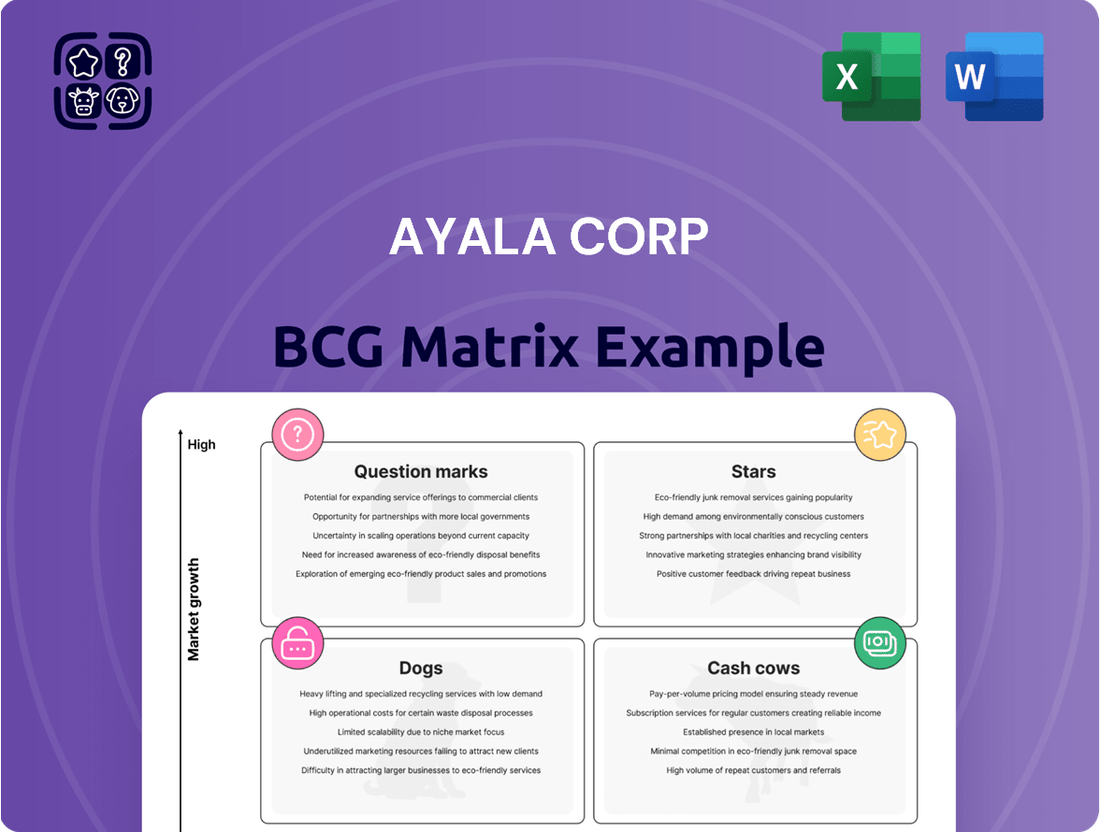

Ayala Corp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Ayala Corporation's BCG Matrix reveals a dynamic portfolio, with established Cash Cows likely funding promising Question Marks and potential Stars. Understanding these placements is crucial for strategic resource allocation and future growth.

Dive deeper into Ayala Corporation's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ACEN, Ayala Corporation's renewable energy subsidiary, is a prime example of a Star in the BCG Matrix. In 2024, ACEN demonstrated robust financial health, achieving a 27% surge in net income to Php 9.36 billion. This growth was fueled by a substantial 25% increase in its attributable renewable energy output, highlighting its strong market position and operational efficiency.

The company's aggressive expansion strategy is further evidenced by its current attributable renewables capacity of 7.0 GW, with significant projects actively under construction. This rapid development in a rapidly growing renewable energy sector underscores ACEN's status as a market leader and a key driver of the energy transition.

Ayala Land, a key player in premium real estate, is showing impressive performance. In 2024, its residential segment saw a significant 23% revenue increase, while commercial and industrial lots experienced an even more substantial 34% growth. This upward trend is fueled by a strong demand for upscale properties and expansion efforts beyond Metro Manila.

