Ayala Corp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

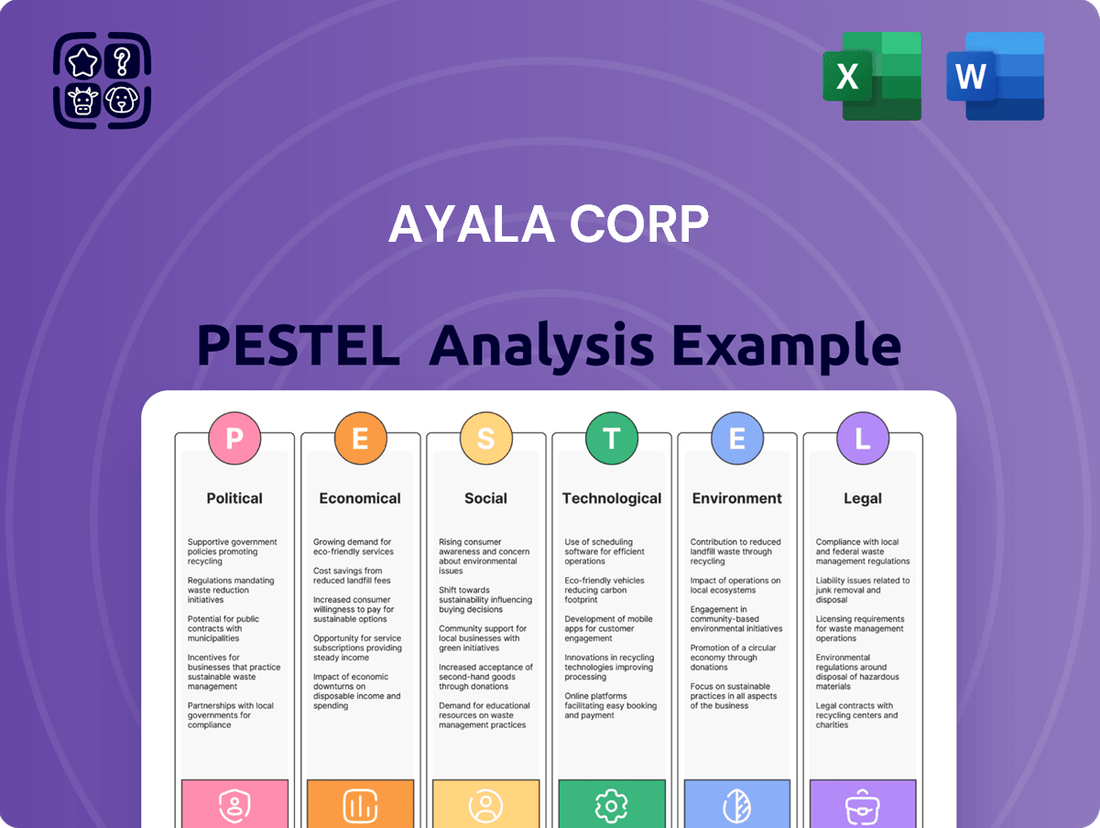

Navigating the dynamic landscape surrounding Ayala Corp requires a keen understanding of external forces. Our PESTLE analysis delves into the political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks that are shaping its strategic direction. Equip yourself with this essential intelligence to anticipate challenges and seize opportunities. Download the full version now and gain a decisive advantage.

Political factors

Ayala Corporation's extensive portfolio, especially in real estate and infrastructure, is heavily shaped by the Philippine government's 'Build Better More' program. This initiative, along with other infrastructure drives, can unlock new development prospects and scale up existing ventures, including mixed-use communities and transit centers.

The government's commitment to speeding up infrastructure projects directly affects Ayala's investment decisions and project scheduling. For instance, the Department of Transportation's 2024 infrastructure budget allocation highlights a continued push for connectivity projects, which directly benefits Ayala's infrastructure arm, AC Infrastructure.

The Philippines' dynamic regulatory environment significantly shapes Ayala Corporation's core businesses, particularly in telecommunications and banking. For instance, Globe Telecom's performance is directly influenced by the National Telecommunications Commission's (NTC) spectrum allocation policies, which can impact network expansion and service offerings. In 2024, the NTC continued to manage spectrum efficiently, aiming to improve broadband quality and expand 5G coverage nationwide, a key area for Globe's growth.

Similarly, the banking sector, represented by Bank of the Philippine Islands (BPI), operates under the watchful eye of the Bangko Sentral ng Pilipinas (BSP). The BSP's directives on capital adequacy, digital banking, and consumer protection are critical. As of late 2024, the BSP has been emphasizing cybersecurity and data privacy, requiring significant investment from BPI to ensure compliance and maintain customer trust. These regulatory shifts directly impact operational costs and strategic planning for sustained business development.

