Ayala Corp Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

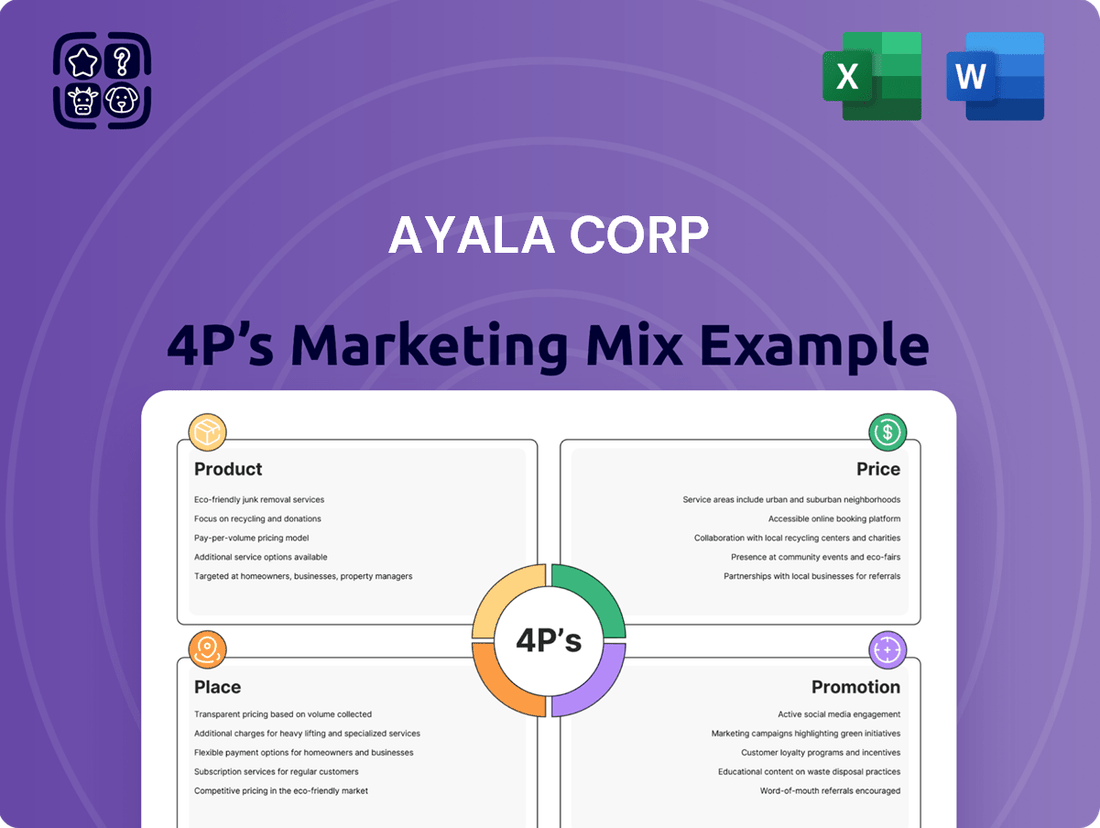

Ayala Corporation masterfully orchestrates its Product, Price, Place, and Promotion strategies to solidify its market leadership. This comprehensive analysis reveals how their diverse product portfolio, strategic pricing, extensive distribution networks, and impactful promotional campaigns create a powerful synergy.

Want to understand the intricate details of Ayala Corp's marketing success and gain actionable insights? Unlock the full 4Ps Marketing Mix Analysis to discover their winning formula and apply it to your own business strategies.

Product

Ayala Land, a cornerstone of Ayala Corporation's strategy, champions integrated community development, a key element in its 4P's marketing mix. This approach focuses on creating vibrant, self-sustaining environments that cater to diverse needs.

These master-planned communities offer a seamless blend of residential offerings, from high-end to mid-market housing, complemented by essential commercial hubs like malls and office spaces. The company also incorporates leisure and hospitality components, such as hotels, and increasingly, industrial logistics facilities, reflecting a holistic vision for urban living.

This integrated model aims to enhance the quality of life for Filipinos by providing convenience and accessibility within a single development. For instance, Ayala Land's 2023 financial performance highlighted robust growth, with its estate development and leasing businesses contributing significantly, underscoring the success of its community-centric strategy.

