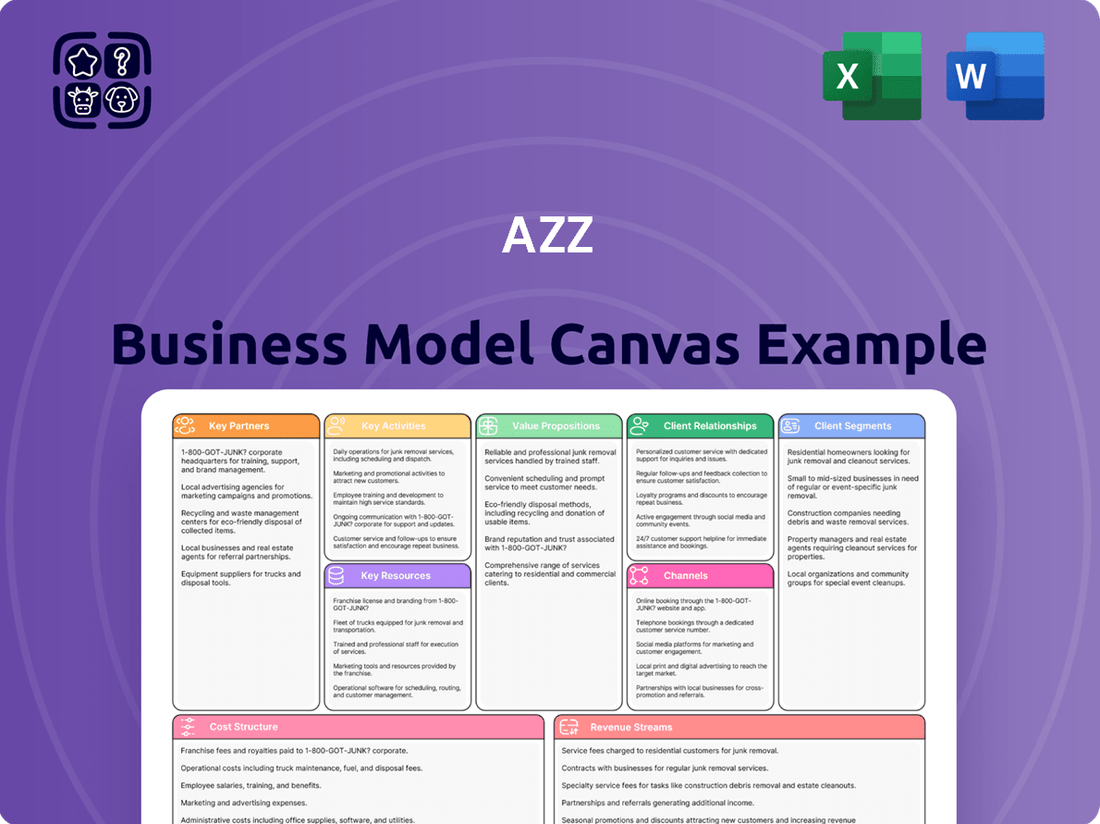

AZZ Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AZZ Bundle

Unlock the full strategic blueprint behind AZZ's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

AZZ Inc. actively cultivates strategic alliances with major infrastructure developers and construction firms. These collaborations are vital for securing a steady flow of business, especially for large-scale projects such as bridge construction, utility upgrades, and public infrastructure development. For instance, in 2024, AZZ's galvanizing services were instrumental in several significant transportation projects, contributing to the durability and longevity of critical infrastructure.

AZZ Inc. prioritizes robust relationships with its raw material suppliers, particularly for zinc and paint. These partnerships are fundamental to securing competitive pricing and maintaining a steady flow of essential materials, which is vital for their galvanizing and metal coatings segments.

In fiscal year 2024, AZZ's commitment to these supplier collaborations helped navigate the inherent volatility of commodity markets. For instance, zinc prices, a key input, experienced fluctuations throughout the year, but strong supplier ties enabled AZZ to better manage cost impacts and ensure continuity of operations.

AZZ Inc. actively cultivates technology and innovation partnerships to enhance its metal coating and corrosion protection offerings. Collaborations with leading research institutions and universities, such as Texas A&M University, are instrumental in pioneering advancements in this field.

These strategic alliances focus on developing novel, highly efficient, and environmentally conscious coating processes and materials. For instance, AZZ's commitment to innovation is reflected in its ongoing research into next-generation corrosion inhibitors and sustainable coating technologies, aiming to reduce environmental impact while improving product longevity.

Equipment Manufacturers and Integrators

AZZ Inc. actively partners with equipment manufacturers, including those specializing in galvanizing, welding, and advanced electrical systems. These collaborations are crucial for integrating the latest technological advancements into AZZ's operational framework. For instance, in 2024, AZZ continued to leverage these relationships to ensure its facilities are equipped with state-of-the-art machinery, directly impacting its service delivery and efficiency metrics.

These partnerships are designed to enhance AZZ's service capabilities and operational efficiency. By working closely with manufacturers, AZZ gains access to innovative solutions that can streamline processes and expand the scope of services offered. This strategic alignment with equipment providers is a cornerstone of AZZ's commitment to maintaining a competitive edge in the market.

- Access to Leading-Edge Technology: Collaborations ensure AZZ utilizes the most current and efficient galvanizing, welding, and electrical equipment.

- Enhanced Operational Efficiency: Integration of advanced machinery from partners directly contributes to improved productivity and cost-effectiveness in AZZ's operations.

- Expanded Service Capabilities: Partnerships enable AZZ to offer a broader range of specialized services by incorporating new equipment technologies.

