Arcosa Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Discover how Arcosa leverages its Product innovation, strategic Pricing, extensive Place distribution, and targeted Promotion to capture market share. This analysis goes beyond the surface, revealing the synergy between their marketing elements.

Unlock the full potential of Arcosa's marketing strategy with our comprehensive 4Ps analysis, offering actionable insights into their product development, pricing architecture, channel management, and communication tactics. Get ready to elevate your own business planning.

Product

Arcosa's product portfolio is a cornerstone of its market strategy, offering essential components for infrastructure development. Its offerings are strategically divided into Construction Products, Engineered Structures, and Transportation Products, addressing critical needs across various sectors.

This diversified product mix allows Arcosa to cater to a wide array of infrastructure projects, from road construction to energy transmission. For instance, in the first quarter of 2024, Arcosa reported strong performance in its Construction Products segment, driven by demand for aggregates and paving services, crucial for highway and commercial construction.

The Engineered Structures segment, which includes wind towers and storage tanks, also saw robust demand, reflecting the ongoing investment in renewable energy and industrial infrastructure. The company's Transportation Products, such as railcars, are vital for the movement of goods, supporting supply chains across North America.

Arcosa's Construction Aggregates and Specialty Materials segment offers essential building blocks like sand, gravel, and limestone, crucial for everything from roads to homes. In 2023, their Construction Products segment, which includes aggregates, generated $1.2 billion in revenue, demonstrating the significant demand for these fundamental materials.

Beyond basic aggregates, Arcosa provides specialized materials such as lightweight aggregates and gypsum. These products cater to diverse needs, including agricultural applications and industrial processes, underscoring the broad utility of their offerings in the built environment.

Arcosa's Engineered Structures segment is a powerhouse in providing essential components for the energy and communication industries. They produce critical utility structures for power grids, robust wind towers vital for renewable energy expansion, and specialized structures supporting telecommunications and traffic management. This segment directly addresses the growing global demand for reliable energy infrastructure and advanced communication networks.

The company's commitment to growth and market expansion is evident through strategic moves, such as the 2024 acquisition of Ameron Pole Products. This acquisition significantly bolstered Arcosa's offerings in both steel and concrete poles, broadening their product portfolio and deepening their market penetration in essential infrastructure projects. This strategic integration enhances their ability to serve a wider range of customer needs in these high-demand sectors.

Transportation s for Essential Logistics

Arcosa's Transportation segment is a cornerstone of essential logistics, focusing on the manufacture of inland barges, specifically tank and hopper barges. These vessels are critical for moving a wide array of commodities efficiently along the nation's waterways, underpinning the supply chain. The company's strategic divestiture of its steel components business in August 2024 underscores a sharpened focus on its core barge manufacturing operations, ensuring it remains a key player in supporting vital transportation networks.

The demand for inland barge transportation remains robust, driven by the need to move bulk goods like grain, coal, and chemicals. For instance, in 2023, inland waterways transported approximately 563 million tons of goods, highlighting the segment's significance. Arcosa's commitment to this sector ensures the continued availability of essential equipment that keeps these vital supply lines moving.

- Core Products: Inland barges, including tank and hopper barges, crucial for commodity transport.

- Strategic Focus: Divested steel components business in August 2024 to concentrate on barge manufacturing.

- Market Role: Provides essential equipment supporting the nation's supply chain and logistics infrastructure.

- Industry Importance: Inland waterways are a vital artery for moving bulk goods, with significant tonnage moved annually.

Focus on Quality and Sustainable Solutions

Arcosa's commitment to quality is a cornerstone of its brand, fostering a reputation for dependable infrastructure components. This dedication translates into durable products that meet stringent industry standards, a key differentiator in the competitive market. For instance, Arcosa's wind towers are built to withstand demanding environmental conditions, ensuring longevity and reducing maintenance needs for customers.

Sustainability is increasingly integrated into Arcosa's product strategy. The company actively develops and promotes solutions that minimize environmental impact, such as utilizing recycled materials in its construction products. In 2023, Arcosa reported progress in its sustainability initiatives, highlighting efforts to reduce greenhouse gas emissions in its manufacturing processes, a move that resonates with environmentally conscious clients and investors.