The company's strategic emphasis on the affluent market segment, which tends to be more resilient during economic fluctuations, is paying off. Ayala Land has reported robust sales across its luxury brands, underscoring the success of its focus on high-value developments. This positioning within a high-growth, high-value niche firmly places Ayala Land as a Star in the BCG Matrix.

Mynt, the company behind GCash, is a shining Star in Ayala Corporation's BCG Matrix. In 2024, its loan disbursements doubled, showcasing robust growth and a significant contribution to Ayala's equity earnings. This performance highlights GCash's dominant position in the Philippines' booming fintech and mobile payments market.

GCash's status as a unicorn, valued at over $2 billion, further solidifies its Star classification. The platform is a market leader in a high-growth digital industry, continuously attracting new users and broadening its financial service portfolio, from payments to lending and investments.

AC Mobility (New Energy Vehicle Segment)

AC Mobility's New Energy Vehicle (NEV) segment is a clear Star in Ayala Corporation's BCG Matrix. In 2024, the company saw a remarkable 46% surge in unit sales, solidifying its strong presence.

This growth is further underscored by AC Mobility's commanding 82% market share within the NEV sector. This dominant position highlights the segment's high-growth potential, fueled by the global transition to sustainable transport solutions.

- Dominant Market Share: AC Mobility holds an 82% share in the rapidly expanding NEV market as of 2024.

- Exceptional Sales Growth: The company achieved a 46% increase in NEV unit sales during 2024.

- Strategic Investments: Ongoing investments in EV business expansion and charging infrastructure reinforce its Star status.

AC Health (Healthway Medical Network)

AC Health's provider group, Healthway Medical Network, is a standout performer, fitting the description of a Star in the BCG Matrix. In 2024, this segment achieved an impressive 22% revenue growth, a significant leap compared to the broader hospital industry's 8% growth. This robust expansion highlights its strong market position and potential for continued dominance.

Healthway Medical Network's growth is central to AC Health's strategic vision of becoming a $2 billion enterprise by 2035. The continuous expansion of its clinic and hospital footprint is a clear indicator of increasing market share and a testament to its successful strategy in the competitive healthcare landscape.

- Healthway Medical Network's 2024 revenue growth: 22%

- Hospital industry average revenue growth (2024): 8%

- AC Health's long-term enterprise goal: $2 billion by 2035

- Key driver of Star status: High market share and high growth rate

Stars in Ayala Corporation's portfolio represent businesses with high market share in high-growth industries. These are typically the company's leading ventures, driving significant revenue and profit. Their strong performance indicates a promising future, often requiring continued investment to maintain their leading positions.

ACEN, the renewable energy arm, is a prime example, achieving a 27% net income surge in 2024, reaching Php 9.36 billion. Ayala Land's residential segment also saw a 23% revenue increase in the same year, driven by demand in the premium property market. Mynt, operating GCash, is a unicorn valued over $2 billion, dominating the fintech space.

AC Mobility's NEV segment is another Star, with a 46% unit sales increase in 2024 and an 82% market share. AC Health's Healthway Medical Network also shines, posting 22% revenue growth in 2024, significantly outpacing the industry average of 8%.

| Business Unit | BCG Category | 2024 Performance Highlight | Market Context |

| ACEN | Star | 27% Net Income Growth | High-growth Renewable Energy |

| Ayala Land | Star | 23% Residential Revenue Growth | Premium Real Estate Demand |

| Mynt (GCash) | Star | Unicorn Valuation (> $2 Billion) | Booming Fintech Market |

| AC Mobility (NEV) | Star | 46% NEV Unit Sales Growth | Dominant 82% NEV Market Share |

| AC Health (Healthway) | Star | 22% Revenue Growth | Outpacing Hospital Industry Growth |

What is included in the product

Ayala Corp's BCG Matrix analysis categorizes its diverse business units, guiding strategic decisions on investment and resource allocation.

A clear Ayala Corp BCG Matrix visually pinpoints underperforming units, relieving the pain of resource misallocation.

