Arcosa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Arcosa's robust market position is built on strong manufacturing capabilities and a diversified product portfolio, but understanding the nuances of its competitive landscape and potential regulatory shifts is crucial. Our full SWOT analysis dives deep into these critical areas, providing actionable intelligence for strategic advantage.

Want the full story behind Arcosa's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Arcosa's strength lies in its diversified portfolio across Construction Products, Engineered Structures, and Transportation Products. This spread across essential infrastructure areas like building materials, energy transmission, and transportation equipment naturally balances market fluctuations. For instance, in the first quarter of 2024, Arcosa reported total revenue of $623.4 million, with its Construction Products segment alone contributing $289.7 million, showcasing its significant role within the company's overall financial performance.

Arcosa demonstrates a robust capability in strategic acquisitions, notably the Stavola acquisition in October 2024 and Ameron Pole Products in April 2024. These moves have effectively broadened its footprint in crucial markets such as aggregates and utility structures, bolstering its competitive position.

The company's strategic divestitures, including the sale of its steel components business, complement its acquisition strategy. This dual approach has been instrumental in refining its portfolio, concentrating on higher-growth segments, mitigating inherent cyclicality, and ultimately driving improved profit margins.

Arcosa is strategically positioned to benefit from significant market trends. The company is well-aligned with the ongoing need to replace and expand transportation infrastructure, a sector that consistently requires investment.

Furthermore, Arcosa is capitalizing on the accelerating global shift towards renewable energy sources, particularly in wind power generation. This focus is evident in their strong performance in manufacturing wind towers, a key component in this expanding market.

The company also benefits from the growth in new transmission, distribution, and telecommunications infrastructure. For example, in the first quarter of 2024, Arcosa reported a backlog of $2.4 billion for its utility structures segment, underscoring sustained demand in these critical infrastructure areas.

Commitment to Sustainability and Operational Efficiency

Arcosa’s commitment to sustainability is woven into its core strategy, with a clear focus on integrating Environmental, Social, and Governance (ESG) principles. This dedication is not just aspirational; it translates into tangible operational improvements. For instance, the company has actively worked to reduce its environmental footprint, achieving a notable 20% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity per revenue dollar between 2018 and 2023. This focus on efficiency also extends to safety, with Arcosa reporting a 25% decrease in its Total Recordable Incident Rate (TRIR) over the same period, underscoring a strong culture of operational excellence.

These efforts highlight Arcosa's proactive approach to responsible business. The company’s sustainability initiatives are designed to enhance long-term value creation by minimizing environmental impact and fostering a safe working environment. This dual focus on ecological responsibility and operational safety positions Arcosa favorably in an increasingly ESG-conscious market, potentially attracting investors and customers who prioritize these values. The company's consistent progress in these areas demonstrates a robust framework for sustainable growth.

- Reduced Emissions Intensity: Achieved a 20% reduction in Scope 1 and 2 GHG emissions intensity per revenue dollar (2018-2023).

- Improved Safety Metrics: Lowered Total Recordable Incident Rate (TRIR) by 25% (2018-2023).

- ESG Integration: Embedded ESG principles into long-term strategic planning and operations.

- Operational Excellence: Demonstrated focus on efficiency and continuous improvement across its facilities.

Solid Financial Performance and Outlook

Arcosa's financial performance remains a significant strength. In 2024, the company achieved record full-year revenues and Adjusted EBITDA, showcasing robust operational execution.

Looking ahead, Arcosa reaffirmed its 2025 full-year guidance, projecting continued substantial growth in both revenue and Adjusted EBITDA. This outlook underscores management's confidence in the company's ability to navigate market dynamics and deliver strong financial results, including healthy cash flow generation.

- Record 2024 Results: Full-year revenues and Adjusted EBITDA exceeded previous benchmarks.

- Reaffirmed 2025 Guidance: Management expects significant revenue and Adjusted EBITDA increases for the full year 2025.

- Strong Cash Flow Potential: The company's performance indicates a solid capacity for generating free cash flow.

Arcosa's diversified business model across construction products, engineered structures, and transportation products acts as a significant strength, providing resilience against sector-specific downturns. This diversification is reflected in its financial performance, with the Construction Products segment alone generating $289.7 million in revenue in Q1 2024.

Strategic acquisitions, such as Ameron Pole Products in April 2024 and Stavola in October 2024, have effectively expanded Arcosa's market reach, particularly in aggregates and utility structures. These moves bolster its competitive standing in key infrastructure markets.

