Ayala Corp Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Unlock the strategic genius behind Ayala Corp's diversified empire with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver exceptional value across multiple industries.

Dive into the core of Ayala Corp's success with our detailed Business Model Canvas, revealing their customer relationships, revenue streams, and cost structures. This is your blueprint to understanding their market dominance.

Ready to gain actionable insights from a titan of industry? Download the full Ayala Corp Business Model Canvas and see how their strategic framework drives innovation and sustainable growth. Perfect for aspiring leaders and strategists.

Partnerships

Ayala Corporation's engagement with government entities is fundamental to its infrastructure development, particularly through public-private partnerships (PPPs). For instance, their involvement in the North-South Commuter Railway project, a significant undertaking in the Philippines, highlights these collaborations. These partnerships are vital for navigating complex regulatory landscapes and securing the necessary permits for large-scale projects.

Working closely with local communities is equally important, especially in their integrated estate developments. This ensures social license to operate and fosters a sense of shared progress. Ayala Land's developments often incorporate community centers and local employment opportunities, demonstrating a commitment to local needs and sustainability. This approach has proven effective in gaining community buy-in and ensuring the long-term success of their projects.

Ayala Corporation actively partners with international investors and major financial institutions to fuel its ambitious growth plans, especially in sectors like renewable energy and property development. These crucial alliances provide the necessary capital for significant capital expenditures and ongoing expansion projects.

A notable aspect of these collaborations is the increasing use of sustainability-linked financing. This approach not only underscores Ayala’s dedication to environmental, social, and governance (ESG) principles but also effectively attracts a broader pool of global capital interested in responsible investments.

For instance, in 2024, Ayala secured a significant sustainability-linked loan facility, demonstrating the strong confidence international financial players have in its long-term strategy and commitment to sustainable business practices. This type of partnership is vital for projects requiring substantial upfront investment.

Ayala Corporation actively partners with technology and digital solution providers to drive its digital transformation. These collaborations are crucial for developing advanced digital platforms and bolstering cybersecurity across its diverse business units.

For instance, Ayala's banking arm, Bank of the Philippine Islands (BPI), has been investing heavily in digital solutions, including partnerships for cloud migration and AI-driven customer service enhancements. In 2024, BPI continued its digital push, aiming to onboard more customers onto its digital channels, reflecting the growing importance of these tech partnerships.

Ayala's telecommunications subsidiary, Globe Telecom, also relies on strategic alliances with global technology firms to expand its 5G network and introduce innovative digital services. These partnerships are vital for maintaining a competitive edge in the rapidly evolving digital landscape, ensuring robust infrastructure and cutting-edge offerings for consumers and businesses alike.

Strategic Business Alliances and Joint Ventures

Ayala Corporation actively pursues strategic business alliances and joint ventures with both domestic and global partners to broaden its operational footprint and penetrate new markets. These collaborations are pivotal for accessing specialized knowledge, sharing financial burdens, and accelerating growth in diverse sectors.

These partnerships are crucial for Ayala Corporation's expansion strategy. For instance, in 2024, the company continued to forge alliances in areas like data center development, automotive ventures, and niche healthcare services. These joint efforts not only mitigate risk but also leverage complementary strengths, enabling faster market entry and innovation.

- Data Center Expansion: AyalaLand's subsidiary, Globe, has been actively expanding its data center capabilities, often through partnerships to accelerate build-outs and meet growing demand for digital infrastructure.

- Automotive Industry Collaborations: Ayala Corporation, through its automotive arm, engages in joint ventures for vehicle distribution and manufacturing, bringing in international brands and technology.

- Healthcare Services: Partnerships in specialized healthcare services allow Ayala to enhance its offerings by integrating advanced medical technologies and expertise from global leaders.

Suppliers and Contractors

Ayala Corporation relies on a vast network of suppliers and contractors to fuel its diverse business interests, including property development, telecommunications, and energy. These partnerships are critical for maintaining high standards and ensuring projects are completed on schedule.

For instance, in 2023, Ayala Land's construction projects significantly depended on a steady supply of building materials and specialized contracting services. Similarly, Globe Telecom's ongoing network expansion in 2024 requires a consistent flow of telecommunications equipment and installation expertise from its key partners.

- Suppliers of construction materials and equipment

- Telecommunications infrastructure providers

- Energy project development and maintenance contractors

- Technology and software vendors

Ayala Corporation's key partnerships are diverse, spanning government, international finance, technology providers, and strategic business alliances. These collaborations are crucial for capital infusion, technological advancement, and market expansion across its various sectors. For example, in 2024, Ayala's banking arm, BPI, continued its digital transformation through tech partnerships, while Globe Telecom leveraged alliances for 5G network expansion. Strategic joint ventures in 2024 also bolstered its presence in data centers and specialized healthcare.

| Partner Type | Examples of Collaboration | Impact/Significance |

| Government Entities | Public-Private Partnerships (PPPs) for infrastructure (e.g., North-South Commuter Railway) | Navigating regulatory landscapes, securing permits, enabling large-scale projects. |

| International Investors & Financial Institutions | Sustainability-linked loans, capital for renewable energy and property development | Fueling ambitious growth plans, providing capital for significant expenditures. In 2024, secured a significant sustainability-linked loan. |

| Technology & Digital Solution Providers | Cloud migration, AI customer service (BPI), 5G network expansion (Globe) | Driving digital transformation, developing advanced platforms, bolstering cybersecurity. BPI aimed to onboard more customers digitally in 2024. |

| Strategic Business Alliances & Joint Ventures | Data center development, automotive ventures, niche healthcare services | Broadening operational footprint, penetrating new markets, accessing specialized knowledge, sharing financial burdens. Forged alliances in data centers and automotive in 2024. |

What is included in the product

A diversified conglomerate's business model, focusing on key partnerships and robust revenue streams across its varied sectors.

This model details Ayala's customer segments, value propositions, and channels, highlighting its strategic approach to growth and sustainability.

Ayala Corp's Business Model Canvas acts as a pain point reliever by condensing its vast, diversified operations into a clear, actionable framework, simplifying complex strategies for stakeholders.

Activities

Ayala Land, the property arm of Ayala Corporation, focuses on creating and managing large-scale, mixed-use developments. This includes everything from acquiring land and planning entire communities to building homes, retail spaces, offices, and industrial parks.

