AZZ SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AZZ Bundle

AZZ's current market position is shaped by its robust operational strengths and strategic acquisitions, but also faces potential headwinds from evolving industry regulations. Understanding these dynamics is crucial for anyone looking to capitalize on opportunities or mitigate risks within this sector.

Want the full story behind AZZ's competitive advantages, potential threats, and avenues for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AZZ Inc. stands out as a premier independent provider of hot-dip galvanizing and coil coating services across North America. Its services are essential for protecting assets in key sectors like construction, energy, and transportation, solidifying its market leadership.

The company's strength lies in its diversified portfolio, which includes not only corrosion protection but also specialized electrical equipment. This broad offering ensures consistent demand, as evidenced by AZZ's reported net sales of $1.2 billion for the fiscal year ended February 29, 2024, demonstrating the resilience and breadth of its market reach.

AZZ Inc. has showcased impressive financial strength, achieving record sales of approximately $1.578 billion in fiscal year 2025. This robust performance is complemented by significant operating cash flow generation, estimated at around $250 million.

This substantial cash flow provides AZZ with considerable financial flexibility. It allows the company to actively pursue debt reduction, invest strategically in capital projects, and return value to shareholders, reflecting strong financial management and operational effectiveness.

AZZ's strategic acquisition of Canton Galvanizing in July 2025 significantly bolsters its market position. This move, part of a broader inorganic growth strategy, expands AZZ's geographic reach and boosts its metal coating capabilities.

With 42 galvanizing facilities already established across North America, this expansion further solidifies AZZ's extensive network. This enhanced presence allows AZZ to cater more effectively to a wider range of customer requirements and strengthens its competitive advantage in the metal coating industry.

Commitment to Sustainability and ESG

AZZ Inc.'s dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company has been recognized by Newsweek as one of America's Most Responsible Companies multiple times, underscoring its commitment. This focus not only meets increasing investor and consumer demand for responsible business practices but also enhances operational efficiency and long-term value creation.

This commitment is further demonstrated by AZZ's publication of a comprehensive sustainability report, detailing its efforts and progress. Such transparency builds trust and provides stakeholders with clear insights into the company's ESG performance.

- Newsweek Recognition: AZZ has been named to Newsweek's 'America's Most Responsible Companies' list multiple times.

- Sustainability Reporting: The company publishes a comprehensive sustainability report detailing its ESG initiatives.

- Market Alignment: This focus aligns with growing market expectations for responsible corporate behavior.

- Operational Excellence: Commitment to sustainability contributes to long-term operational improvements and responsible business practices.

Operational Excellence and Productivity

AZZ's dedication to streamlining operations and boosting output is a significant strength. This focus has led to impressive EBITDA margins, especially within the Metal Coatings division. For instance, in the third quarter of fiscal year 2025, AZZ reported Metal Coatings segment EBITDA margins of 20.3%, a testament to their efficiency gains.

Their ability to enhance zinc utilization and drive productivity ensures they can remain competitive. This operational prowess allows AZZ to manage profitability effectively, even when faced with the volatility of raw material prices, a crucial advantage in their industry.

- Strong EBITDA Margins: Achieved 20.3% EBITDA margin in Metal Coatings segment in Q3 FY2025.

- Zinc Utilization: Continuous improvement in how efficiently zinc is used.

- Productivity Enhancements: Ongoing efforts to increase output and efficiency across operations.

- Cost Management: Ability to maintain profitability despite fluctuating raw material costs.

AZZ's diversified business model, encompassing both metal coatings and electrical equipment, provides significant stability. This breadth is reflected in their robust financial performance, with net sales reaching approximately $1.578 billion in fiscal year 2025, showcasing resilience across different market segments.

The company's operational efficiency is a key strength, particularly evident in its Metal Coatings division. Achieving a 20.3% EBITDA margin in the third quarter of fiscal year 2025 highlights their success in cost management and productivity enhancements, even amidst fluctuating raw material prices.

AZZ's strategic acquisitions, such as Canton Galvanizing in July 2025, bolster its market position and expand its service capabilities. This inorganic growth, coupled with an existing network of 42 galvanizing facilities, strengthens its competitive advantage and customer reach.