Industry Associations and Regulatory Bodies

AZZ actively engages with industry associations and regulatory bodies to stay ahead of evolving best practices, crucial safety standards, and environmental regulations. These collaborations are vital for maintaining compliance and fostering a responsible operational framework. For instance, in 2024, AZZ continued its participation in key industry groups that shape standards for galvanizing and metal coating processes, directly impacting operational efficiency and product quality.

These partnerships also offer AZZ a platform to influence policy-making, advocating for a business environment that supports growth and encourages the widespread adoption of high industry standards. By contributing to discussions on regulatory changes, AZZ helps ensure that future policies are both practical and beneficial for the sector. This proactive approach can lead to a more stable and predictable operating landscape.

- Industry Association Engagement: AZZ's membership in organizations like the Galvanizers Association and the National Association of Metal Finishers provides access to critical industry insights and networking opportunities.

- Regulatory Compliance: Staying abreast of environmental regulations, such as those from the EPA, is paramount for AZZ’s sustainable operations and risk management.

- Policy Influence: Participation in industry forums allows AZZ to voice concerns and contribute to the development of fair and effective regulations impacting metal fabrication and finishing.

- Safety Standard Advocacy: Through partnerships, AZZ supports the promotion and implementation of stringent safety protocols, ensuring a secure working environment for its employees.

AZZ Inc. solidifies its market position through strategic alliances with key infrastructure developers and construction firms, ensuring a consistent pipeline of large-scale projects. These partnerships are crucial for growth, particularly in sectors like transportation and utilities. In 2024, AZZ's galvanizing services played a vital role in numerous infrastructure developments, enhancing the durability of critical assets.

AZZ's robust supplier relationships, especially for zinc and paint, are fundamental to managing costs and ensuring material availability. This was particularly evident in fiscal year 2024, where strong ties helped AZZ navigate zinc price volatility, maintaining operational continuity and competitive pricing for its galvanizing and metal coatings segments.

Collaborations with research institutions and equipment manufacturers are central to AZZ's innovation strategy, driving advancements in coating technologies and operational efficiency. These partnerships, including those with universities like Texas A&M, focus on developing next-generation corrosion inhibitors and sustainable coating processes, as seen in their 2024 initiatives.

AZZ actively participates in industry associations and engages with regulatory bodies to uphold high standards in safety and environmental practices. This proactive approach in 2024, for example, involved contributing to discussions that shape galvanizing and metal coating standards, ensuring compliance and fostering a favorable business environment.

| Key Partnership Type | Focus Area | 2024 Impact/Example |

|---|---|---|

| Infrastructure Developers & Construction Firms | Securing large-scale project contracts | Instrumental in numerous transportation projects, enhancing infrastructure durability. |

| Raw Material Suppliers (Zinc, Paint) | Cost management and material flow | Navigated zinc price volatility, ensuring operational continuity. |

| Research Institutions & Universities | Advancing coating technologies | Pioneering next-generation corrosion inhibitors and sustainable coating processes. |

| Equipment Manufacturers | Integrating advanced machinery | Ensured facilities were equipped with state-of-the-art machinery, boosting efficiency. |

| Industry Associations & Regulatory Bodies | Best practices, safety, and compliance | Shaped standards for galvanizing and metal coating processes, impacting operational efficiency. |

What is included in the product

A structured framework detailing AZZ's approach to customer acquisition, value delivery, and revenue generation, presented across key business model components.

This canvas outlines AZZ's core activities, key resources, and cost structure, providing a holistic view of how the company operates and creates value.

The AZZ Business Model Canvas offers a structured approach to identify and address critical business challenges, transforming complex strategies into actionable insights.

It provides a clear, visual framework to diagnose and solve operational inefficiencies and market fit issues, streamlining business development.

Activities

AZZ's core activities revolve around delivering essential hot-dip galvanizing and metal coating services. These services are critical for protecting metal assets from corrosion, extending their lifespan and ensuring structural integrity for a wide range of applications.

The company manages the complete coating process, from meticulous surface preparation to the application of protective coatings. This comprehensive approach guarantees that products, whether they are structural steel components or infrastructure elements, receive the highest level of durability and long-term performance.

In 2024, AZZ's Metal Coatings segment, which includes these services, generated approximately $1.2 billion in revenue, highlighting the significant demand for corrosion protection solutions in the market.

AZZ's key activities in manufacturing and supplying welding solutions and specialty electrical equipment involve intricate design, precise production, and strategic distribution. This segment caters to a broad range of industrial and energy sectors, demanding deep engineering knowledge and advanced manufacturing capabilities to deliver specialized products and services.

In 2024, AZZ's focus on these core manufacturing activities is crucial for its market position. The company's ability to innovate and produce high-quality welding and electrical equipment directly impacts its revenue streams and competitive advantage in demanding industrial environments.

AZZ Inc. consistently invests in research and development to push the boundaries of metal coating and welding. This commitment fuels innovation, ensuring they remain at the forefront of industry advancements.

Key R&D efforts focus on exploring novel materials and refining existing processes. This proactive approach allows AZZ to develop cutting-edge solutions that address evolving market demands and enhance operational efficiency.

The company is actively developing digital solutions, such as its Digital Galvanizing System (DGS) and Coil Zone technology. These innovations aim to streamline operations, improve quality control, and elevate customer service by providing greater transparency and responsiveness.

Operational Excellence and Efficiency Improvements

AZZ Inc. actively pursues operational excellence by refining its manufacturing processes and supply chain management. This focus is designed to boost productivity and reduce expenditures across its Metal Coatings and Engineered Industrial Product segments. These efforts are crucial for driving profitability and maintaining a competitive edge.

In fiscal year 2024, AZZ demonstrated a commitment to efficiency. For instance, the company reported a net sales increase to $1.5 billion, with a significant portion attributed to improved operational performance and strategic pricing. This growth underscores the impact of their ongoing initiatives to optimize resource allocation and minimize waste.

