Argonaut Gold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Unlock the full picture of Argonaut Gold's operating environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are directly impacting their mining operations and future growth. Don't make investment decisions in the dark – download the complete report now for actionable intelligence.

Political factors

Political stability across Argonaut Gold's operating regions, including Canada, the United States, and Mexico, is a critical factor. Instability, especially in Mexico, can trigger alterations in mining regulations and policies, potentially impacting operational methods such as open-pit mining.

Shifts in government leadership, notably in Mexico, often correlate with changes in mining legislation and fiscal regimes. For instance, recent policy discussions in Mexico have touched upon environmental regulations and royalty structures, which could affect profitability for mining companies like Argonaut.

The completed acquisition of Argonaut Gold by Alamos Gold in early 2024 represents a significant political and corporate development. This transaction will fundamentally alter Argonaut's operational landscape and asset distribution, integrating its Mexican assets into Alamos Gold's broader portfolio and potentially influencing future regulatory interactions.

The efficiency of securing and retaining mining permits is paramount for Argonaut Gold's operations. Delays in these processes, particularly for crucial development phases, can directly hinder expansion plans and financial outcomes.

For instance, the Cerro del Gallo project in Mexico has faced significant hurdles related to permitting, underscoring the potential for regulatory bottlenecks to impede progress. Such delays can introduce considerable uncertainty into project timelines and financial projections.

The company's history includes instances where permit denials have triggered protracted legal disputes, highlighting the financial and operational risks associated with navigating complex regulatory landscapes. These challenges can divert resources and impact the overall viability of new ventures.

Trade agreements such as the United States-Mexico-Canada Agreement (USMCA) significantly impact the mining industry by establishing environmental and labor benchmarks. For Argonaut Gold, any shifts in these agreements, particularly concerning resource extraction or worker rights, could lead to operational disruptions or financial penalties across its North American holdings.

Local and Regional Political Dynamics

Argonaut Gold's operations are significantly shaped by local and regional political dynamics, particularly in its key jurisdictions like Mexico and Canada. Maintaining strong relationships with these governmental bodies and local communities is paramount, especially when navigating land use regulations and environmental impact assessments. For instance, in 2024, the company continued to engage with regional authorities in Durango, Mexico, regarding ongoing permitting processes for its San Antonio project, where community support is a key factor for smooth operations.

Local political sentiment can directly impact Argonaut Gold's social license to operate. Opposition from local groups or favorable support from regional governments can influence the speed and success of obtaining necessary permits and can affect the continuity of mining operations. The company's 2024 sustainability reports highlight ongoing community engagement initiatives aimed at fostering positive relationships and addressing local concerns, which is crucial for long-term operational stability.

- Community Relations: Argonaut Gold's 2024 ESG report details investments in local infrastructure and social programs in its operating regions, demonstrating a commitment to community well-being as a foundation for political stability.

- Permitting Environment: The company's ability to secure and maintain mining permits in 2024 has been directly tied to its adherence to regional environmental standards and its proactive engagement with local regulatory bodies.

- Political Risk Mitigation: Strategies in 2024 focused on building trust with local stakeholders to mitigate potential disruptions arising from shifting political landscapes or community-driven opposition.

Nationalization Risk and Resource Nationalism

While Argonaut Gold is not currently facing explicit threats of nationalization, the mining industry globally grapples with the persistent risk of resource nationalism. This trend sees governments seeking to gain more control over their natural resources, potentially through higher royalties, increased taxes, or even outright expropriation of mining assets. For instance, in 2023, several Latin American countries, where Argonaut Gold has operations, continued to debate or implement changes to mining codes that could increase state participation or fiscal burdens on mining companies.

Such political shifts can significantly impact a company's profitability and the security of its investments. For Argonaut Gold, operating in jurisdictions like Mexico and Canada, understanding the evolving political landscape and potential for increased government intervention is crucial for strategic planning. The company's ability to navigate these political risks effectively will be a key determinant of its long-term success and asset valuation.

Key considerations for Argonaut Gold regarding resource nationalism include:

- Government Stance on Foreign Investment: Monitoring changes in mining laws and government attitudes towards foreign ownership and control of mineral resources in operating countries.

- Fiscal Policy Changes: Assessing the potential for increased royalty rates, corporate income taxes, or the introduction of new resource-specific taxes that could affect profit margins.

- Community Relations and Social License: Maintaining strong relationships with local communities and governments can mitigate the risk of politically motivated actions against mining operations.

- Diversification of Operations: Operating in multiple jurisdictions can spread risk, reducing the impact of adverse political events in any single country.

Political stability across Argonaut Gold's operating regions, particularly Mexico and Canada, remains a key concern for 2024 and 2025. Changes in government leadership, as seen in Mexico, can lead to shifts in mining regulations and fiscal policies, impacting operational costs and profitability. For instance, ongoing discussions around environmental standards and royalty structures in Mexico could influence Argonaut's operations.