Ayala Corporation's performance is significantly influenced by the political stability and governance in the Philippines. A stable environment, characterized by predictable policy implementation and strong rule of law, is crucial for attracting and retaining investment, especially for a conglomerate with extensive infrastructure and real estate holdings. For instance, the Philippines' credit rating, a reflection of its governance, was affirmed by Moody's at Baa2 with a stable outlook as of late 2023, signaling a generally positive perception of its political and economic management.

Political uncertainties, such as upcoming elections or shifts in regulatory frameworks, can create headwinds for businesses like Ayala. These uncertainties can lead to delays in project approvals, changes in tax regimes, or even impact consumer spending patterns. The World Bank's Ease of Doing Business report, while not updated for 2024, has historically highlighted the importance of efficient governance and regulatory clarity for business operations in the Philippines.

Foreign Investment Policies

Government policies on foreign investment are crucial for Ayala Corporation, impacting its ability to secure international partnerships and capital. The Philippine government's commitment to enhancing economic competitiveness through reforms and incentives, like the CREATE Law which offers tax breaks to qualified enterprises, directly influences Ayala's strategic expansion. For instance, in 2023, the Philippines saw a notable increase in foreign direct investment (FDI) inflows, reaching an estimated $9.2 billion, signaling a more welcoming environment for large conglomerates like Ayala.

These policies are designed to attract foreign capital, which is vital for Ayala's diverse portfolio spanning telecommunications, infrastructure, banking, and real estate. The government's proactive stance in streamlining business processes and offering fiscal advantages aims to bolster foreign investment, potentially unlocking new opportunities for Ayala's growth initiatives. For example, the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, enacted in 2021 and continuing its impact through 2024, provides significant tax relief and incentives for businesses investing in strategic sectors.

- FDI Inflows: The Philippines recorded an FDI inflow of approximately $9.2 billion in 2023, indicating a positive trend in foreign investment.

- CREATE Act: This legislation offers tax incentives and rationalized fiscal perks, making the Philippines more attractive for foreign investors.

- Economic Reforms: Ongoing government efforts to improve the ease of doing business are designed to attract and retain foreign capital, benefiting companies like Ayala.

- Sectoral Focus: Policies often target specific sectors, potentially aligning with Ayala's key business areas and encouraging foreign participation.

Public-Private Partnerships (PPPs)

Ayala Corporation's significant participation in infrastructure and essential services hinges on Public-Private Partnerships (PPPs). The Philippine government's commitment to fostering PPPs, particularly for major national development projects, directly impacts Ayala's ability to secure and execute these ventures. For instance, the Department of Transportation's active pursuit of PPPs for airport upgrades and railway expansion projects in 2024 and 2025 presents substantial opportunities for Ayala to deploy its expertise.

The government's policy environment for PPPs, including streamlined approval processes and clear contractual frameworks, is crucial. As of early 2025, the government continues to refine its PPP guidelines to attract more private sector investment. This evolving landscape directly influences Ayala's strategic planning and investment decisions in areas like water utilities and telecommunications infrastructure.

- Government's PPP Pipeline: The Philippine government has identified over PHP 1.5 trillion (approximately USD 25 billion) in potential PPP projects across various sectors for the period 2024-2029, offering a robust pipeline for companies like Ayala.

- Ayala's PPP Projects: Ayala's existing PPP portfolio includes significant ventures like the Mactan-Cebu International Airport and various water distribution projects, demonstrating a proven track record and strong government relations.

- Regulatory Environment: Changes in PPP laws and regulations, such as amendments to the Build-Operate-Transfer (BOT) Law, can either accelerate or hinder the pace of project implementation, directly affecting Ayala's project timelines and financial projections.

Political stability and effective governance are paramount for Ayala Corporation, influencing its vast infrastructure and real estate investments. A stable political climate, marked by predictable policies and adherence to the rule of law, fosters investor confidence. The Philippines' credit rating, affirmed at Baa2 with a stable outlook by Moody's in late 2023, reflects a generally positive perception of its political and economic management, crucial for long-term business planning.

Government policies on foreign investment, such as the CREATE Act, directly impact Ayala's ability to secure international partnerships and capital. The increase in Philippine foreign direct investment (FDI) inflows to approximately $9.2 billion in 2023 signals a more receptive environment for large conglomerates. These policies are designed to boost economic competitiveness and attract foreign capital, vital for Ayala's diverse portfolio.

Ayala's engagement in Public-Private Partnerships (PPPs) is heavily reliant on government commitment and streamlined processes. The Department of Transportation's focus on PPPs for airport and railway projects in 2024-2025 presents significant opportunities. The government's ongoing refinement of PPP guidelines, aiming to attract more private sector investment, directly affects Ayala's strategic planning for infrastructure ventures.

| Factor | Impact on Ayala Corp | 2023-2025 Data/Trend |

|---|---|---|

| Political Stability & Governance | Attracts investment, ensures predictable policy implementation. | Moody's Baa2 stable rating (late 2023) indicates positive perception. |

| Foreign Investment Policies | Facilitates international partnerships and capital inflow. | FDI inflows reached ~$9.2 billion in 2023; CREATE Act offers tax incentives. |

| Public-Private Partnerships (PPPs) | Secures and executes major infrastructure projects. | Government prioritizing PPPs for transport projects (2024-2025); ~USD 25 billion potential PPP pipeline (2024-2029). |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Ayala Corporation, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for Ayala's diverse business portfolio.

