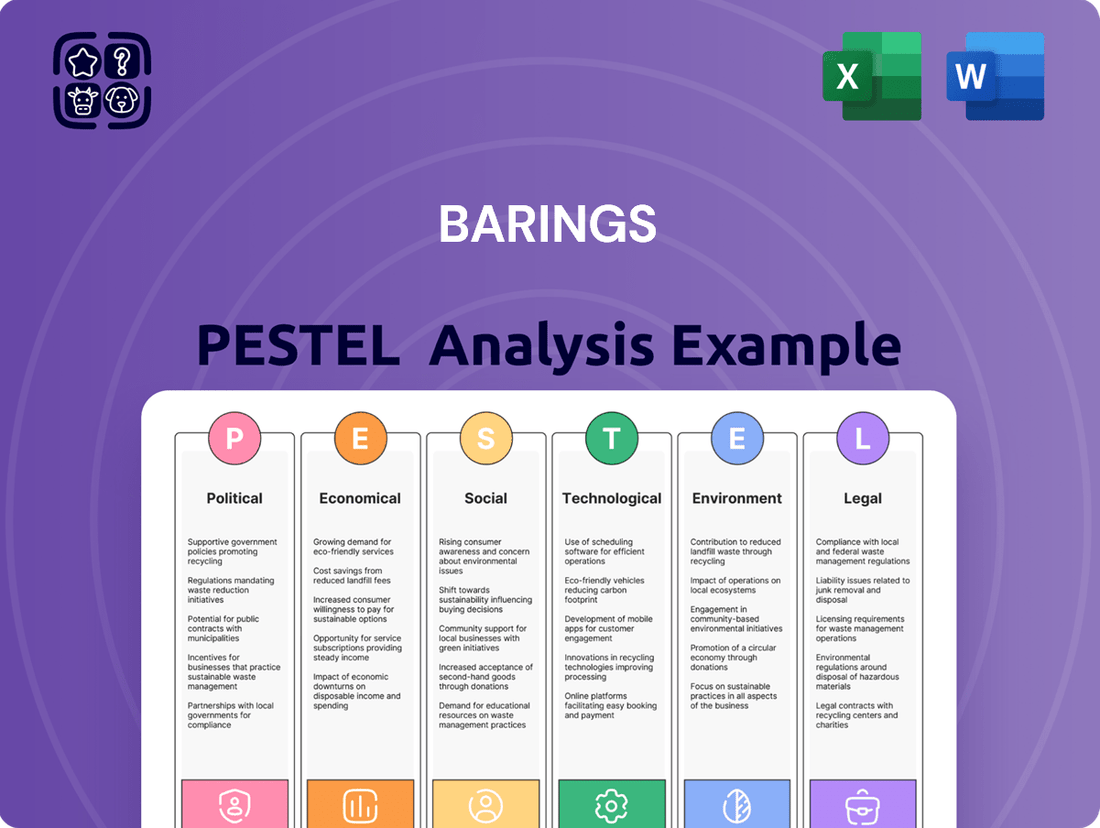

Barings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Unlock the strategic insights into Barings's operating environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are shaping its future. This expertly crafted report provides the clarity you need to make informed decisions. Download the full version now and gain a competitive edge.

Political factors

Global political stability and shifting trade policies are critical for Barings, impacting everything from cross-border investments to market access. Heightened trade tensions or geopolitical instability can trigger financial market volatility and erode investor confidence, directly affecting asset valuations and investment strategies.

Barings' strategic push into regions like the Middle East and North Africa (MENA) highlights a proactive approach to leverage investor-friendly policies and economic diversification initiatives. For instance, Saudi Arabia's Vision 2030 aims to attract significant foreign investment, with projections suggesting the kingdom could attract $100 billion in foreign direct investment annually by 2030, presenting opportunities for global managers.

The asset management sector faces evolving regulatory pressures. While 2024 saw increased emphasis on Environmental, Social, and Governance (ESG) disclosures, with the SEC finalizing climate disclosure rules, there's a growing discussion around potential deregulation in 2025. This could mean adjustments to compliance burdens, impacting how firms like Barings manage ESG reporting and data governance.

Government fiscal policies, encompassing decisions on spending and taxation, alongside monetary policies set by central banks, profoundly shape investment landscapes. For instance, the Federal Reserve's adjustments to interest rates directly impact market performance and the movement of investment capital.

