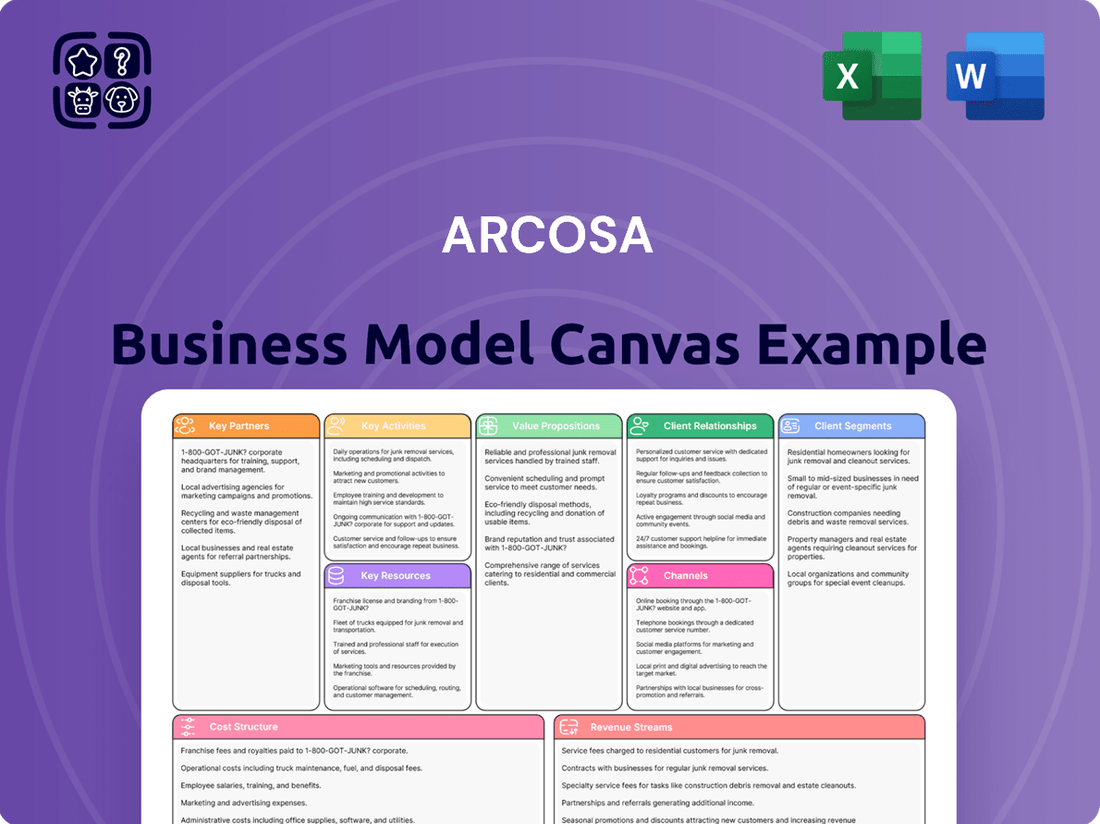

Arcosa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Unlock the full strategic blueprint behind Arcosa's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Arcosa's key partnerships are often formed with strategic acquirers and the entities they acquire. For instance, the acquisition of Stavola Holding Corporation in October 2024 for $1.2 billion and Ameron Pole Products in April 2024 for $180 million highlight this strategy. These moves are vital for Arcosa to broaden its market presence and product lines.

These acquisitions are not just about growth; they are instrumental in Arcosa's ability to access new geographical regions and bolster its product portfolios within existing business segments. The financial impact is clear, with these integrations contributing substantially to Arcosa's overall revenue and its Adjusted EBITDA growth.

Arcosa's engagement with government and regulatory bodies is crucial for its operations, especially in infrastructure and renewable energy. These partnerships ensure compliance with environmental standards and facilitate participation in government-backed development projects.

The Inflation Reduction Act of 2024 is a prime example, offering significant tax credits for wind tower manufacturing. This legislation directly supports Arcosa's renewable energy segment, encouraging investment and expansion in clean energy infrastructure.

By aligning with governmental initiatives, Arcosa not only navigates regulatory landscapes effectively but also taps into public funding streams. This strategic collaboration bolsters its capacity to undertake large-scale projects and maintain a competitive edge in evolving markets.

Arcosa relies heavily on its suppliers for essential raw materials, particularly steel, which is a cornerstone for its Engineered Structures and Transportation Products segments. These partnerships are not just about acquiring materials; they are about building a robust and dependable supply chain. For instance, in 2023, Arcosa's significant reliance on steel meant that maintaining strong supplier relationships was paramount to its operational continuity.

These crucial relationships directly influence Arcosa's ability to manage production costs and maintain efficiency. Fluctuations in steel prices, a common occurrence in the market, can significantly impact Arcosa's profitability. By securing reliable supply agreements, Arcosa aims to mitigate these risks and ensure that its manufacturing processes remain cost-effective, a strategy that proved vital throughout 2023 as global commodity prices experienced volatility.

The strength of these supplier partnerships is also a key factor in Arcosa's capacity to meet its production targets and fulfill its substantial order backlogs. A consistent and timely flow of raw materials allows Arcosa to ramp up production as needed, ensuring that customer orders are met promptly. This capability is essential for maintaining customer satisfaction and reinforcing Arcosa's market position, especially when facing high demand, as seen in its performance metrics from 2023.

Construction and Infrastructure Contractors

Arcosa's key partnerships with construction and infrastructure contractors are vital, as these entities represent the primary customer base for its diverse range of construction products and engineered structures. These relationships are the backbone for effectively distributing and deploying Arcosa's materials and solutions across significant development initiatives.

The company actively collaborates with these contractors to ensure its offerings are precisely tailored to the unique demands and rigorous standards inherent in different infrastructure projects. This synergy guarantees that Arcosa's engineered solutions are not only delivered but also optimally applied, fostering project success and reinforcing Arcosa's market position.

- Primary Customers: Construction and infrastructure contractors are the main buyers of Arcosa's products.

- Distribution Channel: These partnerships serve as a critical channel for Arcosa's materials and engineered structures.

- Project Integration: Collaboration ensures Arcosa's solutions meet project-specific needs and industry standards.