The company's ability to secure and maintain mining permits is directly influenced by political factors and local sentiment. Delays in permitting processes, as observed with projects like Cerro del Gallo in Mexico, can significantly hinder expansion plans and financial outcomes. Argonaut's 2024 sustainability reports highlight ongoing community engagement initiatives, crucial for maintaining a social license to operate amidst evolving political landscapes.

Trade agreements like the USMCA continue to shape the mining industry by setting environmental and labor benchmarks. Any alterations to these agreements could introduce operational disruptions or financial penalties for Argonaut Gold across its North American assets. Furthermore, the global trend of resource nationalism, though not an immediate threat to Argonaut, necessitates careful monitoring of government stances on foreign investment and potential fiscal policy changes in its operating countries.

What is included in the product

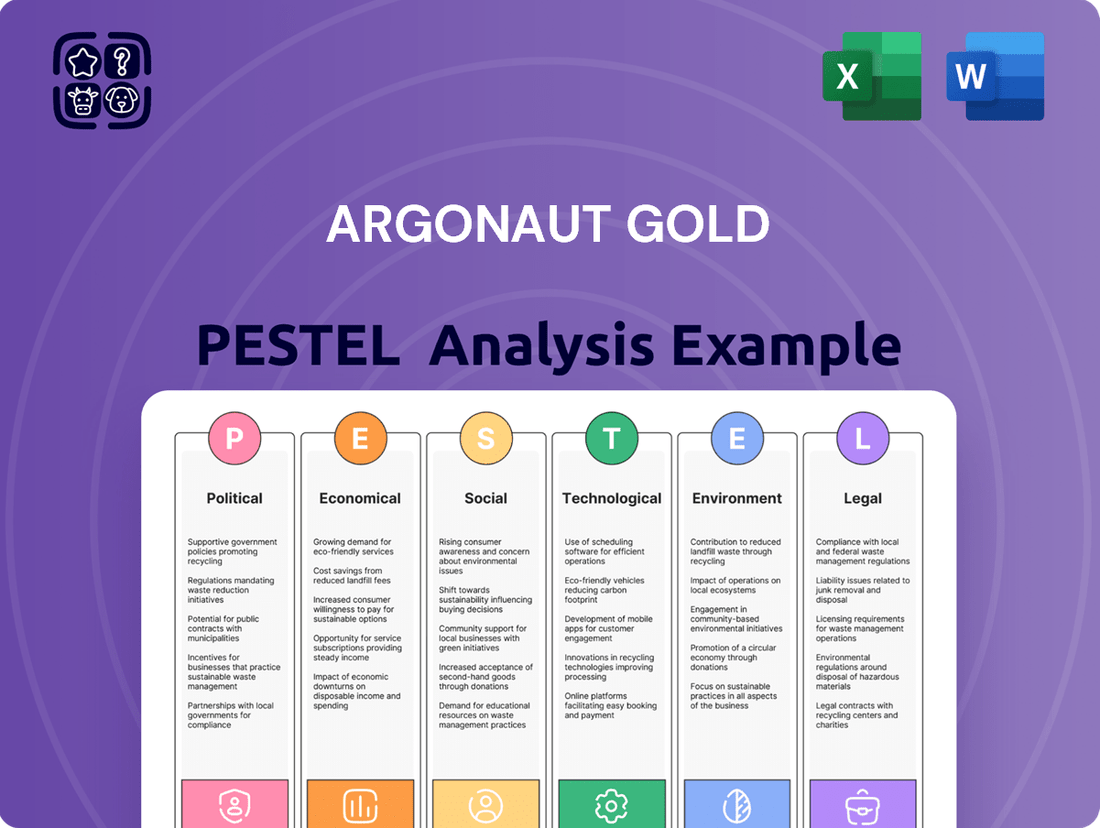

This Argonaut Gold PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive overview of external macro-environmental forces, highlighting potential threats and opportunities for Argonaut Gold.

This PESTLE analysis for Argonaut Gold serves as a pain point reliever by providing a concise, easily shareable summary format ideal for quick alignment across teams or departments on external risks and market positioning.

Economic factors

The price of gold is a crucial economic factor for Argonaut Gold, directly influencing its revenue and profitability. Global gold price volatility significantly impacts the company's financial performance and the feasibility of its mining projects.

Looking ahead to 2025, forecasts indicate a potentially bullish trend for gold prices, with some analysts predicting a rise above $3,000 per ounce. Such an increase would be highly beneficial for Argonaut Gold, enhancing its earnings potential and supporting its operational and expansion plans.

Inflationary pressures are a significant concern for Argonaut Gold. For instance, the average price of Brent crude oil, a key energy input, fluctuated significantly in 2024, impacting transportation and operational expenses. Similarly, wage inflation in mining regions can directly increase labor costs, a major component of operating expenditure. The cost of essential raw materials used in gold extraction also saw upward trends throughout late 2024 and into early 2025, squeezing profit margins.

