Ayala Corp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Ayala Corp navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for any strategic player in their diverse sectors.

The complete report reveals the real forces shaping Ayala Corp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ayala Corporation's diverse operations mean supplier concentration varies significantly. For example, in real estate, a concentrated base of suppliers for specialized construction materials or services can grant them considerable bargaining power. This is particularly true for unique architectural components or advanced building technologies where few providers exist.

Similarly, in the telecommunications sector, Ayala's Globe Telecom faces suppliers of network equipment and sophisticated software who often possess substantial leverage. These companies offer highly specialized, proprietary technology essential for network expansion and maintenance, limiting Globe's options and strengthening the suppliers' negotiating position.

For Ayala Corporation, particularly within its telecommunications arm Globe Telecom, switching costs for suppliers are significant. For instance, integrating new network equipment or software from a different vendor can cost millions of dollars and take months, if not years, to fully implement without disrupting customer service. This substantial investment in specialized hardware and software, along with the training required for personnel, creates a strong incentive for Ayala to maintain long-term relationships with its current suppliers, thereby increasing supplier bargaining power.

Suppliers offering highly specialized technology or proprietary components, particularly in sectors like telecommunications with 5G infrastructure or advanced healthcare equipment, wield significant bargaining power. Ayala Corporation's dependence on such unique offerings can restrict its available choices and underscore the importance of robust supplier partnerships.

Supplier's Ability to Forward Integrate

Suppliers' ability to forward integrate significantly impacts their bargaining power over Ayala Corporation. If a supplier can credibly enter Ayala's existing markets, it creates a direct competitive threat, increasing their leverage. For instance, a major supplier of raw materials to Ayala's real estate development arm might consider developing its own properties, thereby competing directly with Ayala.

This potential for forward integration is a key consideration. Consider the construction sector, where suppliers of cement, steel, or prefabricated components could, in theory, move into property development. Similarly, in Ayala's telecommunications or technology ventures, a software provider or IT infrastructure company could potentially offer integrated services, bypassing Ayala's offerings. In 2023, the construction materials sector saw significant consolidation, with some larger players exploring diversification into related services, a trend that could continue and influence supplier power.

- Supplier Threat: If suppliers can backward integrate, they gain leverage.

- Example Scenario: A construction supplier developing real estate directly challenges Ayala.

- Industry Impact: Technology suppliers offering direct financial services threaten Ayala's fintech arms.

- Market Trend: Consolidation in supplier industries can empower remaining players with integration capabilities.

Importance of Ayala Corp to Suppliers

Ayala Corporation's substantial scale of operations across diverse sectors like telecommunications, banking, and infrastructure positions it as a critical buyer for numerous suppliers in the Philippines. This significant purchasing power can limit the bargaining leverage of individual suppliers, as their reliance on Ayala's business often outweighs Ayala's dependence on any single supplier.

For instance, Ayala's 2023 consolidated revenues reached PHP 449.7 billion, underscoring the sheer volume of goods and services it procures. This large market footprint means that a supplier's revenue could be significantly impacted if they were to lose Ayala as a client, thereby fostering a more balanced negotiation environment.

The company's strategic partnerships and long-term contracts further solidify its position. Ayala's commitment to reliable supply chains, often through preferred supplier agreements, can also incentivize suppliers to offer competitive pricing and favorable terms. This dynamic reduces the bargaining power of suppliers, as they are often motivated to maintain a strong relationship with a key customer like Ayala.

- Significant Customer Base: Ayala Corp's vast operational scale makes it a primary customer for many businesses.

- Revenue Dependence: Suppliers often rely heavily on Ayala's business, diminishing their negotiation leverage.

- Market Influence: Ayala's substantial market presence in the Philippines influences supplier pricing and terms.

Ayala Corporation's substantial purchasing volume, demonstrated by its 2023 consolidated revenues of PHP 449.7 billion, significantly curbs supplier bargaining power. This scale makes Ayala a crucial client for many, reducing suppliers' ability to dictate terms due to their reliance on Ayala's business.