- Market Reach: Working with a broad network of contractors expands Arcosa's presence in large-scale development.

Renewable Energy Developers

Arcosa's strategic focus on renewable energy, particularly wind towers and utility structures, makes partnerships with renewable energy developers crucial. These collaborations are the primary drivers of demand for Arcosa's manufactured components, directly benefiting from the ongoing global transition to cleaner power sources.

The company's involvement in supplying wind towers and related infrastructure positions it as a key partner for developers building new wind farms. For instance, Arcosa secured significant orders for wind towers in 2023, contributing to its robust backlog and demonstrating the direct impact of these developer relationships on its revenue streams.

These long-term contracts with renewable energy developers offer substantial revenue visibility, allowing Arcosa to plan production and capital expenditures more effectively. This visibility is vital as Arcosa continues to invest in expanding its manufacturing capacity to meet the growing needs of the green energy sector.

- Demand Generation: Renewable energy developers directly fuel demand for Arcosa's wind towers and utility structures.

- Revenue Visibility: Long-term orders from these partners provide predictable revenue, enhancing financial planning.

- Sector Growth: Partnerships support Arcosa's expansion and commitment to the burgeoning green energy market.

- Market Position: Collaborations solidify Arcosa's role as a critical supplier in the renewable energy supply chain.

Arcosa's key partnerships extend to financial institutions and capital providers, essential for funding its substantial acquisition strategy and capital expenditure plans. These relationships provide the necessary liquidity to execute growth initiatives, such as the $1.2 billion acquisition of Stavola Holding Corporation in 2024.

Access to capital markets and strong banking relationships allow Arcosa to manage its debt effectively and secure favorable financing terms. This financial backing is critical for maintaining operational flexibility and pursuing strategic opportunities in a dynamic market environment.

Arcosa's partnerships with technology providers and engineering firms are also significant, particularly in developing advanced manufacturing processes and innovative product designs. These collaborations enhance efficiency and product quality, ensuring Arcosa remains competitive.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Impact Example |

|---|---|---|---|

| Acquisition Targets | Stavola Holding Corporation, Ameron Pole Products | Market expansion, product diversification | $1.2 billion acquisition of Stavola |

| Suppliers | Steel providers | Raw material security, cost management | Reliance on steel for production continuity |

| Customers | Construction & infrastructure contractors | Product distribution, project integration | Tailoring solutions for infrastructure projects |

| Industry Partners | Renewable energy developers | Demand generation, revenue visibility | Securing wind tower orders |

| Financial Institutions | Banks, capital markets | Funding acquisitions, capital expenditures | Financing growth initiatives |

What is included in the product

A detailed breakdown of Arcosa's strategy, outlining its diverse customer segments, key revenue streams, and core operational activities across its infrastructure and energy businesses.

Provides a structured framework to systematically identify and address operational inefficiencies, thereby alleviating the pain of complex problem-solving.

Helps pinpoint and resolve strategic gaps by offering a clear, visual representation of how value is created and delivered, easing the burden of business development.

Activities

Arcosa's manufacturing and production activities are central to its business, encompassing the creation of essential infrastructure components. This involves producing a wide array of products, from foundational construction materials like aggregates and asphalt to specialized items such as wind towers, utility structures, and barges.

The company's operational efficiency in these manufacturing processes directly impacts its ability to serve diverse markets and achieve financial success. For instance, in 2024, Arcosa's Construction Products segment, a significant part of its manufacturing base, generated substantial revenue, underscoring the importance of its production capabilities.

Arcosa's strategic acquisitions and divestitures are crucial to its business model, focusing on enhancing its market position and profitability. For example, in 2023, Arcosa completed the acquisition of Ameron, a significant move to bolster its presence in the water and wastewater infrastructure sector. This acquisition, along with others like Stavola, demonstrates a clear strategy to integrate businesses with strong growth potential and higher margins.

Simultaneously, Arcosa actively divests non-core or underperforming assets to streamline operations and reduce exposure to volatile markets. The divestiture of its steel components business in recent years is a prime example of this strategy, aimed at simplifying the company's structure and improving its overall financial profile by shedding cyclicality.

Arcosa's commitment to research and development is central to its strategy for product innovation. This involves continuous efforts to enhance existing products and create new solutions that meet changing market demands, like the growing need for sustainable building materials and sophisticated engineered structures.

This dedication to innovation is crucial for maintaining Arcosa's competitive edge. For instance, in 2023, Arcosa reported that its investments in R&D contributed to the development of advanced composite utility poles, offering a lighter and more durable alternative to traditional materials, which directly addresses evolving infrastructure needs.

Furthermore, R&D activities play a significant role in optimizing how Arcosa manufactures its products, leading to greater efficiency. This focus on innovation not only improves product performance but also drives cost savings, ultimately benefiting the company's bottom line and its customers.

Supply Chain Management and Logistics

Arcosa’s key activities heavily rely on robust supply chain management and logistics to ensure the efficient flow of goods. This encompasses sourcing raw materials from a diverse supplier base and delivering finished products to customers throughout North America. For instance, in 2023, Arcosa reported that its transportation costs represented a significant portion of its operating expenses, highlighting the importance of optimizing logistics networks.

Effective management of these processes directly impacts Arcosa's ability to meet customer demand promptly and control operational expenditures. The company actively works to streamline its distribution channels and manage supplier relationships to mitigate potential disruptions and maintain cost-effectiveness. In 2024, Arcosa continued to invest in technology to enhance visibility and efficiency within its supply chain.

- Supplier Relationship Management: Cultivating strong ties with a wide array of material providers to ensure consistent quality and timely deliveries.

- Transportation Network Optimization: Strategically planning and executing the movement of raw materials and finished goods to minimize costs and transit times.

- Inventory Control: Implementing systems to manage stock levels effectively, balancing the need for availability with the cost of holding inventory.

- Logistics Coordination: Orchestrating the complex movement of products across various modes of transportation to meet customer delivery schedules.

Sales and Marketing

Arcosa's key activities heavily rely on robust sales and marketing to showcase its wide range of products. This includes direct sales engagement, actively participating in bid processes for significant infrastructure projects, and nurturing lasting customer relationships. Effective marketing campaigns emphasize the superior quality, dependable performance, and environmental advantages of Arcosa's offerings.

