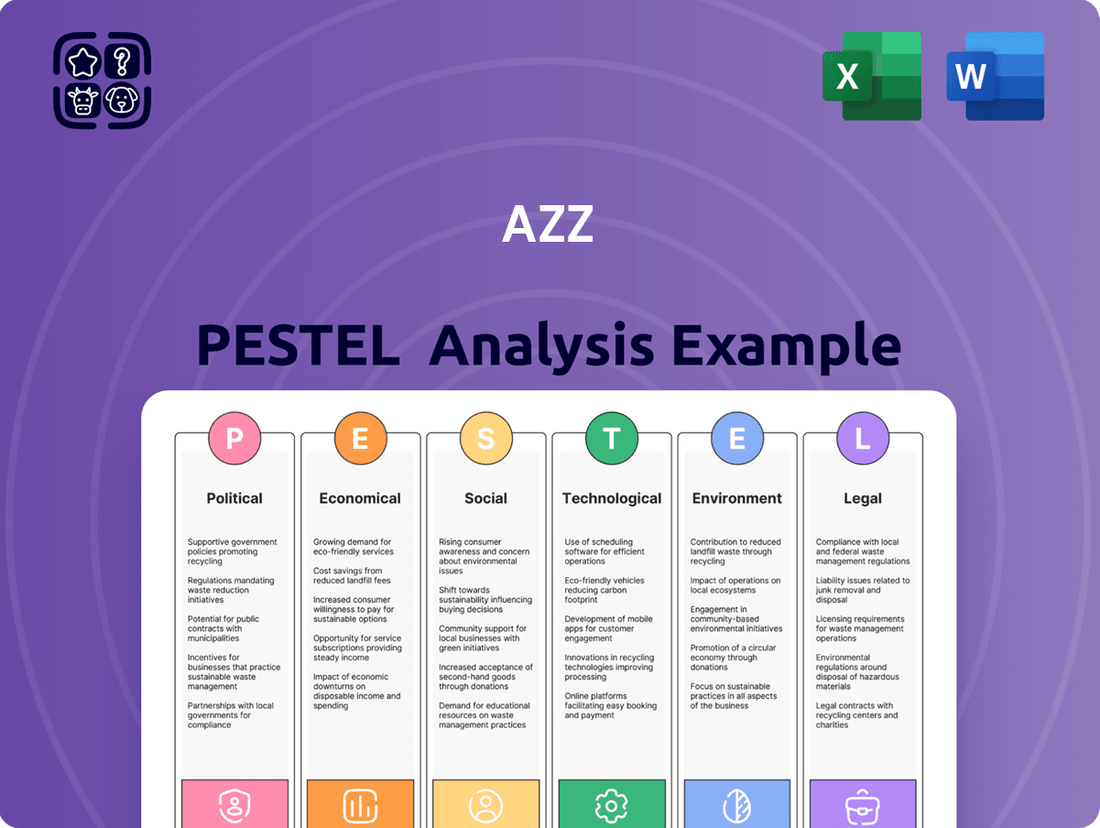

AZZ PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AZZ Bundle

Navigate the complex external forces shaping AZZ's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis today for unparalleled market clarity.

Political factors

Government infrastructure spending is a key driver for AZZ. Increased investment in areas like transportation, energy grids, and utilities directly translates to higher demand for AZZ's galvanizing and metal coating services, essential for protecting infrastructure components. For instance, the Bipartisan Infrastructure Law, enacted in late 2021, is set to allocate significant funds towards these sectors through 2026, potentially boosting AZZ's order books.

The political landscape's focus on domestic manufacturing and resilience also plays a crucial role. Policies favoring onshoring or strengthening domestic supply chains for critical infrastructure components would directly benefit AZZ's operations and market position. This focus is evident in recent discussions around revitalizing American manufacturing capabilities, which could lead to more domestic projects requiring AZZ's specialized services.

Changes in international trade agreements and tariffs directly influence AZZ's operational costs and market competitiveness. For instance, the imposition or alteration of tariffs on key raw materials such as steel and zinc, which are crucial for AZZ's galvanizing and metal fabrication segments, can significantly increase the cost of goods sold. This was evident in 2018 when the US imposed tariffs on steel imports, impacting various industrial sectors.

Geopolitical tensions and ongoing trade disputes can create considerable supply chain volatility and escalate operational expenses for AZZ. These disruptions can affect the timely and cost-effective procurement of materials, ultimately squeezing profit margins. The global economic landscape in 2024 continues to be shaped by these persistent geopolitical factors.

