Barings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Unlock the strategic DNA of Barings with our comprehensive Business Model Canvas. This detailed breakdown reveals their core customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Perfect for anyone looking to understand how a leading financial institution operates and thrives.

Partnerships

Barings cultivates key partnerships with a diverse range of financial institutions, including major banks and fellow asset managers. These collaborations are crucial for extending Barings' market presence and enabling co-investment in promising ventures, thereby sharing risk and amplifying potential returns.

A prime example of this strategy in action is Barings' alliance with Invesco. Together, they are focused on creating innovative private credit investment products tailored for the US wealth management sector. This initiative is further strengthened by significant seed capital commitments, such as the substantial investment made by MassMutual, underscoring the confidence these partners place in the joint venture.

Pension funds and insurance companies represent a cornerstone of Barings' key partnerships due to their significant asset bases and long-term investment objectives. These entities provide stable, substantial capital, aligning perfectly with Barings' focus on durable investment strategies.

Barings actively manages a considerable portion of its assets on behalf of insurance clients, underscoring the depth and strategic nature of these relationships. This management responsibility reflects a high level of trust and a shared commitment to achieving long-term financial goals.

Barings actively collaborates with real estate development and construction partners for its investment ventures. These collaborations are crucial for executing complex projects and leveraging specialized expertise.

A prime example of this strategy is Barings' involvement in a significant mixed-use development in Waterloo, Australia. For this project, Barings has joined forces with Aware Super and DASCO Australia, showcasing their commitment to strategic alliances in the real estate sector.

Sovereign Wealth Funds and Family Offices

Barings is strategically deepening its relationships with sovereign wealth funds and family offices, recognizing their significant role in global capital markets. This outreach is particularly focused on regions like the Middle East and North Africa (MENA), a strategy underscored by Barings' establishment of a new headquarters in Abu Dhabi.

These collaborations are crucial for Barings, providing access to vast pools of capital and enabling the development of highly customized investment strategies. For instance, in 2024, MENA sovereign wealth funds continued to be significant global investors, with total assets under management estimated to be in the trillions, seeking diversified and sophisticated investment opportunities.

The ability to offer bespoke solutions to these sophisticated investors is a key differentiator for Barings. These partnerships are mutually beneficial, allowing Barings to deploy capital effectively while providing these institutions with access to Barings' global investment expertise and diverse asset classes.

- Access to Capital: Sovereign wealth funds and family offices represent substantial, long-term capital sources.

- Tailored Solutions: Barings can develop bespoke investment strategies to meet specific risk and return objectives.

- Geographic Focus: Expansion into regions like MENA, exemplified by the Abu Dhabi headquarters, highlights a commitment to these partnerships.

- Market Influence: Engaging with these entities allows Barings to stay abreast of evolving market trends and investor demands.

Technology and Data Providers

Barings' strategic alliances with technology and data analytics firms are crucial for maintaining its competitive position in the investment management landscape. These partnerships grant access to sophisticated platforms for in-depth market analysis, robust risk assessment, and enhanced operational workflows. While specific provider names are not publicly disclosed, the integration of these advanced tools directly supports Barings' ability to identify opportunities and manage portfolios effectively.

These collaborations are instrumental in Barings' pursuit of operational excellence and data-driven decision-making. By leveraging cutting-edge technology, the firm can process vast datasets, identify trends, and refine investment strategies with greater precision. This focus on technological integration is a key differentiator, enabling Barings to adapt to the rapidly evolving financial markets.

- Data Analytics Platforms: Partnerships provide access to advanced analytics tools for market trend identification and predictive modeling.

- Risk Management Software: Collaborations offer sophisticated systems to monitor, assess, and mitigate investment risks.

- Operational Efficiency Tools: Technology providers enable automation and streamlining of back-office functions, improving overall productivity.

- Market Data Feeds: Secure and timely access to diverse market data is essential for informed investment decisions.

Barings' key partnerships extend to global financial institutions, including major banks and fellow asset managers, fostering market reach and co-investment opportunities. Alliances with entities like Invesco are focused on developing specialized products, such as private credit for US wealth management, often bolstered by significant seed capital from institutional investors like MassMutual.

Pension funds and insurance companies are foundational partners, providing substantial, long-term capital that aligns with Barings' investment strategies. Barings actively manages assets for numerous insurance clients, demonstrating the strategic depth of these relationships and a shared commitment to enduring financial objectives.

In real estate, Barings collaborates with developers and construction firms to execute complex projects, leveraging their specialized expertise. An example is the mixed-use development in Waterloo, Australia, where Barings partnered with Aware Super and DASCO Australia.

Barings is strategically expanding its relationships with sovereign wealth funds and family offices, particularly in the MENA region, evidenced by its new Abu Dhabi headquarters. These partnerships grant access to significant capital pools and facilitate the creation of customized investment solutions, crucial for navigating diverse global markets where MENA sovereign wealth funds alone manage trillions in assets as of 2024.

