Argonaut Gold SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Argonaut Gold's strengths lie in its established gold reserves and experienced management team, but its operations face challenges from rising costs and regulatory hurdles. Understanding these dynamics is crucial for any investor looking to capitalize on the gold market.

Want the full story behind Argonaut Gold's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The commissioning of the Magino mine in November 2023 is a major strength for Argonaut Gold, signifying its transition to a lower-cost, mid-tier producer. This new operation is projected to be the company's largest and most efficient mine.

Despite early ramp-up hurdles, Magino's successful commissioning is crucial for Argonaut's strategic growth. The mine represents a significant investment in future production capacity and cost reduction.

Argonaut Gold's strength lies in its diversified North American asset portfolio. This includes key operations like the Magino mine in Canada and Florida Canyon in the United States. Such geographic spread across politically stable regions significantly reduces exposure to single-jurisdiction operational disruptions or geopolitical uncertainties.

The Florida Canyon mine significantly boosted Argonaut Gold's performance in 2023, reaching its highest production in nearly two decades. This key asset delivered a substantial 115,426 gold ounces, contributing directly to the company's consolidated output and financial health.

Commitment to Sustainable Mining Practices

Argonaut Gold's dedication to sustainable mining is a significant strength, underscored by its 2022 ESG Report. This report formalizes their commitment to ethical and responsible operations, aiming to build stronger relationships with stakeholders and improve long-term viability in their operating regions.

This commitment translates into tangible benefits:

- Enhanced Stakeholder Trust: Transparent ESG reporting fosters confidence among investors, communities, and regulators.

- Improved Operational Efficiency: Focusing on sustainability often leads to better resource management and reduced waste.

- Risk Mitigation: Proactive environmental and social management can prevent costly regulatory issues and operational disruptions.

- Attracting Investment: Growing investor demand for ESG-compliant companies makes this a key differentiator for Argonaut Gold.

Potential for Reserve Expansion

Argonaut Gold has a significant opportunity to grow its mineral reserves through ongoing exploration and development efforts. The company has been actively investing in projects designed to increase its resource base.

A key example of this strategy is the targeted expansion at the Magino project. Argonaut aimed to add between 500,000 and 1 million ounces to its estimated mineral reserves at Magino by the close of 2024. This focus highlights the company's commitment to unlocking further value from its existing assets and securing future production.

This potential reserve expansion is crucial for long-term sustainability and growth.

The commissioning of the Magino mine in November 2023 marks a pivotal moment for Argonaut Gold, positioning it as a lower-cost, mid-tier producer. This new facility is anticipated to become the company's largest and most efficient operation, significantly bolstering its production capabilities.

Argonaut Gold's diversified portfolio across North America, including the flagship Magino mine in Canada and Florida Canyon in the United States, provides a robust operational base. This geographic spread across stable jurisdictions minimizes single-jurisdiction risks.

Florida Canyon demonstrated exceptional performance in 2023, achieving its highest production in nearly two decades with 115,426 gold ounces. This strong output from a key asset directly contributes to the company's consolidated financial health.

The company's commitment to sustainable mining practices, as detailed in its 2022 ESG Report, enhances stakeholder trust and operational efficiency. This focus on environmental, social, and governance factors is increasingly vital for attracting investment and ensuring long-term viability.

Argonaut Gold is actively working to expand its mineral reserves, with a specific focus on the Magino project. The company targeted an addition of 500,000 to 1 million ounces to its estimated mineral reserves at Magino by the end of 2024, underscoring its strategy for future growth.

What is included in the product

Maps out Argonaut Gold’s market strengths, operational gaps, and risks.

Offers a clear, actionable framework to address Argonaut Gold's operational challenges and market vulnerabilities.

Weaknesses

The construction costs for Argonaut Gold's Magino mine experienced a significant overrun, nearly doubling to approximately C$940 million. This substantial increase placed considerable financial pressure on the company.