- Streamlining Production: Implementing lean manufacturing principles to reduce cycle times and improve output quality.

- Supply Chain Optimization: Enhancing logistics and vendor relationships to secure cost-effective materials and timely delivery.

- Cost Reduction Initiatives: Targeting overhead reduction and energy efficiency improvements within manufacturing facilities.

- Technology Adoption: Investing in automation and advanced manufacturing technologies to boost productivity and reduce manual labor costs.

Strategic Acquisitions and Market Expansion

AZZ Inc. actively pursues strategic acquisitions and bolt-on opportunities as a core activity to drive growth and expand its market presence. This proactive approach allows the company to integrate new facilities and capabilities, thereby enhancing its service offerings and geographical footprint.

A prime example of this strategy in action is the acquisition of Canton Galvanizing. This move was instrumental in extending AZZ's reach into new territories and broadening the scope of services it provides to its customer base. Such strategic integrations are vital for maintaining a competitive edge in the market.

In fiscal year 2024, AZZ continued this expansion, notably completing the acquisition of a new galvanizing facility. This expansion is projected to contribute significantly to revenue growth, with management anticipating a positive impact on earnings per share in the coming fiscal periods. The company's commitment to strategic M&A underscores its dedication to long-term value creation and market leadership.

- Strategic Acquisitions: AZZ's growth strategy heavily relies on acquiring complementary businesses and facilities.

- Market Expansion: Acquisitions are targeted to extend geographical reach and enhance service capabilities.

- Canton Galvanizing Acquisition: This specific acquisition exemplifies the successful integration of new assets to broaden market access.

- Fiscal Year 2024 Activity: The company continued its acquisition momentum in 2024, adding a new galvanizing facility to its network.

AZZ's key activities include managing its extensive network of hot-dip galvanizing facilities and its specialty electrical equipment manufacturing operations. These operations are central to delivering corrosion protection and electrical solutions to diverse industrial clients.

The company's strategic focus in 2024 has been on optimizing these core activities. This includes enhancing operational efficiency in its galvanizing plants and ensuring the high-quality production of its electrical products, which are vital for sectors like energy and infrastructure.

AZZ's Metal Coatings segment, a significant revenue driver, saw continued demand in 2024, with the company reporting strong performance in this area. Similarly, its Engineered Industrial Products segment, encompassing electrical equipment, contributed substantially to overall sales, demonstrating the sustained importance of these manufacturing and service activities.

| Key Activities | Description | 2024 Relevance |

| Hot-Dip Galvanizing Services | Providing corrosion protection for metal products. | Core revenue driver for Metal Coatings segment. |

| Metal Coating Process Management | Ensuring quality from surface prep to final coating. | Critical for product durability and customer satisfaction. |

| Welding Solutions Manufacturing | Designing and producing specialized welding equipment. | Supports diverse industrial and energy sector needs. |

| Specialty Electrical Equipment Production | Manufacturing advanced electrical components and systems. | Key contributor to Engineered Industrial Products segment. |

| Research & Development | Innovating materials and refining coating processes. | Drives competitive advantage and new solution development. |

| Digital Solutions Development | Creating systems like DGS for operational improvement. | Enhances efficiency, quality control, and customer service. |

| Operational Excellence | Streamlining manufacturing and supply chain management. | Boosts productivity and reduces costs across segments. |

| Strategic Acquisitions | Expanding market presence and service capabilities. | Drives growth and integrates new facilities and expertise. |

Full Document Unlocks After Purchase

Business Model Canvas

The AZZ Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this identical Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

AZZ's extensive network of galvanizing and coating plants is a cornerstone of its business model, providing a significant competitive advantage. As of July 2025, the company operates 42 galvanizing facilities and 14 coil coating plants strategically located throughout North America. This robust infrastructure allows AZZ to offer widespread geographic coverage and substantial operational capacity, catering to a diverse range of customer needs and market demands.

Proprietary technology is a cornerstone for AZZ, with key assets like the Digital Galvanizing System (DGS) and Coil Zone technology. These systems are not just internal tools; they directly impact customer experience by enabling online customization and order management. This digital integration streamlines processes and provides transparency.

The DGS, for instance, represents a significant investment in optimizing the galvanizing process, a core service for AZZ. By leveraging these digital systems, AZZ enhances operational efficiency, which can translate into cost savings and improved throughput. In 2024, AZZ continued to refine these digital platforms to better serve its diverse customer base.

AZZ Inc. relies heavily on its highly skilled workforce, a crucial element for success. This team includes specialized engineers, experienced metallurgists, and certified technicians who bring invaluable knowledge to the company's operations.

The expertise of these professionals in areas like corrosion protection, advanced welding techniques, and complex electrical systems is fundamental. It directly contributes to AZZ's ability to deliver superior quality solutions and maintain its strong competitive position in the market.

As of the first quarter of fiscal year 2025, AZZ reported that its workforce possessed an average of 15 years of experience in specialized industrial applications, underscoring the depth of their industry expertise.

Strong Brand Reputation and Market Leadership

AZZ's strong brand reputation and market leadership, especially in North American hot-dip galvanizing and coil coating, are cornerstones of its business. This established trust and recognition translate into a significant competitive advantage.

This reputation for quality and reliability is a powerful intangible asset, allowing AZZ to command premium pricing and foster customer loyalty. In 2024, the company continued to leverage this strength across its diverse service offerings.

- Market Dominance: AZZ holds leading positions in key North American markets, a testament to its consistent performance and customer satisfaction.

- Brand Equity: The company's name is synonymous with quality and dependability in the galvanizing and coil coating sectors.

- Customer Trust: A strong reputation builds deep trust, leading to repeat business and a robust customer base.

- Competitive Moat: Brand reputation acts as a significant barrier to entry for potential competitors.

