Argonaut Gold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

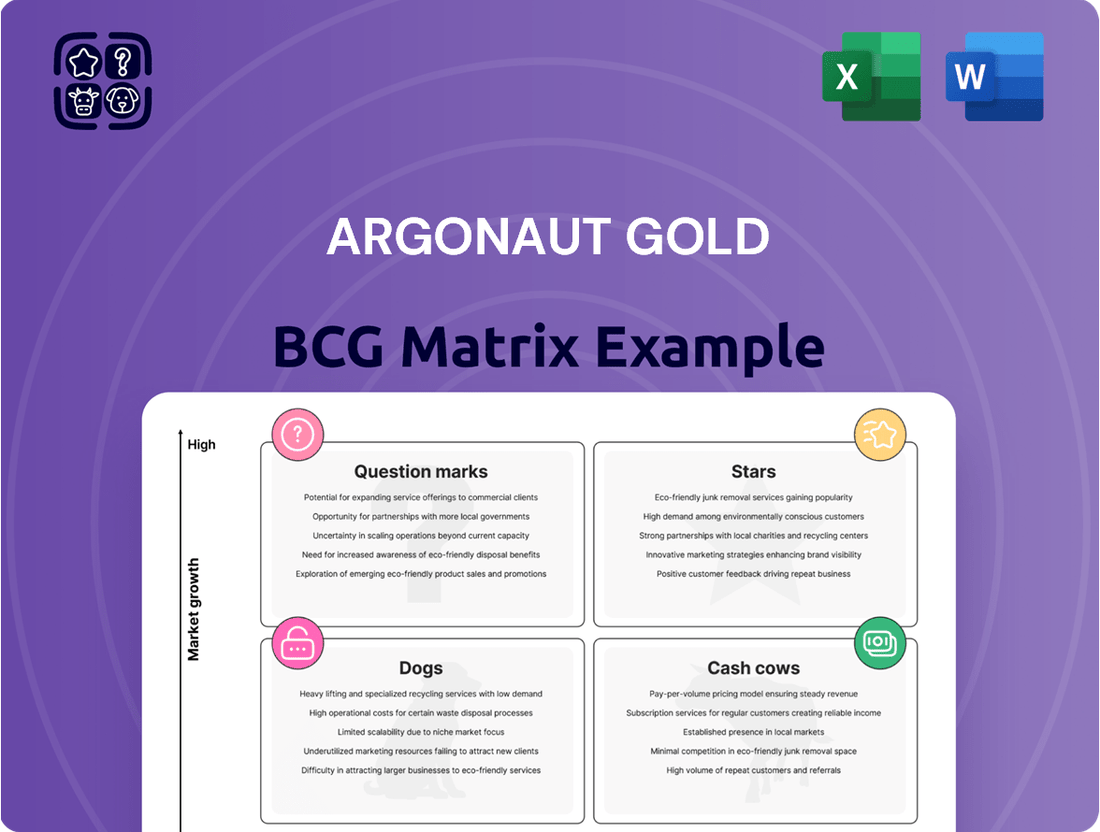

Explore the strategic positioning of Argonaut Gold's mining projects with our insightful BCG Matrix preview. Understand which ventures are poised for growth and which require careful management.

This glimpse into Argonaut Gold's portfolio is just the start. Unlock the full BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for informed investment decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix to receive detailed quadrant analysis, expert commentary, and a clear strategic roadmap for Argonaut Gold's future success.

Stars

The Magino mine, which began operations in November 2023, represents Argonaut Gold's premier growth initiative. It is slated to become the company's largest and most cost-efficient operation, driving significant per-share growth and acting as a transformative asset.

Currently in its ramp-up phase, Magino is projected to reach full production capacity, with plans for further expansion. This positions it as a high-growth potential asset within Argonaut Gold's portfolio.

The Magino mine is a cornerstone of Argonaut Gold's future, with a high production target. In 2024, the mine was aiming for an impressive 150,000 gold equivalent ounces. This sets a strong foundation for its long-term potential.

Looking ahead, Magino's ambition doesn't stop there. The company has a long-term goal to ramp up production to between 200,000 and 250,000 ounces annually. This significant expansion, combined with anticipated low operating costs, strongly suggests Magino is poised to become a market leader in the gold sector.

