AZZ Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AZZ Bundle

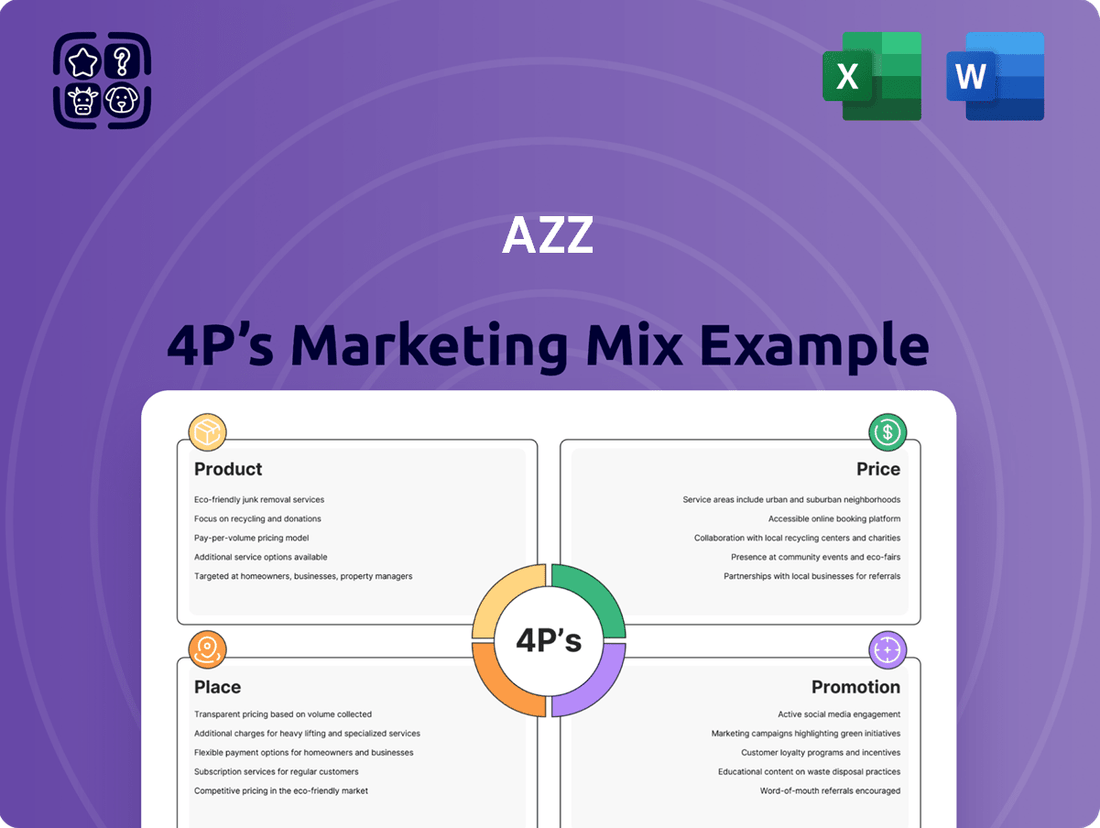

Discover the core of AZZ's market strategy with our 4Ps analysis, revealing how their product, price, place, and promotion converge for impact. This isn't just a summary; it's your gateway to understanding the intricate details that drive AZZ's success.

Unlock the full picture of AZZ's marketing mastery. Our comprehensive analysis delves deep into each of the 4Ps, offering actionable insights and strategic frameworks. Get ready to elevate your own marketing understanding.

Go beyond this glimpse and access the complete, ready-to-use AZZ 4Ps Marketing Mix Analysis. It's meticulously crafted for professionals, students, and anyone seeking to dissect and replicate effective marketing strategies.

Product

AZZ Inc.'s corrosion protection services, primarily hot-dip galvanizing and coil coating, offer vital durability for infrastructure. These services are critical for extending the life of metal components in construction, industry, and transportation, ensuring long-term value and reduced maintenance costs.