This dual focus on quality and sustainability positions Arcosa favorably to capture growing market segments. As infrastructure projects worldwide increasingly prioritize both resilience and environmental responsibility, Arcosa's product offerings are well-aligned with these evolving demands. The company's investment in innovative, sustainable solutions is expected to drive future growth and enhance its market leadership.

- Quality Reputation: Decades of experience building reliable infrastructure solutions.

- Sustainability Integration: Focus on recycled aggregates and energy-efficient manufacturing.

- Market Alignment: Meeting growing demand for environmentally responsible products.

- Operational Excellence: Emphasis on durability and performance across product lines.

Arcosa's product strategy centers on essential infrastructure components, segmented into Construction Products, Engineered Structures, and Transportation Products. This diversification allows them to serve critical needs in construction, energy, and logistics.

The company's Construction Products, including aggregates and paving services, are foundational for infrastructure development. In the first quarter of 2024, this segment demonstrated strong performance, reflecting consistent demand for road and commercial construction materials.

Engineered Structures, such as wind towers and utility poles, address the growing need for renewable energy and robust power grids. The acquisition of Ameron Pole Products in 2024 significantly expanded Arcosa's capabilities in this vital area.

Arcosa's Transportation Products, primarily inland barges, are crucial for efficient commodity movement. The strategic divestiture of their steel components business in August 2024 sharpened their focus on this core, high-demand segment, supporting vital supply chains.

| Product Segment | Key Offerings | 2023 Revenue Contribution (Approx.) | Key Market Driver |

|---|---|---|---|

| Construction Products | Aggregates, paving services, specialty materials | $1.2 Billion (Construction Products segment) | Highway and commercial construction demand |

| Engineered Structures | Wind towers, storage tanks, utility poles | Significant contribution, bolstered by 2024 acquisition | Renewable energy investment, power grid modernization |

| Transportation Products | Inland barges (tank and hopper) | Core focus post-August 2024 divestiture | Bulk commodity transport via inland waterways |

What is included in the product

This analysis provides a comprehensive breakdown of Arcosa's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Arcosa's market positioning.

Provides a clear, concise framework for addressing marketing challenges, making it easier to identify and implement solutions.

Place

Arcosa’s extensive North American presence is a cornerstone of its marketing strategy, with over 150 operational locations primarily concentrated in the United States and Mexico. This vast network ensures their infrastructure products and services are within easy reach for a diverse clientele across the continent. For instance, their significant footprint in the US, coupled with operations in Mexico, positions them to effectively serve a broad spectrum of regional infrastructure needs.

Arcosa primarily leverages its own direct sales force, operating from numerous offices to engage with business-to-business clients. This direct interaction is key to building robust customer relationships and understanding specific needs.

To broaden its reach, Arcosa also employs independent sales representatives and distributors. This hybrid approach allows for deeper market penetration and ensures their products and services are accessible across a wider geographical footprint.

This multi-channel distribution strategy is designed for comprehensive market coverage. For instance, in Q1 2024, Arcosa reported total revenue of $653.3 million, reflecting the effectiveness of their sales and distribution efforts in reaching diverse customer segments.

Arcosa actively pursues strategic acquisitions to broaden its market reach. A prime example is the 2024 acquisition of Stavola Holding Corporation's construction materials business, which notably strengthened their aggregates presence in the vital New York-New Jersey region. This move directly supports their growth objectives by entering a high-demand market.

Further solidifying its national footprint, Arcosa acquired Ameron Pole Products, securing a significant operational presence on the West Coast. These acquisitions are not just about size; they are about strategically positioning Arcosa to better serve customers in key growth areas and enhance overall distribution efficiency.

Proximity to Key Infrastructure Markets

Arcosa's operational footprint is deliberately placed to efficiently reach significant infrastructure markets, encompassing construction, energy, and transportation sectors. This strategic positioning directly translates into reduced logistics expenses and guarantees prompt delivery of crucial materials and components to its customer base.

The company's distribution strategy is further enhanced by its alignment with dominant market trends, such as the ongoing need to upgrade aging transportation networks and the accelerating transition towards renewable energy sources. For instance, Arcosa's wind tower segment directly benefits from the substantial investments in wind energy infrastructure, a sector projected to see continued growth through 2025 and beyond.