Arcosa's financial health is robust, evidenced by record full-year revenues and Adjusted EBITDA in 2024. The company has also reaffirmed its 2025 guidance, projecting continued substantial growth in both revenue and Adjusted EBITDA, indicating strong operational execution and confidence in future performance.

The company's commitment to sustainability is a growing strength, with a 20% reduction in GHG emissions intensity (Scope 1 & 2) achieved between 2018 and 2023. This focus on ESG principles, alongside a 25% decrease in its Total Recordable Incident Rate (TRIR) over the same period, highlights operational excellence and a responsible business approach.

| Segment | Q1 2024 Revenue | Key Growth Driver |

|---|---|---|

| Construction Products | $289.7 million | Infrastructure development, aggregates demand |

| Engineered Structures | $240.3 million | Wind energy, utility infrastructure upgrades |

| Transportation Products | $93.4 million | Transportation infrastructure replacement and expansion |

What is included in the product

Delivers a strategic overview of Arcosa’s internal and external business factors, highlighting its strengths in infrastructure solutions and opportunities in government spending, while also addressing potential weaknesses in supply chain management and threats from economic downturns.

Arcosa's SWOT analysis provides a clear, actionable framework to identify and address operational inefficiencies, thereby alleviating pain points related to resource allocation and strategic focus.

Weaknesses

Arcosa experienced a notable 40% decrease in net income during the first quarter of 2025 when contrasted with the same period in the prior year. This downturn was accompanied by a reduction in diluted earnings per share (EPS), signaling potential headwinds for the company's profitability.

While Arcosa's overall revenue showed growth, the substantial drop in net income raises questions about the company's ability to translate top-line expansion into bottom-line results. This could be due to rising operational costs, increased interest expenses, or other factors impacting margins.

The decline in profitability for Q1 2025 warrants close observation from investors and market analysts. Determining whether this is a transient issue or a reflection of more persistent challenges affecting Arcosa's financial health will be crucial for future assessments.

Arcosa's acquisition of Stavola in late 2024 for $1.2 billion, financed through senior unsecured notes and a term loan, has notably increased its net debt to Adjusted EBITDA ratio. This elevated leverage position, while Arcosa aims to deleverage within 18 months, introduces greater financial risk. Higher debt levels can constrain the company's ability to pursue new investment opportunities or navigate potential economic downturns effectively.

Arcosa's Construction Products segment, its largest business unit, faces significant headwinds from seasonality and weather. This inherent vulnerability can cause considerable swings in both production output and overall revenue streams throughout the year.

For instance, the company's Stavola business experienced a negative impact on its Q1 2025 financial results directly attributable to the typical slowdowns experienced during winter months. This pattern highlights a recurring challenge that can disrupt financial consistency for Arcosa.

Organic Revenue Decline in Some Segments

While Arcosa has shown overall revenue growth, certain segments have faced organic declines. For instance, the Construction Products segment experienced a 6% organic revenue decrease in the first quarter of 2025. This dip was primarily attributed to reduced volumes and a decrease in freight revenue within that specific sector.

This situation highlights that Arcosa's top-line expansion isn't uniformly driven by organic market growth across all its business units. Acquisitions play a role in bolstering overall revenue, but the organic performance in some areas indicates potential challenges or market-specific headwinds that need addressing.

- Organic Revenue Decline: Construction Products segment saw a 6% organic revenue drop in Q1 2025.

- Contributing Factors: Lower volumes and decreased freight revenue impacted the Construction Products segment.

- Acquisition Dependence: A portion of overall revenue growth is linked to acquisitions rather than solely organic expansion.

Reliance on Infrastructure Spending and Policy Clarity

Arcosa's significant reliance on government infrastructure spending creates a notable weakness. For instance, the company's renewable energy segment, a key growth driver, is directly influenced by the stability and continuation of federal tax credits and incentives, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC). Uncertainty or changes in these policies, which are subject to political shifts, can lead to unpredictable demand for Arcosa's wind towers and other renewable energy components.

Furthermore, Arcosa's performance is closely tied to the pace and scale of national infrastructure projects. A slowdown in these projects, perhaps due to budget constraints or legislative delays, directly impacts the demand for Arcosa's engineered products, including bridges and traffic structures. For example, while the Infrastructure Investment and Jobs Act (IIJA) of 2021 allocated substantial funding, the actual disbursement and project initiation timelines can vary, creating periods of uncertainty for Arcosa's order book.

- Policy Dependence: Arcosa's renewable energy business is vulnerable to changes in government incentives like the ITC and PTC.

