Barings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Barings’s competitive landscape is shaped by the intense rivalry among existing firms, the significant bargaining power of buyers, and the constant threat of new entrants. Understanding these forces is crucial for navigating the financial services industry.

The full Porter's Five Forces Analysis reveals the real forces shaping Barings’s industry—from supplier influence to substitute threats. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Barings, a major global investment manager, depends on specialized technology for its operations. This includes everything from executing trades to analyzing vast amounts of data and managing risk. The increasing reliance on advanced fintech, especially solutions leveraging AI and machine learning, means that the companies providing these tools hold considerable sway.

The specialized nature of these fintech solutions, particularly those incorporating AI and machine learning, gives these providers significant bargaining power. For instance, in 2024, the global fintech market was valued at over $1.1 trillion, with a significant portion dedicated to advanced analytics and AI-driven platforms.

Switching costs for these critical systems can be substantial. The complexities involved in integrating new platforms with existing infrastructure, coupled with the challenges of migrating sensitive data, often make it difficult and expensive for firms like Barings to change providers. This can lock them into current relationships, further strengthening the suppliers' position.

The success of an active investment manager like Barings hinges on its human capital, particularly portfolio managers, analysts, and client relationship managers possessing profound market expertise. The demand for these specialized skills, especially in rapidly growing sectors such as private credit and alternative investments, is significant, affording these professionals considerable leverage.

In 2024, the competition for top-tier financial talent remained intense. For instance, average compensation for senior portfolio managers in specialized alternative asset classes could easily exceed $500,000 annually, including base salary and performance bonuses, reflecting the high value placed on their expertise and the direct impact they have on fund performance.

Consequently, firms like Barings must offer highly competitive compensation packages and cultivate a robust corporate culture to attract and retain this critical talent, as the bargaining power of these skilled individuals directly influences operational costs and the firm's ability to execute its investment strategies effectively.

The bargaining power of suppliers for market information and research services is substantial for Barings. Providers like Bloomberg and Refinitiv offer proprietary data and analytical tools that are essential for informed investment decisions, and these platforms are not easily substituted. In 2024, the market for financial data terminals alone was valued in the tens of billions of dollars, reflecting the critical nature and high cost of accessing such comprehensive datasets.

These research providers possess significant leverage because the information they supply is often unique and requires substantial investment to generate. Barings relies on these external sources for economic forecasts and in-depth sector analysis, which are difficult and costly to replicate in-house. For instance, the cost of a single Bloomberg terminal can exceed $25,000 annually, highlighting the investment required and the supplier's pricing power.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers wield significant bargaining power over financial institutions like Barings. This is due to the highly regulated nature of the global financial market, where adherence to complex and ever-changing laws is paramount. For instance, in 2024, financial services firms globally faced increasing scrutiny regarding data privacy regulations, such as GDPR and similar frameworks, necessitating specialized legal and compliance expertise.

The specialized knowledge required to ensure adherence to these intricate global and local financial laws grants these professional service providers substantial leverage. Barings, like other asset managers, relies on these experts to navigate a landscape that saw significant updates in areas like anti-money laundering (AML) and Know Your Customer (KYC) protocols throughout 2024. Failure to comply can result in severe financial penalties and irreparable reputational damage, making Barings highly dependent on the quality and accuracy of these services.

- High switching costs: The specialized nature of compliance services means that changing providers can be time-consuming and expensive, involving extensive knowledge transfer and system integration.

- Concentration of expertise: A limited number of firms possess the deep, niche expertise required to navigate complex financial regulations, reducing the pool of viable alternatives.

- Criticality of service: Non-compliance carries severe financial and reputational risks, making the reliability and accuracy of these services non-negotiable for Barings.

Niche Service Providers for Alternative Assets

As Barings deepens its commitment to alternative assets, including private credit and real estate, its reliance on specialized service providers for crucial functions like deal sourcing and due diligence intensifies. These niche players possess unique expertise and established networks, particularly within specific geographic markets or asset classes, granting them significant bargaining power.

For instance, in the burgeoning MENA region, where Barings is actively expanding its alternative investment footprint, local knowledge is paramount. Providers offering specialized due diligence or asset servicing in this area can command higher fees due to the limited availability of comparable services. This localized expertise translates directly into leverage for these suppliers.