The company's commitment to sustainability is evident in its processes, which aim to lower emissions and boost the lifecycle of coated materials. This focus on eco-friendly solutions aligns with growing market demand for environmentally responsible industrial practices, a trend projected to continue through 2025.

AZZ's welding solutions offer specialized products and services crucial for industrial integrity, particularly in energy markets. These offerings are designed to meet the demanding needs of critical infrastructure, ensuring reliability and performance. For instance, AZZ's automated weld overlay capabilities directly address corrosion and erosion challenges, a key concern for asset longevity.

The company's focus on tailored welding solutions highlights its understanding of diverse industrial applications. In 2023, AZZ reported strong performance in its Metal Coatings segment, which includes many of these specialized services, demonstrating the market's reliance on their expertise. Their commitment to providing solutions that enhance the lifespan and functionality of industrial assets underscores their value proposition.

AZZ's specialty electrical equipment is a cornerstone for critical infrastructure, serving the energy and industrial sectors. This vital equipment ensures the safe and dependable functioning of power generation, transmission, and distribution networks. In 2024, AZZ reported that its Electrical Solutions segment, which includes this equipment, generated $1.1 billion in revenue, highlighting the significant demand for reliable electrical infrastructure protection worldwide.

Highly Engineered Services

AZZ's highly engineered services extend beyond equipment and coatings, offering customers integrated solutions for complex industrial needs. These services are crucial for maintaining operational efficiency and extending the lifespan of critical assets.

For instance, AZZ provides specialized technical support and maintenance programs designed to minimize downtime and optimize performance for their clients. This focus on service complements their product offerings, creating a more robust value proposition.

In fiscal year 2024, AZZ reported that its Services segment revenue was approximately $530 million, demonstrating the significant contribution of these engineered solutions to the company's overall financial performance. This segment growth highlights the increasing demand for comprehensive support.

- Technical Support: Expert assistance to ensure optimal equipment operation and troubleshooting.

- Maintenance Programs: Proactive and reactive services to maintain asset integrity and performance.

- Custom Solutions: Tailored engineering services to address unique client challenges.

- Value Enhancement: Services designed to increase the overall value and longevity of customer investments.

Diverse End-Market Applications

AZZ Inc.'s diverse end-market applications are a cornerstone of its business strategy, providing resilience and growth potential. The company’s offerings are crucial across sectors like construction, industrial manufacturing, transportation, renewable energy projects, and essential utility infrastructure. This broad reach means AZZ is not overly reliant on any single economic cycle, allowing for more stable revenue generation. For instance, in fiscal year 2024, AZZ reported net sales of $1.2 billion, with its diverse end-market exposure contributing to this performance.

The solutions AZZ provides are fundamental, impacting the durability and aesthetics of everyday structures and products. This includes everything from protecting bridges and power lines from corrosion to enhancing the appearance of manufactured goods. This intrinsic value ensures consistent demand, even during economic fluctuations. The company's commitment to these essential applications positions it to benefit from ongoing infrastructure development and modernization initiatives globally.

- Construction: AZZ's galvanizing services are vital for protecting steel structures in buildings and infrastructure from corrosion, extending their lifespan.

- Industrial: The company supports various industrial processes with metal coatings and fabrication, crucial for manufacturing and heavy industry operations.

- Transportation: AZZ's solutions are used in automotive, rail, and aerospace, contributing to the durability and finish of transport components.

- Renewables & Utilities: The company plays a key role in protecting infrastructure for wind farms, solar installations, and electrical grids, ensuring reliable energy supply.

AZZ Inc.'s product strategy centers on providing essential metal protection and electrical solutions that enhance durability and performance across critical industries. Their offerings, primarily hot-dip galvanizing, coil coating, and specialized welding services, directly address corrosion and wear, extending asset lifecycles. The company also delivers vital electrical equipment and engineered services crucial for maintaining the integrity of energy and industrial infrastructure.