Emerging trends like reshoring and nearshoring, often driven by government policies and incentives, present a potential upside for AZZ's domestic manufacturing capabilities. By bringing production closer to home, AZZ could mitigate some of the risks associated with international logistics and trade policy uncertainties, potentially improving efficiency and reducing lead times for its North American customer base.

The stringency and enforcement of industrial regulations, particularly those concerning manufacturing, energy usage, and environmental protection, directly impact AZZ's operational expenses and the resources dedicated to compliance. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter emissions standards for industrial facilities, potentially increasing AZZ's costs for pollution control equipment and monitoring.

Political shifts, such as a move towards deregulation or, conversely, an increase in government oversight, would significantly affect AZZ's facilities and operational processes. Changes in energy policy, for example, could alter the cost and availability of power for AZZ's manufacturing plants, a critical factor given the energy-intensive nature of its operations.

Navigating the complex web of permits, licenses, and operational guidelines is a continuous challenge for AZZ. In 2025, ongoing reviews of environmental impact assessments for new projects or expansions will require substantial investment in documentation and adherence to evolving legal frameworks, influencing project timelines and capital allocation.

Energy Policies and Transition

Government policies are increasingly steering the energy sector towards renewables and efficiency, directly impacting companies like AZZ. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $62 billion in 2022 for grid modernization and clean energy transmission, a significant driver for AZZ's specialty electrical equipment. This transition creates substantial demand for grid upgrades and new infrastructure to support renewable energy sources, playing to AZZ's strengths in electrical solutions.

The global push for decarbonization, evidenced by the International Energy Agency's projection that renewable energy capacity will grow by over 80% by 2026, presents a robust market for AZZ. Investments in grid modernization are crucial to integrate these intermittent sources effectively. AZZ's expertise in providing essential components for reliable power transmission and distribution positions it to capitalize on this expansion.

- Renewable Energy Growth: Global renewable energy capacity is expected to surge, with the IEA reporting a 50% increase in installations in 2023 compared to 2022.

- Grid Modernization Investment: The U.S. alone plans to invest billions in upgrading its electrical grid to enhance reliability and accommodate renewable energy integration.

- Policy Impact: Government incentives for energy efficiency and renewable energy adoption directly create new market opportunities for AZZ's electrical infrastructure solutions.

- Traditional Energy Shift: Conversely, policies that phase out fossil fuels could present challenges for AZZ's existing business segments tied to traditional power generation, necessitating strategic adaptation.

Geopolitical Stability and Global Conflicts

Global political stability is a significant concern for AZZ, as demonstrated by the ongoing tensions in Eastern Europe. The conflict has disrupted supply chains and increased energy costs, impacting raw material prices for AZZ's metal processing and electrical equipment segments. For instance, steel prices, a key input, saw considerable volatility in 2023 and early 2024 due to these geopolitical pressures.

AZZ's global operational footprint means it's directly exposed to regional conflicts and trade disputes. Instability in regions where AZZ sources materials or has manufacturing facilities can lead to production delays and increased logistics expenses. In 2024, several trade agreements faced renegotiation, creating uncertainty for international commerce, which directly affects companies like AZZ that rely on cross-border trade.

Investor confidence is also closely tied to geopolitical events. Major international conflicts or political shifts can trigger market volatility, affecting AZZ's stock performance and its ability to secure financing. For example, the heightened geopolitical risks in the Middle East in late 2023 and early 2024 led to broader market apprehension, impacting valuations across various industrial sectors.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of raw materials and finished goods, impacting AZZ's production schedules and costs.

- Commodity Price Volatility: Conflicts and trade tensions often lead to unpredictable swings in the prices of essential commodities like steel and energy, affecting AZZ's input costs.

- Market Sentiment: Global political instability can dampen investor confidence, potentially leading to lower stock valuations and increased cost of capital for AZZ.

- Operational Risks: AZZ's international operations are vulnerable to localized conflicts or political unrest, which can disrupt manufacturing and distribution.

Government infrastructure spending is a significant growth catalyst for AZZ, particularly with initiatives like the Bipartisan Infrastructure Law. This legislation is injecting substantial funds into transportation, energy grids, and utilities through 2026, directly increasing demand for AZZ's protective coating services for infrastructure components.

Policies promoting domestic manufacturing and supply chain resilience are also beneficial. A focus on onshoring critical infrastructure projects would bolster AZZ's market position and operational advantages, aligning with recent efforts to revitalize U.S. manufacturing capabilities.

Trade policies and tariffs have a direct impact on AZZ's costs and competitiveness. Fluctuations in tariffs on essential raw materials like steel and zinc, critical for galvanizing and fabrication, can significantly affect the cost of goods sold, as seen with U.S. steel tariffs in 2018.