Barings closely tracks these policy shifts to refine its global fixed income and broader investment approaches. As of mid-2024, the Federal Reserve maintained its target federal funds rate range between 5.25% and 5.50%, a stance influenced by persistent inflation data, which has been a key consideration for investment strategy adjustments.

International Investment Agreements

International investment agreements significantly shape capital flows and market access for global financial firms. Bilateral investment treaties (BITs) and multilateral agreements, such as those under the World Trade Organization, can either facilitate or hinder cross-border investments by setting rules on investment protection, dispute resolution, and market entry. For Barings, navigating this landscape is key to expanding its reach; for example, the UK's post-Brexit trade agreements with various nations impact its ability to offer services and attract capital internationally.

Understanding and adapting to these agreements is paramount for a global firm like Barings aiming to broaden its client base and international investment solutions. These pacts can create preferential treatment for investors from signatory countries or impose specific conditions on foreign direct investment, directly influencing strategic decisions regarding market entry and operational structure.

Barings' strategic move to establish a headquarters in Abu Dhabi exemplifies this, aiming to deepen relationships with sovereign wealth funds. These funds, often substantial investors, are frequently shaped by the investment frameworks established by their home countries and their participation in international investment agreements. For instance, the UAE's network of BITs and its role in regional economic blocs influence its investment strategies and partnerships.

- Bilateral Investment Treaties (BITs): As of early 2024, over 3,000 BITs are in force globally, providing a framework for investment protection and promotion between two countries.

- Multilateral Agreements: The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes nations like Japan, Canada, and Australia, sets standards for investment across its member states.

- Impact on Market Entry: Agreements can reduce barriers to entry, such as ownership restrictions or licensing requirements, making it easier for firms like Barings to establish operations and offer services in new markets.

- Sovereign Wealth Fund Influence: Many sovereign wealth funds, like the Abu Dhabi Investment Authority (ADIA), operate within strict national investment mandates influenced by international agreements, making proximity and understanding of these pacts crucial for Barings.

Political Risk in Emerging Markets

Political risk is a significant consideration for investors in emerging markets, encompassing potential policy shifts, nationalization threats, or abrupt governmental changes. Barings, actively involved in emerging markets debt, must meticulously evaluate and mitigate these inherent risks. For instance, in 2024, political instability in several key emerging economies led to increased sovereign bond yields, reflecting heightened investor caution.

Barings' strategy of pinpointing high-quality companies with undervalued growth prospects in these regions directly addresses this challenge. This approach aims to capitalize on intrinsic business strength rather than solely relying on stable political environments. The firm's research in 2024 highlighted that companies with strong corporate governance and diversified revenue streams in emerging markets often proved more resilient to political headwinds.

- Policy Instability: Emerging markets can experience frequent and unpredictable changes in economic and regulatory policies, impacting investment returns.

- Nationalization Risk: The possibility of governments seizing private assets, while less common now, remains a concern in certain sectors and regions.

- Government Turnover: Transitions in political power can lead to shifts in foreign investment policies and contractual agreements.

- Geopolitical Tensions: Regional conflicts or international disputes can spill over and negatively affect the economic and political stability of emerging markets.

Government stability and policy continuity are paramount for Barings, influencing long-term investment strategies and market predictability. Shifts in leadership or policy direction can rapidly alter the investment landscape, as seen with the ongoing adjustments to fiscal policies impacting global capital flows.

Barings must navigate evolving regulatory frameworks, such as the 2024 focus on ESG disclosures, which may see adjustments in 2025, potentially altering compliance requirements for asset managers. Understanding these political underpinnings is crucial for maintaining operational efficiency and strategic alignment.

International relations and trade agreements directly shape market access and capital movement for firms like Barings. The UK's post-Brexit trade deals, for instance, continue to influence its ability to operate and attract investment across different jurisdictions, underscoring the need for constant political risk assessment.

Political risk in emerging markets remains a key concern, with policy instability and government turnover directly impacting investment returns. Barings' strategy of focusing on resilient companies with strong governance in these regions aims to mitigate such political headwinds, a critical approach in 2024's volatile environments.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Barings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on the external factors that impacted Barings.

