AZZ Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AZZ Bundle

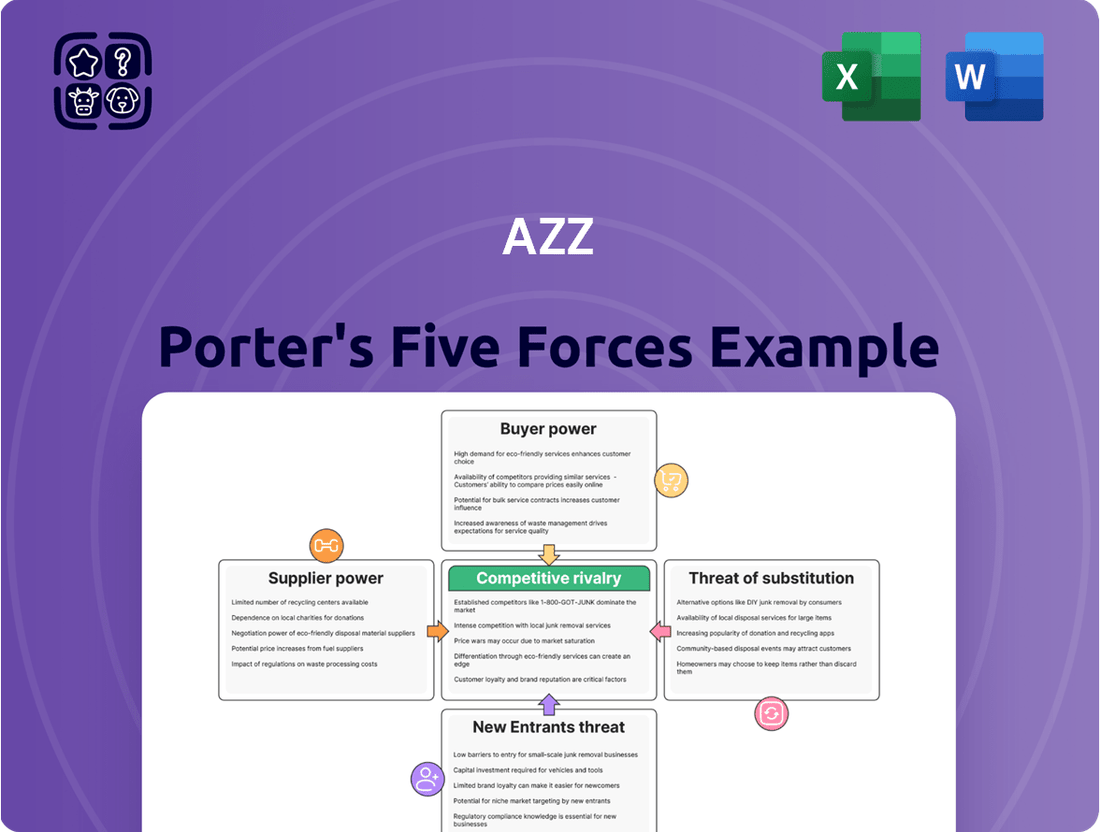

AZZ's competitive landscape is shaped by the interplay of five key forces: the bargaining power of buyers, the threat of new entrants, the threat of substitutes, the bargaining power of suppliers, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any stakeholder looking to navigate AZZ's market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AZZ’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Raw material price volatility, particularly for zinc, natural gas, and paint, presents a significant challenge for AZZ Inc. These materials are fundamental to AZZ's core galvanizing and coil coating operations. For instance, fluctuations in zinc prices, a key input, can directly affect AZZ's cost of goods sold. While specific 2024 data on AZZ's raw material costs isn't publicly detailed yet, historical trends show that elevated zinc prices, such as those seen in late 2023 and early 2024, can compress margins if not passed on to customers.

Supply chain disruptions, like those experienced by many manufacturers in 2024, can significantly bolster the bargaining power of suppliers. When vendors face delays in providing essential components or raw materials, they can dictate terms more forcefully, knowing that alternatives may be scarce or equally impacted. This directly affects AZZ Porter's ability to meet customer demand on time.

For AZZ, these potential vendor delays can cascade into production schedule interruptions and increased costs, as they might need to expedite shipping or source materials from less favorable suppliers. For instance, the global semiconductor shortage, which continued to affect various industries into 2024, highlighted how reliance on a few key component suppliers can create vulnerability.

