Ayala Corp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Ayala Corporation, a diversified conglomerate, boasts significant strengths in its established market presence and broad portfolio, yet faces potential threats from evolving industry landscapes. Understanding these dynamics is crucial for any investor or strategist looking to navigate its complex business environment.

Want the full story behind Ayala's robust financial footing, its strategic partnerships, and the competitive challenges it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Ayala Corporation’s strength lies in its exceptionally diversified business portfolio. This includes significant holdings in real estate through Ayala Land, banking via BPI, telecommunications with Globe Telecom, energy through ACEN, healthcare with AC Health, and infrastructure. This broad industry spread significantly reduces the impact of downturns in any single sector, offering a robust and stable foundation for earnings.

For instance, in the first nine months of 2024, BPI reported a net income of PHP 39.5 billion, while Globe Telecom’s consolidated net income reached PHP 18.6 billion for the same period. Ayala Land’s recurring and non-recurring income also contributed substantially, demonstrating the collective strength of these diverse operations, which collectively provides resilience against sector-specific economic shocks.

Ayala Corporation commands significant market leadership across vital Philippine sectors. Its subsidiaries, Ayala Land, Bank of the Philippine Islands (BPI), and Globe Telecom, are dominant forces in real estate, banking, and telecommunications, respectively. This strong positioning grants substantial competitive advantages, including high brand recognition and considerable market share.

These leadership roles translate into tangible benefits such as economies of scale, enabling cost efficiencies, and pricing power. For instance, as of Q1 2024, BPI reported a net income of PHP 12.1 billion, underscoring its robust financial performance driven by its leading market position.

Ayala Corporation excels in developing integrated ecosystems, primarily through Ayala Land. This strategy fosters synergy across its real estate, retail, and hospitality businesses, creating self-sustaining communities that boost customer loyalty and secure ongoing revenue. For instance, in 2023, Ayala Land reported a net income of PHP 37.7 billion, reflecting the success of its holistic development approach.

Robust Financial Health and Stability

Ayala Corporation demonstrates robust financial health, underpinned by a long operational history and a diversified portfolio of profitable core businesses. This typically translates into strong financial metrics, including healthy cash flows and manageable debt levels, providing a solid foundation for continued investment and resilience.

For instance, as of the first quarter of 2024, Ayala Corporation reported a net income attributable to equity holders of equity holders of P13.4 billion, reflecting the strong performance across its key business segments. The company's consolidated net debt to equity ratio remained at a healthy 1.1x as of March 31, 2024, indicating prudent financial management.

- Strong Cash Flow Generation: Ayala's core businesses consistently generate substantial operating cash flows, enabling reinvestment and debt reduction.

- Manageable Debt Profile: The company maintains a prudent approach to leverage, with debt levels generally well-managed relative to its earnings and assets.

- Resilience in Diverse Economic Conditions: The diversified nature of its business portfolio allows Ayala to weather economic fluctuations more effectively than single-industry focused companies.

- Capacity for Strategic Investments: Its financial stability empowers Ayala to pursue growth opportunities and strategic acquisitions in emerging and existing sectors.

Commitment to Innovation and Technology Adoption

Ayala Corporation's commitment to innovation is a significant strength, particularly evident in its aggressive adoption of new technologies and digital transformation initiatives. This forward-thinking approach is a cornerstone of its strategy across its diverse business units.

This focus on technological advancement is crucial for staying competitive in rapidly evolving sectors like telecommunications and financial services. By embracing digital transformation, Ayala aims to improve customer experiences, streamline operations, and unlock new revenue streams.

For instance, Globe Telecom, a key Ayala subsidiary, has been investing heavily in network upgrades and digital services. In 2024, Globe reported significant progress in its 5G rollout and expansion of fiber-to-the-home services, aiming to enhance connectivity and digital inclusion across the Philippines.

Ayala's innovation drive also extends to its financial services arm, Bank of the Philippine Islands (BPI). BPI has been enhancing its digital banking platforms, introducing new features and improving user interfaces to cater to the growing demand for online financial transactions. By mid-2025, BPI expects its digital channels to handle a substantial majority of its customer transactions.

Ayala Corporation's diversified business model is a core strength, spanning key sectors like real estate, banking, telecommunications, and energy. This broad exposure provides significant resilience, mitigating risks associated with any single industry's performance. For example, in the first nine months of 2024, BPI's net income was PHP 39.5 billion, and Globe Telecom's was PHP 18.6 billion, showcasing the robust earnings from these major segments.