Furthermore, the Magino project encountered higher-than-anticipated dilution rates. This means that more waste rock was processed alongside the ore, resulting in lower average gold grades being fed to the mill in the initial stages of production.

Despite reaching commercial production at the Magino mine, Argonaut Gold experienced slower-than-anticipated ramp-up of mining and milling operations during the first quarter of 2024. This operational lag was primarily caused by issues such as limited availability of loaders and substantial unplanned downtime at the mill, which prevented the company from immediately meeting its projected production levels.

Argonaut Gold grappled with substantial liquidity challenges, leading it to seek waivers on its financial covenants from its lenders. This situation highlighted a strained financial standing, requiring urgent measures to ensure operational continuity.

To address immediate funding needs, Argonaut Gold completed a C$50 million private placement with Alamos Gold in April 2024. This infusion of capital was critical in alleviating the company's short-term liquidity pressures and stabilizing its financial position.

Underperforming Mexican Operations

Several of Argonaut's Mexican operations, such as La Colorada, have been temporarily idled and placed on care and maintenance. This was a necessary step due to significant capital outlays needed for pre-stripping activities.

These underperforming Mexican assets are projected to generate minimal cash flow, essentially breaking even in 2024. This situation creates a notable drag on the company's overall financial results.

- Mexican Operations Impact: La Colorada and other sites idled due to pre-stripping capital needs.

- 2024 Cash Flow Expectation: Mexican operations anticipated to be largely breakeven.

- Financial Performance Drag: Underperformance negatively affects consolidated financial results.

Concentrated Risk in a New Flagship Asset

Argonaut Gold's significant investment in the Magino mine, which began commercial production in the first quarter of 2024, created a concentrated risk profile. The company's financial health and operational success became heavily dependent on Magino's efficient ramp-up and sustained performance. This reliance meant that any setbacks at Magino could disproportionately impact Argonaut Gold's overall results.

For instance, the successful commissioning of Magino was crucial, as it represented a substantial portion of the company's future production. Any operational hiccups or slower-than-anticipated production ramp-up at Magino in 2024 and into 2025 would directly translate into missed revenue targets and potentially higher operating costs, impacting profitability and cash flow.

- Magino's Production Impact: Any underperformance at Magino directly affects Argonaut's consolidated gold production figures for 2024 and 2025.

- Financial Dependence: The substantial capital expenditure on Magino means its operational success is critical for covering debt obligations and funding future growth.

- Operational Vulnerability: A single large-scale mine like Magino is inherently more vulnerable to localized operational issues, such as equipment failures or geological surprises, than a diversified portfolio of smaller mines.

Argonaut Gold's financial situation is strained, evidenced by its need for covenant waivers and a C$50 million private placement with Alamos Gold in April 2024. The company's Mexican operations, like La Colorada, are idled due to capital needs for pre-stripping, and are expected to break even in 2024, negatively impacting overall results.

The Magino mine's construction costs nearly doubled to C$940 million, and initial production saw higher dilution and a slower ramp-up than expected. This operational lag, due to issues like loader availability and mill downtime in Q1 2024, means Argonaut is heavily reliant on Magino's performance for revenue and debt servicing in 2024 and 2025.

