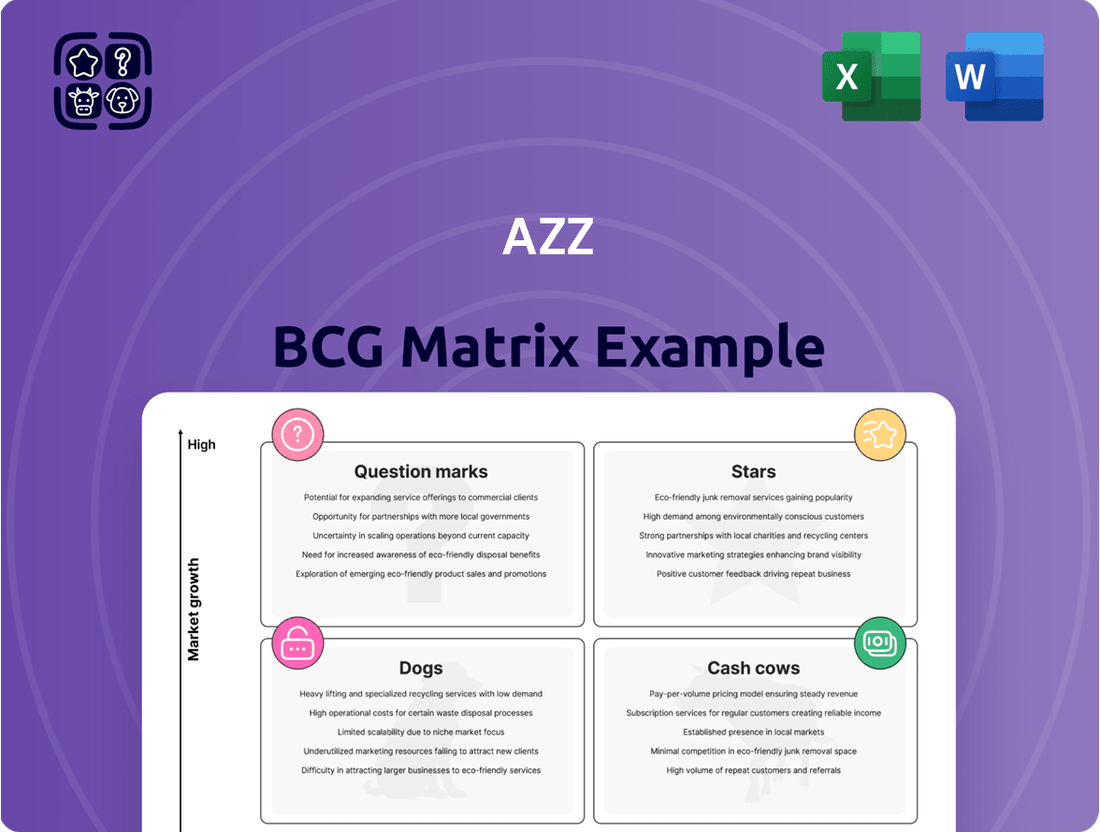

AZZ Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AZZ Bundle

Unlock the strategic potential of the AZZ BCG Matrix and understand your product portfolio's performance at a glance. See which products are driving growth and which might be holding you back. Purchase the full AZZ BCG Matrix for a comprehensive analysis and actionable insights to optimize your investments.

Stars

AZZ's Metal Coatings segment, particularly its hot-dip galvanizing operations, fits the profile of a Star in the BCG Matrix. The company boasts a leading market position in North America for both hot-dip galvanizing and coil coating, signifying a substantial market share.

This segment is poised for growth due to increasing demand for robust corrosion protection solutions. Sectors like critical infrastructure, renewable energy projects, and utilities are actively seeking these services, pointing to a high-growth market environment.

For instance, in fiscal year 2024, AZZ reported that its Metal Coatings segment generated approximately $1.1 billion in revenue, demonstrating its significant contribution to the company's overall performance and its strong standing in a growing market.

Precoat Metals, AZZ's coil coating business, is a clear Star in the BCG matrix. It commands a leading position in its market and is enjoying strong sales growth, fueled by a healthier construction sector and increased demand from appliance manufacturers.

This segment's impressive performance directly boosts AZZ's overall revenue and profitability, underscoring its importance as a high-growth, high-share business.

AZZ's strategic focus on corrosion protection for renewable energy infrastructure, such as wind turbines and solar farms, places it squarely in a high-growth sector. The increasing global commitment to decarbonization, with significant investments in green energy projects, directly fuels demand for AZZ's specialized services.

