Barings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

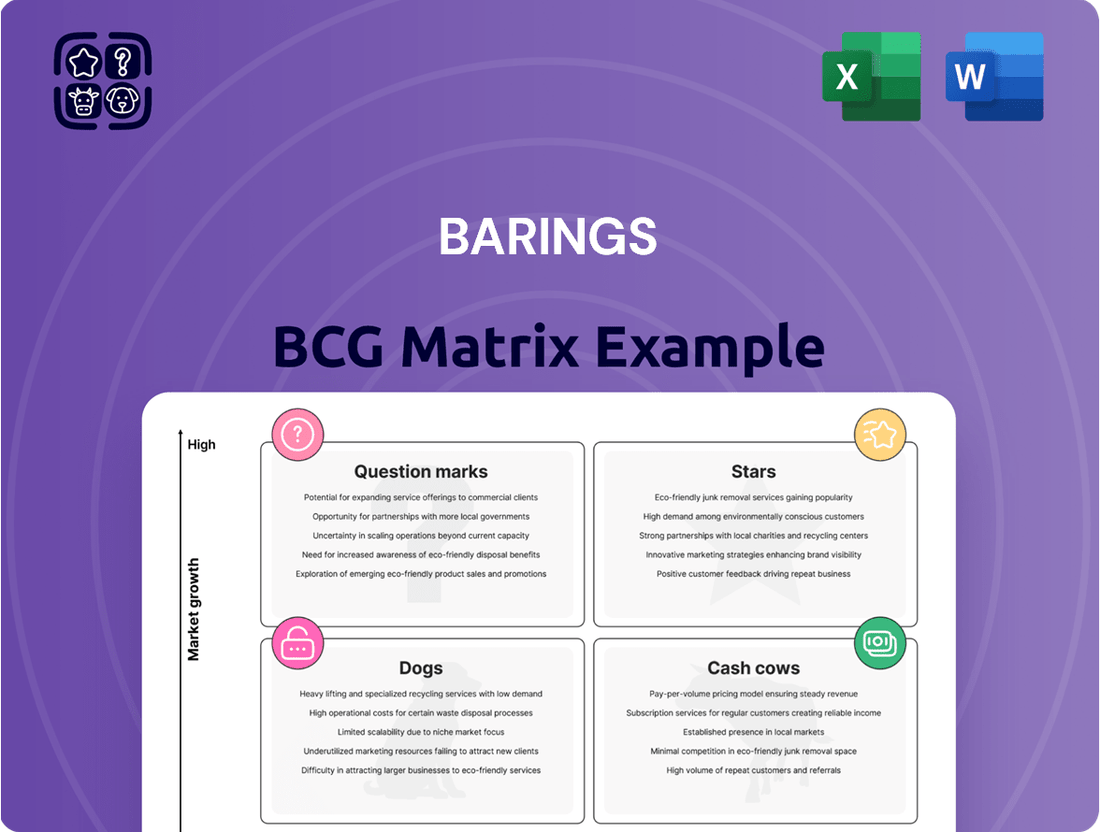

The Barings BCG Matrix is a powerful tool for analyzing a company's product portfolio based on market growth and relative market share. Understanding whether your products are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation and future growth.

This preview offers a glimpse into this essential framework, but to truly unlock its potential and gain actionable insights for your business, you need the complete BCG Matrix. Purchase the full version for a detailed breakdown, data-backed recommendations, and a clear roadmap to optimize your product strategy and investment decisions.

Stars

Barings boasts a significant and enduring footprint in private credit and direct lending, having facilitated over $300 billion in credit investments worldwide. This market segment consistently offers compelling risk-adjusted returns, and its expansion is notable as direct lending increasingly captures market share from traditional public markets.

Barings' deep expertise and robust platform solidify its leadership in this rapidly expanding area. The firm's extensive experience in direct lending, a strategy that involves providing loans directly to companies rather than through public markets, positions it to capitalize on current market trends. For instance, in 2024, the direct lending market continued to see robust activity, with many companies opting for private financing solutions to bypass the volatility and complexities of public capital markets.