- Strategic Location Benefits: Arcosa's facilities are situated near major transportation arteries and key customer hubs, cutting down on freight costs and lead times.

- Market Alignment: The company's product lines directly support critical infrastructure development, aligning with government spending priorities and private sector investment in areas like bridge construction and grid modernization.

- Logistical Efficiency: Proximity to markets allows for more responsive service and potentially lower inventory holding costs, contributing to Arcosa's competitive edge.

Efficient Supply Chain and Inventory Management

Arcosa prioritizes an efficient supply chain to ensure its diverse product range, from wind towers to transportation components, reaches customers effectively. This focus on distribution is crucial for supporting large-scale infrastructure projects where timely delivery is paramount. For instance, in 2023, Arcosa reported a backlog of $1.3 billion, underscoring the need for robust logistics to fulfill these significant orders.

Managing inventory levels is key to meeting fluctuating demand across its various segments. Arcosa's operational strategy aims to balance product availability with cost efficiency, minimizing stockouts while avoiding excessive carrying costs. This careful inventory control is vital for maintaining customer satisfaction and operational smoothness, especially when dealing with the specialized needs of the energy and transportation sectors.

- Supply Chain Efficiency: Arcosa's commitment to an agile supply chain ensures product availability for critical infrastructure projects.

- Inventory Management: Strategic inventory control helps meet market demand while optimizing operational costs.

- Customer Convenience: The company strives to maximize customer ease through reliable and timely product delivery.

- Logistical Focus: Arcosa invests in logistics to navigate potential disruptions and ensure product accessibility across its markets.

Arcosa's strategic placement of over 150 operational sites across North America, particularly in the US and Mexico, ensures proximity to key infrastructure markets. This extensive network, bolstered by recent acquisitions like Stavola Holding Corporation's construction materials business in the New York-New Jersey region and Ameron Pole Products on the West Coast, enhances distribution efficiency and customer accessibility. This physical presence is critical for serving sectors like construction, energy, and transportation, reducing logistics costs and enabling prompt delivery of essential products and components.