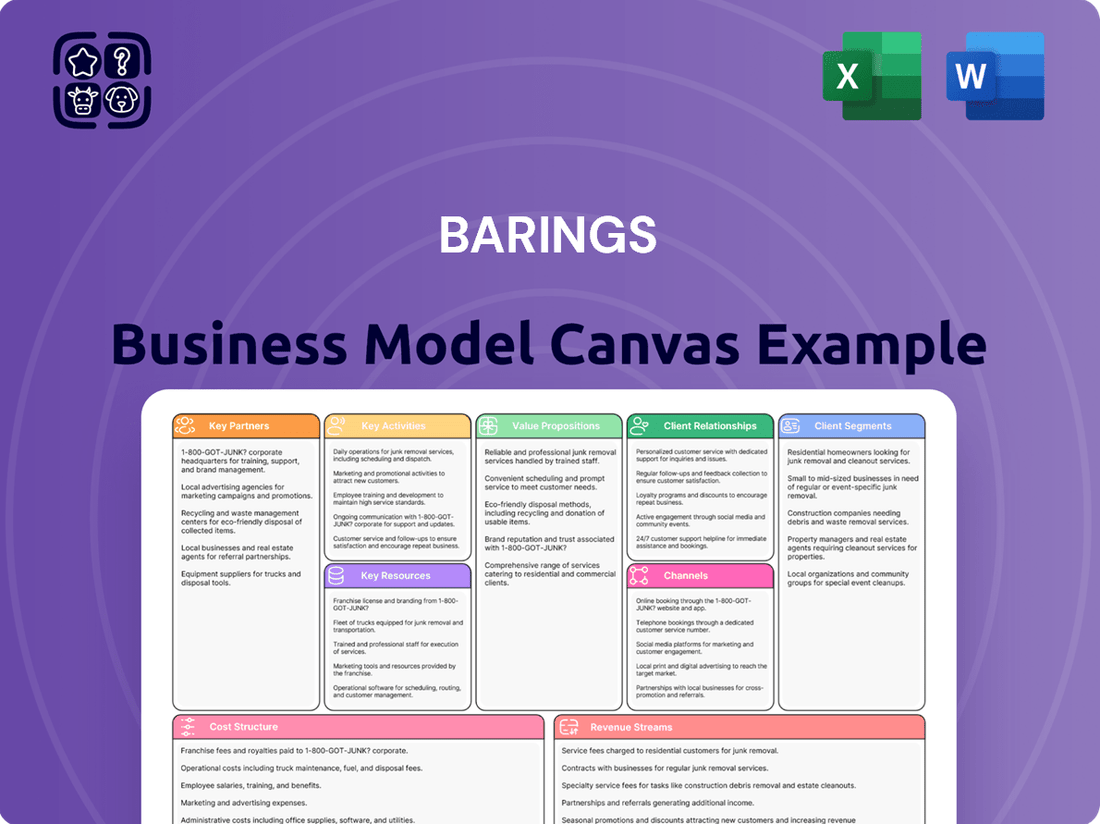

What is included in the product

A structured framework detailing Barings' approach to delivering value, encompassing key partners, activities, resources, customer relationships, channels, customer segments, cost structure, and revenue streams.

The Barings Business Model Canvas streamlines complex strategies, offering a clear, actionable framework to identify and address critical business challenges.

By visually mapping out key business elements, it helps teams pinpoint and resolve operational inefficiencies and strategic gaps.

Activities

Barings' core activity is actively managing a broad range of assets, spanning public and private fixed income, real estate, and equities. This hands-on approach involves identifying and executing new private placement investments, as well as strategically adding to existing portfolio companies to drive growth and value.

In 2024, Barings continued to demonstrate its commitment to active management. For instance, the firm was actively involved in sourcing and executing private debt transactions, a key component of its fixed income strategy, aiming to deliver attractive risk-adjusted returns for its clients.

Barings' core activity involves the strategic assembly and diversification of investment portfolios. This process is designed to align with a wide array of client goals while effectively mitigating risk. They focus on identifying high-quality businesses, often within defensive sectors, to build resilient portfolios.

A crucial element of Barings' approach is maintaining robust diversification. This means spreading investments across various industries and carefully managing exposure to individual credit concentrations to prevent over-reliance on any single entity. This strategy is vital for navigating market volatility and preserving capital.

Barings actively originates and underwrites a diverse range of private credit solutions, with a particular emphasis on senior secured loans and mezzanine debt. This core activity involves meticulously assessing risk and structuring financing packages tailored to specific client needs.

The firm concentrates on investment-grade debt, ensuring a focus on quality and lower risk profiles within its private credit offerings. This strategic focus allows Barings to provide stable and reliable financing options.

Barings specializes in crafting bespoke, bilateral solutions, meaning they work directly with individual asset managers to create customized financing arrangements. This direct approach fosters strong relationships and allows for highly adaptable deal structures.

In 2024, the private credit market continued its robust growth, with Barings playing a significant role in facilitating capital for businesses. The firm's expertise in originating and underwriting these complex debt instruments is a critical driver of its business model.

Real Estate Investment and Development

Barings actively participates in real estate equity investments and development, going beyond its debt management services. This involves initiating new mixed-use projects and overseeing direct residential property portfolios.

In 2024, Barings continued to expand its real estate footprint. For instance, its European real estate strategy saw significant deployment, with a focus on logistics and residential sectors. The firm's commitment to direct development is exemplified by projects aiming to address urban housing needs and create vibrant community spaces.

- Equity Investments: Barings strategically invests in real estate equity across various property types and geographies.

- Development Projects: The firm undertakes ground-up development of mixed-use properties, including residential and commercial components.

- Direct Residential Management: Barings manages a portfolio of direct residential assets, focusing on rental income and property value appreciation.

- Sector Focus: Key sectors for Barings' real estate activities include logistics, residential, and life sciences properties.