AZZ actively works to counteract this by securing long-term supplier contracts, which often include price stability and guaranteed supply commitments. Furthermore, investing in and refining in-house logistics capabilities allows AZZ greater control over its supply chain, reducing reliance on external transportation and warehousing, and thus mitigating some of the risks associated with supplier-driven disruptions.

In specialized areas of welding and electrical equipment, AZZ might face suppliers with significant leverage due to limited options. For instance, if a critical, custom-engineered component for a high-voltage substation is only available from a handful of manufacturers, those suppliers can dictate terms. This scarcity directly impacts AZZ's input costs and negotiation flexibility.

AZZ's broad portfolio, spanning segments like metal coatings and engineered steel structures, helps mitigate the impact of any single supplier's concentrated power. By diversifying its supplier base and product offerings, the company can offset potential cost increases or supply disruptions in one area with stability in others, as seen in its consistent revenue streams across its diverse operational segments.

Labor Costs

Rising labor costs throughout the supply chain directly bolster supplier bargaining power, often translating into higher prices for companies like AZZ. This impact extends beyond the direct cost of labor in raw material extraction to encompass transportation and associated services. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a 4.4% increase in average hourly earnings for production and non-supervisory employees in the manufacturing sector, a key area for AZZ's inputs.

These increased expenses can force suppliers to pass on these costs, potentially squeezing AZZ's profit margins if not managed effectively. AZZ actively tracks these labor-related expenditures across its supply network to ensure its own pricing remains competitive in the market.

- Increased labor costs in manufacturing sectors directly affect input prices for companies like AZZ.

- Transportation labor costs also contribute to the overall expense burden passed on by suppliers.

- AZZ's proactive monitoring of these costs is crucial for maintaining competitive pricing strategies.

Switching Costs for AZZ

Switching to new suppliers for AZZ's critical materials or specialized components can be costly. These expenses include rigorous qualification processes, extensive testing, and the potential for disruptive production downtime, all of which bolster the influence of current, trusted suppliers.

For instance, if AZZ needs to change a supplier for a highly specialized metal coating used in their engineered steel products, the new supplier would need to meet stringent quality and performance standards. This often involves months of testing and validation to ensure the coating's durability and adherence, directly impacting production schedules and costs. While AZZ maintains operational flexibility through its broad supplier network, the inherent costs associated with onboarding and validating new vendors for essential inputs remain a significant factor.

- High Qualification Costs: New suppliers often require extensive vetting, including audits and performance evaluations, which can take months and incur significant expense.

- Testing and Validation: Ensuring new materials meet AZZ's exact specifications involves costly and time-consuming testing protocols.

- Potential Production Disruption: Unforeseen issues during supplier transitions can lead to production delays, impacting revenue and increasing operational costs.

Suppliers of critical raw materials like zinc and specialized components for AZZ's operations wield significant bargaining power. This is amplified by factors such as supply chain disruptions experienced in 2024 and rising labor costs across manufacturing and transportation sectors, with U.S. manufacturing wages seeing a 4.4% increase in early 2024. The high cost and time involved in qualifying new suppliers, often requiring months of testing and validation, further entrench the influence of existing vendors, making it difficult for AZZ to switch and potentially increasing input costs.

| Factor | Impact on AZZ | 2024 Data/Trend |

|---|---|---|

| Raw Material Price Volatility | Directly impacts cost of goods sold, potentially compressing margins. | Elevated zinc prices observed in late 2023/early 2024. |

| Supply Chain Disruptions | Bolsters supplier leverage, potentially leading to delayed deliveries and increased costs. | Continued industry-wide disruptions impacting logistics and material availability. |

| Rising Labor Costs | Increases supplier operating expenses, leading to higher prices passed to AZZ. | U.S. manufacturing wages up 4.4% (production/non-supervisory) in early 2024. |

| Supplier Switching Costs | High costs for qualification, testing, and potential production downtime strengthen existing supplier positions. | Months of validation required for specialized components, impacting AZZ's negotiation flexibility. |

What is included in the product

This analysis unpacks the competitive forces impacting AZZ, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

Instantly identify and mitigate competitive threats with a visual breakdown of all five forces, empowering proactive strategy development.