In 2024, Arcosa continued to focus on these sales and marketing strategies to drive growth across its segments. For instance, the company's infrastructure products segment, which includes wind towers and transportation products, benefits from direct engagement with major developers and government entities. This proactive approach is crucial for securing the large, multi-year contracts that characterize these markets.

- Direct Sales Engagement: Arcosa employs dedicated sales teams to build relationships with key clients in sectors like energy, transportation, and construction.

- Bid and Tender Processes: The company actively participates in competitive bidding for large-scale infrastructure projects, requiring tailored proposals and technical expertise.

- Customer Relationship Management: Maintaining strong, long-term partnerships is vital, ensuring repeat business and gathering valuable market feedback.

- Value Proposition Marketing: Marketing efforts highlight Arcosa's commitment to quality, durability, and sustainable solutions, differentiating its products in competitive markets.

Arcosa's key activities revolve around manufacturing and production, strategic acquisitions, research and development, supply chain management, and sales and marketing. These interconnected functions drive the company's operational success and market positioning.

In 2023, Arcosa's strategic focus included acquisitions like Ameron, strengthening its water infrastructure segment. Simultaneously, it divested non-core assets, such as its steel components business, to streamline operations. Its R&D efforts in 2023 led to advancements like composite utility poles.

The company's supply chain management is critical, with transportation costs being a notable expense, as seen in 2023 figures. Arcosa also actively engages in sales and marketing, particularly through direct sales and participation in bid processes for infrastructure projects throughout 2024.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Manufacturing & Production | Creating infrastructure components like wind towers, utility structures, and barges. | Construction Products segment revenue highlights production importance. |

| Strategic Acquisitions & Divestitures | Integrating businesses and shedding non-core assets. | Ameron acquisition in 2023 bolstered water infrastructure. |

| Research & Development | Innovating products and improving manufacturing processes. | Advanced composite utility poles developed in 2023. |

| Supply Chain Management & Logistics | Sourcing materials and delivering products efficiently. | Investment in technology for supply chain visibility in 2024. |

| Sales & Marketing | Engaging customers, participating in bids, and building relationships. | Focus on infrastructure products segment growth in 2024. |

What You See Is What You Get

Business Model Canvas

The Arcosa Business Model Canvas preview you're viewing is the actual, complete document you'll receive upon purchase. This means the structure, content, and formatting are exactly as you see them, ensuring no surprises. You'll gain immediate access to this ready-to-use resource, allowing you to start refining your business strategy without delay.

Resources

Arcosa’s manufacturing footprint is extensive, featuring numerous facilities across North America. This includes quarries, asphalt plants, and specialized production sites for engineered structures and barges, forming the backbone of their operational capacity and market presence.

These physical assets, encompassing both facilities and specialized equipment, are fundamental to Arcosa’s ability to produce and deliver its diverse range of products. Their strategic locations also enhance the company's geographic reach and responsiveness to customer needs.

A significant recent development is the commencement of operations at Arcosa's new wind tower manufacturing facility in Belen, New Mexico, in mid-2024. This expansion underscores a commitment to growing key segments and investing in advanced manufacturing capabilities.

Arcosa's skilled workforce, encompassing engineers, production specialists, and operational managers, is a cornerstone of its operations. This expertise is critical for maintaining high manufacturing quality and efficiently delivering complex infrastructure projects, directly impacting Arcosa's ability to execute its business model effectively.

In 2023, Arcosa highlighted its commitment to its people, with a focus on attracting and retaining talent across its diverse segments. The company's investment in training and development ensures its workforce remains adept at handling evolving industry demands, a key factor in its operational success.

A robust management team provides the strategic direction necessary for Arcosa's growth and market positioning. Their leadership guides the company through market fluctuations and opportunities, ensuring the optimal deployment of resources and the achievement of long-term objectives.

Arcosa's Construction Products segment relies heavily on its access to and control over natural aggregate quarries and recycled aggregate sites as crucial key resources. These reserves are the bedrock for producing essential construction materials like concrete and asphalt.

The strategic acquisition of Stavola in 2024 was a pivotal move, significantly bolstering Arcosa's aggregates footprint. This expansion directly enhances their capacity to secure and manage the raw materials vital for their product lines.

Intellectual Property and Proprietary Technologies

Arcosa's competitive edge is significantly bolstered by its intellectual property and proprietary technologies, particularly evident in its engineered structures and specialized materials. These innovations likely encompass unique designs for wind towers and utility poles, alongside advanced manufacturing techniques for lightweight aggregates.

This proprietary knowledge translates directly into product differentiation and a substantial competitive advantage in the market. For instance, Arcosa's wind tower segment, a key area of innovation, benefits from specialized designs that enhance efficiency and structural integrity. In 2024, the company continued to leverage these technological strengths to secure significant projects, reflecting the value placed on their unique engineering capabilities.

- Proprietary Designs: Unique engineering blueprints for wind towers and utility structures optimize performance and reduce material usage.

- Advanced Manufacturing: Specialized processes for producing lightweight aggregates and other engineered materials offer distinct product advantages.

- Competitive Differentiation: Intellectual property creates barriers to entry and allows Arcosa to command premium pricing for its innovative solutions.

- Ongoing R&D: Continued investment in research and development ensures the maintenance and expansion of its technological leadership.

Strong Financial Capital and Access to Credit

Arcosa's strong financial capital and access to credit are fundamental to its business model. These resources are essential for fueling day-to-day operations, pursuing strategic acquisitions, and investing in organic growth initiatives. The company's capacity to secure substantial financing underscores its financial health.

A prime example of this financial strength in action was Arcosa's ability to finance the $1.2 billion Stavola acquisition. This significant transaction was supported by the issuance of senior unsecured notes and term loans, demonstrating Arcosa's established relationships with lenders and its favorable credit standing.

- Robust Financial Capital: Arcosa maintains substantial financial reserves to support its diverse business segments and growth strategies.

- Access to Credit Facilities: The company leverages its strong credit profile to secure necessary debt financing for major investments and operational needs.