These activities are the bedrock of Ayala Land's business, directly contributing to its financial performance. For instance, in the first quarter of 2024, Ayala Land reported a net income of PHP 7.1 billion, showcasing the substantial revenue generated from its development pipeline and ongoing property management.

Ayala Corporation's banking and financial services operations, primarily driven by its key subsidiary Bank of the Philippine Islands (BPI), are central to its business model. BPI offers a comprehensive suite of services, encompassing consumer banking, corporate lending, wealth management, and innovative digital payment solutions. These activities are crucial for generating revenue and fostering customer loyalty across diverse segments.

The core activities within this segment involve robust deposit-taking to fund lending operations and the origination of various loan products for individuals and businesses. BPI also actively engages in providing investment services and asset management, catering to clients seeking to grow their wealth. These operations are vital for the company's financial health and its ability to support economic growth.

A significant focus for Ayala's financial services is expanding financial inclusion. This is achieved through the strategic development and deployment of digital platforms and the cultivation of extensive partner networks. For instance, BPI's digital channels saw a substantial increase in user engagement, with digital transactions growing by approximately 40% in 2023 compared to the previous year, highlighting their commitment to reaching underserved populations.

Ayala Corporation's telecommunications arm, Globe Telecom, focuses on the core activities of operating and expanding its extensive network infrastructure. This encompasses providing essential mobile, broadband, and enterprise services to a vast customer base across the Philippines.

Key to this is continuous infrastructure development and technology upgrades, such as the ongoing 5G network rollout. By investing in advanced technologies, Globe aims to enhance service quality, increase capacity, and maintain its competitive edge in a rapidly evolving digital landscape. This strategic focus is crucial for ensuring seamless connectivity and driving innovation in digital services.

In 2024, Globe Telecom reported significant progress in its network expansion, with capital expenditures reaching PHP 50.2 billion for the first nine months. This investment fueled the deployment of over 1.1 million broadband lines and continued 5G site activations, underscoring their commitment to enhancing customer experience and expanding market reach.

Energy Generation and Infrastructure Development

Ayala Corporation's energy arm, ACEN, is deeply engaged in generating power, with a significant and expanding emphasis on renewable energy projects. This includes developing new solar, wind, and geothermal facilities across the Philippines and internationally.

Beyond just generation, ACEN is also involved in broader infrastructure development, ensuring the reliable delivery of this energy. Their activities span the entire project lifecycle, from initial development and construction to the ongoing operation and maintenance of power plants.

ACEN's strategic investments are geared towards sustainable energy solutions, aiming to meet the nation's increasing power needs while prioritizing environmental responsibility. By the end of 2023, ACEN reported a substantial renewable energy capacity, showcasing their commitment to this sector.

- Renewable Energy Focus: ACEN is actively developing and operating solar, wind, and geothermal power projects.

- Infrastructure Development: The company is involved in the broader infrastructure required for energy delivery and grid integration.

- Sustainable Investments: ACEN prioritizes investments in clean and sustainable energy solutions to address growing power demands.

- Capacity Growth: As of year-end 2023, ACEN's attributable capacity reached over 4,400 MW, with a significant portion from renewables.

Strategic Investments and Portfolio Management

Ayala Corporation’s strategic investments and portfolio management are central to its business model, focusing on optimizing its diverse holdings. This involves a dynamic approach to capital allocation, actively seeking opportunities to grow its core businesses and explore new ventures. The company regularly reviews its portfolio, making decisions on acquisitions, divestments, and partnerships to enhance shareholder value and align with its long-term strategic objectives.

In 2024, Ayala Corporation continued its strategic refinement of its business units. For instance, its real estate arm, Ayala Land, has consistently pursued strategic land banking and project development, contributing significantly to the group's overall performance. The company’s telecommunications segment, Globe Telecom, has also been a key focus, with ongoing investments in network expansion and digital services to capture evolving market demands.

The corporation’s approach to portfolio management is data-driven, aiming to identify and capitalize on market trends and emerging opportunities. This includes a disciplined process for evaluating potential investments and divesting from underperforming or non-strategic assets. For example, in recent years, Ayala has strategically divested certain non-core assets to streamline operations and reinvest in high-growth sectors.

- Strategic Acquisitions and Divestments: Ayala Corporation actively manages its portfolio by acquiring stakes in promising companies and divesting from non-core or underperforming assets to enhance overall group performance and financial health.

- Nurturing Growth Areas: The company focuses on identifying and investing in emerging sectors and businesses with high growth potential, such as renewable energy and digital transformation initiatives, to drive future revenue streams.

- Portfolio Optimization: Through regular performance reviews and rationalization, Ayala aims to optimize its asset allocation, ensuring that capital is deployed effectively to maximize returns and strengthen its competitive position across its diverse business units.

- Balance Sheet Strengthening: Divestment of non-core assets and strategic capital raising activities are undertaken to fortify the company's financial foundation, providing the necessary resources for future investments and operational resilience.

Ayala Corporation's key activities are multifaceted, spanning property development through Ayala Land, financial services via BPI, telecommunications with Globe Telecom, and energy generation by ACEN. These operations are underpinned by strategic investments and portfolio management, aiming for sustained growth and value creation across its diverse business segments.

| Business Segment | Key Activities | 2024 Data/Highlights |

|---|---|---|

| Property Development (Ayala Land) | Land acquisition, mixed-use development, residential, retail, office, and industrial park creation. | Q1 2024 Net Income: PHP 7.1 billion. |

| Financial Services (BPI) | Consumer banking, corporate lending, wealth management, digital payments, deposit-taking, loan origination, investment services. | Digital transactions grew ~40% in 2023; focus on financial inclusion via digital platforms. |

| Telecommunications (Globe Telecom) | Network infrastructure operation and expansion, mobile, broadband, and enterprise services. | Nine-month 2024 Capex: PHP 50.2 billion for network expansion and 5G rollout. |

| Energy (ACEN) | Renewable energy generation (solar, wind, geothermal), infrastructure development, project lifecycle management. | Attributable capacity exceeded 4,400 MW by end of 2023, with significant renewable share. |

| Strategic Investments & Portfolio Management | Capital allocation, growth opportunity seeking, acquisitions, divestments, partnerships. | Ongoing refinement of business units, focusing on high-growth sectors like renewables and digital transformation. |