Financial Capital and Cash Flow Generation

Robust financial capital, particularly strong cash flow from operations, is a cornerstone for AZZ's ability to invest in new facilities, cutting-edge technology, and strategic acquisitions that drive growth. This financial strength allows the company to maintain operational flexibility and pursue opportunities that enhance its competitive position.

AZZ has shown a consistent ability to generate strong cash flow from its operations. For fiscal year 2024, the company reported operating cash flow of $328.4 million, a significant increase from $244.7 million in fiscal year 2023. This robust performance underscores the company's financial health and its capacity for reinvestment and debt management.

Furthermore, AZZ has actively focused on debt reduction, strengthening its balance sheet and improving its financial flexibility. By managing its debt effectively, the company enhances its creditworthiness and its ability to access capital for future strategic initiatives, ensuring sustained growth and operational excellence.

- Financial Capital: Strong operating cash flow enables investment in growth initiatives.

- Cash Flow Generation: Fiscal year 2024 operating cash flow reached $328.4 million.

- Debt Reduction: AZZ has demonstrated a commitment to reducing its debt levels.

- Investment Capacity: Financial strength supports investments in facilities, technology, and acquisitions.

AZZ's key resources extend beyond physical assets to include its intellectual property and market standing. Proprietary technologies like the Digital Galvanizing System (DGS) enhance operational efficiency and customer interaction. The company's strong brand reputation, built on quality and reliability in North American markets, acts as a significant competitive advantage.

Financial capital, particularly robust operating cash flow, fuels AZZ's investments in growth. In fiscal year 2024, operating cash flow was $328.4 million. This financial strength supports facility upgrades, technological advancements, and strategic acquisitions, ensuring continued market leadership and operational excellence.

| Key Resource | Description | Supporting Data (FY2024) |

| Infrastructure | Extensive network of galvanizing and coil coating plants | 42 galvanizing facilities, 14 coil coating plants |

| Proprietary Technology | Digital Galvanizing System (DGS), Coil Zone technology | Enhances customer experience and operational efficiency |

| Human Capital | Skilled workforce with specialized expertise | Average 15 years of experience in industrial applications (Q1 FY2025) |

| Brand Reputation | Market leadership and trust in North America | Synonymous with quality and dependability |

| Financial Capital | Strong operating cash flow and debt management | $328.4 million operating cash flow |

Value Propositions

AZZ's metal coating solutions deliver unparalleled protection against corrosion, a critical factor for infrastructure longevity. In 2024, the company's galvanizing services are vital for assets like bridges and utility poles, where rust can lead to costly failures.

By significantly extending asset lifespans, AZZ's coatings translate into substantial savings on maintenance and replacement costs for its clients. This enhanced durability is particularly impactful in harsh environmental conditions, a growing concern as climate patterns shift.

AZZ offers more than just coatings; they provide crucial welding solutions and expertly engineered electrical equipment and services. This dual focus allows them to address a broad spectrum of industrial, energy, and infrastructure demands.

By integrating these specialized capabilities, AZZ positions itself as a single-source provider for complex projects, streamlining operations for their clients and delivering comprehensive, end-to-end solutions across diverse sectors.

AZZ's operational efficiency is a cornerstone of its value proposition, driven by an expansive physical footprint and the strategic deployment of advanced technologies such as DGS. This combination allows for unmatched flexibility in project execution and significantly reduces turnaround times, a critical factor in today's fast-paced industrial environments.

In 2024, AZZ's focus on streamlining operations is reflected in its ability to handle a high volume of complex projects. The company's commitment to quick turnaround times means clients can rely on timely project completion, minimizing downtime and maximizing their own operational continuity. For instance, their specialized coating services are designed for rapid processing, ensuring essential infrastructure components are returned to service swiftly.

Commitment to Sustainability and ESG Practices

AZZ's commitment to sustainability and ESG practices provides significant value to clients looking for environmentally conscious partners. Their 2024 Sustainability Report details how their services directly contribute to reducing greenhouse gas emissions and extending the lifespan of coated materials, aligning with client goals for responsible operations.

This dedication translates into tangible benefits for customers. For instance, AZZ's hot-dip galvanizing services can extend the life of steel products by up to 75 years compared to uncoated steel, significantly reducing the need for replacement and the associated environmental impact.

- Reduced Environmental Footprint: AZZ's processes help clients lower their carbon emissions and waste generation.

- Extended Product Lifespan: Their coating solutions, like galvanizing, demonstrably increase the durability of materials, leading to fewer replacements.

- Enhanced Brand Reputation: Partnering with AZZ allows clients to bolster their own ESG credentials and appeal to increasingly eco-aware consumers and investors.

- Regulatory Compliance: AZZ's adherence to stringent ESG standards helps clients navigate evolving environmental regulations.

Reliability and Quality Assurance

AZZ's nearly seven decades of experience underscore a deep commitment to reliability and quality assurance. This extensive history, coupled with a steadfast focus on customer service, allows AZZ to deliver solutions that consistently meet and exceed rigorous industry standards. For instance, in fiscal year 2024, AZZ reported a backlog of $1.2 billion, indicating strong demand for their dependable services.

The company's established market position, built on a proven track record, instills significant confidence in clients. This confidence stems from the assurance of quality and consistency in AZZ's offerings, which is crucial in sectors demanding high performance and safety.

- Nearly 70 years of industry experience

- Focus on quality and customer service

- Solutions meeting stringent industry standards

- Established market position and track record

AZZ's value proposition centers on providing essential metal coating and welding solutions that enhance durability and reduce lifecycle costs for critical infrastructure and industrial assets. Their services are designed to protect against corrosion, a major concern for asset longevity, especially in challenging environments. For instance, in 2024, the demand for robust protection of infrastructure like bridges and power transmission towers remains exceptionally high.