- Niche Expertise: Providers specializing in areas like private credit in emerging markets or specific real estate sub-sectors possess unique skills and data that are not easily replicated.

- Limited Competition: In many alternative asset segments, the number of highly qualified service providers is limited, reducing Barings' options and increasing supplier leverage.

- Geographic Specialization: Expansion into regions like MENA means Barings must engage local service providers with on-the-ground knowledge, giving these suppliers considerable bargaining power.

- Deal Flow Dependence: For Barings, securing attractive deal flow in less liquid alternative markets often hinges on relationships with these specialized intermediaries.

The bargaining power of suppliers for Barings is significant, particularly for specialized fintech solutions and market data. In 2024, the fintech market exceeded $1.1 trillion, with AI-driven platforms commanding high prices. Switching costs for these critical systems are substantial, often locking firms into existing relationships.

Skilled financial professionals, especially in alternative investments, also possess considerable leverage. In 2024, top portfolio managers could earn over $500,000 annually, reflecting intense competition for talent. This directly impacts Barings' operational costs and strategic execution.

| Supplier Type | Key Services | 2024 Market Data/Impact | Supplier Leverage Factors |

|---|---|---|---|

| Fintech Providers | AI/ML platforms, trading execution | Global fintech market > $1.1 trillion | High switching costs, specialized tech |

| Market Data & Research | Proprietary data, economic forecasts | Data terminal market: tens of billions USD | Unique information, high generation costs |

| Compliance & Legal Services | Regulatory adherence, data privacy | Increased scrutiny on GDPR, AML/KYC | Niche expertise, severe non-compliance risks |

| Specialized Alternative Asset Services | Deal sourcing, due diligence (MENA) | Growing demand in niche/geographic markets | Limited competition, localized knowledge |