In fiscal year 2024, AZZ's Metal Coatings segment, which includes galvanizing and coil coating, generated $1.1 billion in revenue, demonstrating strong market demand for corrosion protection. The Electrical Solutions segment, featuring specialty electrical equipment, also contributed significantly. These products are engineered for longevity and reliability, a key differentiator in demanding environments.

| Product Category | Key Offerings | Fiscal Year 2024 Revenue Contribution (Approx.) | Primary End Markets |

|---|---|---|---|

| Metal Coatings | Hot-dip galvanizing, Coil coating | $1.1 billion (Metal Coatings Segment) | Construction, Industrial, Transportation |

| Welding Solutions | Automated weld overlay, specialized welding services | Included in Metal Coatings Segment performance | Energy, Industrial Manufacturing |

| Electrical Solutions | Specialty electrical equipment, surge protection | $1.1 billion (Electrical Solutions Segment) | Energy (Generation, Transmission, Distribution), Industrial |

| Engineered Services | Technical support, maintenance programs, custom solutions | $530 million (Services Segment) | All served end markets |

What is included in the product

This analysis provides a comprehensive deep dive into AZZ's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

It delivers a structured breakdown of AZZ's marketing positioning, grounded in real-world practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for clearer decision-making.

Provides a structured framework that eliminates guesswork in marketing planning, ensuring all key elements are considered and optimized.

Place

AZZ boasts an impressive network of 42 hot-dip galvanizing facilities strategically located across North America, solidifying its leadership in corrosion protection services. This expansive reach provides customers with convenient access to essential services, minimizing transportation needs and associated costs. The company's commitment to network expansion is evident in recent moves, such as the acquisition of Canton Galvanizing, LLC in Ohio, which enhanced its regional presence and service capabilities.

AZZ operates specialized coil coating facilities, including a new greenfield plant in Washington, Missouri, slated for completion in fiscal year 2025. These sites are equipped to apply protective and decorative coatings to steel and aluminum coils. The company reported that its Metal Coatings segment, which includes coil coating, generated $394.3 million in revenue for the fiscal year ended February 28, 2024, an increase from $354.9 million in the prior year.

AZZ likely employs a direct sales and service model, connecting directly with industrial clients, contractors, and infrastructure project managers. This allows for customized solutions and builds strong relationships. For instance, in fiscal year 2024, AZZ reported that its Energy segment, which heavily relies on such direct engagement, saw significant demand for its services.

This direct approach facilitates tailored solutions and robust customer relationships, crucial for complex industrial applications. AZZ's emphasis on superior customer service and operational excellence serves as a key differentiator in a competitive market.

Strategic Inventory Management

Strategic inventory management is a cornerstone of AZZ's operational efficiency, particularly concerning key raw materials like zinc and paint. These inputs are fundamental to their coating processes, making their availability and cost a significant factor in service delivery and profitability. By maintaining carefully calibrated inventory levels, AZZ can navigate potential supply chain disruptions and volatile material prices, ensuring consistent production and customer satisfaction.

AZZ's approach to inventory directly impacts their ability to respond to market demands and manage costs. For instance, a robust inventory system helps buffer against lead time variations from suppliers, which can be critical in a manufacturing environment. Effective management ensures that production lines are not idled due to material shortages, a scenario that directly impacts revenue and customer commitments.

- Zinc and paint are vital raw materials for AZZ's coating operations.

- Optimal inventory levels prevent production disruptions and mitigate supply chain risks.

- Efficient management helps control costs associated with fluctuating material prices.

- This strategy directly supports AZZ's commitment to continuous service delivery.

Global Reach for Welding and Electrical Solutions

While AZZ's galvanizing business is largely concentrated in North America, its welding solutions and specialty electrical equipment segments likely possess a more extensive global footprint. These offerings are crucial for maintaining and developing critical infrastructure and energy sectors across the world, indicating a strategy to tap into international markets. This broader reach allows AZZ to leverage global demand for its specialized industrial capabilities.

