Barings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

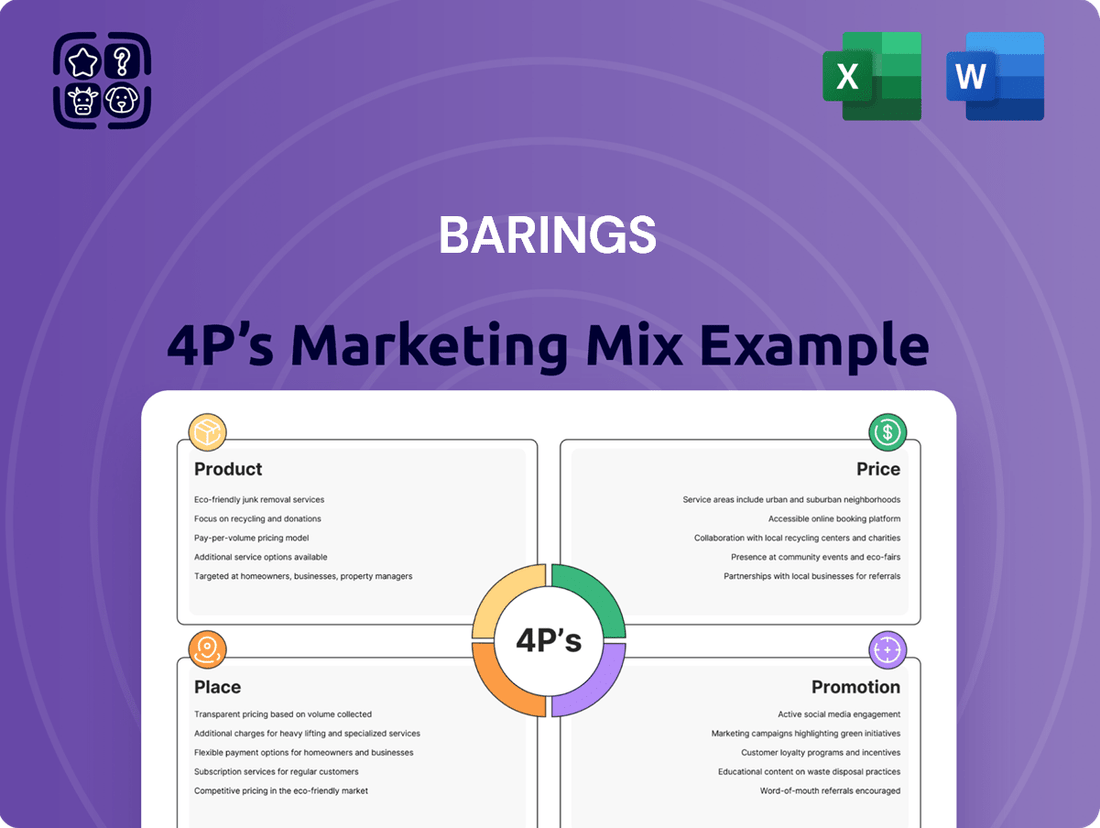

Barings' marketing success is built on a robust 4Ps strategy, from their carefully curated product offerings to their strategic pricing, distribution, and promotional efforts.

Dive deeper into how Barings leverages each element of the marketing mix to achieve its business objectives.

Unlock actionable insights and a comprehensive understanding of their approach by accessing the full 4Ps Marketing Mix Analysis, ready to inform your own strategies.

Product

Barings' product strategy centers on offering a diversified array of investment solutions. This includes robust capabilities in public and private fixed income, real estate, and various equity markets, designed to meet a wide range of client goals, from income generation to growth.

This comprehensive product suite allows Barings to serve a broad client base, including institutional investors and financial advisors, by providing tailored strategies. For instance, in 2024, Barings noted significant client interest in private credit solutions, reflecting a demand for alternative income streams.

The firm's approach emphasizes active management, leveraging deep market expertise to construct and manage these diverse portfolios. This active stance is crucial for navigating evolving market conditions and identifying opportunities for capital appreciation and stable income, a strategy that has seen Barings manage over $400 billion in assets as of Q1 2025.

Barings extends its product offering beyond traditional asset classes by providing specialized investment vehicles like Business Development Companies (BDCs) and Collateralized Loan Obligations (CLOs). These cater to specific investor demands for private credit and structured finance exposure.

