Argonaut Gold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

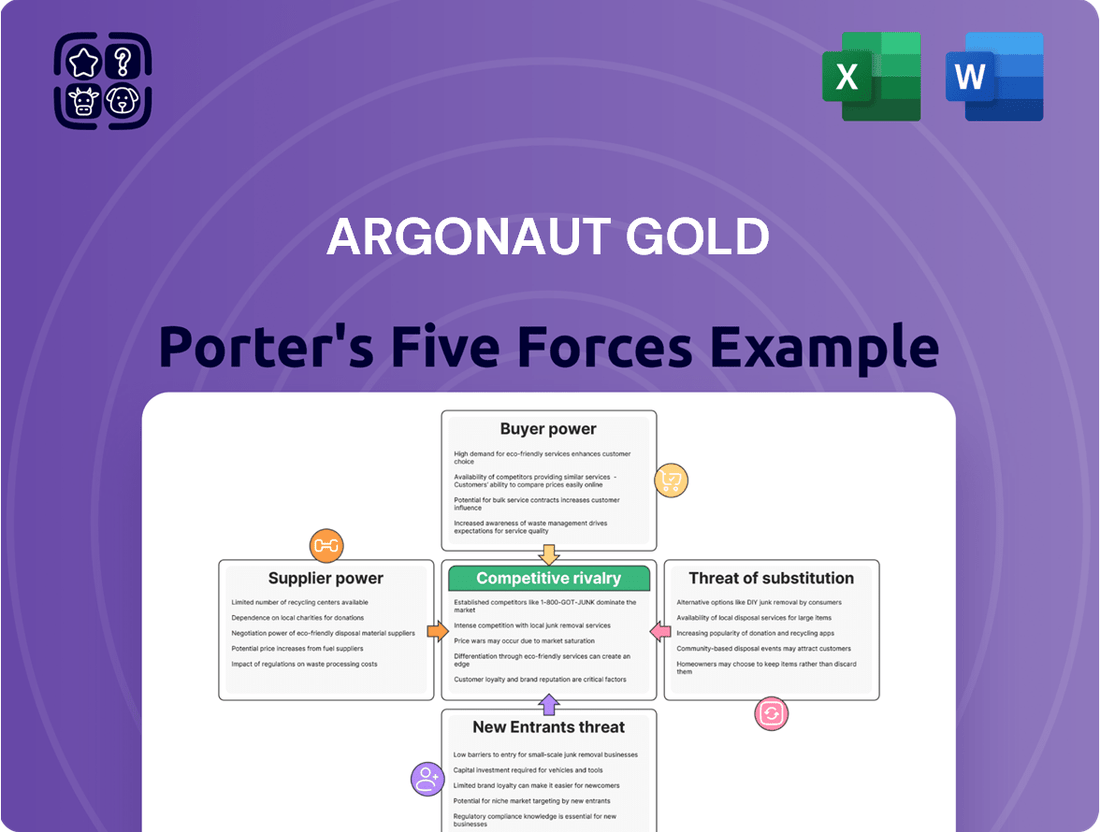

Argonaut Gold faces significant competitive forces, including the intense rivalry among existing gold producers and the substantial threat of substitute products like other precious metals. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic market. The threat of new entrants, while potentially moderated by high capital requirements, remains a factor to consider.

The complete report reveals the real forces shaping Argonaut Gold’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The mining sector's dependence on highly specialized equipment, advanced technology, and a niche skilled workforce significantly bolsters supplier leverage. When only a handful of companies can provide essential components or services, their ability to dictate terms and prices escalates.

For instance, major mining equipment manufacturers like Liebherr, Caterpillar, Komatsu, and Sandvik often hold substantial influence. In 2024, these companies continued to be key players, with Caterpillar reporting over $67 billion in revenue, underscoring their market dominance and the critical nature of their offerings to mining operations like Argonaut Gold.

High switching costs significantly bolster the bargaining power of suppliers for gold producers like Argonaut Gold. Imagine a scenario where a gold mine relies on specialized, heavy-duty excavation machinery or complex geological modeling software. Transitioning to a new supplier for these critical components isn't a simple swap; it involves substantial investments in new equipment, extensive training for personnel on unfamiliar systems, and potential disruptions to ongoing operations. For instance, the cost of decommissioning old machinery and integrating new, potentially incompatible, equipment can run into millions of dollars, not to mention the downtime that impacts production schedules.