Helps support discussions on external risk and market positioning during planning sessions by highlighting the political, economic, social, technological, environmental, and legal forces that contributed to Barings' downfall.

Economic factors

The prevailing interest rate environment is a critical economic lever for asset management firms like Barings. As of mid-2025, central banks globally are navigating a complex landscape. For instance, the US Federal Reserve has maintained its benchmark interest rate in the 5.25%-5.50% range through early 2025, signaling a cautious approach to inflation management.

Lower interest rates, when implemented, typically fuel economic expansion and bolster investor sentiment, which can translate to higher assets under management (AUM) and increased revenue for asset managers. This is because cheaper borrowing costs encourage investment and economic activity. Conversely, periods of interest rate uncertainty, such as the ongoing discussions around potential rate cuts or hikes in 2025, can introduce significant market volatility, directly affecting investment returns and the overall performance of managed portfolios.

Inflationary or deflationary pressures significantly impact the real value of returns and the effectiveness of investment strategies. In periods of rising inflation, assets that can keep pace with or outpace price increases become more attractive.

For a firm like Barings, with substantial holdings in floating rate loans, an inflationary environment can be beneficial. These loans typically adjust their interest rates upwards as benchmark rates rise due to inflation, thereby protecting purchasing power and potentially yielding higher returns. As of early 2024, inflation rates in major economies, while moderating from 2023 peaks, remained a key focus for central banks.

The Federal Reserve's continued emphasis on bringing inflation back to its 2% target will undoubtedly shape market dynamics throughout 2024 and into 2025. This focus influences interest rate decisions, bond yields, and overall investment risk appetite.

Global economic growth, projected by the IMF to reach 3.2% in 2024 and 3.2% again in 2025, provides a generally supportive backdrop for financial markets, bolstering investor confidence and asset under management (AUM). This steady expansion encourages capital deployment across various asset classes.

However, persistent recession risks loom, stemming from factors like ongoing geopolitical tensions and potential supply chain disruptions. For asset managers, this necessitates a strategic approach, diversifying capital allocation between public and private markets to mitigate downside risks and capitalize on opportunities for positive financial impact.

Market Volatility and Investor Confidence

Market volatility, a persistent feature in 2024, has been significantly influenced by shifting fiscal policies and evolving monetary stances from central banks globally. This uncertainty directly affects asset manager stock prices and their ability to achieve consistent organic growth. For instance, the VIX index, a key measure of market volatility, experienced notable spikes throughout 2024 in response to geopolitical events and inflation concerns.

Conversely, periods of increased investor confidence, often coinciding with more stable economic conditions and predictable policy environments, provide a strong tailwind for organic growth. When investors feel secure, they are more likely to allocate capital across various asset classes, including fixed income and exchange-traded funds (ETFs). This trend was evident in the first half of 2025, where a perceived easing of inflationary pressures led to a notable inflow into broad market ETFs.

- Market Volatility Impact: Economic uncertainty and policy shifts in 2024 led to increased market volatility, impacting asset manager valuations.

- Investor Confidence Driver: Stable economic conditions and clear monetary policies in early 2025 boosted investor confidence.

- Asset Class Performance: Higher confidence correlated with positive organic growth momentum in fixed income and ETFs.

- VIX Index Trends: The VIX index reflected heightened market apprehension during 2024 due to geopolitical and economic factors.

Capital Flows and Liquidity

The global economic landscape in 2024 and early 2025 is characterized by significant capital flows and evolving market liquidity, directly impacting investment management firms like Barings. Investors are actively assessing opportunities across various asset classes and geographical regions, with a keen eye on yield differentials and economic growth prospects. For instance, the shift in monetary policy stances by major central banks continues to influence investor risk appetite.

Lower interest rate environments, which persisted in many developed economies through much of 2024, generally encouraged a move towards higher-risk assets. This reallocation can boost revenue for asset managers by increasing assets under management in growth-oriented strategies. However, the pace of rate cuts and the potential for inflation to remain sticky are key considerations for portfolio construction.

Barings, like its peers, must navigate these dynamics by prudently managing its own liquidity and unfunded commitments. This is a critical aspect highlighted in its financial reporting, ensuring operational stability and the ability to meet obligations. For example, Barings' interim financial statements for 2024 would detail its liquidity ratios and any significant unfunded commitments, which are vital for investor confidence.