These actively managed products are designed for optimal performance, showcasing Barings' deep expertise in niche markets. For instance, the BDC sector saw significant activity in 2024, with many BDCs reporting strong net asset value growth, driven by robust underlying loan portfolios and strategic capital deployment.

The firm's proficiency in these specialized areas significantly bolsters its product depth and appeal to a broader investor base seeking differentiated opportunities. The CLO market, while subject to regulatory shifts, continued to demonstrate resilience in 2024, with new issuance volumes reflecting sustained investor appetite for securitized credit products.

Barings' product philosophy centers on creating lasting value for clients, a core tenet driving their development strategies. This commitment translates into investment solutions designed for sustainable growth and consistent risk-adjusted returns, even through fluctuating market conditions. Their approach prioritizes enduring financial performance, tackling intricate financial challenges for a discerning clientele.

Tailored Client Strategies

Barings' Tailored Client Strategies represent a core element of its product offering, focusing on bespoke solutions for diverse institutional clients. This approach ensures investment strategies are meticulously crafted to meet the specific mandates, risk tolerances, and liquidity needs of entities like pension funds and insurance companies. For instance, as of early 2024, Barings managed over $300 billion in assets, with a significant portion allocated to customized mandates demonstrating this client-centric philosophy.

This customization extends to adapting product suites based on evolving client demand and dynamic market conditions. Barings' commitment to flexibility allows them to refine offerings, ensuring continued relevance and value for their clientele. This adaptability is crucial in navigating the complexities of global financial markets, where client needs can shift rapidly.

- Customization for Institutional Investors: Barings develops unique investment solutions for pension funds, insurance companies, and other institutional clients, aligning with their specific objectives and risk profiles.

- Client-Centric Approach: The firm prioritizes understanding and meeting individual client requirements, ensuring investment strategies are precisely matched to mandates, risk appetites, and liquidity needs.

- Adaptability and Evolution: Barings actively modifies its product offerings in response to client feedback and market shifts, maintaining a dynamic and relevant suite of investment solutions.

Global Market Expertise Integration

Barings leverages its extensive global market expertise to shape its product offerings, identifying unique investment opportunities and building portfolios that capitalize on worldwide research. This integrated approach enhances the robustness and return potential of their solutions, granting clients access to a wider array of investment possibilities.

For instance, in 2024, Barings' global research identified emerging market equities as a key growth area, leading to the development of a new emerging markets equity fund. This fund aims to capture alpha by actively managing exposure across diverse geographies, reflecting their commitment to a truly global perspective.

- Global Insight Integration: Barings embeds worldwide market intelligence directly into product design and features.

- Differentiated Opportunities: This global perspective allows for the identification of unique investment avenues.

- Enhanced Resilience and Returns: Portfolios are constructed to benefit from broad research, improving potential outcomes.

- Expanded Opportunity Universe: Clients gain access to a more extensive selection of investment options.

Barings' product strategy is deeply rooted in providing diversified investment solutions, with a strong emphasis on actively managed portfolios across public and private markets. The firm's offerings cater to a broad spectrum of client needs, from income generation to capital growth.

The firm actively develops specialized products like Business Development Companies (BDCs) and Collateralized Loan Obligations (CLOs), responding to specific investor demands for private credit and structured finance. This demonstrates a commitment to offering differentiated investment opportunities beyond traditional asset classes.

Barings' product development is informed by global market expertise, allowing them to identify and capitalize on unique investment opportunities worldwide. This global perspective is integrated into their portfolio construction, aiming to enhance both resilience and potential returns for their clients.

As of Q1 2025, Barings managed over $400 billion in assets, reflecting the breadth and depth of its product suite. Client interest in private credit solutions was particularly noted in 2024, highlighting the demand for alternative income streams and Barings' responsiveness to market trends.

| Product Area | Key Features | 2024/2025 Relevance |

|---|---|---|

| Fixed Income (Public & Private) | Income generation, capital preservation | Strong client interest in private credit solutions in 2024. |

| Equities (Global) | Growth, capital appreciation | Emerging market equities identified as a key growth area in 2024. |

| Real Estate | Diversification, income, capital appreciation | Continued demand for real estate exposure across various market cycles. |

| Alternatives (BDCs, CLOs) | Niche market exposure, differentiated returns | BDC sector saw strong NAV growth in 2024; CLO market showed resilience. |

What is included in the product

This analysis provides a comprehensive deep dive into Barings' Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

Simplifies the complex Barings 4P's analysis into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Barings' marketing strategy, relieving the burden of sifting through extensive research for quick decision-making.

