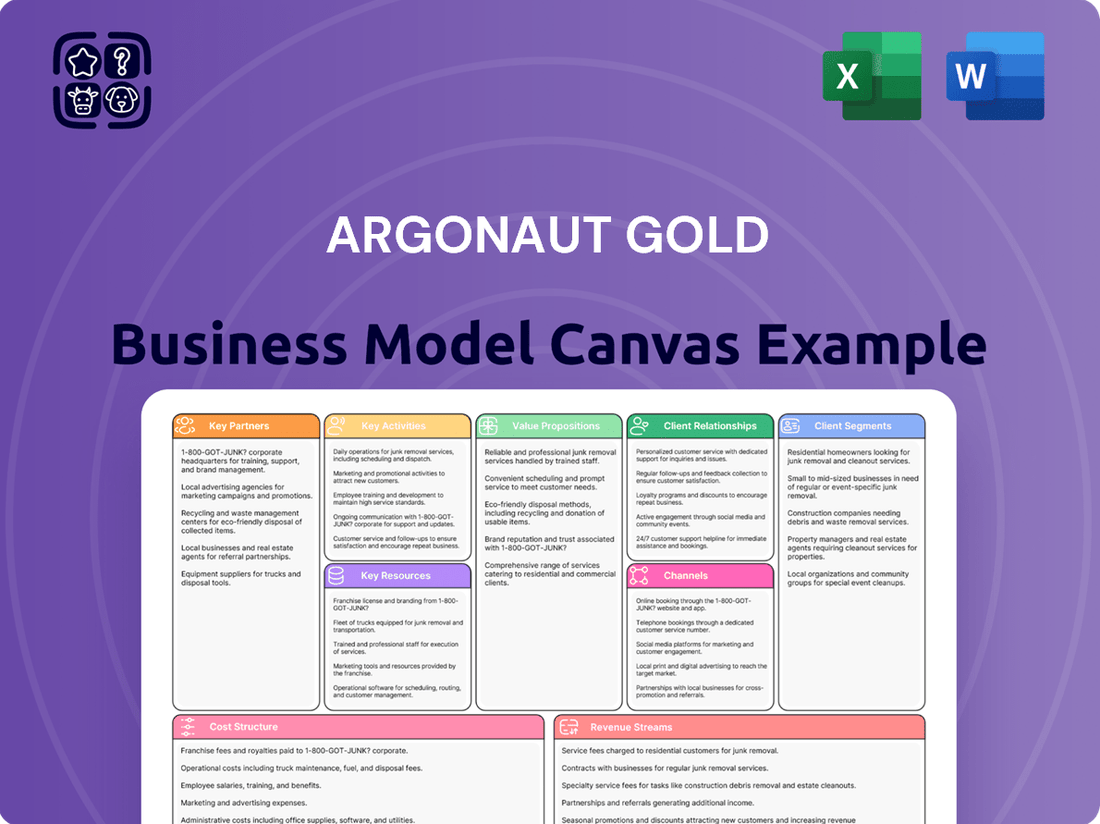

Argonaut Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Unlock the strategic blueprint behind Argonaut Gold's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and key revenue streams, offering invaluable insights for anyone in the mining industry or looking to understand competitive strategies.

Dive into the core of Argonaut Gold's operations with the complete Business Model Canvas. It meticulously outlines their key resources, activities, and cost structure, providing a clear roadmap of how they achieve their business objectives. This is an essential tool for strategic planning and competitive analysis.

Ready to gain a competitive edge? Download the full Argonaut Gold Business Model Canvas to explore their vital partnerships and channels, understand their cost drivers, and uncover their profit formula. It's the ultimate resource for actionable business intelligence.

Partnerships

Argonaut Gold's recent arrangement agreement with Alamos Gold Inc., where Alamos acquired all outstanding shares of Argonaut, represents a significant strategic partnership. This deal is crucial for integrating Argonaut's Magino mine with Alamos's nearby Island Gold mine. The combined entity is projected to become a larger, more cost-efficient gold operation.

Financial institutions are crucial partners for Argonaut Gold, providing essential debt financing and capital for its development projects. These relationships are vital for funding exploration, construction, and operational expansions.

A notable example of this partnership occurred in 2024 when Argonaut Gold successfully completed a private placement equity financing with Alamos Gold. This strategic move provided immediate liquidity and crucial capital to support growth objectives, particularly during the acquisition phase of its business strategy.

Argonaut Gold relies heavily on its equipment and technology suppliers. These partnerships are vital for securing the heavy mining machinery and advanced processing technologies, such as those used in heap leaching, that underpin their open-pit operations. For instance, in 2024, the company continued to focus on optimizing its fleet and ensuring access to reliable spare parts to maintain efficient mining and milling rates across its projects.

Government and Regulatory Bodies

Argonaut Gold actively collaborates with governmental and regulatory bodies to secure and maintain vital permits and licenses for its mining activities. This partnership is critical for navigating the complex landscape of exploration, development, and ongoing operations.

Compliance with environmental regulations is a cornerstone of these relationships, ensuring that operations adhere to standards for resource management and impact mitigation. For instance, in 2024, Argonaut Gold continued its focus on environmental stewardship across its projects, aligning with evolving regulatory frameworks.

Securing approvals for essential infrastructure, such as tailings management facilities and heap leach pads, relies heavily on these governmental partnerships. These approvals are fundamental to the operational viability and sustainability of its mining ventures.

- Permitting and Licensing: Essential for exploration, development, and mining operations.