The company's strategic supplier relationships and long-term contracts further enhance its negotiating position, encouraging competitive pricing and favorable terms. This customer-supplier dynamic often results in a more balanced negotiation environment, limiting the leverage of individual suppliers.

| Ayala Corp. Financial Metric (2023) | Value (PHP) | Implication for Supplier Bargaining Power |

|---|---|---|

| Consolidated Revenues | 449.7 billion | Indicates significant purchasing volume, reducing supplier leverage. |

| Key Operating Segments | Real Estate, Telecommunications, Banking, Water, Energy, etc. | Diversified procurement needs, potentially limiting supplier concentration in any single area. |

What is included in the product

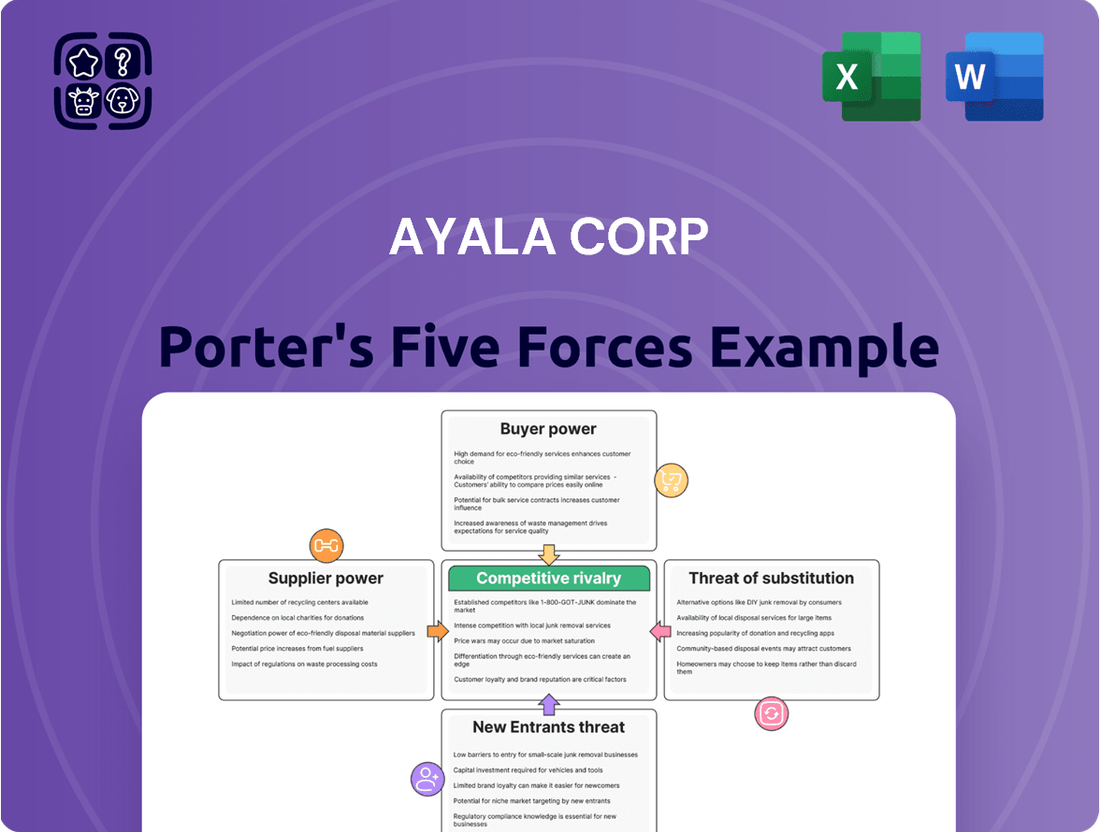

This Porter's Five Forces analysis for Ayala Corp dissects the competitive intensity within its diverse business segments, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitutes and rival firms.

Instantly identify and address competitive threats with a dynamic Porter's Five Forces analysis, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Ayala Corporation's customer base is incredibly varied, encompassing individual homebuyers, bank clients, and large enterprises relying on its telecommunications services. This diversity means the bargaining power of these customer groups is not uniform.

Individual customers, like retail banking clients or those purchasing residential properties, generally possess limited bargaining power. Their influence is often diffused across a vast customer base, making it difficult to negotiate significant concessions.