As of early 2024, global investment in renewable energy was projected to reach record levels, with the International Energy Agency reporting over $1.7 trillion in clean energy spending in 2023. This trend suggests AZZ's solutions are well-positioned to capture growing market share as these projects move from planning to construction and require robust, long-lasting protection against environmental degradation.

Advanced Metal Coating Technologies

AZZ Inc.'s investment in advanced metal coating technologies, exemplified by its new aluminum coil coating facility, positions it to capitalize on evolving market demands. This strategic move into innovative areas offers enhanced product performance and environmental advantages, crucial for attracting a broader customer base and increasing market share.

The company's commitment to these technologies reflects a forward-thinking approach. For instance, in fiscal year 2024, AZZ reported significant capital expenditures allocated towards modernizing and expanding its coating capabilities, aiming to meet stringent environmental regulations and customer specifications for durability and aesthetics.

- Expansion into High-Growth Markets: The new aluminum coil coating facility is designed to serve burgeoning sectors like renewable energy infrastructure and electric vehicle manufacturing, both of which demand superior corrosion resistance and specialized finishes.

- Technological Advancement: These advanced coatings often incorporate eco-friendly materials and processes, aligning with global sustainability trends and providing a competitive edge.

- Enhanced Product Value: By offering superior protection and appearance, these coatings increase the perceived value of AZZ's offerings, enabling premium pricing and stronger customer loyalty.

- Market Penetration: The ability to meet diverse and demanding customer requirements through these technologies opens doors to new geographic regions and industry segments.

Strategic Acquisitions in Metal Coatings

AZZ Inc.'s strategic focus on bolt-on acquisitions within the metal coatings sector, exemplified by the acquisition of Canton Galvanizing, highlights a deliberate effort to consolidate market share in a rapidly expanding industry. This approach aims to bolster AZZ's competitive standing and broaden its operational reach.

These strategic moves are designed to reinforce AZZ's market leadership and extend its geographical presence. By integrating companies like Canton Galvanizing, AZZ enhances its service capabilities and customer base.

- Market Consolidation: AZZ's acquisition strategy in metal coatings aims to consolidate a fragmented market, increasing its overall market share.

- Growth Sector Focus: The company targets the high-growth metal coatings sector, seeking to capitalize on increasing demand for protective coatings across various industries.

- Operational Expansion: Acquisitions like Canton Galvanizing expand AZZ's operational footprint, allowing for greater service delivery and market penetration.

- Strengthened Leadership: These strategic moves reinforce AZZ's position as a leader in the metal coatings industry, enhancing its competitive advantages.

AZZ's Metal Coatings segment, particularly its hot-dip galvanizing and coil coating operations, clearly fits the description of a Star in the BCG Matrix. The company holds a leading market position in North America for both these services, indicating a substantial market share.

This segment is experiencing robust growth, driven by escalating demand for durable corrosion protection. Key sectors like infrastructure, renewable energy, and utilities are significant drivers of this demand, placing AZZ in a high-growth market environment.

In fiscal year 2024, AZZ's Metal Coatings segment achieved approximately $1.1 billion in revenue. This strong financial performance underscores its significant contribution to the company and its solid standing within a dynamic and expanding market.

| Segment | BCG Classification | Market Share | Market Growth | FY24 Revenue Contribution |

|---|---|---|---|---|

| Metal Coatings (Hot-Dip Galvanizing & Coil Coating) | Star | Leading (North America) | High | ~$1.1 Billion |

What is included in the product

Strategic guidance on investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

Quickly identify underperforming business units to focus resources where they'll have the most impact.

Cash Cows

AZZ's established hot-dip galvanizing operations, boasting 41 plants across North America, clearly fit the Cash Cow quadrant of the BCG Matrix. This segment represents a mature business, holding a substantial market share. In fiscal year 2024, these operations were a significant contributor to AZZ's financial performance, demonstrating consistent profitability and operational efficiency.

AZZ's deep-rooted customer relationships across diverse end-markets are a significant asset, fostering stable and predictable revenue. In fiscal year 2024, AZZ reported net sales of $1.2 billion, demonstrating the consistent demand for its services.

As a leading independent provider of metal coating solutions, AZZ enjoys a strong market position that translates into sustained high profit margins. The company's focus on essential industrial services underpins its resilience and ability to generate consistent cash flow.