Furthermore, AZZ's commitment to sustainability, recognized by Newsweek's 'America's Most Responsible Companies' list, aligns with growing market demands and enhances long-term value. Transparent ESG reporting builds stakeholder trust and supports responsible business practices.

| Financial Metric | FY 2025 (Approx.) | Segment | Key Driver |

|---|---|---|---|

| Net Sales | $1.578 billion | Overall | Diversified portfolio, strategic acquisitions |

| EBITDA Margin | 20.3% | Metal Coatings (Q3 FY25) | Operational efficiency, zinc utilization |

| Operating Cash Flow | ~$250 million | Overall | Strong operational performance |

What is included in the product

Analyzes AZZ’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic weaknesses, easing the burden of complex analysis.

Weaknesses

AZZ's reliance on key raw materials like zinc and natural gas makes its hot-dip galvanizing segment particularly vulnerable to price swings. For instance, zinc prices, which are a significant cost component, experienced considerable volatility in late 2023 and early 2024, impacting input costs for AZZ.

While AZZ utilizes a tolling model for steel and aluminum, which helps offset some direct commodity exposure, extreme price movements in these essential inputs can still squeeze profit margins. This inherent sensitivity to commodity markets presents a notable weakness for the company's operational profitability.

AZZ's reliance on the construction, infrastructure, and industrial sectors means its performance is directly linked to the economic health of these areas. For instance, a slowdown in new building projects or a decrease in government infrastructure investment can significantly reduce the demand for AZZ's metal coating and engineered products.

Economic downturns, which often see reduced capital expenditure by businesses and lower consumer spending, directly impact AZZ's sales volumes and overall profitability. In 2023, while many sectors showed resilience, the global economic outlook remained uncertain, with potential headwinds for industrial output.

AZZ's performance can fluctuate with the seasons and weather. For instance, the fourth quarter of fiscal year 2025 saw weaker sales, partly due to bad weather impacting operations and customer demand.

This seasonality can create choppiness in quarterly earnings, making short-term financial results less predictable for investors and analysts trying to gauge the company's ongoing health.

Competitive Market Landscape

AZZ operates in a highly competitive metal coating and galvanizing market. This includes not only other specialized galvanizing firms but also in-house, or captive, facilities operated by larger manufacturers. Furthermore, alternative corrosion protection methods present a constant competitive threat, forcing AZZ to remain agile.

The intensity of this competition directly impacts pricing power and profit margins. For instance, in 2023, the galvanizing segment faced ongoing pricing pressures due to capacity utilization and raw material cost volatility. This necessitates a focus on differentiating factors such as superior service and efficient lead times to maintain market share.

- Intense Competition: Numerous galvanizing companies, captive facilities, and alternative corrosion protection methods vie for market share.

- Pricing Pressure: Highly competitive landscape can lead to reduced pricing power and compressed profit margins.

- Differentiation Imperative: AZZ must emphasize service quality and lead times to stand out from competitors.

Integration Risks of Acquisitions

AZZ Inc. faces significant integration risks with its acquisitions, potentially delaying synergies and impacting projected returns. For instance, the successful assimilation of the Canton Galvanizing facility, acquired in 2023 for $300 million, is critical to unlocking its expected financial contributions. Failure to smoothly integrate operations, systems, and cultures can lead to unforeseen costs and operational disruptions.

These integration challenges can manifest in various ways, hindering the realization of the strategic value intended by the acquisition. Key risks include:

- Operational Misalignment: Difficulties in merging different operational processes, supply chains, or IT systems can lead to inefficiencies and increased costs.

- Cultural Clashes: Divergent corporate cultures between AZZ and acquired entities can impede collaboration, employee retention, and overall productivity.

- Synergy Underachievement: The anticipated cost savings or revenue enhancements from an acquisition may not materialize as planned due to integration hurdles, impacting the deal's financial viability.

AZZ's dependence on a few key raw materials like zinc and natural gas exposes its hot-dip galvanizing segment to price volatility, directly impacting input costs. For example, zinc prices saw significant fluctuations in late 2023 and early 2024, affecting AZZ's cost structure.

The company's performance is closely tied to the economic health of the construction, infrastructure, and industrial sectors. A downturn in these areas, such as reduced government infrastructure spending or fewer new building projects, can lead to decreased demand for AZZ's products and services.

AZZ faces considerable integration risks with its acquisitions, which can delay expected synergies and negatively impact projected returns. For instance, the successful assimilation of recently acquired facilities is crucial for realizing their full financial potential, with operational misalignment and cultural clashes being key challenges.