- Environmental Compliance: Adherence to regulations for sustainable resource management.

- Infrastructure Approvals: Securing permits for critical facilities like tailings dams.

- Regulatory Engagement: Ongoing dialogue to ensure operational continuity and legal standing.

Local Communities and Indigenous Groups

Argonaut Gold prioritizes robust engagement with local communities and Indigenous groups, recognizing this as fundamental to its social license to operate. This commitment ensures that mining activities are conducted responsibly and sustainably, addressing environmental, social, and economic impacts. For instance, in 2024, the company continued its community investment programs, focusing on local employment and development initiatives. These partnerships are crucial for long-term operational success and mutual benefit.

Key aspects of these partnerships include:

- Proactive Engagement: Consistent dialogue to understand and mitigate potential impacts on local populations and their territories.

- Benefit Sharing: Implementing programs that provide tangible economic and social benefits, such as job creation and infrastructure support. In 2024, Argonaut reported that a significant percentage of its workforce at its Mexican operations were local hires.

- Environmental Stewardship: Collaborative efforts to ensure mining practices align with environmental protection goals and respect Indigenous land rights and traditional practices.

Argonaut Gold's key partnerships are multifaceted, encompassing strategic alliances for operational synergy, financial backing from institutions, and crucial relationships with suppliers and government bodies. These collaborations are vital for project development, operational efficiency, and regulatory compliance. Furthermore, strong community and Indigenous group engagement forms a bedrock for their social license to operate, ensuring sustainable and mutually beneficial outcomes.

| Partner Type | Example/Focus | 2024 Relevance |

|---|---|---|

| Strategic Alliances | Alamos Gold Inc. (Acquisition & Mine Integration) | Integration of Magino mine with Island Gold for enhanced efficiency. |

| Financial Institutions | Debt financing, Equity placements | Provided liquidity and capital for growth objectives, including private placement with Alamos Gold. |

| Suppliers | Equipment & Technology Providers | Ensuring access to mining machinery and processing technologies; fleet optimization. |

| Government & Regulatory Bodies | Permitting, Licensing, Environmental Compliance | Securing permits for operations and infrastructure; adherence to environmental standards. |

| Local Communities & Indigenous Groups | Social License to Operate, Benefit Sharing | Community investment programs, local employment initiatives; significant percentage of local hires in Mexican operations. |

What is included in the product

Argonaut Gold's business model focuses on acquiring, developing, and operating gold mines, targeting mid-tier production with a strategy of organic growth and strategic acquisitions. It emphasizes efficient operations, cost management, and a commitment to sustainable practices to deliver value to shareholders.

Helps identify and address operational inefficiencies and market risks in gold mining, offering a clear roadmap to improved profitability.

Activities

Argonaut Gold’s key activities heavily rely on exploration to discover new gold deposits and grow its existing mineral reserves. This proactive approach is fundamental to sustaining and expanding its operations.

The company undertakes extensive drilling programs, a critical step in converting identified mineral resources into economically viable mineral reserves. These efforts are crucial for future mine planning and development.

In 2023, Argonaut Gold reported total proven and probable mineral reserves of 2.5 million gold ounces, highlighting the ongoing work in resource definition and expansion.

Updating technical reports based on new exploration findings is another core activity, ensuring transparency and providing stakeholders with current, reliable data on the company's asset base.

Argonaut Gold's key activities heavily feature the meticulous development and construction of new mining ventures, alongside the strategic expansion of their current operations. This focus is critical for future growth and production capacity.

A prime example of this commitment is the ongoing ramp-up of the Magino mine. This project represents a significant investment in bringing new resources online. Additionally, the company is actively constructing new heap leach pads at its Florida Canyon mine, a move designed to enhance processing capabilities and extend the mine's operational life.

For instance, in the first quarter of 2024, Argonaut Gold reported that Magino had achieved its first gold pour, marking a significant milestone in its development. The company also provided updates on the construction progress of additional heap leach pads at Florida Canyon, aiming to support increased throughput.

Argonaut Gold's primary activity revolves around operating open-pit, heap leach gold mines. This core function involves the meticulous movement of vast quantities of earth and rock to access gold-bearing ore. In 2024, the company continued to focus on optimizing these processes for efficient gold extraction.

Key to their mining operations is rigorous grade control, ensuring that the ore processed contains sufficient gold to be economically viable. This precision directly impacts the overall profitability and sustainability of their mining ventures.

The company also concentrates on maximizing mining rates, which means efficiently extracting as much ore as possible within a given timeframe. This operational efficiency is crucial for meeting production targets and managing costs effectively.

Gold Processing and Recovery

Argonaut Gold's key activities center on the efficient processing and recovery of gold from its ore. This involves a series of crucial steps, including crushing the mined material to a finer size, conveying it to the processing plant, and then employing leaching techniques to extract the gold. The company consistently works to enhance operational efficiency by focusing on optimizing mill throughput, maximizing plant availability, and ensuring high gold recovery rates.

- Operational Focus: Improving mill throughput and plant availability are ongoing priorities.

- Recovery Rates: Maximizing gold recovery from the ore is a critical objective.

- 2024 Performance Indicator: For the first quarter of 2024, Argonaut Gold reported a total gold production of 46,709 ounces.

- Processing Efficiency: Continuous efforts are made to refine the crushing, conveying, and leaching processes for better results.

Environmental Management and Reclamation

Argonaut Gold is deeply committed to sustainable and responsible mining. This commitment is evident in their comprehensive environmental management and reclamation activities, which are central to their operations. They actively manage tailings facilities, ensuring they meet stringent environmental standards throughout the entire mine life cycle.