- Infrastructure Spending Volatility: The company's revenue streams are sensitive to the timing and volume of government-funded infrastructure projects.

- Project Delays Impact: Any delays in the execution of national infrastructure initiatives can directly affect Arcosa's sales pipeline and production schedules.

- Regulatory Uncertainty: Evolving regulations or a lack of clarity in environmental and permitting processes can hinder project development, impacting Arcosa's product demand.

Arcosa's substantial debt load, particularly after the $1.2 billion Stavola acquisition, raises financial risk. The increased net debt to Adjusted EBITDA ratio, despite plans to deleverage, could limit future investment flexibility and financial resilience during economic downturns.

The Construction Products segment, Arcosa's largest, is inherently vulnerable to seasonal weather patterns and the timing of infrastructure projects. This can lead to significant fluctuations in revenue and operational performance throughout the year, as seen with the Q1 2025 impact on Stavola's results.

While overall revenue grew, a 6% organic decline in the Construction Products segment during Q1 2025 due to lower volumes and reduced freight revenue highlights that growth isn't uniform across all business units. This suggests potential market-specific challenges or a reliance on acquisitions for top-line expansion.

What You See Is What You Get

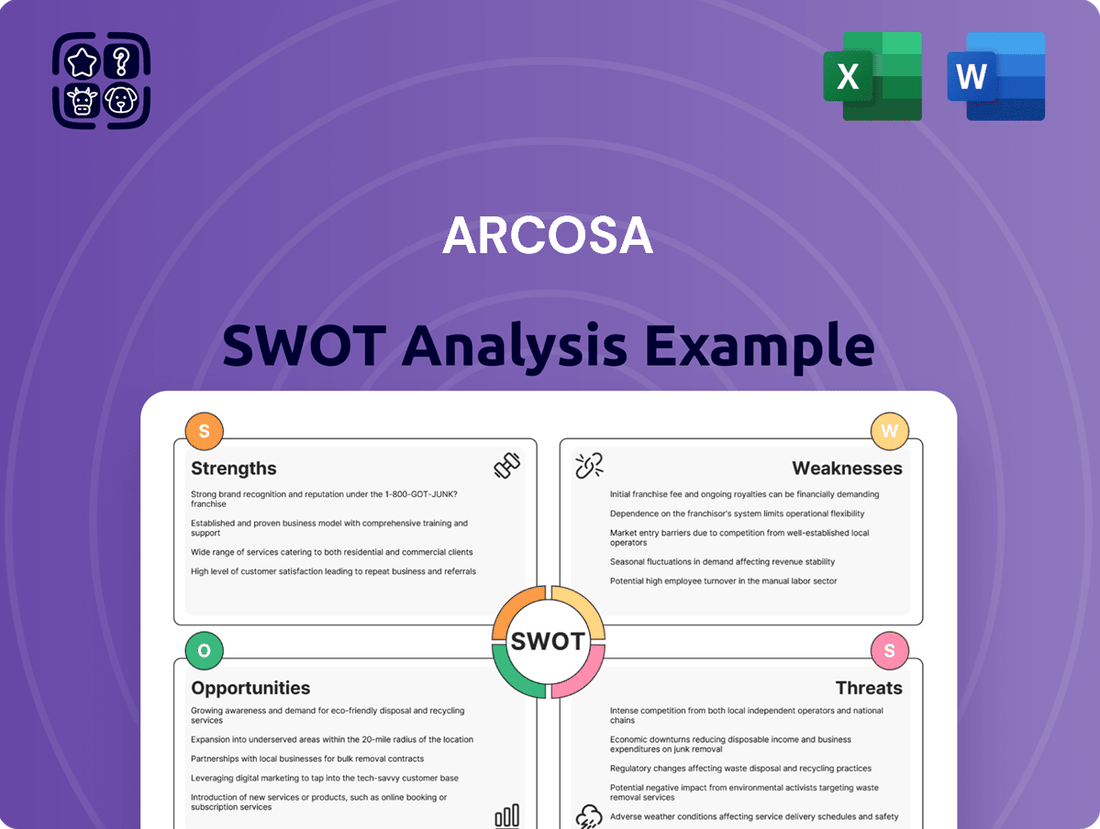

Arcosa SWOT Analysis

The file shown below is not a sample—it’s the real Arcosa SWOT analysis you'll download post-purchase, in full detail. You'll gain access to a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, providing valuable strategic insights.

This preview reflects the real Arcosa SWOT analysis document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of the key factors influencing Arcosa's business environment, enabling informed decision-making.