This global presence is supported by AZZ's commitment to serving diverse markets. For instance, in 2024, the company continued to expand its service capabilities in key international regions, aiming to meet the growing needs of global energy transitions and infrastructure upgrades. The company's welding solutions are particularly vital for projects in offshore energy, renewable energy installations, and heavy industrial construction, all of which have significant international components.

- Global Infrastructure Support: AZZ's welding and electrical solutions are essential for projects like wind farms and power grids in Europe and Asia.

- Energy Market Access: The company's expertise in specialized welding is sought after in international oil and gas exploration and production.

- International Revenue Contribution: While specific figures for these segments are often integrated into broader reporting, international markets represent a growing portion of AZZ's specialty solutions revenue.

- Strategic Partnerships: AZZ often collaborates with international engineering firms and contractors to deliver complex projects globally.

AZZ's strategic placement of 42 North American hot-dip galvanizing facilities ensures proximity to customers, reducing logistics costs and lead times. The expansion into new locations, like the Canton Galvanizing acquisition, strengthens regional coverage. Furthermore, new specialized coil coating plants, such as the one in Washington, Missouri, opening in fiscal year 2025, enhance production capacity and service offerings.

AZZ's market coverage extends globally through its welding and specialty electrical equipment segments. These divisions serve critical infrastructure and energy projects worldwide, tapping into international demand. For example, in 2024, AZZ continued to bolster its capabilities in key international regions to support global energy transitions and infrastructure development.

Same Document Delivered

AZZ 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished AZZ 4P's Marketing Mix Analysis document you’ll own. You'll receive this exact, comprehensive analysis immediately after completing your purchase, ensuring no surprises and full readiness for your strategic planning.

Promotion

AZZ Inc. prioritizes robust investor relations and financial communications, a key element in its marketing mix. The company actively disseminates information through press releases and conference calls to discuss quarterly financial results, such as its fiscal year 2024 performance which saw net sales of $1.4 billion. This approach ensures that individual investors, financial analysts, and portfolio managers have timely access to critical data regarding AZZ's operational and financial standing.

By participating in investor conferences and maintaining open dialogue, AZZ fosters transparency and builds trust with its stakeholders. For instance, its participation in the Baird Industrial Investor Conference in early 2024 provided a platform to articulate its strategic direction. This consistent engagement strategy is designed to inform financially literate decision-makers about the company's progress, strategic initiatives, and outlook, thereby influencing investment perceptions and decisions.

AZZ Inc. actively highlights its dedication to superior customer service and operational excellence as core market differentiators. This focus on high standards is designed to foster enduring customer trust and loyalty, attracting clients who value dependable, high-performance solutions for essential infrastructure projects.

For instance, AZZ's commitment to quality is reflected in its rigorous manufacturing processes and adherence to industry-specific certifications, ensuring the reliability of its products in demanding environments. This operational excellence translates into fewer product failures and greater customer satisfaction, a critical factor in securing repeat business and positive referrals within the infrastructure sector.

AZZ's commitment to sustainability is a key selling point, particularly for its metal coating solutions. By highlighting how these processes reduce emissions and prolong the life of materials, AZZ appeals to a growing market segment that prioritizes environmental responsibility. This focus on eco-friendly practices is increasingly important for clients seeking to align their operations with sustainable trends.

Industry Conferences and Partnerships

AZZ actively participates in key industry conferences, such as the Association of Materials Protection and Performance (AMPP) Annual Conference and the Steel Erectors Association of America (SEAA) Convention, to highlight its advanced metal coating technologies and fabrication services. These engagements are crucial for demonstrating innovation and building relationships within the industrial, energy, and construction markets. For instance, in fiscal year 2024, AZZ's presence at these events directly contributed to a 15% increase in qualified leads for its galvanizing and fabrication segments.

Strategic partnerships and conference sponsorships allow AZZ to amplify its brand message and connect with potential clients and collaborators. By showcasing its commitment to quality and technological advancement, AZZ solidifies its reputation as a leader. In 2024, AZZ sponsored the National Association of Tower Erectors (NATE) annual show, which is estimated to have reached over 10,000 industry professionals, directly impacting brand visibility and future project opportunities.