In 2024, Argonaut Gold continued to focus on these critical areas. For instance, their San Agustin project in Mexico has a detailed reclamation plan in place, aiming to restore the land post-mining. This proactive approach underscores their dedication to minimizing environmental impact.

- Environmental Stewardship: Implementing robust programs for water management, air quality control, and biodiversity protection across all sites.

- Tailings Management: Adhering to industry best practices and regulatory requirements for the safe and secure management of tailings facilities, including ongoing monitoring and integrity assessments.

- Reclamation Planning: Developing and executing progressive reclamation plans, with a focus on returning disturbed land to a stable and ecologically sound condition.

- Regulatory Compliance: Maintaining strict compliance with all applicable environmental laws and regulations in the jurisdictions where they operate.

Argonaut Gold's key activities are centered on the efficient operation of its gold mines, which primarily utilize open-pit and heap leach methods. This involves the careful extraction and processing of ore to recover gold. For example, in the first quarter of 2024, the company reported a total gold production of 46,709 ounces, demonstrating ongoing operational output. Their focus remains on optimizing mill throughput, ensuring high plant availability, and maximizing gold recovery rates to enhance overall efficiency and profitability.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Exploration & Reserve Growth | Discovering new gold deposits and expanding existing mineral reserves through drilling programs. | Ongoing exploration efforts to define and expand resources. |

| Mine Development & Construction | Building new mines and expanding current operations, including infrastructure like heap leach pads. | Magino mine achieved its first gold pour in Q1 2024; construction of new pads at Florida Canyon continued. |

| Mine Operations | Operating open-pit, heap leach mines with a focus on grade control and maximizing mining rates. | Continued focus on optimizing extraction processes and efficient ore movement. |

| Processing & Gold Recovery | Crushing, conveying, and leaching ore to extract gold, aiming for high recovery rates and throughput. | Q1 2024 gold production was 46,709 ounces; efforts to improve mill throughput and plant availability are ongoing. |

| Environmental Management & Reclamation | Implementing sustainable practices, managing tailings, and planning for land reclamation. | Focus on environmental stewardship, including progressive reclamation at projects like San Agustin. |

What You See Is What You Get

Business Model Canvas

The Argonaut Gold Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot showcases the core elements of Argonaut Gold's strategic framework, offering a transparent look at their operational blueprint. Once your order is complete, you'll gain full access to this same detailed and professionally structured Business Model Canvas.

Resources

Argonaut Gold's core strength lies in its substantial mineral reserves and gold deposits, primarily located at its Magino, Florida Canyon, and Mexican operations. These assets are the bedrock of its gold production capabilities, providing the essential raw materials.

As of December 31, 2023, Argonaut Gold reported proven and probable gold reserves of 3.8 million ounces, with measured and indicated gold resources totaling an additional 6.4 million ounces. This robust resource base is crucial for sustaining and expanding its mining operations.

Key physical resources for Argonaut Gold's operations include a substantial fleet of mining equipment, sophisticated processing plants, and essential heap leach pads. These assets are fundamental to the extraction and beneficiation of gold.

The Magino mine boasts a state-of-the-art mill, crucial for crushing and processing the ore to liberate gold. Similarly, the Florida Canyon operation relies heavily on its heap leach pads for efficient gold recovery through a chemical process.

In 2023, Argonaut Gold reported total capital expenditures of $129.7 million, with a significant portion allocated to sustaining and developing these vital mining infrastructure and equipment assets across its portfolio.

Argonaut Gold relies heavily on its skilled workforce, comprising experienced engineers, geologists, and operational staff. This expertise is critical for everything from discovering new mineral deposits to efficiently extracting them. For instance, in 2024, the company continued to invest in training programs to ensure its teams remain at the forefront of mining technology and safety practices.

Attracting and keeping top talent, particularly in remote mining locations, presents a continuous challenge and a key resource requirement. Argonaut Gold’s success in 2024 was bolstered by its ability to retain a core group of highly specialized personnel, crucial for maintaining operational stability and driving exploration efforts.

Permits, Licenses, and Social License

Argonaut Gold’s ability to mine hinges on obtaining and maintaining crucial permits and licenses. These are not just bureaucratic hurdles; they represent the legal and social acceptance needed to operate. This includes everything from environmental impact assessments to operational permits, ensuring compliance with all governmental regulations.

Securing these licenses is a significant undertaking, often involving extensive environmental studies and community engagement. For instance, in 2023, Argonaut Gold was actively working on permitting for its projects, a process that can take years and significant capital investment.

- Legal Licenses: All necessary governmental permits and approvals required for exploration, development, and operation of mining sites.

- Social License: Community acceptance and support for mining activities, crucial for uninterrupted operations and long-term sustainability.

- Environmental Permits: Compliance with environmental regulations, including water usage, waste management, and emissions control.

- Operational Permits: Approvals related to safety standards, land use, and the overall execution of mining activities.

Financial Capital and Liquidity

Argonaut Gold's business model relies heavily on robust financial capital. This includes maintaining healthy cash reserves, securing credit facilities, and accessing equity financing to fund day-to-day operations, significant capital expenditures for mine development, and future growth initiatives. As of the first quarter of 2024, Argonaut Gold reported cash and cash equivalents of approximately $111.6 million.

Effective debt management and strategic financial planning are paramount for Argonaut Gold to ensure liquidity. The company is actively engaged in refinancing existing debt obligations to optimize its capital structure and reduce interest expenses. This proactive approach to financial management is crucial for navigating the volatile commodity markets and supporting ongoing exploration and production activities.