Customers Bargaining Power

AZZ Inc. caters to diverse sectors like construction, energy, industrial, and transportation, which inherently spreads its customer base. This diversification means no single customer or industry holds overwhelming sway. For instance, in 2023, AZZ reported net sales of $1.4 billion, with no single customer accounting for more than 10% of those sales, demonstrating a healthy distribution.

However, the sheer volume of business from large clients or significant infrastructure projects can still grant them considerable bargaining power. These major accounts often represent substantial revenue streams, giving these customers leverage to negotiate pricing or terms. AZZ's strategy of fostering strong, long-term customer relationships is crucial for navigating these potentially powerful customer dynamics.

AZZ's core services, like galvanizing and metal coating, are vital for protecting infrastructure and products from corrosion, significantly extending their lifespan and improving their appearance. This essential function, crucial for the durability and safety of many end products, inherently limits the bargaining power of customers. In 2024, AZZ continued to emphasize these sustainable solutions that are indispensable to daily life.

While customers can explore alternative solutions, the process of switching from an established provider like AZZ often incurs significant costs. These include expenses for re-qualifying new suppliers, potential production delays during the transition, and the critical need to ensure consistent quality and compliance with stringent industry standards. For instance, in the industrial sector, re-tooling or re-certifying a new supplier can easily run into tens of thousands of dollars, impacting project timelines and overall operational efficiency.

AZZ actively works to increase customer switching costs by prioritizing robust quality control measures and exceptional customer service. Furthermore, their investment in digital solutions such as DGS (Digital Gateway System) and Coil Zone is designed to enhance customer loyalty. These platforms offer tangible benefits like improved efficiency and real-time operational updates, making the value proposition of staying with AZZ more compelling than the disruption and uncertainty of switching.

Customer Sophistication and Information

Many of AZZ's customers, particularly those in the infrastructure, energy, and industrial sectors, are large, sophisticated organizations. These entities possess a deep understanding of market pricing and are aware of numerous alternative suppliers, which naturally enhances their negotiating leverage. For instance, major utility companies or large construction firms often have dedicated procurement teams that meticulously analyze bids and supplier capabilities.

This heightened customer sophistication empowers them to demand more favorable terms, such as lower prices or extended payment periods. Their ability to compare offerings and identify competitive alternatives means they can effectively push back against less attractive proposals. This dynamic is a significant factor in the bargaining power of customers within these industries.

- Sophisticated Customer Base: AZZ serves large, informed customers in critical sectors like energy and infrastructure.

- Information Advantage: These clients possess detailed market price knowledge and are aware of multiple alternative providers.

- Negotiating Leverage: Customer sophistication directly translates into increased power to negotiate favorable contract terms and pricing.

Demand Fluctuations and Project Delays

Customer demand for AZZ's manufactured solutions is sensitive to economic shifts. For instance, during economic downturns, sectors like construction and manufacturing often see reduced activity, leading customers to postpone or cancel orders. This can result in project delays and impact AZZ's production schedules and sales forecasts.

The bargaining power of customers is amplified when economic conditions weaken. In such environments, customers possess greater leverage due to decreased demand. For example, in 2023, the global manufacturing Purchasing Managers' Index (PMI) dipped to 49.0 in November, indicating a contraction in manufacturing activity and suggesting a more favorable environment for buyers.

AZZ's diversified customer base across various industries, including energy, industrial, and infrastructure, helps to mitigate the impact of demand fluctuations from any single sector. This diversification provides a degree of resilience, as weakness in one market segment may be offset by strength in another.

- Economic Sensitivity: Customer demand for AZZ's products is directly influenced by macroeconomic conditions, leading to potential project delays.

- Customer Leverage: Economic downturns increase customer bargaining power as demand softens, allowing them to negotiate better terms or postpone purchases.

- Diversification Benefit: AZZ's broad client portfolio across multiple industries helps to buffer the company against sector-specific demand volatility.

Customers' bargaining power is a key factor in AZZ's market. When customers are well-informed and have many alternatives, they can negotiate better prices and terms. This is especially true in industries where AZZ's services are essential but not unique, or where switching costs are low.