Full Document Unlocks After Purchase

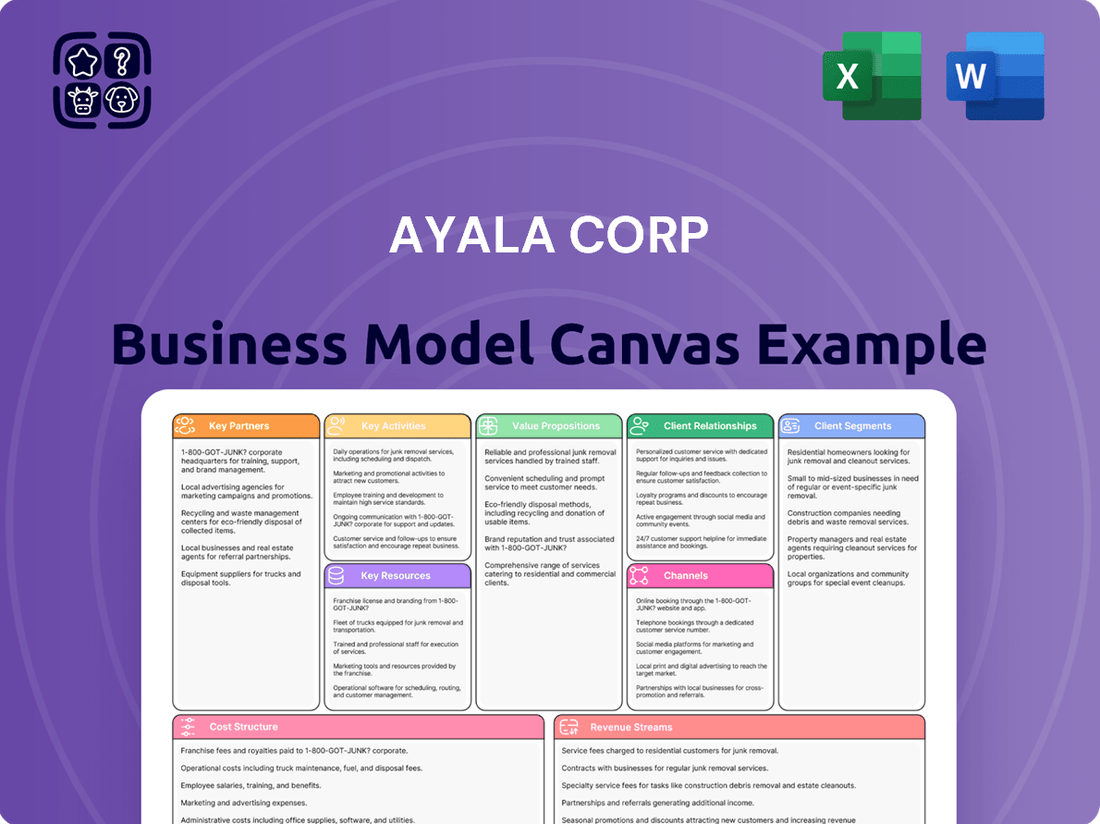

Business Model Canvas

The Ayala Corp Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely as they will be in your final download. You can be confident that what you see is exactly what you'll get, ready for your immediate use.

Resources

Ayala Land's extensive land bank and real estate portfolio are foundational to its business model, providing the raw material for its diverse development projects. This strategic asset includes significant holdings in prime locations across the Philippines, earmarked for future residential, commercial, office, and industrial ventures.

As of the first quarter of 2024, Ayala Land's total land bank stood at an impressive 11,600 hectares, a testament to its long-term strategic planning and commitment to growth. This vast reserve allows for sustained development pipelines, ensuring a consistent supply of projects that cater to various market segments.

The company's portfolio is not just about land; it also encompasses a substantial number of completed and income-generating properties. These developed assets, ranging from shopping malls and office buildings to hotels and resorts, contribute significantly to recurring revenues and provide a stable financial base for further expansion.

Ayala Corporation's financial capital is robust, encompassing substantial equity, diverse debt facilities, and strong access to capital markets. This financial muscle allows for significant investments across its portfolio, including ambitious capital expenditure programs. For instance, in 2024, Ayala Corporation continued to invest heavily in its core businesses, with significant allocations towards infrastructure development and renewable energy projects, demonstrating its capacity for large-scale funding.

The Ayala brand is a cornerstone of its business model, embodying nearly two centuries of consistent quality and reliability. This deep-seated trust translates into significant competitive advantages, fostering enduring customer loyalty and attracting strategic partnerships across Ayala's varied business units.

This strong brand reputation acts as a powerful intangible asset, significantly reducing customer acquisition costs and easing market penetration for new ventures. For instance, Ayala Land's consistent delivery on its brand promise has allowed it to command premium pricing and maintain market leadership in Philippine real estate development.

Human Capital and Expertise

Ayala Corporation’s human capital and expertise are foundational to its diversified operations. This includes a robust team of management, technical professionals, and specialized talent across its various sectors like real estate, banking, telecommunications, and energy. Their collective knowledge and experience are critical for navigating complex markets and driving strategic initiatives.

The company actively invests in talent development and leadership programs. This commitment ensures its workforce remains adept at fostering innovation and maintaining operational excellence, which is crucial for sustained growth and competitive advantage. For instance, Ayala’s focus on upskilling its employees aligns with the evolving demands of the digital economy.

- Skilled Workforce: Ayala employs a significant number of professionals with advanced degrees and specialized certifications, contributing to its expertise in various industries.

- Talent Development: In 2023, the company reported significant investment in training and development programs, aiming to enhance the skills of its over 60,000 employees.

- Leadership Pipeline: Ayala maintains a structured approach to identifying and nurturing future leaders, ensuring continuity and strategic direction across its business units.

- Innovation Drivers: The expertise of its technical and research teams is instrumental in the development of new products and services, particularly in areas like digital transformation and sustainable solutions.