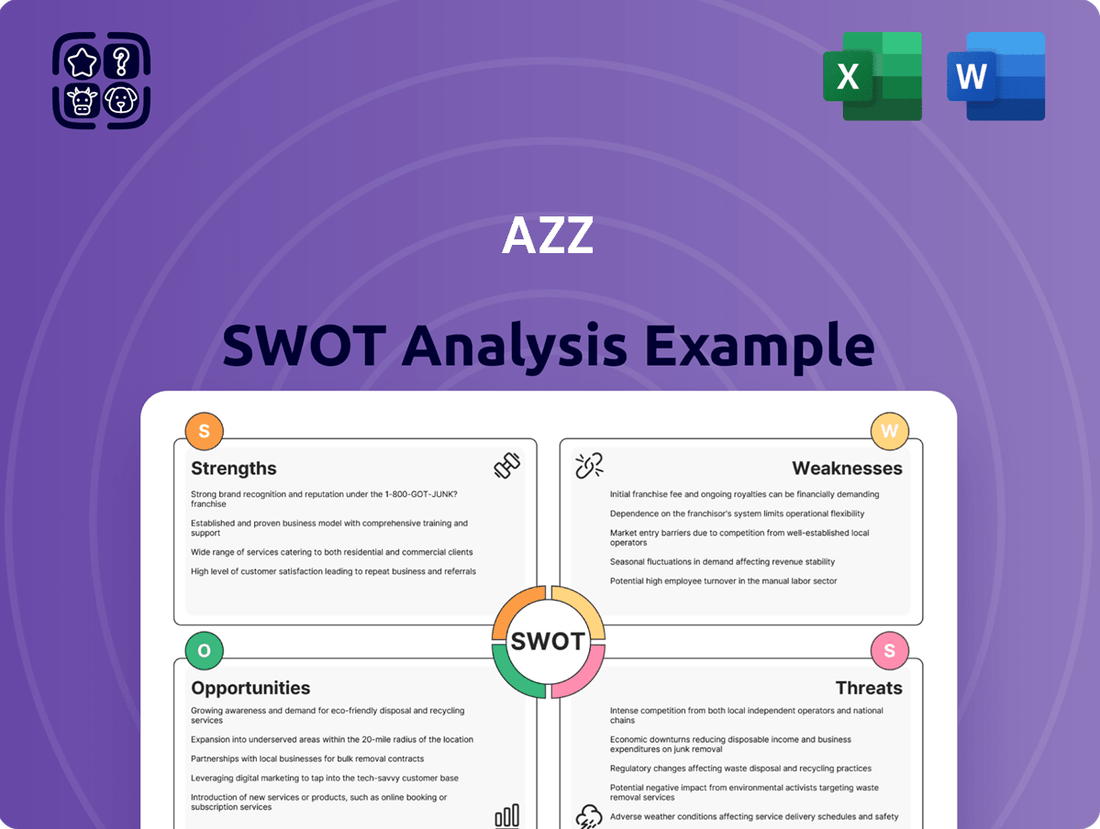

Preview Before You Purchase

AZZ SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting – a professional and comprehensive report.

This is a real excerpt from the complete AZZ SWOT analysis. Once purchased, you’ll receive the full, editable version, providing you with all the insights needed.

You’re viewing a live preview of the actual AZZ SWOT analysis file. The complete version, packed with detailed strategic information, becomes available after checkout.

Opportunities

North America's infrastructure spending is on the rise, creating a substantial tailwind for AZZ. Government initiatives and private sector investments are pouring into essential sectors like transportation and energy.

AZZ's expertise in corrosion protection, crucial for extending the lifespan of bridges, highways, and utility networks, positions it to capture a significant share of these projects. For instance, the U.S. Bipartisan Infrastructure Law alone allocates over $1 trillion to infrastructure improvements through 2026, offering a robust pipeline of opportunities for companies like AZZ.

AZZ has a significant opportunity to grow by entering new geographic markets. This can be achieved through both acquiring existing companies and building new facilities from the ground up, especially in areas that are currently not well-served by their offerings.

The company's recent acquisition of Canton Galvanizing is a prime example of this strategy, successfully bolstering its footprint in the Midwest region. This move not only expands their operational capacity but also deepens their market penetration in a key industrial area.

AZZ's commitment to technological advancement is crucial for staying ahead in the metal coating and galvanizing industry. By investing in and adopting cutting-edge technologies for their processes, AZZ can significantly boost operational efficiency and develop superior product offerings, all while minimizing their environmental footprint. For instance, advancements in automated application systems can reduce material waste and improve coating uniformity, directly impacting cost savings and product quality.

