Argonaut Gold Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Discover how Argonaut Gold leverages its product offerings, pricing strategies, distribution channels, and promotional activities to capture market share. This analysis goes beyond surface-level observations to reveal the core elements of their marketing success.

Uncover the intricate details of Argonaut Gold's 4Ps—from the specific attributes of their gold products to their competitive pricing models and strategic distribution networks. Understand their promotional campaigns and how they resonate with investors.

Ready to gain a competitive edge? Access the complete, in-depth 4Ps Marketing Mix Analysis for Argonaut Gold, offering actionable insights and a strategic blueprint you can adapt for your own business planning.

Product

Argonaut Gold's core product is gold, quantified in Gold Equivalent Ounces (GEOs). These GEOs represent the total precious metal output from their mining activities, primarily gold, but also including other recoverable metals valued at their gold equivalent.

In 2023, Argonaut Gold reported production of 178,908 GEOs, demonstrating their operational capacity. This output is the direct result of their strategic focus on developing and operating gold mines.

The company's revenue is overwhelmingly driven by the sale of these GEOs, making gold the central commodity in their marketing mix. Their portfolio of producing and development assets is geared towards maximizing this gold output.

Argonaut Gold's product is its portfolio of gold assets, including the significant Magino mine in Canada. This portfolio strategy encompasses mines currently in operation and those in development, aiming to transition them into full production.

The company's approach to product development is evident in its progression of projects from exploration to operational status. While Florida Canyon in the US and several Mexican mines were previously key operational assets, recent strategic moves have seen them reclassified or spun out, refocusing Argonaut on its core development pipeline.

Argonaut Gold's operational optimization focuses on boosting gold recovery and efficiency. This involves increasing daily mining rates and mill throughput, particularly at significant sites like the Magino mine.

For instance, in the first quarter of 2024, Magino achieved a daily mining rate of approximately 104,000 tonnes and a mill throughput of 10,300 tonnes per day, demonstrating progress towards their efficiency goals.

The company's strategic aim is to ensure a steady and cost-effective production of gold, directly impacting their product delivery and market competitiveness.

Mineral Reserve Expansion

Mineral Reserve Expansion is central to Argonaut Gold's strategy, ensuring a robust product pipeline. This involves continuous exploration and development to grow the company's gold reserves, directly impacting future production capacity and mine life.

Argonaut Gold actively funds drill programs specifically designed to upgrade mineral resources into proven and probable reserves. For instance, as of their latest reporting, significant progress has been made in converting resources at key projects, bolstering the long-term supply outlook.

- Exploration Investment: Argonaut Gold's commitment to exploration fuels reserve growth, securing future gold output.

- Resource to Reserve Conversion: Drill programs are crucial for converting identified resources into economically viable reserves, extending mine life.

- Long-Term Supply Assurance: This focus on reserve expansion is a direct strategy to guarantee a consistent supply of gold for years to come.

Sustainable Mining Practices

Argonaut Gold's product extends beyond the physical metal to include its dedication to sustainable and responsible mining. The company actively incorporates Environmental, Social, and Governance (ESG) principles into its operational framework, striving to lessen its ecological footprint and foster constructive community relationships.

This commitment to ESG principles enhances the perceived value of Argonaut Gold's product, resonating with stakeholders who increasingly demand ethical resource extraction. For instance, in 2023, Argonaut reported a 15% reduction in water intensity across its operations, demonstrating tangible progress in environmental stewardship.

- Environmental Stewardship: Focus on water management, waste reduction, and biodiversity conservation.

- Social Engagement: Prioritizing community development, local employment, and stakeholder dialogue.

- Governance: Upholding ethical business practices, transparency, and robust risk management.

- Stakeholder Alignment: Meeting the growing demand for responsibly sourced minerals from investors and consumers.

Argonaut Gold's product is its gold output, measured in Gold Equivalent Ounces (GEOs), reflecting the company's primary focus on gold mining. This output is directly tied to their operational capacity and strategic mine development, with a strong emphasis on key assets like the Magino mine.