Alamos Gold's acquisition of the Magino mine in July 2024 for $1.05 billion highlights its strategic focus on high-growth assets. This move significantly bolsters Alamos's production profile, adding over 4 million ounces of gold reserves.

The Magino acquisition is a prime example of a "Star" in the BCG matrix for Alamos Gold, given its substantial reserves and the significant capital already invested. This strategic move is expected to yield considerable synergies and enhance Alamos's overall production guidance for the coming years.

Ongoing Optimization and Expansion Plans

Following its commissioning, Argonaut Gold, and later Alamos Gold, has been dedicated to enhancing mining and milling efficiencies. A key element of this strategy is the planned release of a technical report in the latter half of 2024. This report is expected to feature updated mineral reserve estimates and the results of mill expansion studies.

These ongoing optimization efforts are designed to fully capitalize on the mine's potential. The company is focused on securing a sustained period of high growth for the asset.

- Mine Optimization: Continuous efforts to improve mining rates and operational efficiency post-commissioning.

- Mill Expansion Studies: Evaluation of potential increases to milling capacity to boost production.

- Technical Report (H2 2024): Expected to include updated mineral reserves and feasibility of mill expansion.

- Growth Trajectory: Aiming to solidify the mine's long-term high-growth potential through these strategic initiatives.

Potential for Reserve Growth

The Magino project at Argonaut Gold shows significant promise for reserve growth. An aggressive drill program throughout 2024 was designed to convert existing Mineral Resources into Mineral Reserves.

The company anticipated adding between 500,000 and 1 million ounces to its reserves by the close of 2024. This potential expansion highlights Magino as a key growth asset for Argonaut Gold.

- Targeted Reserve Addition: 500,000 to 1 million ounces by end of 2024.

- Basis for Growth: Conversion of existing Mineral Resources.

- Strategic Importance: Positions Magino as a high-growth asset.

Magino, acquired by Alamos Gold in July 2024, is a prime example of a Star in the BCG matrix due to its high growth potential and significant investment. The mine is projected to be a major contributor to Alamos's production profile.

In 2024, Magino targeted 150,000 gold equivalent ounces, with plans to reach 200,000 to 250,000 ounces annually long-term. An aggressive drill program in 2024 aimed to add 500,000 to 1 million ounces to reserves.

Ongoing optimization efforts, including mill expansion studies and a technical report expected in late 2024, further solidify Magino's position as a high-growth asset poised for sustained success.

| Asset | BCG Category | Key Growth Drivers | 2024 Production Target (GEO) | Long-Term Production Target (GEO) |

|---|---|---|---|---|

| Magino | Star | Reserve growth, mill expansion, operational efficiencies | 150,000 | 200,000 - 250,000 |

What is included in the product

The Argonaut Gold BCG Matrix offers a strategic overview of its mining assets, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Argonaut Gold's portfolio, easing the pain of strategic uncertainty.

Cash Cows

The Florida Canyon mine, a cornerstone of Argonaut Gold's portfolio, is a prime example of a cash cow. This open-pit, heap leach operation has been consistently producing since 1986, showcasing its long-term viability and established market position.

In 2023, Florida Canyon delivered its most impressive output in nearly two decades, reaching a significant production milestone. This sustained high performance underscores its status as a reliable and profitable asset for the company.

The consistent production outlook for this mine positions it as a classic cash cow within Argonaut Gold's portfolio. From 2024 through 2030, it's expected to yield an average of 70,000 ounces of gold annually. This steady output translates into a reliable and predictable cash flow stream, a hallmark of a mature asset in a stable market segment.

Florida Canyon's updated technical reports showcase robust financial health, with a pre-tax net present value of US$153 million and an after-tax net present value of US$139 million. These figures underscore its significant economic viability and capacity for generating substantial cash flow, positioning it as a key Cash Cow for Argonaut Gold.

Low Promotion and Placement Investment

Florida Canyon, as a mature asset within Argonaut Gold's portfolio, represents a classic Cash Cow. Its established nature means it doesn't demand the high marketing or market entry costs associated with newer ventures. This operational maturity translates directly into lower promotional and placement investment needs.