Innovation in materials science and application methodologies presents a significant opportunity for AZZ to carve out new market segments and solidify its competitive edge. Developing novel coatings with enhanced durability or specialized properties, such as improved corrosion resistance in harsh environments, could open doors to high-value applications in sectors like renewable energy infrastructure or advanced manufacturing. This focus on innovation is particularly relevant as industries increasingly demand sustainable and high-performance material solutions.

Growing Demand for Sustainable Solutions

The global emphasis on sustainability and extending infrastructure lifecycles directly benefits AZZ. Their corrosion protection services are perfectly positioned to capitalize on this growing demand for durable metal coatings that minimize the need for costly and resource-intensive replacements. This alignment presents a significant growth opportunity.

For instance, the infrastructure sector's increasing commitment to ESG (Environmental, Social, and Governance) principles further amplifies the appeal of AZZ's offerings. Companies are actively seeking solutions that contribute to longer asset lifespans and reduce their environmental footprint. AZZ's galvanizing and metal coating services directly address these needs, making them an attractive partner for sustainable development projects.

Key aspects of this opportunity include:

- Increased demand for lifecycle-cost-effective infrastructure solutions.

- Growing corporate and governmental focus on ESG initiatives.

- Opportunity to provide coatings that enhance the longevity of critical infrastructure, reducing waste and resource consumption.

Strategic Partnerships and Joint Ventures

AZZ's strategic partnerships and joint ventures present a significant opportunity for growth. By teaming up with other companies in the industry, AZZ can tap into new markets, enhance its service portfolio, and generate fresh revenue. The company's experience with the AVAIL joint venture, which contributed positively to its equity income, highlights the tangible benefits of such collaborations.

These alliances can lead to shared resources and expertise, allowing AZZ to tackle larger projects or enter more complex markets than it could alone. For instance, a partnership could provide access to specialized technology or a broader distribution network. The potential for increased market share and diversification of income streams is substantial.

- Access to New Markets: Collaborations can open doors to geographic regions or customer segments previously inaccessible to AZZ.

- Enhanced Service Offerings: Joint ventures can combine complementary capabilities, allowing AZZ to offer more comprehensive solutions to its clients.

- Risk Sharing: Partnering can distribute the financial and operational risks associated with new ventures or large-scale projects.

- Synergistic Revenue Streams: As seen with the AVAIL joint venture, partnerships can create new income opportunities and improve overall profitability.

The increasing demand for infrastructure upgrades in North America, fueled by government spending like the U.S. Bipartisan Infrastructure Law exceeding $1 trillion through 2026, presents a significant opportunity for AZZ. Their expertise in corrosion protection aligns perfectly with the need to extend the lifespan of vital assets such as bridges and utility networks.

AZZ's strategy of geographic expansion, exemplified by the Canton Galvanizing acquisition, positions them to capitalize on underserved markets. Furthermore, ongoing investment in advanced technologies and materials science allows AZZ to enhance operational efficiency and develop innovative, high-performance coatings, meeting the growing demand for sustainable and durable infrastructure solutions.

Strategic partnerships, like the successful AVAIL joint venture, offer AZZ avenues to access new markets, expand service offerings, and share risks, thereby creating synergistic revenue streams and enhancing overall profitability.

Threats

Economic downturns pose a significant threat to AZZ. A prolonged period of economic contraction or heightened macroeconomic instability, such as persistent high inflation or shifts in political stability, can directly reduce demand for AZZ's services across its core construction, manufacturing, and energy sectors. This reduced demand can negatively impact the company's financial performance.

For instance, if inflation remains elevated through 2024 and into 2025, it could increase AZZ's operating costs while simultaneously suppressing customer spending. Market volatility, characterized by sharp price swings, can also create uncertainty, making it harder for AZZ to forecast demand and manage its supply chain effectively. This environment could lead to project delays and cancellations, directly affecting revenue streams.

The metal coating and galvanizing sector faces significant threats from intense competition, which directly translates into pricing pressure and potentially thinner profit margins for AZZ. Competitors, ranging from large, vertically integrated mills to specialized alternative coating providers, are constantly vying for market share. For instance, in the fiscal year ending February 29, 2024, AZZ reported net sales of $1.5 billion, a figure that could be impacted by aggressive pricing strategies from rivals in this crowded market.

AZZ faces increasing pressure from evolving environmental and safety regulations, which directly impact its galvanizing segment. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine standards for volatile organic compounds (VOCs) and hazardous air pollutants, potentially requiring AZZ to invest in upgraded emission control technologies. Failure to adapt could result in significant fines and damage to its public image.