Effectively managing these rising costs is paramount for Argonaut Gold's profitability. In 2024, the company focused on optimizing energy consumption and exploring more efficient extraction techniques to mitigate the impact of higher energy prices. Negotiating favorable contracts for raw materials and investing in automation to reduce reliance on labor were also key strategies. Failure to control these escalating operational and capital costs, especially in a high inflation environment, directly threatens the company's ability to generate strong returns.

Currency exchange rates are a significant factor for Argonaut Gold, a Canadian company with operations in the United States and Mexico. Fluctuations between the Canadian dollar (CAD), US dollar (USD), and Mexican peso (MXN) directly affect how the company's revenues and expenses translate into its reported financial results. For instance, a stronger USD relative to CAD can boost reported earnings when US-based revenue is converted back to Canadian dollars, while a weaker MXN can reduce the cost of Mexican operations when expressed in CAD.

In early 2024, the CAD was trading around 0.73 USD, and the MXN was approximately 16.5 MXN per USD. If Argonaut Gold generates a substantial portion of its revenue in USD, a strengthening USD against the CAD would positively impact its financial statements. Conversely, if operating costs in Mexico rise significantly due to peso appreciation against the CAD, this could negatively affect profitability.

Access to Capital and Financing Conditions

Argonaut Gold's ability to secure financing is critical for its operations and future projects. Market conditions, including fluctuating interest rates and investor sentiment, directly affect the cost and availability of capital. For instance, in early 2024, the Federal Reserve's cautious approach to rate cuts, while signaling potential easing, kept borrowing costs elevated for many companies, including those in the mining sector.

These financing conditions significantly impact Argonaut's growth prospects and its ability to manage liquidity. Higher interest rates can increase the debt servicing burden, potentially limiting funds available for exploration and development. Conversely, periods of strong investor confidence can lead to more favorable financing terms, supporting expansion initiatives.

Key factors influencing Argonaut's access to capital include:

- Interest Rate Environment: Rising or stable high interest rates increase the cost of debt financing.

- Investor Confidence: Positive sentiment towards the gold mining sector and Argonaut's specific projects enhances capital availability.

- Credit Market Conditions: The overall health and liquidity of credit markets influence the ease of securing loans and issuing bonds.

- Company Performance: Argonaut's operational results, cash flow generation, and balance sheet strength are paramount for attracting investment.

Economic Growth and Industrial Demand

Global economic growth plays a nuanced role in gold demand. While robust economic expansion can boost industrial demand for gold in sectors like electronics and jewelry, its primary function often shifts to a safe-haven asset during periods of uncertainty. For instance, in 2024, as global economic growth projections remained mixed, gold prices saw upward movement, reflecting its safe-haven appeal amidst geopolitical tensions and inflation concerns.

Strong economic growth can also indirectly influence Argonaut Gold's operations. It can increase demand for other minerals that are often extracted alongside gold, potentially improving the economics of multi-commodity mines. Furthermore, a booming economy can lead to tighter labor markets and higher wages, impacting operational costs for mining companies like Argonaut Gold.

- Economic Growth Impact: Global GDP growth, projected by the IMF to be around 3.2% for 2024, influences industrial gold use, though safe-haven demand often dominates.

- Industrial vs. Safe Haven: While industrial applications exist, gold's price in 2024 was heavily supported by its role as a hedge against inflation and geopolitical risks, rather than solely economic expansion.

- Operational Costs: A strong economy can elevate labor costs, a significant factor for mining firms like Argonaut Gold, potentially increasing their cost of production.

The price of gold is a crucial economic factor for Argonaut Gold, directly influencing its revenue and profitability. Global gold price volatility significantly impacts the company's financial performance and the feasibility of its mining projects.

Looking ahead to 2025, forecasts indicate a potentially bullish trend for gold prices, with some analysts predicting a rise above $3,000 per ounce. Such an increase would be highly beneficial for Argonaut Gold, enhancing its earnings potential and supporting its operational and expansion plans.

Inflationary pressures are a significant concern for Argonaut Gold. For instance, the average price of Brent crude oil, a key energy input, fluctuated significantly in 2024, impacting transportation and operational expenses. Similarly, wage inflation in mining regions can directly increase labor costs, a major component of operating expenditure. The cost of essential raw materials used in gold extraction also saw upward trends throughout late 2024 and into early 2025, squeezing profit margins.

Effectively managing these rising costs is paramount for Argonaut Gold's profitability. In 2024, the company focused on optimizing energy consumption and exploring more efficient extraction techniques to mitigate the impact of higher energy prices. Negotiating favorable contracts for raw materials and investing in automation to reduce reliance on labor were also key strategies. Failure to control these escalating operational and capital costs, especially in a high inflation environment, directly threatens the company's ability to generate strong returns.

Currency exchange rates are a significant factor for Argonaut Gold, a Canadian company with operations in the United States and Mexico. Fluctuations between the Canadian dollar (CAD), US dollar (USD), and Mexican peso (MXN) directly affect how the company's revenues and expenses translate into its reported financial results. For instance, a stronger USD relative to CAD can boost reported earnings when US-based revenue is converted back to Canadian dollars, while a weaker MXN can reduce the cost of Mexican operations when expressed in CAD.