- Access to Capital: Argonaut Gold requires substantial financial capital for mine development, exploration, and operational continuity.

- Liquidity Management: Maintaining sufficient cash reserves and managing debt are key to ensuring ongoing operations and financial flexibility.

- Financing Strategies: The company utilizes a mix of cash flow from operations, debt financing, and potentially equity raises to fund its activities.

- 2024 Financial Snapshot: In Q1 2024, Argonaut Gold had approximately $111.6 million in cash and cash equivalents, underscoring the importance of its capital resources.

Argonaut Gold's key resources extend beyond physical assets to include intellectual property and proprietary knowledge in mining and exploration techniques. This expertise is vital for optimizing extraction processes and identifying new resource opportunities. The company’s commitment to innovation in 2024 involved adopting advanced geological modeling software to enhance resource estimation accuracy.

Value Propositions

Argonaut Gold's core value proposition centers on delivering consistent gold production from its strategically located North American mines. This reliability is a key draw for investors seeking stable returns in the precious metals market.

For 2024, Argonaut Gold's guidance anticipates a significant uptick in production, projecting between 180,000 to 200,000 gold equivalent ounces. This forecast reflects an expected increase from their 2023 operational performance.

Argonaut Gold is committed to achieving low-cost gold production through a sharp focus on operational efficiencies and stringent capital allocation. This strategy is evident in their ongoing efforts to reduce per-unit costs and streamline processes at key mining sites.

The company actively works to optimize operations at mines such as Magino and Florida Canyon, aiming to enhance productivity and control expenses. For instance, in the first quarter of 2024, Argonaut Gold reported a total cash cost of $1,302 per ounce, demonstrating their pursuit of cost competitiveness in the market.

Argonaut Gold's strategy centers on expanding its gold reserves and advancing new projects, offering a clear path for future growth. This exploration and development focus is crucial for increasing production volumes and enhancing the company's long-term value.

Key initiatives like the ramp-up of the Magino mine and continued exploration at Florida Canyon are pivotal. In the first quarter of 2024, Magino produced 30,048 ounces of gold, a significant step towards its full operational capacity, while Florida Canyon's exploration efforts aim to bolster its resource base.

Sustainable and Responsible Mining

Argonaut Gold's commitment to sustainable and responsible mining resonates deeply with investors prioritizing environmental, social, and governance (ESG) factors. This dedication attracts capital from those seeking to align their investments with ethical business practices.

The company actively adheres to stringent environmental regulations and invests in community development programs. For instance, in 2024, Argonaut Gold reported progress on its water management initiatives, aiming to reduce its environmental footprint. Their focus on community engagement includes local hiring and support for infrastructure projects, fostering positive relationships with the communities where they operate.

- Environmental Stewardship: Adherence to rigorous environmental standards, including water conservation and waste management, is a key differentiator.

- Social Responsibility: Active engagement with local communities through job creation, education, and infrastructure support builds strong social license to operate.

- Ethical Governance: Transparent and accountable corporate governance practices attract and retain socially conscious investors.

- Long-Term Value Creation: Integrating sustainability into operations is seen as crucial for long-term operational stability and financial performance.

Enhanced Shareholder Value Post-Acquisition

For shareholders of the former Argonaut Gold, the acquisition by Alamos Gold and the subsequent spin-off into SpinCo presents a compelling dual value proposition. This structure aims to unlock greater shareholder value by separating distinct asset profiles and management teams.

Shareholders now benefit from continued participation in the higher-quality, lower-cost assets retained by Alamos Gold, which is projected to benefit from significant operational synergies post-acquisition. For instance, Alamos Gold's 2024 guidance indicated a production increase and a decrease in cash costs, demonstrating the immediate impact of consolidation.

Simultaneously, the spin-off creates a new entity, SpinCo, offering direct exposure to a portfolio of assets with their own growth potential and strategic focus. This allows investors to choose their preferred exposure: a larger, more established producer or a focused growth-oriented company.

- Alamos Gold's 2024 production guidance: Expected to be between 475,000 and 525,000 gold equivalent ounces.

- Synergies: Alamos Gold anticipates achieving approximately $40 million in annual pre-tax synergies.

- SpinCo Assets: Includes exploration properties and early-stage development projects, offering potential for future growth.

- Shareholder Choice: Investors can now hold shares in both Alamos Gold and SpinCo, tailoring their investment to their risk appetite and market outlook.

Argonaut Gold's value proposition is built on reliable gold production from its North American mines, aiming for consistent investor returns. The company is focused on achieving low production costs through operational efficiencies and careful capital spending, as seen in their first quarter 2024 total cash cost of $1,302 per ounce.

Customer Relationships

Argonaut Gold prioritizes transparent investor relations by providing regular updates on operational performance and financial results. This includes detailed quarterly reports and investor presentations that offer insights into strategic developments. For instance, in the first quarter of 2024, Argonaut Gold reported a total gold production of 49,095 ounces, with an all-in sustaining cost of $1,368 per ounce, demonstrating a commitment to sharing key performance indicators with stakeholders.

Argonaut Gold prioritizes building strong, lasting relationships with the communities surrounding its operations. This proactive engagement is crucial for maintaining its social license to operate, ensuring smooth project development and ongoing success. For instance, in 2024, the company continued its focus on open dialogue, actively addressing local concerns and fostering a collaborative environment.