A PESTLE analysis of Ayala Corp provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, helping to identify and mitigate external challenges.

This analysis offers a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for better strategic decision-making.

Economic factors

Ayala Corporation's fortunes are intrinsically linked to the Philippines' economic trajectory. The nation's GDP growth, projected at a robust 5.6% for 2024, is a key indicator of a healthy operating landscape. This expansion, fueled by robust domestic consumption and increased government spending on infrastructure, creates a fertile ground for Ayala's diverse portfolio.

This economic momentum directly benefits Ayala's real estate ventures, as rising incomes and consumer confidence translate into higher demand for housing and commercial spaces. Similarly, its banking arm, Bank of the Philippine Islands (BPI), stands to gain from increased lending activity and a more vibrant business environment. The positive economic climate, supported by a deceleration in inflation, further bolsters consumer spending, a critical driver for Ayala's consumer-facing businesses.

Inflation and interest rates are crucial economic factors impacting Ayala Corporation. For instance, the Bangko Sentral ng Pilipinas (BSP) maintained its policy rate at 6.50% as of May 2024, reflecting a cautious stance amidst persistent inflation concerns. Higher borrowing costs directly affect Ayala's financial services arm, BPI, and increase the expense of capital for its diverse businesses, including real estate and infrastructure.

Conversely, a scenario with lower and stable inflation, coupled with potential easing of interest rates by the BSP, could significantly benefit Ayala. This environment would likely stimulate consumer spending and boost investment across its subsidiaries. For example, a reduction in borrowing costs would make real estate projects more attractive and increase demand for loans from BPI, thereby enhancing overall profitability.

The Philippines boasts a burgeoning middle class, representing a significant 40% of the nation's population. This demographic is a powerful driver of consumption, directly benefiting Ayala Corporation's core businesses in real estate, retail, and telecommunications. As this segment grows and becomes more affluent, their spending power increases, fueling demand across these sectors.

Further strengthening consumer spending is the consistent flow of remittances from overseas Filipino workers, which reached an estimated $32.5 billion in 2023. Coupled with robust employment rates, these financial inflows directly translate into greater purchasing power for households, providing a stable foundation for continued consumer activity and supporting Ayala's revenue streams.

Real Estate Market Dynamics

The Philippine real estate market presents a mixed bag for Ayala Land. While residential property prices saw a notable increase in 2024, especially in areas outside Metro Manila, the high-end condominium segment within central business districts has experienced a slight softening. This dynamic directly influences Ayala Land's sales and development strategies.

Rental market conditions also play a crucial role. As of early 2025, rental yields in prime urban locations remain competitive, though vacancy rates in certain commercial spaces are being closely monitored. This requires Ayala Land to adapt its leasing models and tenant mix to maintain occupancy and revenue streams.

- Property Price Trends: Residential property prices outside Metro Manila grew by an estimated 5-7% in 2024, while prime CBD luxury condo prices saw a marginal decrease of 1-2%.

- Rental Market: Average rental yields in key business districts hovered around 4-5% in late 2024, with a slight uptick in vacancy rates for office spaces to around 8-10%.

- Ayala Land's Exposure: Ayala Land's diverse portfolio, spanning residential, commercial, and office spaces, means it is directly affected by these varying market conditions across different segments and geographies.

Foreign Exchange Rates and Remittances

Fluctuations in foreign exchange rates directly impact Ayala Corporation's international operations and the cost of imported goods for its various subsidiaries. For instance, a weaker Philippine Peso (PHP) can increase the cost of imported raw materials for manufacturing arms like AC Industrials, while a stronger Peso might benefit businesses with significant overseas earnings when repatriated.

Remittances from Overseas Filipino Workers (OFWs) remain a vital pillar of the Philippine economy, consistently bolstering household consumption. In 2023, remittances reached a record high of approximately $33.5 billion, according to the Bangko Sentral ng Pilipinas (BSP). This sustained inflow of foreign currency supports consumer spending, which in turn benefits Ayala's retail and property development segments, such as Ayala Land.

- Remittance Growth: OFW remittances have shown consistent year-on-year growth, averaging around 4-5% annually in recent years leading up to 2024.

- Peso Volatility: The Philippine Peso experienced fluctuations in 2024, trading within a range of approximately 55-59 PHP to 1 USD, impacting import costs and export competitiveness.