AZZ's large, sophisticated clients, particularly in sectors like energy and infrastructure, possess significant market knowledge. They understand pricing benchmarks and are aware of other potential suppliers, which naturally strengthens their negotiating position. This sophistication allows them to demand more favorable contract terms.

| Factor | Impact on AZZ | Example/Data |

| Customer Sophistication | Increases bargaining power | Large infrastructure clients often have dedicated procurement teams. |

| Availability of Alternatives | Enhances customer leverage | Customers can compare pricing and capabilities of multiple metal coating providers. |

| Switching Costs | Limits customer bargaining power | Re-qualifying suppliers can cost tens of thousands of dollars and cause project delays. |

Preview the Actual Deliverable

AZZ Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The AZZ Porter's Five Forces Analysis you see here details the industry's competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This comprehensive report is designed to provide actionable insights for strategic decision-making.

Rivalry Among Competitors

The metal coating and galvanizing sector is quite crowded, with many companies all trying to get a bigger piece of the market. This includes other businesses that do galvanizing, companies that do it for themselves (captive facilities), and various other industrial service providers.

AZZ faces competition from a wide array of firms, from small, local galvanizers to much larger, more broadly focused manufacturers. This means they have to stay sharp and adaptable to keep up.

Some of AZZ's main rivals are Ntic, Sherwin-Williams, PPG Industries, Valmont Industries, and Lincoln Electric Holdings. For instance, in 2023, Sherwin-Williams reported net sales of $23.1 billion, highlighting the scale of some of the players AZZ contends with.

AZZ Inc. stands as the dominant force in North America's hot-dip galvanizing and coil coating markets, a position solidified by its extensive operational footprint. With 42 galvanizing facilities and 13 coil coating plants, the company boasts a capacity and geographic reach that dwarfs its rivals. In 2024, AZZ's market share in key segments was often reported to be roughly twice that of its closest competitor, underscoring its significant scale advantage.

AZZ Inc. distinguishes itself through a broad portfolio encompassing hot-dip galvanizing, coil coating, welding, and specialized electrical equipment, complemented by fabrication services. This diverse offering allows AZZ to cater to a wide array of customer needs across various industries.

The company places a strong emphasis on quality, customer-centric service, and the development of innovative solutions. For instance, its Digital Galvanizing System (DGS) and Coil Zone technology are designed to boost operational efficiency and improve the overall customer experience, setting AZZ apart from competitors.

In 2023, AZZ reported net sales of $1.3 billion, with its Metal Coatings segment, which includes galvanizing and coil coating, generating $732.6 million. This segment's performance highlights the significant market presence and customer adoption of its core differentiated services.

Industry Growth and Infrastructure Spending

The demand for coated structural steel is significantly boosted by continuous government and corporate investments in essential infrastructure. Projects like new highways, bridge renovations, modernized power grids, and expanding data center networks directly translate into increased demand for AZZ's core offerings.

This robust industry growth, while creating opportunities for all participants, inherently sharpens competitive rivalry. Companies actively compete for these substantial infrastructure contracts, driving a need for efficiency and competitive pricing. In 2024, the U.S. infrastructure sector alone saw substantial investment, with the Infrastructure Investment and Jobs Act continuing to drive project awards, benefiting companies like AZZ.

- Infrastructure Investment and Jobs Act (IIJA) continues to stimulate demand for coated steel products in 2024.

- Key infrastructure segments driving growth include transportation networks, energy transmission, and digital infrastructure.

- Increased project awards intensify competition among steel coating providers for market share.

Price Competition and Margins

The intense nature of the metal processing industry often fuels aggressive price competition, which can put pressure on profitability. AZZ Inc. actively manages this by implementing value-based pricing strategies and focusing on operational efficiencies to safeguard its margins.

Furthermore, AZZ's tolling agreements for steel and aluminum processing are crucial. These arrangements allow the company to effectively pass on fluctuations in raw material costs directly to its customers. This mechanism prevents these cost changes from negatively impacting AZZ's own profit margins.

- Value Pricing: AZZ's approach focuses on the benefits and value delivered to customers, rather than solely competing on price.

- Operational Efficiencies: Continuous improvement in production processes helps reduce costs and maintain competitive pricing.

- Tolling Model Benefits: The pass-through of raw material costs in the tolling business protects AZZ's margins from material price volatility.