Opportunities

Arcosa is strategically positioned to capitalize on the sustained federal and state investments aimed at upgrading America's aging infrastructure. The Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, allocates significant funding towards transportation, water, broadband, and energy grids, creating a robust demand environment for Arcosa's diverse product offerings.

This ongoing infrastructure spending, projected to continue through 2025 and beyond, directly fuels demand for Arcosa's construction products like aggregates and pipe, as well as its engineered structures and transportation components. For example, the IIJA earmarks over $110 billion for roads, bridges, and major infrastructure projects, providing a clear runway for Arcosa's growth.

The global transition to renewable energy, especially wind power, is a major tailwind for Arcosa. This shift directly fuels demand for their Engineered Structures segment, which manufactures essential components like wind towers. As of late 2024, the installed wind capacity worldwide continues to climb, creating a robust market for Arcosa's products.

Furthermore, the necessary upgrades and expansion of electricity transmission and distribution infrastructure to support these renewables present another significant growth opportunity. The need for more robust grid systems to handle intermittent renewable sources means increased demand for utility structures. Policy support for clean energy, like potential extensions of tax credits in 2025, could further accelerate this infrastructure build-out.

Arcosa's proven 'buy-and-integrate' strategy presents a significant opportunity for growth. The company actively seeks strategic acquisitions to refine its portfolio and capture greater market share within fragmented sectors.

Future acquisitions in rapidly expanding or less volatile markets could substantially boost Arcosa's revenue, improve its profit margins, and solidify its competitive standing. For instance, in the first quarter of 2024, Arcosa completed two acquisitions, adding approximately $20 million in annualized revenue.

Leveraging Strong Backlog for Future Revenue

Arcosa's Engineered Structures segment is a key driver of future growth, holding a significant backlog of orders. This backlog offers considerable revenue visibility, with a substantial portion slated for delivery in 2025. This strong order book provides a stable platform for operational planning and resource deployment, ensuring consistent performance in the coming years.

- Engineered Structures Backlog: A substantial portion of Arcosa's backlog is concentrated in its Engineered Structures segment.

- 2025 Revenue Visibility: A significant amount of this backlog is scheduled for fulfillment during 2025, providing clear revenue projections.

- Operational Stability: This robust backlog supports efficient operational planning and resource allocation, fostering sustained performance.

- Foundation for Growth: The strong order pipeline offers a solid foundation for near to medium-term revenue growth and financial stability.

Recovery in Residential and Non-Residential Construction

A significant opportunity for Arcosa lies in the anticipated recovery of both residential and non-residential construction sectors. The single-family housing market is showing signs of renewed strength, which directly translates to increased demand for Arcosa's construction products like aggregates and concrete. This resurgence in housing is a key indicator of broader economic health.

Furthermore, the non-residential sector is experiencing robust demand driven by substantial investments in AI infrastructure, data centers, and advanced manufacturing facilities. These large-scale projects require significant quantities of construction materials, directly benefiting Arcosa's Construction Products segment. This dual-pronged demand from housing and specialized industrial construction provides a strong foundation for revenue growth.

- Housing Market Rebound: Projections for 2024 and 2025 indicate a steady increase in single-family housing starts, a direct driver for construction material sales.

- Infrastructure Investment: Demand for data centers and manufacturing plants, fueled by technological advancements, is expected to remain high, supporting Arcosa's non-residential segment.

- Economic Activity Indicator: The recovery in construction activity signals a broader positive economic trend, boosting overall demand for Arcosa's core offerings.

Arcosa is well-positioned to benefit from the ongoing infrastructure spending, particularly through the Infrastructure Investment and Jobs Act, which is expected to continue driving demand for its construction products and engineered structures through 2025. The company's strategic acquisitions also present a clear avenue for growth, as demonstrated by recent additions that boosted annualized revenue. Furthermore, the increasing demand for renewable energy, especially wind power, directly supports Arcosa's Engineered Structures segment, with a substantial backlog providing revenue visibility into 2025.

The anticipated recovery in both residential and non-residential construction, fueled by housing market strength and investments in areas like data centers, offers significant upside. This dual demand from housing and specialized industrial construction provides a strong foundation for revenue growth in 2024 and 2025.

| Opportunity Area | Key Driver | Projected Impact (2024-2025) |

|---|---|---|

| Infrastructure Investment | IIJA Funding, Grid Modernization | Sustained demand for construction products and utility structures |

| Renewable Energy Transition | Wind Power Expansion | Increased demand for wind towers and related structures |

| Strategic Acquisitions | Portfolio Enhancement, Market Share Growth | Revenue diversification and margin improvement |

| Construction Market Recovery | Housing Starts, Data Centers, Advanced Manufacturing | Higher sales of aggregates, concrete, and other construction materials |

Threats

A general economic downturn presents a significant threat to Arcosa, potentially dampening demand across its diverse segments. For instance, a slowdown in infrastructure spending, a key market for Arcosa's construction products, could directly impact revenue streams. The company's reliance on construction and energy markets means it's particularly susceptible to shifts in capital expenditure by its customers.