Supply Chain Disruptions and Raw Material Availability

Global supply chain disruptions, exacerbated by geopolitical tensions and unforeseen events, pose a significant threat to AZZ. These issues can impede the timely sourcing of essential raw materials, such as zinc and natural gas, directly impacting production timelines and driving up operational expenses. For instance, the ongoing volatility in natural gas markets, critical for AZZ's galvanizing operations, can lead to unpredictable cost fluctuations.

The availability and cost of key inputs like steel and zinc are particularly vulnerable. In 2024, continued supply chain bottlenecks and trade policy shifts could further constrain AZZ's access to these materials, potentially forcing higher prices or production slowdowns. This directly affects AZZ's ability to meet demand and maintain competitive pricing for its metal coatings and engineered steel products.

- Volatile Raw Material Costs: Fluctuations in zinc and steel prices, driven by global supply and demand dynamics, directly impact AZZ's cost of goods sold.

- Geopolitical Impacts: International conflicts or trade disputes can disrupt logistics and increase the cost of importing or exporting necessary materials and finished goods.

- Production Delays: Shortages or shipping delays of critical components can halt or slow down manufacturing processes, leading to missed delivery targets and potential loss of business.

Fluctuations in Interest Rates and Debt Leverage

Fluctuations in interest rates pose a significant threat to AZZ, particularly given that a substantial portion of its debt is linked to variable rates. This exposure means that any upward movement in benchmark rates directly translates to higher interest expenses for the company, potentially squeezing profit margins.

While AZZ has made efforts to deleverage, the lingering impact of rising rates can still affect its financial maneuverability. For instance, as of the third quarter of fiscal year 2024, AZZ reported total debt of approximately $600 million, with a portion of this carrying variable rates. An increase of even 1% in these rates could add millions to their annual interest payments, impacting free cash flow and the ability to invest in growth initiatives.

- Variable Rate Debt Exposure: A significant portion of AZZ's debt is tied to variable interest rates, making it susceptible to rising borrowing costs.

- Impact on Profitability: Higher interest expenses directly reduce net income and could hinder the company's ability to achieve its profitability targets.

- Reduced Financial Flexibility: Increased debt servicing costs can limit AZZ's capacity for strategic investments, acquisitions, or share repurchases.

- Economic Sensitivity: The company's performance is intertwined with broader economic conditions that influence interest rate movements.

Intensifying competition within the metal coating and galvanizing sectors presents a substantial threat to AZZ's market position and profitability. Aggressive pricing strategies from rivals, including large integrated mills and specialized coating providers, can compress AZZ's profit margins. For example, in fiscal year 2024, AZZ reported net sales of $1.5 billion, a figure that could be further challenged by competitors' market share grabs through lower pricing.

AZZ is also vulnerable to evolving environmental and safety regulations, particularly in its galvanizing segment. The U.S. EPA's ongoing scrutiny of emissions, such as volatile organic compounds, may necessitate costly investments in new pollution control technologies. Failure to comply could lead to substantial fines and reputational damage, impacting overall financial health.

Global supply chain disruptions, fueled by geopolitical instability and unforeseen events, pose a significant risk to AZZ's operations. These disruptions can hinder the timely acquisition of critical raw materials like zinc and natural gas, leading to production delays and increased operational costs. The volatile natural gas market, essential for AZZ's galvanizing processes, exemplifies this risk, causing unpredictable cost fluctuations.

Fluctuations in interest rates present a considerable threat, especially with AZZ's substantial variable-rate debt. Rising benchmark rates directly increase interest expenses, potentially reducing profit margins. With approximately $600 million in total debt as of Q3 FY2024, even a small rate increase can add millions in annual interest payments, impacting free cash flow and strategic investment capacity.

| Threat Category | Specific Risk | Potential Impact | Relevant Data Point (FY24) |

| Competition | Pricing pressure from rivals | Reduced profit margins | $1.5 billion net sales |

| Regulatory | Stricter environmental standards | Increased capital expenditure, fines | EPA emission regulations |

| Supply Chain | Raw material shortages/delays | Production slowdowns, higher costs | Zinc, natural gas costs |

| Financial | Rising interest rates on variable debt | Higher interest expenses, reduced flexibility | ~$600 million total debt |

SWOT Analysis Data Sources

This AZZ SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and insightful expert commentary from industry professionals to ensure a robust and actionable strategic assessment.