Ayala Corporation, through its subsidiaries like Bank of the Philippine Islands (BPI) and Ayala Capital, offers a wide array of financial services. These span consumer banking, lending, asset management, payments, and insurance. In 2024, BPI continued to lead in digital banking, reporting a significant increase in its digital transactions.

The company's financial services also encompass securities brokerage, foreign exchange, leasing, and both corporate and investment banking. This comprehensive offering caters to a diverse clientele, from individual savers to major corporations, reflecting Ayala's commitment to providing integrated financial solutions across the market.

Globe Telecom, Ayala Corporation's telecommunications subsidiary, is a cornerstone of its digital solutions offering. It provides a comprehensive suite of mobile and corporate data services, alongside essential connectivity solutions and burgeoning digital platforms. This robust portfolio directly addresses the communication and digital needs of both individual consumers and businesses.

A key strategic thrust for Globe in 2024 and 2025 is its intensified focus on innovation and digital enablement, with a particular emphasis on supporting micro, small, and medium enterprises (MSMEs). The company is actively investing in advanced, AI-powered solutions designed to enhance efficiency and growth for these vital business segments. This strategic direction positions Globe as a critical partner in the digital transformation journey of Philippine businesses.

Further demonstrating its commitment to digital solutions, Globe actively supports digital health services through its platform, KonsultaMD. This initiative underscores Ayala Corporation's broader strategy of leveraging technology to improve quality of life and access to essential services, aligning telecommunications with critical social needs. Globe's ongoing investments in infrastructure and digital services are crucial for achieving these objectives.

Emerging Businesses in Essential Services

Ayala Corporation's expansion into emerging businesses within essential services is a cornerstone of its 4Ps strategy, focusing on Product diversification to meet critical development needs. The company is actively investing in sectors like renewable energy through ACEN, healthcare via AC Health, and infrastructure and logistics under AC Logistics. This strategic product development aims to capture growth opportunities while addressing societal demands.

AC Health, for example, is a significant part of this product expansion, with plans to broaden its healthcare network. This includes increasing its hospital and multi-specialty clinic presence, notably with the development of a specialized cancer hospital. As of early 2025, AC Health's network includes over 40 clinics and 7 hospitals, demonstrating tangible product growth.

The company's commitment extends to other essential services, such as electric mobility through ACMobility and education. These ventures represent a deliberate product strategy to build a portfolio of businesses that are both resilient and contribute to national development. ACEN, for instance, aims to significantly increase its renewable energy capacity, targeting 20,000 MW of renewable energy capacity by 2030.

Key emerging businesses and their focus areas include:

- ACEN: Expanding renewable energy generation capacity, with a target of 20,000 MW by 2030.

- AC Health: Growing its healthcare network, including hospitals and clinics, with a focus on specialized care.

- AC Logistics: Developing integrated logistics and supply chain solutions to support various industries.

- ACMobility: Investing in electric vehicle infrastructure and services to promote sustainable transportation.

Sustainability-Focused Offerings

Ayala Corporation's product strategy increasingly embeds sustainability, evident in Ayala Land's green-certified buildings and ACEN's renewable energy ventures. This commitment resonates with a growing segment of consumers and investors prioritizing environmental responsibility.

Ayala Land's commercial properties, including malls, offices, and hotels, are actively transitioning to renewable energy sources. The company has set ambitious goals, aiming for net-zero emissions, which directly impacts their operational footprint and long-term viability.

- Green Buildings: Ayala Land's portfolio features numerous green-certified developments, meeting rigorous environmental standards.

- Renewable Energy Integration: A significant portion of energy used in their malls, offices, and hotels is sourced from renewables.

- Net-Zero Ambitions: The corporation is actively pursuing net-zero emissions targets, demonstrating a forward-looking approach to climate change.

- Enhanced Value Proposition: This sustainability focus strengthens their appeal to environmentally conscious customers and attracts ESG-focused investments.

Ayala Corporation's product strategy is characterized by its expansion into essential services and a strong emphasis on sustainability. This includes significant investments in renewable energy via ACEN, healthcare through AC Health, and integrated logistics under AC Logistics. The company aims to meet critical development needs and capture growth opportunities by building a resilient portfolio.