The company enjoys market leadership in crucial Philippine industries, with subsidiaries like Ayala Land, BPI, and Globe Telecom holding dominant positions. This allows for economies of scale and strong brand recognition, translating into competitive advantages and pricing power. BPI's Q1 2024 net income of PHP 12.1 billion highlights the financial benefits of its leading market share.

Ayala Corporation demonstrates strong financial health, characterized by consistent cash flow generation and prudent debt management. As of March 31, 2024, its net income attributable to equity holders was P13.4 billion, with a net debt to equity ratio of 1.1x, indicating financial stability and capacity for strategic investments.

Ayala's commitment to innovation is a key differentiator, particularly in digital transformation initiatives across its subsidiaries. Globe Telecom, for instance, is heavily investing in 5G and fiber expansion in 2024 to enhance connectivity, while BPI is prioritizing its digital banking platforms, expecting them to handle a majority of transactions by mid-2025.

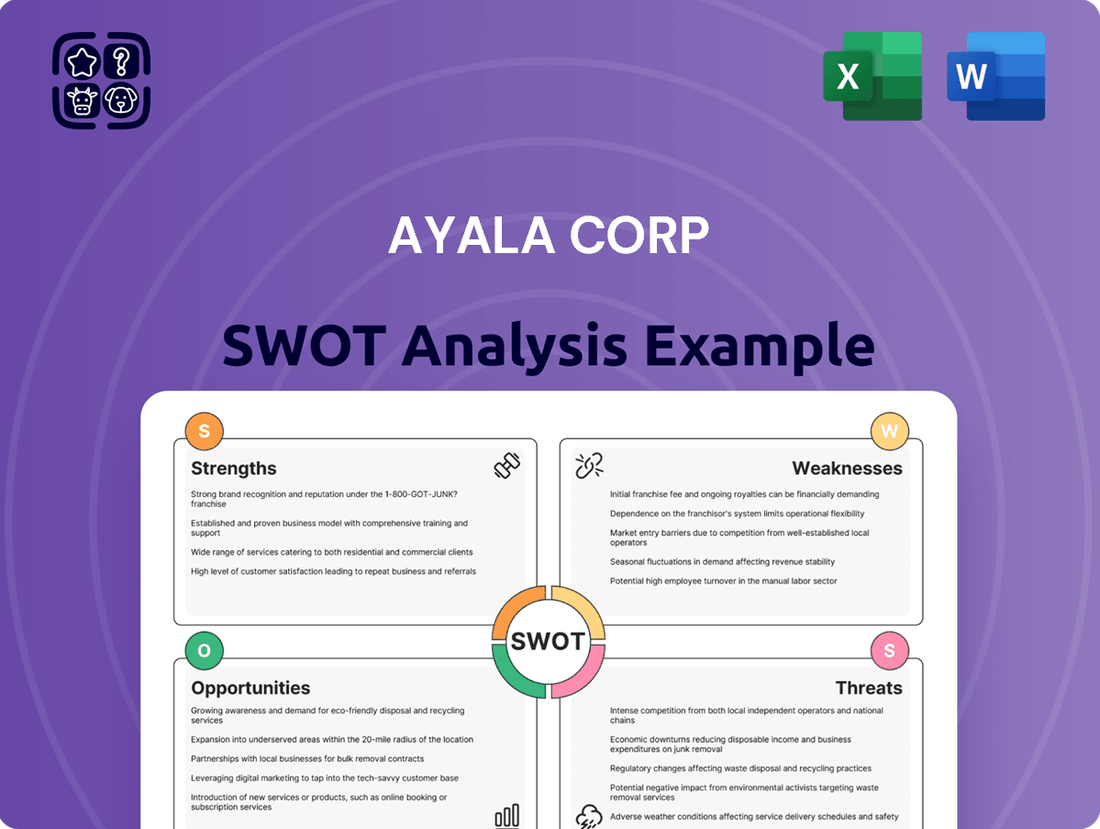

What is included in the product

Offers a full breakdown of Ayala Corp’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address Ayala Corp's strategic challenges and leverage its competitive advantages.

Weaknesses

Ayala Corporation's heavy reliance on the Philippine economy presents a significant weakness. As a conglomerate with the majority of its operations based domestically, the company is highly susceptible to fluctuations in the country's economic performance and political climate. For instance, a slowdown in Philippine GDP growth, which was projected to be around 5.5% to 6.5% for 2024 by the Philippine government, could directly dampen demand across Ayala's diverse portfolio, from real estate to telecommunications.