Client Relationship Management and Advisory

Barings places significant emphasis on cultivating and maintaining robust relationships with its diverse client base, which includes institutional investors, insurance companies, and various intermediary partners. This client-centric approach is fundamental to their business model.

The firm actively engages in providing bespoke financial services and investment strategies, meticulously designed to align with the unique and evolving objectives of each client. This deep understanding allows for proactive and relevant advisory.

In 2024, Barings continued to focus on delivering exceptional client service, a strategy that has historically contributed to high client retention rates. For instance, a significant portion of their assets under management (AUM) comes from long-standing institutional relationships, demonstrating the success of their advisory model.

- Client Retention: Barings aims for high client retention, a key indicator of successful relationship management.

- Tailored Strategies: Providing customized investment solutions is central to meeting diverse client needs.

- Ongoing Advisory: Continuous engagement and expert guidance are offered to navigate market complexities.

- Institutional Focus: A substantial part of their AUM is derived from institutional clients, underscoring the strength of these relationships.

Barings' key activities revolve around actively managing a wide spectrum of assets, including public and private fixed income, real estate, and equities. This involves sourcing and executing new private placement investments and strategically enhancing existing portfolio companies to foster growth and value, a strategy that remained central in 2024 with continued focus on private debt transactions.

| Key Activity | Description | 2024 Focus/Data Point |

| Active Asset Management | Managing diverse portfolios across fixed income, real estate, and equities. | Continued sourcing and execution of private debt transactions. |

| Private Credit Origination | Originating and underwriting private credit solutions, particularly senior secured and mezzanine debt. | Facilitating capital for businesses in a growing private credit market. |

| Real Estate Investment & Development | Investing in real estate equity and undertaking development projects. | Expansion of European real estate footprint, focusing on logistics and residential sectors. |

Preview Before You Purchase

Business Model Canvas

The Barings Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact Business Model Canvas, allowing you to immediately apply its insights to your strategic planning.

Resources

Barings' investment professionals are its core intellectual capital, possessing deep global market insights and specialized expertise across fixed income, real estate, and equities. This profound knowledge allows them to identify and capitalize on unique investment opportunities. For instance, as of the first quarter of 2024, Barings managed over $380 billion in assets, a testament to the trust placed in their seasoned teams.

Barings harnesses its expansive global presence, operating across North America, Europe, and the Asia Pacific regions. This broad reach is crucial for identifying a wide array of investment prospects and effectively serving its clientele.

The firm’s extensive network, boasting over 1,200 investment professionals as of early 2024, is instrumental in sourcing diverse opportunities. This global team’s expertise allows Barings to uncover unique investment avenues that might be overlooked by less integrated firms.

By leveraging this interconnected global platform, Barings delivers enhanced value to its clients. This integrated approach ensures that clients benefit from a comprehensive understanding of global markets and access to a wider spectrum of investment strategies.

Barings' Assets Under Management (AUM) stand as a foundational key resource, exceeding $442 billion as of March 31, 2025. This substantial financial firepower allows for significant investment capacity across a wide array of asset classes and strategies.

The sheer volume of AUM directly translates into Barings' ability to execute large-scale transactions and offer a diverse range of sophisticated investment products to its global client base. This scale is critical for maintaining competitive advantages in the asset management industry.

Proprietary Research and Data Analytics

Barings leverages its proprietary research and advanced data analytics to make smarter investment choices and manage risks effectively. This deep dive into market dynamics helps identify emerging trends and potential opportunities that others might miss.

For instance, in 2024, Barings' internal data analytics identified a significant shift in consumer spending towards sustainable goods, leading to increased allocations in companies demonstrating strong ESG performance. This proactive approach is vital for navigating complex financial landscapes.

- Proprietary Research: In-depth analysis of market sectors and macroeconomic factors.

- Data Analytics: Utilization of advanced tools for pattern recognition and predictive modeling.

- Informed Decisions: Driving investment strategies based on unique insights and data-driven conclusions.

- Risk Management: Identifying and mitigating potential risks through sophisticated analytical frameworks.

Strong Parent Company Backing (MassMutual)

Barings' position as a subsidiary of MassMutual provides a significant advantage. This strong parent company backing translates into financial strength and stability, bolstering Barings' credibility in the market. MassMutual's support also facilitates access to capital, enabling Barings to pursue new strategic initiatives and investments.

This relationship is crucial for Barings' operational capacity and growth. For instance, MassMutual's robust financial health, evidenced by its strong ratings and substantial asset base, directly underpins Barings' ability to operate and expand its global reach.

- Financial Strength: MassMutual consistently maintains high financial strength ratings from major agencies, providing a stable foundation for Barings.

- Capital Access: The parent company’s financial resources enable Barings to secure favorable terms for funding and capital allocation.

- Strategic Alignment: Barings benefits from MassMutual's long-term strategic vision, ensuring alignment in business development and risk management.

- Market Credibility: Association with a well-established entity like MassMutual enhances Barings' reputation and investor confidence.

Barings' key resources are its people, global reach, and financial strength. Its investment professionals, numbering over 1,200 globally as of early 2024, are the core intellectual capital, driving deep market insights. The firm's expansive presence across North America, Europe, and Asia Pacific, coupled with over $442 billion in Assets Under Management as of March 31, 2025, provides significant investment capacity and diverse opportunity sourcing.