AC Health, as of early 2025, operates over 40 clinics and 7 hospitals, with plans to further expand its network, including a specialized cancer hospital. ACEN, on the other hand, is committed to increasing its renewable energy capacity, targeting 20,000 MW by 2030.

This product diversification is complemented by a deep commitment to sustainability, seen in Ayala Land's green-certified buildings and ACEN's renewable energy projects. These initiatives not only appeal to environmentally conscious consumers but also attract ESG-focused investments, enhancing the company's overall value proposition.

| Company/Subsidiary | Key Product/Service Focus | 2024/2025 Data/Targets |

|---|---|---|

| ACEN | Renewable Energy Generation | Target: 20,000 MW renewable energy capacity by 2030. |

| AC Health | Healthcare Network Expansion | As of early 2025: 40+ clinics, 7 hospitals. Plans for specialized cancer hospital. |

| AC Logistics | Integrated Logistics & Supply Chain | Developing solutions to support various industries. |

| Ayala Land | Green Buildings & Sustainable Properties | Numerous green-certified developments; transitioning malls, offices, hotels to renewables. |

What is included in the product

This analysis provides a comprehensive breakdown of Ayala Corporation's marketing strategies, examining its diverse product portfolio, pricing approaches across various sectors, extensive distribution networks (place), and multifaceted promotional activities.

Provides a clear, concise overview of Ayala Corp's 4Ps marketing strategy, simplifying complex marketing decisions for leadership and cross-functional teams.

Streamlines understanding of Ayala Corp's product, price, place, and promotion strategies, enabling faster, more informed marketing planning and execution.

Place

Ayala Corporation's extensive physical network is a cornerstone of its market presence, particularly evident in the Philippines. This vast infrastructure underpins its diverse business segments, offering tangible touchpoints for customers and stakeholders across the archipelago.

Ayala Land, a key subsidiary, boasts a significant physical footprint through its integrated property developments. These estates, strategically positioned nationwide, include residential communities, commercial malls, office buildings, and hospitality establishments, creating vibrant economic hubs. For instance, as of early 2024, Ayala Land manages over 170 commercial centers and a substantial portfolio of residential projects.

Complementing this, Bank of the Philippine Islands (BPI) maintains an expansive physical distribution network. This includes a robust presence of branches, ATMs, and cash acceptance machines, totaling over 1,100 branches and 2,500 ATMs nationwide as of late 2023, ensuring accessibility for a broad customer base and facilitating financial transactions across the country.

Ayala Corporation leverages strong digital channels to broaden its reach and improve customer access. Bank of the Philippine Islands (BPI) provides extensive internet and mobile banking services, making financial transactions seamless for millions. This digital infrastructure is crucial for meeting the evolving needs of today's consumers.

Globe Telecom, another key Ayala subsidiary, enhances digital connectivity and supports mobile e-wallet solutions through its stake in Mynt, the operator of GCash. By mid-2024, GCash boasted over 70 million registered users, demonstrating the massive adoption and convenience of these digital payment platforms. These initiatives significantly boost customer convenience, directly addressing modern consumer expectations for on-demand services.

Ayala Land is strategically expanding its property footprint, with a focus on developing new commercial leasing spaces and retail centers in burgeoning regions throughout the Philippines. By 2025, the company plans to introduce several new malls, further solidifying its presence in key growth corridors and catering to increasing consumer demand.

Globe Telecom is aggressively broadening its reach, investing in infrastructure to connect underserved and remote communities. This expansion aims to significantly increase the number of areas with reliable connectivity, reflecting a commitment to digital inclusion and market penetration across the archipelago.

Integrated Ecosystem Approach

Ayala Corporation’s integrated ecosystem approach is a cornerstone of its ‘Place’ strategy, particularly evident in its property development arm, Ayala Land. This involves strategically co-locating and integrating diverse services within master-planned communities, fostering a unique synergistic experience. For instance, residential projects are often complemented by adjacent retail centers, essential healthcare facilities, and accessible banking services, significantly boosting convenience and perceived value for both residents and businesses operating within these Ayala-developed enclaves.