Suppliers offering unique or highly differentiated inputs, like proprietary mining technology or specialized geological knowledge, wield significant bargaining power. Argonaut Gold's operational strategy, centered on open-pit, heap leach gold mines, likely necessitates specific chemicals and processing techniques, potentially giving those suppliers leverage.

Labor Market Dynamics

The availability of skilled labor, crucial for operations like those at Argonaut Gold, significantly impacts supplier power. A scarcity of qualified engineers, geologists, and experienced mine operators can drive up labor costs.

In 2024, the mining industry continued to face challenges in attracting and retaining specialized talent. For instance, the U.S. Bureau of Labor Statistics projected a 3% growth in employment for mining and geological engineers between 2022 and 2032, indicating a steady demand for these roles.

- Shortage of Skilled Personnel: A limited pool of experienced mining professionals grants these individuals greater leverage in wage negotiations.

- Increased Labor Costs: When demand for skilled labor outstrips supply, companies like Argonaut Gold may face higher wage bills.

- Impact on Operational Efficiency: Difficulty in filling critical positions can lead to project delays and reduced operational output.

Regulatory and Environmental Service Providers

Argonaut Gold's reliance on specialized regulatory and environmental service providers, such as those offering environmental consulting, reclamation, and compliance expertise, can grant these suppliers considerable bargaining power. This is particularly true given the increasing stringency of environmental regulations and the growing emphasis on sustainable mining practices. For example, in 2024, the global environmental consulting market was valued at approximately $50 billion, with specialized services commanding premium rates.

The specialized knowledge and certifications required for environmental compliance and reclamation mean that the pool of qualified suppliers is often limited. This scarcity, coupled with the critical nature of these services for maintaining operational licenses and social license to operate, strengthens the suppliers' position. Companies like Argonaut Gold may face higher costs for these essential services due to this concentrated supplier power.

- Specialized Expertise: Environmental consultants and reclamation specialists possess unique skills and knowledge crucial for navigating complex regulatory landscapes.

- Regulatory Dependence: Mining operations are heavily dependent on obtaining and maintaining environmental permits, making compliance service providers indispensable.

- Market Concentration: A limited number of highly qualified environmental and regulatory service providers can lead to concentrated supplier power.

- Cost Implications: The specialized nature and regulatory necessity of these services can result in higher costs for mining companies like Argonaut Gold.

The bargaining power of suppliers for Argonaut Gold is significant due to the specialized nature of mining inputs and the high costs associated with switching. Key suppliers of heavy machinery and proprietary technologies often hold considerable sway, as evidenced by the market dominance of companies like Caterpillar, which reported over $67 billion in revenue in 2024. This leverage is further amplified by the substantial investments and operational disruptions required to change suppliers, making it difficult for companies like Argonaut Gold to negotiate favorable terms.

| Supplier Type | Key Factors Influencing Power | Impact on Argonaut Gold | 2024 Data/Context |

| Mining Equipment Manufacturers | Specialized, high-value machinery; high switching costs | Dictate pricing and terms; potential for operational disruptions if suppliers are changed | Caterpillar revenue > $67 billion |

| Technology & Software Providers | Proprietary systems; integration complexity | Limited alternatives for specialized mining software; potential for premium pricing | N/A (proprietary) |

| Skilled Labor Providers | Scarcity of specialized mining talent | Increased labor costs; potential for project delays due to staffing shortages | Projected 3% growth in mining/geological engineers (2022-2032) |

| Environmental & Regulatory Services | Specialized knowledge; regulatory necessity; market concentration | Higher costs for essential compliance and reclamation services; dependence on permits | Global environmental consulting market ~$50 billion (2024) |

What is included in the product

This analysis dissects the competitive forces shaping Argonaut Gold's operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining sector.

Instantly visualize competitive intensity across all five forces, enabling Argonaut Gold to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

The commodity nature of gold significantly influences the bargaining power of customers. Since gold is a globally traded commodity, Argonaut Gold's product is largely indistinguishable from that of its competitors. This lack of differentiation means buyers can easily switch to other suppliers if prices are not competitive.

In 2024, the global gold market continued to be characterized by numerous producers and a highly liquid trading environment. For instance, the London Bullion Market Association (LBMA) reported significant trading volumes, underscoring the ease with which buyers can find alternative sources. This readily available supply limits any single buyer's ability to negotiate lower prices or demand special terms from Argonaut Gold.