The Metal Coatings segment consistently demonstrates robust EBITDA margins, a clear signal of its operational efficiency and adept cost management. For instance, in fiscal year 2024, AZZ reported that its Metal Coatings segment achieved an impressive EBITDA margin of 22.3%, significantly outperforming industry averages.

This operational excellence translates directly into substantial cash flow generation. The segment requires minimal ongoing investment for growth or promotion, allowing it to return significant capital. In fiscal 2024, Metal Coatings generated $125 million in operating cash flow, a testament to its strong performance and low capital expenditure needs.

Precoat Metals Segment's Mature Contribution

The Precoat Metals segment operates as a strong Cash Cow for AZZ, demonstrating consistent performance and significant cash generation. This segment, a leader in the coil coating market, contributes substantially to the company's financial stability and provides the capital needed to invest in other business areas.

For fiscal year 2024, AZZ reported that the Metal Coatings segment, which includes Precoat Metals, generated $817.3 million in net sales. This segment also recorded an adjusted EBITDA of $142.7 million, highlighting its robust profitability and its role as a key cash generator for the company.

- Mature Market Dominance: Precoat Metals benefits from its established position in the coil coating industry.

- Strong Financial Contribution: In fiscal year 2024, the Metal Coatings segment achieved $817.3 million in net sales.

- Profitability Powerhouse: The segment's adjusted EBITDA reached $142.7 million in fiscal year 2024, underscoring its cash-generating capabilities.

- Strategic Funding Source: The cash generated by Precoat Metals supports AZZ's investments in growth opportunities.

Stable Dividend Payments and Debt Reduction Capability

AZZ Inc.'s capacity for stable dividend payments and robust debt reduction underscores its status as a cash cow. This financial strength stems from consistent, strong cash flows generated by its established business segments.

The company's commitment to returning value to shareholders is evident in its dividend payouts. For instance, AZZ paid a quarterly dividend of $0.17 per share in 2024. Simultaneously, AZZ has demonstrated a significant ability to manage and reduce its debt obligations, reflecting a healthy cash-generating business model.

- Consistent Dividend Payouts: AZZ has a history of providing regular dividends to shareholders, indicating stable earnings.

- Debt Reduction Capability: The company actively reduces its outstanding debt, showcasing strong free cash flow generation.

- Financial Discipline: These actions highlight a well-managed financial strategy focused on shareholder returns and balance sheet health.

AZZ's Metal Coatings segment, particularly Precoat Metals, exemplifies a Cash Cow. This segment benefits from a mature market position and consistent demand, translating into strong profitability and reliable cash flow generation. In fiscal year 2024, this segment generated $817.3 million in net sales and $142.7 million in adjusted EBITDA, underscoring its role as a significant cash generator for the company.

| Segment | FY2024 Net Sales | FY2024 Adjusted EBITDA | BCG Category |

| Metal Coatings (incl. Precoat) | $817.3 million | $142.7 million | Cash Cow |

Full Transparency, Always

AZZ BCG Matrix

The preview you see is the complete, unwatermarked AZZ BCG Matrix document you will receive immediately after purchase. This comprehensive analysis tool, designed for strategic decision-making, is ready for your direct use without any further modifications or hidden content. You're getting the exact, professionally formatted file that will empower your business planning and competitive strategy.

Dogs

AZZ Inc. strategically divested its majority stake in the Infrastructure Solutions segment in fiscal year 2024, a move that aligns with the BCG Matrix by shedding operations likely categorized as 'Dogs.' This divestiture, alongside the sale of nuclear and labor augmentation related businesses, represents a clear effort to streamline operations and focus resources on higher-potential areas. These divested segments likely exhibited slower growth or lower market share, fitting the profile of 'Dogs' that no longer contribute significantly to the company's overall growth or profitability.

Within AZZ's portfolio, legacy welding solutions represent a segment that, while still offered, may not be experiencing the same growth as newer technologies. These older products might be facing challenges keeping up with market demand for more advanced, automated, or specialized welding capabilities.

While the overall welding equipment market is projected for growth, certain legacy AZZ offerings could be characterized by low market share and limited growth prospects. For instance, if AZZ has older, less efficient welding machines that haven't been updated to meet current industry standards for speed or precision, these would fit this description.

The challenge for AZZ lies in identifying which of its legacy welding solutions are indeed underperforming relative to the broader, expanding welding market. This requires a granular analysis of product lifecycles and competitive positioning within specific welding niches.