What is included in the product

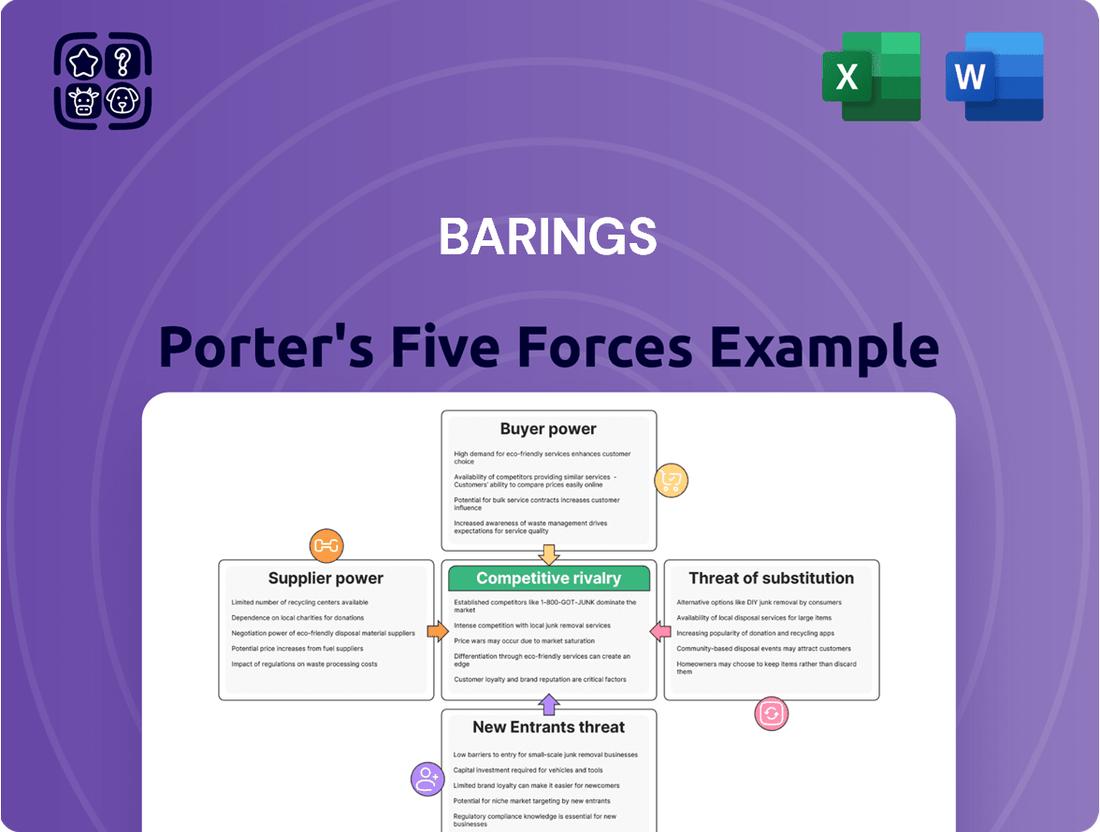

Barings' Porter's Five Forces analysis dissects the competitive intensity within its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a comprehensive breakdown of each Porter's Five Forces element, revealing hidden vulnerabilities.

Customers Bargaining Power

Large institutional clients, such as pension funds and sovereign wealth funds, represent a significant force for Barings. These entities often manage billions in assets, giving them considerable leverage when selecting investment managers.

In 2024, for instance, the average U.S. public pension fund managed over $20 billion, and many global sovereign wealth funds exceed $100 billion under management. This scale allows them to demand highly competitive fee structures and specialized investment solutions from firms like Barings, directly impacting profitability.

The ability of these sophisticated investors to switch managers or negotiate lower fees means Barings must continually demonstrate value and competitive pricing to retain and attract this crucial client segment.

Customers, especially large institutional investors and those in established investment areas, are becoming much more aware of fees. This is largely because passive investment strategies, like index funds, often deliver solid returns at a much lower cost. This trend naturally puts pressure on firms like Barings to lower the fees they charge for their active management services.

To keep charging competitive fees, Barings needs to clearly demonstrate the value they provide. This means consistently outperforming benchmarks, offering unique or specialized investment approaches, or delivering an exceptional level of service and client support. For instance, in 2024, the average expense ratio for actively managed equity funds in the US was around 0.68%, compared to 0.06% for passive equity funds, highlighting the significant fee differential clients consider.

Clients at Barings face numerous investment options, from rival active managers and low-cost passive funds to increasingly sophisticated self-directed platforms. This abundance of choice significantly reduces the effort and expense involved in switching, thereby enhancing their bargaining power.

While Barings emphasizes building enduring client relationships, the inherent ease of asset transfer to competitors or the adoption of substitute investment products directly amplifies customer leverage. For instance, the global asset management industry saw significant inflows into passive strategies in 2023, reaching trillions of dollars, indicating a strong client preference for lower-cost alternatives when available.

Furthermore, increased transparency in investment performance metrics and fee structures, a trend amplified by regulatory pushes and readily accessible online comparisons, empowers clients. They can more easily assess value and identify cost-effective alternatives, directly impacting their willingness to negotiate or seek better terms.

Demand for Customization and Integrated Solutions

The demand for customization is a significant driver of customer bargaining power. Modern investors, from individuals to institutions, increasingly seek tailored investment solutions that align with their unique financial goals and ethical considerations, such as Environmental, Social, and Governance (ESG) preferences. This client-centric approach empowers customers as they look for bespoke portfolios and integrated services, compelling firms like Barings to adapt their offerings to meet these specific needs.

This trend is evident in the growing market for personalized financial advice. For example, in 2024, the global robo-advisor market, which offers automated, algorithm-driven financial planning services, was projected to continue its robust growth, reflecting a strong preference for customized investment management. This signifies a shift where clients are less willing to accept one-size-fits-all approaches, thereby increasing their leverage in negotiating terms and service levels with financial providers.

- Growing Demand for ESG Integration: A significant portion of investors, particularly younger generations, now prioritize investments that reflect their values, pushing asset managers to offer more ESG-focused products and customization options.

- Rise of Bespoke Portfolio Management: High-net-worth individuals and family offices are increasingly demanding highly customized portfolios, leading to greater negotiation power with wealth management firms.

- Client-Driven Service Evolution: Financial institutions are compelled to offer integrated solutions that combine investment management, financial planning, and tax advisory services to retain clients, giving clients more choice and influence.

Access to Information and Digital Tools

The widespread availability of financial data and sophisticated digital platforms significantly amplifies customer bargaining power. Clients can now effortlessly scrutinize investment managers' track records, fee structures, and service portfolios. For instance, platforms like Morningstar and Bloomberg provide detailed, comparable data, enabling investors to make highly informed choices.