The company's product strategy also incorporates mineral reserve expansion through active exploration and drilling programs, aiming to ensure a consistent future supply of gold. This focus on long-term resource management is crucial for sustained production.

Furthermore, Argonaut Gold emphasizes responsible mining practices, integrating Environmental, Social, and Governance (ESG) principles to enhance product value and meet stakeholder expectations for ethical sourcing.

| Metric | 2023 Performance | Q1 2024 Performance |

|---|---|---|

| Total GEOs Produced | 178,908 | N/A (Q1 specific data not provided in source) |

| Magino Mine Daily Mining Rate | N/A (Average for 2023 not provided) | ~104,000 tonnes |

| Magino Mine Mill Throughput | N/A (Average for 2023 not provided) | ~10,300 tonnes per day |

| Water Intensity Reduction | 15% (across operations) | N/A |

What is included in the product

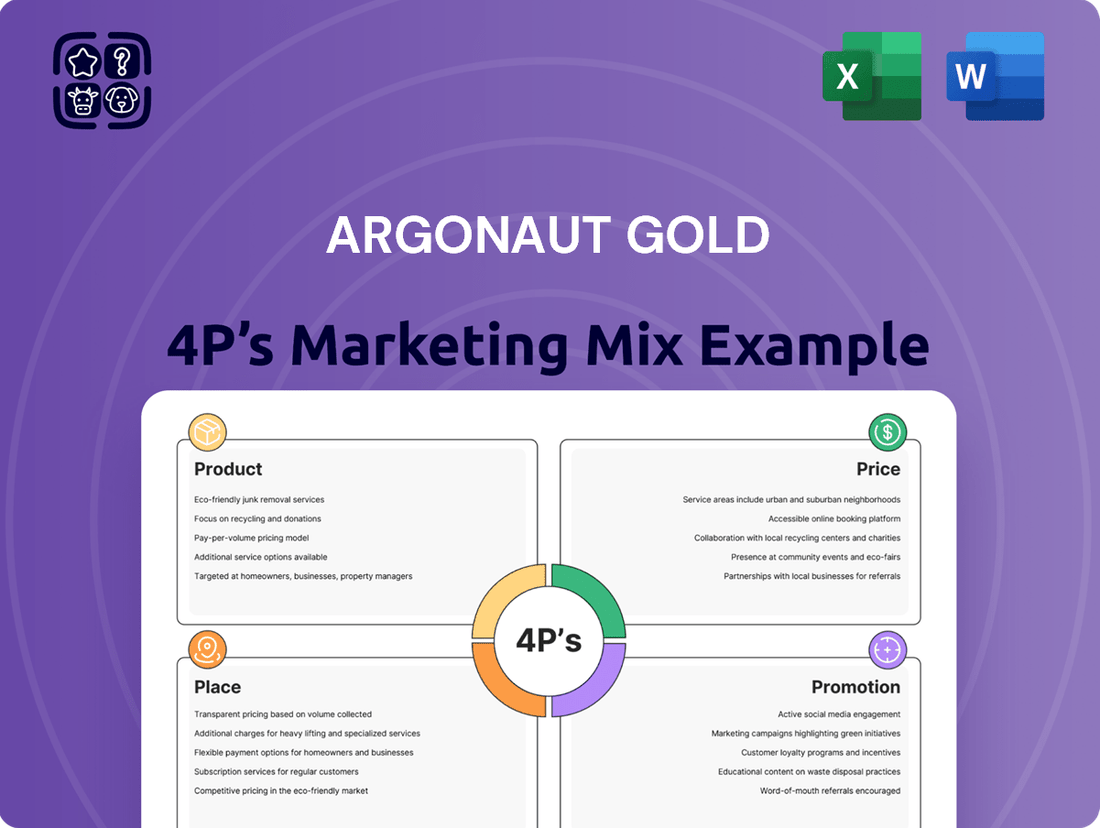

This analysis provides a comprehensive breakdown of Argonaut Gold's marketing strategies, examining their Product, Price, Place, and Promotion tactics. It's designed for professionals seeking to understand the company's market positioning and competitive approach.