- Consumer Spending Impact: The strong remittance inflows directly fuel consumer demand, providing a stable customer base for Ayala's diverse businesses, from telecommunications (Globe) to banking (BPI).

The Philippine economy is projected for steady growth, with a GDP forecast of 5.6% for 2024. This expansion is underpinned by strong domestic demand and increased government infrastructure spending, creating a favorable environment for Ayala Corporation's varied business interests.

Inflationary pressures and interest rate policies by the Bangko Sentral ng Pilipinas significantly influence Ayala. The policy rate remained at 6.50% as of May 2024, reflecting a cautious approach to managing inflation. Higher borrowing costs directly impact BPI's lending activities and increase capital expenses for Ayala's development projects.

A growing middle class, representing about 40% of the population, is a key driver of consumption. This demographic's increasing affluence directly benefits Ayala's retail, telecommunications, and real estate segments.

Remittances from Overseas Filipino Workers (OFWs) are a crucial economic stabilizer, reaching an estimated $33.5 billion in 2023. These inflows bolster consumer spending, supporting Ayala's revenue streams across multiple industries.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projection) | Impact on Ayala Corp. |

|---|---|---|---|

| GDP Growth | 7.6% | 5.6% | Supports overall business expansion and consumer spending. |

| Inflation Rate (Average) | 5.6% | 4.0% - 4.5% | Lower inflation can boost consumer purchasing power and reduce operating costs. |

| Policy Rate (BSP) | 6.50% (as of May 2024) | Expected to remain stable or slightly decrease later in the year. | Affects borrowing costs for BPI and capital expenditures for subsidiaries. |

| OFW Remittances | ~$33.5 billion | Projected to grow by 3-4% | Drives consumer demand, benefiting retail and property sectors. |

Preview the Actual Deliverable

Ayala Corp PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ayala Corporation delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. You'll gain actionable insights into the strategic landscape of one of the Philippines' largest conglomerates.

Sociological factors

The Philippines continues its rapid urbanization, with the Philippine Statistics Authority projecting that 68.3% of the population will live in urban areas by 2025. This demographic shift fuels demand for well-planned residential, commercial, and recreational spaces, directly benefiting Ayala Land's strategy of developing integrated communities and townships that offer convenience and a high quality of life.

Ayala Land's focus on creating master-planned estates, such as Nuvali and Bonifacio Global City, caters directly to the needs of an increasingly urbanized population seeking self-contained environments. These developments offer a blend of housing, retail, office spaces, and leisure amenities, attracting residents and businesses alike, and are expected to see sustained growth as urban migration continues.

The Philippines' demographic profile, characterized by a young and expanding population, presents a significant advantage for Ayala Corporation. With a median age of approximately 25.7 years as of 2024, this youthful demographic translates into a readily available and dynamic labor force, crucial for industries like manufacturing and services. This also fuels a robust consumer base, driving demand across Ayala's diverse portfolio, including telecommunications, banking, and property development.

This demographic dividend directly supports sustained demand for essential services offered by Ayala's subsidiaries. For instance, Globe Telecom benefits from increasing mobile penetration and data consumption among younger Filipinos, while Bank of the Philippine Islands (BPI) sees growth opportunities in serving the financial needs of a burgeoning young workforce and their families. The constant influx of new consumers ensures a consistent market for new technologies and services.

The Philippines' digital adoption has surged, with internet penetration reaching 77.4% in early 2024, according to DataReportal. This rapid growth fuels a shift in consumer behavior, increasing demand for digital services across various sectors.

This digital shift directly impacts companies like Ayala Corporation. Globe Telecom, for instance, saw its mobile data revenue grow by 10% year-on-year in the first quarter of 2024, driven by increased digital service consumption. Similarly, BPI's digital banking platforms are experiencing significant uptake, reflecting this lifestyle change.

Health and Wellness Consciousness

The increasing emphasis on health and wellness within the Philippines is a significant sociological trend benefiting Ayala Corporation. This shift drives demand for improved healthcare infrastructure and services, directly supporting Ayala's strategic investments in AC Health. For instance, the Philippine healthcare market was valued at approximately USD 25.2 billion in 2023 and is projected to grow, reflecting this heightened consciousness.

This growing awareness translates into a greater appetite for quality healthcare facilities, advanced medical services, and accessible pharmaceutical products. Ayala's commitment to providing essential services aligns perfectly with these evolving consumer needs. The company's expansion in this sector is well-timed, as Filipinos are increasingly prioritizing preventative care and seeking better health outcomes.

- Increased demand for private healthcare services: Filipinos are showing a greater willingness to spend on private healthcare, seeking more personalized and efficient medical attention.

- Growth in the pharmaceutical sector: The market for medicines and health supplements is expanding as people become more proactive about their well-being.

- Focus on preventative health: There's a noticeable trend towards regular health check-ups and wellness programs, creating opportunities for diagnostic services and health management solutions.

