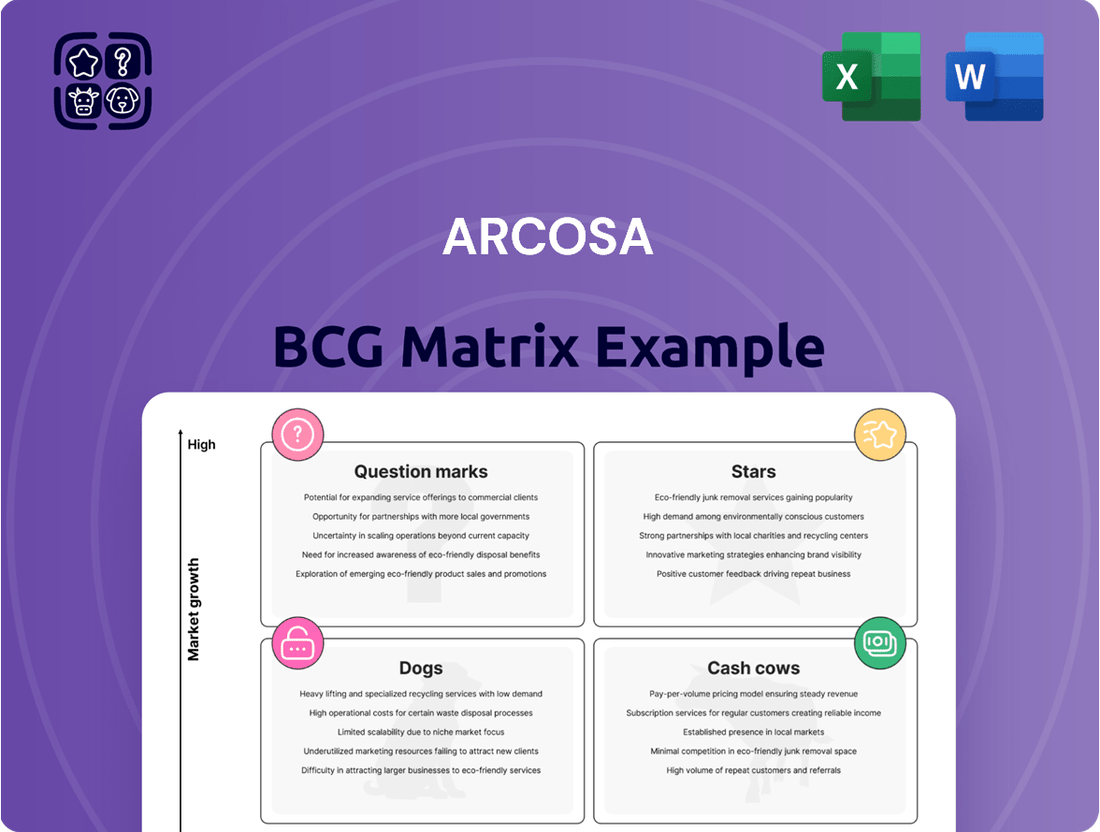

Arcosa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Unlock the strategic potential of Arcosa's product portfolio with a clear understanding of its position within the BCG Matrix. This preview offers a glimpse into how Arcosa's offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, providing a foundational understanding of their market performance and resource requirements.

Dive deeper into Arcosa's strategic positioning by purchasing the full BCG Matrix report. Gain access to detailed quadrant placements, data-driven insights into market share and growth, and actionable recommendations to optimize your investment and product development strategies for Arcosa.

Don't miss out on the complete picture. The full Arcosa BCG Matrix report provides the granular detail and strategic clarity needed to make informed decisions about resource allocation and future growth, transforming this preview into a powerful strategic tool.

Stars

Arcosa's wind tower segment is a star in its BCG portfolio, fueled by the global push for renewables. The company's significant order book, totaling around $750 million for deliveries between 2024 and 2028, underscores this strong market position.

The passage of supportive legislation, such as the Inflation Reduction Act, has been a major catalyst, leading to over $1.1 billion in new wind tower orders for Arcosa since its enactment. This robust demand necessitated the opening of a new manufacturing facility in New Mexico, which commenced operations in mid-2024 to meet increasing customer needs.