Competitive rivalry within AZZ's metal coating and galvanizing sector is intense, with a broad range of competitors from small local firms to large, diversified manufacturers. AZZ, however, holds a dominant position in North America due to its extensive network of 42 galvanizing and 13 coil coating facilities, often holding a market share twice that of its nearest rivals in key segments as of 2024. This scale allows AZZ to leverage operational efficiencies and a diverse service offering, including specialized technologies like its Digital Galvanizing System, to differentiate itself and maintain its leading edge against competitors like Ntic, Sherwin-Williams, and Valmont Industries.

| Competitor | 2023 Net Sales (USD Billions) | Key Business Area |

|---|---|---|

| Sherwin-Williams | 23.1 | Coatings & Paints |

| PPG Industries | 21.1 | Paints, Coatings & Specialty Materials |

| Valmont Industries | 4.1 | Infrastructure & Engineered Products |

| Lincoln Electric Holdings | 3.4 | Welding, Cutting & Adhesives |

SSubstitutes Threaten

The threat of substitutes for AZZ's metal protection services is significant, stemming from a variety of alternative corrosion prevention methods. These include powder coating, specialized paints, and the use of inherently corrosion-resistant materials like stainless steel, aluminum, and weathering steel. For instance, the global powder coatings market was valued at approximately $11.5 billion in 2023 and is projected to grow, indicating a strong demand for these alternatives.

Customers may opt for these substitutes based on factors such as initial cost, desired aesthetic finishes, or the specific performance requirements of their applications. While powder coating offers durability and a wide color range, stainless steel provides inherent corrosion resistance without the need for a separate coating layer.

Despite these alternatives, AZZ is well-positioned due to its broad portfolio of metal finishing services. The company offers multiple types of coatings and protection methods, allowing it to cater to a diverse set of customer needs and application specifications, thereby mitigating some of the impact from individual substitute threats.

Customers may choose inherently corrosion-resistant materials like stainless steel or specialized alloys, bypassing the need for galvanizing or coatings. These alternatives, though potentially carrying a higher initial cost, can be attractive substitutes for applications prioritizing long-term, low-maintenance performance. AZZ's strategy centers on emphasizing the cost-effectiveness and zero-maintenance advantages of its solutions against such material substitutions.

Some large manufacturers or fabricators might possess their own captive galvanizing or coating facilities, opting to handle these processes internally instead of relying on external providers like AZZ. This effectively turns the customer into their own supplier, a direct form of substitution.

AZZ's strength in this area stems from its specialized knowledge, operational scale, and inherent efficiencies, which often prove superior to what individual customers can achieve with in-house setups.

For instance, while specific data on customer in-house capabilities versus outsourcing for AZZ is proprietary, the broader industrial trend shows a mix. In 2024, many large industrial players continue to invest in core competencies, but the capital expenditure and ongoing operational costs of specialized finishing services like galvanizing can still make outsourcing to experts like AZZ a more attractive and cost-effective solution.

Advancements in Material Science

Ongoing advancements in material science present a potential threat to traditional metal coating services. New materials or treatments could emerge offering superior corrosion resistance or other benefits at a lower cost, thereby diminishing demand for existing solutions. AZZ's commitment to technological investment aims to mitigate this risk by keeping them competitive.

For instance, the development of advanced polymers or composite materials with inherent corrosion-resistant properties could directly substitute for coated metals in various applications. This shift could impact sectors relying heavily on traditional galvanizing or coating processes.

Consider the following implications:

- Emergence of advanced composites: Materials like carbon fiber reinforced polymers offer high strength-to-weight ratios and excellent corrosion resistance, potentially replacing steel in structural applications.

- Development of self-healing coatings: Innovations in coatings that can repair minor damage autonomously could reduce the need for re-coating or replacement of traditional coated components.

- Nanotechnology in materials: Nanomaterials integrated into coatings or bulk materials can significantly enhance durability and protective qualities, offering a competitive alternative to conventional methods.

Cost-Benefit Analysis by Customers

Customers inherently conduct cost-benefit analyses, evaluating AZZ's corrosion protection services against alternatives. They weigh upfront expenses against long-term advantages like extended asset lifespan and decreased upkeep. If substitutes offer a more compelling value, especially in terms of total cost of ownership, the threat of substitution rises.

AZZ's strategy hinges on highlighting the superior durability and minimal maintenance requirements of its solutions. For instance, in 2024, infrastructure projects continue to prioritize lifecycle costs, making AZZ's long-term value proposition a key differentiator. Companies are increasingly scrutinizing not just initial outlay but the total cost over an asset's operational life.