Conversely, large corporate clients, particularly those utilizing Ayala's telecommunications or infrastructure services, can wield substantial bargaining power. These entities often have the scale to negotiate customized service agreements and potentially more favorable pricing, as seen with major enterprise clients of Globe Telecom.

Customers in Ayala Corporation's diverse portfolio often have a good number of choices. For instance, in the real estate sector, buyers can pick from numerous developers, each offering different projects and price points. This abundance of options naturally gives customers more leverage when making purchasing decisions.

Similarly, the banking industry presents a competitive landscape where customers can easily switch between institutions. Multiple banks provide comparable financial products and services, meaning customers aren't tied to a single provider and can seek better deals or customer service elsewhere.

In telecommunications, Ayala's Globe Telecom faces stiff competition from major players like PLDT and DITO Telecommunity. This intense rivalry means customers have a clear choice between providers offering similar mobile and broadband services. As of early 2024, the Philippine telecommunications market is characterized by aggressive pricing and service upgrades, further empowering consumers with greater bargaining power.

Ayala Corporation's customers exhibit varying degrees of price sensitivity. In sectors like telecommunications, where competition is fierce, customers are highly attuned to pricing, forcing Ayala to implement competitive pricing strategies and promotional offers to retain market share.

Conversely, in segments such as premium real estate or specialized financial services, customer price sensitivity tends to be lower. Here, buyers often prioritize factors like quality, brand reputation, and exclusivity over minor price differences, allowing Ayala to command higher margins.

For instance, in the telecommunications market, Globe Telecom, a key Ayala subsidiary, faces intense competition, necessitating aggressive data plan pricing. In 2023, the average revenue per user (ARPU) for mobile services remained a critical metric, with industry players constantly adjusting their offers to attract and retain subscribers.

Customer Information and Transparency

Customers today possess unprecedented access to information, significantly bolstering their bargaining power across Ayala Corporation's diverse business units. The internet and readily available comparison platforms allow consumers to easily research and contrast prices, product features, and customer reviews for everything from real estate to financial services and telecommunications. This transparency directly impacts Ayala's ability to dictate terms.

For instance, in the real estate sector, potential buyers can meticulously compare property listings, financing options, and developer reputations, forcing Ayala Land to be more competitive with pricing and offerings. Similarly, Bank of the Philippine Islands (BPI) customers can readily compare interest rates, fees, and service quality with other financial institutions, enhancing their leverage. Globe Telecom customers also benefit from this information asymmetry reversal, easily switching providers based on competitive plans and service performance. In 2023, digital channels accounted for a significant portion of customer interactions across Ayala's businesses, highlighting the pervasive influence of online information.

- Informed Consumers: Increased internet penetration and the proliferation of online review sites empower customers to make more informed purchasing decisions.

- Price Sensitivity: Customers can easily compare prices across different providers, leading to greater price sensitivity and reduced loyalty if better deals are available elsewhere.

- Demand for Value: This transparency drives demand for better value, forcing companies like Ayala to continuously innovate and offer competitive pricing and superior service to retain customers.

- Digital Comparison Tools: The widespread use of comparison websites and apps for banking, telco, and real estate services directly amplifies customer bargaining power.

Low Switching Costs for Customers

The bargaining power of customers is significantly influenced by low switching costs, a key factor for Ayala Corporation. In many of Ayala's operating sectors, customers can easily move to a competitor without incurring substantial expenses or effort. For example, changing mobile network providers is often a simple process, especially with initiatives like mobile number portability.

This ease of transition directly empowers customers, forcing companies like Ayala to compete more aggressively on price, service quality, and innovation to retain their user base. In 2023, the telecommunications sector, a major Ayala subsidiary, saw continued intense competition with aggressive data plan offerings, reflecting this customer leverage.

- Low Switching Costs: Customers can readily switch between service providers in sectors like telecommunications and banking.

- Mobile Number Portability: This feature significantly reduces barriers for mobile subscribers to change networks.

- Increased Customer Leverage: The ease of switching grants customers more power to demand better terms and pricing.

- Competitive Pressure on Ayala: Ayala must continuously enhance its offerings to prevent customer attrition.