This integration creates a self-sustaining environment that enhances customer loyalty and operational efficiencies across Ayala's various business units. By offering a comprehensive suite of services, from housing and retail to healthcare and finance, Ayala Land's communities become more attractive and livable. This strategy directly supports Ayala Corporation's overall market positioning by offering a complete lifestyle solution, a key differentiator in the competitive real estate and services sector.

- Synergistic Development: Ayala Land’s master-planned communities integrate residential, retail, office, and hospitality components, creating vibrant hubs.

- Cross-Selling Opportunities: The presence of multiple Ayala businesses (e.g., BPI, AC Health) within these communities facilitates cross-selling and enhances customer lifetime value.

- Enhanced Resident Experience: Residents benefit from convenient access to essential services like banking, healthcare, and shopping, improving quality of life.

- Economic Impact: As of early 2024, Ayala Land’s ongoing projects continue to drive significant economic activity, with substantial capital expenditures allocated to developing these integrated ecosystems.

Partnerships for Market Access

Ayala Corporation actively cultivates strategic alliances to broaden its market penetration and enhance distribution networks. These collaborations are crucial for accessing new customer segments and leveraging existing infrastructure.

AC Logistics, a key subsidiary, is forging partnerships with international players to bolster its domestic operations. This strategy aims to integrate global best practices and expand its service offerings within the Philippines.

Similarly, Bank of the Philippine Islands (BPI) is enhancing its digital payment ecosystem. By partnering with platforms like EasyPay, BPI is increasing the accessibility of its e-wallet top-up services, thereby reaching a wider user base. In 2024, BPI reported a 15% year-on-year increase in digital transactions, underscoring the impact of such strategic integrations.

- AC Logistics: Collaborating with global logistics providers to enhance local delivery networks.

- BPI: Expanding e-wallet top-up options through partnerships with payment gateways like EasyPay.

- Market Access: Strategic alliances aim to reach an estimated 2 million new digital banking users by end-2025.

Ayala Corporation's physical presence is a critical component of its marketing strategy, emphasizing accessibility and integrated experiences across its diverse businesses. This extensive network ensures customers can engage with Ayala's offerings through both traditional and modern channels, reinforcing brand visibility and customer convenience throughout the Philippines.

What You Preview Is What You Download

Ayala Corp 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Ayala Corp 4P's Marketing Mix analysis is complete and ready for your immediate use.

Promotion

Ayala Corporation's commitment to transparent communication is evident in its integrated reporting, exemplified by its 2024 Integrated Report. This report meticulously details not only financial results but also crucial environmental, social, and governance (ESG) performance, offering a holistic view of the company's value creation. For instance, the 2023 Integrated Report highlighted a 12% increase in net income to PHP 32.2 billion, underscoring strong financial stewardship alongside its ESG initiatives.

Investor relations are actively managed through a multi-channel approach. Ayala Corporation hosts quarterly analyst briefings and annual stockholders' meetings, providing platforms for direct engagement and dialogue. Investor presentations further elaborate on strategic priorities and performance, ensuring institutional and retail investors are well-informed. In 2024, the company continued its proactive engagement, participating in numerous investor conferences and roadshows to foster deeper understanding and build lasting relationships.

Ayala Corporation actively communicates its dedication to sustainability and robust Environmental, Social, and Governance (ESG) principles. This commitment is a cornerstone of their marketing strategy, resonating with investors increasingly prioritizing responsible corporate behavior.

The company's consistent inclusion in the prestigious FTSE4Good Index Series underscores its adherence to global ESG standards. Furthermore, Ayala Land's recognition by TIME Magazine as one of the World's Most Sustainable Companies in 2025 provides concrete evidence of their leadership in this domain.

These accolades directly address the escalating investor demand for sustainable investment opportunities. By highlighting their ESG performance, Ayala effectively attracts capital from a growing segment of the market that seeks both financial returns and positive societal impact.

Ayala Land actively builds its brand by fostering thriving, master-planned communities that enhance residents' quality of life and stimulate local economic development. This approach emphasizes the creation of integrated estates, showcasing a commitment to holistic urban development rather than just individual property sales.

For instance, in 2024, Ayala Land continued its focus on developing sustainable and inclusive communities. Their ongoing projects, such as those in NUVALI and Vertis North, exemplify this strategy by incorporating green spaces, commercial hubs, and residential areas designed for long-term value and community engagement. This dedication to community building is a core element of their brand promise.