In early 2024, the CAD was trading around 0.73 USD, and the MXN was approximately 16.5 MXN per USD. If Argonaut Gold generates a substantial portion of its revenue in USD, a strengthening USD against the CAD would positively impact its financial statements. Conversely, if operating costs in Mexico rise significantly due to peso appreciation against the CAD, this could negatively affect profitability.

Argonaut Gold's ability to secure financing is critical for its operations and future projects. Market conditions, including fluctuating interest rates and investor sentiment, directly affect the cost and availability of capital. For instance, in early 2024, the Federal Reserve's cautious approach to rate cuts, while signaling potential easing, kept borrowing costs elevated for many companies, including those in the mining sector.

These financing conditions significantly impact Argonaut's growth prospects and its ability to manage liquidity. Higher interest rates can increase the debt servicing burden, potentially limiting funds available for exploration and development. Conversely, periods of strong investor confidence can lead to more favorable financing terms, supporting expansion initiatives.

Key factors influencing Argonaut's access to capital include:

- Interest Rate Environment: Rising or stable high interest rates increase the cost of debt financing.

- Investor Confidence: Positive sentiment towards the gold mining sector and Argonaut's specific projects enhances capital availability.

- Credit Market Conditions: The overall health and liquidity of credit markets influence the ease of securing loans and issuing bonds.

- Company Performance: Argonaut's operational results, cash flow generation, and balance sheet strength are paramount for attracting investment.

Global economic growth plays a nuanced role in gold demand. While robust economic expansion can boost industrial demand for gold in sectors like electronics and jewelry, its primary function often shifts to a safe-haven asset during periods of uncertainty. For instance, in 2024, as global economic growth projections remained mixed, gold prices saw upward movement, reflecting its safe-haven appeal amidst geopolitical tensions and inflation concerns.

Strong economic growth can also indirectly influence Argonaut Gold's operations. It can increase demand for other minerals that are often extracted alongside gold, potentially improving the economics of multi-commodity mines. Furthermore, a booming economy can lead to tighter labor markets and higher wages, impacting operational costs for mining companies like Argonaut Gold.

- Economic Growth Impact: Global GDP growth, projected by the IMF to be around 3.2% for 2024, influences industrial gold use, though safe-haven demand often dominates.

- Industrial vs. Safe Haven: While industrial applications exist, gold's price in 2024 was heavily supported by its role as a hedge against inflation and geopolitical risks, rather than solely economic expansion.

- Operational Costs: A strong economy can elevate labor costs, a significant factor for mining firms like Argonaut Gold, potentially increasing their cost of production.

Economic factors significantly shape Argonaut Gold's operational landscape. Gold prices, with forecasts for 2025 suggesting potential increases above $3,000 per ounce, directly impact revenue. Inflation, evidenced by rising energy and raw material costs in 2024, pressures profit margins, necessitating cost management strategies. Currency fluctuations, such as the CAD to USD rate around 0.73 in early 2024, affect reported earnings and operational expenses across different jurisdictions.

| Economic Factor | 2024/2025 Data Point | Impact on Argonaut Gold |

|---|---|---|

| Gold Price Forecast | Potentially >$3,000/oz in 2025 | Increased revenue and profitability |

| Inflation (Brent Crude) | Significant fluctuations in 2024 | Higher operational and transportation costs |

| Currency Exchange Rate (CAD/USD) | ~0.73 in early 2024 | Affects translation of USD revenues and costs |

| Global GDP Growth | Projected ~3.2% for 2024 (IMF) | Influences industrial demand, but safe-haven demand is key; potential for higher labor costs |

| Interest Rates | Elevated in early 2024 (Fed cautious on cuts) | Increases cost of capital and debt servicing |

Full Version Awaits

Argonaut Gold PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Argonaut Gold provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape for informed decision-making.

Sociological factors

Argonaut Gold prioritizes robust community relations, understanding that a social license to operate is critical for sustained mining activities. In 2023, the company reported investing approximately $1.5 million in community development initiatives across its El Castillo, Mina Florida, and San Antonio operations in Mexico, focusing on education, health, and infrastructure improvements. This commitment aims to foster trust and mutual benefit, directly impacting operational stability.

Argonaut Gold recognizes that strong labor relations are foundational to operational stability. The company's commitment to fair wages and safe working conditions in 2024 aims to foster a dedicated workforce, thereby minimizing the risk of disruptive strikes or disputes. This focus is particularly vital in the mining sector, where employee morale directly impacts productivity and safety.

A key element of Argonaut Gold's workforce management strategy is maximizing local employment opportunities. In 2024, the company continued its efforts to prioritize hiring from communities surrounding its operations, including a specific focus on Indigenous employees. This approach not only contributes to local economic development but also builds goodwill and a sense of shared benefit, strengthening the social license to operate.