| Metric | 2023 Value | 2024 (Q1) Value |

|---|---|---|

| Total Revenue | $3.1 billion (approx.) | $653.3 million |

| Backlog | $1.3 billion | Not specified for Q1 2024 |

| Operational Locations | 150+ | 150+ |

Preview the Actual Deliverable

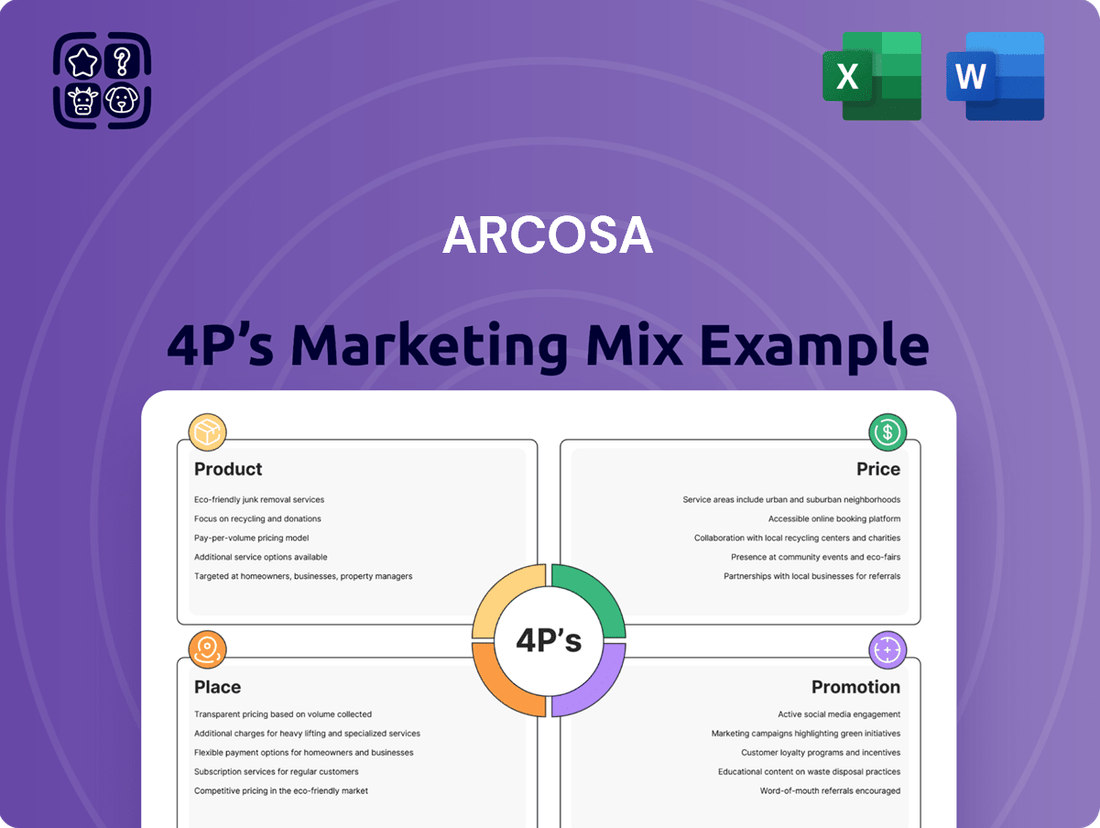

Arcosa 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Arcosa 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can be confident that the insights and strategies presented are exactly what you'll download, providing a clear roadmap for Arcosa's marketing efforts.

Promotion

Arcosa's investor relations strategy focuses on clear and consistent communication with its financially-literate audience. This involves readily available information through quarterly earnings calls, detailed annual reports, and insightful investor presentations. These channels are vital for sharing comprehensive financial data, strategic direction, and key performance indicators.

Arcosa's strategic acquisition and divestiture announcements are key promotional tools, highlighting its portfolio optimization. For instance, the 2023 acquisition of Stavola for $370 million signals a push into attractive, adjacent markets, while the divestiture of its steel components business in 2023, which generated approximately $230 million, allowed Arcosa to streamline operations and focus on higher-growth segments.

Arcosa's commitment to sustainability is actively promoted through its annual Sustainability Reports, with recent publications including the 2024 and 2023 editions. These reports detail their environmental, social, and governance (ESG) efforts and achievements.

These reports function as a key promotional element, showcasing Arcosa's dedication to responsible operations, including specific emissions reduction targets and their robust safety culture. This transparency is crucial for attracting investors and stakeholders who increasingly value sustainability in their investment decisions.

Direct B2B Sales and Relationship Building

Arcosa's direct B2B sales strategy is crucial for its infrastructure product offerings. Their sales teams engage directly with clients in construction, energy, and transportation, fostering strong, long-term relationships. This personal touch is vital for explaining the unique benefits of their specialized products and tailoring solutions to specific customer needs.

This direct approach enables Arcosa to effectively communicate its value proposition and competitive advantages. For instance, in the first quarter of 2024, Arcosa reported a 14% increase in revenue for its Engineered Structures segment, underscoring the success of its customer-centric sales efforts in key markets.

- Direct Sales Force: Arcosa utilizes a dedicated sales force to build and maintain client relationships.

- Sector Focus: Key customer segments include construction, energy, and transportation industries.

- Relationship Value: Emphasis on long-term partnerships for sustained business growth.

- Tailored Solutions: Direct engagement allows for customized product and service offerings.

Industry Reputation and Operational Excellence

Arcosa's industry reputation, built on decades of quality and service, acts as a powerful promotional tool. Their consistent operational excellence, demonstrated through successful project execution, underpins this strong credibility. This established track record instills confidence in potential clients, solidifying Arcosa's standing as a premier infrastructure solutions provider.

This reputation is further bolstered by tangible results. For instance, Arcosa's commitment to operational efficiency was evident in their Q1 2024 performance, where they reported a 9% increase in revenue to $582.7 million, showcasing their ability to deliver value and maintain strong client relationships.

- Proven Track Record: Arcosa's history of successful project completion is a key differentiator.

- Customer Confidence: Their reputation for reliability directly translates to increased trust from clients.

- Market Leadership: Operational excellence reinforces their position as a leader in the infrastructure sector.

- Financial Stability: Consistent revenue growth, like the 9% increase in Q1 2024, reflects their ability to leverage their reputation into tangible financial success.