- Global Capital Allocation: In 2024, emerging markets saw renewed interest as investors sought higher yields, though geopolitical risks remained a factor.

- Interest Rate Sensitivity: The Federal Reserve's indications of potential rate cuts in late 2024/early 2025 influenced fixed income markets, prompting shifts in duration strategies.

- Liquidity Management: Barings' focus on maintaining robust liquidity buffers is essential, especially given potential market volatility.

- Unfunded Commitments: Managing unfunded commitments ensures Barings can meet its investment obligations without straining its capital base.

The global economic outlook for 2024 and 2025 presents a mixed bag for asset managers like Barings. While the IMF projected global growth at 3.2% for both years, persistent recessionary risks due to geopolitical tensions and supply chain issues remain a concern.

Interest rate environments continue to be a key driver. The US Federal Reserve maintained its benchmark rate between 5.25%-5.50% through early 2025, signaling a cautious approach to inflation. This stability, while dampening aggressive growth, offers a degree of predictability for fixed-income strategies.

Inflationary pressures, though moderating from 2023 highs, are still a central focus for policymakers, influencing investment decisions and the real return on assets. For Barings, managing portfolios in this environment requires careful consideration of assets that can hedge against price increases.

| Economic Indicator | 2024 Projection | Early 2025 Trend | Impact on Barings |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Steady | Supportive for AUM growth |

| US Federal Funds Rate | 5.25%-5.50% | Maintained | Influences fixed income yields and risk appetite |

| Inflation (Major Economies) | Moderating but elevated | Key policy focus | Drives asset selection for real returns |

Full Version Awaits

Barings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Barings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Barings' strategic landscape.

Sociological factors

The investor base is evolving, with Gen Z and Millennials becoming increasingly prominent. By 2025, it's projected that Millennials will represent a substantial portion of the global workforce, bringing their unique financial expectations. These younger investors, often characterized by their digital nativity, are showing a strong preference for technology-driven financial solutions, including AI-powered advisory services. For instance, a recent survey indicated that over 60% of Gen Z investors are comfortable using robo-advisors for portfolio management.

Furthermore, these emerging investor demographics are demonstrating a heightened interest in alternative asset classes and investments that align with environmental, social, and governance (ESG) principles. Reports from 2024 show a significant uptick in retail investor participation in private equity and venture capital funds, often accessed through digital platforms. This shift signals a critical need for financial institutions to adapt their client engagement strategies and product development to cater to these evolving preferences, ensuring relevance and continued market share in the coming years.

Investor priorities are steadily moving towards Environmental, Social, and Governance (ESG) criteria. This trend is fueled by growing client demand and stricter regulatory demands for ESG disclosures, even amidst political challenges and criticism of ESG investing.

The sustainable investing market continues its expansion, with assets under management in ESG funds reaching an estimated $3.7 trillion globally by the end of 2024, according to industry reports. Asset managers are actively incorporating ESG factors into artificial intelligence models to enhance investment strategies and are prioritizing the improvement of data quality for more robust ESG reporting.

Younger investors, especially Gen Z and Millennials, are increasingly demanding tailored investment experiences. For instance, a 2024 survey indicated that 65% of investors under 40 prefer digital wealth management platforms that offer personalized recommendations.

This societal shift is pushing asset managers to adopt AI and advanced analytics. These technologies enable the creation of customized investment portfolios and financial advice, moving away from one-size-fits-all approaches to meet diverse and evolving client needs.

Financial Literacy and Education

The growing influence of younger investors, particularly Gen Z, underscores the importance of financial literacy. Surveys in late 2023 and early 2024 indicated that a significant portion of Gen Z, around 55%, began learning about personal finance before the age of 18, a trend that is accelerating market participation.

This demographic shift necessitates accessible and understandable investment education. As of mid-2024, platforms offering simplified investing tools and educational content are seeing increased engagement, with over 40% of new retail investor accounts opened by individuals under 30.

- Increased Gen Z Engagement: A notable 60% of Gen Z respondents in a 2024 financial survey expressed interest in actively managing their investments.

- Demand for Digital Tools: The preference for mobile-first, user-friendly investment apps is a key driver for financial education outreach.

- Bridging the Knowledge Gap: While early learning is common, ensuring all individual investors possess a foundational understanding of risk and diversification remains crucial for sustainable market growth.