Cash Cows

Bank of the Philippine Islands (BPI) exemplifies a strong cash cow for Ayala Corporation. In 2024, BPI achieved a record net income of P62 billion, marking a significant 20% year-over-year increase, and its total revenues climbed 23% to P170.1 billion. This robust performance was driven by substantial loan growth and improved net interest margins, showcasing its consistent profitability.

As a leading financial institution in the Philippines with a mature market presence, BPI’s consistent ability to generate substantial cash flow is vital. This financial strength allows it to effectively fund other strategic initiatives and investments across the diversified Ayala Group, reinforcing its status as a reliable source of capital.

Globe Telecom's core mobile and data services represent a significant cash cow for Ayala Corporation. As of the end of 2023, Globe maintained a dominant 54.7% majority in mobile revenue market share. This strong market position translated into impressive financial results, with the company achieving record gross service revenues of P165 billion in 2024.

Despite some one-off factors impacting its overall net income, Globe's core net income saw a healthy 14% increase. This growth highlights the robust underlying performance of its essential telecommunications services, even in a mature market. The company's substantial subscriber base and consistent revenue streams solidify its status as a reliable generator of cash.

Ayala Land's established commercial leasing and hospitality segments are clear cash cows for Ayala Corporation. In 2024, this unit generated P45.6 billion in revenue, marking a robust 9% increase. This growth stems from the strong performance of its existing portfolio, including well-established shopping centers, office buildings, and hotels.

These mature business lines, characterized by high market share within stable, albeit slower-growing, markets, are the bedrock of consistent and substantial cash flow. The reliable income generated by these assets, such as prime shopping malls and BPO-occupied office towers, significantly supports Ayala Land's overall financial health and contributes meaningfully to the broader Ayala Corporation's financial strength.

Ayala Land (General Residential Development)

Ayala Land's general residential development segment, beyond its high-end projects, consistently generates robust revenue. This segment benefits from the mature Philippine housing market and Ayala Land's established market position.

In 2024, property development revenues for Ayala Land surged by 22% to P112.9 billion, underscoring the strength of its broader residential offerings.

- Consistent Revenue Generation: The diverse residential portfolio, catering to various market segments, acts as a stable cash generator for Ayala Land.

- Market Leadership: Ayala Land's long-standing presence and reputation in the Philippine property market ensure continued demand and sales.

- Financial Performance: A 22% increase in property development revenues to P112.9 billion in 2024 highlights the segment's significant contribution to overall profitability.

- Market Maturity: The established nature of the housing market provides a predictable and reliable environment for this cash cow segment.

Ayala Corporation (Overall Diversified Core Businesses)

Ayala Corporation's overall diversified core businesses represent its cash cows. In 2024, the conglomerate achieved its strongest financial performance, with core net income surging 10% to a record P45 billion. This impressive growth was primarily fueled by its established market leaders in banking, real estate, and telecommunications.

These well-entrenched entities consistently generate substantial profits, serving as the bedrock for Ayala's financial strength and providing the necessary capital for future investments and strategic expansion initiatives.

- Banking: Ayala's banking arm, Bank of the Philippine Islands (BPI), continues to be a dominant force, reporting robust growth in loans and deposits throughout 2024.

- Real Estate: Ayala Land, Inc. demonstrated sustained demand for its residential and commercial properties, contributing significantly to the conglomerate's profitability.

- Telecommunications: Globe Telecom maintained its market leadership, with subscriber growth and increased data consumption driving strong revenue performance.

Ayala Corporation's cash cows are its mature, market-leading businesses that consistently generate substantial profits. These established entities provide a stable financial foundation, enabling the conglomerate to fund growth opportunities and strategic investments across its diverse portfolio.

The Bank of the Philippine Islands (BPI) remains a prime example, reporting a record net income of P62 billion in 2024, a 20% increase year-over-year. Globe Telecom's core services also contribute significantly, with gross service revenues reaching P165 billion in 2024, supported by its dominant market share in mobile revenue.