Arcosa leverages strategic acquisitions and divestitures as key promotional activities, signaling portfolio strength and market focus. The 2023 acquisition of Stavola for $370 million expanded its market reach, while the divestiture of its steel components business for approximately $230 million in the same year allowed for greater operational concentration. These moves are communicated to investors and stakeholders, highlighting strategic growth and efficiency.

Arcosa's commitment to Environmental, Social, and Governance (ESG) principles is actively promoted through its annual Sustainability Reports, with recent editions published for 2024 and 2023. These reports detail specific achievements, such as emissions reduction targets and safety initiatives, enhancing its corporate image and attracting sustainability-conscious investors.

The company's direct B2B sales approach fosters strong client relationships within the construction, energy, and transportation sectors. This direct engagement allows Arcosa to effectively communicate its value proposition and tailor solutions, contributing to revenue growth, such as the 14% increase in its Engineered Structures segment in Q1 2024.

Arcosa's established industry reputation for quality and service serves as a significant promotional asset. This credibility, backed by consistent operational excellence and tangible financial results like the 9% revenue increase to $582.7 million in Q1 2024, reinforces its market leadership and client confidence.

| Promotional Activity | Key Information/Data | Impact/Benefit |

|---|---|---|

| Acquisitions & Divestitures | Stavola Acquisition ($370M, 2023); Steel Components Divestiture (~$230M, 2023) | Portfolio optimization, market expansion, operational focus |

| Sustainability Reporting | 2024 & 2023 Sustainability Reports; ESG initiatives | Enhanced corporate image, attraction of ESG investors |

| Direct Sales & Client Relations | 14% revenue growth in Engineered Structures (Q1 2024) | Strong customer relationships, tailored solutions, market penetration |

| Industry Reputation | 9% revenue increase to $582.7M (Q1 2024); operational excellence | Client confidence, market leadership, sustained growth |

Price

Arcosa leverages a value-based pricing strategy, especially in its aggregates segment, prioritizing the value captured over sheer sales volume. This aligns its pricing with the critical role and superior quality of its infrastructure materials, ensuring customers pay for the tangible long-term benefits received.

This strategic pricing directly contributes to Arcosa's profitability, aiming for margin enhancement and sustained financial health. For instance, in the first quarter of 2024, Arcosa reported a significant increase in its Construction Products segment's revenue, driven by strong demand and effective pricing strategies that reflect the value of their offerings.

Arcosa's traffic structures segment operates in a highly competitive bid market, primarily engaging with state Departments of Transportation and large highway contractors. This environment demands pricing strategies that are not only competitive to win contracts but also ensure the company's profitability. For instance, in 2023, Arcosa reported revenue of $2.3 billion, with its construction products segment, which includes traffic structures, contributing significantly.

Successfully navigating these competitive bids requires Arcosa to meticulously balance aggressive pricing with the underlying costs of materials, labor, and manufacturing efficiencies. The company's ability to manage its cost structure effectively is paramount to securing market share and maintaining healthy margins in this price-sensitive sector.

Arcosa's strategic acquisitions, such as the integration of Stavola, have demonstrably boosted its pricing power and overall margins. These moves are not just about growth; they're about acquiring businesses that operate at higher profitability levels.

The incorporation of these higher-margin businesses directly translates to improved unit profitability for Arcosa. This financial uplift enhances the company's overall performance, showing the tangible benefits of strategic M&A in the 2024-2025 period.

By adding these accretive entities, Arcosa is better positioned to optimize its pricing strategies. This allows for more effective pricing in both existing and newly entered markets, solidifying its competitive edge.

Flexible Pricing Policies and Terms

Arcosa's pricing strategies are likely tailored to the significant scale of its infrastructure projects, aiming for competitive attractiveness within its core markets of construction and energy. While precise discount structures and financing terms are not publicly detailed, the company's approach would logically prioritize accessibility for large developers and contractors. This flexibility is key to winning substantial contracts and building enduring client partnerships.

For instance, Arcosa's ability to offer adaptable payment terms or volume-based pricing can be a critical differentiator when bidding on multi-year, multi-million dollar infrastructure developments. This approach supports their goal of securing large project commitments and cultivating long-term relationships with major clients in sectors like transportation and utilities.