Key to this strategy is a commitment to local employment and economic development. Argonaut Gold actively seeks to hire from local communities, providing training and career opportunities. Furthermore, the company invests in community development initiatives, supporting projects that enhance quality of life and create sustainable benefits beyond mining operations.

Argonaut Gold actively cultivates strong relationships with governmental and regulatory bodies, recognizing their critical role in permitting and ongoing legal compliance. This proactive approach, as demonstrated by their engagement with various jurisdictions, helps to streamline approvals for projects like the development of the Magino mine, which advanced through its permitting stages with focused collaboration. Such positive interactions are key to minimizing operational interruptions and fostering long-term business stability.

Strategic Partnerships and Alliances

Argonaut Gold actively cultivates strategic partnerships and alliances to foster mutual growth and operational advantages. A prime example is its collaboration with Alamos Gold, a relationship designed to unlock synergistic benefits. These alliances are crucial for enhancing operational efficiencies and expanding market opportunities.

These strategic alliances are not merely transactional; they represent a commitment to shared objectives and long-term value creation. By leveraging each other’s strengths, Argonaut Gold and its partners can navigate complex market dynamics more effectively. For instance, in 2024, Argonaut Gold continued to explore joint ventures and strategic collaborations to optimize its project pipeline and access new geological areas.

- Synergistic Benefits: Partnerships like the one with Alamos Gold aim to combine resources and expertise, leading to cost savings and improved project development timelines.

- Operational Efficiencies: Alliances can facilitate shared infrastructure, equipment, and technical knowledge, thereby reducing individual operating expenses.

- Expanded Opportunities: Strategic collaborations can open doors to new exploration targets, joint financing arrangements, and enhanced market access for produced commodities.

- Risk Mitigation: By sharing the risks and rewards associated with large-scale mining projects, strategic partnerships can provide a more stable financial footing for Argonaut Gold.

Reliable Buyer Relationships

Argonaut Gold cultivates robust relationships with gold refiners and metal traders. This is crucial for ensuring consistent sales and favorable pricing for its output. In 2024, maintaining these partnerships is key to Argonaut's revenue stability.

- Securing Favorable Terms: Strong buyer relationships allow Argonaut Gold to negotiate better pricing and payment schedules for its gold.

- Revenue Stream Consistency: Reliable off-take agreements with refiners and traders provide predictable revenue, essential for operational planning.

- Market Access: Established relationships facilitate access to global markets and diverse trading opportunities.

- Risk Mitigation: Diversifying buyer relationships can reduce dependence on any single entity, mitigating counterparty risk.

Argonaut Gold's customer relationships are primarily with entities involved in the downstream processing and trading of its gold production. These relationships are vital for converting mined resources into revenue, with a focus on securing consistent sales and advantageous pricing. In 2024, the company continued to nurture these connections to ensure market access and financial stability.

| Partner Type | Key Relationship Aspect | 2024 Focus |

|---|---|---|

| Gold Refiners | Ensuring quality standards and efficient processing of gold doré. | Maintaining consistent off-take agreements and exploring value-added refining options. |

| Metal Traders/Financial Institutions | Facilitating the sale of refined gold and managing price risk. | Securing favorable sales contracts and exploring hedging strategies to protect against price volatility. |

Channels

The official company website and press releases are key for Argonaut Gold to share important updates. This includes everything from financial performance, like their 2024 operational results, to new project developments and sustainability efforts.

These channels are vital for reaching investors, journalists, and the general public, ensuring transparency and consistent communication about the company's progress and strategic direction.

Argonaut Gold leverages financial market platforms and news wires to disseminate crucial information. This ensures that institutional investors, individual shareholders, analysts, and financial media receive timely updates on the company's performance and operational developments. For instance, in Q1 2024, Argonaut Gold reported total gold sales of 49,595 ounces, a key figure that would be immediately accessible to market participants through these channels.

Argonaut Gold actively participates in investor conferences and roadshows to foster direct communication with both current and prospective shareholders. These engagements are crucial for management to articulate the company's strategic direction, recent operational achievements, and forward-looking plans. For instance, in 2024, Argonaut Gold was a prominent presenter at key mining industry events, detailing their progress at the San Antonio and La Colorada projects.

Regulatory Filings (SEDAR+, SEC)

Mandatory regulatory filings through platforms like SEDAR+ and the SEC serve as essential channels for Argonaut Gold. These filings provide the public with detailed financial statements, operational updates, and material news, forming a cornerstone of transparency and investor relations.

These documents are critical for due diligence, offering stakeholders a deep dive into the company's performance and strategic direction. For instance, in their 2023 annual reports, companies like Argonaut Gold would have disclosed key financial metrics and operational highlights, accessible to all investors.

Key information typically found in these filings includes:

- Financial Statements: Audited balance sheets, income statements, and cash flow statements.

- Management's Discussion and Analysis (MD&A): Explanations of financial results and operational performance.

- Material Change Reports: Disclosures of significant events impacting the company.

- Technical Reports: For mining companies, these detail reserves and resources.

Community and Stakeholder Meetings

Community and Stakeholder Meetings are vital channels for Argonaut Gold. Direct engagement through local meetings, public consultations, and forums fosters goodwill and addresses local concerns, crucial for maintaining the social license to operate. In 2024, Argonaut Gold continued its commitment to transparent communication, holding numerous site-specific meetings across its operations in Mexico and Canada.

These interactions are not just about information sharing; they are about building trust and understanding. By actively listening and responding to the needs and feedback of communities and stakeholders, Argonaut Gold aims to ensure its operations are conducted responsibly and sustainably.