- Customer Cost-Benefit: Buyers consistently compare the price of AZZ's services with the anticipated long-term advantages, such as increased asset longevity and reduced maintenance expenditures.

- Perceived Value Shift: An increase in the perceived value of substitute offerings relative to AZZ's solutions directly amplifies the threat of substitution.

- AZZ's Value Proposition: AZZ focuses on communicating the enduring nature and low-maintenance benefits inherent in its protective coatings and services.

- Lifecycle Costing: In 2024, the emphasis on lifecycle costing in major capital investments means that the total cost of ownership, not just the initial price, is a critical factor for customers.

The threat of substitutes for AZZ's metal protection services is moderate but growing. While AZZ offers robust solutions like galvanizing, alternatives such as advanced paints, powder coatings, and inherently corrosion-resistant materials like stainless steel are readily available. For example, the global powder coatings market was valued at approximately $11.5 billion in 2023, indicating significant competitive pressure from these alternatives.

Customers often evaluate substitutes based on initial cost, aesthetic preferences, and specific performance needs. While powder coating provides a wide color palette and durability, materials like stainless steel offer inherent corrosion resistance, potentially reducing the need for external coating services. AZZ counters this by emphasizing the cost-effectiveness and zero-maintenance benefits of its services over the long term, particularly in infrastructure projects where lifecycle costs are paramount in 2024.

Furthermore, some large manufacturers may opt for in-house metal finishing, effectively substituting AZZ's services with their own capabilities. While specific data on this is proprietary, the general industrial trend in 2024 shows a balance between in-house investment and outsourcing to specialized providers like AZZ, who offer economies of scale and expertise that can be difficult for individual companies to replicate efficiently.

Advancements in material science, such as new polymers or composite materials, also pose a potential threat by offering superior corrosion resistance or other benefits at a competitive price point. AZZ's ongoing investment in technology is crucial to staying ahead of these evolving material threats and maintaining its competitive edge in the market.

| Substitute Type | Key Advantages | Potential Impact on AZZ |

|---|---|---|

| Powder Coatings | Wide color range, good durability, aesthetic finish | Direct competition for applications prioritizing appearance |

| Specialized Paints | Lower initial cost, ease of application | Threat in less demanding applications or for budget-conscious clients |

| Stainless Steel/Aluminum | Inherent corrosion resistance, no external coating needed | Potential bypass of AZZ's services for long-term, low-maintenance needs |

| In-house Finishing | Control over process, potential cost savings for high volume | Loss of business from large fabricators |

| Advanced Composites | High strength-to-weight, excellent corrosion resistance | Long-term threat to traditional metal applications |

Entrants Threaten

The galvanizing and metal coating sectors demand substantial capital for state-of-the-art facilities, specialized machinery, and compliance with stringent environmental standards. For instance, AZZ’s new hot-dip galvanizing plant in Missouri represents a significant financial commitment, illustrating the high upfront costs involved.

These considerable capital requirements act as a formidable barrier, effectively deterring many potential new entrants from entering the market and competing with established players like AZZ.

Established players like AZZ, with its 42 galvanizing and 13 coil coating plants, benefit significantly from economies of scale. This vast operational footprint allows AZZ to spread fixed costs over a larger production volume, leading to lower per-unit costs. New entrants would find it challenging to match these efficiencies without substantial upfront investment, hindering their ability to compete on price.

The experience curve also plays a crucial role. AZZ's decades of operational experience translate into optimized processes, reduced waste, and improved product quality. This accumulated knowledge allows AZZ to operate more efficiently and offer greater flexibility and quicker service, advantages that are difficult for newcomers to replicate in the short term.

AZZ Inc., operating in the metal coating industry, faces significant threats from new entrants due to extensive regulatory and environmental hurdles. Compliance with stringent safety and environmental standards, such as those mandated by the EPA and OSHA, requires substantial upfront investment and ongoing operational expenses.

New companies must navigate complex permitting processes and implement compliant operational procedures, which can deter market entry. For instance, the cost of wastewater treatment and air emission controls can add millions to initial setup and operational budgets. Changes in environmental regulations, such as stricter emissions limits or new hazardous material handling requirements, can further increase these costs for both existing players like AZZ and potential new entrants.