Arcosa's Engineered Structures segment, specifically its utility structures, is a strong performer, likely a star in the BCG matrix. This is driven by robust demand for essential infrastructure upgrades across North America. The push for increased electrification and the need to strengthen existing power grids are major tailwinds.

Order activity in this sector remains consistently healthy, reflecting Arcosa's significant market share. This indicates the company is well-positioned in a critical area of infrastructure development that is essential for modern society's energy needs. For instance, in the first quarter of 2024, Arcosa reported a substantial backlog for its utility structures, underscoring the ongoing demand.

Arcosa's strategic focus on these long-term infrastructure trends, such as grid modernization and expansion, is a key factor in its continued growth and leadership in the utility structures market. This segment's alignment with national infrastructure priorities provides a stable and expanding revenue stream.

Arcosa's construction products segment, specifically aggregates in the New York-New Jersey MSA, represents a significant growth driver, bolstered by the strategic acquisition of Stavola in October 2024. This move dramatically amplified Arcosa's presence in a key, high-demand construction market.

The integration of Stavola's operations offers Arcosa greater access to less volatile, infrastructure-focused markets, which are crucial for sustained growth and expanding market share within this robust construction sector. This strategic expansion is designed to capitalize on the region's ongoing infrastructure development needs.

The aggregates business has demonstrated impressive pricing power and a strong contribution from inorganic growth, reflecting the success of the Stavola acquisition and the favorable market conditions in the New York-New Jersey area. This performance underscores the strategic value of this segment within Arcosa's portfolio.

Construction Products - Specialty Materials

Arcosa's specialty materials business is a star performer within its Construction Products segment. This segment has seen significant operational enhancements, directly fueling the company's overall expansion. Its strong market standing and growing share in specialized construction materials highlight its importance.

These materials are crucial for a wide array of infrastructure development, directly benefiting from the robust demand seen across the construction industry. For instance, Arcosa reported in its 2023 annual report that its Construction Products segment, which includes specialty materials, generated $1.3 billion in revenue, a notable increase from the previous year.

- Operational Improvements: Arcosa has focused on optimizing its specialty materials operations, leading to better efficiency and profitability.

- Growth Contribution: This segment is a key driver of growth for the broader Construction Products division.

- Market Position: The company holds a strong and expanding market share in essential niche construction materials.

- Demand Linkage: Demand for these specialty materials is closely tied to the health of infrastructure spending and construction activity.

Overall Organic Growth in Core Infrastructure Segments

Arcosa demonstrated impressive organic growth in its core infrastructure segments throughout 2024. This momentum is projected to continue, with expectations for double-digit organic growth in 2025.

This strong performance signifies Arcosa's ability to expand market share organically within expanding infrastructure markets. It underscores their leadership in key areas.

- Robust 2024 Organic Growth: Arcosa's core infrastructure segments experienced significant expansion in 2024, indicating healthy internal growth drivers.

- Projected Double-Digit Growth for 2025: The company anticipates continued strong performance with double-digit organic growth expected in 2025.

- Market Share Expansion: This organic growth reflects Arcosa's success in increasing its market presence within the dynamic infrastructure sector.

- Complementary to Acquisitions: The organic expansion strategy effectively supplements Arcosa's efforts to achieve overall business growth through strategic acquisitions.

Arcosa's wind tower business is a prime example of a star in the BCG matrix, benefiting from the global shift towards renewable energy sources. The company's substantial order backlog, estimated at around $750 million for deliveries spanning 2024 through 2028, highlights its commanding market position. Supportive government policies, such as the Inflation Reduction Act, have significantly boosted demand, leading to over $1.1 billion in new wind tower orders for Arcosa since the act's implementation. To meet this surging demand, Arcosa opened a new manufacturing facility in New Mexico in mid-2024.

The utility structures within Arcosa's Engineered Structures segment also qualify as stars. This strength is driven by the continuous need for essential infrastructure upgrades across North America, particularly the expansion of electricity grids and the reinforcement of existing power networks. Arcosa's consistent order activity, reflecting its substantial market share, confirms its solid footing in this critical infrastructure sector. The company's strategic focus on grid modernization and expansion aligns perfectly with national infrastructure priorities, ensuring a stable and growing revenue stream.