Ayala Corporation's customers, particularly in sectors like telecommunications and banking, possess significant bargaining power due to high competition and low switching costs. The widespread availability of information online allows consumers to easily compare prices and services, forcing Ayala to offer competitive pricing and superior value to retain its customer base. For instance, Globe Telecom, a major Ayala subsidiary, faces intense rivalry, leading to aggressive data plan pricing and promotions throughout 2023 and into early 2024.

This customer leverage is amplified by digital comparison tools and initiatives like mobile number portability, which reduce the effort and expense of switching providers. In real estate, while premium segments may see lower price sensitivity, the overall market offers numerous alternatives, giving buyers considerable choice. The ability for customers to easily access information and switch providers directly translates into greater demands for better terms and service quality from Ayala's various business units.

| Ayala Corp Business Unit | Key Customer Segment | Bargaining Power Drivers | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Globe Telecom (Telecommunications) | Individual & Corporate Subscribers | High competition, low switching costs, information access | Intense competition led to aggressive data plan pricing; ARPU remained a key metric. |

| Ayala Land (Real Estate) | Homebuyers, Property Investors | Numerous developers, price transparency, brand preference | Buyers compare listings and financing; competitive pricing strategies employed. |

| Bank of the Philippine Islands (BPI) (Banking) | Retail & Corporate Clients | Multiple banking options, interest rate transparency, service quality | Customers easily compare fees and services; digital channels for interaction grew. |

Same Document Delivered

Ayala Corp Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Ayala Corporation's competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within its diverse industries. This comprehensive breakdown equips you with a clear understanding of the strategic forces shaping Ayala's market positions.

Rivalry Among Competitors

Ayala Corporation operates in highly competitive sectors. Its real estate arm, Ayala Land, faces formidable rivals like SM Prime Holdings and Robinsons Land Corporation, both significant players with extensive project pipelines and market share.

In the banking industry, Bank of the Philippine Islands (BPI) competes fiercely with other major Philippine banks such as BDO Unibank and Metrobank, as well as international financial institutions operating locally, all vying for deposits and lending opportunities.

Globe Telecom, a key subsidiary, is engaged in a concentrated market with PLDT and DITO Telecommunity. This telecom landscape is characterized by aggressive pricing strategies and substantial investments in network infrastructure, as evidenced by the ongoing 5G network buildouts and subscriber acquisition efforts throughout 2024.

Ayala Corporation operates across diverse sectors, each with its own growth trajectory, which significantly shapes competitive rivalry. For instance, the Philippine real estate sector has shown robust growth, with the Philippine economy projected to expand by 5.8% in 2024 according to the World Bank. This expansion can temper direct competition as the market size increases, allowing multiple players to gain share.

However, in more mature segments within banking or telecommunications, where growth rates might be slower, competition for market share can become more intense. Ayala's banking arm, BPI, for example, reported a net income of PHP 49.4 billion in 2023, reflecting a healthy but mature industry.

The presence of rapid growth in specific industries, such as renewable energy where Ayala is investing, can attract new entrants and potentially increase rivalry. Yet, the overall expansion of the market often absorbs this new competition, creating opportunities rather than solely intensifying existing pressures.

Ayala Corporation actively pursues product differentiation across its diverse business segments. Ayala Land, for instance, focuses on creating integrated communities, offering a unique value proposition beyond mere housing. In banking and telecommunications, BPI and Globe leverage their strong brand reputations, built over decades, to foster customer trust and loyalty. This differentiation aims to carve out distinct market positions and reduce direct price competition.

While strong brand loyalty, particularly evident in BPI's substantial deposit base and Globe's extensive subscriber network, can act as a buffer against intense rivalry, it's not an insurmountable shield. For example, BPI reported a net income of PHP 49.4 billion in 2023, showcasing its financial strength, yet the banking sector remains highly competitive with digital banks and other established players introducing innovative products and aggressive pricing strategies. Similarly, Globe Telecom, which saw its net income reach PHP 18.8 billion in 2023, constantly faces pressure from rivals launching new data plans and services, requiring continuous investment in network upgrades and marketing to maintain its market share.