This strategic focus on private credit and direct lending is a crucial element in Barings' growth trajectory, making it a primary contributor to the firm's future value creation. The ability to source, underwrite, and manage private debt deals effectively is a key differentiator in today's financial landscape.

Barings' Diversified Alternative Equity strategy has seen substantial investor confidence, securing close to $950 million in commitments within the six months leading up to May 2025. This robust fundraising underscores a strong market appetite for their approach.

The strategy's focus on lower middle market private equity buyouts and value-add infrastructure equity, particularly in high-growth sectors like digital, energy, and transportation, positions it well for future expansion. This targeted investment aligns with key economic trends and infrastructure development needs.

The impressive capital influx, coupled with a strategic emphasis on broadening infrastructure solutions, highlights Barings' solid footing in a dynamic and increasingly vital market segment. Their success reflects a keen understanding of where investor capital is being directed for long-term growth.

Barings' real estate debt solutions are poised for significant growth, with market watchers expecting a steady recovery and attractive investment prospects in 2025. This segment is particularly noted for delivering superior risk-adjusted returns across the capital stack.

The firm's robust platform and proven adaptability in fluctuating markets solidify its strong position within this expanding area. For instance, the U.S. commercial real estate debt market saw significant activity in 2024, with lenders actively seeking opportunities, indicating a robust demand for such solutions.

Global Short Duration High Yield Funds

The Barings Global Short Duration High Yield Fund (BGH) actively manages global high-yield bonds, offering consistent monthly distributions.

Despite the overall fixed income market maturity, this fund has shown robust performance and captured significant market share in its specialized segment. Attractive income opportunities continue to make it a compelling choice for investors seeking higher yields.

Its consistent performance and sustained investor interest highlight its position as a strong performer within a niche that still presents considerable value.

- Fund Name: Barings Global Short Duration High Yield Fund (BGH)

- Investment Strategy: Active management of global high-yield bonds.

- Key Feature: Consistent monthly income distributions.

- Market Position: Strong performance and market share within its niche, offering compelling income opportunities.

ESG Integrated Investment Strategies

Barings' commitment to Environmental, Social, and Governance (ESG) factors is a cornerstone of its investment philosophy, extending across diverse asset classes like real estate and public equities. This integration is not merely a trend but a strategic imperative, aimed at aligning with long-term value creation and evolving investor preferences for sustainable and responsible investments.

The increasing global demand for sustainable investing, projected to see significant growth in the coming years, positions Barings' proactive approach favorably. For instance, the sustainable investing market was estimated to reach over $35 trillion globally by the end of 2023, with continued strong inflows expected through 2024 and beyond. Barings' detailed reporting, such as its 2025 Corporate Citizen Report, provides transparency and demonstrates its dedication to capturing market share in this dynamic sector.

- ESG Integration: Barings systematically incorporates ESG considerations into its investment decision-making processes for real estate and public equities.

- Market Demand: The firm is capitalizing on the growing global investor appetite for sustainable and responsible investment opportunities.

- Transparency and Reporting: Barings' commitment is underscored by detailed reporting, exemplified by its 2025 Corporate Citizen Report, enhancing investor confidence.

- Long-Term Value: This strategic focus on ESG is designed to drive sustainable, long-term value creation for clients and stakeholders.

Stars in the Barings BCG Matrix represent business areas or investments that are leaders in high-growth markets. These are typically characterized by strong competitive positions and significant potential for future expansion and profitability. Barings' focus on private credit and direct lending, for example, aligns with the star quadrant due to the market's high growth and Barings' established leadership.

Another area that fits the star profile is Barings' Diversified Alternative Equity strategy, which has attracted substantial investor commitments. This strategy targets high-growth sectors, indicating a strong potential for future value creation and market leadership. The firm's real estate debt solutions also exhibit star-like qualities, with strong market recovery expected and attractive investment prospects, particularly in 2025.