Arcosa's aggregates business in the New York-New Jersey metropolitan statistical area (MSA) is another star, significantly bolstered by the October 2024 acquisition of Stavola. This acquisition has substantially expanded Arcosa's footprint in a high-demand construction market, providing greater access to infrastructure-focused markets. The aggregates segment has shown strong pricing power and impressive inorganic growth, largely due to the Stavola acquisition and favorable market conditions.

The specialty materials within Arcosa's Construction Products segment are also considered stars. These materials are vital for a wide range of infrastructure projects and have experienced significant operational improvements, directly contributing to the company's overall expansion. For example, Arcosa's Construction Products segment, which includes specialty materials, generated $1.3 billion in revenue in 2023, marking a notable increase.

| Segment | BCG Classification | Key Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Wind Towers | Star | Renewable energy push, supportive legislation (IRA) | ~$750M order backlog (2024-2028), >$1.1B new orders post-IRA, new NM facility operational mid-2024 |

| Utility Structures | Star | Infrastructure upgrades, electrification, grid modernization | Consistent healthy order activity, substantial Q1 2024 backlog |

| Aggregates (NY-NJ MSA) | Star | Strategic acquisition (Stavola), infrastructure development | Acquisition completed Oct 2024, strong pricing power, inorganic growth contribution |

| Specialty Materials | Star | Infrastructure spending, construction activity | $1.3B revenue for Construction Products in 2023, operational enhancements |

What is included in the product

The Arcosa BCG Matrix offers strategic insights by categorizing its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding investment decisions.

Arcosa BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Arcosa's established natural aggregates business, particularly its legacy operations, functions as a classic Cash Cow. This segment boasts a substantial market share in a mature industry, providing a dependable stream of revenue.

These aggregates are critical building blocks for construction and infrastructure projects, ensuring consistent demand and robust pricing power, especially with the strong pricing momentum observed in 2024. While seasonal factors like weather can influence quarterly volumes, the long-term demand remains fundamentally stable.

Arcosa's inland barges, a key part of its Transportation Products segment, are a strong cash cow. The company is a top builder in a market undergoing a significant fleet replacement cycle, driven by an aging infrastructure.

This segment boasts a robust order book, with tank barge orders completely filled through 2025. Such a commanding market presence in this steady, though cyclical, industry ensures a reliable and substantial stream of cash flow for Arcosa.

Arcosa's Engineered Structures segment, particularly its mature traffic structures business bolstered by the Ameron acquisition, is a classic Cash Cow. These products, vital for highway and road construction, command a solid market share in established infrastructure sectors.

This business unit generates consistent, reliable earnings. The need for significant, high-risk investment is minimal, allowing it to function as a dependable cash generator for the company. For instance, Arcosa reported its Engineered Structures segment revenue grew 15% year-over-year to $309.6 million in the first quarter of 2024, reflecting strong demand and the impact of acquisitions.

Construction Products - Recycled Aggregates

Arcosa's recycled aggregates business is a prime example of a Cash Cow within its Construction Products segment. This operation consistently generates strong cash flow due to its established position in a mature market with steady demand.

The business benefits from ongoing construction activity, which supports increased volumes and revenues. In 2024, Arcosa reported that its Construction Products segment, which includes recycled aggregates, saw robust performance driven by infrastructure spending and a strong housing market.

- Steady Cash Generation: The mature nature of the recycled aggregates market ensures consistent demand, leading to predictable revenue streams and strong cash flow for Arcosa.

- Lower Investment Needs: Compared to developing new product lines or expanding into emerging markets, the recycled aggregates business requires less capital investment, further enhancing its cash generation capabilities.

- Environmental Appeal: The environmentally conscious nature of recycled aggregates aligns with growing market preferences for sustainable building materials, supporting continued demand.

- Contribution to Segment Growth: In the first quarter of 2024, Arcosa's Construction Products segment reported a significant increase in revenues, partly attributed to the strong performance of its aggregates business.

Certain Legacy Engineered Structures Products

Certain legacy engineered structures products within Arcosa likely function as cash cows. These established offerings often dominate mature markets, generating consistent profits with minimal investment. For instance, Arcosa's historical strength in bridge components and utility poles, while not high-growth, provides a stable revenue stream.