- Digital health adoption: The pandemic accelerated the acceptance of telemedicine and digital health platforms, an area where Ayala can further innovate.

Social Equity and Inclusivity Initiatives

Ayala Corporation actively champions social equity and inclusivity, a commitment woven into its operational fabric and community outreach as detailed in its sustainability reporting. This focus translates into a people-first culture, emphasizing diversity, equity, and inclusion across its various business units.

These initiatives are not merely philanthropic; they directly bolster Ayala's brand reputation, making it more attractive to a growing segment of socially conscious consumers and top-tier talent. For instance, in 2023, Ayala Land reported that 40% of its new hires were women, reflecting a conscious effort to improve gender diversity within its workforce.

Ayala's dedication to these principles can lead to stronger stakeholder relationships and a more resilient business model, particularly in diverse markets. The corporation’s commitment is further evidenced by its ongoing partnerships with NGOs, aiming to uplift marginalized communities. In 2024, the Ayala Foundation launched a new program focused on digital literacy for underserved youth, expecting to reach over 10,000 students by year-end.

- People-First Culture: Ayala prioritizes employee well-being and development, fostering an inclusive environment.

- Diversity & Inclusion: Initiatives aim to increase representation across gender, age, and background.

- Community Engagement: Programs focus on social equity, education, and livelihood for underserved sectors.

- Brand Reputation: A strong social equity stance enhances brand loyalty and attracts talent.

Ayala Corporation's deep understanding of the Philippine demographic landscape, particularly its young and growing population, is a significant sociological advantage. This youthful demographic, with a median age around 25.7 years in 2024, fuels a dynamic labor force and a robust consumer base, driving demand across Ayala's diverse business segments like telecommunications and banking.

The increasing urbanization trend, with projections showing 68.3% of Filipinos living in urban areas by 2025, directly benefits Ayala Land's strategy of developing integrated communities. This shift creates sustained demand for well-planned residential, commercial, and recreational spaces, supporting the growth of its master-planned estates.

A growing emphasis on health and wellness is also a key sociological factor, boosting demand for healthcare services and products. Ayala's investment in AC Health is well-positioned to capitalize on this trend, as the Philippine healthcare market was valued at approximately USD 25.2 billion in 2023.

Ayala's commitment to social equity and inclusivity strengthens its brand reputation and stakeholder relationships. In 2023, Ayala Land reported 40% of its new hires were women, underscoring its focus on diversity and inclusion.

Technological factors

Ayala Corporation is deeply invested in digital transformation, utilizing AI and data analytics to drive innovation across its businesses. This strategic focus aims to boost operational efficiency and create novel offerings in sectors like banking, telecommunications, and real estate.

For instance, Globe Telecom, an Ayala subsidiary, reported a 7% increase in mobile data revenue in Q1 2024, driven by digital services and network upgrades. This highlights the tangible impact of their technological investments.

Bank of the Philippine Islands (BPI) is also enhancing its digital capabilities, with digital transactions accounting for over 70% of total transactions in 2023. This digital shift is crucial for meeting evolving customer expectations and maintaining a competitive edge.

Telecommunications infrastructure advancement is a cornerstone for Ayala Corporation's subsidiary, Globe Telecom. The ongoing deployment of 5G technology and the expansion of fiber optic networks are critical for delivering faster speeds and enhanced connectivity, directly impacting Globe's service offerings and market competitiveness.

Globe Telecom is actively investing in energy-efficient network strategies and AI/ML-driven energy management systems to optimize operational costs and meet sustainability targets. These modernization efforts, including upgrading hardware, are essential for maintaining robust network performance while addressing environmental concerns. For instance, Globe's commitment to building a more sustainable network saw them achieve a 14% reduction in Scope 1 and 2 emissions in 2023 compared to their 2019 baseline.

The financial technology (Fintech) and digital banking landscape is rapidly transforming how financial services are delivered, directly impacting Bank of the Philippine Islands (BPI). Ayala Corporation's strategic investments in this area, particularly through its stake in Mynt, the operator of GCash, underscore a commitment to harnessing these technological shifts. GCash, as of early 2024, boasts over 50 million registered users, showcasing the significant reach and adoption of digital payment solutions in the Philippines.

Smart City and PropTech Integration

Ayala Land is actively incorporating smart city and PropTech solutions into its real estate projects, aiming to create more efficient and appealing living and working spaces. This strategic move reflects a broader industry trend towards technologically advanced urban development.

These integrations encompass smart infrastructure, advanced energy management systems, and digital platforms designed for streamlined property management. This focus on technology is crucial for meeting the evolving demands of urban dwellers and businesses.

For instance, Ayala Land's Vertis North development in Quezon City showcases these principles, featuring integrated building management systems and smart amenities. The company's commitment to PropTech is evident in its ongoing investments, with a significant portion of its capital expenditures allocated to digital transformation and innovation in its developments.