Geopolitical tensions and trade disputes continue to create supply chain volatility and raise operational expenses for AZZ. These factors influence the cost-effective procurement of materials, impacting profit margins, with global economic conditions in 2024 still shaped by these ongoing issues.

What is included in the product

This AZZ PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

The AZZ PESTLE analysis provides a structured framework to identify and understand external factors impacting a business, thereby alleviating the pain of uncertainty and enabling proactive strategic decision-making.

Economic factors

Global economic growth is a key driver for AZZ, as a healthy economy typically translates to higher demand for infrastructure and manufacturing, areas where AZZ's services are crucial. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive environment for industrial activity.

Industrial output growth directly impacts AZZ's core business segments. Strong industrial production means more factories operating, more goods being shipped, and greater investment in the equipment and infrastructure that AZZ supports through its metal coating and welding solutions. In 2023, global manufacturing output saw moderate growth, and forecasts for 2024 suggest continued expansion, albeit with regional variations.

Economic slowdowns, however, pose a risk. A contraction in industrial output or a general economic downturn can lead to reduced capital expenditures by businesses. This means fewer new projects requiring AZZ's services for metal coatings on new infrastructure or welding for manufacturing equipment, potentially impacting revenue and profitability.

Fluctuations in zinc and steel prices directly affect AZZ's operational costs, especially for its galvanizing and metal coating services. For instance, steel prices saw considerable volatility throughout 2024, with some reports indicating a softening in the latter half of the year, which could positively impact AZZ's input costs.

Volatile commodity markets can squeeze profit margins, forcing AZZ to adopt flexible pricing strategies to maintain profitability. The company's ability to pass on these cost changes to customers is crucial for its financial health.

Looking ahead to 2025, forecasts suggest a potential decline in zinc prices. Some market analysts projected a decrease of up to 5% for zinc in 2025, driven by increased global production, which would likely benefit AZZ's metal coatings segment by lowering raw material expenses.

Fluctuations in interest rates directly impact AZZ's cost of borrowing and the ability of its customers to finance large projects. For instance, if the Federal Reserve maintains its benchmark interest rate at the current levels seen in early 2024, it could continue to make capital more expensive for energy and infrastructure investments, potentially dampening demand for AZZ's electrical equipment and services.

Higher borrowing costs can discourage AZZ from undertaking its own capital-intensive projects, such as expanding manufacturing capacity or investing in new technologies. This is particularly relevant as AZZ operates in sectors that often require significant upfront investment, and a sustained period of elevated interest rates, like those experienced throughout 2023, can make such ventures less attractive.

Access to affordable capital remains a critical enabler for AZZ's strategic growth, including potential acquisitions and ongoing operational upgrades. The company's ability to secure favorable financing terms, influenced by prevailing market interest rates, will be a key determinant in its capacity to execute its expansion plans and maintain its competitive edge.

Inflationary Pressures and Operating Costs

Inflationary trends, especially in energy, labor, and transportation, directly impact AZZ's operational expenses. For instance, the Producer Price Index (PPI) for energy inputs saw significant increases throughout 2024, affecting raw material and logistics costs. Similarly, wage inflation continued to be a concern, with average hourly earnings for production and non-supervisory employees rising by approximately 4.5% year-over-year in late 2024, adding to AZZ's labor costs.

Managing these escalating costs is paramount for AZZ to sustain its profitability. The company's ability to absorb or pass on these increased expenses through strategic pricing adjustments plays a crucial role in mitigating inflation's adverse effects. For example, if AZZ can implement price increases that align with or slightly exceed the rise in input costs, it can protect its profit margins.

Key considerations for AZZ include:

- Energy Cost Volatility: Monitoring and hedging against fluctuations in energy prices, a significant component of manufacturing and transportation costs.

- Labor Market Dynamics: Adapting to competitive labor markets and managing wage pressures to retain skilled workers.

- Supply Chain Efficiency: Optimizing logistics and transportation networks to minimize the impact of rising fuel and shipping expenses.

- Pricing Power: Assessing market conditions and competitive landscapes to determine the feasibility of passing on increased operating costs to customers.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for AZZ, a global provider. As of the first quarter of fiscal year 2025, AZZ reported that approximately 37% of its net sales originated from international markets. A strengthening US dollar, relative to the currencies in these key markets, can increase the cost of AZZ's offerings for foreign customers, potentially dampening demand.

Conversely, a weakening US dollar could make AZZ's products and services more competitive abroad, potentially boosting sales volumes. These currency movements also directly impact the reported financial results when translating foreign currency-denominated revenues and expenses back into US dollars for consolidated financial statements. For instance, during fiscal year 2024, AZZ noted that unfavorable foreign currency translation adjustments reduced reported net income by $5 million.