- Acquisition Funding: Demonstrated ability to raise significant capital, such as the $1.2 billion used for the Stavola acquisition, through debt instruments like senior unsecured notes and term loans.

- Investment Capacity: This financial flexibility enables Arcosa to consistently invest in its infrastructure, expand its market reach, and pursue value-enhancing opportunities.

Arcosa's key resources also include its extensive network of physical assets, such as quarries, asphalt plants, and manufacturing facilities. These are critical for producing and delivering a wide array of products, from essential construction materials to highly engineered structures. The company's strategic investment in new facilities, like the Belen, New Mexico wind tower plant operational since mid-2024, further enhances its production capacity and market reach.

Intellectual property and proprietary technologies, particularly in engineered structures and specialized materials, provide Arcosa with a significant competitive advantage. These innovations, including unique designs for wind towers and advanced manufacturing processes, differentiate Arcosa's offerings and support premium pricing. The company's continued investment in research and development in 2024 aims to maintain this technological leadership.

Arcosa's financial capital and access to credit are vital for its operations and growth. The company's ability to secure substantial financing, exemplified by the $1.2 billion Stavola acquisition in 2024, highlights its financial health and strong relationships with lenders. This financial flexibility allows for ongoing investment in infrastructure and strategic expansion.

The company's skilled workforce, comprising engineers, production specialists, and management, is another crucial resource. Arcosa's commitment to attracting and retaining talent, with a focus on training and development as noted in 2023, ensures its operational efficiency and ability to handle complex projects, directly supporting its business model.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Manufacturing facilities, quarries, specialized equipment | New wind tower facility in Belen, NM operational mid-2024 |

| Intellectual Property | Proprietary designs, advanced manufacturing techniques | Continued investment in R&D for technological leadership |

| Financial Capital | Cash reserves, access to credit facilities | $1.2 billion Stavola acquisition funded via debt in 2024 |

| Skilled Workforce | Engineers, production specialists, management | Focus on talent attraction and development |

Value Propositions

Arcosa supplies critical materials and products that form the backbone of essential infrastructure projects. These high-quality offerings are indispensable for sectors like construction, energy transmission, and transportation, directly contributing to economic development and societal progress.

In 2023, Arcosa's Infrastructure Products segment generated $1.3 billion in revenue, highlighting the significant demand for its foundational components. This segment's products, such as engineered steel structures for wind energy and utility poles, are vital for modernizing and expanding the nation's critical infrastructure.

Arcosa's various business segments have cultivated strong reputations for reliability and exceptional service over many years. This deep-seated commitment to quality and streamlined operations is a cornerstone of their value proposition, ensuring customers consistently receive dependable products and services.

This dedication to operational excellence directly impacts Arcosa's ability to execute large-scale projects efficiently. It translates into optimized production processes and punctual delivery, which are absolutely critical for clients undertaking significant infrastructure or industrial endeavors.

For instance, in 2024, Arcosa's infrastructure products segment, a key area for demonstrating reliability in large projects, reported strong performance, underscoring the market's trust in their operational capabilities and consistent delivery.

Arcosa's value proposition hinges on its diverse product portfolio spanning Construction Products, Engineered Structures, and Transportation Products. This strategic diversification across key markets ensures Arcosa addresses a wide array of infrastructure requirements, mitigating risks associated with over-reliance on any single sector.

For instance, in 2023, Arcosa reported net sales of $2.2 billion, with its Construction Products segment contributing significantly. This broad market reach allows Arcosa to offer integrated, comprehensive solutions, solidifying its position as a go-to provider for varied infrastructure needs.

Strategic Geographic Presence

Arcosa's strategic geographic presence is a cornerstone of its business model, boasting over 150 locations throughout North America. This extensive network, bolstered by strategic acquisitions, ensures efficient customer service across diverse regions.

This widespread footprint translates into tangible benefits, including reduced transportation costs and enhanced responsiveness for clients. For example, Arcosa's expanded aggregates footprint has successfully opened doors into key metropolitan markets, solidifying its market penetration.

- Extensive Network: Over 150 locations across North America.

- Efficiency Gains: Reduced transportation costs and improved customer responsiveness.

- Market Access: Strategic acquisitions and expanded footprints provide entry into major metropolitan areas.

- Geographic Advantage: Serves diverse regions effectively, catering to varied customer needs.

Commitment to Sustainability and ESG Practices

Arcosa’s dedication to sustainability is more than just a buzzword; it's woven into their operations. They actively pursue environmental responsibility, energy efficiency, and meaningful community engagement. This focus attracts clients who prioritize eco-friendly solutions, thereby building lasting value.

Their commitment is backed by tangible actions. For instance, Arcosa has made strides in reducing their emissions intensity. In 2023, their Scope 1 and 2 emissions intensity was 0.16 metric tons of CO2e per thousand dollars of revenue, a reduction from previous years.

- Environmental Responsibility: Arcosa prioritizes reducing its ecological footprint through various initiatives.

- Energy Efficiency: The company actively seeks ways to optimize energy consumption across its operations.

- Community Engagement: Arcosa invests in and supports the communities where it operates.

- Recycled Aggregates: A key part of their strategy involves the increased use and promotion of recycled aggregates in construction projects.

Arcosa's value proposition centers on providing essential, high-quality infrastructure products and services, underpinned by a robust operational reputation and a commitment to sustainability. This multifaceted approach ensures reliability for critical projects and appeals to environmentally conscious clients.

The company's diverse product range, including construction materials, engineered structures, and transportation components, addresses a broad spectrum of infrastructure needs. This diversification, coupled with a strategic geographic presence across North America, allows Arcosa to offer comprehensive solutions and maintain efficient customer service.