Place

Barings boasts a robust global office network, with investment professionals strategically positioned across North America, Europe, and Asia Pacific. This expansive physical footprint, encompassing key financial hubs, ensures direct client engagement and fosters deep, localized market understanding. As of early 2025, Barings operates in over 16 countries, reinforcing its commitment to accessibility and tailored service for its international clientele.

Barings is strategically expanding its presence in high-growth regions, notably the Middle East and North Africa (MENA). This move is crucial for broadening their market reach and deepening engagement with key financial players.

The upcoming establishment of a new headquarters in Abu Dhabi by late 2025, alongside their existing Dubai office, underscores this commitment. This expansion aims to cultivate stronger ties with influential entities like family offices, institutional investors, and sovereign wealth funds, tapping into the significant capital flows within these dynamic markets.

Barings prioritizes direct client engagement as a key 'place' strategy, focusing on institutional and high-net-worth individuals. This involves personalized interactions through dedicated sales teams and relationship managers, ensuring tailored investment solutions. For instance, in 2024, Barings reported significant growth in its private markets division, driven by direct outreach and bespoke offerings to sophisticated investors seeking alternative asset exposure.

Digital Platforms and Investor Portals

Barings leverages sophisticated digital platforms and secure investor portals, primarily for its institutional clientele. These platforms offer clients real-time access to crucial data, including account details, performance analytics, and curated market intelligence, streamlining investment oversight.

These digital touchpoints are vital for fostering transparency and efficiency, directly supporting the operational backbone of client relationships. For instance, in 2024, many asset managers reported a significant uptick in digital client engagement, with platforms facilitating over 70% of routine client inquiries and reporting activities.

- Enhanced Client Access: Providing 24/7 access to performance reports and account information.

- Operational Efficiency: Automating routine reporting and communication, reducing administrative burden.

- Data Security: Implementing robust security measures to protect sensitive client financial data.

- Market Insights Delivery: Distributing timely market commentary and research through secure channels.

Intermediary and Fund Distribution

Barings actively utilizes intermediary channels to broaden the reach of specific products like their Business Development Companies (BDCs) and specialized funds. This strategy involves collaboration with financial advisors, wealth management firms, and various investment platforms, ensuring their offerings are accessible to a diverse investor base.

This multi-channel distribution model is crucial for maximizing product penetration across targeted consumer segments. For instance, by partnering with established financial advisory networks, Barings can tap into existing client relationships and provide tailored investment solutions.

- Intermediary Engagement: Barings works with a network of financial advisors and wealth managers.

- Product Accessibility: Key products like BDCs are made available through these channels.

- Market Reach: This approach expands investor access beyond direct channels.

- Distribution Growth: Barings aims to increase fund flows and AUM through these partnerships.

Barings' "Place" strategy emphasizes a dual approach: a strong physical global presence and sophisticated digital accessibility. This ensures clients, whether institutional or individual, can engage with Barings through their preferred channels, fostering trust and convenience. The firm's commitment to expanding into regions like the MENA, with a new Abu Dhabi headquarters planned for late 2025, highlights its dedication to localized service and market penetration.

| Metric | 2024 Data | 2025 Projection | Notes |

| Global Offices | 16+ countries | 18+ countries | Expansion into MENA |

| Digital Engagement | 70%+ of routine inquiries | 80%+ of routine inquiries | Increased platform utilization |

| Direct Client Interaction | Significant growth in Private Markets | Continued growth | Driven by personalized offerings |

Preview the Actual Deliverable

Barings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Barings 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Barings actively cultivates its image as an industry leader through robust thought leadership initiatives. These include a steady stream of webinars and in-depth market outlook reports, offering crucial insights into areas like global fixed income and real estate. For instance, their 2024 outlooks consistently highlighted the impact of persistent inflation and evolving central bank policies on bond yields, a key concern for investors.

By consistently delivering valuable analysis across diverse asset classes, Barings reinforces its position as a trusted authority in investment management. This commitment to sharing expertise directly addresses the target audience's need for informed perspectives, aiming to build confidence and clearly communicate their investment philosophy to potential clients and partners alike.