These products are characterized by their steady demand and established market presence. They require less capital expenditure for innovation or expansion compared to newer ventures. Arcosa's reported performance in its Engineered Structures segment, which includes these legacy items, consistently shows robust cash generation, a hallmark of a cash cow.

- Market Dominance: These products often hold a significant share in mature, stable sub-markets.

- Consistent Profitability: They reliably contribute earnings without requiring substantial new capital investment.

- Foundation of Cash Flow: These legacy items form a crucial base for the segment's overall financial health.

Arcosa's established natural aggregates business, particularly its legacy operations, functions as a classic Cash Cow. This segment boasts a substantial market share in a mature industry, providing a dependable stream of revenue.

These aggregates are critical building blocks for construction and infrastructure projects, ensuring consistent demand and robust pricing power, especially with the strong pricing momentum observed in 2024. While seasonal factors like weather can influence quarterly volumes, the long-term demand remains fundamentally stable.

Arcosa's inland barges, a key part of its Transportation Products segment, are a strong cash cow. The company is a top builder in a market undergoing a significant fleet replacement cycle, driven by an aging infrastructure.

This segment boasts a robust order book, with tank barge orders completely filled through 2025. Such a commanding market presence in this steady, though cyclical, industry ensures a reliable and substantial stream of cash flow for Arcosa.

Arcosa's Engineered Structures segment, particularly its mature traffic structures business bolstered by the Ameron acquisition, is a classic Cash Cow. These products, vital for highway and road construction, command a solid market share in established infrastructure sectors.

This business unit generates consistent, reliable earnings. The need for significant, high-risk investment is minimal, allowing it to function as a dependable cash generator for the company. For instance, Arcosa reported its Engineered Structures segment revenue grew 15% year-over-year to $309.6 million in the first quarter of 2024, reflecting strong demand and the impact of acquisitions.

Arcosa's recycled aggregates business is a prime example of a Cash Cow within its Construction Products segment. This operation consistently generates strong cash flow due to its established position in a mature market with steady demand.

The business benefits from ongoing construction activity, which supports increased volumes and revenues. In 2024, Arcosa reported that its Construction Products segment, which includes recycled aggregates, saw robust performance driven by infrastructure spending and a strong housing market.

| Business Segment | Product Category | Cash Cow Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Construction Products | Natural Aggregates | Mature market, stable demand, strong pricing power | Robust performance driven by infrastructure spending |

| Transportation Products | Inland Barges | Top builder, fleet replacement cycle, full order book through 2025 | Reliable and substantial cash flow generation |

| Engineered Structures | Traffic Structures (incl. Ameron) | Established infrastructure sectors, consistent earnings, minimal new investment | 15% year-over-year revenue growth (Q1 2024) |

| Construction Products | Recycled Aggregates | Established position, steady demand, environmentally appealing | Strong contribution to segment revenue growth |

What You See Is What You Get

Arcosa BCG Matrix

The Arcosa BCG Matrix preview you are viewing is the identical, complete document you will receive upon purchase. This means you'll get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate professional use. The strategic insights and data presented are exactly as they will be delivered, ready for your business planning and decision-making processes. You can confidently assess the value of this resource, knowing that the purchased version is the uncompromised, final output.

Dogs

Arcosa's divested steel components business, sold in August 2024, clearly falls into the Dogs category of the BCG Matrix. This segment was shedding value, with revenues shrinking and reporting a negative Adjusted EBITDA in Q3 2024, underscoring its poor financial performance.

The strategic divestiture was driven by Arcosa's aim to streamline operations and mitigate the inherent cyclicality and complexity associated with this particular business line. The declining financial metrics strongly suggest a low market share in a stagnant or shrinking market, making it a prime candidate for removal from the portfolio.

Arcosa strategically divested several small underperforming operations within its Construction Products segment in Q2 2024. These units likely possessed low market share and limited growth prospects, making them prime candidates for the 'Dog' quadrant in a BCG analysis. Such divestitures are crucial for portfolio streamlining and reallocating capital to more promising ventures.

Arcosa's portfolio may include highly specialized legacy products facing declining demand. These products, often characterized by market shifts or technological obsolescence, would likely contribute minimally to revenue and could even operate at a loss. For instance, if Arcosa has a small market share in a segment where demand has fallen by over 20% year-over-year, as seen in some mature industrial equipment sectors in 2024, these items would fit this category.