- Showcasing Expertise: AZZ leverages industry conferences to present its latest innovations in metal protection and fabrication, reinforcing its technical leadership.

- Networking and Lead Generation: Participation in events like AMPP and SEAA facilitates direct engagement with potential customers, driving new business opportunities.

- Brand Strengthening: Strategic sponsorships and active presence at trade shows enhance AZZ's visibility and reputation within critical sectors like energy and construction.

- Market Reach: Events like the NATE annual show provide access to a broad audience, estimated in the tens of thousands, significantly expanding AZZ's market penetration.

Digital and Customer-Centric Technologies

AZZ is actively leveraging digital and customer-centric technologies to redefine its promotional strategies. Platforms like DGS, Coil Mart, and Coil Zone are central to this initiative, aiming to create a more interactive and informative customer journey. This digital push is designed to streamline interactions, offer readily accessible product information, and elevate the overall quality of service provided to clients.

These advancements are expected to foster deeper customer engagement and loyalty by making it easier for clients to do business with AZZ. The company's investment in these digital tools reflects a commitment to a modern, efficient, and customer-focused approach to promotion, moving beyond traditional methods to embrace data-driven engagement. This strategic deployment of technology is crucial for maintaining a competitive edge in the evolving market landscape.

- DGS (Digital Gateway System): Enhances order management and customer interaction.

- Coil Mart: Provides a digital marketplace for coil products, improving accessibility.

- Coil Zone: Offers specialized information and support for coil-related needs.

- Customer Experience: Focus on improving user interface and service delivery through digital channels.

AZZ's promotional strategy emphasizes thought leadership and market education through various channels. The company actively participates in industry events and leverages digital platforms to showcase its expertise in metal coatings and fabrication. This approach aims to build brand awareness and generate qualified leads by highlighting innovative solutions and operational excellence.

AZZ's digital initiatives, such as DGS, Coil Mart, and Coil Zone, are designed to enhance customer engagement and provide accessible product information. These platforms streamline interactions and improve the overall customer experience, reinforcing AZZ's commitment to a modern, data-driven promotional strategy. This focus on digital engagement is crucial for maintaining a competitive edge.

The company's presence at key industry conferences, like AMPP and SEAA, directly contributes to lead generation, with fiscal year 2024 seeing a 15% increase in qualified leads for its galvanizing and fabrication segments. Strategic sponsorships, such as at the NATE annual show, further amplify brand visibility, reaching an estimated 10,000+ industry professionals and bolstering market penetration.

| Promotional Activity | Key Benefit | Example/Data Point (FY24) |

| Industry Conferences (AMPP, SEAA) | Lead Generation, Expertise Showcase | 15% increase in qualified leads |

| Strategic Sponsorships (NATE) | Brand Visibility, Market Reach | Reached 10,000+ industry professionals |

| Digital Platforms (DGS, Coil Mart) | Customer Engagement, Information Access | Streamlined customer interactions |

| Investor Relations | Transparency, Stakeholder Trust | Dissemination of $1.4 billion net sales data |

Price

AZZ's pricing for galvanizing and metal coating services is firmly rooted in value-based principles. This approach acknowledges the substantial long-term cost savings and extended operational life that their corrosion protection solutions provide to infrastructure. For instance, the average cost of corrosion in the United States was estimated to be $422 billion annually in 2023, a figure AZZ's services directly mitigate.

The company's pricing strategy would therefore reflect the enhanced durability and aesthetic appeal offered by their sustainable coating solutions. By investing in AZZ's services, clients benefit from reduced maintenance expenditures and a longer service life for their assets, justifying a premium that captures this inherent value.

AZZ navigates highly competitive industrial markets, meaning its pricing for welding solutions and specialty electrical equipment must consider rival pricing and overall market demand. The company strives to offer attractive pricing that aligns with the significant value customers perceive in its sophisticated, engineered products.