Furthermore, increased inflation or periods of political instability in the Philippines can create headwinds for Ayala. High inflation rates, like the 4.9% recorded in the Philippines in December 2023, can erode consumer purchasing power and increase operating costs for Ayala's businesses. Political uncertainties can also deter investment and disrupt business operations, directly impacting the conglomerate's profitability and growth prospects.

Ayala Corporation's core growth areas like real estate, infrastructure, and energy demand substantial upfront investment. For instance, major infrastructure projects can easily run into billions of dollars, requiring significant capital allocation. This inherent capital intensity can put pressure on the company's cash flow, especially if external financing costs rise or market demand softens.

The need for continuous investment to maintain and expand these capital-intensive businesses can lead to increased financial leverage. If not carefully managed, this can make Ayala Corp more vulnerable to economic downturns or rising interest rates, as seen in the global economic climate of 2024-2025, where borrowing costs have remained elevated.

Ayala Corporation operates in sectors like banking and telecommunications, which are heavily influenced by government rules. For instance, the Bangko Sentral ng Pilipinas (BSP) frequently updates banking regulations, impacting capital requirements and lending practices. In 2024, the BSP continued its focus on digital banking frameworks, which could necessitate further investment and adaptation from Ayala's banking arm, Bank of the Philippine Islands (BPI).

Shifts in taxation and industry-specific policies present another significant challenge. A change in the corporate income tax rate or specific levies on telecommunications services, for example, could directly alter profitability. The Philippine government's ongoing discussions around digital infrastructure and data privacy in 2024 and projected into 2025 mean that Ayala's telco segment, Globe Telecom, must remain agile to comply with evolving mandates.

Intense Competition Across Key Sectors

Ayala Corporation operates in highly competitive sectors, facing significant pressure from both domestic and global rivals. This intense rivalry, evident in industries like telecommunications, banking, and real estate development, necessitates constant strategic adaptation and innovation to maintain its market position.

The company's exposure to these competitive forces can result in downward pressure on pricing, potentially impacting profit margins. For instance, in the telecommunications sector, intense competition has historically led to price wars, requiring significant capital expenditure for network upgrades to remain competitive.

- Telecommunications: Fierce competition from players like Globe Telecom and Converge ICT in the Philippine market.

- Banking: Strong competition from other major Philippine banks such as BDO Unibank and Metrobank.

- Real Estate: Facing challenges from developers like SM Prime Holdings and Robinsons Land Corporation.

- Infrastructure: Competition in areas like water and power distribution from both local and international entities.

Failure to effectively navigate this competitive environment could lead to a gradual erosion of Ayala Corporation's market share and profitability across its diverse business units.

Complexity of Managing a Diversified Conglomerate

Ayala Corporation's extensive and varied business portfolio, encompassing sectors like telecommunications, real estate, banking, and infrastructure, inherently creates significant operational complexities. Managing such a diverse conglomerate demands intricate organizational structures and robust coordination mechanisms to ensure smooth functioning across all its subsidiaries. This complexity can sometimes hinder the realization of optimal synergies and streamline decision-making processes.

The sheer scale and diversity of Ayala's operations can present challenges in achieving seamless integration and consistent performance across its numerous business units. For instance, as of the first quarter of 2024, Ayala Corporation reported a net income of PHP 10.8 billion, with contributions from various segments, each facing unique market dynamics and operational hurdles. Effectively synchronizing these diverse operations to maximize overall group performance requires sophisticated management strategies and continuous adaptation.

- Operational Overlap: The broad scope of Ayala's businesses can lead to potential overlaps in services or markets, requiring careful management to avoid internal competition and ensure strategic focus.

- Coordination Challenges: Aligning the strategic objectives and operational execution across distinct business units, such as Globe Telecom and Ayala Land, necessitates strong central oversight and effective communication channels.

- Synergy Realization: Achieving cross-divisional synergies, like leveraging real estate assets for telecommunications infrastructure, can be more challenging in a highly diversified structure compared to a more focused business.

- Resource Allocation: Distributing capital and management attention effectively across a wide array of businesses, each with varying growth potentials and risk profiles, is a constant balancing act for conglomerate leadership.