- Smart Infrastructure: Ayala Land is investing in connected infrastructure, such as smart grids and intelligent transportation systems within its townships.

- PropTech Solutions: The company utilizes digital platforms for property management, tenant engagement, and smart home features in residential and commercial properties.

- Energy Management: Integration of energy-efficient technologies and smart metering helps reduce operational costs and environmental impact, a key focus for sustainability initiatives.

- Digital Transformation: Ayala Land's digital transformation efforts, including PropTech adoption, are projected to enhance customer experience and operational efficiency across its portfolio.

Cybersecurity and Data Privacy

Ayala Corporation's increasing reliance on digital platforms necessitates robust cybersecurity. The company's subsidiaries, like BPI and Globe Telecom, handle vast amounts of sensitive customer data, making them prime targets for cyber threats. Failure to protect this information can lead to significant financial losses and reputational damage. In 2023, the global cost of cybercrime was estimated to reach $10.5 trillion annually by 2025, highlighting the escalating risks.

Adherence to data privacy regulations is also paramount. Ayala Corporation must navigate evolving legal frameworks such as the Data Privacy Act of 2012 in the Philippines and similar international standards. Compliance ensures customer trust and avoids hefty penalties. For instance, the European Union's GDPR has set a precedent for stringent data protection, with fines reaching up to 4% of annual global turnover.

- Cybersecurity Investment: Ayala Corp must continue to invest in advanced cybersecurity technologies and talent to defend against sophisticated threats.

- Data Privacy Compliance: Strict adherence to data privacy laws is crucial for maintaining customer trust and avoiding legal repercussions.

- Digital Infrastructure Security: Ensuring the integrity and security of all digital platforms and data storage is vital for operational continuity.

- Incident Response Planning: Developing and regularly testing comprehensive incident response plans is essential for mitigating the impact of potential breaches.

Ayala Corporation's technological strategy centers on digital transformation, leveraging AI and data analytics across its diverse business units. This focus is evident in Globe Telecom's Q1 2024 mobile data revenue growth of 7%, driven by digital services and network enhancements.

BPI's digital push is significant, with digital transactions comprising over 70% of its total in 2023, reflecting a strong adoption of digital banking solutions.

Globe Telecom's investment in 5G and fiber optic expansion is crucial for its competitive edge, while its commitment to sustainability led to a 14% reduction in Scope 1 and 2 emissions in 2023.

Ayala Land integrates PropTech and smart city solutions, exemplified by its Vertis North development, enhancing property management and tenant experience.

The company’s digital reliance necessitates robust cybersecurity, especially given the global cost of cybercrime, projected to reach $10.5 trillion annually by 2025, and the need for strict adherence to data privacy laws.

Legal factors

The telecommunications sector in the Philippines operates under a stringent regulatory framework managed by the National Telecommunications Commission (NTC). This oversight directly impacts Globe Telecom's operations, covering crucial areas like spectrum allocation, licensing, and interconnection policies. For instance, the NTC's decisions on spectrum availability and pricing significantly influence the company's ability to expand its network capacity and service offerings, a critical factor in the highly competitive Philippine market.

Consumer protection regulations, also enforced by the NTC, shape how Globe Telecom interacts with its customer base. These rules address issues such as service quality, billing transparency, and data privacy, ensuring fair practices and building customer trust. Compliance with these mandates is essential for maintaining operational licenses and a positive brand reputation, especially as the digital economy grows and consumer expectations rise.

In 2024, the NTC continued to refine policies aimed at fostering greater competition and improving service quality. This includes ongoing efforts to manage spectrum efficiently and encourage new entrants, which can pressure existing players like Globe Telecom to innovate and invest further in their infrastructure. The regulatory environment thus plays a pivotal role in shaping the strategic landscape for telecommunications companies in the Philippines.

Ayala Corporation and its key subsidiaries, including Bank of the Philippine Islands (BPI) and Globe Telecom, are bound by the Data Privacy Act of 2012 (Republic Act No. 10173). This legislation mandates stringent protection of personal data collected from customers.

Compliance involves implementing advanced security protocols and adhering to directives from the National Privacy Commission (NPC). Failure to comply can result in significant penalties, impacting both financial performance and public trust. For instance, BPI, as a major financial institution, handles vast amounts of sensitive customer information, making robust data privacy measures critical to its operations and reputation.

Ayala Land's extensive real estate development operations are intrinsically linked to a complex web of legal frameworks, encompassing land use and zoning ordinances, stringent building codes, and comprehensive environmental regulations. Navigating these requirements is paramount for securing necessary permits, facilitating project execution, and ultimately guaranteeing the legal standing and long-term sustainability of its integrated communities. For instance, in 2023, the Philippines saw continued focus on sustainable building practices, with the Department of Environment and Natural Resources (DENR) reinforcing compliance measures for environmental impact assessments, a critical step for large-scale developments like those undertaken by Ayala Land.