Workforce Demographics and Talent Acquisition

The financial sector, including asset management firms like Barings, is navigating significant shifts in workforce demographics. This evolution directly impacts how companies attract and retain skilled professionals. For instance, a growing demand for expertise in artificial intelligence (AI) and sustainable finance is reshaping talent acquisition strategies.

Barings, aiming to stay competitive, must focus on drawing in and keeping individuals proficient in these emerging fields. The global talent pool is increasingly diverse, presenting both opportunities and challenges in finding the right skill sets. By 2025, the financial services industry is projected to see a notable increase in roles requiring digital and ESG (Environmental, Social, and Governance) competencies.

Furthermore, Barings' expansion into new geographical markets can play a crucial role in local workforce development. Through targeted training and development initiatives, the firm can contribute to building a skilled talent pipeline in these regions. This approach not only supports Barings' operational growth but also fosters economic development within the communities it serves.

- Growing Demand for Tech and ESG Skills: By 2025, demand for AI and sustainable finance expertise is expected to significantly increase within asset management.

- Global Talent Pool Diversification: The international workforce offers a broader range of skills, but also requires adaptable recruitment strategies.

- Regional Workforce Development: Barings' international presence can foster local talent through specialized training programs, enhancing regional expertise in financial services.

Societal values are increasingly prioritizing ethical and sustainable practices, influencing consumer and investor behavior significantly. This trend is driving demand for financial products and services that align with Environmental, Social, and Governance (ESG) principles, with a notable rise in sustainable investing. By 2025, the global sustainable investment market is projected to exceed $50 trillion, reflecting a substantial shift in financial priorities.

Younger generations, particularly Millennials and Gen Z, are at the forefront of this movement, demonstrating a strong preference for companies and investments that exhibit social responsibility and environmental consciousness. A 2024 survey revealed that over 70% of Millennial investors consider ESG factors when making investment decisions, a figure expected to climb.

Furthermore, there's a growing emphasis on financial literacy and accessibility, with a greater demand for transparent and user-friendly financial tools and education. This societal shift necessitates that financial institutions adapt their communication and product offerings to cater to a more informed and values-driven clientele.

Technological factors

Artificial Intelligence and Machine Learning are fundamentally reshaping asset management. These technologies are boosting decision-making accuracy, automating routine tasks, and enabling highly personalized client experiences. By 2027, AI is expected to oversee substantial assets, reflecting its status as a key investment focus for many asset management leaders.

Barings can harness AI for advanced data analysis, generating predictive insights, and implementing real-time risk management. This integration promises to streamline operational workflows, ultimately enhancing efficiency and client service delivery.

As financial firms like Barings lean heavily on digital operations and vast datasets, strong cybersecurity and data protection are no longer optional; they are fundamental. The increasing sophistication of cyber threats means that safeguarding client information and operational integrity is a constant battle.

Regulatory bodies globally are intensifying scrutiny on data handling. For instance, the GDPR continues to shape data protection standards, and many jurisdictions are implementing or updating similar frameworks. In 2024, the focus remains on proactive breach notification and stringent data minimization practices, with significant fines for non-compliance.

Barings must invest continuously in advanced security technologies and employee training to meet these evolving demands. Maintaining client trust is directly tied to their ability to demonstrate robust data protection, which is crucial for retaining business and attracting new clients in a competitive market.

Digital platforms are fundamentally reshaping client engagement in asset management, allowing for more tailored interactions and services. This shift is particularly evident with younger demographics, who increasingly seek financial guidance and education through intuitive, tech-driven channels, highlighting the imperative for wealth managers to adopt sophisticated digital solutions.

By mid-2024, a significant portion of Gen Z and Millennial investors, estimated to be over 60%, indicated a preference for digital-first financial advisory services. This trend necessitates that firms like Barings invest in user-friendly platforms that offer personalized content, seamless onboarding, and accessible communication tools to meet evolving client expectations.

Automation of Operations

The increasing integration of Artificial Intelligence (AI) is revolutionizing operational efficiency within the financial sector, particularly for asset managers. AI-driven automation is taking over time-consuming, repetitive tasks. This includes everything from routine data entry and the generation of complex financial reports to the meticulous monitoring of regulatory compliance.