Ayala Corporation's significant exposure to the Philippine economy makes it vulnerable to domestic economic downturns and political instability. For example, the Philippine government's projected GDP growth of 5.5% to 6.5% for 2024 could be impacted by inflation, which stood at 4.9% in December 2023, potentially reducing consumer spending across Ayala's diverse businesses.

The capital-intensive nature of its core sectors, such as infrastructure and real estate, requires substantial ongoing investment. This can strain cash flow, particularly if borrowing costs remain elevated, as they have been in the 2024-2025 period, increasing financial leverage and vulnerability to economic shocks.

Ayala operates in highly competitive markets like telecommunications and banking, facing pressure from both local and international players. This intense rivalry, exemplified by competition between Globe Telecom and Converge ICT, can lead to price wars and impact profit margins, necessitating continuous innovation and investment to maintain market share.

| Sector | Key Competitors | Impact of Competition |

|---|---|---|

| Telecommunications | Globe Telecom, Converge ICT | Price wars, need for network upgrades |

| Banking | BDO Unibank, Metrobank | Margin pressure, need for digital investment |

| Real Estate | SM Prime Holdings, Robinsons Land | Market share erosion, development cost pressures |

Preview the Actual Deliverable

Ayala Corp SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Ayala Corp's strategic positioning.

This is a real excerpt from the complete document, showcasing the detailed analysis of Ayala Corp's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version ready for strategic planning.

You’re viewing a live preview of the actual SWOT analysis file for Ayala Corp. The complete version, offering actionable insights, becomes available after checkout.

Opportunities

Ayala Corporation can capitalize on the Philippines' rapid digital transformation, a trend that saw digital payments grow significantly in 2024, with transactions expected to reach PHP 1.5 trillion by 2025. Through its subsidiaries like Globe Telecom, which is investing heavily in 5G expansion, and BPI, a leader in digital banking, Ayala is well-positioned to offer innovative fintech solutions and expand its digital service offerings.

Ayala Corporation is well-positioned to capitalize on the Philippine government's ambitious infrastructure development plans, with significant public spending allocated for projects under the "Build, Better, More" program. This presents a direct opportunity for Ayala's construction and engineering arms.

Furthermore, the global imperative for decarbonization fuels the expansion of renewable energy. Ayala's existing investments in solar and wind power, such as those through ACEN Corporation, are poised for substantial growth as demand for clean energy surges, aiming to meet climate targets and energy security needs.

The Philippines' burgeoning middle class, projected to reach 50% of the population by 2025, fuels robust demand for property, essential services, and everyday goods. This demographic expansion directly benefits Ayala Land's real estate developments and the group's extensive retail operations, creating significant avenues for growth.

Urbanization is a powerful catalyst, with an increasing number of Filipinos migrating to cities, concentrating economic activity and consumer spending. This trend amplifies the market opportunities for Ayala Corporation's diverse portfolio, from telecommunications and utilities to financial services, as urban centers become hubs of consumption and development.

Strategic Acquisitions and Partnerships

Ayala Corporation's robust financial standing, evidenced by its strong balance sheet, positions it well for strategic acquisitions. In 2023, the company reported a net income attributable to equity holders of P26.9 billion, demonstrating its capacity to fund growth initiatives. This financial strength allows Ayala to explore opportunities that either bolster its current market presence or facilitate entry into high-growth sectors, such as renewable energy or digital services.

Forging strategic partnerships offers another avenue for expansion. By collaborating with technology providers or established players in emerging markets, Ayala can leverage external expertise and resources. For instance, a partnership could accelerate the deployment of its digital transformation efforts across its diverse business units, enhancing operational efficiency and customer engagement. This approach reduces the capital outlay and risks associated with outright acquisitions while still enabling access to new capabilities and markets.

- Acquisition of complementary businesses: Ayala can acquire companies that offer synergistic products or services, expanding its customer base and revenue streams.

- Joint ventures for new market entry: Partnering with local or international firms can provide crucial market knowledge and distribution networks for entering new geographical regions or sectors.

- Technology licensing or integration: Collaborating on technology development or licensing can bring innovative solutions to Ayala's existing operations, improving competitiveness.

- Strategic alliances for R&D: Partnerships focused on research and development can foster innovation, leading to the creation of next-generation products and services.

Sustainability and ESG Investments

The increasing global focus on Environmental, Social, and Governance (ESG) factors is a significant opportunity for Ayala Corporation to further bolster its sustainability efforts. By channeling investments into eco-friendly technologies, community-focused projects, and robust governance structures, the company can attract a growing pool of impact investors.