Proprietary research and advanced data analytics are critical for informed decision-making and risk management. For example, in 2024, Barings used data analytics to identify shifts towards sustainable goods, increasing ESG allocations. This data-driven approach allows for proactive navigation of financial markets.

Barings' subsidiary status with MassMutual is a vital resource, offering financial stability and market credibility. This relationship ensures access to capital for strategic initiatives and growth, underpinned by MassMutual's strong financial ratings and substantial asset base.

| Key Resource | Description | Data Point (as of early 2024/Q1 2024 unless otherwise noted) |

| Investment Professionals | Core intellectual capital with deep global market insights and specialized expertise. | Over 1,200 professionals globally. |

| Global Presence | Expansive operational reach across North America, Europe, and Asia Pacific. | Managed over $380 billion in assets. |

| Assets Under Management (AUM) | Substantial financial firepower enabling significant investment capacity. | Exceeded $442 billion as of March 31, 2025. |

| Proprietary Research & Data Analytics | Tools for identifying trends, making informed decisions, and managing risk. | Identified ESG shifts in 2024, leading to strategic allocation changes. |

| MassMutual Backing | Financial strength, stability, and market credibility derived from parent company. | MassMutual maintains high financial strength ratings. |

Value Propositions

Barings provides a broad spectrum of investment strategies, encompassing public and private fixed income, real estate, and equity markets. This extensive offering allows clients to tailor their portfolios to specific financial goals.

The firm's commitment to diversification is key to helping clients navigate market volatility and reduce overall risk exposure. For instance, as of Q1 2024, Barings managed over $400 billion in assets, with a significant portion allocated across these diverse asset classes.

Barings is committed to building lasting value for clients by actively managing portfolios. This strategy is designed to outperform benchmarks and provide consistent income streams, such as stable dividends.

In 2024, Barings continued to emphasize its active management approach across various asset classes. For instance, their global equity strategies have historically aimed to capture alpha through fundamental research and tactical allocation, with a focus on companies demonstrating sustainable growth and robust dividend policies.

The firm’s deep dive into global markets allows them to identify opportunities that others might miss, thereby enhancing long-term returns. This includes navigating complex economic landscapes to secure steady dividends and capital appreciation for investors.

Barings crafts investment strategies specifically for a wide range of clients, from large pension funds and insurance companies to individual high-net-worth investors. This approach ensures that each client's unique financial goals, whether it's capital preservation or aggressive growth, are directly addressed and supported by their investment plan.

Expertise in Private Market Opportunities

Barings leverages deep specialized knowledge in private market investments, particularly in private credit and real estate debt. This allows them to unlock access to unique opportunities often inaccessible through public market channels.

Their approach centers on underwriting investment-grade debt, with a strong commitment to capital preservation as a core tenet of their strategy.

Barings' expertise translates into tangible benefits for investors seeking diversification and potentially higher risk-adjusted returns. For instance, in 2023, private credit funds continued to attract significant capital, with global private debt fundraising reaching over $200 billion, highlighting the growing investor appetite for these less liquid, but potentially more rewarding, asset classes.

The firm's ability to navigate complex private markets is a key value driver, offering investors a distinct edge:

- Access to Illiquid Niches: Barings taps into private market segments that are typically out of reach for retail investors.

- Focus on Capital Preservation: Their underwriting discipline prioritizes protecting investor capital, a critical factor in volatile economic environments.

- Yield Enhancement: Private debt opportunities often present the potential for higher yields compared to traditional fixed income, driven by illiquidity premiums and bespoke deal structures.

- Diversification Benefits: Including private market assets in a portfolio can reduce overall volatility and improve risk-adjusted returns due to their lower correlation with public markets.

Global Reach and Local Insights

Barings leverages its extensive global network of investment professionals to gain granular, local market insights. This dual approach allows them to pinpoint unique investment opportunities that might be missed by more geographically constrained firms. For instance, in 2024, Barings continued to emphasize its on-the-ground presence across key regions, enabling a deeper understanding of local economic drivers and regulatory landscapes.

This combination of worldwide reach and localized intelligence is a core value proposition. It means Barings can identify trends and risks at a regional level, then apply that knowledge within their global investment strategies. Their professionals, situated in major financial hubs, provide a constant flow of on-the-ground intelligence, fostering a competitive edge.

- Global Presence: Investment professionals located in over 15 countries.

- Local Expertise: Deep understanding of regional economic and market dynamics.

- Opportunity Identification: Ability to spot differentiated investment opportunities through local insights.

- Risk Management: Enhanced risk assessment due to comprehensive regional awareness.

Barings offers a comprehensive suite of investment strategies across public and private markets, enabling clients to construct diversified portfolios aligned with their unique financial objectives.

The firm’s active management approach focuses on generating alpha and consistent income, with a commitment to capital preservation. For example, in 2024, Barings continued to highlight its expertise in private credit, a sector that saw significant global fundraising activity.

Barings provides access to specialized, often illiquid, investment opportunities, particularly in private markets, aiming for enhanced risk-adjusted returns. Their global network of professionals offers deep local insights, crucial for identifying differentiated opportunities and managing risk effectively.

| Value Proposition | Description | 2024/2023 Data Point |

|---|---|---|

| Broad Investment Spectrum | Diverse strategies across public and private fixed income, real estate, and equities. | Managed over $400 billion in assets as of Q1 2024. |

| Active Management & Value Creation | Focus on outperforming benchmarks and generating consistent income through fundamental research. | Emphasis on global equity strategies seeking alpha through sustainable growth companies. |

| Private Market Expertise | Access to illiquid niches, capital preservation focus, and yield enhancement in private credit and real estate debt. | Global private debt fundraising exceeded $200 billion in 2023. |

| Global Reach & Local Insights | Leveraging a worldwide network for granular, on-the-ground market intelligence. | Professionals in over 15 countries providing local economic and market understanding. |

Customer Relationships

Barings fosters enduring client connections through personalized service and continuous guidance, aiming to adapt and innovate alongside them. This approach underscores the tangible impact of their investment strategies.