Exit Barriers

Ayala Corporation operates in sectors with substantial exit barriers, such as telecommunications and real estate development. These industries often involve massive investments in fixed assets, specialized infrastructure, and complex regulatory environments, making it difficult and costly for companies to leave. For instance, Globe Telecom, a key Ayala subsidiary, requires continuous, significant capital expenditure for network upgrades and expansion, creating a high hurdle for exiting the market.

These high exit barriers mean that companies are often compelled to remain in the market even when facing profitability challenges. This can result in prolonged periods of intense competition as firms fight for market share rather than withdrawing. In 2023, the Philippine telecommunications sector saw continued aggressive pricing strategies, partly driven by the need for established players like Globe to maintain subscriber bases despite high operational costs.

The implications for competitive rivalry are significant. Companies are incentivized to compete fiercely to survive and thrive, rather than seek an exit. This dynamic can lead to consolidation or strategic alliances as companies seek to optimize their positions within these high-barrier industries. The real estate sector, another core Ayala business, also exhibits high exit barriers due to land acquisition costs and long development cycles, further reinforcing competitive pressures.

- High Fixed Asset Investment: Industries like telecommunications demand continuous capital outlays for infrastructure, making divestment challenging.

- Specialized Infrastructure: Unique and costly infrastructure required in sectors such as utilities and property development creates significant exit costs.

- Regulatory Complexities: Navigating permits, licenses, and compliance in regulated industries like telecommunications can be a substantial barrier to exiting.

- Brand Reputation and Customer Loyalty: Established brands in sectors like banking (e.g., Bank of the Philippine Islands, an Ayala affiliate) have built customer loyalty that is difficult to replicate, discouraging new entrants but also making it hard for incumbents to divest without significant loss.

Strategic Stakes and Aggressiveness of Competitors

Ayala Corporation faces intense rivalry from other large, well-capitalized conglomerates in the Philippines. These competitors, much like Ayala, possess significant financial resources and strategic foresight, leading to aggressive market plays. For instance, in the telecommunications sector, Globe Telecom, a major competitor, has been actively investing in network upgrades and expanding its fiber broadband services, mirroring Ayala's own strategic investments through Globe Telecom.

The competitive landscape is further sharpened by competitors' ambitious expansion plans and substantial investments in new technologies. This pursuit of market dominance creates a dynamic environment where all major players, including Ayala's various business units, are constantly pressured to innovate and adapt. For example, in the real estate sector, competitors like SM Prime Holdings have also demonstrated aggressive development strategies, launching new mixed-use projects and expanding their retail footprint, directly challenging Ayala Land's market position.

The strategic stakes are high for all involved, as market share gains can translate into significant long-term profitability. Competitors are not shy about deploying capital to secure leadership positions, whether through organic growth or strategic acquisitions. This dynamic is evident in the energy sector, where competitors are also channeling significant investments into renewable energy projects, aligning with the broader industry shift and creating a competitive race for sustainable energy dominance.

- Aggressive Investment: Competitors are channeling substantial capital into technology and infrastructure, such as SM Prime's continued expansion of its mall and residential developments.

- Market Dominance Pursuit: Companies like Globe Telecom are investing heavily in 5G deployment, directly competing with Ayala's own advancements in telecommunications.

- Sector-Wide Competition: Rivalry extends across all of Ayala's key sectors, including banking (BPI vs. competitors like BDO), real estate (Ayala Land vs. SM Prime), and utilities (Manila Water vs. Maynilad).

- Strategic Ambitions: Competitors, like those in the renewable energy space, are making significant strategic moves to capture market share in emerging growth areas.

Ayala Corporation operates in highly competitive sectors, facing strong rivals in real estate, banking, and telecommunications. For instance, Ayala Land competes with SM Prime Holdings and Robinsons Land, while BPI faces off against BDO Unibank and Metrobank. Globe Telecom's rivalry with PLDT and DITO Telecommunity is intensified by ongoing 5G network investments and subscriber acquisition efforts throughout 2024.

The intensity of competition is influenced by market growth and the nature of the industry. While a growing Philippine economy, projected at 5.8% expansion in 2024 by the World Bank, can temper rivalry by increasing market size, mature sectors like banking, where BPI reported PHP 49.4 billion in net income in 2023, can see more aggressive competition for market share.