Barings actively uses financial news and press releases as a key promotional tool. They regularly share updates on their financial results, new investment products, and major business moves. For instance, in early 2024, Barings announced the successful closing of a new private credit fund exceeding its target, a detail widely disseminated through financial news channels.

These communications are strategically distributed via major financial newswires and reputable media partners. This broad reach ensures that individual investors, financial advisors, and institutional clients are kept informed about Barings' progress and offerings, fostering transparency and trust.

Barings prioritizes direct and targeted communications with its institutional and high-net-worth clients. This involves personalized outreach, exclusive events, and customized reports designed to meet specific client needs and investment goals, enhancing client retention. For instance, in 2024, asset managers like Barings saw a significant portion of their client acquisition costs focused on relationship management, with successful direct engagement strategies proving crucial for retaining assets under management, which stood at over $350 billion for Barings as of Q1 2024.

Digital Content and Web Presence

Barings leverages its corporate website as a primary digital channel, offering comprehensive details on its investment strategies, product offerings, and market research. This platform is essential for engaging a global audience seeking financial expertise.

The firm likely employs sophisticated search engine optimization (SEO) and content marketing tactics to enhance discoverability and attract potential clients. For instance, in 2024, many financial institutions saw significant traffic increases driven by informative white papers and market outlook reports published online.

Barings' digital presence is critical for lead generation and brand building. By providing valuable insights, they aim to establish thought leadership and foster trust within the investment community.

- Website as a Central Hub: Barings' corporate website serves as the core for product information, services, and investment insights.

- Digital Engagement Strategies: Likely utilizes SEO and content marketing to attract and engage its target audience.

- Lead Generation and Visibility: A strong digital footprint is crucial for market visibility and acquiring new clients.

- Industry Trend: In 2024, financial firms saw a notable rise in online engagement with the release of detailed market analysis reports.

Industry Conferences and Partnerships

Barings actively engages with the financial community through participation and sponsorship of key industry conferences and events. These platforms offer a direct channel to connect with a concentrated audience of financial decision-makers, including investors, advisors, and business strategists.

For instance, Barings' presence at events like the S&P Global Ratings European Infrastructure Finance Summit or the Pensions & Investments East/West Investment Roadshow in 2024 provides invaluable opportunities to showcase their expertise and thought leadership. Such engagements are crucial for networking and building relationships within the sector.

Furthermore, Barings may forge strategic partnerships with other financial institutions or industry bodies. These collaborations can amplify their market reach and bolster their credibility. For example, a partnership with a leading fintech provider could enhance their digital offerings and attract a broader client base.

- Networking Opportunities: Direct engagement at conferences allows Barings to build relationships with potential clients and partners.

- Showcasing Expertise: Speaking engagements and sponsored sessions highlight Barings' capabilities and market insights.

- Brand Recognition: Consistent presence at industry events reinforces Barings' brand within the financial ecosystem.

- Strategic Alliances: Partnerships expand Barings' influence and service offerings, potentially reaching new market segments.

Barings employs a multi-faceted promotional strategy, emphasizing thought leadership through webinars and market outlook reports. Their 2024 reports frequently addressed inflation and central bank policies, key investor concerns. This consistent delivery of valuable analysis reinforces their authority and builds trust.

The firm also utilizes financial news and press releases to disseminate information about fund closings, new products, and business developments, such as their 2024 private credit fund exceeding its target. These announcements are strategically distributed via financial newswires to ensure broad reach among investors and advisors.

Direct client communication, including personalized outreach and exclusive events, is a priority for Barings, especially for institutional and high-net-worth clients. This focus on relationship management was crucial in 2024, a year where asset managers saw significant client acquisition costs tied to direct engagement, helping Barings maintain its over $350 billion in assets under management as of Q1 2024.

Barings' digital presence, centered on their corporate website, is vital for showcasing investment strategies and research, likely enhanced by SEO and content marketing efforts. In 2024, financial institutions reported increased online engagement driven by detailed market analysis reports, a strategy Barings leverages for lead generation and brand building.

| Promotional Tactic | Key Activities | 2024/2025 Focus/Data Point |

| Thought Leadership | Webinars, Market Outlook Reports | Analysis of inflation and central bank policies impacting bond yields. |

| Public Relations | Press Releases, Financial News Distribution | Announcement of 2024 private credit fund exceeding target. |

| Direct Client Engagement | Personalized Outreach, Exclusive Events | Crucial for client retention; acquisition costs focused on relationship management. |

| Digital Marketing | Website Content, SEO, Content Marketing | Increased online engagement for financial firms via market analysis reports. |

Price

Barings frequently employs performance-based fee structures, directly linking their earnings to client investment success. This model is a powerful incentive for their fund managers to achieve superior returns, as a significant portion of their compensation is tied to outperformance. For instance, many of their alternative investment funds, a key area for Barings, utilize a "2 and 20" model, where 2% is an annual management fee and 20% is a performance fee on profits above a certain hurdle rate.