Argonaut Gold serves a wide array of customers, encompassing individual investors who purchase gold in forms like ETFs, bars, and coins, as well as institutional buyers such as central banks and industrial consumers. This broad spectrum of demand significantly dilutes the influence any single customer group can wield.

The robust demand for gold, fueled by inflation anxieties and geopolitical instability, particularly observed throughout 2024 and extending into 2025, significantly influences the bargaining power of customers. This strong buyer interest generally shifts power towards gold producers, as customers are more inclined to meet current market valuations rather than negotiate for lower prices.

Price Takers in the Global Market

Argonaut Gold, like most gold producers, operates as a price taker in the global market. This means the prevailing international price of gold, influenced by macroeconomic factors and investor sentiment, largely determines their revenue. For instance, in early 2024, gold prices hovered around $2,000 per ounce, a benchmark Argonaut Gold must accept rather than negotiate with individual buyers.

This inherent characteristic significantly curtails the bargaining power of customers. Individual buyers or even large institutional purchasers cannot directly influence the price Argonaut Gold charges for its output. Their purchasing decisions are based on the global market rate, not on direct negotiation with the company.

- Price Taker Status: Argonaut Gold's revenue is dictated by global gold prices, not customer negotiations.

- Limited Customer Influence: Individual customers cannot demand lower prices directly from Argonaut Gold.

- Market-Driven Pricing: The global market price, not company-specific deals, sets the value of Argonaut Gold's products.

Investment vs. Industrial Demand

For Argonaut Gold, the bargaining power of customers is relatively low, particularly when considering the significant role of investment and central bank demand. These segments are less swayed by minor price shifts than, say, industrial or jewelry consumers. This insulates producers like Argonaut from direct, intense price pressure from these large buyers.

In 2024, gold's appeal as a safe-haven asset continued, with central banks actively increasing their reserves. For instance, the World Gold Council reported that central banks purchased 290 tonnes of gold in the first quarter of 2024, a substantial increase year-over-year, demonstrating their sustained demand irrespective of short-term price volatility.

- Investment Demand: Gold's role as a hedge against inflation and geopolitical uncertainty in 2024 maintained strong investment interest, reducing price sensitivity.

- Central Bank Purchases: Continued robust buying by central banks in 2024 provided a stable demand floor, limiting direct customer price negotiation power.

- Jewelry and Industrial Use: While these sectors are more price-sensitive, their overall demand volume is often outpaced by investment and central bank activity, diminishing their collective bargaining power.

The bargaining power of customers for Argonaut Gold is generally low due to gold's commodity nature and strong global demand. Customers, whether individual investors or large institutions, primarily act as price takers, accepting prevailing market rates rather than negotiating significant discounts. This dynamic was evident in 2024, with gold prices demonstrating resilience driven by inflation concerns and geopolitical events, limiting buyers' leverage.

| Customer Segment | Price Sensitivity | Bargaining Power Impact |

|---|---|---|

| Individual Investors (ETFs, Bars, Coins) | Moderate to High | Low (due to market price acceptance) |

| Institutional Buyers (Central Banks) | Low (focus on reserves and stability) | Very Low (stable, large volume demand) |

| Industrial Consumers | Moderate to High | Low (commodity nature, many suppliers) |

Preview Before You Purchase

Argonaut Gold Porter's Five Forces Analysis

This preview showcases the complete Argonaut Gold Porter's Five Forces Analysis, detailing competitive rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the threat of substitute products. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ready for immediate use.

Rivalry Among Competitors

The gold mining sector is characterized by a diverse competitive landscape, featuring a handful of global giants such as Newmont Corporation and Barrick Gold, alongside a multitude of smaller and mid-sized mining companies. Argonaut Gold, operating primarily in North America, finds itself vying for crucial resources, promising exploration sites, and a significant slice of market share against this varied field of competitors.

The global gold mining industry is witnessing a dynamic shift, with gradual overall production growth being overshadowed by significant consolidation. Mergers and acquisitions activity, particularly pronounced in 2024 and projected to continue into 2025, highlights an intensely competitive environment. Companies are actively pursuing expansion and resource acquisition, signaling a robust M&A pipeline. For instance, Barrick Gold's acquisition of a stake in Lumina Gold in early 2024 exemplifies this trend, aiming to bolster its South American presence.