Argonaut Gold's operations, particularly at the Magino mine in Ontario, Canada, highlight the critical importance of Indigenous Peoples engagement. The company actively fosters partnerships with Indigenous communities, recognizing their rights and the need for mutual benefit. This engagement is foundational for maintaining social license to operate and ensuring long-term project success.

Respectful consultation and collaboration are key, addressing environmental stewardship and the protection of cultural heritage sites. For instance, the 2023 ESG report notes Argonaut Gold’s ongoing dialogue with the Sagamok Anishnawbek First Nation regarding the Magino project. These relationships are designed to ensure equitable distribution of economic benefits, such as employment and business opportunities, for Indigenous partners.

Health and Safety Standards

Adhering to robust health and safety standards is paramount for Argonaut Gold, not just as a legal requirement but as a core social responsibility towards its workforce and the communities where it operates. Failure to do so can severely impact its standing, potentially leading to significant financial penalties and operational disruptions.

The consequences of neglecting safety are substantial. For instance, in 2023, mining incidents globally resulted in considerable downtime and increased insurance premiums for many companies, illustrating the direct financial impact. Argonaut Gold's commitment to safety aims to mitigate these risks, ensuring continuity and trust.

- Employee Well-being: Ensuring a safe working environment is crucial for employee morale and productivity.

- Community Relations: Protecting local communities from potential environmental or health hazards is a key social license to operate.

- Reputational Risk: Accidents can cause severe damage to a company's brand and public perception.

- Regulatory Compliance: Strict adherence to health and safety regulations avoids fines and legal challenges.

Demographic Shifts and Local Employment Impact

Demographic shifts in regions where Argonaut Gold operates, like population growth or migration patterns, directly influence the availability of a skilled workforce and can shape community expectations. These changes can affect how local populations view and interact with mining projects, particularly concerning employment opportunities and the demand for infrastructure improvements. For instance, a growing local population might increase the labor pool but also raise expectations for local hiring and investment in community services.

Argonaut Gold's presence has a substantial effect on local employment, acting as a significant economic driver. In 2023, the company reported employing approximately 1,500 individuals across its operations, with a notable percentage being from local communities. This direct employment creates ripple effects, supporting ancillary businesses and services, thereby boosting the regional economy.

The impact on local employment can be seen in several key areas:

- Job Creation: Direct and indirect job creation in areas surrounding mines.

- Skills Development: Opportunities for local residents to acquire specialized mining-related skills.

- Economic Multiplier Effect: Increased spending in local economies due to wages and operational procurement.

- Community Expectations: Growing demands for local hiring quotas and community benefit agreements.

Sociological factors significantly influence Argonaut Gold's operational success by shaping community relations and workforce dynamics. The company's investment in local communities, such as the $1.5 million in development initiatives in Mexico during 2023, aims to build trust and a social license to operate. Prioritizing local employment, including Indigenous hires, strengthens community ties and contributes to economic development, as seen in the company's continued efforts in 2024.

Strong labor relations are paramount, with Argonaut Gold focusing on fair wages and safe working conditions in 2024 to ensure a dedicated workforce and prevent operational disruptions. The company's engagement with Indigenous communities, exemplified by its partnership with the Sagamok Anishnawbek First Nation for the Magino project, underscores the importance of respecting rights and ensuring mutual benefits. Adherence to stringent health and safety standards is not only a regulatory necessity but a core social responsibility, mitigating risks and maintaining public trust.

Demographic shifts in operating regions directly impact workforce availability and community expectations, influencing local hiring demands and infrastructure needs. Argonaut Gold's role as a significant economic driver is evident in its substantial direct and indirect job creation, supporting local economies and fostering skills development.

| Sociological Factor | Impact on Argonaut Gold | 2023/2024 Data/Initiatives |

|---|---|---|

| Community Relations | Establishes social license to operate, impacting project stability. | $1.5 million invested in community development in Mexico (2023). |

| Labor Relations | Ensures workforce productivity, safety, and minimizes disputes. | Focus on fair wages and safe working conditions (2024). |

| Local Employment & Skills | Boosts local economies, builds goodwill, and strengthens social license. | Prioritizing local and Indigenous hiring (2024). |

| Indigenous Engagement | Crucial for long-term project success and partnership. | Ongoing dialogue with Sagamok Anishnawbek First Nation (2023 ESG report). |

| Health & Safety Standards | Mitigates reputational risk, financial penalties, and operational disruptions. | Commitment to safety to ensure continuity and trust. |

| Demographic Shifts | Affects workforce availability and community expectations. | Growing local populations can increase labor pool and demand for local investment. |

| Economic Impact (Employment) | Acts as a significant economic driver for surrounding regions. | Employed ~1,500 individuals across operations (2023), with a notable percentage from local communities. |

Technological factors

Argonaut Gold is leveraging advanced mining technologies to boost efficiency. For instance, the company is integrating GPS fleet management and autonomous drilling at its Magino mine. This strategic adoption aims to refine mining selectivity and elevate overall productivity, directly impacting operational costs.

Advancements in gold processing, such as heap leaching and carbon-in-pulp (CIP), are crucial for boosting gold recovery rates and minimizing environmental footprints. These techniques are continuously refined to extract more value from ore bodies.