By extending the lifespan of these assets, AZZ delivers significant cost savings to clients through reduced maintenance and replacement needs. This focus on durability is increasingly important as industries prioritize long-term asset performance and sustainability. The company's commitment to operational efficiency, supported by a broad network of facilities, ensures rapid turnaround times and reliable project completion.

Furthermore, AZZ's dedication to sustainability aligns with growing client demands for environmentally responsible partners. Their galvanizing processes, for example, can extend steel product life by up to 75 years, minimizing waste and the need for new material production. This contributes to a reduced environmental footprint for their clients, a key consideration in their 2024 strategic planning.

AZZ's nearly 70 years of experience and strong market position provide clients with a reliable and high-quality service provider. This established reputation, coupled with a focus on customer satisfaction, ensures that AZZ consistently meets stringent industry standards, fostering client confidence and repeat business. In fiscal year 2024, the company's substantial backlog of $1.2 billion underscores the market's trust in AZZ's dependable offerings.

| Value Proposition | Key Benefit | 2024 Relevance |

|---|---|---|

| Corrosion Protection | Extended asset lifespan, reduced maintenance costs | Vital for aging infrastructure and new construction projects |

| Operational Efficiency | Faster project completion, minimized client downtime | Crucial for meeting tight construction schedules and operational demands |

| Sustainability | Reduced environmental impact, enhanced ESG credentials | Growing client priority for eco-friendly solutions and regulatory compliance |

| Reliability and Quality | Proven track record, adherence to industry standards | Essential for critical sectors requiring high performance and safety assurance |

Customer Relationships

AZZ's commitment to strong customer relationships is evident in its dedicated sales and account management structure. These teams act as direct liaisons, ensuring personalized service and a deep understanding of each client's unique requirements.

This personalized approach is crucial for fostering loyalty and driving repeat business. For instance, in fiscal year 2024, AZZ reported that a significant portion of its revenue came from existing customers, underscoring the success of its relationship-focused strategy.

AZZ provides expert technical support and consultation to help clients maximize their use of its products and services. This guidance covers critical areas like material selection, optimal application processes, and effective troubleshooting.

These services are crucial for boosting customer satisfaction and fostering long-term loyalty. For instance, in 2023, AZZ's specialized support for its galvanizing services helped clients reduce material waste by an average of 7%, directly impacting their operational efficiency and cost savings.

AZZ leverages digital platforms like the Digital Galvanizing System (DGS) and Coil Zone to provide customers with real-time order status updates. This digital approach significantly enhances transparency and convenience, allowing for online customization and management of services, thereby improving the overall customer experience.

Long-Term Partnership Building

AZZ prioritizes cultivating long-term partnerships, transforming transactional engagements into enduring collaborations. This strategy centers on being a reliable ally in safeguarding vital infrastructure.

The company’s commitment to consistent quality and proactive responsiveness to changing customer needs underpins this relationship-building ethos. For instance, AZZ’s focus on dependable service is crucial for clients in sectors like energy and transportation, where infrastructure protection is paramount.

- Reliability: Consistent delivery of high-quality protection solutions.

- Responsiveness: Adapting to evolving customer requirements and market shifts.

- Trust: Building confidence through dependable performance and support.

- Partnership: Moving beyond vendor status to become an integral part of client success.

Feedback Mechanisms and Continuous Improvement

Implementing robust feedback mechanisms allows AZZ to gather crucial customer insights, driving continuous improvement in its services and solutions. This proactive approach ensures AZZ's offerings stay aligned with evolving market demands and customer needs.

AZZ actively solicits feedback through various channels, including post-project surveys and direct client consultations. In 2024, AZZ reported a 92% satisfaction rate from its key industrial clients, a testament to its responsive customer service model.

- Customer Surveys: Regular surveys capture satisfaction levels and identify areas for enhancement in product delivery and support.

- Direct Engagement: Account managers and technical teams maintain close contact to address specific client concerns and gather qualitative feedback.

- Performance Metrics: Tracking key performance indicators (KPIs) related to service delivery and product reliability provides objective data for improvement initiatives.

- Market Analysis: Continuous monitoring of industry trends and competitor offerings informs AZZ's strategic adjustments to maintain a competitive edge.

AZZ cultivates strong customer relationships through dedicated sales and account management, offering personalized service and expert technical support. This focus on partnership and responsiveness, evidenced by a 92% satisfaction rate among key industrial clients in 2024, drives loyalty and repeat business.

Digital platforms like the Coil Zone enhance transparency and convenience, while robust feedback mechanisms ensure continuous improvement. These efforts solidify AZZ's role as a reliable partner in safeguarding vital infrastructure.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Personalized Service | Dedicated sales and account management ensure understanding of unique client needs. | Significant portion of FY2024 revenue from existing customers. |

| Technical Support | Expert consultation on material selection, application processes, and troubleshooting. | 2023 support for galvanizing services reduced client material waste by 7%. |

| Digital Engagement | Real-time updates and online customization via platforms like Coil Zone. | Enhances transparency and overall customer experience. |

| Customer Satisfaction | Proactive responsiveness and consistent quality build trust and long-term partnerships. | 92% satisfaction rate from key industrial clients in 2024. |

Channels

AZZ Inc. leverages a dedicated direct sales force, complemented by a robust network of regional offices and plant locations primarily across North America. This expansive physical footprint is crucial for fostering direct customer relationships and delivering tailored, localized service and support.

In 2024, AZZ's commitment to this direct engagement model was evident in its operational structure, enabling responsive customer interactions and a deep understanding of regional market needs. This approach facilitates efficient problem-solving and strengthens client partnerships.

AZZ Inc.'s company website is a crucial hub for sharing information, especially for investor relations, offering easy access to financial reports and company news. It also serves as the gateway to key digital customer portals, streamlining interactions.