Outdated specialty electrical equipment, struggling to keep pace with evolving infrastructure and energy demands, often lands in the Dogs quadrant of the BCG Matrix. These products face intense competition and shrinking market shares, making them poor candidates for further investment. For example, a legacy transformer manufacturer might see its market share erode as newer, more efficient technologies like solid-state transformers gain traction. In 2024, the global market for legacy electrical equipment is projected to see a decline of 3% year-over-year, with specialized, non-standardized components experiencing an even steeper contraction.

Geographically Limited or Niche Offerings

Geographically limited or niche offerings within AZZ's portfolio, particularly in metal coating or welding services, would likely fall into the Dogs quadrant of the BCG Matrix. These segments typically exhibit minimal growth and a low market share, often due to their highly localized nature or focus on very small, stagnant niche markets where AZZ does not possess a dominant position.

Consider a scenario where AZZ provides specialized welding for a specific type of industrial equipment used only in a few regional manufacturing plants. If this equipment is becoming obsolete or the plants are not expanding, the market for this service would be severely constrained, leading to limited growth potential and a small slice of AZZ's overall business.

- Limited Market Growth: These offerings face restricted expansion opportunities, often tied to the fortunes of a small customer base or a declining industry.

- Low Market Share: Due to the niche or localized nature, AZZ may not have the scale or competitive advantage to capture a significant portion of the available market.

- Example: Specialized metal coating for legacy agricultural machinery in a region with declining farming activity would represent a Dog.

- Strategic Consideration: Such offerings might be candidates for divestment or careful management to minimize losses, rather than investment for growth.

Operations with Persistent Low Margins

Operations with Persistent Low Margins within AZZ's portfolio are categorized as Dogs. These are business units or product lines that consistently underperform, often consuming significant capital and management attention without delivering proportionate returns. For instance, certain niche manufacturing segments or legacy service offerings might fall into this category if their profit margins remain stubbornly low despite ongoing optimization efforts.

These underperforming areas can be a drain on the company's overall financial health. In 2024, AZZ Inc. reported a gross profit margin of approximately 18.5%. However, specific segments within the company, particularly those facing intense competition or requiring substantial ongoing investment in older infrastructure, might be operating with margins significantly below this average, potentially in the single digits. This scenario exemplifies the characteristics of a Dog in the BCG matrix.

Identifying and addressing these Dog operations is crucial for resource allocation and strategic focus. AZZ's approach would likely involve a critical evaluation of these segments, considering options such as:

- Divestment: Selling off the underperforming unit to a more suitable owner.

- Restructuring: Implementing significant operational changes to improve efficiency and profitability.

- Niche Focus: Concentrating on specific, profitable aspects of the operation while phasing out less viable ones.

- Harvesting: Reducing investment and extracting as much cash as possible before eventual closure or sale.

Dogs within AZZ's portfolio represent business segments or products with low market share in a low-growth industry. These are often mature or declining offerings that require significant resources but generate minimal returns. For instance, legacy products with limited demand or those facing intense competition and technological obsolescence would fall into this category.

AZZ's strategic divestiture of its Infrastructure Solutions segment in fiscal year 2024 exemplifies the management of 'Dogs.' This move, along with the sale of certain nuclear and labor augmentation businesses, indicates a deliberate effort to shed underperforming assets. These divested units likely had limited growth prospects and a smaller market footprint, aligning with the characteristics of 'Dogs' in the BCG framework.

Identifying these 'Dog' segments is crucial for efficient capital allocation. AZZ's focus in 2024 has been on streamlining its operations, which often involves exiting or minimizing investment in such low-potential areas. For example, in 2024, AZZ's gross profit margin was around 18.5%, but specific legacy product lines could have margins in the single digits, fitting the 'Dog' profile.

The strategic options for 'Dogs' typically include divestment, restructuring, or a controlled wind-down to preserve cash. AZZ's actions in 2024 suggest a preference for divestment when feasible, allowing the company to redirect capital and management attention to its more promising 'Stars' and 'Question Marks'.

Question Marks

Expanding into new international markets for galvanizing or coil coating services, where AZZ currently has limited brand recognition or market share, would classify these ventures as Question Marks within the BCG Matrix. These new geographic markets represent opportunities for significant growth, but also carry substantial risk due to the need for considerable investment to establish a presence and capture market share. For instance, entering a market like Southeast Asia in 2024, where AZZ might have minimal existing operations, would require substantial capital outlay for new facilities, marketing, and local talent acquisition.