This enhanced transparency means customers are better equipped to negotiate terms and demand greater value. In 2024, the average fee for actively managed equity funds in the US hovered around 0.41%, a figure that clients can readily benchmark against competitors, putting pressure on managers to justify their pricing.

Barings, therefore, faces a critical need to consistently prove its unique value proposition and differentiate its services. This environment necessitates a proactive approach to client retention, focusing on superior performance, specialized expertise, and exceptional client service to stand out against a backdrop of readily available alternatives.

- Increased Transparency: Digital tools allow for easy comparison of performance, fees, and services.

- Informed Decision-Making: Clients can research and analyze options, leading to more empowered choices.

- Negotiation Leverage: Access to market data strengthens clients' ability to negotiate terms.

- Value Demonstration: Firms must clearly articulate and prove their unique selling points to retain business.

Customers, particularly large institutional investors, wield significant bargaining power due to their substantial assets and the availability of numerous investment alternatives. This leverage allows them to negotiate lower fees and demand highly specialized services. For instance, in 2024, the average U.S. public pension fund managed over $20 billion, enabling them to exert considerable influence on investment managers' fee structures.

The increasing preference for lower-cost passive investment strategies, which had seen trillions invested globally by 2023, further pressures active managers like Barings to justify their fees and demonstrate superior value. This environment necessitates a clear articulation of unique selling propositions and a focus on client retention through performance and service.

| Factor | Impact on Bargaining Power | Example/Data (2024 unless specified) |

|---|---|---|

| Investor Scale | High | Average U.S. public pension fund management: $20B+ |

| Fee Sensitivity | High | Active equity fund expense ratios: ~0.41% vs. Passive: ~0.06% |

| Availability of Alternatives | High | Significant inflows into passive strategies (trillions globally by 2023) |

| Demand for Customization | High | Robust growth in the robo-advisor market |

| Transparency & Data Access | High | Easy comparison of performance and fees via platforms like Morningstar |

Full Version Awaits

Barings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Barings Porter's Five Forces analysis. You'll gain detailed insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use, providing a clear roadmap for strategic decision-making.

Rivalry Among Competitors

The global investment management arena is intensely competitive, populated by a vast range of participants. These include massive, diversified asset management firms, niche specialist boutiques, and innovative fintech startups, all vying for market share. Barings finds itself in direct competition with this broad spectrum of entities across public and private fixed income, real estate, and equity sectors.

This inherent diversity among competitors significantly escalates the rivalry within various asset classes and client segments. For instance, as of Q1 2024, the global assets under management (AUM) in the investment management industry reached an estimated $100 trillion, with significant portions held by both large incumbents and increasingly agile new entrants, highlighting the crowded competitive space.

Competitive rivalry is intensified by a relentless pressure on fees, particularly within established investment areas. The growing preference for less expensive passive investment options means firms like Barings must actively demonstrate the value they provide through superior returns or unique approaches.

For instance, the global ETF market, a prime example of passive investing, saw assets under management reach approximately $10 trillion by the end of 2023, a significant increase that highlights the shift in investor demand and puts pressure on active management fees.

This fee compression forces active managers to focus on operational efficiency and to develop innovative products that can truly differentiate themselves to sustain profitability in a crowded marketplace.

To stand out and combat fee compression in standard investment areas, firms like Barings are heavily investing in alternative assets such as private credit, real estate, and infrastructure. This strategic pivot intensifies competition in these expanding, more profitable sectors, demanding specialized knowledge and strong deal-sourcing networks.

Barings' own growth in private credit and real assets exemplifies this industry trend, as these areas offer higher potential returns but also require significant operational and analytical capabilities to navigate effectively.

Industry Consolidation and Strategic Partnerships

The financial services industry is witnessing significant consolidation, driven by firms aiming for greater scale, expanded service offerings, and entry into new markets. Mergers and acquisitions (M&A) remain a critical strategy for enhancing competitive standing, even with occasional market slowdowns.

This trend is evident in the robust M&A activity within the sector. For instance, in 2024, the global M&A market saw continued interest in financial services, with deal volumes reflecting a strategic push for integration and synergy. Barings itself has actively pursued strategic partnerships and expansions, underscoring its commitment to navigating this evolving landscape.

- Increased M&A Activity: Financial services firms are actively engaging in mergers and acquisitions to achieve economies of scale and broaden their service portfolios.