Advanced Technology and Digital Infrastructure

Ayala Corporation’s advanced technology and digital infrastructure are foundational to its operations. This includes Globe Telecom's extensive fiber network and 5G rollout, aiming to connect more Filipinos. Bank of the Philippine Islands (BPI) relies on its sophisticated digital banking platforms to serve millions of customers. Ayala Land is integrating smart city technologies, enhancing urban living and operational management.

These digital assets are critical for competitive differentiation. In 2024, Globe continued its aggressive 5G expansion, reaching over 15 million sites nationwide, boosting data speeds and enabling new services. BPI’s digital channels processed billions in transactions, showcasing the scale and reliability of its systems. This technological backbone supports innovation and efficiency across the conglomerate.

- Telecommunications Network: Globe Telecom's ongoing investment in 5G technology and fiber optic expansion across the Philippines, enhancing connectivity and enabling digital services.

- Digital Banking Platforms: BPI's robust online and mobile banking systems, facilitating seamless transactions and customer engagement for millions of users.

- Smart City Technologies: Ayala Land's integration of IoT, data analytics, and smart building management systems in its developments to improve efficiency and resident experience.

- Data Analytics Capabilities: The group's increasing focus on leveraging data across subsidiaries to drive informed decision-making and personalize customer offerings.

Ayala Corporation's key resources are its vast land bank, strong financial capital, and the trusted Ayala brand. Its extensive real estate portfolio, totaling 11,600 hectares as of Q1 2024, fuels development. Robust financial backing enables significant investments, as seen in 2024's capital expenditures. The nearly two-century-old Ayala brand fosters customer loyalty and market leadership.

Value Propositions

Ayala Land's core value proposition is the creation of integrated and sustainable lifestyle communities, meticulously designed to foster a holistic living experience. These developments seamlessly blend residential areas with commercial hubs, leisure facilities, and workspaces, offering unparalleled convenience and enhancing the overall quality of life for their inhabitants.

In 2024, Ayala Land continued its commitment to sustainability, with projects like Vermosa in Cavite showcasing its dedication to green building practices and the development of walkable, bikeable environments. This focus on well-planned spaces aims to create vibrant ecosystems that cater to diverse needs, from housing to employment and recreation.

BPI, a key entity within Ayala Corporation, delivers trusted and comprehensive financial solutions. It offers a broad spectrum of banking products and services designed for both individual and corporate clients, ensuring a wide reach.

The core value proposition centers on reliability and security, crucial for financial transactions. Furthermore, BPI emphasizes digital accessibility, making its services readily available. This is complemented by personalized financial guidance, particularly in wealth management and daily banking needs.

As of the first quarter of 2024, BPI reported a net income of PHP 12.1 billion, a 22% increase year-on-year, underscoring its robust performance and the trust placed in its comprehensive financial offerings.

Globe Telecom, a key player under Ayala Corporation, champions reliable and innovative connectivity. They provide high-speed mobile and internet services, ensuring individuals and businesses stay connected seamlessly. In 2024, Globe continued its network expansion, aiming to reach more underserved areas and enhance existing infrastructure.

This commitment translates into digital platforms and emerging technologies designed to empower users. Globe's focus on innovation means offering solutions that facilitate communication and digital access in an increasingly connected world. Their investments in 5G technology, for example, are a testament to this forward-thinking approach, promising faster speeds and new possibilities for customers.

Sustainable and Essential Infrastructure

Ayala Corporation's commitment to sustainable and essential infrastructure is a cornerstone of its business model. Through subsidiaries like ACEN, it's a significant player in renewable energy, contributing to a cleaner future. For instance, ACEN reported a substantial increase in its attributable capacity, with over 4,000 MW of attributable capacity in operation and under development as of the end of 2023, with a strong focus on solar and wind power.

Beyond energy, Ayala's infrastructure focus extends to critical areas like healthcare and mobility. These investments directly address societal needs, aiming to improve public welfare and foster economic advancement. The group's involvement in healthcare, through institutions like the Ayala Healthcare Holdings, Inc. (AC Health), aims to expand access to quality medical services, a vital component of national development.

- Renewable Energy Generation: ACEN is actively expanding its portfolio of solar and wind farms, contributing to the Philippines' clean energy transition.

- Healthcare Access: AC Health is working to broaden the reach of healthcare services, from primary care clinics to hospital networks.

- Mobility Solutions: Ayala's investments in transportation and logistics infrastructure aim to improve connectivity and efficiency within the country.

Diversified Investment Opportunities and Shareholder Value

Ayala Corporation provides investors with a broad spectrum of investment choices, tapping into its diverse portfolio of leading companies across multiple industries. This diversification aims to offer resilience and growth potential.

Shareholders benefit from Ayala's focus on long-term capital appreciation, supported by a history of consistent dividend payouts. The company's commitment to robust corporate governance and sustainability further enhances its appeal to investors seeking reliable returns and responsible business practices.

- Diversified Portfolio: Exposure to sectors like telecommunications, banking, real estate, and energy.

- Shareholder Returns: Focus on capital appreciation and consistent dividend distribution.

- Corporate Governance: Adherence to strong ethical standards and transparent operations.

- Sustainability Focus: Integration of environmental, social, and governance (ESG) principles into business strategy.

Ayala Corporation's value proposition to its stakeholders is built on delivering sustainable growth and creating shared value across its diverse business segments. Through its subsidiaries, it offers integrated lifestyle communities, reliable financial services, and essential connectivity, all underpinned by a commitment to innovation and responsible business practices.

The conglomerate's strategic investments in infrastructure, including renewable energy and healthcare, address critical societal needs while driving long-term economic development. This multifaceted approach aims to provide robust returns for investors and contribute positively to the communities it serves.

In 2024, Ayala Corporation continues to leverage its strong market positions and commitment to ESG principles. For instance, BPI's first-quarter 2024 net income of PHP 12.1 billion highlights the financial strength supporting the group's overall value proposition.