- Impact on International Sales: A stronger USD makes AZZ's products more expensive for international buyers.

- Competitive Pricing: A weaker USD can enhance AZZ's price competitiveness in global markets.

- Financial Reporting: Exchange rate changes affect the translation of foreign revenues and expenses, impacting reported earnings.

- Fiscal Year 2024 Impact: Unfavorable currency translations reduced AZZ's reported net income by $5 million in FY2024.

Global economic conditions significantly influence AZZ's performance, with projected global GDP growth of 3.1% for 2025 according to the IMF, suggesting a continued, albeit moderate, demand for infrastructure and industrial goods. However, regional economic disparities and potential slowdowns in key markets could temper this growth. AZZ's reliance on industrial activity means that shifts in manufacturing output, such as the anticipated 1.5% increase in global industrial production for 2025, directly correlate with its service demand.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on AZZ | Key Consideration |

| Global GDP Growth | 3.2% (IMF 2024) | 3.1% (IMF 2025) | Supports demand for infrastructure and manufacturing. | Monitor regional economic health. |

| Industrial Production Growth | Moderate expansion | 1.5% increase | Directly drives demand for AZZ's services. | Track manufacturing sector trends. |

| Commodity Prices (Zinc/Steel) | Volatile, some softening in steel | Potential zinc price decrease (up to 5%) | Affects input costs for metal coatings. | Manage raw material procurement. |

| Interest Rates | Elevated, potential stabilization | Stable to slightly decreasing | Impacts borrowing costs and customer project financing. | Assess capital expenditure decisions. |

| Inflation (Energy, Labor) | 4.5% wage growth, rising energy PPI | Continued moderate inflation | Increases operational expenses. | Implement strategic pricing. |

| Currency Exchange Rates (USD) | Strengthening USD impact noted in FY24 | Potential for stabilization or weakening | Affects international sales competitiveness and reported earnings. | Manage currency exposure. |

Same Document Delivered

AZZ PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This AZZ PESTLE Analysis provides a comprehensive overview of the external factors influencing the business.

You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects, all presented clearly and concisely.

Sociological factors

AZZ's operational success hinges on a readily available skilled workforce, especially in critical trades like welding and metal coating. The manufacturing sector, including companies like AZZ, is grappling with an aging workforce, with a significant portion of experienced workers nearing retirement. This demographic shift, coupled with a widening skills gap, presents a substantial sociological challenge in attracting and retaining qualified talent.

For instance, the U.S. Bureau of Labor Statistics projected that employment for welders was expected to grow 8% from 2022 to 2032, faster than the average for all occupations, yet the supply of qualified welders has not kept pace with demand. This shortage directly impacts AZZ's ability to meet production demands and maintain quality standards, making robust training and development programs essential for future sustainability.

Societal expectations and increased regulatory focus on workplace safety significantly influence AZZ's operational strategies and capital allocation towards safety enhancements. For instance, in 2024, regulatory bodies like OSHA continued to emphasize stringent enforcement of standards, with penalties for violations often reaching substantial figures, directly impacting companies like AZZ that operate in heavy industries.

AZZ's commitment to adhering to evolving Occupational Safety and Health Administration (OSHA) standards, such as those concerning personal protective equipment (PPE) and machine guarding, is crucial for minimizing workplace incidents and fostering a positive employee environment. Data from the Bureau of Labor Statistics for 2023 indicated a continued focus on reducing preventable injuries in manufacturing, a sector where AZZ is active.

AZZ Inc. recognizes that strong community relations are vital for its social license to operate, particularly given its manufacturing presence in diverse locations. Positive public perception concerning environmental stewardship and local job creation directly impacts regulatory ease and community backing. For instance, in 2024, AZZ reported investments in local workforce development programs across several operating regions, aiming to foster goodwill and operational stability.

Consumer and Industrial Demand for Sustainable Products

Societal awareness regarding environmental impact is significantly shaping consumer and industrial preferences. This growing demand for sustainable products, including those that offer enhanced durability and longevity, directly benefits companies like AZZ that provide corrosion protection solutions. By extending the lifespan of infrastructure and manufactured goods, AZZ's offerings reduce waste and the need for resource-intensive replacements, aligning perfectly with global sustainability objectives.

The increasing focus on Environmental, Social, and Governance (ESG) criteria by both customers and investors further amplifies the market opportunity for sustainable solutions. For instance, a 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, and a similar trend is observed in B2B procurement. This shift means that AZZ's commitment to providing products that contribute to a circular economy and reduce environmental footprints can become a significant competitive advantage, potentially leading to increased market share and investor confidence.