Inefficient or Outdated Facilities

Facilities that are no longer efficient or up-to-date can be a significant drag on a company's performance. These assets often suffer from operational inefficiencies, leading to higher production costs and reduced competitiveness. For instance, a manufacturing plant built decades ago might lack the automation and energy-saving technologies present in newer facilities, directly impacting its cost-effectiveness.

Such underperforming assets can be categorized as 'Dogs' within a BCG matrix framework. They consume valuable resources, including capital, labor, and management attention, without generating substantial returns. The challenge with these 'Dogs' is that revitalizing them often requires substantial investment, and even then, the success rate of turnaround plans can be low, making them a poor use of capital.

- Operational Inefficiencies: Older facilities may have outdated machinery, poor layout, and higher energy consumption, leading to increased operating costs.

- Lack of Competitiveness: These assets may struggle to meet current market demands for quality, speed, or customization compared to modern competitors.

- Resource Drain: They tie up capital that could be better invested in growth areas or more efficient operations, negatively impacting overall profitability.

- Turnaround Challenges: Significant capital injections are often needed to upgrade or replace these facilities, with no guarantee of a positive return on investment.

Specific Sub-Product Lines with Negative Organic Volume Trends

Within Arcosa's broader segments, specific sub-product lines exhibiting consistent declines in organic volume, without adequate price increases to compensate, and where the company holds a minor market share, would be classified as Dogs in the BCG Matrix. These underperforming areas are unlikely to boost overall growth or profitability.

For instance, if a particular legacy product line within Arcosa's infrastructure products segment experienced a 5% year-over-year organic volume decrease in 2024, and its market share in that niche was only 3%, it would likely be a Dog. This scenario highlights a situation where the product is not gaining traction and is not a significant player in its market.

- Declining Organic Volume: Sub-product lines showing consistent year-over-year decreases in units sold or services rendered, without offsetting price growth.

- Low Market Share: Arcosa's position in these specific sub-markets is negligible, indicating a lack of competitive strength.

- Profitability Strain: These areas struggle to contribute positively to Arcosa's bottom line due to low sales volume and potential cost inefficiencies.

- Limited Growth Potential: The outlook for these specific sub-product lines is dim, with little expectation of future market expansion or improved performance.

Arcosa's divestiture of its steel components business in August 2024, which showed declining revenues and a negative Adjusted EBITDA in Q3 2024, exemplifies a 'Dog' in the BCG Matrix. This move reflects a strategic effort to shed underperforming assets and reduce operational complexity.

Similarly, the divestment of several small, underperforming units within the Construction Products segment in Q2 2024 also points to 'Dogs'. These units likely suffered from low market share and limited growth prospects, necessitating their removal to focus resources on more viable ventures.

Legacy products facing obsolescence or dwindling demand, holding a minimal market share in shrinking markets, also fit the 'Dog' profile. For instance, a product line with a 3% market share and a 5% year-over-year volume decline in 2024 would be a prime example.

Inefficient, outdated facilities can also be categorized as 'Dogs'. These assets, often burdened by high operating costs and a lack of competitiveness, consume capital without generating significant returns, making them a drain on overall company performance.

Question Marks

Arcosa's new wind tower facility in Belen, New Mexico, which commenced operations in mid-2024, is a substantial investment in a high-growth sector. This facility is currently in its initial operational phase, focusing on scaling production and building market share, which means it's consuming cash in the short term.

Despite the current cash consumption, the Belen facility holds significant promise. As it ramps up to full capacity and efficiency, it is positioned to transition into a Star within Arcosa's portfolio, capitalizing on the strong demand within the wind energy market.

Arcosa's Florida concrete pole plant, much like its New Mexico counterpart for wind towers, is currently in a ramp-up phase. This signifies a new or expanding operation within the Engineered Structures segment, aiming to capture a growing demand for concrete poles.

This strategic move positions the Florida plant as a 'Question Mark' in Arcosa's BCG Matrix. It necessitates continued investment to build market share and realize its full profit potential. For instance, Arcosa's Engineered Structures segment reported a revenue of $1,058.4 million in 2023, and new facilities like the Florida plant are crucial for future growth within this segment.