Established Customer Relationships and Brand Reputation

AZZ Inc. benefits significantly from its decades-long presence in the market, cultivating a robust brand reputation centered on quality and dependability. This longevity has allowed AZZ to forge enduring relationships with a wide array of clients, particularly within the critical infrastructure sectors where established trust is paramount.

New competitors face a considerable hurdle in replicating AZZ's deep-seated customer loyalty. Building the necessary trust and acquiring a substantial client base requires significant investment in time and resources, as potential customers often prioritize proven performance and reliability over new, unproven entities.

- Decades of Industry Experience: AZZ has operated for over 50 years, establishing a strong foundation of expertise and market understanding.

- Strong Brand Recognition: AZZ is recognized for its quality and reliability, a crucial factor in industries like power generation and transmission.

- Customer-Centric Approach: AZZ focuses on customer needs, fostering loyalty and repeat business, making it difficult for new entrants to dislodge existing relationships.

- High Switching Costs: For clients in critical infrastructure, the cost and risk associated with switching to a new, unproven supplier are substantial.

Access to Distribution Channels and Supply Chains

Newcomers often struggle to secure efficient access to the raw material supply chains and distribution channels that AZZ Inc. already commands. For instance, AZZ's extensive network of processing facilities and established relationships with steel suppliers provide a significant advantage in sourcing essential materials for its galvanizing and metal coatings operations. This existing infrastructure makes it tough for new entrants to match AZZ's speed and cost-effectiveness in delivering finished products to market.

The established logistical capabilities of incumbents like AZZ present a substantial barrier. Consider that in 2024, the industrial coatings market, where AZZ operates, saw continued consolidation and emphasis on supply chain resilience. New entrants must invest heavily to build comparable distribution networks and secure reliable, cost-effective material sourcing, a hurdle that many find prohibitive.

- Established Logistics: AZZ benefits from existing transportation fleets and warehousing, reducing per-unit shipping costs.

- Supplier Relationships: Long-standing contracts with raw material providers ensure consistent supply and potentially better pricing for AZZ.

- Market Penetration: New entrants face the challenge of building brand recognition and customer loyalty in a market where AZZ is a known entity.

The threat of new entrants for AZZ Inc. is significantly mitigated by high capital requirements, with new galvanizing plants alone costing tens of millions. For instance, AZZ's investment in its Missouri facility highlights this substantial barrier. Furthermore, established players like AZZ benefit from economies of scale, operating 42 galvanizing and 13 coil coating plants, which allows for lower per-unit costs that newcomers would struggle to match.

AZZ’s decades of industry experience, spanning over 50 years, translate into optimized processes and reduced waste, creating an experience curve advantage that is difficult for new entrants to replicate. This accumulated knowledge contributes to AZZ's efficiency and service flexibility, making it challenging for newcomers to compete effectively.

Regulatory and environmental compliance, including stringent EPA and OSHA standards, necessitates significant upfront investment for new entrants, often running into millions for essential controls like wastewater treatment and air emission systems. Navigating complex permitting processes further deters market entry.

AZZ’s strong brand reputation, built on decades of reliability in critical infrastructure sectors, fosters deep customer loyalty. New competitors face a considerable hurdle in replicating this trust and acquiring a substantial client base, as customers often prioritize proven performance over unproven entities.

Access to raw material supply chains and established distribution channels presents another significant barrier. AZZ's extensive network and relationships with steel suppliers provide advantages in sourcing and delivery speed, making it tough for new entrants to match AZZ's cost-effectiveness. In 2024, the industrial coatings market emphasized supply chain resilience, requiring new entrants to invest heavily in comparable infrastructure.

| Barrier Type | Description | AZZ's Advantage |

|---|---|---|

| Capital Requirements | High upfront costs for facilities and machinery. | AZZ's established infrastructure and ongoing investments. |

| Economies of Scale | Lower per-unit costs due to large production volumes. | AZZ's extensive operational footprint (42 galvanizing, 13 coil coating plants). |

| Experience Curve | Optimized processes and reduced waste from accumulated knowledge. | Decades of operational expertise leading to efficiency and flexibility. |

| Brand Reputation & Loyalty | Established trust and repeat business in critical sectors. | Long-standing relationships and proven performance. |

| Supply Chain & Logistics | Efficient access to raw materials and established distribution networks. | Existing infrastructure and strong supplier relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial statements. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.