Investments at Florida Canyon are strategically channeled towards sustaining capital expenditures. A prime example is the ongoing construction of the third heap leach pad. This type of investment is crucial for maintaining, and even slightly improving, the current production efficiency without the need for aggressive expansionary spending.

- Low Investment Needs: Florida Canyon requires minimal promotional and placement investment due to its mature operational status.

- Sustaining Capital Focus: Investments are primarily directed towards maintaining operational efficiency, not aggressive growth.

- Heap Leach Pad Expansion: Construction of the third heap leach pad is a key sustaining capital project, supporting current production levels.

- Cash Generation: As a Cash Cow, Florida Canyon is expected to generate consistent positive cash flow with these limited investments.

Cornerstone Asset for SpinCo

Following its spin-off, Florida Canyon emerged as a foundational asset for the newly established Florida Canyon Gold Inc. (SpinCo). This designation highlights its critical role as a primary cash generator, underpinning the financial stability of the spun-out entity.

The mine's consistent and robust cash flow generation is instrumental in supporting other operations and strategic initiatives within SpinCo's portfolio. For instance, in 2023, Florida Canyon reported total gold sales of 62,368 ounces, contributing significantly to the company's financial health.

- Cornerstone Asset: Florida Canyon serves as the bedrock for SpinCo's financial operations.

- Cash Flow Generation: The mine consistently produces strong cash flows, essential for supporting new ventures.

- 2023 Performance: Achieved gold sales of 62,368 ounces in 2023, demonstrating its productive capacity.

The Florida Canyon mine is a prime example of a cash cow for Argonaut Gold, consistently generating reliable cash flow. Its mature operational status and established market position mean it requires minimal investment for promotion or market entry. Instead, capital is strategically allocated to sustaining projects, such as the construction of a third heap leach pad, to maintain efficient production.

| Metric | Value | Year |

| Florida Canyon Gold Sales | 62,368 ounces | 2023 |

| Projected Annual Production | ~70,000 ounces | 2024-2030 |

| Pre-Tax NPV | US$153 million | Updated Technical Reports |

| After-Tax NPV | US$139 million | Updated Technical Reports |

What You See Is What You Get

Argonaut Gold BCG Matrix

The Argonaut Gold BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no incomplete data, and no demo content—just a professionally designed, analysis-ready BCG Matrix report ready for your strategic decision-making. You can confidently use this preview to understand the depth and quality of the analysis, knowing the purchased version will be exactly the same, enabling you to seamlessly integrate it into your business planning and presentations.

Dogs

El Castillo mine, a former asset of Argonaut Gold, has transitioned into its reclamation phase following the cessation of mining activities in December 2022. This move places it squarely in the 'Dog' category of the BCG Matrix, indicating a low market share and low growth potential, as it no longer generates significant revenue from active production. Argonaut Gold reported that reclamation activities were underway, with expenditures focused on environmental restoration rather than new resource extraction.

The limited residual value of certain assets, like those Argonaut Gold might have in its portfolio, means they are no longer primary cash generators. While some residual leaching was anticipated in 2024, the mine has transitioned out of its core operational phase for significant cash flow.

This positions the asset within the BCG matrix as having a low market share and no discernible future growth prospects within the company's active operational strategy. It's essentially an asset winding down its productive life.

The El Castillo mine, once a cash generator for Argonaut Gold, has transitioned into a cash consumer. Its primary outflows are now directed towards reclamation and ongoing environmental management, a common characteristic of mature or closing mining operations.

Heliostar, the current owner of these Mexican assets, has outlined a strategy where anticipated funds from the San Agustin Mine will be allocated to cover the eventual closure costs of El Castillo. This approach aims to ensure responsible decommissioning without placing an undue burden on other ventures.

Divested Asset

El Castillo, previously a component of Argonaut Gold's Mexican operations, was divested as part of a strategic move to streamline its portfolio. This asset was spun out to Florida Canyon Gold Inc., which then sold it to Heliostar Metals. This transaction clearly signals Argonaut Gold's focus on higher-growth opportunities, categorizing El Castillo as a divested asset within its strategic planning.

The divestment of El Castillo aligns with a common business strategy to shed underperforming or non-core assets. For Argonaut Gold, this meant moving away from a low-growth, low-share position in its portfolio. In 2023, Argonaut Gold reported total gold production of 169,217 ounces, with its Mexican operations contributing significantly, but the specific performance of El Castillo post-divestment is now under Heliostar Metals' purview.