The acquisition of Ameron Pole Products in April 2024 significantly broadened Arcosa's product portfolio, particularly in the lighting pole and traffic signal sectors. While this move was immediately accretive to Arcosa's earnings, the specific new product lines introduced are likely in the nascent stages of market adoption.

These newly integrated offerings target high-growth segments within the infrastructure market. However, achieving substantial market share will necessitate continued strategic investment and focused marketing efforts to propel them from their current position towards becoming 'Stars' in Arcosa's BCG matrix.

Emerging Digital Infrastructure Products

Emerging digital infrastructure products for Arcosa, within a BCG matrix framework, would likely be classified as Stars or Question Marks. Given Arcosa's alignment with the expansion of transmission, distribution, and telecommunications infrastructure, nascent developments in areas like 5G network components or data center support would fall into high-growth markets.

These ventures, where Arcosa's current market share is likely low, would require strategic investment to capture potential growth, positioning them as Question Marks. For example, the global 5G infrastructure market was valued at approximately $35 billion in 2023 and is projected to grow significantly, presenting an opportunity for Arcosa to establish a foothold.

- 5G Network Components: Arcosa could develop specialized components for 5G base stations and small cells, tapping into the rapid deployment of this technology.

- Data Center Support: Products supporting data center construction and operations, such as specialized enclosures or cooling solutions, align with the increasing demand for digital storage and processing.

- Fiber Optic Infrastructure: Investments in components for expanding fiber optic networks are crucial for both telecommunications and data center connectivity.

Future Organic Growth Initiatives (Early Stage)

Arcosa is actively exploring new avenues for growth, investing in research and development for potential future product lines. These early-stage initiatives are crucial for long-term expansion but currently represent a smaller portion of overall revenue.

For example, Arcosa's investments in emerging technologies within its segments, such as advanced materials for energy infrastructure or innovative solutions for transportation, would fall into this category. The company is committed to nurturing these nascent ideas, understanding they require significant time and resources to mature into substantial market contributors.

- Focus on R&D: Arcosa is dedicating resources to developing new technologies and product concepts.

- Early Market Development: These initiatives are in the initial phases, with market penetration and profitability yet to be established.

- Strategic Investment: The company views these as vital for future competitive advantage and revenue diversification.

- Long-Term Potential: While not immediate revenue drivers, these projects hold promise for substantial future growth.

The Florida concrete pole plant, still in its ramp-up phase, represents a classic 'Question Mark' within Arcosa's portfolio. It requires ongoing investment to gain traction and establish a stronger market presence. This strategic push aims to transform it into a future revenue driver.

Similarly, new product lines from the Ameron acquisition, though accretive, are in their early stages of market acceptance. These require sustained investment to climb the BCG matrix. Arcosa's focus on emerging digital infrastructure, such as 5G components, also places these ventures in the 'Question Mark' category, demanding capital to secure market share in high-growth areas.

Arcosa's commitment to R&D for nascent technologies further solidifies its 'Question Mark' investments. These early-stage projects, while not immediate profit centers, are crucial for future diversification and competitive positioning. The company is strategically allocating resources to nurture these potential growth engines.

| Segment/Product Line | BCG Category | Rationale | 2023 Revenue (Segment) | Growth Potential |

|---|---|---|---|---|

| Florida Concrete Pole Plant | Question Mark | Ramp-up phase, needs investment for market share. | $1,058.4 million (Engineered Structures) | High (Infrastructure demand) |

| New Ameron Product Lines | Question Mark | Early market adoption, requires investment for growth. | N/A (Specific product lines not detailed) | High (Lighting, traffic signals) |

| 5G Network Components | Question Mark | Nascent development, low current market share, high growth market. | N/A (Specific product lines not detailed) | Very High (Global 5G market ~$35B in 2023) |

| Data Center Support Products | Question Mark | Early market development, requires investment. | N/A (Specific product lines not detailed) | High (Data center expansion) |

| Fiber Optic Infrastructure Components | Question Mark | Early market development, requires investment. | N/A (Specific product lines not detailed) | High (Telecommunications growth) |

| Emerging R&D Initiatives | Question Mark | Early-stage, not yet revenue drivers, long-term potential. | N/A (Specific projects not detailed) | High (Future diversification) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.