Arcosa's commitment to sustainability, demonstrated by emissions reduction efforts and the promotion of recycled materials, further enhances its appeal. This focus on environmental responsibility, alongside operational excellence, solidifies Arcosa's position as a trusted partner in infrastructure development.

| Value Proposition Component | Description | Supporting Data/Fact |

|---|---|---|

| Essential Infrastructure Products | Supplies critical materials for construction, energy, and transportation sectors. | Infrastructure Products segment revenue was $1.3 billion in 2023. |

| Reliability and Operational Excellence | Cultivated strong reputation for dependable products and streamlined operations. | Consistent delivery is critical for large-scale client projects. |

| Diverse Product Portfolio | Offers integrated solutions across Construction Products, Engineered Structures, and Transportation Products. | Net sales were $2.2 billion in 2023, with significant contribution from Construction Products. |

| Strategic Geographic Presence | Extensive network of over 150 locations across North America ensures efficient service. | Expanded aggregates footprint opened doors into key metropolitan markets. |

| Commitment to Sustainability | Focus on environmental responsibility, energy efficiency, and community engagement. | Scope 1 and 2 emissions intensity was 0.16 metric tons of CO2e per thousand dollars of revenue in 2023. |

Customer Relationships

Arcosa cultivates enduring, collaborative partnerships with its key clients, which include major contractors, government entities, and utility providers. This strategy is fundamental to building trust and gaining a thorough understanding of client requirements, enabling the development of tailored solutions and securing ongoing business. For instance, Arcosa's Infrastructure Products segment reported a 15% increase in revenue for the first quarter of 2024, partly driven by strong demand from utility customers seeking reliable infrastructure components for long-term projects.

Arcosa's customer relationships are built on a foundation of direct sales and dedicated account management. This approach ensures that each client receives personalized attention, with teams working closely on everything from project specifics to delivery timelines. This direct interaction is key to Arcosa's ability to adapt swiftly to client needs and evolving market demands.

In 2023, Arcosa reported that its direct sales force was instrumental in securing significant contracts across its various segments, contributing to a robust backlog. This direct engagement allows for a deep understanding of client requirements, fostering strong, long-term partnerships and ensuring high levels of customer satisfaction.

Arcosa's customer relationships are significantly strengthened by its robust technical support and deep engineering expertise. This isn't just about selling products; it's about partnering with clients to ensure their success.

The company actively provides technical guidance, helping customers choose the right materials and structures for their specific applications. This hands-on approach ensures optimal performance and integration of Arcosa's offerings into diverse projects, adding substantial value beyond the transaction itself.

For instance, in 2024, Arcosa's engineering teams likely engaged with numerous clients on complex infrastructure projects, offering critical insights into material science and structural integrity. This expertise is a cornerstone of their customer loyalty and repeat business.

Post-Sale Service and Maintenance

For Arcosa's Engineered Structures and Transportation Products, post-sale service and maintenance are crucial for building lasting customer relationships. This support ensures their infrastructure products perform optimally and last longer after installation.

Reliable after-sales service directly impacts customer satisfaction and fosters loyalty, which is vital for repeat business and Arcosa's reputation in the market.

- Ensuring Product Longevity: Post-sale support helps Arcosa's customers maintain the integrity and functionality of critical infrastructure components, maximizing their lifespan.

- Driving Customer Loyalty: Dependable service builds trust and satisfaction, encouraging repeat purchases and positive word-of-mouth referrals.

- Optimizing Performance: Regular maintenance and readily available support ensure Arcosa's products operate at peak efficiency, meeting client expectations.

Customer-Centric Innovation

Arcosa's customer relationships are deeply rooted in a customer-centric approach to innovation. This means that feedback directly from their clients plays a crucial role in shaping new products and refining existing ones. For instance, in 2024, Arcosa continued to emphasize direct engagement with infrastructure developers and operators to identify pain points and opportunities.

By actively listening to the evolving challenges within the infrastructure sectors, Arcosa is able to tailor its offerings more effectively. This proactive understanding allows them to not only meet current customer demands but also to anticipate future needs, ensuring their solutions remain relevant and valuable in a dynamic market.

- Client Feedback Integration: Arcosa actively solicits and incorporates client input into its product development lifecycle, fostering collaborative innovation.

- Market Responsiveness: The company's strategy involves closely monitoring infrastructure market trends to proactively adapt its solutions.

- Tailored Solution Development: Arcosa focuses on creating customized solutions that directly address the specific requirements of its diverse customer base.

Arcosa prioritizes long-term, collaborative relationships with key clients like contractors, government bodies, and utilities. This direct engagement, supported by dedicated account management and robust technical expertise, ensures tailored solutions and high customer satisfaction. For example, Arcosa's Infrastructure Products segment saw a 15% revenue increase in Q1 2024, partly due to strong utility demand.

Post-sale service and maintenance are critical for Arcosa's Engineered Structures and Transportation Products segments, enhancing product longevity and customer loyalty. This focus on after-sales support ensures optimal performance and fosters repeat business.

Arcosa's customer relationships are strengthened by a customer-centric innovation approach, where client feedback directly influences product development. By understanding evolving market challenges, Arcosa proactively adapts its offerings to meet current and future customer needs.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Account Management | Personalized attention and project collaboration | Securing significant contracts, maintaining robust backlog |

| Technical Support & Engineering Expertise | Providing guidance for optimal product application | Ensuring client success and driving repeat business |

| Post-Sale Service & Maintenance | Ensuring product longevity and performance | Enhancing customer satisfaction and loyalty |

| Customer-Centric Innovation | Integrating client feedback into product development | Proactively adapting solutions to market needs |

Channels

Arcosa leverages a direct sales force to connect with major clients like large construction firms, government agencies, and energy companies. This approach enables direct interaction, the negotiation of significant contracts, and the development of customized solutions for intricate infrastructure needs.

This direct channel is crucial for fostering robust, personal connections with the primary decision-makers in these key industries. For instance, in 2023, Arcosa reported that its Infrastructure Products segment, heavily reliant on direct sales, saw significant revenue growth, underscoring the effectiveness of this strategy in securing large-scale projects.

Arcosa's integrated network of company-owned manufacturing facilities and distribution centers across North America is a cornerstone of its business model. This setup allows for direct control over production quality and efficiency, ensuring Arcosa can meet demand effectively.

In 2024, Arcosa continued to optimize this network. For instance, the company's strategic investments in expanding its manufacturing capacity for wind towers, a key product line, directly support the efficient production and localized supply needed for renewable energy projects. This integrated approach minimizes logistics costs, contributing to competitive pricing and enhanced market responsiveness.

Arcosa's corporate website is a vital channel for its online presence and investor relations. It acts as the central hub for all corporate information, including financial reports, investor presentations, and sustainability initiatives. This digital platform is key to transparent communication with shareholders and the broader financial community.