- Divestment Rationale: El Castillo was identified as a low-growth, low-share asset within Argonaut Gold's portfolio.

- Transaction Path: Spun out to Florida Canyon Gold Inc., then sold to Heliostar Metals.

- Strategic Impact: Allowed Argonaut Gold to focus resources on more promising assets.

- Market Context: Divestments are typical for companies aiming to optimize their asset base and improve financial performance.

Low Strategic Priority

El Castillo mine, due to its closure and ongoing reclamation efforts, represented a low strategic priority for Argonaut Gold. This aligns with the characteristics of a 'Dog' in the BCG Matrix, a business unit or product with low market share in a low-growth market. Such entities typically require minimal investment and are often candidates for divestment or liquidation to free up resources for more promising ventures.

As of Argonaut Gold's operational updates, El Castillo was no longer an active production site. The company's focus shifted to its higher-performing assets, such as the San Antonio and La Colorada mines. For instance, in the first quarter of 2024, Argonaut Gold reported total gold production of 38,892 ounces, with San Antonio contributing significantly to this output.

- El Castillo's Status: Closed and undergoing reclamation, signifying an end to its operational revenue generation.

- BCG Matrix Classification: Categorized as a 'Dog' due to its lack of growth and market share, necessitating a strategic decision to minimize or divest.

- Resource Allocation: Capital and management attention were redirected from El Castillo to more profitable and strategically important assets within Argonaut Gold's portfolio.

- Financial Impact: While not generating revenue, El Castillo incurred costs associated with its closure and environmental stewardship, further reinforcing its low strategic priority.

El Castillo mine, now under Heliostar Metals, has transitioned into a 'Dog' in the BCG Matrix. This classification stems from its cessation of active mining in December 2022 and its current reclamation phase, meaning it no longer contributes to revenue generation but incurs costs for environmental management. Argonaut Gold divested this asset to focus on higher-growth opportunities, a strategic move typical for managing low-share, low-growth segments.

The mine's status as a 'Dog' is further solidified by its lack of future growth potential within Argonaut Gold's operational strategy, even after its sale. While Heliostar Metals now manages its closure, the asset's core productive life has ended, necessitating resource allocation for reclamation rather than expansion.

This strategic shift for Argonaut Gold is evident in their 2024 production focus, with mines like San Antonio contributing significantly. For example, in Q1 2024, Argonaut Gold reported 38,892 ounces of gold, with San Antonio being a key producer. El Castillo's current state represents a closed operation with ongoing closure liabilities.

The financial implications for Argonaut Gold involved shedding an asset that would have required continued investment for minimal return. Heliostar's plan to use funds from San Agustin Mine to cover El Castillo's closure costs highlights the asset's ongoing expense profile, characteristic of a 'Dog' requiring management of its decline.

| Asset | Previous Owner | Current Owner | BCG Category | Status |

|---|---|---|---|---|

| El Castillo | Argonaut Gold | Heliostar Metals | Dog | Reclamation Phase |

Question Marks

The San Agustin mine, previously a key operating asset for Argonaut Gold in Mexico, faces an uncertain future. Projected to contribute gold production from 2024 through 2026, its relatively short mine life, coupled with Argonaut's strategic move to spin out and subsequently sell its Mexican assets, casts a shadow over its long-term viability within the company's portfolio.

The San Agustin project for Argonaut Gold presented a classic strategic dilemma, fitting the profile of a question mark in a BCG matrix. This meant it operated in a high-growth industry but had a low market share, demanding careful consideration of future investment.

The decision was stark: either commit significant capital to boost its market position and viability, or exit the venture. Argonaut's eventual sale of San Agustin to Heliostar Metals in late 2023 for approximately $12.3 million underscores this strategic uncertainty.

This transaction highlights the need for substantial new investment to revive production, with Heliostar Metals planning to restart operations in 2025.

San Agustin, while operational, presented a mixed picture in 2024. Its production levels and cost efficiency required close attention.

In the second quarter of 2024, San Agustin saw a decrease in its gold equivalent ounces (GEOs) produced compared to the same period in 2023. This decline in output, coupled with an increase in both cash costs and all-in sustaining costs (AISC) per ounce, highlighted operational hurdles and a less favorable cost structure.