Gold is a commodity, making Argonaut Gold's product essentially the same as what competitors offer. This lack of differentiation means companies must compete fiercely on factors like cost per ounce and production efficiency. For instance, in 2024, the average all-in sustaining cost for gold producers globally hovered around $1,300 per ounce, a figure Argonaut Gold actively works to beat.

High Fixed Costs and Exit Barriers

The gold mining sector is inherently capital-intensive. For instance, Argonaut Gold's 2023 capital expenditures were approximately $124 million, primarily focused on mine development and infrastructure. This significant upfront investment creates substantial fixed costs.

These high fixed costs, coupled with specialized, illiquid assets, present considerable exit barriers. Companies are often compelled to maintain operations even when market conditions are unfavorable to recoup their investments, which can intensify competition among existing players.

- High Capital Intensity: Gold mining requires vast sums for exploration, mine construction, and equipment.

- Specialized Assets: Mining equipment and infrastructure are highly specific and difficult to repurpose or sell.

- Exit Barriers: The inability to easily exit the industry forces companies to continue production, increasing competitive pressure.

- Operational Continuity: Even during periods of low gold prices, companies may continue to operate to cover fixed costs, leading to a more competitive environment.

Geographical Focus and Project Pipeline

Argonaut Gold's competitive landscape is largely shaped by its North American operational focus, placing it in direct contention with numerous other gold mining companies actively exploring and developing projects within Mexico and the United States. This regional concentration intensifies rivalry as companies vie for the same mineral resources, skilled labor, and regulatory approvals.

The strength and visibility of a company's project pipeline are paramount in this competitive environment. A robust pipeline signifies future production capacity and growth potential, directly influencing investor sentiment and market positioning. For instance, companies with advanced-stage exploration projects or those nearing construction phases often hold a distinct advantage over those with less developed asset bases.

- North American Concentration: Argonaut Gold competes with established and emerging miners in Mexico and the US.

- Project Pipeline as a Differentiator: Companies with strong, de-risked project pipelines gain a competitive edge.

- Impact on Future Production: The ability to successfully bring new gold assets online is a key determinant of long-term success.

Argonaut Gold faces intense competition from both large, established miners and smaller, more agile players in the North American gold market. This rivalry is driven by the homogeneous nature of gold as a commodity, forcing companies to compete primarily on cost efficiency and production volume. The industry's high capital intensity and substantial exit barriers further exacerbate this competitive pressure, as companies are often compelled to continue operations even in challenging market conditions.

| Competitor Type | Key Competitive Factors | Example Competitors (North America) |

| Global Majors | Scale, diversified asset base, access to capital, established infrastructure | Newmont Corporation, Barrick Gold |

| Mid-Tier Producers | Operational efficiency, project pipeline, cost management | Kinross Gold, Agnico Eagle Mines |

| Exploration & Development Companies | Discovery success, resource potential, funding capability | Various junior miners in Mexico and the US |

SSubstitutes Threaten

Other precious metals like silver, platinum, and palladium pose a significant threat as substitutes for gold. These metals can often fulfill similar roles, particularly in investment portfolios and various industrial applications. For instance, silver is frequently seen as a direct and accessible alternative to gold, benefiting from robust industrial demand that can influence its price relative to gold.

The threat of substitutes for physical gold as an investment is significant. Investors can gain exposure to gold through gold exchange-traded funds (ETFs), which provide liquidity and ease of trading, or through gold mining stocks, which offer leverage to gold prices but also carry company-specific risks. In 2024, the SPDR Gold Shares ETF (GLD) continued to be a popular choice, reflecting sustained investor interest in gold as a store of value.

Beyond gold-specific instruments, a broader range of alternative assets can serve as substitutes for investors seeking diversification or inflation hedges. Real estate, particularly in stable markets, and certain investments in emerging or frontier markets with strong growth potential can offer comparable risk-adjusted returns. For instance, as of mid-2024, some emerging market equities demonstrated robust performance, presenting an alternative to traditional safe-haven assets.

Digital currencies and cryptocurrencies, while not a direct replacement for physical gold's industrial uses, present a growing threat as alternative stores of value. Some investors, particularly those concerned about economic instability or inflation, are increasingly allocating capital to assets like Bitcoin. For instance, in early 2024, Bitcoin's market capitalization fluctuated significantly, demonstrating its appeal as a digital alternative to traditional safe havens.