Ayala's strategy of product differentiation, seen in Ayala Land's integrated communities and BPI and Globe's strong brand reputations, aims to mitigate direct price wars. However, even strong brand loyalty, as reflected in BPI's substantial deposit base and Globe's extensive subscriber network, faces challenges from innovative products and aggressive pricing from competitors.

| Ayala Subsidiary | Key Competitors | 2023 Net Income (PHP Billions) | Competitive Factor |

|---|---|---|---|

| Ayala Land | SM Prime Holdings, Robinsons Land | N/A (Segmental Data) | Integrated communities vs. extensive project pipelines |

| BPI | BDO Unibank, Metrobank | 49.4 | Brand trust vs. digital innovation and pricing |

| Globe Telecom | PLDT, DITO Telecommunity | 18.8 | 5G network buildouts and subscriber acquisition |

SSubstitutes Threaten

The threat of substitutes for Ayala Corporation is significant, as customers can often find alternative ways to meet their needs. For instance, in the real estate sector, while Ayala Land offers formal housing, informal housing solutions and self-build options represent viable substitutes, particularly for budget-conscious consumers.

In the banking and financial services segment, Ayala's Bank of the Philippine Islands (BPI) faces competition from fintech companies and digital payment platforms. These alternatives are increasingly popular for their convenience and lower transaction costs, potentially drawing customers away from traditional banking services.

For example, the growth of mobile wallet usage in the Philippines is a clear indicator of this trend. In 2023, transaction volume for e-wallets reached PHP 1.7 trillion, a substantial increase from previous years, highlighting the increasing acceptance and adoption of these substitute payment methods.

The threat of substitutes for Ayala Corporation's businesses intensifies when these alternatives offer a more attractive price-performance ratio. For instance, in the telecommunications sector where Globe Telecom operates, over-the-top (OTT) communication applications such as WhatsApp and Telegram provide a cost-effective way for users to communicate, directly impacting traditional voice and SMS revenue streams. As of early 2024, the global mobile messaging market is projected to continue its growth, indicating sustained pressure from these digital alternatives.

Customer willingness to switch to alternatives for Ayala Corporation's offerings, such as those in telecommunications or banking, is influenced by convenience, cost savings, and the perceived value of those alternatives. For example, the increasing adoption of digital banking and mobile payment platforms, driven by their user-friendliness and often lower transaction costs compared to traditional methods, highlights this trend.

In 2024, the Philippine digital payments market saw significant growth, with transaction volumes expected to rise substantially, indicating a growing customer propensity to substitute traditional financial services with more accessible digital options. This shift directly impacts Ayala's financial services arm, Bank of the Philippine Islands (BPI), and its telecommunications subsidiary, Globe Telecom, by presenting readily available and often cheaper alternatives.

Technological Advancements Enabling Substitutes

Rapid technological advancements are continuously creating new and more effective substitutes for existing products and services. This dynamic landscape means that what is a dominant offering today could be easily replaced tomorrow. For instance, in the healthcare sector, telemedicine platforms are increasingly substituting traditional in-person clinic visits, offering convenience and accessibility.

In the energy sector, the rise of decentralized renewable energy solutions, such as rooftop solar and battery storage, presents a significant long-term threat to traditional grid-supplied power. Ayala Corporation, with its substantial investments in energy infrastructure through ACEN Corporation, faces the potential for these distributed systems to erode demand for centralized power generation. By 2024, global renewable energy capacity additions continued to surge, with solar PV leading the charge, underscoring the growing viability of these substitutes.

- Technological Disruption: New technologies consistently emerge, offering alternative ways to meet customer needs, thereby increasing the threat of substitutes.

- Healthcare Substitutes: Telemedicine is a prime example, reducing reliance on physical healthcare facilities and potentially impacting traditional revenue streams.

- Energy Sector Vulnerability: Decentralized renewable energy solutions directly challenge the business model of grid-dependent utilities, a key area for Ayala.

- Market Trends: Global adoption rates for renewables, like solar, are accelerating, indicating a growing acceptance and competitive pressure from substitute technologies.

Regulatory and Social Factors Supporting Substitutes

Government initiatives, such as the Bangko Sentral ng Pilipinas's push for greater digital payments adoption, directly support substitutes for traditional financial services. For instance, the National Retail Payment System (NRPS) aims to increase electronic transactions, making digital wallets and online banking more appealing alternatives.