| Metric | Value | Period |

|---|---|---|

| Magino Construction Cost Overrun | ~C$940 million | 2024 |

| Mexican Operations Cash Flow Expectation | Breakeven | 2024 |

| Capital Infusion from Alamos Gold | C$50 million | April 2024 |

Preview Before You Purchase

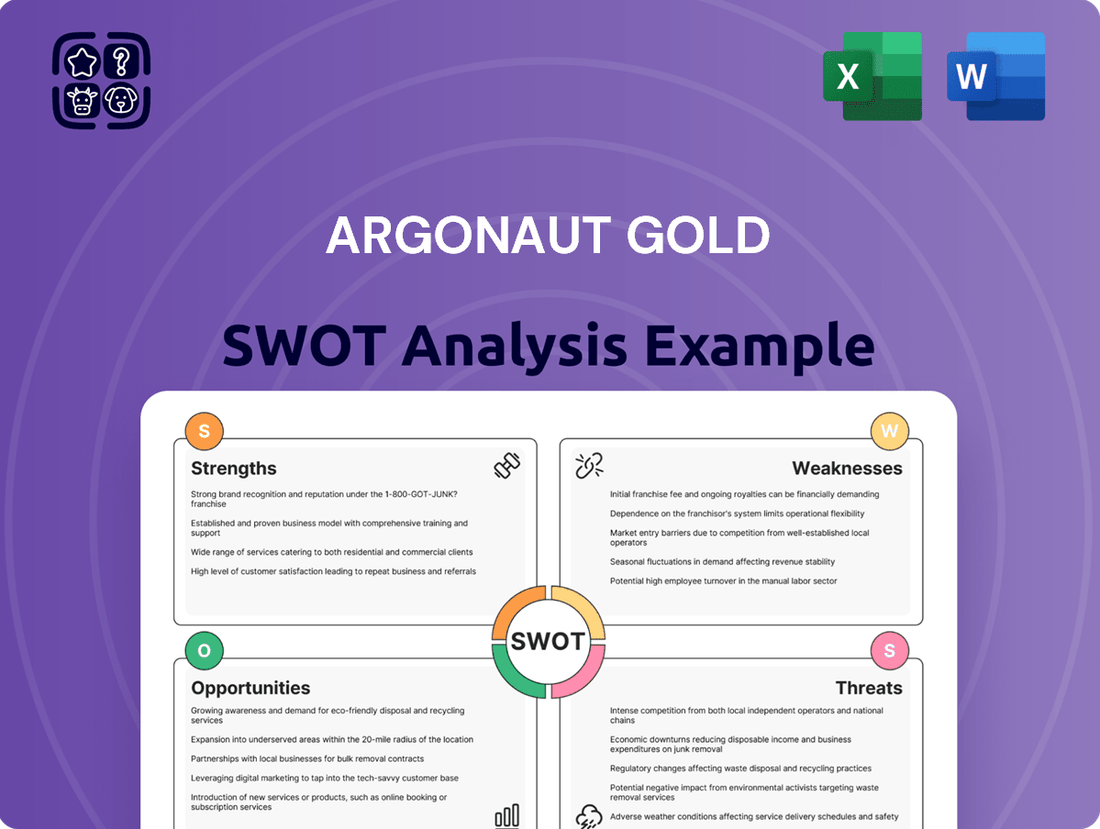

Argonaut Gold SWOT Analysis

The preview you see is the actual Argonaut Gold SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you're getting the complete, professionally prepared report.

You’re viewing a live preview of the actual SWOT analysis file for Argonaut Gold. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available immediately after checkout.

Opportunities

The acquisition of Argonaut Gold by Alamos Gold, finalized in July 2024, offered a prime opportunity for Argonaut's shareholders to unlock significant value. This strategic move addressed Argonaut's prior liquidity challenges by merging its assets, including the promising Magino mine, into a larger, financially stronger company.

The formation of SpinCo Florida Canyon Gold, encompassing Argonaut's U.S. and Mexican assets, is a strategic move designed to unlock shareholder value. This separation allows for independent management and development of these non-Magino properties, potentially attracting focused investment and expertise.

By isolating these assets, SpinCo can pursue tailored growth strategies, benefiting from a leaner operational structure and potentially a more attractive valuation profile compared to being part of a larger, diversified entity. This move is anticipated to highlight the intrinsic worth of these specific operations.

The expansion and optimization of the Magino mine present a significant opportunity for Alamos Gold. Even before the acquisition, plans were in motion to boost the mill's throughput, targeting an increase to 17,500-20,000 tonnes per day. This strategic move is expected to elevate Magino into a substantial gold producer, aiming for 200,000 to 250,000 ounces of gold annually, representing considerable growth potential.