Ayala Land's commercial leasing and hospitality segments, along with its residential development business, are also key cash generators. These segments saw revenues of P45.6 billion and P112.9 billion respectively in 2024, reflecting strong demand and market leadership.

| Business Unit | 2024 Revenue (PHP Billion) | Year-over-Year Growth | Key Driver |

|---|---|---|---|

| BPI | 170.1 | 23% | Loan growth, Net interest margins |

| Globe Telecom | 165.0 | N/A (Gross Service Revenue) | Subscriber growth, Data consumption |

| Ayala Land (Commercial/Hospitality) | 45.6 | 9% | Established portfolio performance |

| Ayala Land (Property Development) | 112.9 | 22% | Strong residential demand |

What You’re Viewing Is Included

Ayala Corp BCG Matrix

The Ayala Corp BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for immediate strategic application. You'll gain access to the full analysis without any hidden surprises or demo content, ensuring you have a robust tool for business planning.

Dogs

AC Industrials, encompassing traditional manufacturing and non-NEV automotive distribution, saw its net loss significantly reduced by two-thirds in 2024. Despite this improvement, some of these segments operate in markets with sluggish growth and a smaller market presence.

Ayala Corporation's strategic focus on exiting or restructuring businesses with limited scalability or profitability concerns suggests that these particular areas within AC Industrials might be candidates for such actions. For instance, if a traditional auto parts supplier within the group experienced a revenue decline of 5% in 2024 while the overall automotive market grew by 2%, it would highlight the challenges these segments face.

Ayala Corporation's smaller ventures, often categorized as question marks or even potential dogs in a BCG-like analysis, collectively posted equity losses of ₱1.35 billion in 2024. This financial performance underscores the challenges these units face, likely due to operating in stagnant markets or struggling to capture meaningful market share.

These underperforming segments are essentially cash consumers, demanding resources without generating commensurate returns. Ayala's strategic imperative is to either steer these ventures toward profitability or undertake decisive actions, such as divestment or restructuring, to mitigate ongoing financial drains.

Within Ayala Land's extensive real estate holdings, certain legacy assets, perhaps older developments or those in less dynamic locations, may reside in mature, slow-growth sectors. These properties could exhibit a smaller market share when contrasted with Ayala Land's more contemporary, high-demand projects.

While not posing a substantial financial burden, these legacy assets might yield only break-even returns or necessitate considerable upkeep relative to their income generation. This profile aligns with the characteristics of a 'Dog' in the BCG Matrix, signifying low growth and low market share.

For instance, older commercial spaces in established but non-expanding business districts might fall into this category. In 2024, while specific asset-level data for 'Dogs' isn't publicly segmented, Ayala Land's overall revenue growth was robust, underscoring the strategic management of its diverse portfolio, which includes identifying and addressing underperforming assets.

Non-Core, Limited-Scalability Investments

Ayala Corporation strategically manages its diverse business interests by identifying and addressing non-core investments with limited scalability. These are often businesses operating in mature or slow-growing sectors where the company's market share is relatively small, making substantial growth difficult to achieve.

The rationale behind this approach is to reallocate capital and management focus toward more promising ventures. For instance, in 2023, Ayala Corporation continued its portfolio rationalization efforts, which included evaluating the performance and strategic fit of all its business units. While specific divestitures in this category are often not immediately publicized, the overarching strategy aims to enhance overall group profitability and shareholder value by shedding underperforming or non-strategic assets.

- Limited Market Share: Businesses in this category typically hold a small percentage of their respective market, hindering their ability to leverage economies of scale.

- Low Growth Potential: They operate in industries with minimal expansion prospects, making significant revenue increases unlikely.

- Capital Reallocation: Ayala's strategy involves divesting or minimizing these investments to free up resources for more dynamic and scalable opportunities.

Certain Automotive Brands under AC Mobility (Non-EV)

Within AC Mobility's portfolio, its non-EV brands, such as Volkswagen and Maxus, are positioned in a market segment that, while still significant, is experiencing a slower growth trajectory compared to the burgeoning electric vehicle (EV) sector. These brands are working to stem losses, a positive step, but their long-term market share and growth potential are directly influenced by the global automotive industry's rapid electrification trend.

For instance, while AC Mobility's overall performance is bolstered by its strong showing in the New Energy Vehicle (NEV) segment, classifying it as a Star in the BCG matrix, the traditional internal combustion engine (ICE) vehicle divisions face a different reality. These segments are navigating a market where consumer preference and regulatory landscapes are increasingly favoring EVs, potentially capping the growth ceiling for ICE models.