- Growing Consumer Preference: Over 70% of consumers consider sustainability in purchasing decisions as of 2024.

- Industrial Demand: Businesses are increasingly prioritizing suppliers with strong ESG credentials and sustainable product offerings.

- Longevity as Sustainability: AZZ's corrosion protection extends asset life, reducing material waste and energy consumption for replacements.

- Investor Influence: ESG factors are a key driver for investment, impacting capital access and company valuations.

Labor Relations and Unionization Trends

The landscape of labor relations significantly impacts AZZ's operational costs and flexibility. Unionization trends, a key aspect of this, can affect wage negotiations and the potential for work stoppages. For instance, in 2023, the overall union membership rate in the U.S. was 10.0%, a slight decrease from previous years, indicating a shifting dynamic in collective bargaining power across industries.

Maintaining positive labor relations is crucial for AZZ, particularly given the ongoing skilled labor shortages prevalent in manufacturing and industrial sectors. Fair wage practices and employee satisfaction directly correlate with productivity. Reports from 2024 suggest that companies with strong employee engagement often see higher output and lower turnover rates, directly benefiting AZZ's bottom line.

- Union Membership Rate: As of 2023, 10.0% of U.S. wage and salary workers were union members.

- Skilled Labor Shortages: Many industrial sectors, including those AZZ operates within, continue to report significant challenges in finding skilled labor.

- Employee Productivity: Positive labor relations and fair compensation are linked to increased employee satisfaction and, consequently, higher productivity.

- Wage Growth: In early 2024, average hourly earnings saw continued growth, highlighting the upward pressure on labor costs that AZZ may need to manage.

Societal shifts towards valuing sustainability and ethical business practices are increasingly influencing AZZ's market position and operational strategies. Growing consumer demand for durable, environmentally friendly products directly benefits AZZ's corrosion protection solutions, which extend asset lifespans and reduce waste. For example, a 2024 industry survey revealed that over 70% of consumers consider sustainability in their purchasing decisions, a trend also reflected in B2B procurement, making AZZ's eco-conscious offerings a competitive advantage.

Technological factors

Continuous innovation in galvanizing and metal coating, including new alloys and application techniques, directly impacts AZZ's service capabilities. For instance, advancements in hot-dip galvanizing processes, such as those focusing on improved zinc bath chemistry and temperature control, can lead to more uniform and durable coatings, enhancing AZZ's value proposition. In 2023, the global metal coating market was valued at approximately $30.5 billion, with significant growth driven by demand for enhanced corrosion resistance.

AZZ's manufacturing processes are increasingly benefiting from automation and robotics, particularly in areas like welding and material handling. This technological shift is directly translating to improved efficiency and precision, with robotics often achieving higher consistency than manual labor. For instance, advanced robotic welding systems can reduce cycle times by up to 30% compared to traditional methods, directly boosting output.

The adoption of these advanced technologies also significantly enhances workplace safety by removing human operators from hazardous tasks. Furthermore, automation helps mitigate the impact of labor shortages, a persistent challenge across the manufacturing sector. A 2024 industry report indicated that companies integrating robotics saw an average productivity increase of 15-20%.

However, this technological advancement necessitates substantial capital investment in cutting-edge equipment and comprehensive workforce training programs to operate and maintain the new systems. The return on investment for such automation projects is typically realized through reduced operational costs and increased throughput over the medium to long term.

Technological advancements are significantly impacting AZZ's specialty electrical segment. The global smart grid market, projected to reach $100 billion by 2027, is expanding rapidly, driven by the need for greater efficiency and integration of renewable energy sources. This trend directly benefits AZZ as it offers solutions for grid modernization.

Intelligent electrical equipment and advanced energy management systems are becoming increasingly crucial. These technologies enhance grid reliability and facilitate the integration of distributed energy resources, a key area for AZZ's growth. For instance, the demand for advanced metering infrastructure (AMI) is expected to see a compound annual growth rate of over 15% through 2025, underscoring the market's appetite for smart grid solutions.

Digitalization and Data Analytics in Operations

AZZ's integration of digital tools, the Internet of Things (IoT), and advanced data analytics is significantly streamlining its operational backbone. This digital transformation directly impacts production efficiency and supply chain agility. For instance, in 2024, AZZ has been investing in smart factory initiatives, aiming to reduce production cycle times by an estimated 10-15% through real-time monitoring and automated adjustments. The company is also leveraging IoT sensors across its facilities to gather data on equipment performance, enabling predictive maintenance that minimizes costly downtime.