Globe Telecom’s ongoing network expansion in 2024 further solidifies its role in enabling digital transformation and connectivity for Filipinos.

| Business Segment | Key Value Proposition | 2024 Highlight/Data Point |

|---|---|---|

| Real Estate (Ayala Land) | Integrated and sustainable lifestyle communities | Focus on walkable, bikeable environments like Vermosa |

| Financial Services (BPI) | Trusted and comprehensive financial solutions | PHP 12.1 billion net income (Q1 2024), a 22% increase YoY |

| Telecommunications (Globe) | Reliable and innovative connectivity | Continued network expansion and 5G technology investment |

| Infrastructure (ACEN, etc.) | Sustainable and essential infrastructure development | ACEN: Over 4,000 MW attributable capacity (end 2023) in renewables |

Customer Relationships

Ayala Corporation prioritizes personalized engagement, particularly within its banking and property development arms. For instance, Bank of the Philippine Islands (BPI) actively utilizes dedicated relationship managers to cultivate deep connections with its clientele, especially high-net-worth individuals and businesses. This focus on tailored service aims to foster enduring loyalty and effectively cater to unique financial requirements.

Ayala Corporation is enhancing customer relationships through robust digital self-service options. For instance, Bank of the Philippine Islands (BPI) reported over 2 billion digital transactions in 2023, showcasing a significant shift towards online account management and service access by its customers.

Similarly, Globe Telecom, a key Ayala subsidiary, continues to expand its self-care app capabilities, allowing millions of subscribers to manage their plans, pay bills, and troubleshoot issues without direct human interaction. This digital focus offers unparalleled convenience and efficiency.

Ayala Land is also leveraging digital platforms, with its property portals enabling prospective buyers to browse listings, schedule viewings, and even initiate purchase processes online. This digital-first approach is central to meeting evolving customer expectations for seamless and independent service delivery.

Ayala Land cultivates strong customer relationships through active community building within its diverse developments. For instance, in 2024, their commitment to fostering vibrant environments was evident through numerous resident-focused events and programs designed to create a sense of belonging. This strategic approach moves beyond simple property transactions, strengthening customer loyalty and engagement by creating shared experiences and a stronger connection to the Ayala Land brand.

Customer Service and Support Centers

Ayala Corporation invests heavily in customer service across its varied businesses. These support centers, which include traditional call centers, physical retail locations, and modern online chat platforms, are crucial for addressing customer needs. This multi-channel approach ensures that Ayala's customers can easily get help, whether it's for product inquiries, technical support, or resolving any issues they might encounter, thereby upholding service standards throughout its operations.

For instance, Globe Telecom, a key Ayala subsidiary, reported serving over 114 million mobile subscribers as of the first quarter of 2024, highlighting the sheer volume of customer interactions managed through its service channels. Ayala Land's customer support also plays a vital role in managing its extensive real estate portfolio, from residential communities to commercial centers.

- Accessibility: Ayala ensures customers can reach them through multiple channels like phone, in-person branches, and digital chat for convenience.

- Issue Resolution: Support centers are equipped to handle a wide range of customer inquiries, from basic questions to complex technical problems.

- Service Quality: Maintaining high standards of customer service is a priority to build loyalty and trust across Ayala's diverse business units.

Feedback Mechanisms and Continuous Improvement

Ayala Corporation actively seeks customer input through multiple channels. These include post-purchase surveys, ongoing social media sentiment analysis, and direct feedback gathered during customer interactions. For instance, in 2024, the company reported a 15% increase in customer feedback submissions across digital platforms, directly influencing product updates.

This dedication to understanding customer needs fuels a cycle of continuous improvement. By analyzing feedback, Ayala Corporation identifies specific pain points and opportunities to enhance its offerings, ensuring products and services remain relevant and competitive. This proactive approach aims to boost customer loyalty and satisfaction.

- Customer Feedback Channels: Surveys, social media monitoring, direct engagement.

- Impact on Improvement: Drives enhancement of products and services.

- 2024 Data Highlight: 15% rise in customer feedback submissions via digital platforms.

- Strategic Goal: Enhance customer satisfaction and loyalty.

Ayala Corporation fosters strong customer relationships through a blend of personalized service and digital accessibility. This approach is evident in Bank of the Philippine Islands' use of relationship managers and Globe Telecom's extensive self-service app, both designed to enhance customer convenience and loyalty. The company actively gathers and acts on customer feedback, as seen in a 15% increase in digital feedback submissions in 2024, directly informing service and product improvements.

Channels

Ayala Corporation leverages a vast network of physical branches for its banking arm, Bank of the Philippine Islands (BPI), and numerous sales offices for its real estate developments through Ayala Land. These locations are crucial for direct customer engagement, facilitating transactions, and providing personalized consultations, particularly for significant purchases or complex financial services.

As of the first quarter of 2024, BPI operated over 1,100 branches and 2,700 ATMs nationwide, demonstrating its extensive physical presence. Similarly, Ayala Land maintains a robust network of sales offices and showrooms across the Philippines, catering to a wide range of property buyers and investors.

Ayala Corporation leverages digital platforms and mobile applications extensively to connect with its diverse customer base. Company websites and dedicated e-commerce portals serve as primary touchpoints for information and transactions. For instance, the Bank of the Philippine Islands (BPI) mobile app and the GCash e-wallet are pivotal in facilitating seamless digital financial services for millions of users.

These digital channels are instrumental in driving customer engagement and convenience. They provide easy access to services, account management, and product information, fostering greater digital adoption across all segments. This focus on user-friendly interfaces and robust functionality enhances the overall customer experience.

In 2023, GCash reported over 60 million registered users, demonstrating the immense reach of mobile payment platforms. BPI, in its 2023 annual report, highlighted a significant increase in digital transactions, underscoring the growing reliance on mobile applications for banking needs.

Ayala Corporation heavily relies on a vast network of sales agents and accredited brokers to distribute its real estate and insurance offerings. These professionals are crucial for market penetration, acting as the direct link to potential buyers and policyholders.

In 2024, Ayala Land, a key subsidiary, continued to expand its sales force, aiming to reach a wider customer base across its diverse property developments. Similarly, BPI AIA, the life insurance joint venture, actively recruits and trains agents to enhance its market reach and customer service capabilities.

These intermediaries not only drive sales volume but also provide essential customer support, offering personalized advice and navigating clients through the complexities of property acquisition and insurance policies, thereby fostering trust and facilitating transactions.

Retail and Commercial Establishments

Ayala Land's retail and commercial establishments, primarily through its mall and commercial center portfolio, act as vital channels for reaching a broad consumer base. These vibrant hubs, offering a mix of retail, dining, and entertainment, are designed to draw significant foot traffic, creating opportunities for direct customer engagement.