This strategic alignment with ESG principles not only enhances Ayala Corporation's brand image but also positions it to capture long-term value creation in a market increasingly prioritizing responsible business practices. For instance, in 2023, global sustainable investment assets reached an estimated $37.4 trillion, highlighting the substantial capital available for companies demonstrating strong ESG performance.

- Attract Impact Investors: Growing demand for investments aligned with ESG principles.

- Enhance Brand Reputation: Strong ESG credentials can improve public perception and trust.

- Long-Term Value Creation: Sustainable practices often lead to operational efficiencies and reduced risks.

- Access to Capital: Many financial institutions now offer preferential terms for ESG-compliant projects.

Ayala Corporation is poised to benefit from the Philippines' ongoing digital transformation, with digital payment volumes projected to exceed PHP 1.5 trillion by 2025, presenting opportunities for its fintech and telecommunications arms like Globe and BPI.

The company can leverage the Philippine government's infrastructure spending under the "Build, Better, More" program, directly benefiting its construction and engineering divisions.

Ayala's commitment to renewable energy, exemplified by ACEN Corporation's solar and wind projects, aligns with global decarbonization efforts and growing demand for clean energy solutions.

The expanding middle class in the Philippines, expected to comprise 50% of the population by 2025, will drive demand for Ayala Land's real estate and the group's retail offerings.

Urbanization trends will concentrate economic activity, increasing market opportunities for Ayala's diverse portfolio, from utilities to financial services.

Ayala's strong financial position, with P26.9 billion net income in 2023, enables strategic acquisitions and investments in high-growth sectors like digital services and renewables.

Strategic partnerships can accelerate digital transformation and market entry, reducing risk and leveraging external expertise.

The increasing global focus on ESG factors presents an opportunity to attract impact investors and enhance brand reputation, with sustainable investment assets reaching an estimated $37.4 trillion in 2023.

| Opportunity | Description | Supporting Data/Trend |

| Digital Transformation | Expanding digital services and fintech solutions. | Digital payments to exceed PHP 1.5 trillion by 2025. |

| Infrastructure Development | Capitalizing on government spending for projects. | Philippine "Build, Better, More" program. |

| Renewable Energy Growth | Expanding solar and wind power investments. | Global decarbonization trend and clean energy demand. |

| Growing Middle Class | Meeting demand for property, retail, and services. | Middle class projected to reach 50% of PH population by 2025. |

| Urbanization | Leveraging concentrated economic activity in cities. | Increasing migration to urban centers. |

| Strategic Acquisitions/Partnerships | Expanding market presence and capabilities. | P26.9 billion net income in 2023; potential for synergistic ventures. |

| ESG Focus | Attracting impact investors and enhancing reputation. | $37.4 trillion in global sustainable investment assets (2023). |

Threats

A significant economic downturn in the Philippines, a key market for Ayala Corporation, poses a substantial threat. For instance, if the Philippine GDP growth slows considerably, as projected by some analysts for 2025 due to global headwinds, it could directly dampen consumer spending across Ayala's diverse portfolio, from property development to retail.

Sustained high inflation, another pressing concern, erodes purchasing power and increases operating costs for Ayala's businesses. If inflation remains elevated, exceeding the Bangko Sentral ng Pilipinas' target range of 2-4% throughout 2024 and into 2025, it would negatively affect demand for real estate and potentially slow loan growth for BPI, a major subsidiary.

Ayala Corporation faces intensifying regulatory scrutiny globally and in the Philippines. Governments are increasingly examining large conglomerates and vital sectors, which could result in stricter rules, antitrust actions, or altered operating permits. For instance, the Philippine Competition Commission has been active in investigating market concentration across various industries.

These potential policy shifts may elevate compliance expenditures for Ayala Corporation and could restrict avenues for future expansion. Changes in areas like telecommunications, banking, or infrastructure, where Ayala has significant interests, could directly impact its revenue streams and strategic planning.

Rapid technological shifts, especially in areas like telecommunications and fintech, present a considerable challenge. New, nimble companies are entering these sectors, leveraging innovation to gain ground. For instance, the growth of digital banking platforms in the Philippines, with transaction volumes expected to rise significantly by 2025, highlights this trend.