Rising inflation is another considerable challenge, directly impacting Arcosa's cost of goods sold and operational expenses. Increased prices for raw materials like steel and energy can squeeze profit margins if not effectively passed on to customers. This pressure was evident in early 2024 reports indicating elevated input costs for many industrial manufacturers.

Furthermore, the current environment of increasing interest rates poses a threat by raising Arcosa's borrowing costs. Higher interest expenses can reduce net income and make it more expensive to finance new projects or acquisitions, potentially hindering deleveraging efforts and overall financial flexibility. This trend impacts companies with existing debt and those looking to raise capital.

Arcosa operates in markets characterized by significant fragmentation and intense competition. This includes a mix of large, established public companies and a multitude of smaller, regional players vying for market share.

This competitive landscape can exert considerable pricing pressure, potentially limiting Arcosa's ability to maintain healthy margins. Furthermore, it could necessitate higher spending on sales and marketing, or even increase the cost of acquiring strategic businesses, thereby impacting overall profitability and hindering expansion efforts.

Arcosa faces significant risks from supply chain disruptions and fluctuating material costs, especially for steel and aggregates. For instance, in Q4 2023, Arcosa reported that higher input costs, particularly for steel in its Wind segment, put pressure on margins, although strategic pricing actions helped mitigate some of this impact. Consistent access to these key materials at predictable prices is vital for maintaining profitability across its diverse business units.

Regulatory and Environmental Compliance Risks

Arcosa, as a manufacturer of infrastructure products, faces significant threats from evolving regulatory landscapes, particularly concerning environmental compliance. Changes in environmental policies, such as those related to emissions or material sourcing, could necessitate costly upgrades to manufacturing processes or product designs. For instance, increased scrutiny on carbon emissions in manufacturing could impact Arcosa's production costs for steel-based products.

Failure to adhere to these regulations can result in substantial financial penalties and operational disruptions. In 2024, the EPA continued to enforce stringent air and water quality standards, which could affect facilities involved in metal fabrication and concrete production. Non-compliance not only leads to fines but also carries the risk of reputational damage, potentially impacting customer trust and market share.

The ongoing push for sustainability and climate action means that regulatory requirements are likely to become more demanding. Arcosa must remain agile in adapting to these shifts to mitigate risks such as:

- Increased operational costs due to new emission control technologies.

- Potential fines for non-compliance with evolving environmental standards.

- Reputational damage affecting brand perception and customer loyalty.

- Supply chain disruptions if suppliers cannot meet new environmental mandates.

Integration Risks of Acquired Businesses

Integrating acquired companies like Stavola and Ameron presents significant challenges. These integration risks can manifest as unexpected costs and operational inefficiencies if systems, cultures, and day-to-day operations don't mesh smoothly. For instance, Arcosa's acquisition of Stavola in late 2022 for $280 million, and Ameron in early 2023 for $170 million, both require careful post-acquisition integration to realize their full potential. Failure to achieve anticipated synergies from these deals could negatively impact Arcosa's overall financial performance and strategic objectives.

Key integration risks include:

- Cultural Clashes: Differences in organizational culture can hinder collaboration and employee morale, impacting productivity.

- System Incompatibilities: Merging disparate IT, accounting, and operational systems can be complex and costly, leading to disruptions.

- Failure to Realize Synergies: Overestimating cost savings or revenue growth opportunities from acquisitions can result in unmet financial targets.

Arcosa faces a significant threat from intense market competition, with numerous players vying for market share, which can lead to pricing pressures and reduced profit margins. The company's reliance on key materials like steel and aggregates exposes it to supply chain disruptions and volatile input costs, as seen with steel price increases impacting its Wind segment in late 2023. Furthermore, evolving environmental regulations, such as stricter emission standards, could necessitate costly upgrades to manufacturing processes, potentially increasing operational expenses and impacting profitability.

SWOT Analysis Data Sources

This Arcosa SWOT analysis is built on a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide the reliable, data-driven insights necessary for a thorough and accurate strategic assessment.