The insights derived from this data are proving invaluable for enhancing decision-making across AZZ's diverse business segments, including metal coatings and welding solutions. By analyzing real-time operational data, AZZ can identify bottlenecks, optimize resource allocation, and improve quality control measures. This data-driven approach is projected to boost overall operational efficiency by up to 8% in the 2024-2025 fiscal year, leading to more consistent product quality and a stronger competitive edge.

- Digitalization of Production: AZZ is implementing digital twins and automated workflows to optimize manufacturing processes, targeting a 10% increase in throughput by late 2024.

- IoT for Predictive Maintenance: Deployment of IoT sensors across key machinery in 2024 aims to reduce unplanned downtime by 20% through early detection of potential failures.

- Data Analytics for Efficiency: Real-time data analysis is being used to refine supply chain logistics, with a goal of reducing lead times by 5% in the coming year.

- Enhanced Quality Control: Advanced analytics are enabling more precise quality monitoring in metal coating applications, contributing to a projected 3% reduction in material waste.

Advanced Welding Technologies and Materials

Innovations like AI-powered robotic welding and advanced laser welding are significantly enhancing precision and speed in fabrication processes, crucial for sectors AZZ serves. For instance, the global welding market was valued at approximately USD 15.5 billion in 2023 and is projected to grow, with advanced technologies being key drivers.

The development of new alloys and composite materials necessitates sophisticated welding techniques that AZZ can adopt. This allows the company to cater to emerging industries requiring high-strength, lightweight, or corrosion-resistant components, thereby expanding its service portfolio. The demand for specialized welding in sectors like aerospace and renewable energy, which utilize advanced materials, is a significant growth avenue.

By integrating these cutting-edge welding solutions, AZZ can offer more efficient, sustainable, and high-quality services. This technological edge is vital for maintaining competitiveness and meeting the evolving demands for complex industrial fabrications, potentially leading to improved project margins and new market penetration.

- AI-driven welding systems are increasing efficiency by up to 30% in some industrial applications, reducing human error.

- Laser welding offers greater precision and faster processing speeds, particularly beneficial for intricate components in sectors like automotive and electronics.

- Development of new materials like advanced high-strength steels (AHSS) and composites requires specialized welding expertise, opening new service opportunities for AZZ.

Technological advancements in galvanizing and metal coating, such as improved zinc bath chemistry and temperature control, enhance AZZ's service capabilities by ensuring more uniform and durable coatings. The global metal coating market was valued at approximately $30.5 billion in 2023, with corrosion resistance being a key driver.

Automation and robotics are boosting AZZ's manufacturing efficiency and precision, with robotic welding systems potentially reducing cycle times by up to 30%. This technology also enhances safety and mitigates labor shortages, with companies integrating robotics seeing average productivity increases of 15-20% in 2024.

AZZ's specialty electrical segment benefits from the expanding smart grid market, projected to reach $100 billion by 2027. Demand for advanced metering infrastructure (AMI) is expected to grow at over 15% annually through 2025, reflecting the need for grid modernization and renewable energy integration.

Digitalization, including IoT and data analytics, is streamlining AZZ's operations. Smart factory initiatives in 2024 aim to reduce production cycle times by 10-15%, while IoT sensors enable predictive maintenance, minimizing downtime and improving operational efficiency by up to 8% in the 2024-2025 fiscal year.

Legal factors

AZZ Inc.'s galvanizing and metal coating businesses face significant legal hurdles due to strict environmental regulations. These laws govern everything from air emissions and wastewater discharge to the safe handling of chemicals, with non-compliance risking hefty fines and the potential loss of operating permits. For instance, the Environmental Protection Agency (EPA) sets national ambient air quality standards, and AZZ must adhere to these to operate its facilities.

The company's commitment to compliance is crucial, especially as environmental legislation evolves. Emerging regulations targeting carbon emissions and broader sustainability initiatives are increasingly shaping industrial practices. In 2023, the U.S. government continued to emphasize climate action, with ongoing discussions and potential new rules impacting energy-intensive industries like metal processing.

AZZ Inc. must strictly adhere to Occupational Safety and Health Administration (OSHA) regulations, which are fundamental legal obligations affecting both its manufacturing processes and service delivery. Failure to comply can result in significant fines and operational disruptions.

Recent OSHA updates, including new rules on ensuring properly fitting personal protective equipment (PPE) and more stringent requirements for submitting injury and illness data, demand ongoing attention and financial commitment to workplace safety programs. For instance, OSHA's emphasis on effective PPE fitting directly impacts the safety of workers in AZZ's fabrication and galvanizing facilities.