- Strategic Imperative: Consolidation is viewed as a key lever for firms to bolster their competitive advantage and market reach.

- Barings' Approach: Barings' own strategic expansions and alliances demonstrate its participation in this industry-wide consolidation trend.

- Market Dynamics: Fluctuations in M&A deal flow do not diminish its importance as a strategic tool for competitive positioning.

Technological Advancements and AI Adoption

The asset management sector is experiencing a significant transformation driven by rapid technological advancements and the widespread adoption of artificial intelligence. Firms that successfully integrate AI are better positioned to enhance operational efficiency, improve client interactions, and develop more sophisticated analytical capabilities, thereby gaining a competitive advantage. For instance, by mid-2024, many asset managers reported using AI for tasks ranging from portfolio construction to risk management, with some studies indicating potential cost savings of up to 20% through automation.

Barings, like its peers, faces intense pressure to continuously invest in and upgrade its technological infrastructure. This investment is crucial not only for maintaining operational parity but also for meeting the increasingly sophisticated demands of clients for personalized services and data-driven insights. The ongoing race to adopt cutting-edge technologies means that companies lagging in this area risk falling behind in client acquisition and retention. For example, in 2024, a significant portion of capital expenditure for leading asset management firms was allocated to AI and data analytics platforms.

- AI Integration: Firms are leveraging AI for enhanced data analysis, predictive modeling, and automated client reporting.

- Efficiency Gains: Early adopters of AI have reported notable improvements in operational efficiency, with some seeing reductions in manual processing times by over 30%.

- Client Expectations: Clients increasingly expect personalized investment strategies and transparent, technology-driven communication.

- Competitive Imperative: Continuous investment in technology is essential for Barings to remain competitive and attract/retain assets under management in a rapidly evolving market.

The competitive rivalry within the investment management industry is fierce, characterized by a broad range of players from large institutions to nimble fintech startups. This intense competition is further fueled by a persistent downward pressure on fees, especially in traditional investment products. For instance, by the end of 2023, the global ETF market, a significant driver of passive investing, managed approximately $10 trillion in assets, underscoring the demand for lower-cost options and pressuring active managers.

To counter fee compression and differentiate themselves, firms like Barings are increasingly focusing on alternative assets such as private credit and real estate, which also attract heightened competition due to their higher return potential. This strategic shift necessitates specialized expertise and robust deal-sourcing capabilities.

| Competitive Factor | Industry Trend (2023-2024) | Impact on Barings |

|---|---|---|

| Fee Pressure | Growth of passive investing (e.g., ETFs nearing $10T AUM by end-2023) | Requires demonstrable alpha or unique value proposition for active management. |

| Shift to Alternatives | Increased investment in private markets for higher yields | Intensifies competition in specialized, higher-margin sectors. |

| Technological Adoption | AI integration for efficiency and analytics (potential 20% cost savings reported by mid-2024) | Necessitates continuous investment in tech to maintain operational parity and client expectations. |

SSubstitutes Threaten

The most significant threat of substitutes for Barings' active management services comes from passive investment vehicles like Exchange Traded Funds (ETFs) and index funds. These products provide investors with broad market exposure at substantially lower expense ratios compared to actively managed counterparts.

The shift towards passive investing is a well-documented trend. For instance, in 2023, global ETF assets under management reached approximately $11.5 trillion, a notable increase from previous years, indicating a strong investor preference for lower-cost alternatives. This growing adoption directly challenges the value proposition of traditional active management.

The cost-effectiveness and often comparable, if not superior, performance of passive funds present a compelling alternative for investors seeking market returns without the higher fees associated with active stock selection. This trend puts pressure on Barings to demonstrate clear alpha generation to retain and attract assets.

Robo-advisors and digital wealth management platforms offer automated, cost-effective investment solutions. These platforms directly challenge traditional financial advisors by providing accessible portfolio management, particularly for retail investors. For instance, by mid-2024, the assets under management for leading robo-advisors in the US were projected to exceed $2 trillion, highlighting their significant market penetration and appeal.

The increasing popularity of direct indexing and Separately Managed Accounts (SMAs) presents a significant threat to traditional asset managers. These solutions empower investors with unparalleled customization and tax efficiency, allowing direct ownership of individual securities. This shift means clients can bypass the need for a full-service active manager for specific portfolio segments, impacting the revenue streams of those relying on commingled funds.