- Market Shift: The global automotive market is demonstrably shifting towards electrification, with projections indicating continued strong growth in EV sales throughout 2024 and beyond.

- Brand Performance: While specific 2024 financial data for AC Mobility's individual ICE brands like Volkswagen and Maxus may not be publicly detailed, the broader automotive industry context suggests these segments are under pressure to adapt.

- Strategic Focus: AC Mobility's strategic emphasis on NEVs, which are performing as Stars, highlights the company's recognition of where future growth and market dominance lie, potentially impacting resource allocation for its ICE offerings.

- Competitive Landscape: The competitive intensity in the ICE segment remains high, but the most significant disruption is coming from the rapidly expanding EV market, where new players and established automakers are heavily investing.

Ayala Corporation's "Dogs" are its business units with low market share in slow-growing industries. These ventures consume resources without generating substantial returns, prompting strategic review. For example, some legacy real estate assets within Ayala Land might fit this profile, offering minimal growth and requiring upkeep. Similarly, certain non-EV automotive segments within AC Mobility face market shifts favoring electrification, potentially limiting their future expansion.

| Business Unit Segment | Market Growth | Market Share | Strategic Implication |

| AC Industrials (select traditional manufacturing) | Sluggish | Small | Potential restructuring or divestment |

| Ayala Land (select legacy assets) | Mature/Slow | Relatively small | Focus on efficiency or potential disposition |

| AC Mobility (non-EV brands) | Slowing (vs. EV) | Moderate (but facing disruption) | Adaptation or resource reallocation |

Question Marks

AC Health, Ayala Corporation's healthcare arm, is a significant player in the Philippines' burgeoning healthcare sector. The company is actively investing in building a comprehensive, integrated healthcare ecosystem, encompassing hospitals, clinics, and pharmacies. This ambitious undertaking aims for a $2 billion valuation by 2035, reflecting its long-term growth strategy.

Despite a widening net loss in 2024, a common characteristic of companies in heavy investment phases, AC Health's strategic focus remains on capturing market share. This expansion, while consuming substantial cash, is crucial for establishing its presence across various healthcare touchpoints in a high-growth market.

AC Logistics, a subsidiary of Ayala Corporation, is currently positioned as a Question Mark in the BCG Matrix. In 2024, the company experienced widened net losses, a common characteristic of Question Marks that are investing heavily for future growth. This suggests that AC Logistics is in a phase of significant cash consumption as it builds its operations and market presence.

Despite the current losses, Ayala Corporation's strategic partnership with A.P. Møller Capital, a prominent global player in the logistics sector, signals strong confidence in AC Logistics' future potential. This collaboration is aimed at expanding the local logistics business, underscoring the belief in high growth prospects within the Philippine logistics market. Such partnerships are crucial for Question Marks to acquire the necessary expertise and capital to scale effectively.

The logistics industry itself is a dynamic and growing sector, presenting a fertile ground for companies like AC Logistics to capture market share. However, achieving profitability in this competitive landscape requires substantial and sustained investment. Therefore, AC Logistics' current status as a Question Mark reflects its need for ongoing capital infusion to overcome initial losses and capitalize on the anticipated market expansion, with the ultimate goal of becoming a star performer in the future.

Ayala Corporation's new infrastructure ventures are firmly positioned in the question mark category of the BCG matrix. These investments, such as those in renewable energy and water utilities, represent high-growth potential areas within the Philippines, a market ripe for development. For instance, the Philippine government's infrastructure spending plans for 2024 aim to boost economic activity and create opportunities for companies like Ayala.

These ventures typically demand significant capital outlay at the outset, with limited immediate returns. Ayala's commitment to projects like the North-South Commuter Railway, which requires substantial funding, exemplifies this. The company is investing heavily in these nascent projects, anticipating they will capture significant market share and generate substantial profits as the Philippine economy continues to expand and infrastructure needs are met.

Emerging Digital and Technology Initiatives (beyond GCash)

Ayala Corporation's strategic push into emerging digital and technology initiatives, beyond its flagship GCash, positions these ventures as potential future stars. The company anticipates 2025 to be a pivotal year for these smaller, newer businesses, aiming for significant growth and market penetration.