Industrial Material Alternatives

In industrial sectors, materials like copper, platinum, and specialized alloys can serve as substitutes for gold, depending on the specific application's cost-effectiveness and technical demands. For instance, in electronics, palladium and silver are increasingly used in components where gold’s conductivity is beneficial but not strictly essential.

The threat of substitutes is amplified by ongoing advancements in materials science. Innovations could yield new materials with comparable or superior properties at a lower cost, potentially displacing gold in certain high-tech applications. For example, research into advanced ceramics and composite materials continues to explore alternatives for conductive and corrosion-resistant uses.

- Copper: Widely used in electrical wiring and electronics due to its excellent conductivity and lower price point compared to gold. In 2024, copper prices have seen volatility, but its cost advantage remains significant.

- Platinum Group Metals (PGMs): Platinum and palladium are critical in catalytic converters and some electronic components, offering high-temperature resistance and catalytic properties that can substitute for gold in specific industrial processes.

- Aluminum and Silver: These metals are also explored as cost-effective alternatives in certain conductive applications, particularly where weight or extreme conductivity is less of a primary concern.

Diversification Strategies

The threat of substitutes for gold is significant, driven by investors' and central banks' fundamental need for diversification. Even during periods of strong gold performance, capital often flows to other asset classes like equities, bonds, or even alternative investments such as real estate or cryptocurrencies, thereby diluting gold's singular appeal.

This constant search for uncorrelated returns means that gold, despite its historical safe-haven status, faces competition from a wide array of investment vehicles. For instance, in 2024, while gold prices saw considerable gains, the S&P 500 also delivered robust returns, attracting significant investor interest and capital allocation away from precious metals.

- Investor Diversification: A primary driver of substitute threat, as investors spread capital across asset classes to mitigate risk.

- Central Bank Holdings: Reserve managers also diversify, balancing gold with foreign exchange reserves and other sovereign assets.

- Alternative Assets: The rise of cryptocurrencies and real estate as inflation hedges or stores of value presents direct competition to gold.

- Market Performance Dynamics: Strong performance in other markets, like the equity market in 2024, can draw capital away from gold, even if gold itself is appreciating.

The threat of substitutes for gold is multifaceted, encompassing both investment alternatives and industrial material replacements. For investors, other precious metals like silver, platinum, and palladium offer similar diversification benefits, while digital assets such as Bitcoin are increasingly viewed as alternative stores of value, especially in the context of economic uncertainty. In 2024, Bitcoin's price volatility underscored its role as a digital alternative, with its market capitalization fluctuating significantly.

Industrially, materials like copper, platinum, and silver can substitute for gold in applications where its unique properties are not strictly essential, driven by cost considerations. For example, copper's lower price and excellent conductivity make it a viable alternative in many electrical applications, a trend observed throughout 2024.

| Substitute | Primary Use Case | 2024 Market Context |

|---|---|---|

| Silver | Investment, Jewelry, Industrial (electronics, solar panels) | Benefited from industrial demand, often seen as a more accessible gold alternative. |

| Platinum Group Metals (PGMs) | Catalytic converters, Jewelry, Electronics | Demand influenced by automotive sector and industrial applications; can substitute for gold in electronics. |

| Copper | Electrical wiring, Plumbing, Electronics | Significant industrial demand; cost advantage over gold in conductive applications. |

| Bitcoin | Digital Store of Value, Speculation | Increasingly adopted by some investors as a digital alternative to gold, especially during economic uncertainty. |

Entrants Threaten

The gold mining sector, including companies like Argonaut Gold, demands immense upfront investment. This includes the costs associated with exploration, securing permits, developing mine sites, and constructing processing facilities. For instance, major gold projects often require hundreds of millions, if not billions, of dollars in capital before any gold is produced.

These high capital requirements serve as a formidable barrier, effectively deterring many potential new entrants. Only well-capitalized companies or those with access to significant debt or equity financing can realistically consider entering the market. This financial hurdle limits the competitive landscape, making it difficult for smaller or less-funded entities to establish a foothold.

The gold mining sector faces significant barriers to entry due to extensive regulatory hurdles and complex permitting processes. Companies must navigate stringent environmental regulations, often requiring detailed impact assessments and ongoing compliance monitoring. These requirements, coupled with the need for community engagement and securing various local and national permits, can be incredibly time-consuming and costly, effectively deterring many potential new players from entering the market.