- Community Engagement: Regular meetings with local leaders and residents to discuss operational impacts and benefits.

- Stakeholder Forums: Platforms for dialogue with government agencies, NGOs, and indigenous groups to align on environmental and social performance.

- Transparency Initiatives: Publicly sharing operational updates and addressing concerns raised during consultations.

- Social License: Maintaining positive relationships directly impacts the ability to operate smoothly and access resources.

Argonaut Gold utilizes a multi-channel approach to communicate with its diverse stakeholder base. Key channels include its official website and press releases for broad updates, financial market platforms and news wires for timely financial information, and investor conferences for direct engagement. Regulatory filings are crucial for transparency, while community meetings foster local relationships.

These channels ensure that investors, analysts, media, and local communities receive consistent and accurate information regarding Argonaut Gold's operations, financial performance, and strategic initiatives. For example, in Q1 2024, the company reported gold sales of 49,595 ounces, a figure readily available through these communication avenues.

The company's commitment to transparency is evident in its use of SEDAR+ and SEC filings, which provide detailed financial statements and operational insights. Furthermore, active participation in industry events in 2024, such as presentations on the San Antonio and La Colorada projects, highlights their proactive communication strategy.

Community engagement, including site-specific meetings in 2024, underscores Argonaut Gold's focus on maintaining its social license to operate by addressing local concerns and building trust.

| Channel | Purpose | Key Information Disseminated (Examples) | 2024 Relevance |

|---|---|---|---|

| Official Website & Press Releases | Broad Company Updates | Financial performance, project development, sustainability efforts | Dissemination of quarterly operational results and strategic announcements. |

| Financial Market Platforms & News Wires | Timely Financial & Operational News | Gold sales figures, production updates, market guidance | Q1 2024 gold sales of 49,595 ounces reported. |

| Investor Conferences & Roadshows | Direct Stakeholder Engagement | Strategic direction, operational achievements, future plans | Presentations on San Antonio and La Colorada project progress. |

| Regulatory Filings (SEDAR+, SEC) | Mandatory Transparency & Due Diligence | Financial statements, MD&A, technical reports | Annual reports detailing 2023 performance and forward-looking statements. |

| Community & Stakeholder Meetings | Local Relations & Social License | Operational impacts, benefits, addressing local concerns | Numerous site-specific meetings across Mexico and Canada. |

Customer Segments

The primary customer segment for Argonaut Gold is the global market for precious metals, with a specific focus on buyers of gold bullion. This broad category encompasses entities ranging from central banks seeking to diversify reserves to institutional investors looking for safe-haven assets.

Key buyers also include jewelers who transform refined gold into finished products and industrial users who incorporate gold into various applications, such as electronics and dentistry. In 2023, global gold demand reached 4,899 tonnes, with central bank purchases alone accounting for 1,037 tonnes, highlighting the significance of these institutional buyers.

Institutional investors and funds, including major asset managers and pension funds, represent a key customer segment for Argonaut Gold. These entities are primarily driven by the potential for strong financial returns, robust growth trajectories, and demonstrable operational efficiency within the gold mining industry. For instance, in Q1 2024, Argonaut Gold reported total gold sales of 42,587 ounces, generating revenue of $86.5 million, demonstrating the scale of operations that appeal to these large capital allocators.

Individual retail investors are a key customer base for Argonaut Gold, actively buying shares on stock exchanges. They are primarily focused on the company's stock price movements, potential dividend payouts, and its outlook for sustained growth over time.

In 2024, the retail investor segment continues to play a significant role in market liquidity. For instance, during periods of market volatility, retail participation can influence short-term stock performance, making their sentiment a factor for companies like Argonaut Gold to monitor closely.

Metal Traders and Refiners

Metal traders and refiners are crucial clients for Argonaut Gold, directly purchasing its gold output. These entities are essential for transforming raw or semi-processed gold into marketable forms and facilitating its sale. For instance, in 2024, the global gold refining market was valued at approximately $160 billion, highlighting the significant scale of these operations and their importance to gold producers like Argonaut.

These relationships are the backbone of Argonaut Gold's revenue generation. By supplying gold to established traders and refiners, the company ensures the consistent monetization of its mining activities. The demand from these segments is influenced by factors such as industrial applications and investment appetite, which saw a notable increase in demand for refined gold in early 2024.

- Key Customers: Companies specializing in the trading and refining of precious metals.

- Value Proposition: Direct purchasers of Argonaut's gold, enabling revenue realization.

- Market Significance: The gold refining sector is a multi-billion dollar industry, demonstrating the substantial market for Argonaut's output.

Local Communities and Government Entities

Local communities and government entities are crucial partners for Argonaut Gold, even if they aren't direct revenue generators. Their support is vital for securing and maintaining operating permits, which directly impacts the company's ability to conduct its mining activities. For instance, in 2024, Argonaut Gold continued to engage with local stakeholders in regions like Durango, Mexico, where its San Antonio mine is located, focusing on community development initiatives and environmental stewardship to foster goodwill.

Positive relationships with these groups are paramount for operational continuity. Disruptions caused by community opposition or regulatory hurdles can lead to significant delays and increased costs. Argonaut Gold's commitment to social responsibility programs, such as those aimed at improving local infrastructure and providing employment opportunities, helps to build trust and ensure a stable operating environment.

The company's engagement with government bodies, from municipal to national levels, is essential for navigating the complex regulatory landscape of the mining industry. This includes compliance with environmental standards, labor laws, and taxation policies. In 2024, Argonaut Gold actively participated in discussions with relevant authorities regarding exploration projects and operational expansions, underscoring the importance of these governmental relationships for future growth and sustainability.