- Competitive Positioning: Pricing is designed to be attractive to large-scale infrastructure clients.

- Project Acquisition: Flexible terms are crucial for securing major contracts.

- Client Relationships: Adaptable pricing fosters long-term partnerships.

- Market Accessibility: Policies aim to make Arcosa's offerings accessible to its target demographic.

Consideration of Macroeconomic and Cost Factors

Arcosa's pricing strategy is deeply intertwined with macroeconomic forces and cost considerations. The company actively monitors market demand, competitor pricing, and broader economic trends, such as the persistent inflation and rising energy costs that have characterized the 2024-2025 period. This awareness allows Arcosa to adapt its pricing to maintain profitability.

A key aspect of Arcosa's pricing resilience is its ability to manage price increases in critical segments. For instance, in its aggregates business, the company has successfully maintained pricing momentum, which has been instrumental in counteracting softer sales volumes. These volume dips can often be attributed to external factors like adverse weather conditions, a common challenge in the construction and infrastructure sectors.

This dynamic approach to pricing enables Arcosa to navigate the complexities of fluctuating market conditions effectively. By strategically adjusting prices, Arcosa can mitigate the impact of rising input costs and external demand pressures, ensuring financial stability and supporting its growth objectives.

- Inflationary Impact: Arcosa's pricing must contend with the ongoing inflationary pressures observed through 2024 and into 2025, which increase input costs for materials and labor.

- Energy Cost Volatility: Fluctuations in energy prices directly affect Arcosa's operational costs, particularly in its manufacturing and transportation segments, necessitating careful price adjustments.

- Aggregates Pricing Power: Arcosa has demonstrated an ability to pass on cost increases in its aggregates segment, with average selling prices showing resilience despite some volume headwinds. For example, in Q1 2024, Arcosa reported that its Aggregates segment achieved a 6.4% increase in average selling price year-over-year.

- Competitor Benchmarking: Arcosa continuously analyzes competitor pricing to ensure its own price points remain competitive while reflecting the value and quality of its products and services.

Arcosa's pricing strategy is a nuanced blend of value-based approaches and competitive market responsiveness. In its aggregates segment, the company prioritizes capturing the intrinsic value of its high-quality materials, ensuring customers recognize the long-term benefits. This strategy directly supports margin enhancement, as seen in the first quarter of 2024 when Arcosa's Construction Products segment revenue increased, partly due to effective pricing reflecting product value.

For the traffic structures segment, pricing is inherently competitive, requiring a delicate balance to win bids against state Departments of Transportation and large contractors. Arcosa's 2023 revenue of $2.3 billion highlights the scale of operations where efficient cost management, from materials to labor, is paramount for profitable contract acquisition. The company's ability to manage these costs is critical for maintaining healthy margins in this price-sensitive sector.

Strategic acquisitions, such as Stavola, have bolstered Arcosa's pricing power and improved overall margins by integrating higher-profitability businesses. This move enhances unit profitability and strengthens Arcosa's market position, allowing for more optimized pricing strategies in both existing and new markets throughout the 2024-2025 period.

Arcosa's pricing must also navigate macroeconomic factors like inflation and energy cost volatility, particularly evident in 2024-2025. The company demonstrates pricing resilience by passing on cost increases, as evidenced by a 6.4% year-over-year increase in average selling prices for its Aggregates segment in Q1 2024, a move crucial for offsetting softer sales volumes potentially caused by external factors like weather.

| Segment | Pricing Strategy | Key Factors Influencing Pricing | 2024/2025 Data Point |

| Aggregates | Value-based, margin enhancement | Quality of materials, long-term benefits, inflation, energy costs | 6.4% increase in average selling price (Q1 2024) |

| Traffic Structures | Competitive bid market, cost management | State DOTs, large contractors, labor costs, manufacturing efficiencies | Revenue of $2.3 billion (2023) |

| Overall | Acquisition integration, market accessibility | Macroeconomic trends, competitor benchmarking, payment terms | Integration of Stavola boosting margins |

4P's Marketing Mix Analysis Data Sources

Our Arcosa 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including official company filings, investor reports, and Arcosa's own corporate website. We also incorporate insights from industry publications and competitor analysis to provide a well-rounded view of their strategy.