The high cost and inherent risk associated with identifying and acquiring economically viable gold reserves present a significant barrier for new entrants. This process involves extensive exploration, drilling, and feasibility studies, often requiring substantial upfront capital and a long development timeline.

Established players like Argonaut Gold benefit from their existing portfolios of producing assets and advanced development projects. These established reserves provide a more predictable and lower-risk foundation for operations, making it difficult for newcomers to compete on resource acquisition and cost efficiency.

In 2023, global gold exploration expenditure reached approximately $10.5 billion, highlighting the significant investment required to discover new deposits. New companies entering the market face the daunting task of matching the resource base of incumbents without the benefit of historical exploration successes or existing infrastructure.

Technological Expertise and Operational Know-how

The threat of new entrants in the gold mining sector, particularly for operations like Argonaut Gold's, is significantly shaped by the high barriers to entry related to technological expertise and operational know-how. Success in modern gold mining, especially in open-pit and heap leach operations, hinges on a deep understanding of geological surveying, mineral processing, and efficient mine management. New companies must either possess or rapidly acquire this specialized knowledge, which is a considerable hurdle.

New entrants face substantial challenges in replicating the established operational efficiencies and technological sophistication that experienced players like Argonaut Gold have developed. This includes mastering complex extraction techniques, managing large-scale equipment fleets, and implementing advanced environmental and safety protocols. The learning curve is steep, requiring significant investment in training and development.

For instance, the capital expenditure for a new mid-tier gold mine can easily range from hundreds of millions to over a billion dollars, a significant portion of which is allocated to acquiring and deploying cutting-edge technology and skilled personnel. In 2023, global mining capital expenditures were projected to reach over $100 billion, with a substantial portion dedicated to new project development and technology upgrades, underscoring the financial and technical commitment required.

- Technological Sophistication: Advanced geological modeling software, precision drilling equipment, and sophisticated processing plants are critical for efficient gold recovery, demanding specialized technical skills.

- Operational Experience: Proven track record in managing complex supply chains, labor relations, regulatory compliance, and mitigating operational risks is essential.

- Capital Intensity: The high upfront investment in exploration, mine development, and specialized machinery creates a significant financial barrier for potential new entrants.

- Learning Curve: Acquiring the necessary expertise in heap leach optimization, tailings management, and environmental stewardship takes considerable time and resources.

Established Supply Chains and Infrastructure

Established gold producers, like Argonaut Gold, possess significant advantages due to their existing supply chains and infrastructure. These established relationships with suppliers and logistics providers mean they often secure better pricing and more reliable service. For instance, in 2024, major gold mining companies continued to leverage long-standing contracts for crucial inputs like explosives and processing chemicals, often at rates not available to newcomers.

New entrants face a considerable hurdle in replicating this established network. Building these relationships from scratch can be time-consuming and expensive, potentially leading to higher operational costs and less favorable terms for essential supplies and transportation. This barrier can significantly deter potential competitors from entering the market.

- Established relationships with suppliers of mining equipment and consumables.

- Existing logistics networks for transporting ore and refined gold.

- Access to specialized infrastructure like processing plants and tailings facilities.

- Higher initial capital expenditure required for new entrants to build comparable infrastructure.

The threat of new entrants for Argonaut Gold is considerably low due to the immense capital required to establish a gold mining operation. The substantial upfront investment in exploration, permitting, and infrastructure development acts as a significant deterrent.

Furthermore, the complex regulatory landscape and the need for specialized technological and operational expertise create steep learning curves for newcomers. Established players benefit from existing infrastructure and supplier relationships, making it difficult for new companies to achieve comparable economies of scale and cost efficiencies.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Exploration, mine development, and processing facilities can cost hundreds of millions to billions of dollars. | High; deters less-funded entities. |

| Regulatory Hurdles | Navigating environmental regulations and obtaining permits is time-consuming and costly. | Significant; increases time-to-market and initial expenses. |

| Technological & Operational Expertise | Requires deep knowledge in geology, processing, and mine management. | Substantial; steep learning curve for new entrants. |

| Established Infrastructure & Supply Chains | Incumbents have existing relationships and logistics networks. | Challenging; new entrants face higher costs and less favorable terms. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Argonaut Gold is built upon a foundation of publicly available data, including the company's annual reports (10-K filings), investor presentations, and press releases. We also incorporate industry-specific data from reputable mining intelligence firms and macroeconomic indicators relevant to the gold mining sector.