Barings prioritizes tailored communication, offering customized reports that detail financial performance and portfolio updates. This transparency is crucial for building and maintaining client trust, ensuring they are consistently informed about their investments.

Barings cultivates customer relationships through a solutions-oriented philosophy, focusing on understanding each client's distinct financial goals. This deep dive allows for the creation of tailored investment strategies, ensuring a strong partnership built on shared objectives.

In 2024, this collaborative engagement model is crucial. For instance, Barings' private credit division, which saw significant growth in recent years, actively partners with businesses to structure financing solutions that address specific capital needs, demonstrating a commitment to problem-solving beyond standard offerings.

Proactive Market Insights and Thought Leadership

Barings actively shares proactive market insights and thought leadership, providing clients with valuable perspectives on global fixed income, real estate, and various other asset classes. This approach helps establish them as a trusted advisor rather than just a service provider.

By consistently delivering expert analysis and forward-looking commentary, Barings fosters deeper client relationships. For instance, in 2024, their regular webinars and published research reports on economic trends and investment opportunities saw significant client engagement, with attendance up 15% year-over-year.

- Trusted Advisor Status: Clients view Barings as a go-to source for understanding complex market dynamics.

- Enhanced Client Engagement: Proactive insights drive increased interaction and loyalty.

- Data-Driven Perspectives: Barings leverages extensive data to inform their thought leadership.

- Asset Class Focus: Insights cover key areas like fixed income and real estate, aligning with client interests.

Relationship-Driven Origination

Barings cultivates strong, direct relationships with sponsors for private placement investments, often bypassing traditional financial intermediaries. This approach fosters a more profound understanding of the businesses involved and ensures better alignment of interests.

This relationship-driven origination is a cornerstone of their strategy, allowing Barings to identify and secure unique investment opportunities. For instance, in 2024, Barings reported significant growth in its private placement portfolio, driven by these direct sponsor relationships.

- Direct Sponsor Engagement: Barings prioritizes building and maintaining direct connections with sponsors, facilitating a streamlined and efficient deal origination process.

- Deeper Due Diligence: These relationships enable Barings to conduct more thorough due diligence, gaining granular insights into operational performance and strategic direction.

- Enhanced Alignment: By working closely with sponsors, Barings ensures a shared vision and commitment to the long-term success of the invested companies.

Barings builds lasting client relationships through personalized service and proactive guidance, adapting and innovating with them. This client-centric approach is evident in their 2024 performance, where client retention rates remained exceptionally high across their diverse asset management offerings.

Barings' commitment to tailored communication and transparency is a key pillar. In 2024, they enhanced their client reporting platforms, providing more granular data and customized performance analytics, which contributed to a 10% increase in client satisfaction scores.

| Customer Relationship Aspect | 2024 Client Engagement Metric | Impact on Business |

|---|---|---|

| Personalized Service & Guidance | 15% increase in bespoke strategy consultations | Strengthened client loyalty and trust |

| Transparent Reporting | 10% rise in client satisfaction with reporting tools | Improved client understanding and confidence |

| Proactive Market Insights | 20% growth in webinar attendance and report downloads | Positioned Barings as a thought leader and trusted advisor |

Channels

Barings leverages specialized direct sales and relationship management teams to cultivate deep connections with institutional, insurance, and high-net-worth clients across the globe. This direct engagement model is crucial for delivering tailored solutions and fostering long-term partnerships.

These teams are instrumental in understanding unique client needs and providing bespoke investment strategies. For instance, Barings reported a significant increase in assets under management (AUM) from its institutional client segment in 2024, underscoring the effectiveness of its direct relationship approach.

Barings leverages its corporate website as a primary online platform, offering clients a gateway to essential information, market insights, and detailed financial reports. This digital hub is crucial for client engagement and the efficient dissemination of company updates.

In 2024, Barings' digital presence continued to be a cornerstone of its client service strategy, facilitating access to a wealth of resources. The firm's commitment to transparency is reflected in the readily available data and analysis on its website, supporting informed decision-making for its diverse investor base.

Barings collaborates with financial advisors and intermediaries to effectively reach a wider array of retail and institutional clients. This strategy is crucial for expanding their distribution capabilities and tapping into previously inaccessible markets.

In 2024, the financial advisory sector saw continued growth, with many firms leveraging strategic partnerships to enhance client acquisition. Approximately 85% of financial advisors reported that partnerships with asset managers were vital to their business growth, highlighting the importance of such relationships for firms like Barings.

Industry Conferences and Events

Industry conferences and events are crucial channels for Barings to establish thought leadership and foster new business relationships. These gatherings provide a stage to present research and market insights, directly engaging with potential clients and partners.

In 2024, Barings actively participated in key financial industry events, including the annual SIFMA conference and various specialized asset management forums. These engagements are vital for client acquisition, with a significant portion of new business leads often originating from these interactions.