Competition Laws and Anti-Trust Regulations

The Philippine Competition Act (Republic Act No. 10667) plays a crucial role in shaping Ayala Corporation's operational landscape by mandating fair competition across all its diverse business segments. This legislation is particularly significant for its major subsidiaries, such as Globe Telecom and Bank of the Philippine Islands (BPI), by prohibiting anti-competitive behaviors.

Ayala Corporation must ensure its subsidiaries, especially those with substantial market share, adhere strictly to regulations preventing practices like cartelization or predatory pricing. For instance, Globe Telecom, as a leading telecommunications provider, is subject to scrutiny to prevent monopolistic tendencies and ensure equitable access to services for consumers and smaller competitors.

- Market Share Scrutiny: Ayala's dominant subsidiaries, like Globe Telecom, face ongoing review by the Philippine Competition Commission (PCC) to prevent market abuse.

- Merger & Acquisition Oversight: Any future mergers or acquisitions undertaken by Ayala Corporation's units require PCC approval to ensure they do not substantially lessen competition in relevant markets.

- Compliance Burden: Adherence to the Competition Act necessitates robust internal compliance programs across all Ayala business units to avoid penalties and maintain market integrity.

Labor Laws and Employment Regulations

Ayala Corporation, a major employer in the Philippines, navigates a complex landscape of labor laws and employment regulations. Compliance with these statutes, which govern everything from minimum wage to mandated employee benefits, is fundamental to its operations. For instance, the Philippine government, through the Department of Labor and Employment (DOLE), actively enforces regulations like the Labor Code of the Philippines, ensuring fair treatment and safe working conditions for all employees across industries.

Adherence to these legal frameworks directly impacts Ayala Corporation's ability to maintain a productive and motivated workforce, while also influencing its operational expenses. For example, the mandated 13th-month pay, a legal requirement for most employers in the Philippines, represents a significant portion of employee compensation. Furthermore, evolving regulations around contractual employment and the rights of gig workers, which are becoming increasingly relevant, require continuous adaptation.

- Wage and Hour Laws: Ensuring compliance with minimum wage rates, overtime pay, and statutory holiday pay as stipulated by Philippine labor laws.

- Employee Benefits: Adhering to mandatory benefits such as Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-IBIG) contributions, alongside legally mandated leave entitlements.

- Workplace Safety and Health: Implementing and maintaining safe working environments in accordance with the Occupational Safety and Health Standards (OSHS).

- Termination and Dismissal Procedures: Following due process requirements for employee separation, including just and authorized causes for termination.

Ayala Corporation's operations, particularly in telecommunications via Globe Telecom and finance through BPI, are heavily influenced by the Philippine Competition Act. This law mandates fair competition, prohibiting monopolistic practices and requiring oversight for mergers and acquisitions by the Philippine Competition Commission (PCC). For instance, Globe Telecom's market share necessitates continuous adherence to regulations preventing anti-competitive behavior.

The Data Privacy Act of 2012 is another critical legal factor, obligating Ayala Corporation and its subsidiaries to protect customer data, with the National Privacy Commission (NPC) overseeing compliance. BPI's handling of sensitive financial information underscores the importance of robust data security measures to avoid penalties and maintain trust.

Ayala Land's real estate ventures are governed by land use, zoning, building codes, and environmental regulations, requiring adherence to standards like environmental impact assessments. In 2023, there was a continued emphasis on sustainable building practices, impacting project approvals and operational sustainability.

Labor laws, including minimum wage, benefits, and workplace safety standards enforced by the Department of Labor and Employment (DOLE), are fundamental to Ayala Corporation's employment practices. Compliance with mandates like the 13th-month pay and evolving regulations for gig workers directly affects operational costs and workforce management.

Environmental factors

Ayala Corporation and its subsidiaries, like Ayala Land and Globe Telecom, are making significant strides towards their Net Zero emissions target by 2050. This commitment translates into substantial investments in renewable energy sources and the implementation of energy-efficient practices across their diverse operations.

These efforts are crucial for reducing greenhouse gas emissions throughout their business portfolios. For instance, Ayala Land has been actively developing green buildings and sustainable communities, while Globe Telecom is investing in more energy-efficient network infrastructure.

Ayala Land is actively pursuing resource efficiency and robust waste management across its projects. These initiatives include significant efforts to divert waste away from landfills, demonstrating a commitment to environmental stewardship. For instance, in 2023, Ayala Land reported a waste diversion rate of 61% across its commercial properties, a notable increase from the previous year.

The company is also exploring innovative pilot programs focused on managing challenging waste streams like plastics and food waste. This forward-thinking approach is integral to achieving Ayala Land's ambitious sustainability targets and reinforcing its reputation for responsible business operations within the Philippine real estate sector.