Consumer preferences are also evolving, with a growing demand for sustainable and digitally-native solutions. This trend is evident in the increasing adoption of renewable energy sources, which act as a substitute for traditional fossil fuel-based power generation. Ayala Corporation's own investments in renewable energy, like ACEN Corporation, highlight this shift.

- Digital Payments Growth: In 2023, the Philippines saw a significant increase in digital transactions, with the volume of e-wallets transactions growing by 30% year-on-year, as reported by the Bangko Sentral ng Pilipinas.

- Renewable Energy Adoption: ACEN Corporation, a subsidiary of Ayala Corporation, reported a 34% increase in attributable net income in 2023, driven by its expanding renewable energy portfolio, signaling strong market acceptance of these substitutes.

- Consumer Preference Shift: Surveys indicate a growing consumer interest in eco-friendly products and services, with a notable percentage expressing willingness to pay a premium for sustainable options, impacting sectors where Ayala operates.

The threat of substitutes for Ayala Corporation is substantial, driven by technological advancements and evolving consumer preferences. In telecommunications, over-the-top (OTT) messaging apps like WhatsApp offer free or low-cost communication, directly challenging Globe Telecom's traditional services. Similarly, the financial sector sees fintech solutions and digital payment platforms like GCash and Maya providing convenient alternatives to traditional banking, as evidenced by the PHP 1.7 trillion e-wallet transaction volume in the Philippines in 2023.

| Ayala Business Segment | Key Substitutes | Impact on Ayala | Supporting Data (2023/Early 2024) |

|---|---|---|---|

| Telecommunications (Globe) | OTT Messaging Apps (WhatsApp, Telegram) | Reduced SMS/voice revenue | Global mobile messaging market growth continues. |

| Financial Services (BPI) | Digital Payment Platforms (GCash, Maya) | Customer migration to digital channels | PHP 1.7 trillion e-wallet transaction volume (2023). |

| Real Estate (Ayala Land) | Informal housing, self-build | Competition for budget-conscious segment | Ongoing demand for affordable housing solutions. |

| Energy (ACEN) | Decentralized Renewables (Rooftop Solar) | Potential erosion of grid power demand | Global renewable capacity additions surge, solar PV leads. |

Entrants Threaten

Ayala Corporation operates in sectors like real estate, banking, and telecommunications, all demanding significant upfront capital. For instance, a major real estate project can easily require billions of pesos in land acquisition and construction costs. This high capital threshold naturally deters smaller, less-resourced newcomers from entering these competitive markets.

The banking sector, regulated and requiring substantial liquidity, presents similar capital barriers. New banks need billions in initial capital to meet regulatory requirements and establish trust, making it difficult for startups to challenge established players like Bank of the Philippine Islands (BPI), a key Ayala subsidiary.

Similarly, telecommunications infrastructure, with its need for extensive network build-out and spectrum licensing, demands massive investments. Globe Telecom, Ayala's telco arm, has consistently invested billions annually in network upgrades, a financial commitment that new entrants would struggle to match, thereby limiting the threat of new entrants.

Ayala Corporation's established businesses, like Ayala Land in real estate and Globe Telecom in telecommunications, benefit significantly from economies of scale. For instance, Ayala Land's extensive land bank and ongoing projects allow for lower per-unit construction costs. Globe's vast network infrastructure likewise reduces the cost of adding new subscribers. These existing efficiencies create a substantial barrier for new entrants, who would need immense capital investment to achieve comparable cost advantages and compete effectively on price.

Furthermore, Ayala leverages economies of scope by cross-selling services. A customer buying a property from Ayala Land might be offered financing through BPI or connectivity solutions from Globe, creating a synergistic advantage. New competitors entering the market without this integrated business model find it challenging to replicate such bundled value propositions, making it difficult to attract and retain customers against Ayala's diversified offerings.

Ayala Corporation enjoys considerable brand loyalty across its diverse portfolio, particularly in sectors like telecommunications (Globe) and banking (BPI). This loyalty acts as a significant barrier, as new entrants must overcome deeply ingrained customer preferences and trust built over years. For instance, BPI's customer base, cultivated through decades of service, represents a substantial hurdle for any new financial institution aiming to capture market share.