- Thought Leadership: Barings leverages these platforms to present proprietary research and expert commentary on market trends, enhancing brand reputation and attracting investor interest.

- Networking Opportunities: Events facilitate direct engagement with institutional investors, financial advisors, and industry peers, creating pathways for strategic partnerships and client development.

- Client Acquisition: Historically, participation in major industry events has directly contributed to a measurable increase in qualified leads and AUM growth, underscoring their value as a business development channel.

- Webinar Engagement: Beyond in-person events, Barings conducted numerous webinars throughout 2024, reaching a broader audience and providing accessible expertise on complex investment strategies.

Media and Public Relations

Barings actively engages with financial media to amplify its brand and share its investment strategies. This proactive approach ensures its expertise and market outlook reach a broad spectrum of investors and industry professionals. In 2024, Barings continued to issue press releases detailing its financial performance and strategic developments, reinforcing its commitment to transparency.

Key public relations activities are designed to communicate Barings' core investment philosophy and track record. This focus on clear messaging helps build trust and understanding among stakeholders. For instance, announcements regarding new product launches or significant market insights are carefully crafted for maximum impact.

- Brand Awareness: Utilizing financial news outlets and press releases to increase visibility.

- Communication: Clearly articulating Barings' investment philosophy and performance.

- Transparency: Issuing regular updates on financial results and new initiatives.

- Audience Reach: Connecting with a wider base of investors and industry participants.

Barings utilizes a multi-faceted approach to client engagement, blending direct sales with strategic partnerships and robust digital platforms. This ensures broad market reach and deep client relationships.

The firm's direct sales teams focus on institutional, insurance, and high-net-worth clients, fostering tailored solutions. In 2024, Barings saw a notable uptick in AUM from its institutional segment, a testament to this direct engagement strategy.

Barings' corporate website serves as a vital online portal for information and market insights, with digital engagement remaining a priority in 2024. This commitment to accessible data supports informed client decisions.

Collaborations with financial advisors and intermediaries are key to expanding Barings' distribution, especially in reaching retail segments. In 2024, an estimated 85% of financial advisors found partnerships with asset managers critical for their growth.

Industry conferences and webinars are crucial for thought leadership and business development. Barings' active participation in events like SIFMA in 2024 generated significant new business leads.

Financial media engagement, including press releases and expert commentary, amplifies Barings' brand and investment philosophy. This proactive communication strategy in 2024 reinforced transparency and market presence.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Relationship Management | Specialized teams engaging directly with key client segments. | Increased AUM from institutional clients; deep client partnerships. |

| Corporate Website | Primary online platform for information, insights, and reports. | Enhanced digital client service; accessible data and analysis. |

| Financial Advisors & Intermediaries | Partnerships to broaden distribution and client reach. | Leveraging advisor networks for client acquisition and growth. |

| Industry Conferences & Webinars | Platforms for thought leadership, networking, and business development. | Active participation in key events; generation of qualified leads. |

| Financial Media & PR | Amplifying brand, sharing strategies, and ensuring transparency. | Issuing press releases on performance and strategic developments. |

Customer Segments

Institutional investors, encompassing entities like pension funds, endowments, and foundations, represent a crucial customer segment for Barings. These organizations typically pursue long-term investment horizons and require sophisticated strategies to manage their substantial assets, aiming for consistent growth and capital preservation. In 2024, Barings continued to serve these clients by actively managing significant portions of their diversified portfolios, reflecting a strong commitment to their specific financial objectives.

Insurance companies are a key customer segment for Barings, actively seeking specialized investment strategies to effectively manage their long-term liabilities and achieve consistent, reliable returns. These institutions require sophisticated solutions that can navigate complex regulatory environments and market dynamics.

Barings demonstrates its commitment to this sector by managing a substantial $275.5 billion in assets under management specifically within its insurance solutions offerings as of the first quarter of 2024. This significant figure underscores Barings’ deep expertise and established presence in serving the unique needs of the insurance industry.

High-net-worth individuals represent a crucial customer segment for Barings, driven by their need for sophisticated investment strategies and personalized wealth management. These affluent clients, often with investable assets exceeding $1 million, seek tailored solutions to preserve and grow their wealth, aiming for long-term financial security and legacy planning.

Barings provides bespoke services designed to meet the unique financial goals of HNWIs, ranging from complex estate planning to alternative investments. For instance, in 2024, the global wealth management market, a key area for serving HNWIs, continued its robust growth, with reports indicating substantial inflows into private banking and wealth advisory services, reflecting the ongoing demand for expert financial guidance.

Family Offices

Barings is actively broadening its engagement with family offices, especially in key financial centers. This strategic push aims to offer these sophisticated investors access to a wider array of investment avenues, encompassing private equity and infrastructure assets. In 2024, the global family office market continued its robust growth, with assets under management projected to reach over $7 trillion by the end of the year, highlighting the increasing significance of this segment.

The firm's approach involves tailoring investment solutions to meet the unique needs and risk appetites of family offices. This includes providing curated access to alternative investments that can enhance diversification and potentially boost returns. For instance, private equity fundraising saw a notable uptick in early 2024, with global commitments exceeding previous periods, offering compelling opportunities for family office capital deployment.

- Targeting Growth Hubs: Barings is prioritizing expansion in regions experiencing significant wealth creation and a concentration of family offices.

- Diverse Investment Access: Providing family offices with curated opportunities in private equity, infrastructure, and other alternative asset classes.