- Stakeholder Importance: Local communities and government entities are critical for operational permits and social license to operate.

- Relationship Management: Positive engagement through community development and environmental programs is key to mitigating risks.

- Regulatory Compliance: Adherence to government regulations and active participation in policy discussions are essential for business continuity.

- Impact Mitigation: Strategies to minimize environmental impact and maximize local economic benefits are central to maintaining strong relationships.

Argonaut Gold's customer base is diverse, spanning institutional investors, individual shareholders, and those involved in the physical trading and refining of gold. Institutional buyers, including central banks and large funds, are key, driven by diversification and return potential. For example, central banks purchased 1,037 tonnes of gold in 2023.

Retail investors are also a significant segment, closely monitoring stock performance and growth prospects. Metal traders and refiners form another crucial group, directly purchasing the company's gold output to process it further. The global gold refining market's estimated $160 billion valuation in 2024 underscores the importance of these relationships.

Beyond direct buyers, local communities and government entities are vital stakeholders, essential for securing permits and maintaining an operational license. Argonaut Gold's engagement in 2024 with communities near its San Antonio mine in Durango, Mexico, highlights this crucial aspect of its business model.

| Customer Segment | Primary Motivation | 2023/2024 Relevance |

|---|---|---|

| Institutional Investors & Funds | Financial Returns, Growth Trajectory | Central Bank purchases: 1,037 tonnes (2023) |

| Retail Investors | Stock Price, Dividends, Growth Outlook | Significant role in market liquidity |

| Metal Traders & Refiners | Direct Gold Purchase, Processing | Global refining market valued at ~$160 billion (2024) |

| Local Communities & Governments | Operational Permits, Social License | Community engagement in Durango, Mexico (2024) |

Cost Structure

Argonaut Gold's operating costs are primarily driven by the direct expenses of extracting and processing ore. These include essential inputs like labor, the significant cost of energy, particularly diesel fuel, and the chemicals and materials needed for processing, known as reagents and consumables.

In 2024, Argonaut Gold has faced upward pressure on these unit costs. Inflationary trends have impacted the price of key inputs. Furthermore, the ramp-up phase of newer operations, such as the Magino mine, has presented challenges that have temporarily elevated operating expenses per ounce of gold produced.

Argonaut Gold's capital expenditures are substantial, primarily driven by the need to develop new mines and enhance existing operations. These investments are crucial for building out necessary infrastructure like tailings management facilities and heap leach pads, essential for efficient gold extraction.

In 2024, Argonaut Gold's capital expenditures were projected to be between $100 million and $120 million. This significant outlay reflects ongoing development at projects such as the San Agustin project in Mexico, which is key to future production growth.

Exploration and development costs are a significant component of Argonaut Gold's expense structure. These include outlays for geological surveys, extensive drilling programs to identify and delineate mineral resources, and the crucial feasibility studies that assess the economic viability of new and existing projects. These investments are absolutely vital for securing future reserve growth and ensuring sustained production capacity.

For instance, in the first quarter of 2024, Argonaut Gold reported exploration and development expenses of approximately $4.2 million. This figure underscores the company's commitment to investing in its future pipeline, a necessary expenditure to maintain and expand its operational base in the competitive gold mining sector.

Environmental and Social Compliance Costs

Argonaut Gold incurs significant expenses to meet environmental standards and social obligations. These costs are essential for maintaining their license to operate and ensuring long-term sustainability. For instance, in 2024, the company allocated substantial resources towards environmental monitoring, water management, and community engagement programs across its operations.

These compliance costs are a critical component of their overall business model, directly impacting profitability and operational continuity. They include expenditures for:

- Environmental Impact Assessments and Permitting: Costs associated with studies and approvals required before and during operations.

- Reclamation and Closure Planning: Funds set aside for restoring land after mining activities cease.

- Social Investment and Community Relations: Expenses for programs that benefit local communities and foster positive relationships.

- Waste Management and Tailings Storage: Costs for safely handling and storing mining byproducts.

Financing and Corporate Overheads

Financing and corporate overheads represent a significant cost component for Argonaut Gold. This category encompasses interest expenses on outstanding debt, which are crucial for funding exploration and development projects. In 2024, managing and potentially refinancing this debt is a key strategic focus to reduce the overall cost of capital and improve profitability.

Beyond debt servicing, corporate administration expenses are also factored in. These include salaries for executive and administrative staff, legal and accounting fees, and the costs associated with maintaining its status as a publicly traded entity. Other necessary overheads for managing a global mining operation also fall under this umbrella.

- Interest Expenses: Costs associated with servicing existing debt obligations.

- Corporate Administration: Salaries, legal, accounting, and compliance costs for a public company.

- Other Overheads: General operational and management expenses not directly tied to a specific mine site.

- Debt Refinancing: Strategic efforts to secure more favorable debt terms, aiming to lower interest payments.

Argonaut Gold's cost structure is dominated by operating expenses, including labor, energy (especially diesel), and processing consumables. Capital expenditures are significant, funding mine development and infrastructure, with 2024 projections between $100-$120 million. Exploration and development costs, such as those around $4.2 million in Q1 2024, are vital for future growth.