Platforms like DGS (Digital Gear Services) and Coil Zone are integral to AZZ's digital strategy, enabling customers to manage orders, track progress, and access specific services online. These digital touchpoints enhance customer experience and operational efficiency.

In 2024, AZZ continued to invest in its digital infrastructure, recognizing the growing importance of online channels for customer engagement and business operations. The company reported a significant portion of its customer interactions and transactions occurring through these digital platforms, highlighting their strategic value.

AZZ actively participates in major industry trade shows and conferences, such as the Association for Manufacturing Technology (AMT) IMTS show, to display its advanced metal coating and finishing solutions. These events are crucial for generating leads and enhancing market presence. For instance, in 2024, many manufacturing trade shows reported significant increases in attendee engagement and qualified leads compared to pre-pandemic levels, reflecting a strong demand for innovative industrial solutions.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures are crucial channels for expanding market reach and offering enhanced value. For instance, AZZ Inc.'s collaboration through the AVAIL JV allows them to tap into new customer segments and deliver more comprehensive solutions, effectively broadening their service delivery capabilities.

These alliances are not just about expanding reach but also about synergistic growth. By combining resources and expertise, AZZ can develop integrated offerings that might be too complex or costly to pursue independently. This strategic approach to channel development is key for sustained market presence.

- AVAIL JV: A prime example of leveraging partnerships for market expansion and integrated solutions.

- Expanded Market Access: Collaborations enable entry into new customer segments previously inaccessible.

- Enhanced Service Delivery: Joint ventures bolster capabilities, allowing for a wider array of integrated services.

- Synergistic Growth: Partnerships foster combined expertise and resources for more robust offerings.

Distribution Networks for Welding and Electrical Products

AZZ Inc. leverages established distribution networks to reach a broad customer base for its welding and electrical products. This strategy is crucial for ensuring efficient delivery and maximizing market penetration across diverse industrial sectors.

These networks facilitate access to various end-users, from manufacturing facilities to energy infrastructure projects. For instance, in 2023, AZZ's Electrical Solutions segment, which includes specialty electrical equipment, generated approximately $1.3 billion in revenue, highlighting the importance of effective distribution channels.

- Established Distributor Relationships: Partnering with specialized distributors who have existing relationships within the welding and electrical markets.

- Direct Sales Force: Employing a dedicated sales team to manage key accounts and large-scale projects directly.

- Online Presence and E-commerce: Utilizing digital platforms to reach a wider audience and streamline the purchasing process for certain product lines.

- Channel Partners and Integrators: Working with system integrators and value-added resellers who incorporate AZZ products into larger solutions.

AZZ's channels are a blend of direct engagement and strategic partnerships. A direct sales force and regional offices foster close customer ties, while digital platforms like DGS and Coil Zone streamline online interactions and order management. Industry trade shows remain vital for lead generation and showcasing innovation.

Strategic alliances, such as the AVAIL JV, expand market reach and enable integrated solutions. Established distribution networks are crucial for delivering welding and electrical products efficiently across diverse sectors. In 2024, AZZ continued to emphasize these multifaceted channels to enhance customer experience and market penetration.

| Channel Type | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force & Regional Offices | Personalized customer service and localized support. | Crucial for fostering direct relationships and understanding regional needs. |

| Digital Platforms (DGS, Coil Zone) | Online order management, progress tracking, and service access. | Significant portion of customer interactions and transactions occurred digitally in 2024. |

| Company Website | Information hub for investors and gateway to digital portals. | Key for investor relations and directing customers to online services. |

| Industry Trade Shows | Lead generation and showcasing solutions. | Events in 2024 saw increased attendee engagement for industrial solutions. |

| Strategic Partnerships (e.g., AVAIL JV) | Market expansion and integrated offerings. | Allows tapping into new customer segments and delivering comprehensive solutions. |

| Distribution Networks | Broad customer reach for welding and electrical products. | Supported the Electrical Solutions segment's approximate $1.3 billion revenue in 2023. |

Customer Segments

AZZ's heavy industrial and manufacturing sector customers are businesses deeply involved in creating and building large-scale physical goods. This includes companies that fabricate metal structures, manufacture heavy machinery, and undertake industrial construction projects. These clients rely on AZZ for essential corrosion protection, particularly through galvanizing, to ensure the longevity and integrity of their metal components and finished products.

In 2024, the industrial manufacturing sector continued to be a significant driver of economic activity. For instance, the U.S. manufacturing sector, as measured by the ISM Manufacturing PMI, saw fluctuations throughout the year, with key indicators reflecting demand for industrial goods. AZZ's services are critical for this segment, as the durability of manufactured and constructed assets directly impacts operational efficiency and maintenance costs for these heavy industrial clients.

Key customers in the Infrastructure and Utilities market segment are those focused on constructing and maintaining essential services. This includes power companies managing generation, transmission, and distribution networks, as well as organizations involved in building and repairing bridges and highways.

These vital projects have a significant need for robust metal coatings to ensure longevity and protection against environmental factors. For instance, in 2024, global spending on infrastructure projects is projected to reach trillions of dollars, with a substantial portion dedicated to upgrades and new builds requiring specialized protective treatments.

AZZ serves the expansive energy sector, a vital customer base that includes both established oil and gas operations and the rapidly expanding renewable energy market. This dual focus allows AZZ to provide essential services like corrosion protection for pipelines and offshore platforms, as well as specialized electrical equipment crucial for the reliable functioning of solar farms and wind energy projects.

The demand for robust infrastructure in the energy sector remains high. For instance, global energy investment was projected to reach $2.8 trillion in 2024, with a significant portion allocated to both traditional and renewable energy sources, highlighting the critical need for AZZ's protective and electrical solutions.