By offloading these operational burdens, asset managers can dedicate more of their valuable time to strategic initiatives. This shift allows them to concentrate on higher-value activities, such as in-depth market analysis, portfolio optimization, and identifying alpha-generating opportunities. Such a reallocation directly boosts overall productivity and enhances the potential for superior investment returns.

- AI adoption in financial services is projected to reach $3.7 trillion by 2030, according to PwC.

- Automation in finance can reduce operational costs by up to 40% by streamlining processes.

- Firms leveraging AI for operational efficiency are seeing an average 15% increase in employee productivity.

Integration of Alternative Data Sources

The integration of alternative data sources is revolutionizing financial analysis. Generative AI and advanced machine learning models can now process vast amounts of unstructured data, from satellite imagery to social media sentiment, offering a more holistic market perspective. This enhanced analytical capability allows firms like Barings to uncover hidden patterns and predict market movements with greater accuracy.

For instance, in 2024, the alternative data market was projected to reach over $10 billion, highlighting its growing importance. By leveraging these diverse datasets, Barings can refine its investment strategies, identify emerging opportunities, and mitigate risks more effectively. This data-driven approach provides a significant competitive edge in today's dynamic financial landscape.

- Enhanced Market Insights: Generative AI models can analyze alternative data, such as supply chain disruptions or consumer behavior shifts, to provide a more nuanced understanding of market dynamics.

- Precise Forecasting: The incorporation of real-time alternative data allows for more accurate financial forecasts, improving capital allocation and risk management.

- Competitive Advantage: Firms that effectively integrate alternative data can identify investment opportunities before competitors, leading to superior returns.

- Data Volume Growth: The sheer volume of alternative data available continues to grow exponentially, with estimates suggesting it will comprise over 80% of all data by 2025, making its analysis crucial.

Technological advancements, particularly in AI and machine learning, are transforming asset management by enhancing decision-making and automating tasks. By 2027, AI is anticipated to manage a significant portion of assets, underscoring its role as a critical investment area for financial leaders.

Barings can leverage AI for sophisticated data analysis, predictive insights, and real-time risk management, streamlining operations and improving client service. Cybersecurity is paramount as firms rely on digital operations, with regulatory bodies like those enforcing GDPR increasing scrutiny on data handling, necessitating robust protection measures.

Digital platforms are revolutionizing client engagement, with a majority of younger investors preferring tech-driven financial advice. This trend demands user-friendly platforms offering personalized content and seamless communication to meet evolving client expectations.

AI adoption in financial services is projected to reach $3.7 trillion by 2030, with automation potentially reducing operational costs by up to 40%. Firms utilizing AI for efficiency are observing an average 15% increase in employee productivity.

Legal factors

The asset management sector is bracing for significant regulatory shifts in 2025, impacting areas such as environmental, social, and governance (ESG) reporting and the burgeoning digital asset market. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) continues to evolve, with updated guidance expected in 2025 that could increase compliance burdens for asset managers. Barings must remain agile, ensuring robust adherence to these evolving frameworks to maintain trust and operational integrity.

Regulators worldwide are intensifying efforts to combat illicit financial flows, with significant updates to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) frameworks expected throughout 2024 and into 2025. These evolving regulations aim to enhance transparency and deter criminal activity within the financial sector.

As a global investment manager, Barings faces the imperative to meticulously comply with these increasingly stringent AML/CTF requirements. Failure to do so could result in substantial fines, reputational damage, and operational disruptions. For instance, in 2023, fines for AML breaches globally exceeded $5 billion, a figure anticipated to rise as enforcement tightens.

Data privacy and recordkeeping are paramount. Regulators are increasingly scrutinizing firms for inadequate data management and the use of unapproved communication channels. Barings must guarantee that all official communications are recorded and monitored, alongside implementing comprehensive incident response plans for any data breaches.

ESG Disclosure and Sustainable Investing Regulations

Regulatory bodies worldwide are increasingly mandating Environmental, Social, and Governance (ESG) disclosures and setting standards for sustainable investing. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) and the upcoming Corporate Sustainability Reporting Directive (CSRD) are reshaping how financial products are categorized and reported, with SFDR's Article 8 and Article 9 funds becoming key distinctions. Barings must ensure its product offerings align with these evolving frameworks, providing clear, data-backed evidence of their sustainability credentials to avoid accusations of greenwashing. The firm's ability to navigate these complex regulations, such as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, will be crucial for investor confidence and market access.