Access to Distribution Channels

The threat of new entrants regarding access to distribution channels for a company like Ayala Corporation is significantly moderated by the sheer scale and cost required to replicate or gain access to these established networks. Building out extensive distribution, whether it's a nationwide network of bank branches, a robust real estate sales force, or a widespread telecom cell site infrastructure, represents a substantial capital investment and a considerable time commitment. New players often find it difficult and expensive to establish their own comparable channels or to secure favorable terms for access to existing ones, thereby creating a barrier that protects incumbents.

For instance, in the telecommunications sector, where Ayala operates through Globe Telecom, the rollout of 5G infrastructure alone requires billions of dollars in investment. As of early 2024, Globe continued its aggressive expansion, aiming to cover more areas, a process that new entrants would find exceptionally challenging to match. Similarly, in real estate, Ayala Land's established sales networks and project locations are a significant advantage. The cost to establish a comparable presence and brand recognition in the Philippine property market is immense.

- High Capital Investment: Establishing physical distribution networks, like bank branches or retail stores, demands significant upfront capital, deterring many potential new entrants.

- Established Networks: Ayala's existing distribution channels, built over years, provide a competitive advantage that is difficult and costly for newcomers to replicate.

- Regulatory Hurdles: In sectors like banking and telecommunications, regulatory approvals for establishing and operating distribution networks can be complex and time-consuming.

- Economies of Scale: Ayala's scale allows for greater efficiency and lower per-unit distribution costs, making it harder for smaller new entrants to compete on price.

Regulatory Barriers and Government Policy

Ayala Corporation operates in sectors like banking and telecommunications, which are heavily regulated. These industries often have substantial licensing requirements and compliance burdens, acting as significant deterrents for potential new competitors looking to enter the market. For instance, the Bangko Sentral ng Pilipinas (BSP) mandates strict capital requirements for new banks, which can run into billions of pesos, making entry a considerable financial undertaking.

Government policies can also establish high entry barriers, particularly in essential services. While some policies aim to foster competition, others, such as spectrum allocation policies in telecommunications, can favor incumbent players or create complex bidding processes that new entrants find difficult to navigate. In 2024, the Philippine government continued to refine its digital transformation agenda, which, while encouraging innovation, also involves navigating evolving regulatory frameworks that require significant investment and expertise to comply with.

- Stringent Licensing: Industries like banking require extensive approvals and adherence to capital adequacy ratios, such as those set by the BSP, which can be in the billions of Philippine pesos.

- Regulatory Compliance Costs: New entrants must invest heavily in systems and processes to meet ongoing regulatory demands in sectors like telecommunications and energy.

- Government Policy Influence: Policies on spectrum allocation, foreign ownership limits, and service quality standards can create significant hurdles for new players seeking market entry.

Ayala Corporation's diversified operations, spanning telecommunications, banking, and real estate, face a generally low threat from new entrants. This is primarily due to the substantial capital requirements and established brand loyalty that act as significant barriers to entry across these sectors. For example, Globe Telecom's continuous network expansion, involving billions in capital expenditure annually, makes it difficult for new telcos to compete. Similarly, Bank of the Philippine Islands (BPI) benefits from decades of customer trust and regulatory capital requirements, which are substantial hurdles for emerging financial institutions.

Economies of scale and scope further solidify Ayala's position. Its integrated business model, allowing for cross-selling of services between its subsidiaries, creates a unique value proposition that new, unintegrated competitors struggle to match. This synergy, coupled with established distribution networks and brand recognition, effectively deters potential new market participants from challenging Ayala's market share.

Regulatory environments in key Ayala sectors, such as banking and telecommunications, also present significant barriers. Stringent licensing, compliance costs, and government policies on spectrum allocation, for instance, necessitate considerable investment and expertise, which new entrants may lack. These factors collectively ensure that the threat of new entrants remains relatively contained for Ayala Corporation.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ayala Corporation leverages data from its annual reports, investor presentations, and publicly available financial statements. We also incorporate insights from reputable industry research firms and economic databases to provide a comprehensive view of the competitive landscape.