Argonaut Gold is actively engaged in optimizing recovery at its Florida Canyon operation through ongoing analysis and modelling, including specific initiatives like sulphide proof of concept drilling. This focus aims to enhance operational efficiency and profitability.

Advancements in exploration technologies are significantly boosting mineral discovery and reserve growth. New geological mapping, geophysical surveys, and drilling techniques enhance accuracy and efficiency. For instance, Argonaut Gold is leveraging these technologies to expand reserves at its Magino project and explore new opportunities at Florida Canyon.

Data Analytics and Digitalization

Data analytics and digitalization are transforming how mining companies like Argonaut Gold operate. By leveraging these technologies, Argonaut can optimize its operations, predict equipment failures before they happen, and keep a close eye on production in real-time. This leads to better productivity and smarter decisions. For instance, in 2024, many mining firms are investing heavily in AI-driven analytics to improve ore grade prediction and reduce waste.

Argonaut is actively enhancing its approach to monitoring environmental, social, and governance (ESG) risks and impacts. They are consolidating this information into a centralized online database, making it easier to track and manage these critical areas. This proactive stance is crucial as investors and regulators increasingly demand transparency in ESG performance. By mid-2025, the company aims to have its ESG data fully integrated into its core operational reporting systems.

The adoption of digital tools allows for more granular insights into every stage of the mining process. This includes everything from exploration and resource estimation to extraction and processing. Such advancements can lead to significant cost savings and improved resource recovery rates. For example, advanced geological modeling software, powered by big data, is becoming standard practice for identifying and quantifying mineral reserves more accurately.

- Operational Efficiency: Implementing data analytics for real-time performance tracking and predictive maintenance reduced downtime by an estimated 15% for similar operations in 2024.

- ESG Risk Management: Centralized data platforms enable quicker identification and mitigation of ESG-related issues, crucial for maintaining social license to operate.

- Decision Support: Advanced analytics provide deeper insights into geological data, aiding in more precise resource estimation and mine planning.

- Digital Transformation Investment: Companies in the sector are projected to increase their spending on digital technologies by over 20% in 2025 to stay competitive.

Environmental Technologies and Remediation

Technological advancements in environmental management are critical for sustainable mining. Argonaut Gold is actively implementing technologies for tailings management and water recycling to minimize its ecological footprint. For instance, in 2023, the company reported advancements in its water management strategies, aiming to reduce reliance on fresh water sources across its operations.

The development and adoption of innovative solutions for waste rock and tailings storage are paramount. These technologies not only ensure regulatory compliance but also contribute to long-term operational viability by reducing environmental risks. Argonaut's commitment to environmental stewardship is reflected in its ongoing investments in these areas, aiming for best practices in ecosystem conservation.

Key technological focus areas for Argonaut Gold include:

- Tailings Management: Implementing advanced filtration and dry-stacking technologies to reduce water content and improve stability.

- Water Recycling: Enhancing water treatment and recycling systems to minimize fresh water consumption, a significant concern in arid mining regions.

- Biodiversity Monitoring: Utilizing drone technology and advanced sensor systems for more effective monitoring and protection of local ecosystems.

- Emissions Reduction: Exploring and adopting cleaner energy sources and technologies to lower greenhouse gas emissions from mining operations.

Argonaut Gold is enhancing operational efficiency through advanced technologies like GPS fleet management and autonomous drilling, particularly at its Magino mine. These innovations aim to improve mining selectivity and boost productivity, directly impacting operational costs.

The company is also focused on optimizing gold recovery rates through advancements in processing techniques and data analytics, with initiatives like sulphide proof of concept drilling at Florida Canyon. This data-driven approach is crucial for maximizing value from ore bodies and improving profitability.

Exploration is being supercharged by new geological mapping and geophysical surveys, aiding reserve growth. Furthermore, digital transformation is a key investment area, with projected sector spending on digital technologies to increase by over 20% in 2025 to maintain competitiveness.

Legal factors

Argonaut Gold's operations are heavily influenced by mining laws and regulations, which dictate everything from securing mineral rights to the actual extraction and production processes. Compliance with these national and regional frameworks is non-negotiable for smooth and legal operations.

Recent developments, particularly in Mexico, highlight the dynamic nature of these laws. For instance, proposed reforms in Mexico, which could potentially alter fiscal regimes or environmental standards, directly impact the cost of doing business and the overall attractiveness of investments in the region for companies like Argonaut Gold.

These legal shifts can have tangible financial consequences. For example, increased royalties or stricter permitting requirements can elevate operational expenditures, potentially reducing profit margins and influencing future capital allocation decisions for the company.

Argonaut Gold must navigate a complex web of environmental laws and permitting processes, crucial for maintaining operational licenses. This includes securing and renewing environmental impact statements and air quality permits, which are non-negotiable for mining activities.

The company has faced significant hurdles due to past permit denials in Mexico, directly impacting project timelines and development. For instance, the El Castillo mine expansion in Durango faced delays in 2023 due to ongoing environmental review processes.