Digital Transformation Advocacy

Globe Telecom, a key player under Ayala Corporation, champions digital transformation, especially for Micro, Small, and Medium Enterprises (MSMEs). Their campaign, 'Choose the Courage to Transform,' directly addresses the need for businesses to adopt new technologies. This strategic promotion positions Globe not just as a service provider, but as a crucial partner in navigating the digital landscape.

This advocacy is backed by tangible support for MSMEs. For instance, in 2023, Globe's enterprise segment revenue grew by 14% year-on-year, reaching PHP 145.5 billion, indicating a strong market response to their digital enablement efforts. Their focus on AI-powered solutions and digital tools is designed to equip businesses with the competitive edge needed in today's evolving economy.

The 'Choose the Courage to Transform' initiative highlights several key benefits for MSMEs:

- Enhanced Operational Efficiency: Encouraging the adoption of digital tools to streamline processes.

- Expanded Market Reach: Leveraging digital platforms to connect with a wider customer base.

- Innovation and Growth: Facilitating the integration of new technologies like AI for business development.

- Digital Skill Development: Providing resources and support to upskill employees in digital competencies.

Corporate Social Responsibility and Sponsorships

Ayala Corporation's commitment to Corporate Social Responsibility (CSR) and sponsorships is primarily channeled through the Ayala Foundation. This strategic approach allows for focused impact and aligns with the company's broader vision for national development. For instance, the Atletang Ayala program directly supports Filipino athletes, fostering national pride and athletic excellence.

These CSR efforts are not merely philanthropic; they are integral to Ayala Corporation's brand building and stakeholder engagement. By investing in programs that benefit society, such as supporting athletes, Ayala cultivates a positive brand image and reinforces its role as a responsible corporate citizen. This can translate to enhanced customer loyalty and a stronger reputation in the market.

- Ayala Foundation's Role: Manages CSR initiatives, ensuring strategic alignment and effective execution of programs.

- Atletang Ayala Program: A key sponsorship supporting Filipino athletes, contributing to national sports development.

- Brand Perception Impact: CSR activities enhance Ayala's reputation, fostering goodwill and demonstrating commitment to societal progress.

- National Development Focus: Initiatives are designed to contribute to the Philippines' overall growth and well-being.

Ayala Corporation's promotional activities are multi-faceted, aiming to build brand equity and communicate value to diverse stakeholders. Globe Telecom's 'Choose the Courage to Transform' campaign, for instance, actively promotes digital solutions for MSMEs, with Globe's enterprise segment revenue growing 14% year-on-year to PHP 145.5 billion in 2023. Ayala Land fosters community development through integrated estates like NUVALI and Vertis North, emphasizing long-term value and resident well-being.

The company also leverages corporate social responsibility through the Ayala Foundation, notably the Atletang Ayala program, to enhance its brand image and societal contribution. This strategic communication of ESG principles, as seen in Ayala Land's recognition by TIME Magazine in 2025 for sustainability, resonates with investors seeking responsible growth opportunities.

Price

Ayala Land’s pricing strategy is deeply rooted in value-based principles, ensuring that the cost of their properties aligns with the perceived benefits and quality offered. This approach is evident across their broad portfolio, from luxury condominiums to more accessible housing developments.

For instance, reservation sales for Ayala Land's residential projects, especially those in the premium segment, consistently show robust demand. This strong uptake, as seen in the continued success of projects like those in Bonifacio Global City, underscores their ability to price products at a level that reflects their market value and the prestige associated with the Ayala brand.

BPI's pricing strategy for its extensive financial products, including loans and deposits, aims for competitive attractiveness, factoring in market demand and prevailing economic conditions. For instance, as of early 2024, BPI's personal loan interest rates typically range from 1.25% to 2.5% per month, depending on the loan amount and tenor, positioning them competitively against other major banks.

Ayala Corporation's subsidiary, BPI, also strategically uses bond issuances to fund its operations, notably its support for Micro, Small, and Medium Enterprises (MSMEs). In 2023, BPI successfully raised PHP 25 billion through its peso-denominated bond offering, which directly impacts the pricing of its business loans and services by providing a stable and cost-effective funding source.

