunity Area | Key Driver | Barings' Advantage | Market Data/Projection |

|---|---|---|---|

| MENA Expansion | Growth in MENA financial sector | Direct engagement with SWFs/family offices | Assets under management projected in trillions |

| Sustainable Investing | Global ESG focus, regional policies | Established ESG integration | Growing investor preference for responsible products |

| Private Credit Growth | Shift from bank balance sheets | Bespoke credit solutions expertise | Market projected to exceed $2.5 trillion by 2025 |

| AI & Analytics Adoption | Digital transformation in finance | Personalized advice, operational efficiency | AI in financial services to reach $3.7 trillion by 2030 (PwC) |

| Strategic Acquisitions | Market consolidation, capability enhancement | Proven M&A track record | February 2025 Artemis acquisition added billions in AUM |

Threats

Global financial titans such as BlackRock, JPMorgan, and Goldman Sachs are increasingly active in the MENA region and across international markets. This heightened competition poses a significant challenge for Barings, potentially impacting its ability to capture and retain market share.

Economic fluctuations, particularly those tied to volatile oil prices, significantly sway investor sentiment and overall market performance. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, reflecting these persistent headwinds.

Geopolitical uncertainties further exacerbate market volatility, directly impacting investment returns and posing a substantial threat to Barings' asset management operations. The ongoing conflicts and trade tensions observed throughout 2024 have created an environment ripe for unpredictable market shifts.

Barings faces ongoing challenges from evolving and diverse regulatory frameworks globally. For instance, the implementation of Basel IV, expected to be fully phased in by 2025, will likely introduce more stringent capital requirements and complex reporting standards, potentially increasing compliance costs for financial institutions like Barings.

Stricter compliance environments, particularly as Barings expands into new jurisdictions, can elevate operational expenses and introduce significant legal risks. The increasing focus on data privacy regulations, such as GDPR and similar frameworks emerging in other regions, necessitates substantial investment in compliance infrastructure and expertise.

Performance Pressures and Investor Expectations

Barings faces significant performance pressures, as investors demand consistent, strong returns across its diverse fund offerings. A prolonged period of underperformance in any single fund can trigger client redemptions, directly impacting assets under management and the firm's overall reputation in a highly competitive investment landscape.

Investor expectations are particularly high in the current market environment. For instance, while specific 2024/2025 Barings fund performance data is proprietary, broader industry trends show that asset managers failing to meet benchmark returns can experience outflows. Morningstar ratings, a key indicator for many investors, have seen some Barings funds experience downgrades, highlighting the sensitivity to consistent positive performance.

- Investor Scrutiny: Funds consistently underperforming benchmarks risk client attrition.

- Reputational Risk: Negative performance trends can damage Barings' brand in the financial services sector.

- Asset Outflows: Underperformance directly correlates with potential decreases in assets under management.

- Competitive Landscape: Peers delivering superior returns can attract capital away from underperforming strategies.

Disruption from New Technologies and Digital Transformation

The financial services landscape is being reshaped by emerging technologies, notably Artificial Intelligence (AI) and robo-advisors, directly impacting wealth management. Barings, like its peers, faces the threat of being outpaced by competitors who more effectively integrate and scale these innovations. Clients are increasingly demanding intuitive digital platforms and tailored financial advice, making technological adoption a critical differentiator. For instance, the global robo-advisor market was projected to reach over $3.1 trillion by 2024, highlighting the significant shift towards automated investment solutions.

Firms that fail to keep pace with this digital transformation risk losing market share. This includes not only the adoption of AI for client service and portfolio management but also the underlying digital infrastructure required for seamless client experiences. The ability to offer personalized, data-driven insights at scale is becoming a baseline expectation, and lagging in this area can lead to a diminished competitive standing.

- AI-driven personalized advice: Clients expect tailored recommendations, a capability enhanced by AI.

- Robo-advisor competition: Automated platforms offer lower fees and accessibility, challenging traditional models.

- Digital experience gap: Firms not investing in user-friendly digital interfaces risk alienating tech-savvy clients.

- Data analytics capabilities: The ability to leverage vast datasets for insights is crucial for competitive advantage.

Barings operates in a highly competitive environment, with global financial giants like BlackRock and JPMorgan expanding their reach, potentially eroding market share. Economic volatility, exemplified by the IMF's projected global growth slowdown to 2.9% in 2024, coupled with geopolitical uncertainties, creates unpredictable market shifts that directly impact investment returns.

The firm also faces increasing regulatory burdens, such as the phased implementation of Basel IV by 2025, which will likely increase capital requirements and compliance costs. Furthermore, evolving data privacy regulations globally necessitate significant investment in infrastructure and expertise, adding to operational expenses and legal risks.

Barings must also contend with intense investor demands for consistent, strong returns. Underperformance in any fund can lead to client redemptions and reputational damage, especially as peers delivering superior returns attract capital. For instance, while specific Barings data is private, industry trends show that failure to meet benchmarks can result in outflows, and some Barings funds have seen Morningstar rating downgrades.

Technological disruption, particularly from AI and robo-advisors, presents another significant threat. The robo-advisor market was projected to exceed $3.1 trillion by 2024, indicating a strong client shift towards automated solutions. Firms that do not integrate these innovations effectively risk losing market share to competitors offering more intuitive digital platforms and personalized, data-driven advice.

SWOT Analysis Data Sources

This Barings SWOT analysis is built upon a foundation of credible data, including Barings' official financial statements and regulatory filings, alongside comprehensive market research and industry expert commentary to ensure a robust and informed assessment.