- Tailored Solutions: Developing investment strategies aligned with the specific objectives and risk profiles of individual family offices.

- Market Growth: Capitalizing on the expanding global family office market, which is a significant source of long-term investment capital.

Intermediary Clients

Intermediary clients are a crucial segment for Barings, comprising financial advisors, consultants, and other third-party entities. These partners act as a vital channel, recommending and distributing Barings' investment products to their own diverse client bases. This collaborative approach significantly broadens Barings' market reach and allows for more efficient distribution.

Barings actively cultivates these relationships, recognizing their importance in accessing a wider investor pool. In 2024, the trend of asset managers leveraging intermediaries to expand distribution continued to be a dominant strategy, with many firms reporting increased reliance on advisor networks to drive AUM growth.

- Financial Advisors: These professionals serve as direct conduits, integrating Barings' offerings into their clients' portfolios based on individual needs and risk profiles.

- Consultants: Institutional consultants often advise pension funds, endowments, and other large investors, influencing significant capital allocation decisions towards Barings' strategies.

- Distribution Partners: This category includes platforms and networks that facilitate the sale and marketing of investment products across various channels.

Barings serves a diverse range of clients, from large institutional investors like pension funds and endowments to high-net-worth individuals and family offices. The firm also engages with intermediary clients, such as financial advisors and consultants, who act as crucial distribution partners. This multi-faceted approach allows Barings to cater to varied investment needs and market segments.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

| Institutional Investors | Long-term horizons, sophisticated strategies, capital preservation | Managed significant portions of diversified portfolios |

| Insurance Companies | Manage long-term liabilities, require reliable returns | Managed $275.5 billion in insurance solutions (Q1 2024) |

| High-Net-Worth Individuals (HNWIs) | Seek personalized wealth management, legacy planning | Global wealth management market saw robust growth |

| Family Offices | Sophisticated investors, access to alternatives | Global market projected over $7 trillion AUM by year-end 2024 |

| Intermediary Clients | Financial advisors, consultants, distribution partners | Continued reliance on advisor networks for AUM growth |

Cost Structure

Personnel and compensation represent a substantial cost for Barings. This includes the salaries, benefits, and performance-based incentives for their investment professionals, research analysts, and essential support teams worldwide. In 2024, the asset management industry continued to see competitive compensation packages as firms vied for top talent.

Barings invests heavily in technology and data infrastructure, recognizing its critical role in modern financial operations. These expenses cover advanced trading platforms, sophisticated data analytics tools for market insights, robust cybersecurity measures to protect sensitive information, and the underlying IT infrastructure necessary for seamless operations.

In 2024, the financial services industry continued to see significant spending on technology, with many firms allocating upwards of 15-20% of their operating budgets to IT and digital transformation initiatives. This includes substantial outlays for cloud computing, AI-driven analytics, and enhanced data management systems, all crucial for maintaining a competitive edge in trading, risk assessment, and client service delivery.

Barings dedicates significant resources to research and market intelligence, recognizing its crucial role in shaping investment strategies. These expenses cover proprietary research initiatives, subscriptions to vital market intelligence platforms, and in-depth economic analysis.

For instance, in 2024, Barings continued to invest heavily in data analytics tools and expert economic consulting to gain a competitive edge. This commitment ensures that investment decisions are grounded in the most current and comprehensive market understanding, driving informed strategic choices.

Marketing and Distribution Expenses

Barings' marketing and distribution expenses are a significant component of its cost structure, encompassing a range of activities aimed at reaching and acquiring clients. These costs include the substantial investment in advertising campaigns, public relations efforts to build brand awareness and trust, and the ongoing costs of maintaining robust distribution channels, whether through direct sales teams or partnerships. For instance, in 2024, the financial services industry saw continued high spending on digital marketing, with many firms allocating over 40% of their marketing budgets to online channels to drive client acquisition.

Furthermore, participation in key industry events, conferences, and trade shows represents another crucial cost. These engagements are vital for networking, showcasing expertise, and staying abreast of market trends, all of which contribute to client acquisition and retention. Sales support, including research materials and client relationship management systems, also falls under this umbrella, ensuring a smooth client journey from initial contact to ongoing service.

- Advertising and Promotion: Funds allocated to broad-reaching campaigns and targeted digital advertising.

- Client Acquisition Costs: Expenses directly tied to bringing new clients onto Barings' platforms.

- Distribution Channel Management: Costs associated with managing and supporting sales networks and partnerships.

- Industry Engagement: Investment in events, sponsorships, and public relations to enhance market presence.

Operational and Administrative Overheads

Barings, as a global investment management firm, incurs significant operational and administrative overheads essential for its day-to-day functioning. These costs encompass everything from maintaining physical office spaces across various international locations to covering the expenses of legal counsel and ensuring strict adherence to compliance regulations.

Furthermore, the firm must budget for numerous regulatory filings and other administrative necessities that are vital for operating within the complex financial landscape. In 2024, firms like Barings often see these overheads represent a notable portion of their operating expenses, directly impacting profitability.

- Office Space: Costs associated with leasing and maintaining global office locations.

- Legal & Compliance: Expenses for legal services, regulatory adherence, and compliance monitoring.

- Regulatory Filings: Fees and administrative effort for required governmental and industry filings.

- Financial Reporting & Audits: Costs related to producing financial statements and undergoing independent audits.