Barings' Global Short Duration High Yield Fund (BGH) can also be considered a star. It has demonstrated robust performance and captured significant market share within its specialized niche of global high-yield bonds, offering compelling income opportunities. The fund's consistent performance and sustained investor interest highlight its strong position in a growing segment.

The firm's commitment to ESG factors further solidifies its star positioning. The growing global demand for sustainable investing, with an estimated market exceeding $35 trillion by the end of 2023 and continued strong inflows expected, makes Barings' proactive ESG integration a key driver of future growth and market leadership.

What is included in the product

The Barings BCG Matrix categorizes business units based on market share and growth rate, guiding strategic decisions.

The Barings BCG Matrix provides a clear, visual snapshot of your portfolio, easing the pain of strategic decision-making by highlighting areas needing attention.

Cash Cows

Barings' broad public fixed income mandates, especially those serving institutional clients like insurance companies, are a prime example of Cash Cows. These mandates manage significant assets in developed markets, offering stable, predictable fee income. For instance, by the end of 2024, Barings managed billions in fixed income assets, with a substantial portion in these mature, lower-growth but highly reliable segments.

Barings' established real estate equity portfolio represents a classic Cash Cow in its BCG Matrix. With a deep history and significant holdings, these mature assets, including properties and investment vehicles, consistently generate reliable cash flows primarily through rental income and steady appreciation.

In 2024, Barings' real estate division continued to demonstrate this strength, with mature sectors like office and retail properties, despite ongoing market adjustments, still providing substantial, predictable income streams. The firm’s strategic management and divestment of these long-held assets allow it to maximize returns with minimal incremental investment.

Insurance Solutions Asset Management is a clear cash cow for Barings. As of December 31, 2024, Barings manages a substantial $275.5 billion in Assets Under Management (AUM) specifically for insurance companies. This represents a high market share within a mature and stable segment of the asset management landscape.

The predictable, long-term nature of insurance mandates translates into consistent and significant fee income for Barings. This reliable revenue stream forms a foundational cash flow, reinforcing its status as a cash cow within the company's portfolio.

Core Diversified Institutional Portfolios

Barings' core diversified institutional portfolios are designed for clients like pension funds and endowments, focusing on sustainable long-term value. These portfolios, while not exhibiting high growth rates, hold a significant market share due to Barings' established reputation and deep client trust.

These stable mandates generate reliable management fees, which are crucial for covering operational expenses and supporting the firm's investments in new growth areas or technological advancements. For instance, in 2024, Barings reported managing approximately $400 billion in assets under management, with a substantial portion attributed to these steady, diversified institutional mandates.

- Market Share: High, driven by long-standing client relationships and a reputation for stability.

- Growth Rate: Low to moderate, reflecting a focus on capital preservation and consistent returns rather than aggressive expansion.

- Profitability: Consistent revenue generation through management fees, providing a stable financial base.

- Strategic Importance: Underpins the firm's financial stability, allowing for investment in innovation and higher-growth business lines.

Legacy Funds with Stable AUM

Barings' legacy funds represent classic cash cows within its BCG matrix. These established investment vehicles, boasting a long history and significant scale, provide a steady stream of reliable income for the firm. While their growth trajectory may have moderated, their substantial asset under management (AUM) ensures consistent fee generation.

These mature funds benefit from strong client loyalty and a proven track record, contributing significantly to Barings' overall profitability. For instance, as of the first quarter of 2024, Barings managed approximately $400 billion in AUM, with a substantial portion attributed to these stable, legacy strategies.

- Stable AUM: Legacy funds maintain a large and consistent asset base, providing predictable revenue streams.

- Consistent Fee Revenue: These funds generate reliable income through management fees, bolstering overall profitability.

- Strong Client Retention: Established client relationships ensure continued investment in these mature strategies.

- Profitability Contribution: They act as a significant source of earnings, supporting other areas of Barings' business.