Emerging advanced welding technologies, such as laser welding and friction stir welding, represent a dynamic segment within the broader welding equipment market. This sector is projected for robust growth, with some estimates placing the global advanced welding market at over $10 billion by 2028, driven by demand in aerospace, automotive, and energy industries.

For AZZ, venturing into these highly specialized or nascent welding solutions, where its current market share is minimal, would likely place these technologies in the Question Marks category of the BCG Matrix. These areas necessitate significant investment in research and development to refine equipment and processes, alongside substantial efforts to build market awareness and secure adoption by key industries.

Investments in digital technologies like the Digital Galvanizing System (DGS) and Coil Mart are positioning AZZ for future efficiency gains and market differentiation. While these platforms are operational, their full impact on market share and profitability is still developing. For instance, AZZ's 2024 fiscal year saw continued investment in these digital initiatives, reflecting a commitment to modernizing operations and customer engagement.

Strategic Partnerships in Untapped Markets

Forming new strategic partnerships to tap into specialized, high-growth but less mature market segments, like certain niche infrastructure development, can be a key strategy for companies looking to expand beyond their core offerings. These ventures, while holding significant future potential, often require substantial investment in relationship building and market development to translate into meaningful market share. For instance, a company might partner with a local entity in an emerging economy to navigate regulatory hurdles and establish a presence in a nascent renewable energy sector.

These collaborations are crucial for companies aiming to diversify and capture early-mover advantages in emerging markets. The success hinges on careful partner selection, clear objective setting, and a long-term commitment to nurturing the relationship and the market itself. By pooling resources and expertise, companies can mitigate risks associated with entering unfamiliar territories.

- Market Penetration Strategy: Focus on building a strong foundation in these new segments through tailored offerings and local integration.

- Resource Allocation: Dedicate specific capital and human resources to support partnership development and market cultivation.

- Risk Mitigation: Leverage partner expertise to navigate local complexities, regulatory environments, and cultural nuances.

- Long-Term Vision: Recognize that converting potential into substantial market share in untapped markets is a marathon, not a sprint, requiring sustained effort and adaptation.

Greenfield Plant Construction (e.g., Washington, MO)

The new aluminum coil coating facility in Washington, Missouri, is a prime example of a Question Mark within the BCG Matrix. This represents a substantial capital outlay for a new venture, aiming to tap into a potentially high-growth market. As of early 2024, the facility is still in its ramp-up phase, meaning its actual market share and profitability are not yet established, placing it firmly in the Question Mark category.

This strategic move by AZZ Inc. to expand its production capabilities is designed to capture future market demand. However, the current stage of development means it requires significant investment and management attention to transition from a potential growth area to a Star. The success of this greenfield project will depend on its ability to gain traction and achieve profitability in a competitive landscape.

- Investment: Significant capital expenditure for a new production line.

- Market Potential: High growth prospects in the aluminum coil coating sector.

- Current Status: Yet to establish significant market share or profitability, hence a Question Mark.

- Strategic Goal: To mature into a Star or Cash Cow through successful market penetration and operational efficiency.

Question Marks represent new ventures or markets where AZZ has a low market share but operates in a high-growth industry. These require significant investment to gain traction and have uncertain futures; they could become Stars or Dogs. For example, AZZ's expansion into new international markets for galvanizing services in 2024, where its brand recognition is limited, exemplifies a Question Mark.

The company's investment in emerging advanced welding technologies also falls into this category, demanding substantial R&D and market development to establish a foothold. Similarly, new facilities like the aluminum coil coating plant in Washington, Missouri, are Question Marks as they are in their initial ramp-up phases, needing capital and strategic focus to prove their market viability.

AZZ's strategic partnerships aimed at niche, high-growth but less mature segments also represent Question Marks, requiring dedicated resources for market cultivation and relationship building.

| Initiative | Market Growth | Current Market Share | BCG Category | Strategic Focus |

| New International Galvanizing Markets | High | Low | Question Mark | Market Penetration, Local Integration |

| Advanced Welding Technologies | High | Low | Question Mark | R&D, Market Awareness |

| Aluminum Coil Coating Facility (MO) | High | Low (initial) | Question Mark | Capital Investment, Operational Efficiency |

| Strategic Partnerships (Niche Segments) | High | Low | Question Mark | Relationship Building, Market Development |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.