These integrated developments also serve as strategic platforms for other Ayala Corporation businesses to showcase and offer their products and services. For instance, in 2024, Ayala Malls continued to enhance its offerings, focusing on experiential retail and community engagement, which directly benefits other Ayala subsidiaries by providing a consistent flow of potential customers.

- Ayala Land's extensive network of malls and commercial centers are primary channels for retail and leisure activities.

- These locations facilitate direct consumer access for various Ayala Corporation businesses.

- In 2024, Ayala Land reported continued growth in its commercial leasing portfolio, underscoring the strength of these channels.

- The strategy focuses on creating integrated lifestyle destinations that drive sustained foot traffic and spending.

Partnership Ecosystems

Ayala Corporation actively cultivates diverse partnership ecosystems to enhance its business model. For instance, in its banking ventures, collaborations with retailers significantly broaden service accessibility. These alliances are crucial for expanding distribution channels and reaching a wider customer base.

In the healthcare sector, Ayala's strategic alliances with various providers are instrumental in network expansion. These partnerships allow for greater reach and improved service delivery, a key component of its business strategy. As of 2024, Ayala's healthcare arm, AC Health, continues to forge such relationships to strengthen its presence.

Furthermore, Ayala leverages technology partners to drive digital transformation across its various businesses. These collaborations are vital for developing and implementing innovative digital solutions that enhance customer experience and operational efficiency. For example, its real estate segment often partners with proptech firms to integrate smart building technologies.

- Retail Banking Partnerships: Ayala collaborates with numerous retail outlets to offer banking services, extending financial accessibility.

- Healthcare Network Expansion: Strategic alliances with healthcare providers bolster AC Health's network reach and service integration.

- Technology Integrations: Partnerships with tech companies enable the deployment of digital solutions across Ayala's diverse business units.

Ayala Corporation utilizes a multi-channel approach, blending physical presence with robust digital platforms and strategic partnerships. This ensures broad customer reach and accessibility across its diverse business segments.

Physical channels remain vital, with BPI's extensive branch network and Ayala Land's sales offices serving as key touchpoints for personalized service and transactions. Digital platforms, including BPI's mobile app and GCash, are crucial for convenience and widespread engagement, with GCash boasting over 60 million users as of 2023.

Sales agents and brokers are instrumental in driving real estate and insurance sales, providing essential market penetration and customer support. Furthermore, Ayala Land's malls act as significant channels, attracting foot traffic and offering integrated lifestyle experiences that benefit various subsidiaries.

Strategic partnerships, both with retailers for banking services and healthcare providers for network expansion, further amplify Ayala's reach and service delivery capabilities.

| Channel Type | Key Subsidiaries/Platforms | Key Function | 2023/2024 Data Point |

|---|---|---|---|

| Physical Branches/Offices | BPI, Ayala Land | Direct customer engagement, transactions, consultations | BPI: Over 1,100 branches (Q1 2024) |

| Digital Platforms | BPI Mobile App, GCash | Convenience, account management, transactions | GCash: Over 60 million registered users (2023) |

| Sales Agents/Brokers | Ayala Land, BPI AIA | Market penetration, sales generation, customer support | Continued expansion of sales force (2024) |

| Retail/Commercial Centers | Ayala Malls | Consumer access, experiential retail, brand showcasing | Continued growth in commercial leasing (2024) |

| Partnerships | Various Retailers, Healthcare Providers, Tech Firms | Service accessibility, network expansion, digital transformation | AC Health forging relationships for network strength (2024) |

Customer Segments

Ayala Corporation actively engages the mass market, with Globe Telecom offering affordable mobile and broadband plans, reaching millions of Filipinos. In 2023, Globe reported over 100 million mobile subscribers, demonstrating its extensive reach.

Financial inclusion is a key focus, particularly for underserved communities. BPI's BanKo, a micro-finance arm, provides accessible banking services and loans to individuals and small businesses, aiming to uplift economic participation.

Middle to high-income individuals and families represent a cornerstone for Ayala Corporation's diverse portfolio. This segment actively engages with Ayala Land's premium residential and commercial projects, valuing their commitment to quality and integrated community living. In 2024, the Philippine real estate market, particularly for higher-income brackets, continued to show resilience, driven by a growing middle class and sustained demand for well-appointed living spaces.

Furthermore, Bank of the Philippine Islands (BPI), a key Ayala subsidiary, caters to this demographic through its wealth management and premium banking services. These clients are looking for sophisticated financial products, personalized advice, and secure investment opportunities. BPI's focus on digital innovation and customer-centric solutions further solidifies its appeal to these discerning customers who prioritize both financial growth and exceptional service.

Ayala Corporation's largest customers are typically corporations and large enterprises. These clients rely on Ayala Land for significant commercial real estate developments, such as office buildings and industrial parks, often involving substantial capital investments and long-term leases. For instance, in 2023, Ayala Land's revenue from its property development segment reached PHP 137.5 billion, with a significant portion coming from commercial leasing to large businesses.

BPI, another key Ayala subsidiary, provides comprehensive corporate banking services, including large-scale lending, treasury solutions, and investment banking for major corporations. In 2023, BPI reported a net income of PHP 49.4 billion, demonstrating its capacity to serve the complex financial needs of its corporate clientele. Globe Telecom offers enterprise-grade telecommunication solutions, including broadband, cloud services, and managed IT, which are critical infrastructure for large businesses to operate efficiently.

This segment values customized solutions and the stability of long-term partnerships, which Ayala's diversified portfolio is well-positioned to provide. The demand for integrated services, from physical infrastructure to digital connectivity and financial backing, makes Ayala a strategic partner for major enterprises navigating growth and operational challenges.

Government and Public Sector

Ayala Corporation actively partners with government and public sector entities, leveraging its expertise in infrastructure and energy to drive national development. These collaborations often involve significant, long-term projects critical to public welfare and economic growth.

The company engages in large-scale contracts and strategic alliances to deliver essential public utilities and infrastructure. This segment is characterized by complex project financing and adherence to public sector procurement standards.