The push for transparency in sustainable investing is intensifying. In 2024, the Securities and Exchange Commission (SEC) in the United States continued to refine its proposed climate disclosure rules, aiming for standardized reporting of climate-related risks. Similarly, the UK's Financial Conduct Authority (FCA) has been enhancing its sustainability disclosure requirements, including new anti-greenwashing rules implemented in late 2023. Barings needs to proactively adapt its reporting mechanisms to meet these diverse and often stringent global requirements, ensuring that claims about ESG integration are substantiated by robust data and clear methodologies.

- SFDR Classification: Barings must clearly define and report on its funds under SFDR's Article 8 (promoting environmental or social characteristics) and Article 9 (having sustainable investment as their objective) categories.

- TCFD Alignment: Demonstrating adherence to TCFD recommendations for climate-related risk disclosure is essential for global market acceptance.

- Anti-Greenwashing Measures: Implementing rigorous internal processes to verify and communicate the sustainability features of investment products is paramount to maintain credibility.

- Data Transparency: Providing clear, accessible, and verifiable data on ESG metrics and impact is a fundamental requirement for regulatory compliance and investor trust.

Consumer Protection and Fiduciary Standards

Regulations such as Regulation Best Interest (Reg BI) and similar conduct standards are increasingly crucial for safeguarding retail investors. These rules mandate that financial professionals act in the best interest of their clients when making recommendations. For a firm like Barings, which serves a diverse clientele including retail investors, strict adherence to these standards is paramount.

Barings must ensure its internal policies, comprehensive employee training programs, and robust surveillance systems are fully aligned with these consumer protection mandates. This proactive approach is essential to maintain trust and compliance in the evolving financial landscape. For instance, as of late 2024, the Securities and Exchange Commission (SEC) continues to emphasize the importance of Reg BI compliance through ongoing examinations and enforcement actions, highlighting the heightened scrutiny on fiduciary duties.

- Regulatory Focus: Reg BI and similar conduct standards are designed to elevate the standard of care for retail investors, ensuring advice prioritizes client needs.

- Barings' Responsibility: The firm must integrate these obligations into its operational framework, covering policies, training, and monitoring.

- Market Trend: Regulatory bodies are actively enforcing these consumer protection measures, making compliance a critical business imperative.

- Investor Confidence: Demonstrating a commitment to fiduciary standards builds investor confidence and supports long-term client relationships.

The evolving legal landscape presents both challenges and opportunities for Barings. Increased regulatory scrutiny on ESG disclosures, particularly under frameworks like the EU's SFDR, necessitates robust data and clear reporting to avoid greenwashing accusations. Global efforts to combat financial crime are also intensifying, demanding strict adherence to AML/CTF regulations, with significant fines levied for non-compliance. Furthermore, consumer protection rules like Regulation Best Interest (Reg BI) require a heightened standard of care for retail investors, impacting advisory practices and internal compliance structures.

| Regulatory Area | Key Developments (2024-2025) | Impact on Barings | Example Data/Trend |

|---|---|---|---|

| ESG Disclosure | SFDR updates, CSRD implementation, TCFD recommendations | Increased compliance burden, need for verifiable ESG data | Global ESG assets projected to reach $70 trillion by 2025 (source: Bloomberg Intelligence) |

| AML/CTF | Stricter enforcement, enhanced transparency requirements | Operational adjustments, robust monitoring systems essential | Global AML fines exceeded $5 billion in 2023, expected to rise |

| Consumer Protection | Reg BI, conduct standards | Mandatory best interest standard for retail advice, enhanced training | SEC's continued emphasis on Reg BI compliance through examinations |

Environmental factors

Climate change continues to be a major focus, driving significant shifts towards clean energy and carbon reduction initiatives. Barings must actively manage physical climate risks, such as extreme weather events impacting supply chains and operations. For instance, the increasing frequency of severe weather events in 2024 has already led to billions in damages globally, highlighting the tangible financial implications.

Investment strategies are increasingly being shaped by the UN's Sustainable Development Goals (SDGs), with a growing demand for investments that contribute to nature restoration and sustainable practices. The green finance market is expanding rapidly; by the end of 2024, global green bond issuance is projected to reach over $1 trillion, presenting substantial opportunities for Barings to engage in climate solutions and sustainable financing.