These fluctuations in production and cost performance are key factors contributing to San Agustin's classification as a 'Question Mark' within the BCG matrix, indicating a need for strategic evaluation and potential intervention.

Part of Divestment Strategy

The San Agustin project's inclusion in the divestment strategy highlights its perceived lack of long-term strategic fit within Argonaut Gold's evolving portfolio. This asset was part of a larger package of Mexican holdings spun off to Florida Canyon Gold Inc., which was subsequently acquired by Heliostar Metals. This transaction signals a clear move by Argonaut to streamline its operations and focus on assets with stronger alignment to its core growth objectives.

The divestment of San Agustin, alongside other Mexican assets, suggests a strategic recalibration by Argonaut Gold. This move is often seen in the mining sector when companies prioritize projects with more immediate or clearer paths to production and profitability, or those that better fit their geological and operational expertise. For instance, in 2023, Argonaut focused on advancing its Florida Canyon and San Antonio projects in Nevada, indicating a geographic and operational concentration.

- Divestment Rationale: San Agustin was part of a broader divestment of Mexican assets, indicating a strategic decision to exit or reduce exposure to certain geographies or project types.

- Portfolio Optimization: The sale reflects Argonaut's effort to optimize its asset base, concentrating on projects deemed more central to its future growth and profitability.

- Transaction Details: The asset was initially spun out to Florida Canyon Gold Inc. and then sold to Heliostar Metals, demonstrating a multi-step process to transfer ownership and management.

- Strategic Re-evaluation: This action implies that San Agustin's long-term viability and contribution to Argonaut's strategic objectives were questioned, prompting its removal from the core portfolio.

Cerro del Gallo Project: Development-Stage Uncertainty

The Cerro del Gallo project, a development-stage asset for Argonaut Gold, is a prime example of a Question Mark within the BCG framework. It's envisioned to produce 80,000 gold equivalent ounces annually for 15.5 years, but currently, it's not generating revenue as it's not in production.

This lack of current production means it has no market share today. However, the project holds significant potential for future growth if it can overcome the hurdles associated with its development phase. The success hinges on substantial capital investment and effective management of inherent development risks.

Until Cerro del Gallo transitions from development to production, its contribution to Argonaut Gold's portfolio remains uncertain, classifying it firmly as a Question Mark. It represents an investment that consumes cash without providing immediate returns, a common characteristic of such strategic positions.

- Projected Production: 80,000 GEOs annually.

- Estimated Mine Life: 15.5 years.

- Current Market Share: None (non-producing asset).

- Strategic Classification: Question Mark (high growth potential, high risk, cash consumer).

Question Marks represent assets with high growth potential but low market share, requiring careful strategic decisions regarding investment. San Agustin, a former Argonaut Gold mine, exemplifies this, having been sold in late 2023 to Heliostar Metals for $12.3 million.

San Agustin's 2024 performance showed declining gold equivalent ounces (GEOs) produced in Q2 compared to 2023, alongside increased cash and all-in sustaining costs (AISC) per ounce. This operational performance, coupled with its divestment, solidified its Question Mark status, indicating a need for significant new investment for future viability.

Cerro del Gallo, another Argonaut Gold asset, is also a Question Mark. While it has a projected mine life of 15.5 years and an anticipated production of 80,000 GEOs annually, it is currently a non-producing asset. This means it consumes cash without generating revenue, a defining characteristic of a Question Mark.

| Asset | BCG Classification | 2024 Performance/Status | Strategic Action | Key Metrics |

|---|---|---|---|---|

| San Agustin | Question Mark | Decreased Q2 2024 GEO production; Increased Q2 2024 cash costs and AISC per ounce. | Sold to Heliostar Metals for $12.3 million in late 2023. | Projected production 2024-2026 (prior to sale); Short mine life. |

| Cerro del Gallo | Question Mark | Development stage, not in production. | Requires significant capital investment for development and future production. | Projected 80,000 GEOs annually; 15.5-year mine life. |

BCG Matrix Data Sources

Our Argonaut Gold BCG Matrix is informed by a blend of public financial disclosures, industry-specific market research, and internal operational data to provide a comprehensive view.