Ayala Corporation must be vigilant and adaptable to these evolving technologies. If the company cannot keep pace with disruptive innovations, it risks losing market share and its competitive edge. The increasing adoption of AI and automation across industries, as seen in the manufacturing sector where efficiency gains are projected to be substantial, underscores the need for continuous technological integration.

Climate Change Risks and Natural Disasters

The Philippines' extreme vulnerability to climate change and natural disasters like typhoons and floods presents a significant threat to Ayala Corporation. In 2023 alone, the country experienced numerous weather disturbances, with damages from typhoons estimated to be in the billions of pesos, impacting infrastructure and agricultural output. These events can directly disrupt Ayala's operations, damage its extensive infrastructure across various sectors, and lead to escalating insurance premiums.

The physical and financial ramifications of these climate-related risks are substantial. For instance, rising sea levels threaten coastal properties and infrastructure owned by Ayala Land, while increased frequency and intensity of typhoons can impact the power generation and distribution networks of ACEN. The economic impact of these disasters is considerable; the National Disaster Risk Reduction and Management Council reported damages exceeding PHP 20 billion from weather-related incidents in the first half of 2024.

- Increased operational disruptions: Typhoons and floods can halt business activities for extended periods.

- Infrastructure damage: Ayala's assets, from buildings to power lines, are susceptible to physical damage.

- Rising insurance costs: Insurers are likely to increase premiums due to the heightened risk profile.

- Supply chain interruptions: Disasters can disrupt the flow of goods and services crucial for Ayala's diverse businesses.

Geopolitical Tensions and Global Supply Chain Disruptions

Broader geopolitical tensions, such as ongoing conflicts and trade disputes, continue to pose a significant risk. These tensions can directly affect input costs and energy prices, as seen with the volatility in oil markets throughout 2024, impacting Ayala's diverse business segments. For instance, disruptions to global shipping routes, exacerbated by regional instability, can lead to project delays and increased operational expenses for its manufacturing and infrastructure arms.

Supply chain disruptions remain a critical concern, affecting the availability and cost of essential goods and services. Ayala Corporation, with its broad portfolio spanning telecommunications, banking, infrastructure, and real estate, is particularly susceptible to these global shocks. The company's reliance on imported components for its technology ventures and construction materials for infrastructure projects means that supply chain bottlenecks can directly translate to reduced profitability and slower project execution.

- Increased Input Costs: Global commodity prices, influenced by geopolitical events, can drive up raw material expenses for Ayala’s manufacturing and construction businesses.

- Energy Price Volatility: Fluctuations in global energy markets directly impact operating costs for all Ayala subsidiaries, from transportation to data centers.

- Project Delays: Supply chain disruptions can halt or slow down the delivery of critical materials and equipment, leading to extended timelines and cost overruns for infrastructure and property development projects.

- Reduced Profitability: The combined effect of higher costs and potential project delays can significantly squeeze profit margins across Ayala Corporation's diverse operations.

Intensifying competition from both established players and agile new entrants across its various sectors poses a significant threat. For instance, in the telecommunications space, the ongoing aggressive pricing strategies by competitors could pressure Globe Telecom's market share. Similarly, in the banking sector, the rapid expansion of digital-only banks in the Philippines, which saw account openings surge by over 30% in 2024, presents a direct challenge to BPI's traditional customer base.

The increasing cost of capital and potential tightening of credit conditions, especially if interest rates remain elevated through 2025, could impact Ayala Corporation's ability to finance new projects and refinance existing debt. Higher borrowing costs would directly affect the profitability of its capital-intensive businesses like infrastructure and real estate development, potentially leading to slower growth or project deferrals.

Ayala Corporation's extensive operations are exposed to currency fluctuations, particularly the Philippine Peso against major currencies like the US Dollar. A significant depreciation of the Peso, which experienced volatility in early 2024, could increase the cost of imported goods and services, impacting its manufacturing and technology arms, and also raise the cost of servicing foreign-denominated debt.

| Threat Category | Specific Risk | Potential Impact on Ayala Corp | Example/Data Point (2024-2025) |

| Competition | Aggressive pricing by rivals | Market share erosion, reduced profitability | Digital banks account openings up 30% in 2024 |

| Financial | Rising interest rates | Increased cost of capital, slower project financing | Philippine policy rate maintained at elevated levels through 2024 |

| Economic | Currency depreciation | Higher import costs, increased debt servicing | PHP depreciation against USD observed in early 2024 |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Ayala Corporation's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate SWOT assessment.