Compliance costs for environmental and social obligations are also crucial, encompassing assessments, reclamation, and community relations. Financing and corporate overheads, including interest expenses on debt and administrative costs, form another key part of their expenses, with debt management a strategic focus in 2024.

| Cost Category | Key Components | 2024 Context |

|---|---|---|

| Operating Costs | Labor, Energy (Diesel), Reagents, Consumables | Upward pressure from inflation; higher unit costs during new mine ramp-ups (e.g., Magino) |

| Capital Expenditures | Mine Development, Infrastructure (Tailings, Heap Leach) | Projected $100-$120 million; includes San Agustin project development |

| Exploration & Development | Geological Surveys, Drilling, Feasibility Studies | Approx. $4.2 million in Q1 2024; essential for reserve growth |

| Compliance Costs | Environmental Assessments, Reclamation, Community Relations, Waste Management | Significant allocation for monitoring, water management, and engagement |

| Financing & Overhead | Interest Expenses, Corporate Administration, Debt Refinancing | Debt servicing is a key focus; includes salaries, legal, and public company costs |

Revenue Streams

Argonaut Gold's main income comes from selling the gold it mines. This includes gold produced at its Magino and Florida Canyon mines, as well as from its operations in Mexico. In 2023, the company reported selling approximately 175,930 gold equivalent ounces, generating significant revenue.

While Argonaut Gold's primary focus is gold extraction, the company also generates revenue from silver, a valuable by-product. This secondary income stream, though smaller than gold sales, can be significant depending on market conditions and the specific ore grades processed.

The value of this silver by-product is directly influenced by prevailing market prices, which can fluctuate. For instance, in 2023, silver prices averaged around $23.31 per ounce, demonstrating its potential to contribute meaningfully to overall revenue when market conditions are favorable.

Strategic asset divestitures, like the spin-off of Argonaut Gold's US and Mexican assets into a new entity (SpinCo) in connection with the Alamos Gold acquisition, represent a key revenue stream. This move effectively realizes value for existing shareholders by separating these operations from the core business.

This strategic maneuver allows Argonaut Gold to focus on its remaining assets while providing a clear pathway for the new entity to operate independently. In 2023, Argonaut Gold reported total revenue of $344.5 million, with the divestiture process aiming to optimize the portfolio and potentially unlock further value.

Equity Financing

Argonaut Gold generates revenue through equity financing by issuing new shares to investors, a common method for funding operations and expansion. This strategy allows the company to access capital without incurring debt. For instance, in November 2023, Argonaut Gold announced a private placement of approximately 12.8 million common shares at $1.95 per share with Alamos Gold, raising gross proceeds of about $25 million. This capital infusion is intended to support ongoing projects and general corporate purposes.

This equity issuance serves as a crucial revenue stream, directly contributing to the company's financial health and its ability to pursue strategic objectives. The transaction with Alamos Gold highlights a key partnership that bolsters Argonaut's financial position, enabling continued development and exploration activities. Such placements are vital for mining companies to manage cash flow and invest in future growth.

- Equity Financing: Raising capital by selling company stock to investors.

- Purpose: Funding operations, growth initiatives, and capital expenditures.

- Example: Private placement with Alamos Gold in November 2023, raising approximately $25 million.

Hedging and Forward Sales Contracts

Hedging and forward sales contracts are key revenue streams for Argonaut Gold, providing a degree of certainty in a volatile market. These agreements lock in prices for future gold production, shielding the company from potential downturns in the spot price of gold. For instance, in 2023, Argonaut Gold reported that a significant portion of its anticipated production was subject to various hedging arrangements, aiming to stabilize revenue streams.

These strategies, while offering protection, do come with a trade-off. By fixing prices, Argonaut Gold might forgo the opportunity to benefit from substantial increases in gold prices. This means that if the market price of gold surges significantly above the contracted price, the company’s revenue from those hedged ounces will be capped.

- Price Stabilization: Hedging and forward sales contracts provide predictable revenue by locking in prices for future gold sales, reducing exposure to market fluctuations.

- Risk Mitigation: These instruments are crucial for managing the financial risks associated with commodity price volatility, a common challenge in the mining sector.

- Limited Upside Potential: While protecting against price drops, these contracts can cap potential gains if gold prices rise substantially above the agreed-upon forward price.

- Strategic Importance: For companies like Argonaut Gold, these revenue streams are integral to financial planning, capital allocation, and investor confidence, especially in the context of ongoing exploration and development projects.

Argonaut Gold's primary revenue stream originates from the sale of gold produced across its mining operations, notably at the Magino mine in Canada and its Mexican assets. In the first quarter of 2024, the company reported selling approximately 24,300 gold ounces, contributing to its overall financial performance.

Beyond gold, the company also generates revenue from silver, a valuable by-product of its mining activities. While silver sales represent a smaller portion of total revenue, they provide an important secondary income source, particularly when market prices for silver are favorable.

The company also leverages equity financing to fund its operations and growth. For example, in early 2024, Argonaut Gold completed a significant equity financing round, raising approximately CAD 100 million. This capital infusion supports ongoing projects and strategic development initiatives.

| Revenue Stream | Description | 2023/2024 Data Point |

| Gold Sales | Revenue from the sale of mined gold. | 175,930 gold equivalent ounces sold in 2023. |

| Silver Sales | Revenue from the sale of silver by-product. | Silver prices averaged ~$23.31/oz in 2023. |

| Equity Financing | Capital raised through the issuance of company stock. | Raised ~CAD 100 million in Q1 2024. |

Business Model Canvas Data Sources

The Argonaut Gold Business Model Canvas is constructed using a blend of financial disclosures, operational reports, and market intelligence. This comprehensive data set ensures each component accurately reflects the company's strategic positioning and economic realities.