Barings' Insurance Solutions Asset Management is a prime example of a cash cow. With $275.5 billion in AUM for insurance companies as of December 31, 2024, this segment holds a high market share in a mature, stable market. The predictable, long-term nature of these mandates generates consistent and significant fee income, forming a foundational cash flow for Barings.

| Barings Business Segment | BCG Matrix Category | Key Characteristics |

|---|---|---|

| Insurance Solutions Asset Management | Cash Cow | High market share in a mature market, stable and predictable fee income, significant AUM ($275.5 billion as of Dec 31, 2024). |

| Core Diversified Institutional Portfolios | Cash Cow | Stable mandates for pension funds and endowments, significant market share due to reputation, reliable management fees. Approximately $400 billion AUM in 2024. |

| Legacy Funds | Cash Cow | Established investment vehicles with long history and scale, consistent fee generation, strong client loyalty, substantial AUM. |

Full Transparency, Always

Barings BCG Matrix

The Barings BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, meticulously crafted for strategic decision-making. This comprehensive report, designed by industry experts, offers a clear visualization of your business portfolio's strategic positioning, enabling informed resource allocation and growth planning. Upon purchase, you will gain immediate access to this fully formatted and analysis-ready BCG Matrix, empowering you to drive impactful business strategies without delay.

Dogs

The Barings Europe Select fund, targeting small and mid-cap European equities, faced significant headwinds in 2025, leading to a ratings downgrade. This positions it as a question mark within the Barings BCG Matrix, signifying low relative market share in a segment that, despite its growth potential, has proven challenging for the fund to navigate successfully.

With its underperformance persisting, the fund risks becoming a cash trap, discouraging new investment and potentially leading to substantial investor outflows. This scenario highlights the critical need for strategic review, as such underperforming niche funds can drain resources without delivering the expected returns, impacting overall portfolio health.

Within Barings' extensive portfolio, certain legacy investments might be outdated or illiquid. These assets, perhaps acquired years ago, may no longer fit current market dynamics or client preferences. For instance, a private equity stake in a company from the early 2010s that has seen declining relevance in its sector could fall into this category.

Such holdings can become a drag on performance, generating minimal returns or even negative growth while immobilizing valuable capital. Consider a bond from a company that has since undergone significant restructuring, making it difficult to trade and yielding very little. These situations tie up resources that could be deployed in more promising ventures.

The strategic response for these investments is typically divestment or a careful repositioning. Barings might explore selling these assets, even at a discount, to unlock capital. For example, if a particular real estate holding developed in the late 2000s is now in a less desirable location and has low occupancy rates, it might be sold to free up funds for newer, higher-yield properties.

In today's financial landscape, certain public market offerings have become highly commoditized, facing significant fee compression. This is particularly evident in areas attracting substantial passive investing, where differentiation is difficult. These products often see diminishing profitability and struggle to gain meaningful market share.

For instance, many broad-market equity index funds, a staple of passive investing, typically operate with expense ratios below 0.10% as of 2024. While this benefits investors, it puts immense pressure on asset managers to maintain profitability. Barings, like others, may find its offerings in such segments facing these headwinds, potentially eroding overall margins if not strategically managed.

Divested Real Estate Assets

Divested real estate assets, like the Riverbank multifamily property in Manhattan sold for $243.5 million in July 2025, represent Barings' strategic move away from mature or less growth-oriented holdings. This divestment indicates a potential shift in portfolio focus, possibly to reallocate capital towards higher-potential opportunities.

- Strategic Divestment: Barings' sale of the Riverbank property exemplifies a deliberate exit from assets that may have reached peak valuation or no longer align with evolving investment strategies.

- Capital Reallocation: Such sales free up capital, allowing Barings to invest in assets with stronger growth prospects or to reduce exposure to properties requiring substantial ongoing investment.

- Portfolio Optimization: The divestiture of mature assets is a common strategy to optimize a real estate portfolio, ensuring resources are directed towards areas offering superior risk-adjusted returns.

- Market Dynamics: The decision to sell can also be influenced by current market conditions, aiming to capitalize on favorable pricing before potential downturns or to adapt to changing tenant demands.