Self-Directed Investing and Discount Brokerages

The rise of self-directed investing, fueled by accessible discount brokerages and a wealth of online research, presents a significant threat of substitutes for traditional investment managers. For instance, by mid-2024, many major online brokerages were still offering commission-free trades on stocks and ETFs, dramatically lowering the barrier to entry for individuals managing their own assets. This trend empowers financially literate individuals to bypass the need for professional portfolio management.

This shift means that clients can now construct and actively manage their own investment portfolios, directly substituting the core services previously offered by firms like Barings. The proliferation of sophisticated, yet user-friendly, digital platforms further amplifies this threat, allowing even novice investors to access advanced analytical tools and execute trades with ease.

Consider these points highlighting the impact:

- Lowered Costs: Commission-free trading eliminates a significant cost component traditionally associated with professional management.

- Increased Accessibility: Online platforms and mobile apps make investing tools and information readily available to a broader audience.

- Empowerment of Individual Investors: Abundant educational resources and research platforms enable individuals to make informed investment decisions independently.

- Competition from Robo-Advisors: Automated investment platforms offer low-cost, algorithm-driven portfolio management, further competing with human advisors.

Alternative Investment Platforms and Direct Investments

Investors increasingly bypass traditional asset managers for direct access to alternative investments. Platforms specializing in private equity or venture capital, for instance, offer curated opportunities that may appeal more than a broader multi-asset manager's alternative suite. In 2024, the global alternative investment market continued its robust growth, with private equity fundraising alone reaching an estimated $1.3 trillion by year-end, indicating a strong appetite for direct or specialized platform access.

This trend presents a significant threat of substitutes for firms like Barings if their alternative investment products aren't perceived as sufficiently diverse or competitive. Consider the rise of crowdfunding platforms for real estate or private credit; these allow investors to participate in specific deals with lower minimums, directly challenging the need for intermediaries managing diversified funds.

The accessibility and transparency offered by some alternative investment platforms can also be a draw. For example, platforms providing detailed performance data and fee structures for individual private equity funds might attract investors who find Barings' broader fund offerings less transparent or appealing for specific niche exposures. By mid-2025, it's projected that over 30% of institutional investors will have increased their allocation to alternative assets through specialized channels.

- Direct Investment Appeal: Investors can select specific private equity or venture capital deals, offering greater control and potentially higher targeted returns.

- Platform Specialization: Niche platforms cater to specific alternative asset classes, providing expertise and deal flow that broader managers may not match.

- Market Growth: The alternative investment market, particularly private equity, saw substantial fundraising in 2024, highlighting investor demand for direct or specialized access.

- Competitive Pressure: Firms like Barings face pressure to ensure their alternative offerings are competitive in terms of diversity, performance, and transparency compared to specialized substitutes.

The threat of substitutes for Barings' core offerings is significant, driven by the increasing accessibility and cost-effectiveness of alternative investment vehicles and platforms. These substitutes allow investors to bypass traditional asset management structures, directly impacting Barings' market share and revenue potential.

Passive investment strategies, such as ETFs and index funds, continue to gain traction due to their lower fees and broad market exposure. In 2023, global ETF assets surpassed $11.5 trillion, reflecting a strong investor preference for these cost-efficient alternatives. This trend directly challenges active managers like Barings, who must demonstrate superior alpha generation to justify higher fees.

Robo-advisors and direct indexing platforms are also emerging as powerful substitutes. By mid-2024, US robo-advisor assets were projected to exceed $2 trillion, showcasing their growing appeal, particularly among retail investors seeking automated, low-cost portfolio management. Direct indexing allows for greater customization and tax efficiency, enabling investors to replicate index performance with personalized holdings, thereby reducing reliance on traditional fund managers.

| Substitute Type | Key Characteristics | 2023/2024 Data Point | Impact on Barings |

|---|---|---|---|

| Passive Funds (ETFs, Index Funds) | Lower expense ratios, broad market exposure | Global ETF AUM ~$11.5 trillion (2023) | Pressure on active management fees, need to prove alpha |

| Robo-Advisors | Automated, low-cost portfolio management | US Robo-Advisor AUM projected >$2 trillion (mid-2024) | Competition for retail investor assets, shift to digital solutions |

| Direct Indexing/SMAs | Customization, tax efficiency, direct security ownership | Increasing adoption among institutional and high-net-worth clients | Reduced demand for commingled funds, need for personalized solutions |

| Alternative Investment Platforms | Specialized access to private equity, venture capital, etc. | Global private equity fundraising ~$1.3 trillion (2024 est.) | Competition for alternative asset allocations, need for differentiated offerings |