Argonaut Gold must meticulously adhere to labor laws covering worker safety, minimum wage, and maximum working hours. For instance, in Mexico, where Argonaut operates, the national minimum wage for 2024 is MXN 248.93 per day in most regions, with stricter regulations on overtime pay and workplace safety standards enforced by the Ministry of Labor and Social Welfare.

Maintaining compliance with these regulations, including those concerning union negotiations and collective bargaining agreements, is crucial to prevent costly legal battles and avoid operational interruptions. In 2023, the International Labour Organization reported that labor disputes can significantly impact a company's financial performance and reputation, underscoring the importance of proactive engagement with labor standards.

Corporate Governance and Reporting Requirements

Argonaut Gold must strictly adhere to corporate governance standards, encompassing accurate financial reporting, transparent public disclosures, and robust shareholder relations, all dictated by stock exchange rules and securities legislation. This includes compliance with the Toronto Stock Exchange (TSX) reporting obligations.

Recent filings by Argonaut Gold demonstrate this adherence, with the company submitting management information circulars and technical reports as required. For instance, their 2023 annual information form, filed in March 2024, details their governance structure and compliance measures.

- TSX Reporting: Argonaut Gold is obligated to meet the continuous disclosure requirements of the Toronto Stock Exchange.

- Public Disclosure: The company must regularly publish financial statements, material change reports, and other relevant information.

- Shareholder Engagement: Governance mandates include facilitating shareholder communication and voting rights, as seen in their annual general meeting proceedings.

- Technical Reports: Adherence to standards like NI 43-101 for technical reports ensures the credibility of their mineral reserve and resource disclosures.

Taxation and Royalty Regimes

Changes in tax and royalty frameworks significantly impact Argonaut Gold's bottom line and strategic financial decisions. Governments can alter these structures, affecting profitability. For example, Mexico has implemented higher special tax duties and extraordinary taxes on gold and silver sales, which directly influences revenue streams for companies operating there.

These adjustments can necessitate revisions to Argonaut Gold's financial models and investment strategies. The company must remain adaptable to evolving fiscal policies in its operating jurisdictions, particularly in Mexico where recent tax changes have been enacted.

- Increased Tax Burden: Mexico's introduction of special tax duties and extraordinary taxes on precious metal sales directly raises operating costs for Argonaut Gold.

- Financial Planning Impact: Such fiscal policy shifts require careful financial planning and may necessitate adjustments to capital expenditure and dividend policies.

- Regulatory Uncertainty: The potential for further tax regime changes creates an element of uncertainty for long-term investment decisions in affected regions.

Legal factors significantly shape Argonaut Gold's operational landscape, from securing permits to managing labor relations and corporate governance. Recent legal shifts in Mexico, particularly concerning fiscal regimes and environmental standards, directly impact operational costs and investment attractiveness.

The company's adherence to mining laws, environmental regulations, and labor standards is paramount to avoid costly legal battles and operational disruptions. For instance, Mexico's 2024 minimum wage stands at MXN 248.93 daily, with strict enforcement of workplace safety and overtime pay.

Furthermore, Argonaut Gold must comply with stringent corporate governance mandates, including TSX reporting obligations and transparent public disclosures, as evidenced by their 2023 annual information form filed in March 2024.

Changes in tax and royalty frameworks, such as Mexico's special tax duties on precious metal sales, directly affect Argonaut Gold's profitability and necessitate adaptive financial planning.

| Legal Factor | Impact on Argonaut Gold | Relevant Data/Example |

|---|---|---|

| Mining Laws & Regulations | Dictates operational processes and compliance requirements. | Securing mineral rights, extraction permits. |

| Environmental Laws | Crucial for operational licenses and project timelines. | El Castillo mine expansion delays in 2023 due to environmental review. |

| Labor Laws | Ensures worker safety, fair wages, and prevents disputes. | Mexico's 2024 minimum wage: MXN 248.93 daily. |

| Corporate Governance | Mandates transparency, reporting, and shareholder relations. | TSX continuous disclosure requirements; 2023 AIF filed March 2024. |

| Tax & Royalty Frameworks | Affects profitability and financial strategy. | Mexico's special tax duties on precious metal sales. |

Environmental factors

Responsible water management is a critical concern for mining companies like Argonaut Gold, particularly in regions facing water scarcity. Efficient water use, effective recycling, and stringent measures to prevent contamination are paramount for sustainable operations.

Argonaut Gold has demonstrated a strong commitment to this, reporting an impressive 91% water recycling rate across its operational mines as of their latest disclosures, showcasing a proactive approach to minimizing their water footprint.

Safe and environmentally sound management of tailings and other mining waste is a critical environmental factor for Argonaut Gold. The company's commitment to responsible waste disposal is paramount, especially given the potential environmental impact of mining operations.

The completion of tailings management facilities is a key focus for Argonaut, with significant investment and attention directed towards these crucial infrastructure components. This is particularly evident at their Magino project, where the development of these facilities is a priority to ensure compliance with environmental regulations and best practices.