Simplifies complex marketing strategies by translating Argonaut Gold's 4Ps into actionable pain point solutions for investors and stakeholders.

Place

Argonaut Gold's operational footprint is firmly planted in North America, with key mining activities concentrated in Canada and the United States. This geographical focus allows the company to leverage established mining infrastructure and regulatory environments.

The company's primary assets, crucial for its production and future growth, are situated within these North American jurisdictions. For instance, as of the first quarter of 2024, Argonaut Gold reported its Florida Canyon mine in Nevada, USA, as a significant contributor to its production profile.

The Magino mine in Ontario, Canada, is Argonaut Gold's primary production site and a key component of its 'place' strategy. Its strategic location in a prolific gold-producing region is a significant advantage.

This strategic importance was underscored by Alamos Gold's acquisition of Magino. The deal, valued at approximately $150 million in cash and stock, was completed in late 2023, positioning Magino as a crucial asset for Alamos.

The integration of Magino is expected to generate substantial value through shared infrastructure and operational synergies with Alamos' nearby Island Gold mine. This consolidation is anticipated to enhance overall operational efficiency and cost-effectiveness.

The Florida Canyon mine in Nevada, USA, is a key operational hub for Argonaut Gold, forming a crucial part of its 'place' strategy. This site has a proven track record of substantial production, underpinning the company's output. In recent periods, Argonaut Gold has invested in enhancing the mine's efficiency, including expanding its leach pad capacity, to boost future yields.

Mexican Assets (Spin-off to SpinCo)

Argonaut Gold's Mexican operations, encompassing the La Colorada, San Agustin, and El Castillo mines, are now classified as discontinued operations. This strategic repositioning involves spinning these assets into a new entity, 'SpinCo,' a junior gold producer. This action effectively changes the 'place' of these valuable assets within the broader corporate structure, creating a distinct investment opportunity.

As of the first quarter of 2024, Argonaut Gold reported that its Mexican segment, now slated for SpinCo, contributed significantly to its overall production profile. For instance, La Colorada, a key asset in this portfolio, produced approximately 16,000 gold ounces in Q1 2024, demonstrating its ongoing operational capacity. The spin-off aims to unlock value by allowing SpinCo to focus exclusively on optimizing these Mexican assets, potentially attracting specialized investment and management expertise.

- La Colorada: A flagship asset within the Mexican portfolio, contributing a substantial portion of the gold ounces produced.

- San Agustin & El Castillo: These mines complement La Colorada, offering diversified production and resource potential under the SpinCo umbrella.

- Strategic Separation: The spin-off allows for focused management and capital allocation for the Mexican assets, distinct from Argonaut Gold's remaining operations.

- Market Positioning: SpinCo is positioned as a pure-play junior gold producer, targeting investors interested in emerging gold mining opportunities in Mexico.

Global Metal Markets

The ultimate 'place' for Argonaut Gold's product is the vast global metal market. As a gold producer, the company's extracted gold enters this international arena, a complex network rather than a single physical point of sale.

This global marketplace includes a diverse range of buyers, from industrial consumers and jewelry manufacturers to central banks and financial institutions. The price and demand for gold are influenced by macroeconomic factors, geopolitical events, and investor sentiment worldwide.

- Global Gold Market Size: The World Gold Council reported that global gold demand reached 4,408.5 tonnes in 2023, highlighting the significant scale of the market Argonaut Gold operates within.

- Key Trading Hubs: Major financial centers like London, New York, and Shanghai are critical hubs for gold trading, facilitating transactions and price discovery.

- Price Volatility: Gold prices can fluctuate significantly; for instance, the average gold price in 2024 has seen movements influenced by inflation data and central bank policies.

- Argonaut Gold's Distribution: Argonaut Gold sells its doré bars, a semi-pure alloy of gold and silver, to accredited melters and refiners who then process it into marketable forms for the global market.

Argonaut Gold's 'place' strategy centers on its North American mining assets, particularly the Magino mine in Ontario, Canada, and the Florida Canyon mine in Nevada, USA. These locations offer access to established infrastructure and favorable regulatory environments. The company is also strategically divesting its Mexican operations, including La Colorada, San Agustin, and El Castillo, into a new entity, SpinCo, to unlock value and focus management on core assets.