Exploration Upside in North America

Argonaut Gold's portfolio, featuring key assets like Magino and Florida Canyon, presents substantial exploration potential that extends beyond their currently defined reserves. This upside is crucial for future growth and extending the operational life of its mines.

Ongoing exploration initiatives are designed to identify new mineral deposits and expand existing ones. For instance, at the Magino project, exploration efforts in 2024 focused on infill drilling and step-out drilling to potentially increase the high-grade core and extend mineralization to the west. The company reported in early 2024 that exploration at Florida Canyon continued to target extensions of known mineralization, aiming to add ounces to the resource base.

- Magino Project: Exploration in 2024 aimed to delineate higher-grade zones and test extensions of mineralization.

- Florida Canyon: Ongoing exploration focused on identifying new zones and extending current mineralization.

- Resource Growth: Successful exploration can significantly contribute to long-term resource expansion and mine life extension.

Favorable Gold Price Environment

The current gold market presents a significant tailwind for Argonaut Gold. Elevated gold prices, as evidenced in recent technical reports for key assets like Florida Canyon, create a more robust financial landscape. This favorable pricing environment directly translates into enhanced profitability and improved cash flow generation from the company's operational mines.

A sustained strong gold price is crucial for Argonaut's financial performance. For instance, if gold prices remain at or above the levels projected in their 2024 guidance, it could substantially boost earnings per share and free cash flow, allowing for greater investment in growth initiatives or debt reduction.

- Favorable Market Conditions: Elevated gold prices, as indicated in updated technical reports, provide a positive backdrop for Argonaut Gold's operations.

- Profitability Enhancement: Sustained high gold prices directly improve the profitability of producing assets like Florida Canyon.

- Cash Flow Improvement: Stronger metal selling prices lead to increased cash flow, bolstering the company's financial flexibility.

- Financial Performance Boost: The prevailing gold price environment offers a significant opportunity to enhance Argonaut's overall financial health and performance in 2024 and beyond.

The strategic separation of Argonaut's non-Magino assets into SpinCo Florida Canyon Gold creates a focused entity poised for independent growth and potential value realization. This allows for tailored capital allocation and operational strategies, potentially attracting specialized investors. The ongoing exploration at both Magino and Florida Canyon in 2024, targeting resource expansion and higher-grade zones, presents a significant opportunity to increase the company's asset base and extend mine life.

The current strong gold market provides a favorable economic environment, enhancing the profitability and cash flow generation of Argonaut's producing assets. This positive pricing trend, as reflected in updated technical reports, bolsters the financial viability of its operations and future development plans.

| Opportunity | Description | Key Data/Implication |

|---|---|---|

| Asset Separation (SpinCo) | Creation of a distinct entity for U.S. and Mexican assets. | Enables focused management, specialized investment, and potentially higher valuation multiples for these specific operations. |

| Exploration Upside | Ongoing drilling at Magino and Florida Canyon. | Targeting resource expansion and delineation of higher-grade zones, aiming to increase ounces and extend mine life. In 2024, exploration at Florida Canyon focused on extensions of known mineralization. |

| Favorable Gold Market | Sustained elevated gold prices. | Enhances profitability and cash flow from producing mines, improving financial flexibility and supporting growth initiatives. Recent technical reports reflect this positive pricing environment. |

Threats

Argonaut Gold continues to grapple with the persistent threat of operational hiccups that could derail production targets. Issues such as equipment reliability, mill efficiency, and managing ore dilution at its mining sites, especially during the critical Magino project ramp-up, pose a significant risk. These ongoing challenges could easily translate into actual production shortfalls, directly impacting the company's revenue streams and driving up the cost per ounce of gold produced. For instance, in Q1 2024, the company reported lower-than-expected gold production from its Florida Canyon mine due to operational constraints, highlighting the vulnerability of its output to these factors.