Globe Telecom's pricing strategy for its mobile and corporate data services is a dynamic interplay of robust demand and intense market competition. The company navigates this landscape by focusing on strategic cost management and operational efficiencies to sustain profitability, even as it contends with the lower margins inherent in data-centric offerings.

Strategic Capital Allocation and Investment Pricing

Ayala Corporation’s pricing strategy extends to its capital allocation, prioritizing investments that fuel long-term growth and value. The company strategically earmarks substantial funds for both established core businesses and promising new ventures, reflecting a forward-looking approach to market positioning and competitive advantage.

For instance, Ayala Land’s significant capital expenditures in 2024, projected to be between PHP 100 billion to PHP 120 billion, underscore a pricing strategy focused on expanding its property development footprint and enhancing its recurring income streams. This substantial investment signals confidence in the market and a commitment to maintaining a competitive edge through aggressive expansion.

- Ayala Land's 2024 Capital Expenditure: PHP 100 billion to PHP 120 billion, targeting expansion and recurring income projects.

- Focus on Core Businesses: Continued investment in real estate, banking (BPI), and telecommunications (Globe) to solidify market leadership.

- Emerging Ventures: Allocation of capital towards new growth areas, such as renewable energy and healthcare, to diversify revenue and capture future market opportunities.

- Value Creation Pricing: The investment approach inherently prices future growth and market share gains into the company's overall valuation.

Financing Options and Sustainable Finance

Ayala Corporation and its diverse subsidiaries actively leverage a range of financing strategies to fuel their growth and strategic initiatives. These options include traditional debt instruments like bond issuances, alongside a growing emphasis on sustainable finance. This dual approach allows them to tap into a broad investor base and support their commitment to environmentally and socially responsible projects.

The company's success in securing sustainable financing, amounting to an impressive $6.2 billion by the close of 2024, highlights a key aspect of their capital pricing. This achievement signals an attractive cost of capital for investors prioritizing Environmental, Social, and Governance (ESG) factors. Consequently, Ayala Corporation can offer competitive pricing on its products and services, reinforcing its market position.

- Bond Issuances: Ayala Corporation regularly utilizes bond markets to raise capital for its various business segments, providing a stable source of funding for long-term projects.

- Sustainable Financing: The company has secured significant sustainable financing, reaching $6.2 billion as of end-2024, demonstrating strong investor confidence in its ESG commitments.

- Attractive Capital Pricing: This sustainable financing reflects an appealing cost of capital for ESG-focused investors, enabling competitive product pricing.

- Diversified Funding: The combination of traditional and sustainable financing options provides Ayala Corporation with financial flexibility and resilience.

Ayala Corporation's pricing strategy is intrinsically linked to its capital structure and financing costs. The company's ability to secure favorable terms on its debt and equity issuances directly influences the pricing of its products and services across its diverse subsidiaries.

For instance, BPI's competitive personal loan rates, typically ranging from 1.25% to 2.5% monthly in early 2024, are supported by its successful PHP 25 billion bond issuance in 2023. This issuance provided a stable, cost-effective funding source, allowing BPI to offer attractive rates to its clients.

Globe Telecom's pricing for data services, while facing margin pressures, is managed through operational efficiencies, enabling it to remain competitive. Ayala Land's aggressive 2024 capital expenditure of PHP 100 billion to PHP 120 billion signals a pricing strategy focused on market expansion and value creation, anticipating future demand and premium placement.

| Subsidiary | Pricing Strategy Element | Supporting Data/Fact |

|---|---|---|

| BPI | Competitive Loan Pricing | Personal loan rates: 1.25%-2.5% monthly (early 2024) |

| BPI | Funding Cost Impact | PHP 25 billion bond issuance in 2023 |

| Ayala Land | Value-Based Pricing & Expansion | 2024 Capital Expenditure: PHP 100 billion - PHP 120 billion |

| Globe Telecom | Dynamic Data Pricing | Focus on cost management and operational efficiency |

4P's Marketing Mix Analysis Data Sources

Our Ayala Corporation 4P's analysis is grounded in a comprehensive review of public disclosures, including annual reports and investor presentations, alongside insights from industry analyses and competitive benchmarking. This approach ensures our understanding of their product portfolio, pricing strategies, distribution networks, and promotional activities is both accurate and current.