Ayala Corporation, primarily through its energy subsidiary ACEN, is making significant strides in the renewable energy transition. ACEN's portfolio, which includes solar, wind, and geothermal power, is crucial to the Philippines' energy goals. By the end of 2024, ACEN aimed to have 5,000 MW of attributable capacity, with a substantial portion coming from renewables.

Beyond ACEN, Ayala Land is integrating renewable energy into its developments, powering commercial properties and communities with cleaner sources. Similarly, Globe Telecom is deploying solar-powered cell sites across its network, reducing its carbon footprint. These initiatives align with the Philippine government's target to increase the share of renewable energy in the power generation mix to 35% by 2030.

Water Management and Conservation

Given the Philippines' tropical climate, characterized by distinct wet and dry seasons, effective water management and conservation are paramount for Ayala Corporation's diverse operations, especially within its extensive real estate developments and burgeoning integrated communities. The company's commitment to sustainable water practices directly impacts its long-term operational resilience and the overall well-being of the communities it serves.

Ayala Land, a key subsidiary, reported in its 2023 sustainability report that it implemented various water-saving initiatives across its projects, including rainwater harvesting systems and greywater recycling, contributing to a 5% reduction in potable water consumption compared to the previous year. These efforts are crucial as the Philippines faces increasing water stress, with projections indicating a significant deficit by 2030 if current consumption patterns persist.

- Water Scarcity Concerns: The Philippines is projected to face a significant water deficit by 2030, making efficient water use a critical operational factor for businesses like Ayala Corp.

- Ayala Land's Initiatives: Ayala Land has actively pursued water conservation, with projects like Parklinks and Arca South incorporating advanced water management systems, including rainwater harvesting and greywater recycling.

- Community Impact: Sustainable water management in residential and commercial developments ensures reliable water supply for residents and businesses, fostering long-term community stability and minimizing environmental impact.

- Regulatory Environment: Evolving environmental regulations in the Philippines regarding water usage and wastewater discharge necessitate continuous adaptation and investment in water-efficient technologies by companies like Ayala.

Biodiversity and Ecosystem Protection

Ayala Land, a key subsidiary of Ayala Corporation, actively integrates biodiversity and ecosystem protection into its master planning for large-scale developments. This commitment is crucial for minimizing ecological impact and fostering sustainable growth across its integrated communities.

Responsible land use and thorough environmental impact assessments are fundamental to Ayala Land's approach. These practices ensure that development activities are conducted with a keen awareness of their potential effects on local ecosystems, aiming to preserve natural habitats and biodiversity.

For instance, in 2023, Ayala Land reported a significant portion of its land bank dedicated to green and open spaces, reflecting its strategy to balance development with environmental stewardship. The company continues to invest in programs that support biodiversity conservation within and around its projects, aligning with national and international environmental goals.

- Biodiversity Integration: Ayala Land's master-planned communities incorporate significant green and open spaces, a strategy that has seen consistent investment and expansion.

- Environmental Impact Assessments: Rigorous EIAs are standard practice, guiding development to mitigate negative ecological footprints and protect sensitive habitats.

- Sustainable Development Focus: The company's approach prioritizes long-term ecological health, aiming to create developments that are both economically viable and environmentally responsible.

- Conservation Initiatives: Ayala Land actively engages in biodiversity conservation programs, contributing to the protection of local flora and fauna within its project areas.

Ayala Corporation and its subsidiaries are actively addressing environmental concerns, particularly in relation to climate change and resource management. Their commitment to Net Zero emissions by 2050 is driving investments in renewable energy, with ACEN targeting 5,000 MW of attributable capacity by the end of 2024, a significant portion from renewables.

Water scarcity is a critical environmental factor, with the Philippines projected to face a deficit by 2030. Ayala Land is implementing water-saving initiatives, achieving a 5% reduction in potable water consumption in 2023 through systems like rainwater harvesting and greywater recycling.

Biodiversity protection is integrated into Ayala Land's master planning, with substantial land banks dedicated to green spaces and ongoing investment in conservation programs. Rigorous environmental impact assessments are standard practice to mitigate ecological footprints.

| Environmental Factor | Ayala Corp. Initiatives | Key Data/Targets |

| Climate Change & Emissions | Net Zero by 2050, Renewable Energy Investments | ACEN: 5,000 MW capacity by end-2024 (renewables focus) |

| Water Management | Water Conservation, Rainwater Harvesting, Greywater Recycling | Ayala Land: 5% potable water reduction (2023) |

| Biodiversity & Land Use | Green Spaces, Ecosystem Protection, EIAs | Significant land bank for green/open spaces |

| Waste Management | Waste Diversion, Resource Efficiency | Ayala Land: 61% waste diversion rate (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ayala Corporation is built on a comprehensive review of data from reputable sources, including financial reports from the Philippine Stock Exchange, economic forecasts from the Bangko Sentral ng Pilipinas, and industry-specific market research from firms like Fitch Ratings and Moody's.