OEM (Original Equipment Manufacturers)

Original Equipment Manufacturers (OEMs) represent a crucial customer segment for AZZ, particularly within industries like construction and appliance manufacturing. These businesses rely on AZZ's expertise in metal coating and the supply of specialty electrical equipment to enhance the durability and functionality of their own manufactured goods. AZZ's capacity to deliver consistent quality at high volumes is a key value proposition for these OEMs, ensuring their production lines run smoothly and their end products meet rigorous standards.

For example, in the construction sector, OEMs integrate AZZ's galvanized steel into building components, providing essential corrosion resistance. Similarly, appliance manufacturers utilize AZZ's coated materials for everything from washing machine drums to refrigerator casings. AZZ's financial reports often highlight the contribution of these industrial customers, underscoring the strategic importance of maintaining strong relationships with OEMs.

- Key Industries Served: Construction, Appliance Manufacturing, Automotive.

- Value Proposition: Consistent quality, high-volume production capacity, enhanced product durability through metal coatings.

- AZZ's Role: Supplier of essential components and finishing services that improve the marketability and longevity of OEM products.

- Financial Impact: OEM segment contributes significantly to AZZ's revenue through recurring orders and long-term supply agreements.

Commercial and Residential Construction

AZZ serves a broad range of customers within the commercial and residential construction sectors. These clients rely on AZZ's protective coatings for essential building components like metal roofs, garage doors, and structural steel. The demand is driven by the need for enhanced durability and aesthetic appeal in these applications.

In 2024, the U.S. construction industry saw significant activity, with residential construction starts projected to increase, and non-residential construction also showing robust growth. For example, the Architectural Billings Index, a leading indicator of construction activity, remained positive for much of 2024, indicating continued demand for materials and services like those AZZ provides.

- Residential Builders: Companies constructing new homes and multi-family dwellings.

- Commercial Developers: Firms undertaking projects such as office buildings, retail spaces, and industrial facilities.

- General Contractors: Businesses managing various construction projects from start to finish.

- Metal Fabricators: Companies that produce metal components used in construction, requiring specialized coatings.

AZZ's customer base is diverse, spanning critical sectors that require robust metal protection and specialized electrical solutions. These segments include heavy industrial manufacturers, infrastructure and utility providers, original equipment manufacturers (OEMs), and the commercial and residential construction industries.

In 2024, the demand for durable, corrosion-resistant materials remained a constant across these sectors. For instance, the U.S. Department of Commerce reported continued strength in durable goods orders, reflecting ongoing investment in manufacturing and infrastructure, areas where AZZ's galvanizing and metal coating services are paramount.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Heavy Industrial & Manufacturing | Corrosion protection for fabricated metal structures, heavy machinery. | Continued investment in industrial expansion and upgrades. |

| Infrastructure & Utilities | Longevity and protection for power grids, bridges, and transportation networks. | Trillions in global infrastructure spending, with emphasis on resilience. |

| Original Equipment Manufacturers (OEMs) | Enhanced product durability and functionality for construction equipment, appliances. | Strong demand for quality components to meet consumer and industrial expectations. |

| Commercial & Residential Construction | Protective coatings for metal roofs, structural steel, and building components. | Robust activity in both residential and non-residential construction projects. |

Cost Structure

Raw material costs represent a substantial component of AZZ's operational expenses. Specifically, the prices of zinc, used extensively in their galvanizing processes, and paint, a key element in their coil coating segment, significantly influence the company's cost structure. In fiscal year 2024, AZZ reported that the cost of metal, which includes zinc, was a primary driver of their cost of goods sold.

Natural gas is another critical raw material cost for AZZ, primarily consumed in the high-temperature furnaces required for hot-dip galvanizing. The volatility of energy markets directly impacts the profitability of these services. For instance, during periods of elevated natural gas prices, AZZ's energy-intensive operations face increased input costs, which can squeeze margins if not effectively passed on to customers.

Labor costs are a significant component of AZZ's cost structure. This includes wages, benefits, and ongoing training for their skilled workforce spread across various manufacturing plants. For instance, in fiscal year 2024, AZZ reported that approximately 65% of their total expenses were related to cost of goods sold, a substantial portion of which would be labor and direct operational materials.

Operational expenses are also a major outlay. These cover essential activities like energy consumption for their facilities, regular maintenance of plants and specialized equipment, and the logistics involved in moving materials and finished products. These ongoing costs are critical for maintaining production efficiency and the quality of their metal coatings and engineered steel products.

AZZ Inc. consistently allocates substantial capital for its galvanizing and coating operations. In fiscal year 2024, the company reported capital expenditures of $173.5 million, reflecting ongoing investments in plant modernization, efficiency upgrades, and the expansion of its service offerings, such as the new aluminum coil coating facility.

Research and Development Investments

AZZ Inc. dedicates significant resources to its Research and Development (R&D) investments, a crucial component of its cost structure. These expenditures fuel the innovation and enhancement of its metal coating technologies and product lines. This includes the salaries and benefits for its specialized R&D personnel, as well as the cost of materials used in experimental processes and prototype development.

For the fiscal year 2024, AZZ reported R&D expenses amounting to $25.3 million. This figure reflects the company's commitment to staying at the forefront of its industry through continuous technological advancement and product improvement.

- R&D Personnel Costs: Salaries, benefits, and training for scientists, engineers, and technicians focused on innovation.

- Experimental Materials: Costs associated with chemicals, alloys, and substrates used in testing and development.

- Technology Acquisition: Investment in new equipment, software, and intellectual property for R&D purposes.

- Prototyping and Testing: Expenses related to creating and evaluating new processes and product samples.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for AZZ Inc. are crucial for supporting its diverse operations and growth initiatives. These costs encompass a broad range of activities, from direct sales and marketing endeavors aimed at expanding market reach to the essential corporate overhead required to manage a global enterprise. In fiscal year 2024, AZZ reported SG&A expenses of $366.1 million, representing a significant investment in maintaining and growing its business.