Entrants Threaten

The investment management industry is a heavily regulated space. New entrants must navigate extensive licensing requirements, substantial capital mandates, and continuous adherence to intricate global financial laws. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust compliance frameworks, making it difficult for undercapitalized or inexperienced firms to enter the market.

New entrants face substantial capital hurdles. Establishing operations, acquiring cutting-edge technology, and attracting top talent demand significant upfront investment. For instance, to compete with firms like Barings, which managed over $400 billion in assets as of early 2024, new players need substantial financial backing and a long-term perspective.

In the financial services sector, brand reputation and trust are critical deterrents to new entrants. Established players like Barings have cultivated decades of client loyalty and a strong, recognizable brand, making it incredibly difficult for newcomers to gain traction. For instance, a 2024 survey indicated that over 70% of investors prioritize a firm's established reputation when choosing a financial partner.

Access to Talent and Specialized Expertise

New entrants face significant hurdles in attracting and retaining the specialized talent needed to compete in sophisticated financial markets. Securing professionals with deep expertise in areas like private credit, real estate, or emerging markets is a major challenge.

Established firms, such as Barings, benefit from existing talent networks and well-developed recruitment strategies. This makes it considerably harder for newcomers to poach or develop the critical human capital necessary to build a competitive offering.

- Talent Acquisition Costs: New entrants might spend upwards of 15-20% of their initial operating budget on recruitment and onboarding specialized staff, compared to established firms' more efficient, lower percentage costs.

- Retention Challenges: In 2024, the average turnover rate for junior investment professionals in competitive sectors was around 18%, a figure likely higher for new firms without established brand loyalty or comprehensive benefits packages.

- Expertise Gap: A significant portion of highly sought-after financial expertise, particularly in niche alternative asset classes, is concentrated within established firms, creating an immediate knowledge and experience deficit for new players.

Distribution Channels and Client Relationships

Established investment managers have built robust distribution channels and nurtured deep, long-standing relationships with key client segments. For instance, in 2024, major asset managers continued to leverage their established networks, securing a significant portion of new fund inflows. New entrants struggle to replicate this existing infrastructure and trust, making it difficult to gain traction.

Building these crucial client relationships and accessing effective distribution channels presents a formidable barrier for newcomers. It takes time and significant investment to establish credibility and reach the target audience. By 2025, the trend of consolidation among distribution platforms is expected to further exacerbate this challenge for aspiring entrants.

- Established networks are a significant competitive advantage.

- New entrants face high costs in building distribution and client relationships.

- Client loyalty and trust are difficult to win over quickly.

- Access to capital markets and investor bases is often controlled by incumbents.

The threat of new entrants into the investment management industry, particularly for firms aiming to compete with established players like Barings, remains significantly low. This is primarily due to the formidable barriers related to stringent regulatory compliance, substantial capital requirements, and the critical need for established brand reputation and trust. For instance, in 2024, regulatory bodies continued to enforce rigorous oversight, making the initial setup and ongoing operation exceedingly costly and complex for newcomers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Compliance | Extensive licensing, capital mandates, and adherence to global financial laws. | High initial and ongoing costs, significant operational complexity. |

| Capital Requirements | Need for substantial upfront investment in technology, talent, and operations. | Difficulty for undercapitalized firms to establish a competitive presence. |

| Brand Reputation & Trust | Decades of client loyalty and a strong, recognizable brand are hard to replicate. | New entrants struggle to gain traction against established trust. |

| Talent Acquisition & Retention | Securing specialized expertise is challenging and costly for new firms. | Creates an immediate knowledge and experience deficit. |

| Distribution Channels & Client Relationships | Established networks and long-standing client relationships are difficult to build. | New entrants face high costs and time investment to gain market access. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Barings is built upon a foundation of comprehensive data, including Barings' own annual reports and investor presentations, alongside industry-specific market research reports and financial news from reputable sources.