While not a direct sales conduit for every product, the website is indispensable for disseminating crucial updates, such as Arcosa's 2023 annual report which highlighted a 10% increase in revenue to $2.3 billion. It effectively communicates the company's strategic direction and financial performance to its stakeholders.

The company leverages its online presence to showcase its commitment to environmental, social, and governance (ESG) principles. For instance, Arcosa's sustainability reports, readily available online, detail progress on its environmental targets and social responsibility efforts, reinforcing investor confidence and brand reputation.

Industry Trade Shows and Conferences

Arcosa leverages industry trade shows and conferences as a crucial channel to connect with its customer base and showcase its diverse product offerings. These events are vital for generating new leads and strengthening relationships within the construction, energy, and transportation industries. In 2024, Arcosa continued its active participation in key sector events, aiming to demonstrate its innovative solutions and market leadership.

These gatherings offer a direct platform for Arcosa to engage with potential clients, understand evolving market needs, and highlight its capabilities. By exhibiting at these venues, the company can effectively build its brand and gather intelligence on emerging technologies and competitive landscapes. For instance, participation in events like the American Association of State Highway and Transportation Officials (AASHTO) annual meeting or the CONEXPO-CON/AGG show provides direct access to decision-makers in critical infrastructure sectors.

- Lead Generation: Trade shows provide a concentrated environment for Arcosa to identify and engage with prospective customers, directly contributing to sales pipeline growth.

- Brand Visibility: Active presence at industry conferences enhances Arcosa's brand recognition and reinforces its position as a key player in its served markets.

- Market Intelligence: These events offer invaluable opportunities to gather insights into customer preferences, competitor activities, and technological advancements.

- Product Demonstration: Arcosa utilizes these platforms to showcase the functionality and benefits of its products, such as specialized equipment for infrastructure development.

Acquired Distribution Networks

Arcosa's strategy of acquiring established companies significantly bolsters its distribution capabilities. For instance, the acquisition of Stavola provided immediate access to its extensive network of asphalt and aggregate distribution points, enhancing Arcosa's presence in key East Coast markets. This move, completed in 2023, immediately expanded Arcosa's geographic reach and customer base.

Similarly, the acquisition of Ameron in 2022 brought with it a robust distribution system for concrete pipe and related products across the Western United States. These strategic integrations allow Arcosa to leverage existing infrastructure, bypassing the significant time and capital investment typically required to build out new distribution channels from the ground up. This approach accelerates market penetration and strengthens its competitive position.

- Immediate Market Access: Acquired networks provide instant entry into new regions and customer segments.

- Reduced Infrastructure Costs: Avoids the expense and time of building new distribution facilities.

- Enhanced Geographic Reach: Expands Arcosa's operational footprint and market penetration.

- Customer Base Integration: Gains access to established customer relationships and sales channels.

Arcosa's channel strategy is multifaceted, combining direct sales, its own integrated network, online presence, industry events, and strategic acquisitions. This approach ensures broad market reach and deep customer engagement across its diverse product lines.

The direct sales force is critical for securing large contracts with major clients in infrastructure, energy, and government sectors. This personal engagement allows for tailored solutions and strengthens key relationships, as evidenced by the significant revenue growth in Arcosa's Infrastructure Products segment in 2023, which relies heavily on this direct channel.

Arcosa's company-owned manufacturing and distribution network provides direct control over quality and efficiency. Investments in 2024, such as expanding wind tower manufacturing capacity, support efficient, localized supply chains, minimizing logistics costs and enhancing market responsiveness.

The corporate website serves as a vital hub for investor relations and information dissemination, reinforcing transparency and communication with stakeholders. While not a primary sales channel for all products, it effectively communicates strategic direction and financial performance, as seen in the 2023 annual report detailing a 10% revenue increase to $2.3 billion.

Participation in industry trade shows and conferences in 2024 is key for lead generation, brand visibility, and market intelligence. Events like AASHTO and CONEXPO-CON/AGG offer direct engagement with decision-makers in critical infrastructure sectors, showcasing Arcosa's capabilities and innovative solutions.

Strategic acquisitions have significantly enhanced Arcosa's distribution capabilities. The 2023 acquisition of Stavola, for example, provided immediate access to an extensive distribution network on the East Coast, expanding geographic reach and customer base.

| Channel | Description | Key Activities | 2023/2024 Impact | Strategic Importance |

|---|---|---|---|---|

| Direct Sales Force | Dedicated sales team engaging major clients. | Contract negotiation, customized solutions. | Drove significant revenue growth in Infrastructure Products segment (2023). | Secures large-scale projects, builds strong client relationships. |

| Integrated Network | Company-owned manufacturing and distribution facilities. | Production control, efficient supply chain management. | Investments in wind tower capacity expansion (2024) optimize localized supply. | Ensures quality, cost-competitiveness, and market responsiveness. |

| Corporate Website | Online hub for information and investor relations. | Financial reports, ESG initiatives, company updates. | Communicated 2023 annual report showing $2.3B revenue (+10%). | Enhances transparency, brand reputation, and stakeholder communication. |

| Industry Trade Shows | Participation in sector-specific events. | Lead generation, product demonstration, market intelligence. | Continued active participation in key sector events (2024). | Builds brand, gathers market insights, engages potential clients. |

| Acquired Distribution Networks | Leveraging distribution systems from acquired companies. | Market access, geographic expansion, customer integration. | Stavola acquisition (2023) expanded East Coast presence; Ameron (2022) strengthened Western US distribution. | Accelerates market penetration, reduces infrastructure costs. |

Customer Segments

Large-scale infrastructure contractors are crucial clients for Arcosa, encompassing major construction and engineering firms involved in significant projects like highways, bridges, and commercial developments.

These companies depend on a steady and dependable supply of essential construction materials, such as aggregates and asphalt, to keep their ambitious projects on schedule.

Arcosa’s capacity to deliver these high-volume, quality products reliably positions it as a vital partner for these contractors. For instance, in 2024, Arcosa's Construction Products segment, which serves this customer base, experienced strong demand driven by ongoing infrastructure spending, contributing significantly to its overall revenue.