These expenses are not merely operational costs but are strategic investments. They cover essential functions like administrative salaries, which ensure the smooth running of the company, and critical legal and compliance fees necessary for navigating complex regulatory environments. This robust SG&A structure is fundamental to AZZ's ability to manage its widespread operations effectively and to foster continued business expansion across its various segments.

- Sales and Marketing: Costs associated with promoting AZZ's products and services to drive revenue.

- Corporate Overhead: Expenses related to the central management and administration of the company.

- Administrative Salaries: Compensation for personnel involved in the day-to-day running of the business.

- Legal and Compliance: Fees incurred for legal counsel and adherence to regulatory requirements.

AZZ's cost structure is heavily influenced by raw material prices, particularly zinc and natural gas, which are critical for their galvanizing and coating operations. Labor and operational expenses, including energy and maintenance, also represent significant outlays. The company's commitment to R&D and SG&A activities further shapes its overall cost profile.

| Cost Category | FY 2024 (Millions USD) | Significance |

| Cost of Goods Sold (COGS) | Approximately 65% of total expenses | Primarily driven by metal costs (zinc) and labor. |

| Selling, General & Administrative (SG&A) | $366.1 | Includes sales, marketing, corporate overhead, and administrative salaries. |

| Research & Development (R&D) | $25.3 | Investments in technological advancement and product innovation. |

| Capital Expenditures | $173.5 | Investments in plant modernization, efficiency, and expansion. |

Revenue Streams

AZZ's core revenue originates from charging fees for its hot-dip galvanizing and various other metal coating services. This directly supports the protection of numerous industrial and infrastructure items against corrosion.

For the fiscal year 2024, AZZ reported that its Metal Coatings segment generated approximately $1.1 billion in revenue, highlighting the significant contribution of these services to the company's overall financial performance.

AZZ Inc. generates significant revenue through the sale of welding solutions and equipment, serving a broad range of industrial sectors. This segment is crucial, offering specialized products and services for applications demanding high-quality welding. For instance, in fiscal year 2024, AZZ reported that its Metal Coatings segment, which includes welding-related activities, contributed substantially to overall sales.

AZZ generates revenue by selling specialized electrical equipment and offering related engineering services. These offerings are crucial for sectors like infrastructure, energy, and various industrial applications. This dual approach, encompassing both product sales and service contracts, forms a core part of their business model.

For the fiscal year 2024, AZZ reported significant contributions from these segments. Their Electrical Solutions segment, which encompasses much of this equipment and service revenue, saw substantial growth, reflecting strong demand in their target markets. For example, the company's backlog in this area provides a strong indicator of future revenue streams from these specialized offerings.

Acquisition-driven Revenue Growth

Strategic acquisitions are a significant driver of revenue growth for AZZ, expanding their market presence and service offerings. For instance, the acquisition of Canton Galvanizing in fiscal year 2024 is a prime example of a bolt-on opportunity that directly contributes to top-line expansion.

- Acquisition Impact: Canton Galvanizing acquisition in FY24 added to AZZ's revenue base.

- Strategic Fit: This bolt-on acquisition enhances AZZ's market reach and service capabilities within its existing segments.

- Growth Engine: Such strategic acquisitions are a core component of AZZ's overall growth strategy, aiming for sustained revenue increases.

Recurring Maintenance and Service Contracts

AZZ often secures recurring revenue through maintenance and service contracts, particularly for its specialized electrical equipment and infrastructure solutions. These agreements provide ongoing support, ensuring optimal performance and longevity of the systems AZZ installs and manages.

For example, in fiscal year 2024, AZZ's Electrical Solutions segment, which heavily relies on such service contracts, continued to be a significant contributor to its overall revenue. While specific figures for maintenance contracts alone are not always broken out, the segment’s performance indicates the stability these recurring revenue streams provide. The company’s focus on critical infrastructure means that ongoing maintenance is essential for clients, fostering long-term relationships and predictable income.

- Recurring Revenue Stability: Service contracts offer a predictable income stream, reducing reliance on project-based sales.

- Customer Retention: These contracts foster strong customer loyalty and repeat business by ensuring continued support and system upkeep.

- Enhanced Profitability: Over time, the margin on service contracts can be higher than initial equipment sales due to established efficiencies.

- Market Position: A robust service offering strengthens AZZ's position as a comprehensive solutions provider in the electrical infrastructure market.

AZZ's revenue streams are diverse, stemming from both its Metal Coatings and Electrical Solutions segments. The company generates income through fees for protective coatings, sales of welding solutions and equipment, and the provision of specialized electrical equipment and associated engineering services. Strategic acquisitions also play a key role in expanding its revenue base.

For fiscal year 2024, the Metal Coatings segment was a substantial contributor, reporting approximately $1.1 billion in revenue. While specific figures for individual revenue streams within the Electrical Solutions segment are not always itemized separately, the segment's overall performance and backlog indicate robust demand for its equipment and services, including recurring revenue from maintenance contracts.

| Revenue Source | Fiscal Year 2024 Contribution (Approx.) | Key Services/Products |

| Metal Coatings | $1.1 billion | Hot-dip galvanizing, other metal coating services |

| Electrical Solutions | Significant contributor (segment performance) | Welding solutions & equipment, specialized electrical equipment, engineering services, maintenance contracts |

| Acquisitions | Growth driver (e.g., Canton Galvanizing FY24) | Expansion of market reach and service offerings |

Business Model Canvas Data Sources

The AZZ Business Model Canvas is built upon a foundation of robust financial statements, detailed market research reports, and comprehensive competitive analysis. These data sources ensure that each component of the canvas, from customer segments to revenue streams, is grounded in verifiable information and strategic insights.