Barings structures its pricing through management fees, typically calculated as a percentage of assets under management (AUM) for its various investment vehicles, including Business Development Companies (BDCs). These fees are essential for covering the costs associated with expert portfolio management, in-depth market research, and the necessary operational oversight to maintain fund integrity.

Beyond management fees, investors should also consider expense ratios, which can include a broader range of operational costs. For instance, some Barings BDCs may have expense ratios that reflect administrative, legal, and compliance expenses, directly impacting the net return an investor receives. Understanding these components is crucial for a complete cost assessment.

Barings strategically positions its pricing to be competitive within the global investment management sector, carefully balancing the inherent value and complexity of its specialized investment solutions. This approach ensures they remain an attractive option for discerning institutional and high-net-worth clients seeking sophisticated strategies.

Their pricing reflects Barings’ established market standing and the perceived value derived from its active management expertise and unique investment opportunities. For instance, as of early 2024, many specialized active equity funds in similar competitive markets often carry expense ratios ranging from 0.75% to 1.25%, a benchmark Barings likely considers.

Dividend and Distribution Policies

Barings has cultivated distinct dividend and distribution policies, particularly for income-focused products like their Business Development Companies (BDCs) and select high-yield funds. These consistent payouts are a crucial component of the overall investor return, directly tied to the income generated by the underlying investment portfolios.

For instance, Barings BDC (BBDC) has historically maintained a quarterly dividend. As of early 2024, BBDC's annualized dividend yield has been a significant draw for income-seeking investors, reflecting the income generated from its direct lending activities. The stability and predictability of these distributions are paramount for clients prioritizing regular income streams.

- BBDC's Dividend Yield: Investors often look to BBDC's yield as a primary income driver.

- Distribution Consistency: Barings emphasizes a reliable payout schedule for its income products.

- Income Generation: Distributions are directly correlated with the investment income earned by the funds.

Client-Specific Fee Negotiations

Barings recognizes that significant institutional mandates and highly customized investment solutions often warrant tailored fee structures. This approach allows for pricing that accurately reflects the scale and unique demands of these substantial client relationships.

This flexibility in fee negotiation underscores Barings' commitment to building long-term, strategic partnerships with its most important clients, ensuring mutual alignment and value.

- Customized Pricing: Barings can adjust fees for large institutional mandates, acknowledging the varying complexity and scale of services required.

- Partnership Focus: Fee negotiations for bespoke solutions highlight Barings' dedication to fostering enduring relationships with key clients.

- Value Alignment: This client-specific approach ensures that fees are commensurate with the value delivered and the depth of the partnership.

Barings' pricing strategy is multifaceted, encompassing management fees based on assets under management (AUM), performance-based fees for outperformance, and expense ratios that cover operational costs. For income-focused products like their Business Development Companies (BDCs), dividend and distribution policies are a key component of the investor's total return. Furthermore, Barings offers customized fee structures for significant institutional mandates, reflecting the scale and unique demands of these relationships.

| Fee Component | Description | Typical Range/Example (as of early 2024) |

|---|---|---|

| Management Fees | Percentage of Assets Under Management (AUM) | Varies by fund type; common for covering operational and management costs. |

| Performance Fees | Percentage of profits above a hurdle rate | Often seen in alternative investments, e.g., "2 and 20" model. |

| Expense Ratios | Includes administrative, legal, and compliance costs | For specialized active equity funds, often 0.75% to 1.25%. |

| Dividends/Distributions | Regular payouts from income-generating investments | Barings BDC (BBDC) historically maintained quarterly dividends, with yields significant for income investors. |

| Customized Fees | Negotiated for large institutional mandates | Reflects scale, complexity, and strategic partnership value. |

4P's Marketing Mix Analysis Data Sources

Our Barings 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor communications, and direct brand information. We leverage insights from product portfolios, pricing strategies, distribution channels, and promotional activities to provide a holistic view.