Arcosa's utility and energy segment caters to electric utilities and renewable energy developers who need critical infrastructure components. This includes engineered solutions like utility poles and transmission towers essential for power delivery and wind towers for renewable energy generation.

The demand from this customer base is significantly influenced by substantial investments in modernizing and strengthening power grids, often referred to as grid hardening. Furthermore, the ongoing expansion of renewable energy sources, such as wind and solar, directly drives the need for Arcosa's products.

In 2024, the energy sector continued to see robust investment in transmission and distribution infrastructure, with a particular focus on integrating more renewable capacity. For instance, the U.S. Department of Energy's Grid Resilience and Innovation Partnerships (GRIP) program is injecting billions into grid modernization efforts, directly benefiting suppliers of transmission towers and related structures.

State and local government agencies, particularly Departments of Transportation, represent a crucial customer segment for Arcosa. These entities are the primary drivers of public infrastructure development, making them significant purchasers of Arcosa's construction products and traffic structures.

Arcosa's engagement with these government bodies often involves navigating competitive bidding processes, a standard procurement method for public projects. This highlights the need for Arcosa to offer competitive pricing and high-quality products to secure contracts.

The products Arcosa supplies directly contribute to public safety and the enhancement of urban environments. For instance, in 2024, infrastructure spending by U.S. state and local governments was projected to reach over $400 billion, underscoring the substantial market opportunity for companies like Arcosa.

Marine Transportation and Shipping Companies

Arcosa's Transportation Products segment serves marine transportation and shipping companies that rely on barges for moving goods. These customers operate across inland and coastal waterways, making barge demand a direct reflection of commodity flow and trade activity.

The demand within this segment is significantly shaped by the need for fleet renewal. An aging barge fleet necessitates replacement, creating ongoing opportunities for Arcosa. For instance, in 2023, Arcosa reported that its marine segment, which includes barges, saw robust demand, contributing to its overall financial performance.

- Key Customer Needs: Reliable, durable barges for efficient commodity transport.

- Market Drivers: Fleet aging and replacement cycles, commodity prices, and trade volumes.

- 2024 Outlook: Continued demand expected due to ongoing infrastructure needs and replacement cycles for older vessels.

Telecommunications Providers

Arcosa's Engineered Structures segment is a key supplier to telecommunications providers, furnishing essential infrastructure for wireless networks. This includes specialized poles designed for small-cell deployments, crucial for enhancing 5G and future wireless capabilities.

The demand from this sector is driven by the ongoing expansion of network coverage and the relentless pace of technological upgrades. Arcosa's ability to deliver robust and reliable structures is paramount to meeting these evolving needs.

- Small-cell deployment: Arcosa provides poles specifically engineered to support the dense network of small-cell antennas required for 5G and beyond.

- Network expansion: Telecommunication companies rely on Arcosa for durable infrastructure to extend their wireless coverage to new areas and improve capacity.

- Technological advancements: The increasing complexity and weight of new wireless equipment necessitate advanced structural solutions, which Arcosa is positioned to deliver.

Arcosa serves a diverse customer base, including large infrastructure contractors who require a consistent supply of aggregates and asphalt for major projects. Additionally, electric utilities and renewable energy developers depend on Arcosa for engineered solutions like utility poles and wind towers, crucial for grid modernization and clean energy expansion. State and local government agencies, particularly Departments of Transportation, are significant buyers of construction materials and traffic structures, driven by public infrastructure investment. Marine transportation companies also rely on Arcosa for barges, reflecting the need for fleet renewal and efficient commodity movement.

| Customer Segment | Key Products/Services | 2024 Market Drivers |

|---|---|---|

| Large Infrastructure Contractors | Aggregates, Asphalt | Infrastructure spending, project timelines |

| Utilities & Renewable Energy Developers | Utility Poles, Transmission Towers, Wind Towers | Grid modernization, renewable energy growth |

| State & Local Governments (DOTs) | Construction Materials, Traffic Structures | Public infrastructure investment |

| Marine Transportation Companies | Barges | Fleet renewal, commodity trade |

| Telecommunications Providers | Small-cell poles | 5G deployment, network expansion |

Cost Structure

Arcosa's cost structure heavily relies on raw material procurement, with steel being a primary expense for its engineered structures and transportation segments. For instance, in 2023, Arcosa reported that steel prices, a key input, experienced volatility, directly influencing their cost of goods sold.

The company also incurs significant costs related to natural resources for its aggregates business. These commodity price swings necessitate robust management strategies, including efficient sourcing and optimized supply chain operations, to maintain profitability.

Manufacturing and production expenses represent a significant portion of Arcosa's cost structure. These include direct labor for assembly and fabrication, the energy required to power their manufacturing facilities, and ongoing maintenance for their specialized equipment and plants.

In 2024, Arcosa's focus on operational efficiency is crucial for managing these costs. For instance, investments in more energy-efficient machinery and streamlined production workflows directly impact the bottom line by reducing utility bills and labor hours per unit.

Arcosa's logistics and transportation costs are significant due to the substantial size and weight of many of its products, such as wind towers and precast concrete. These expenses encompass freight charges for inbound raw materials and outbound finished goods. For instance, in 2023, Arcosa reported that its cost of goods sold, which includes these logistics, was $2.1 billion, reflecting the inherent transportation demands.

The company actively works to manage these substantial outlays. Strategic decisions regarding the location of its manufacturing facilities and the optimization of its supply chain networks are key to mitigating these costs. By placing plants closer to raw material sources or major customer hubs, Arcosa aims to reduce the distance goods must travel, thereby controlling freight expenses.

Acquisition-Related Costs and Integration Expenses

Arcosa's commitment to growth through acquisitions means substantial investment in merger and acquisition (M&A) activities. These costs encompass thorough due diligence, legal and advisory fees, and the complex process of integrating new businesses into Arcosa's existing operations.

For instance, in 2023, Arcosa completed several strategic acquisitions, including the purchase of two businesses that expanded its presence in the renewable energy sector. While specific M&A expenses are not always broken out in detail, such transactions typically involve significant upfront capital and ongoing integration costs that can affect immediate financial performance.

- Due Diligence Costs: Expenses incurred to thoroughly investigate potential acquisition targets, including financial, legal, and operational reviews.