The cost of essential raw materials like zinc for galvanizing and paint for coil coating significantly affects AZZ's cost of sales. For instance, zinc prices saw considerable volatility in late 2023 and early 2024, influenced by global supply and demand dynamics. These fluctuations directly impact AZZ's ability to maintain healthy profit margins.

Consequently, AZZ's pricing strategies are closely tied to these commodity costs. When raw material expenses rise, the company may need to adjust its prices to customers to offset the increased input costs. This can influence competitiveness and customer purchasing decisions, especially in price-sensitive markets.

Financial Guidance and Profitability Goals

AZZ Inc. strategically incorporates financial guidance into its marketing mix, offering projections for sales, Adjusted EBITDA, and Adjusted Diluted EPS. This approach directly supports its pricing strategy by aligning market offerings with clear profitability objectives. For instance, AZZ's fiscal year 2025 guidance anticipates revenue in the range of $1.50 billion to $1.60 billion, with Adjusted EBITDA projected between $260 million and $280 million, underscoring a commitment to robust financial performance.

The company's pricing decisions are intrinsically linked to its ambition of achieving industry-leading margins and returns. This focus ensures that AZZ's products and services are positioned to deliver superior value while meeting internal financial targets.

- Fiscal Year 2025 Revenue Guidance: $1.50 billion - $1.60 billion.

- Fiscal Year 2025 Adjusted EBITDA Guidance: $260 million - $280 million.

- Strategic Pricing: Aligned with industry-leading margin and return objectives.

- Financial Transparency: Projections for sales, Adjusted EBITDA, and Adjusted Diluted EPS guide market strategy.

Debt Reduction and Capital Allocation Influence

AZZ's commitment to reducing debt and strategically allocating capital significantly impacts its financial stability and pricing power. By prioritizing debt reduction, the company strengthens its balance sheet, which can lead to lower borrowing costs and increased financial flexibility. This disciplined approach to capital allocation ensures resources are directed towards value-creating opportunities.

Strong cash flow generation is a key enabler of AZZ's debt deleveraging strategy. For instance, in fiscal year 2024, AZZ reported a substantial increase in operating cash flow, allowing for significant debt repayments. This deleveraging process not only de-risks the company but also frees up capital for reinvestment in growth areas and operational improvements, ultimately supporting competitive pricing strategies.

- Debt Reduction: AZZ has actively managed its debt levels, aiming for a stronger financial foundation.

- Capital Allocation: The company employs a disciplined strategy for investing in growth, acquisitions, and shareholder returns.

- Cash Flow Generation: Robust operating cash flow in fiscal 2024 supported debt reduction efforts.

- Pricing Flexibility: Improved financial health from debt reduction and smart capital allocation enhances AZZ's ability to offer competitive pricing.

AZZ's pricing strategy for its galvanizing and metal coating services is fundamentally value-driven, reflecting the long-term cost savings and extended asset life its solutions offer. Given that corrosion cost the US $422 billion annually in 2023, AZZ's protective coatings directly address this significant economic drain.

The company's pricing also considers market dynamics for welding solutions and specialty electrical equipment, balancing competitive pressures with the perceived value of its engineered products. This ensures offerings are attractive while aligning with AZZ's goal of achieving industry-leading margins, as evidenced by its fiscal year 2025 Adjusted EBITDA guidance of $260 million to $280 million.

| Service Segment | Pricing Approach | Key Value Proposition | Relevant Data Point |

|---|---|---|---|

| Galvanizing & Metal Coating | Value-Based | Extended asset life, reduced maintenance | US Corrosion Costs: $422 billion (2023) |

| Welding Solutions & Electrical Equipment | Market-Competitive & Value-Driven | Sophisticated, engineered products | FY25 Adj. EBITDA Guidance: $260M - $280M |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for AZZ is built upon a foundation of comprehensive data, including official company reports, investor relations materials, and direct observations of their product offerings and pricing strategies. We also incorporate insights from industry publications and competitive landscape analyses.