AZZ Inc. must navigate a complex web of product liability laws and stringent industry-specific quality standards across its diverse business segments, including metal coatings, welding solutions, and electrical equipment. Compliance ensures the durability, safety, and performance of its offerings, which is not only a legal requirement but also fundamental to preserving customer confidence and mitigating the risk of expensive lawsuits.

For instance, in the electrical equipment sector, adherence to standards like those set by UL (Underwriters Laboratories) or CSA (Canadian Standards Association) is critical. Failure to meet these benchmarks could lead to product recalls, significant financial penalties, and severe reputational damage. In 2023, the Consumer Product Safety Commission (CPSC) reported over 40,000 product-related injuries treated in emergency rooms, highlighting the real-world impact of product safety failures.

International Trade Laws and Sanctions

Operating on a global scale, AZZ Inc. must meticulously adhere to a complex web of international trade laws, customs regulations, and economic sanctions. Failure to comply can lead to significant trade disputes, hefty penalties, and severe restrictions on its international business operations. For instance, the evolving landscape of sanctions, particularly those impacting key manufacturing regions, could directly affect AZZ's supply chain and market access.

Navigating these legal frameworks is paramount for maintaining smooth international commerce. Trade tariffs, a significant component of international trade law, directly influence the cost of goods and can impact pricing strategies and market competitiveness. For example, the United States' imposition of tariffs on steel and aluminum in 2018 created challenges for many industrial companies, and ongoing discussions around global trade policies in 2024 continue to present uncertainties.

- Compliance is critical: AZZ's global operations necessitate strict adherence to international trade laws and sanctions to prevent legal repercussions.

- Tariff impact: Trade tariffs directly affect the cost of imported materials and finished goods, influencing AZZ's pricing and market positioning.

- Sanctions risk: Economic sanctions, which can change rapidly, pose a direct risk to AZZ's supply chain and ability to conduct business in certain regions.

- Regulatory vigilance: Continuous monitoring of evolving trade regulations and sanctions is essential for proactive risk management in 2024 and beyond.

Corporate Governance and Reporting Requirements

As a publicly traded entity, AZZ Inc. must adhere to stringent corporate governance standards and financial reporting mandates, overseen by bodies like the U.S. Securities and Exchange Commission (SEC) and the stock exchanges where its shares are listed. For instance, in fiscal year 2025, AZZ reported total revenues of $1.4 billion, necessitating detailed financial disclosures to maintain investor confidence and regulatory compliance.

The evolving landscape of Environmental, Social, and Governance (ESG) reporting presents an additional layer of compliance. New mandates, expected to be fully implemented by 2026, will require companies like AZZ to provide more granular and transparent disclosures regarding their sustainability practices, potentially impacting operational strategies and investor relations.

- SEC Filings: AZZ is obligated to file annual reports (10-K) and quarterly reports (10-Q) detailing its financial performance and operational activities.

- Stock Exchange Rules: Compliance with listing requirements from exchanges such as the New York Stock Exchange (NYSE) or Nasdaq ensures adherence to governance best practices.

- ESG Mandates: Upcoming regulations will necessitate comprehensive reporting on climate-related risks, diversity metrics, and ethical supply chain management.

- Shareholder Activism: Increased shareholder focus on ESG factors in 2024-2025 means AZZ must proactively address these concerns in its corporate governance and reporting.

AZZ's legal obligations extend to product liability and industry-specific standards, crucial for its metal coatings and electrical equipment segments. Adherence to certifications like UL or CSA is vital to prevent recalls and legal action, underscoring the importance of quality control.

The company's global operations require strict compliance with international trade laws and sanctions, impacting supply chains and market access. Trade tariffs and evolving sanctions in 2024 necessitate continuous regulatory vigilance to mitigate risks.

As a public company, AZZ faces rigorous corporate governance and financial reporting mandates from the SEC. Upcoming ESG reporting requirements for 2026 will demand greater transparency in sustainability practices, influencing investor relations.

Environmental factors

AZZ's reliance on zinc, a key component in galvanizing, means that its availability and price are directly influenced by global mining output and demand. In 2023, global refined zinc production was estimated at around 13.5 million metric tons, with prices experiencing volatility due to supply chain disruptions and geopolitical factors.

Water is another crucial resource for AZZ's manufacturing processes, particularly for cooling and cleaning. Regions where AZZ operates may face water scarcity, especially during 2024-2025, driven by climate change and increased agricultural or industrial demand. This can lead to higher water treatment costs and potential operational constraints if not managed proactively.

Climate change is intensifying extreme weather, posing significant risks to AZZ's operations. Increased hurricane activity, for instance, directly impacts the electrical grid infrastructure AZZ serves, potentially leading to project delays and disruptions. In 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, underscoring the growing threat to supply chains and facility resilience.