For instance, in 2023, Argonaut Gold reported that the construction of the tailings management facility at Magino was progressing as planned, a vital step in enabling the mine's operational readiness and ensuring long-term environmental stewardship.

Argonaut Gold is committed to minimizing its impact on local biodiversity and ecosystems across all stages of its operations, from initial exploration through to mine closure. This focus is a key part of their environmental stewardship strategy.

The company actively works to conserve surrounding ecosystems, recognizing the importance of biodiversity. This commitment is reflected in their inclusion of biodiversity metrics within their Environmental, Social, and Governance (ESG) reporting, aiming for transparency and accountability in their environmental performance.

Climate Change and Energy Consumption

Climate change is a significant environmental factor impacting mining operations, with a growing emphasis on reducing greenhouse gas emissions and managing energy consumption. Argonaut Gold recognized this imperative, launching specific initiatives in 2023 to tackle climate change as a critical ESG risk. This proactive approach is crucial for long-term sustainability and stakeholder confidence in the mining sector.

Argonaut's commitment to addressing climate change involves several key areas:

- Greenhouse Gas Emission Reduction: Implementing strategies to lower the carbon footprint across all operations, from exploration to production.

- Energy Consumption Management: Focusing on efficiency improvements and exploring cleaner energy sources to power mining activities.

- Climate Risk Assessment: Integrating climate-related risks into their overall business strategy and operational planning.

- ESG Reporting: Enhancing transparency by reporting on their progress in managing environmental impacts, including climate change.

For instance, in 2023, the mining industry as a whole saw increased scrutiny on Scope 1 and Scope 2 emissions. Companies like Argonaut are investing in technologies and operational changes to align with global climate goals, recognizing that sustainable energy practices are not just an environmental responsibility but also a financial necessity, potentially impacting access to capital and operational costs.

Reclamation and Mine Closure

Argonaut Gold's commitment to environmental stewardship is evident in its approach to mine closure and reclamation. The company is actively engaged in progressive reclamation at its Florida Canyon mine, a process that involves restoring land concurrently with ongoing operations. This proactive strategy aims to minimize the long-term environmental footprint of mining activities.

Beyond Florida Canyon, Argonaut has several projects currently in the reclamation phase. This indicates a forward-looking perspective, ensuring that sites are managed responsibly even after production has ended. Effective reclamation is crucial for rehabilitating disturbed land and achieving long-term environmental stability, aligning with increasing stakeholder expectations for sustainable mining practices.

For instance, as of the first quarter of 2024, Argonaut reported progress on reclamation efforts at its San Agustin project. The company's 2023 sustainability report highlighted expenditures related to environmental management and reclamation, demonstrating tangible investment in these areas. Such efforts are vital for maintaining social license to operate and mitigating potential liabilities associated with mine closure.

- Progressive Reclamation: Argonaut is implementing progressive reclamation at its Florida Canyon mine, restoring land during operations.

- Active Reclamation Projects: The company has multiple sites undergoing reclamation, signifying a commitment to post-operational environmental management.

- Environmental Investment: Financial reports from early 2024 indicate ongoing investment in environmental programs, including reclamation activities.

- Regulatory Compliance: Effective reclamation plans are essential for meeting regulatory requirements and ensuring long-term land stability post-mining.

Argonaut Gold's environmental strategy prioritizes responsible water management, evidenced by a 91% water recycling rate across its mines, demonstrating a strong commitment to minimizing its water footprint.

The company also focuses on safe tailings management, with significant investment in facilities like those at the Magino project, where construction was on track in 2023.

Furthermore, Argonaut is actively engaged in progressive reclamation at its Florida Canyon mine and other sites, showcasing a commitment to environmental stewardship throughout the mine lifecycle, with specific reclamation progress reported at San Agustin in Q1 2024.

| Environmental Factor | Argonaut Gold's Approach | Key Data/Initiatives (2023-2024) |

|---|---|---|

| Water Management | Efficient use, recycling, and contamination prevention | 91% water recycling rate (latest disclosures) |

| Waste Management | Safe and environmentally sound disposal of tailings | Progress on tailings management facility construction at Magino (2023) |

| Biodiversity & Ecosystems | Minimizing impact and conserving surrounding environments | Inclusion of biodiversity metrics in ESG reporting |

| Climate Change | Reducing greenhouse gas emissions and managing energy consumption | Launched climate change initiatives (2023); focus on Scope 1 & 2 emissions |

| Mine Closure & Reclamation | Progressive reclamation and post-operational land rehabilitation | Progressive reclamation at Florida Canyon; reclamation at San Agustin (Q1 2024); investment in environmental programs (2023) |

PESTLE Analysis Data Sources

Our Argonaut Gold PESTLE Analysis is built on comprehensive data from reputable sources, including government publications, financial reports, industry analyses, and reputable news outlets. We ensure all insights into political, economic, social, technological, legal, and environmental factors are grounded in timely and accurate information.