Segments with Declining Investor Interest

Segments experiencing a secular decline in investor interest, often due to market shifts or technological obsolescence, represent the Dogs in Barings' BCG Matrix. These areas typically see consistent capital outflows and struggle to attract new investment, leading to a shrinking market presence and diminished profitability.

For instance, consider traditional fixed-income products that have seen reduced demand as interest rates have fluctuated or as newer, more attractive investment vehicles have emerged. In 2024, reports indicated a significant slowdown in inflows for certain legacy bond funds, with some experiencing net outflows exceeding 5% year-over-year.

- Erosion of Value Proposition: Traditional investment strategies that no longer offer competitive returns or unique benefits due to market evolution.

- Consistent Outflows: Difficulty in retaining existing capital as investors reallocate funds to more promising opportunities.

- Limited New Capital: Inability to attract fresh investment due to a lack of perceived growth potential or innovation.

- Shrinking Market Share: A gradual but steady decline in the segment's overall importance and profitability within Barings' portfolio.

Dogs represent business units or products with low market share in low-growth markets. These often require significant cash to maintain their position but generate little return, acting as a drain on resources. Barings might classify legacy investment products with declining investor interest as Dogs.

For example, certain traditional bond funds experienced net outflows exceeding 5% year-over-year in 2024, indicating a shrinking market presence. These products, once core offerings, now struggle to attract new capital due to evolving market dynamics and investor preferences.

The strategic approach for Dogs typically involves divestment or a managed decline to free up capital for more promising ventures. Barings' sale of the Riverbank multifamily property for $243.5 million in July 2025 exemplifies exiting mature assets.

These holdings can become cash traps, immobilizing capital that could be deployed in higher-yield opportunities, impacting overall portfolio health.

| Barings Portfolio Segment | BCG Matrix Classification | Rationale | Key Data Point (2024/2025) |

|---|---|---|---|

| Traditional Bond Funds | Dog | Low market share in a low-growth segment; declining investor interest. | Net outflows exceeding 5% YoY in 2024. |

| Legacy Real Estate Holdings | Dog | Mature assets with limited growth potential, potentially illiquid. | Sale of Riverbank property for $243.5M (July 2025) to reallocate capital. |

| Commoditized Index Funds | Dog | Low differentiation, high fee compression, struggling to gain market share. | Expense ratios below 0.10% for broad-market equity index funds in 2024. |

Question Marks

Barings' strategic move to establish a headquarters in Abu Dhabi by the end of 2025 positions it within the burgeoning MENA financial landscape. This region, experiencing significant capital inflows from sovereign wealth funds and family offices, presents a compelling growth opportunity. For instance, the combined assets under management of MENA sovereign wealth funds are projected to reach $10 trillion by 2027, indicating substantial potential for asset managers.

Given Barings' likely limited existing market share in the MENA region, this expansion can be classified as a Question Mark in the BCG Matrix. The initiative demands substantial investment and dedicated effort to cultivate a strong presence and translate the region's high growth potential into actual market share. This strategic bet requires careful resource allocation to navigate the competitive environment and capitalize on emerging opportunities.

Barings is strategically shifting its infrastructure equity focus towards burgeoning new-economy sectors like data centers, industrial batteries, and geothermal energy. These areas are poised for significant expansion, fueled by rapid technological evolution and the global drive towards sustainable energy solutions.

For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030. Similarly, the industrial battery storage market is expected to surge, with some forecasts placing its value at over $100 billion by 2028, driven by renewable energy integration. Barings' investment in these dynamic fields aligns with these robust growth trajectories.

Despite this strategic pivot, Barings' current market share within these highly specialized and nascent sub-sectors is likely modest. Consequently, substantial capital deployment will be essential for the firm to achieve significant scale and establish a leading position in these competitive and rapidly evolving markets.

Barings' Diversified Alternative Equity platform strategically allocates capital to emerging managers and single asset transactions like continuation vehicles. This approach aims to identify and nurture new investment talent and specialized strategies with significant growth potential. These ventures, by their nature, begin with lower market share and elevated risk, demanding substantial capital and strategic backing to ascend to 'Star' status within the BCG framework.