- Transaction Fees: Payments to investment bankers, lawyers, accountants, and other advisors involved in structuring and executing the deal.

- Integration Expenses: Costs associated with merging systems, processes, personnel, and cultures of acquired companies, often impacting operational efficiency in the short term.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are a crucial part of Arcosa's cost structure, covering everything from direct sales efforts to the essential functions that keep the company running smoothly. These costs are vital for supporting business operations, driving growth, and ensuring compliance with all necessary regulations.

- Sales and Marketing: Costs associated with promoting Arcosa's products and services, including advertising, sales force compensation, and market research.

- General and Administrative: Expenses related to corporate overhead, such as executive salaries, legal fees, accounting, and IT support.

- Research and Development (R&D): Investments made in developing new products or improving existing ones, which is key for Arcosa's long-term competitiveness.

- Compliance and Other Operating Costs: Expenses incurred to meet regulatory requirements and other general operational needs.

For Arcosa, managing SG&A is about balancing the investment needed for growth against the need for operational efficiency. In 2023, Arcosa reported total SG&A expenses of $271.5 million, representing a significant portion of their overall operating costs but also reflecting their commitment to market presence and innovation.

Arcosa's cost structure is dominated by key inputs like steel and aggregates, with manufacturing, logistics, and SG&A expenses also playing significant roles. The company's 2023 cost of goods sold reached $2.1 billion, underscoring the impact of raw materials and transportation. Strategic acquisitions in 2023 added to these costs through integration efforts.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers |

| Cost of Goods Sold | 2,100 | Steel, aggregates, manufacturing labor, energy |

| Selling, General & Administrative (SG&A) | 271.5 | Sales & marketing, corporate overhead, R&D |

| Acquisition Integration | Variable | Due diligence, transaction fees, system merging |

Revenue Streams

Arcosa generates significant revenue through the sale of construction products, encompassing natural and recycled aggregates, asphalt, and various specialty materials. This segment is a core contributor to the company's financial performance, directly influenced by the health of infrastructure projects and broader construction markets.

In 2024, Arcosa's Construction Products segment demonstrated robust performance, reflecting strong demand from ongoing infrastructure investments. The company reported substantial sales within this category, underscoring its position as a key supplier in the construction materials industry.

Revenue in this segment is generated from the sale of a variety of engineered products. These include essential utility structures that support power grids, towering wind towers crucial for renewable energy generation, robust traffic and lighting structures for infrastructure, and critical telecommunication structures.

The demand for these engineered structures remains exceptionally strong, largely driven by significant investments in the renewable energy sector and ongoing efforts to modernize and upgrade existing power grids. For instance, Arcosa reported that its Engineered Structures segment generated $560.5 million in revenue for the first half of 2024, highlighting the substantial market for these products.

Arcosa Inc. generates significant revenue by manufacturing and selling barges, crucial components for both inland and coastal waterway transportation. This segment benefits from a consistent demand driven by the need to replace aging vessels within the existing fleet.

In 2023, Arcosa reported that its Marine Products segment, which includes barge sales, achieved revenues of $608.3 million. The company highlighted a strong backlog for its barge business, indicating continued sales potential.

Services and Value-Added Solutions

Arcosa's revenue extends beyond its core product sales through a variety of services and value-added solutions. These offerings are designed to deepen customer engagement and create additional income streams.

For instance, Arcosa might provide technical consulting services to assist clients in selecting and implementing the most suitable engineered structures for their projects. This expertise helps customers optimize their investments and ensures project success.

Product customization is another key revenue generator. Arcosa can tailor its standard products to meet specific client requirements, offering unique solutions that command higher margins. This flexibility is crucial in diverse markets like energy and infrastructure.

Maintenance and support services for its engineered structures also contribute to Arcosa's revenue. These ongoing services ensure the longevity and optimal performance of Arcosa's products, fostering long-term customer loyalty and recurring income.

- Technical Consulting: Offering expertise to guide client project decisions.

- Product Customization: Tailoring engineered structures to meet unique client needs.

- Maintenance Services: Providing ongoing support for product longevity and performance.

- Value-Added Solutions: Enhancing customer relationships and generating additional revenue beyond product sales.

Organic Growth and Acquisition Contributions

Arcosa's revenue streams demonstrate a dual engine of growth, driven by both the expansion of its core operations and the strategic integration of acquired businesses. This approach has proven effective in bolstering financial performance.

Inorganic growth, particularly through significant acquisitions such as Stavola and Ameron, has directly contributed to substantial increases in Arcosa's top-line revenue and EBITDA. For instance, the acquisition of Stavola, completed in 2023, added approximately $250 million in annualized revenue. The company anticipates this trend of revenue enhancement through acquisitions to continue.

- Organic Growth: Arcosa's existing segments consistently expand their market share and product offerings, leading to increased revenue from established operations.

- Acquisition Contributions: Strategic purchases, like Stavola and Ameron, inject new revenue streams and expand the company's operational footprint.

- Combined Impact: The synergy between organic expansion and acquisition-driven growth is projected to sustain a robust revenue trajectory for Arcosa.

Arcosa's revenue streams are diversified across several key segments, primarily Construction Products, Engineered Structures, and Marine Products. The company also generates income from specialized services and the strategic integration of acquired businesses.

In 2024, Arcosa's Construction Products segment saw robust sales driven by infrastructure spending, while its Engineered Structures segment benefited from strong demand in renewable energy and grid modernization, reporting $560.5 million in revenue for the first half of 2024. The Marine Products segment, including barge sales, achieved $608.3 million in revenue in 2023, supported by a solid backlog.

| Segment | 2023 Revenue (Millions) | Key Drivers |

|---|---|---|

| Construction Products | $1,787.3 | Infrastructure projects, construction market health |

| Engineered Structures | $1,126.2 | Renewable energy, grid modernization, telecommunications |

| Marine Products | $608.3 | Fleet replacement, waterway transportation needs |

Business Model Canvas Data Sources

The Arcosa Business Model Canvas is constructed using a combination of Arcosa's internal financial statements, investor relations reports, and operational data. This ensures a grounded understanding of the company's current performance and strategic direction.