The global metal market represents the ultimate destination for Argonaut Gold's products. The company sells its doré bars to refiners who process them for various buyers worldwide, including jewelry makers and financial institutions. The market's size and dynamics are crucial, with global gold demand reaching approximately 4,408.5 tonnes in 2023, as reported by the World Gold Council.

| Asset | Location | Status | Q1 2024 Production (Gold Ounces) |

|---|---|---|---|

| Magino | Ontario, Canada | Primary Production Site | N/A (Acquired by Alamos Gold late 2023) |

| Florida Canyon | Nevada, USA | Key Operational Hub | N/A (Specific Q1 2024 ounces not detailed in provided text) |

| La Colorada | Mexico | SpinCo Asset (Discontinued Operation) | ~16,000 |

What You Preview Is What You Download

Argonaut Gold 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Argonaut Gold's 4Ps Marketing Mix is fully complete and ready for your immediate use.

Promotion

Argonaut Gold heavily emphasizes its investor relations as a core promotional strategy, aiming to connect with a financially savvy audience. This involves a consistent flow of information through news releases, detailed financial reports, and engaging investor presentations, all designed to clearly communicate operational performance, strategic shifts, and the company's forward-looking plans. For instance, in their Q1 2024 update, Argonaut Gold reported a significant increase in gold production, reaching 59,024 ounces, a key data point designed to bolster investor confidence and attract new capital.

Argonaut Gold actively communicates its progress through press releases and public announcements, sharing key operational achievements and development project updates. For instance, the company provided 2024 production guidance of 180,000 to 200,000 gold ounces, underscoring its operational targets.

These updates, like the ongoing commissioning of the Magino mine in Ontario, Canada, are crucial for fostering market confidence and demonstrating transparency. The successful ramp-up of Magino is a key factor in Argonaut's 2024 outlook, with the mine expected to contribute significantly to production.

By consistently highlighting milestones such as achieving commercial production at Magino, Argonaut showcases its execution capabilities. This proactive communication strategy reinforces the company's commitment to delivering on its strategic objectives and building investor trust.

Argonaut Gold's commitment to Environmental, Social, and Governance (ESG) reporting is a crucial element of its marketing mix, showcasing its dedication to sustainable and responsible mining. This includes detailed communication on environmental stewardship, robust community engagement, and strong corporate governance practices. Such transparency is vital for attracting investors increasingly focused on ethical and impactful operations.

Strategic Corporate Presentations

Argonaut Gold leverages strategic corporate presentations to clearly communicate its operational roadmap, asset base, and financial health to investors and analysts. These presentations are crucial for outlining the company's strategic direction and highlighting potential avenues for expansion and value creation.

During these events, such as earnings calls and investor days, Argonaut Gold provides in-depth insights into its performance and future outlook. For instance, in their Q1 2024 update, the company reported a significant increase in gold production, underscoring their operational progress.

- Articulating Strategy: Clearly defines Argonaut Gold's approach to exploration, development, and production.

- Showcasing Assets: Details the company's portfolio of mines and exploration projects, including key metrics like reserves and resources.

- Financial Performance: Presents up-to-date financial results, including revenue, costs, and profitability, often referencing specific figures like their Q1 2024 revenue of $106.7 million.

- Growth Opportunities: Outlines future growth plans, such as expansion projects at existing mines or new acquisitions, aiming to demonstrate long-term shareholder value.

Engagement in Industry Forums

Argonaut Gold actively participates in key mining forums and industry events, acting as a vital promotional channel. These gatherings provide direct access to potential investors, financial analysts, and fellow industry professionals, fostering crucial connections.

At these events, Argonaut Gold showcases its project pipeline, highlights the expertise of its management team, and articulates its strategic vision. This direct engagement helps build trust and facilitates a valuable exchange of information within the mining community.

For instance, during 2024, Argonaut Gold's presence at conferences like the Denver Gold Show and the Precious Metals Summit in Beaver Creek allowed them to present updates on their Florida Canyon and San Agustin projects. These forums are critical for reinforcing the company's market presence and enhancing its credibility within the competitive global mining sector.