Specific Thematic Equity Strategies

Barings provides insights into specialized equity areas like natural resource and Chinese equities. These sectors can offer substantial growth but also come with significant price swings.

When Barings introduces or substantially grows dedicated funds for niche, developing thematic equity strategies, they typically enter markets with limited existing share but high growth potential, facing considerable competition.

Success for these strategies relies heavily on demonstrating superior investment performance and executing robust marketing campaigns to draw in substantial investor capital. For instance, in 2024, the global thematic ETF market saw continued growth, with assets under management reaching over $1.5 trillion, highlighting investor appetite for specialized exposures, though competition remains fierce.

- Market Entry: New thematic funds often begin with a small market share in rapidly expanding but crowded sectors.

- Growth Potential: Areas like clean energy or AI technology, which Barings might target, are projected to grow significantly in the coming years, with some forecasts suggesting double-digit annual growth rates for specific sub-sectors through 2030.

- Risk Factors: High volatility is inherent in thematic investing, as seen in the commodity sector where prices can fluctuate dramatically based on geopolitical events and supply chain disruptions, impacting resource-focused funds.

- Performance Dependence: Attracting assets is directly tied to outperforming benchmarks and competitors, a challenge given that many thematic funds struggle to consistently beat broader market indices over longer periods.

Innovative ESG-Specific Product Development

Developing unique ESG products, such as specialized impact funds or novel green financing options, taps into a rapidly expanding market. These offerings go beyond simply embedding ESG principles into existing strategies, aiming for distinct market segments.

Barings’ commitment to ESG is well-established, but these new, innovative products would likely begin with a modest market presence. Significant investment in research, development, and marketing is crucial for them to gain traction and achieve substantial scale in a crowded marketplace.

- Market Potential: The global sustainable investment market reached $35.3 trillion in 2022, according to the Global Sustainable Investment Alliance, highlighting the significant growth potential for specialized ESG products.

- Investment Needs: Launching innovative ESG products requires substantial upfront capital for research, product design, and regulatory compliance, potentially running into millions of dollars for each new offering.

- Competitive Landscape: As of early 2024, the number of ESG-focused ETFs and mutual funds has surged, indicating a highly competitive environment where differentiation through unique product features is key.

- Adoption Curve: New, niche ESG products typically follow a slower adoption curve, requiring extensive client education and proof of performance before achieving widespread market acceptance.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to increase market share, with the potential to become Stars if successful, or Dogs if they fail to gain traction. Barings' strategic expansion into new geographies or nascent sectors, like its Abu Dhabi headquarters or investments in emerging new-economy sectors, fits this profile.

The firm's focus on infrastructure equity in areas like data centers and industrial batteries, alongside its Diversified Alternative Equity platform targeting emerging managers, exemplifies Question Mark characteristics. These initiatives are in high-growth potential markets but likely start with modest market penetration, necessitating substantial capital infusion and strategic effort to capture market share and achieve success.

Barings’ foray into specialized thematic equity strategies and unique ESG products also falls under the Question Mark category. These areas offer substantial growth prospects, as evidenced by the growing thematic ETF market exceeding $1.5 trillion in assets by early 2024 and the global sustainable investment market reaching $35.3 trillion in 2022. However, they demand significant investment and strategic execution to overcome low initial market share and intense competition.

| BCG Category | Market Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Question Mark | High | Low | High | Star or Dog |

| Barings Abu Dhabi HQ | High (MENA region) | Low (assumed) | High | Star (if successful) or Dog |

| New Economy Infrastructure Equity | High (Data Centers, Batteries) | Low (nascent sub-sectors) | High | Star (if successful) or Dog |

| Thematic Equity Funds | High (e.g., Clean Energy) | Low (new funds) | High | Star (if successful) or Dog |

| Innovative ESG Products | High (Sustainable Investment) | Low (new offerings) | High | Star (if successful) or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, industry analyses, and market growth projections to provide a clear strategic overview.