The sustainable finance sector is experiencing robust growth, with green bond issuance projected to reach new heights in 2024 and 2025. This expansion reflects a growing understanding of the dual financial and ethical benefits of aligning investments with environmental, social, and governance (ESG) principles. Barings can strategically deploy capital into ESG-compliant funds and actively support initiatives focused on decarbonization.

Regulatory frameworks are increasingly mandating nature-related disclosures and the development of robust transition plans for companies, pushing for sustainability integration into core operations. This necessitates transparent data and key performance indicators (KPIs) to demonstrate progress and compliance.

As an asset manager, Barings will face escalating requirements for entity-level reporting on sustainability, reflecting a broader trend of enhanced accountability in the financial sector. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) has already significantly impacted how financial market participants report on sustainability risks and impacts, with further refinements expected through 2024 and 2025.

Resource Scarcity and Energy Transition

The escalating global demand for power, particularly fueled by the energy-intensive nature of artificial intelligence and sustained economic expansion, underscores a critical need for transitioning to renewable energy sources. This shift, while presenting significant investment challenges, also unlocks substantial opportunities for forward-thinking investors like Barings.

Barings can strategically position itself by identifying and capitalizing on investments within the clean energy sector and the essential infrastructure required to facilitate this energy transition. For instance, projections indicate that global electricity demand could increase by over 60% by 2050, largely driven by electrification and digital technologies.

- AI's Growing Energy Footprint: The computational power required for training and running advanced AI models is substantial, leading to increased electricity consumption in data centers. For example, some estimates suggest that AI could account for 8-13% of global electricity consumption by 2030.

- Renewable Energy Investment Surge: Global investment in renewable energy reached approximately $660 billion in 2023, a record high, signaling strong market confidence and growth potential in this sector.

- Infrastructure Needs: The energy transition necessitates massive investment in grid modernization, energy storage solutions, and transmission infrastructure to accommodate the intermittent nature of renewables.

- Policy Support: Governments worldwide are implementing policies and incentives, such as tax credits and subsidies, to accelerate the adoption of clean energy technologies, further de-risking investments in the sector.

Biodiversity and Nature-Related Financial Disclosures

Investor attention on nature and biodiversity is rapidly increasing, spurred by growing regulatory demands for initial nature-related financial disclosures. This shift means companies, including those Barings invests in, will face increasing pressure to report on their environmental impacts.

Frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD) are central to this evolution, pushing for more thorough and standardized reporting. Barings must integrate these evolving disclosure requirements into its investment strategies and reporting processes to remain compliant and competitive.

- TNFD Adoption: Over 300 organizations globally had expressed intent to adopt TNFD recommendations by early 2024, signaling a strong market trend.

- Regulatory Push: Jurisdictions like the EU are implementing biodiversity-related regulations that will necessitate greater transparency from businesses.

- Financial Risks: The World Economic Forum estimates that over half of the world's GDP, approximately $44 trillion, is moderately or highly dependent on nature and its services, highlighting potential financial risks for businesses.

The increasing focus on climate change and environmental sustainability is reshaping investment landscapes, pushing for a transition to clean energy. Barings must navigate physical climate risks and capitalize on the burgeoning green finance market, which saw global green bond issuance projected to exceed $1 trillion by the end of 2024.

Investor demand for nature-positive investments is growing, driven by regulatory frameworks like the TNFD, with over 300 organizations signaling intent to adopt its recommendations by early 2024. This trend highlights the financial risks associated with nature dependency, as estimated by the World Economic Forum to impact over half of global GDP.

| Environmental Factor | Trend/Impact | Data Point (2024/2025) |

|---|---|---|

| Climate Change & Energy Transition | Shift to clean energy, carbon reduction | Global green bond issuance projected >$1 trillion (end of 2024) |

| Nature & Biodiversity | Increased investor focus, regulatory demands | >300 organizations signaled intent to adopt TNFD (early 2024) |

| AI Energy Consumption | Growing electricity demand from data centers | AI could account for 8-13% of global electricity by 2030 |

| Renewable Energy Investment | Record investment levels | Global renewable energy investment reached ~$660 billion (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a robust blend of official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.