- Investor Outreach: Direct engagement with potential investors at industry events.

- Information Dissemination: Showcasing projects, management, and strategic direction.

- Networking: Building relationships with analysts, peers, and stakeholders.

- Credibility Building: Reinforcing Argonaut Gold's position in the mining sector.

Argonaut Gold's promotional efforts center on transparent communication with its investor base, utilizing a multi-faceted approach. The company actively disseminates operational updates, financial reports, and strategic outlooks through various channels to build confidence and attract capital.

Key promotional activities include detailed investor relations outreach, participation in industry events, and consistent press releases highlighting operational achievements and future guidance. For example, their 2024 production guidance of 180,000 to 200,000 gold ounces demonstrates a clear operational target for stakeholders.

The company's commitment to ESG principles is also a significant promotional tool, appealing to investors who prioritize sustainable and responsible mining practices. Showcasing milestones like the commissioning of the Magino mine, which is expected to significantly boost 2024 production, reinforces their execution capabilities.

These efforts collectively aim to articulate Argonaut Gold's strategy, showcase its assets, detail financial performance, and highlight growth opportunities, thereby fostering trust and demonstrating long-term shareholder value.

| Promotional Channel | Key Activity | Data/Example (2024/2025 Focus) |

|---|---|---|

| Investor Relations | Regular updates, financial reports, presentations | Q1 2024 production: 59,024 ounces; Q1 2024 revenue: $106.7 million |

| Press Releases & Announcements | Operational achievements, project updates | 2024 Production Guidance: 180,000-200,000 gold ounces |

| Industry Events | Project showcases, networking, strategic vision | Participation in Denver Gold Show, Precious Metals Summit (updates on Florida Canyon, San Agustin) |

| ESG Reporting | Communication on sustainability and governance | Emphasis on environmental stewardship and community engagement |

Price

Argonaut Gold's realized price for its gold is directly tethered to the often-unpredictable global gold market. For instance, in the first quarter of 2024, the average realized gold price was approximately $2,050 per ounce, a significant increase from the average of $1,820 per ounce in the same period of 2023, showcasing the impact of market volatility on the company's top line.

This direct correlation means Argonaut Gold's revenue and profitability are intrinsically linked to these market swings. Financial models and strategic planning heavily rely on assumptions about future gold prices; a $100 per ounce increase in the gold price can substantially alter projected earnings per share.

Consequently, higher global gold prices directly translate to increased revenue for each ounce of gold Argonaut Gold sells. This sensitivity underscores the importance of monitoring macroeconomic factors and market sentiment that influence gold's value.

Argonaut Gold's approach to pricing is intrinsically linked to its cost of production management. The company actively works to lower its cash costs and All-in Sustaining Costs (AISC) per ounce, which are critical metrics for profitability. For instance, in the first quarter of 2024, Argonaut Gold reported an AISC of $1,360 per ounce, a reduction from $1,406 per ounce in the same period of 2023, demonstrating progress in cost optimization.

This focus on efficiency directly influences Argonaut's ability to compete and maintain healthy profit margins in the gold market. The company's strategic initiatives, such as optimizing operations at its Magino mine, are designed to achieve economies of scale and further drive down these per-ounce costs. These efforts are foundational to their pricing strategy, ensuring that their product remains competitive while maximizing returns.

Argonaut Gold's capital allocation strategy is central to its 'price' in the 4P's marketing mix, reflecting the cost of doing business and the investment required to deliver value. This includes disciplined spending on sustaining operations, ensuring current mines run efficiently, and investing in growth opportunities. For instance, in the first quarter of 2024, Argonaut reported total capital expenditures of $25.4 million, with $17.7 million directed towards sustaining capital and $7.7 million for growth projects, demonstrating a clear focus on both operational health and future expansion.

These expenditures are critical for mine development, infrastructure upgrades, and exploration activities, all of which directly influence the company's long-term financial well-being and profitability. The significant investment in exploration, such as the $3.1 million spent in Q1 2024, is a direct investment in future resource discovery and potential mine life extension, underpinning the company's ability to generate future revenue streams and maintain its market position.