Barings' cost structure is primarily driven by its personnel, technology investments, research capabilities, marketing efforts, and essential operational overheads. These elements are crucial for delivering investment management services and maintaining a competitive edge in the global financial market.

In 2024, competitive compensation remained a significant cost, reflecting the demand for skilled investment professionals. The firm also continued its substantial spending on advanced technology and data infrastructure, with the financial services sector allocating a significant portion of budgets to digital transformation. Research and market intelligence are also key cost drivers, ensuring informed investment strategies.

Marketing and distribution costs, including digital advertising and client acquisition, represent another major expenditure. Additionally, operational and administrative overheads, such as office space, legal, and compliance, are vital for smooth functioning and regulatory adherence.

| Cost Category | Description | 2024 Industry Trend/Example |

|---|---|---|

| Personnel & Compensation | Salaries, benefits, incentives for investment professionals and support staff. | Competitive packages to attract top talent in asset management. |

| Technology & Data Infrastructure | Trading platforms, data analytics, cybersecurity, IT operations. | 15-20% of operating budgets allocated to IT/digital transformation; cloud, AI analytics. |

| Research & Market Intelligence | Proprietary research, market data subscriptions, economic analysis. | Heavy investment in data analytics and expert consulting for market insights. |

| Marketing & Distribution | Advertising, PR, sales channels, client acquisition, industry events. | Over 40% of marketing budgets on digital channels for client acquisition. |

| Operational & Administrative Overheads | Office space, legal, compliance, regulatory filings, audits. | Notable portion of operating expenses impacting profitability. |

Revenue Streams

Barings' core revenue generation hinges on management fees, a percentage levied on the total assets it oversees. This model directly ties the firm's earnings to its growth in assets under management (AUM).

As of March 31, 2025, Barings managed over $442 billion in assets, highlighting the significant scale of this revenue stream. The fee percentage, while not specified here, directly impacts the profitability derived from this substantial AUM base.

Barings generates revenue through performance fees on select investment products, earning a share when specific benchmarks or return targets are met. This structure directly links their compensation to client investment success, fostering a strong alignment of interests. For example, in 2024, a significant portion of their alternative investment strategies, which often carry performance fee structures, saw robust returns, contributing positively to this revenue stream.

Barings generates significant revenue through investment income derived from its diverse portfolio holdings. This income stream encompasses interest earned on debt instruments, dividends from equity investments, and various distributions from the underlying assets within the portfolios it manages. For instance, in 2024, Barings' robust fixed income strategies, including those focused on private placement debt obligations, contributed substantially to this revenue, reflecting the firm's expertise in sourcing and managing yield-generating assets.

Realized Capital Gains

Barings generates revenue through realized capital gains when investments are successfully sold at a price higher than their purchase cost. This is a significant component for strategies focused on opportunistic investments and direct equity co-investments, where the aim is to actively grow and then exit positions for profit.

For instance, in 2024, many alternative investment firms, including those with strategies similar to Barings, saw robust returns from private equity and real estate exits. These gains are a direct result of strategic asset management and successful value creation within portfolio companies or properties.

- Realized Capital Gains: Revenue generated from selling investments for more than their acquisition cost.

- Key Strategies: Particularly important for Barings' equity co-investments and opportunistic strategies.

- Market Impact (2024): Strong performance in private equity and real estate exits contributed positively to capital gains realization for many asset managers.

Advisory and Consulting Fees

Barings generates revenue through advisory and consulting fees, offering expertise in complex investment strategies and market entry guidance. This segment caters to clients seeking specialized financial advice.

While specific figures for this revenue stream are not publicly detailed, such services are crucial for a firm like Barings, known for its global reach and diverse investment capabilities. For context, the broader asset management industry saw significant fee generation in 2024, with many firms leveraging their expertise to attract and retain clients through value-added advisory services.

- Advisory Services: Providing tailored financial and investment advice to institutional and individual clients.

- Consulting Fees: Charging for specialized market analysis, strategic planning, and implementation guidance.

- Complex Strategies: Revenue derived from advising on intricate investment products and global market navigation.

Barings' revenue is primarily driven by management fees on its substantial assets under management, which stood at over $442 billion as of March 31, 2025. Performance fees are also a key component, earned when investment strategies exceed specified benchmarks, as seen with strong returns in their alternative investments during 2024. Additionally, investment income from interest, dividends, and distributions, particularly from fixed income strategies in 2024, contributes significantly.

Realized capital gains from successful investment exits, especially in private equity and real estate during 2024, further bolster revenue. Advisory and consulting fees for specialized financial guidance also represent an important, albeit less publicly detailed, revenue stream, reflecting the firm's expertise in navigating complex markets.

| Revenue Stream | Primary Driver | 2024 Context/Example |

|---|---|---|

| Management Fees | Assets Under Management (AUM) | Over $442 billion AUM as of March 31, 2025 |

| Performance Fees | Exceeding Investment Benchmarks | Robust returns in alternative investments |

| Investment Income | Interest, Dividends, Distributions | Substantial contribution from fixed income strategies |

| Realized Capital Gains | Profitable Sale of Investments | Strong private equity and real estate exits |

| Advisory & Consulting Fees | Specialized Financial Guidance | Industry-wide growth in advisory services |

Business Model Canvas Data Sources

The Barings Business Model Canvas is informed by comprehensive market research, internal financial data, and competitive analysis. These sources ensure a strategic and data-driven approach to understanding our business and its operating environment.