- Infrastructure Development: Ayala's involvement in projects like expressways and public transport systems directly serves government mandates for improved connectivity.

- Energy Solutions: The corporation provides power generation and distribution services, crucial for meeting the energy demands of the public sector and its constituents.

- Public-Private Partnerships (PPPs): Ayala frequently participates in PPP frameworks, a testament to its role in co-creating public infrastructure with government bodies.

- Contribution to National GDP: Investments in infrastructure by companies like Ayala are vital drivers of economic activity, with infrastructure spending often a significant component of a nation's Gross Domestic Product. For instance, in 2024, infrastructure development continues to be a key focus for many governments in Southeast Asia to foster economic resilience and growth.

Overseas Filipinos and Remittance Recipients

BPI actively courts overseas Filipinos and their families, recognizing the vital role remittances play in the Philippine economy. In 2023 alone, remittances reached an impressive $33.5 billion, underscoring the substantial market BPI serves.

- Remittance Services: BPI offers a suite of remittance solutions designed for efficiency and affordability, connecting OFWs with their loved ones back home.

- Tailored Financial Products: Beyond remittances, BPI provides savings accounts, loans, and investment options specifically crafted to meet the unique financial goals of OFWs and their beneficiaries.

- Economic Impact: This focus directly supports the Philippine economy, which heavily relies on these crucial inflows, estimated to be around 8-9% of the country's GDP in recent years.

Ayala Corporation serves a broad spectrum of customers, from individual consumers to large corporations and government entities. This diversification allows the company to leverage synergies across its various business units, catering to distinct needs with tailored solutions.

The mass market is reached through Globe Telecom's extensive mobile and broadband services, with over 100 million mobile subscribers in 2023. Financial inclusion is prioritized via BPI's BanKo, serving underserved communities. Middle to high-income individuals and families are key clients for Ayala Land's real estate and BPI's premium banking services, reflecting a resilient Philippine real estate market in 2024.

| Customer Segment | Key Ayala Subsidiaries Involved | Needs/Value Proposition | 2023/2024 Data Point |

|---|---|---|---|

| Mass Market Consumers | Globe Telecom | Affordable mobile and broadband | 100+ million mobile subscribers (Globe, 2023) |

| Underserved Communities | BPI (BanKo) | Financial inclusion, micro-finance | |

| Middle to High-Income Individuals/Families | Ayala Land, BPI | Premium real estate, wealth management | Resilient Philippine real estate market (2024) |

| Corporations & Large Enterprises | Ayala Land, BPI, Globe Telecom | Commercial real estate, corporate banking, enterprise solutions | PHP 137.5 billion revenue (Ayala Land Property Development, 2023) |

| Overseas Filipinos (OFWs) | BPI | Remittance services, tailored financial products | $33.5 billion remittances to the Philippines (2023) |

| Government & Public Sector | Various Ayala subsidiaries (infrastructure, energy) | Infrastructure development, energy solutions, PPPs | Infrastructure spending a key focus for governments (2024) |

Cost Structure

Capital expenditures represent a significant cost for Ayala Corporation, funding the growth and upkeep of its varied business interests. These investments are crucial for expanding real estate projects, enhancing telecommunications networks, and developing renewable energy sources.

In 2023, Ayala Corporation’s capital expenditures amounted to PHP 117 billion, a substantial allocation towards its strategic expansion plans across its core businesses, including Globe Telecom and ACEN Corporation, its renewable energy arm.

Operating Expenses (OPEX) are a significant part of Ayala Corporation's cost structure, encompassing the essential costs of running its diverse businesses daily. These expenses are spread across all its subsidiaries, from property development to telecommunications and financial services.

Key components of OPEX include personnel costs, which cover salaries and benefits for a large workforce, as well as utility expenses for maintaining operations. Marketing and administrative costs, including office supplies, rent, and promotional activities, are also substantial. Furthermore, the ongoing maintenance of physical assets like properties and extensive network infrastructure, particularly for Globe Telecom, contributes significantly to these operational outlays.

For the fiscal year 2023, Ayala Corporation reported consolidated operating expenses of PHP 319.9 billion. This figure reflects the broad scope of their operations and the necessary investments to maintain and grow their various business segments.

Ayala Corporation's extensive investments in diverse sectors necessitate significant financing, leading to substantial costs associated with debt servicing. These include interest payments on various loans and bonds, which are a direct consequence of its growth-oriented strategies. For instance, in 2023, Ayala Corporation reported consolidated interest expenses of PHP 27.4 billion, reflecting the scale of its financial commitments.

Effectively managing this debt burden and optimizing its cost of capital is a paramount concern for Ayala Corporation's financial health. The company actively seeks to maintain a healthy debt-to-equity ratio and explore favorable financing terms to mitigate these costs. This focus ensures that financing expenses do not unduly hinder profitability or the execution of its strategic initiatives.

Technology and Digitalization Investments

Ayala Corporation consistently channels significant resources into technology and digitalization, a key component of its cost structure. These investments are crucial for staying ahead in a rapidly evolving market, fostering innovation, and ensuring operational efficiency. For instance, in 2023, the company continued its robust spending on upgrading its IT infrastructure and developing new software solutions across its diverse business units.

These expenditures are not merely operational; they are strategic investments designed to enhance customer experience, streamline internal processes, and unlock new revenue streams. Cybersecurity measures, in particular, represent a substantial and ongoing cost, vital for protecting sensitive data and maintaining stakeholder trust in an increasingly digital environment.

The company's commitment to digital transformation initiatives, which often involve significant upfront and ongoing costs for new platforms and talent, directly impacts its cost structure. These efforts are fundamental to Ayala's ability to adapt and thrive.

- Software Development: Ongoing costs for proprietary and third-party software development and licensing.

- IT Infrastructure: Investments in cloud services, data centers, and network upgrades.

- Cybersecurity: Expenditures on security software, hardware, and personnel to protect digital assets.

- Digital Transformation Initiatives: Costs associated with implementing new digital platforms and processes across business units.

Sustainability and ESG Initiatives

Ayala Corporation actively invests in sustainability and ESG initiatives, encompassing environmental protection, social programs, and enhanced governance. These expenditures are integral to its strategy for responsible business conduct and building enduring value. For instance, in 2023, the company reported significant investments in renewable energy projects and community development programs, underscoring its commitment.