Debt Refinancing and Liquidity

Argonaut Gold's pricing strategy is intrinsically linked to its financial health, particularly its debt levels and liquidity. The company's ability to manage its capital structure directly impacts its cost of capital and overall financial flexibility, which in turn can influence pricing decisions to ensure profitability and sustainability.

The company has been actively involved in debt refinancing and securing new financing to support its operational needs and future growth initiatives. For instance, in early 2024, Argonaut Gold announced the successful closing of a significant debt facility, providing crucial liquidity. This strategic financial maneuvering is essential for maintaining operational continuity and funding capital expenditures for projects like the development of the Magino mine.

- Debt Management: Argonaut Gold's financial strategy prioritizes managing its debt obligations effectively.

- Liquidity Enhancement: Securing financing, such as the credit facility closed in Q1 2024, bolsters the company's liquidity.

- Cost of Capital: Refinancing efforts aim to optimize the cost of capital, potentially leading to more competitive pricing.

- Operational Funding: Adequate liquidity ensures funds are available for day-to-day operations and strategic expansion.

Market Valuation and Shareholder Returns

From an investor's viewpoint, Argonaut Gold's price is reflected in its share price and overall market valuation. Recent performance, such as the acquisition by Alamos Gold in early 2024, significantly impacts this valuation. The company's focus remains on operational efficiency and strategic expansion to enhance shareholder returns.

The market valuation of Argonaut Gold is directly tied to its financial performance and future prospects. Key drivers include reported earnings, production forecasts, and significant corporate actions. For instance, the acquisition by Alamos Gold in February 2024 fundamentally altered Argonaut's market position and valuation metrics.

- Share Price Performance: Investors closely monitor the fluctuations in Argonaut Gold's stock price as a primary indicator of market sentiment and company value.

- Market Capitalization: The total market value of Argonaut Gold, calculated by multiplying its outstanding shares by the current share price, provides a broad measure of its worth.

- Impact of Strategic Transactions: Events like the acquisition by Alamos Gold in early 2024 have a profound effect on market valuation by consolidating assets and altering the company's financial structure.

- Shareholder Return Focus: Argonaut Gold's strategy aims to deliver value to shareholders through consistent operational improvements and growth initiatives, ultimately influencing the share price and overall market perception.

Argonaut Gold's realized price is directly influenced by global gold market fluctuations, with Q1 2024 seeing an average of $2,050 per ounce, up from $1,820 in Q1 2023. This price sensitivity highlights how macroeconomic factors and market sentiment directly impact the company's revenue and profitability.

The company actively manages its costs to maintain competitive pricing, evidenced by a reduction in All-in Sustaining Costs (AISC) to $1,360 per ounce in Q1 2024 from $1,406 in Q1 2023. Strategic investments in operational efficiency, like at the Magino mine, aim to further lower per-ounce costs and enhance profit margins.

Argonaut's capital allocation strategy, including $25.4 million in Q1 2024 capital expenditures ($17.7 million sustaining, $7.7 million growth), underpins its pricing by ensuring operational health and future expansion capabilities. This disciplined spending supports long-term financial viability.

The acquisition by Alamos Gold in early 2024 significantly impacted Argonaut's market valuation, with investors closely monitoring its share price performance and market capitalization as key indicators of value. The company's ongoing focus is on operational improvements and strategic growth to enhance shareholder returns.

| Metric | Q1 2023 | Q1 2024 | Change |

| Average Realized Gold Price ($/oz) | 1,820 | 2,050 | +12.6% |

| All-in Sustaining Costs (AISC) ($/oz) | 1,406 | 1,360 | -3.3% |

| Total Capital Expenditures ($M) | N/A | 25.4 | N/A |

4P's Marketing Mix Analysis Data Sources

Our Argonaut Gold 4P's Marketing Mix Analysis is informed by a comprehensive review of company disclosures, including financial reports and investor presentations. We also leverage industry-specific data and competitive intelligence to ensure accuracy.