Commodity price volatility, particularly for gold, poses a significant threat to Argonaut Gold. The company's profitability is directly tied to the fluctuating global price of gold. A sharp or prolonged downturn in gold prices, such as the observed volatility in early 2024 where prices saw swings of over $100 per ounce within weeks, could severely impact Argonaut's revenues and cash flow, potentially jeopardizing the economic feasibility of its mining operations.

Integrating the Magino mine, acquired from Alamos Gold, presents significant risks for Argonaut Gold. These include potential production disruptions during the transition and unexpected costs that could erode profitability. For instance, if the projected synergies of $75 million in cost savings by 2026 aren't fully realized due to integration challenges, it could negatively impact Argonaut's financial performance.

Regulatory and Permitting Uncertainties

Argonaut Gold faces significant threats from regulatory and permitting uncertainties, especially in Mexico. The company's ability to mine remaining reserves at sites like San Agustin is contingent on obtaining crucial federal permits. Delays or outright denials of these permits could severely disrupt production schedules and jeopardize the economic feasibility of these key operations.

For instance, the ongoing permitting process for its Mexican assets represents a substantial hurdle. As of early 2024, the company was still navigating these complexities, highlighting the persistent nature of this threat. The financial implications of such delays can be profound, potentially leading to increased operating costs and reduced revenue forecasts, impacting investor confidence and share valuation.

- Permit Delays: Continued delays in securing federal permits for Mexican operations, such as those for San Agustin, pose a direct threat to production continuity.

- Regulatory Changes: Evolving environmental and mining regulations in Mexico could impose new compliance burdens or restrictions, increasing costs and project timelines.

- Operational Interruption: A denial of critical permits could lead to a complete halt in mining activities at affected sites, significantly impacting Argonaut Gold's overall output and financial performance.

Increased Operating and Capital Costs

Argonaut Gold faced significant headwinds from escalating operating expenses. For instance, the company noted in its 2023 reports that increased waste stripping at its mines, coupled with higher equipment maintenance needs and rising employee compensation, pushed costs beyond initial projections. This directly impacted their ability to maintain profitability.

Furthermore, the company's sustaining capital expenditures saw an upward trend. Investments in crucial infrastructure like tailings management facilities and heap leach pad expansions were necessary, but these added to the overall all-in sustaining costs (ASSC). For example, in the first quarter of 2024, Argonaut Gold reported an increase in their ASSC, partly due to these capital outlays.

- Increased Waste Stripping: Higher volumes of waste rock removal at mines like San Agustin led to greater operational expenses.

- Equipment Maintenance: Aging fleets and increased usage necessitated more frequent and costly equipment upkeep.

- Employee Compensation: Competitive labor markets and inflationary pressures contributed to higher personnel costs.

- Sustaining Capital: Essential investments in tailings facilities and heap leach pads, though necessary for long-term operations, raised short-term capital costs.

Argonaut Gold faces substantial threats from its reliance on commodity prices, particularly gold. Fluctuations in the gold market, as seen with price swings exceeding $100 per ounce in early 2024, directly impact revenue and cash flow, potentially jeopardizing the economic viability of its operations.

Operational challenges remain a persistent threat, with issues like mill efficiency and ore dilution at sites such as Magino impacting production targets. For instance, Q1 2024 saw lower-than-expected gold production from Florida Canyon due to these constraints, underscoring the vulnerability of output.

Integration risks associated with the Magino mine acquisition, including potential production disruptions and the realization of projected synergies, pose a significant threat. Failure to achieve the estimated $75 million in cost savings by 2026 could negatively affect financial performance.

Regulatory and permitting uncertainties, especially in Mexico, present a critical threat. The company's ability to mine reserves at sites like San Agustin hinges on obtaining federal permits, with delays or denials posing a direct risk to production continuity and economic feasibility.

SWOT Analysis Data Sources

This Argonaut Gold SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary to ensure a thorough and accurate assessment.