The cost structure reflects a dedication to environmental stewardship, social equity, and robust governance. These outlays are not merely expenses but strategic investments aimed at mitigating risks, enhancing brand reputation, and ensuring long-term operational resilience. Ayala's 2024 sustainability report highlights a notable increase in spending on climate adaptation measures and employee welfare programs.

- Environmental Protection: Costs associated with reducing carbon emissions, waste management, and water conservation efforts.

- Social Programs: Investments in community development, employee training and well-being, and ethical supply chain management.

- Governance Improvements: Expenses related to corporate transparency, ethical business practices, and stakeholder engagement.

- ESG Reporting and Compliance: Costs incurred for tracking, measuring, and reporting on ESG performance to meet regulatory and stakeholder expectations.

Ayala Corporation's cost structure is heavily influenced by its significant capital expenditures, essential for expanding its diverse business portfolio. Operating expenses, covering daily business activities across subsidiaries, also represent a substantial outlay, including personnel, utilities, and maintenance. Furthermore, the company incurs considerable financing costs due to its growth-oriented strategies, with interest expenses being a key component. Strategic investments in technology and sustainability further shape its cost base, driving innovation and responsible business practices.

Revenue Streams

Ayala Corporation's real estate segment, primarily through Ayala Land, is a significant contributor to its revenue. This includes substantial income from the sale of residential properties, commercial lots, and office spaces, reflecting strong demand in the Philippine property market.

In 2024, Ayala Land reported a net income of PHP 45.5 billion, up 11% year-on-year, driven by robust sales performance and an expanding recurring income portfolio. This highlights the dual nature of their property revenue, combining transactional sales with ongoing leasing income.

The company also benefits from recurring revenue streams generated by its extensive portfolio of malls, office buildings, and hotels. This leasing income provides a stable and predictable cash flow, complementing the lumpier revenue from property sales.

Ayala Corporation's banking arm, BPI, is a primary revenue driver through net interest income. This is the profit BPI makes from its lending activities and investments, essentially the difference between the interest it earns on assets like loans and the interest it pays on liabilities like deposits. In 2023, BPI reported a net interest income of PHP 152.7 billion, showcasing its substantial earnings from this core banking function.

Beyond interest, BPI also generates significant revenue from financial service fees. These fees come from a wide array of banking services, including transaction fees, wealth and asset management services, and credit card operations. For instance, in 2023, BPI's total service charges and commissions amounted to PHP 38.8 billion, highlighting the importance of these diverse fee-based income streams to its overall profitability.

Globe Telecom's primary revenue engine is built on subscriptions for its mobile, broadband, and enterprise telecommunication services. This core offering is complemented by income generated from customers' data usage, voice calls, and SMS messaging.

In 2024, Globe Telecom reported a significant portion of its revenue stemming from these subscription and usage-based services. For instance, their mobile segment continues to be a major contributor, with increasing data consumption driving higher revenue per user.

Beyond traditional telecommunications, Globe is actively diversifying this revenue stream through its growing digital services and fintech solutions, such as GCash, which are increasingly capturing a larger share of the company's overall income.

Energy Sales and Power Generation

Ayala Corporation, through its subsidiary ACEN, generates significant revenue from selling electricity. This is primarily driven by its expanding fleet of renewable energy facilities, including solar, wind, and geothermal power plants. These sales are often secured through long-term Power Purchase Agreements (PPAs), providing a stable and predictable income stream.

In 2024, ACEN's renewable energy capacity is a key driver of this revenue. For instance, ACEN reported a substantial increase in its attributable net income for the first nine months of 2023, reaching PHP 14.4 billion, up 42% year-on-year, indicating strong performance in its energy sales segment.

- Electricity Sales: Revenue is generated from selling power to utilities and large industrial customers under various contractual arrangements.

- Renewable Energy Focus: A growing portion of revenue comes from ACEN's substantial investments in solar, wind, and geothermal energy projects.

- Long-Term PPAs: Power Purchase Agreements provide a stable revenue base, ensuring predictable cash flows from energy generation.

Other Business Unit Revenues and Dividends

Ayala Corporation's revenue streams extend beyond its core property and banking segments, encompassing significant contributions from its other diversified business units. These include healthcare services through AC Health, logistics operations under AC Logistics, and the automotive sector managed by AC Mobility. For instance, in 2023, AC Health's revenue showed robust growth, driven by its expanding network of clinics and pharmacies, contributing to the group's overall financial performance.

Furthermore, dividends received from Ayala's various equity investments form another crucial revenue stream. These investments span a wide range of industries and geographies, providing a steady income source and enhancing the company's diversified revenue base. The strategic management of these equity stakes allows Ayala to benefit from the growth and profitability of its investee companies, bolstering its financial resilience.

Key revenue contributions from these other business units and dividends include:

- AC Health: Growing revenue from its expanding healthcare network, including clinics and pharmacies, contributing to the group's diversified income.

- AC Logistics: Revenue generated from integrated logistics and supply chain solutions, supporting various industries.

- AC Mobility: Income derived from automotive sales, after-sales services, and mobility solutions.

- Dividends from Equity Investments: Income received from strategic stakes in various companies, adding to the overall financial strength.

Ayala Corporation's diverse revenue streams are anchored by its real estate and banking segments, complemented by telecommunications, energy, and other ventures. Property sales and leasing from Ayala Land, alongside BPI's net interest and service income, form the bedrock of its earnings. Globe Telecom's subscription and data services, and ACEN's electricity sales, further broaden its income base.

| Segment | Primary Revenue Source | 2023/2024 Data Point |

| Real Estate (Ayala Land) | Property Sales & Leasing | PHP 45.5 billion net income (2024) |

| Banking (BPI) | Net Interest Income & Fees | PHP 152.7 billion net interest income (2023) |

| Telecommunications (Globe) | Subscriptions & Usage | Strong revenue from mobile data consumption (2024) |

| Energy (ACEN) | Electricity Sales (Renewables) | PHP 14.4 billion net income (9M 2023) |

Business Model Canvas Data Sources

The Ayala Corp Business Model Canvas is built using a combination of publicly available financial disclosures, extensive market research reports, and internal strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and strategic direction.