These initiatives are characterized by their presence in high-growth technology sectors, yet they are still in their nascent stages. Consequently, they typically exhibit low market share and require substantial investment to foster adoption and scale. For instance, Ayala's investments in areas like digital health platforms or e-commerce logistics solutions would fit this description. These ventures are currently cash-intensive as they build out their technology and customer base.

- High-Growth Potential: Operating in sectors like AI-driven analytics or sustainable tech solutions, these ventures tap into rapidly expanding markets.

- Early Stage Development: Despite their potential, these businesses are still refining their products and services, aiming for wider market acceptance.

- Significant Cash Burn: Initial phases involve heavy spending on research and development, marketing, and infrastructure to establish a foothold.

- Low Current Market Share: Their nascent nature means they have yet to capture a substantial portion of their target markets, a key indicator for BCG matrix classification.

AC Mobility (Electric Vehicle Charging Infrastructure)

AC Mobility's charging infrastructure segment operates as a Question Mark within Ayala Corporation's BCG Matrix. While the company is experiencing strong growth in electric vehicle sales, the charging infrastructure itself is a high-growth market demanding significant capital infusion. This investment is crucial for building out a widespread and dominant charging network, essential for supporting the burgeoning EV ecosystem.

The expansion of AC Mobility's charging footprint requires substantial capital expenditure. For instance, by the end of 2024, the company aims to have installed a significant number of charging points across various locations in the Philippines. This aggressive build-out is necessary to capture market share in a sector that is still in its formative stages.

- High Growth Potential: The EV charging market is projected for substantial growth, driven by increasing EV adoption rates.

- Capital Intensive: Significant investment is needed to establish a robust and widespread charging network.

- Market Share Ambition: AC Mobility is investing heavily to secure a leading position in this emerging sector.

- Ecosystem Support: The charging infrastructure is vital for the overall success and adoption of electric vehicles.

Ayala Corporation's ventures in new infrastructure, including renewable energy and water utilities, are currently classified as Question Marks. These are positioned in high-growth Philippine markets, with government infrastructure spending in 2024 expected to stimulate economic activity and create opportunities. For example, the North-South Commuter Railway project requires substantial funding, reflecting the significant capital outlay for these early-stage projects with delayed returns.

These ventures are characterized by their significant initial capital demands and limited immediate profitability. Ayala is investing heavily in these developing projects with the aim of capturing substantial market share as the Philippine economy expands and infrastructure needs are met.

Ayala Corporation's digital and technology initiatives, excluding GCash, are also considered Question Marks, with 2025 targeted as a key year for growth. These are in high-growth tech sectors but are still in their early stages, requiring substantial investment for customer adoption and scaling.

These businesses exhibit low market share and high cash burn due to investments in R&D, marketing, and infrastructure. For instance, investments in digital health platforms or e-commerce logistics solutions are currently cash-intensive as they build their technology and customer base.

| Ayala Corp. Venture | BCG Matrix Classification | Rationale | Key Financial/Growth Indicator (2024/2025 Projections) |

|---|---|---|---|

| New Infrastructure (Renewable Energy, Water Utilities) | Question Mark | High growth potential in developing markets, significant initial capital investment, low current market share. | Philippine infrastructure spending planned to boost economic activity in 2024. |

| Digital & Technology Initiatives (Excluding GCash) | Question Mark | Early-stage, high-growth tech sectors, substantial investment for scaling, low current market share. | Targeted for significant growth and market penetration in 2025. |

| AC Logistics | Question Mark | Investing heavily for future growth, widening net losses in 2024, strategic partnership with A.P. Møller Capital for expansion. | Widened net losses in 2024, indicating significant cash consumption for growth. |

| AC Health | Question Mark | Building an integrated healthcare ecosystem, aiming for $2 billion valuation by 2035, widening net loss in 2024 due to heavy investment. | Widening net loss in 2024, characteristic of companies in heavy investment phases. |

| AC Mobility (Charging Infrastructure) | Question Mark | High-growth market requiring significant capital infusion for network build-out, strong growth in EV sales. | Aiming to install a significant number of charging points by end of 2024. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.