AZZ Inc.'s manufacturing operations, particularly in its metal coatings segment, inherently produce industrial waste and byproducts that necessitate stringent waste management and pollution control measures. The company's commitment to minimizing its environmental footprint is crucial, especially given the increasing global focus on sustainability and corporate environmental responsibility.

Adherence to evolving environmental regulations is a significant factor for AZZ. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste management. AZZ's ability to implement effective waste reduction, recycling programs, and responsible disposal methods directly impacts its operational costs and public image.

Sustainable practices are becoming a competitive advantage. Companies like AZZ that invest in technologies and processes to reduce waste generation, increase recycling rates, and ensure environmentally sound disposal can mitigate risks associated with non-compliance and appeal to environmentally conscious investors and customers. For example, by optimizing its galvanizing processes, AZZ could potentially reduce zinc dross generation, a common byproduct that requires careful handling and disposal.

Energy Consumption and Carbon Footprint

AZZ's core operations, particularly galvanizing, metal coating, and welding, are energy-intensive. This directly translates to substantial energy consumption and a significant carbon footprint. For instance, the galvanizing process alone requires high temperatures, leading to considerable electricity and natural gas usage.

In response to growing environmental concerns and regulatory pressures, AZZ is focusing on enhancing energy efficiency across its facilities. This includes adopting advanced technologies and optimizing operational processes to reduce overall energy demand. The company's commitment to sustainability is also reflected in its exploration and adoption of renewable energy sources to power its operations, thereby lowering its reliance on fossil fuels and mitigating its greenhouse gas emissions.

The push for decarbonization is a critical aspect of AZZ's environmental strategy. By investing in cleaner technologies and improving energy management, AZZ aims to meet increasingly stringent environmental regulations and contribute to global climate change mitigation efforts.

- Energy Intensity: Galvanizing and metal coating processes require significant thermal energy, making energy consumption a key environmental consideration for AZZ.

- Carbon Footprint Reduction: Efforts to transition to renewable energy sources and improve operational efficiency are central to AZZ's strategy for reducing its greenhouse gas emissions.

- Regulatory Compliance: Meeting evolving environmental standards and carbon pricing mechanisms necessitates continuous investment in sustainable practices and emissions control.

- Sustainability Reporting: AZZ's 2024 sustainability reports highlight ongoing initiatives to track and reduce energy consumption per unit of production, aiming for a quantifiable decrease in their carbon footprint.

Ecosystem Impact and Biodiversity

AZZ Inc.'s manufacturing processes and reliance on raw materials can affect local ecosystems. For instance, the extraction of metals and energy consumption in their galvanizing and metal coatings segments can lead to habitat disruption and resource depletion. Minimizing waste discharge and adopting sustainable sourcing are crucial for AZZ to mitigate these environmental impacts and maintain its social license to operate.

Responsible environmental stewardship is increasingly important for corporate reputation and regulatory compliance. AZZ's commitment to reducing its ecological footprint, evidenced by its sustainability reports, directly addresses concerns about biodiversity loss and ecosystem health. For example, in 2023, AZZ reported a reduction in Scope 1 and 2 greenhouse gas emissions, a step towards lessening its overall environmental impact.

- Raw Material Sourcing: AZZ's supply chain for steel and other metals can have upstream impacts on land use and biodiversity in mining regions.

- Waste Management: Proper handling and disposal of chemicals and byproducts from galvanizing processes are essential to prevent water and soil contamination.

- Energy Consumption: The energy-intensive nature of metal processing requires efficient operations to reduce reliance on fossil fuels and associated environmental degradation.

- Biodiversity Protection: Implementing measures to protect local flora and fauna at operational sites, especially near sensitive natural areas, is a key aspect of environmental responsibility.

AZZ's environmental performance is shaped by its energy-intensive operations, particularly in galvanizing and metal coating. The company is actively pursuing energy efficiency and exploring renewable energy sources to reduce its carbon footprint, aiming to meet stringent decarbonization goals. These efforts are crucial for regulatory compliance and enhancing its sustainability profile, with 2024 initiatives focusing on quantifiable reductions in energy consumption per unit of production.

The company's environmental strategy also encompasses responsible waste management and minimizing the impact of its operations on local ecosystems. By investing in cleaner technologies and optimizing processes, AZZ aims to reduce industrial waste and prevent pollution, thereby enhancing its corporate reputation and ensuring long-term operational viability.

PESTLE Analysis Data Sources

Our AZZ PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable industry publications, and economic forecasting reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting AZZ.