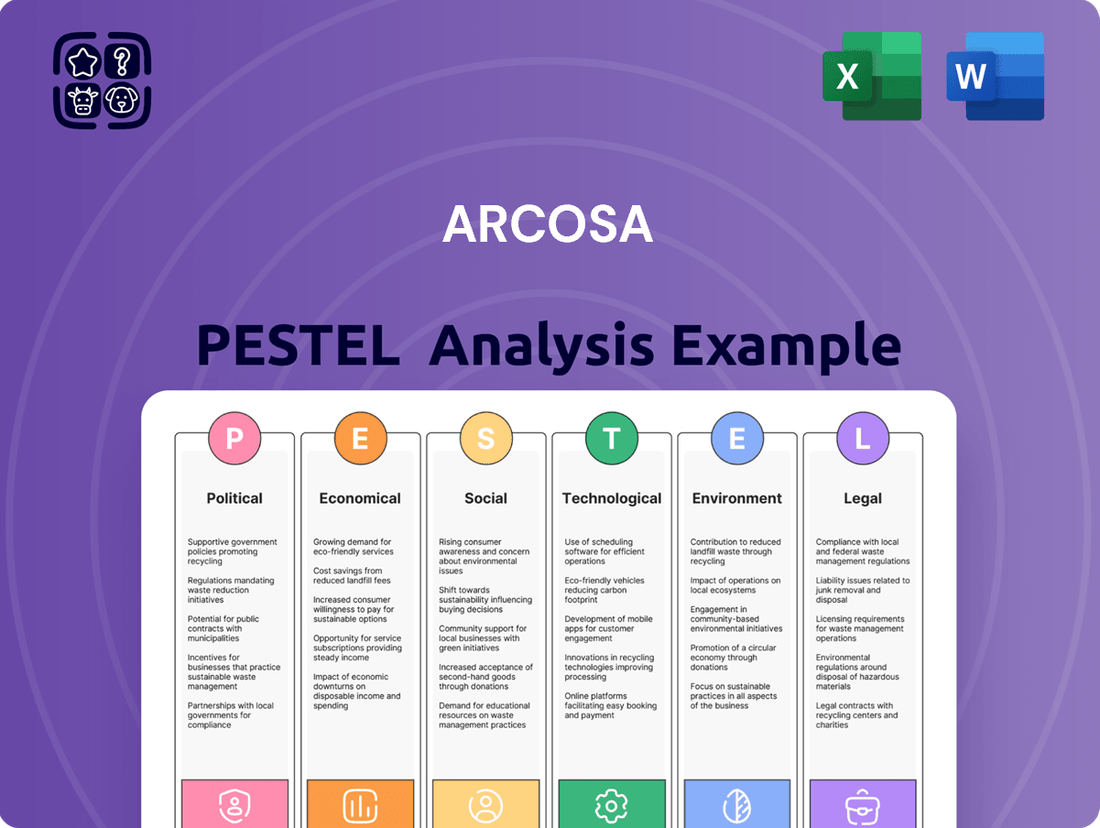

Arcosa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcosa Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Arcosa's trajectory. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

Arcosa, a key player in infrastructure manufacturing, directly benefits from government investment in public works. The Infrastructure Investment and Jobs Act (IIJA) is a significant driver, earmarking substantial federal funds for infrastructure projects.

For 2025, the IIJA is projected to allocate around $134 billion towards transportation, energy, and other vital infrastructure improvements, with an estimated $136 billion planned for 2026. This ongoing financial commitment fosters a robust demand for Arcosa's diverse product lines, especially within its Construction Products and Engineered Structures divisions.

The U.S. EPA's 'Buy Clean' initiative aims to boost American-made, lower-carbon construction materials in federal projects, impacting sectors like asphalt, concrete, glass, and steel, which are key for Arcosa. This policy, while still developing its labeling program over the next couple of years, signals a shift towards sustainability in government spending.

Changes in trade policies and tariffs, especially concerning raw materials like steel, can directly affect Arcosa's production costs and its standing in the market. For instance, a significant increase in steel tariffs could raise expenses for manufacturers relying heavily on imported steel.

Arcosa's strategic sourcing of steel primarily within the U.S. provides a degree of insulation from these potential tariff impacts. Furthermore, its products manufactured in Mexico under USMCA compliance are generally exempt from tariffs, offering a competitive advantage against rivals facing direct import duties.

Regulatory Environment for Construction

The construction sector operates under a complex web of regulations covering safety, labor practices, and environmental protection. Changes to these rules, like updated building codes or new permitting requirements, can directly impact project schedules and expenses for Arcosa's clientele, thereby affecting the demand for its offerings.

For example, the European Union's updated Construction Products Regulation (CPR) is pushing for greater sustainability in building materials, signaling a potential shift that could influence North American markets. This regulatory push towards greener construction practices is a key trend to monitor for companies like Arcosa.

- EU Construction Products Regulation (CPR) Revision: Focuses on enhancing product performance and sustainability, with implications for material sourcing and manufacturing processes.

- North American Regulatory Trends: Anticipated alignment with global sustainability standards may lead to stricter environmental and safety regulations for construction materials.

- Impact on Arcosa: Potential for increased demand for eco-friendly products and adaptation to new compliance requirements for its product lines.

Political Stability and Policy Continuity

Political stability and the continuity of infrastructure policy are paramount for Arcosa, as they directly influence long-term investment and project planning within the infrastructure sector. A stable political environment reduces uncertainty for companies dependent on public works.

The bipartisan passage of the Infrastructure Investment and Jobs Act (IIJA) in the US, signed into law in November 2021, provides a significant tailwind. This legislation allocates an estimated $1.2 trillion, with approximately $550 billion in new federal spending, to address critical infrastructure needs across the nation. This substantial and broadly supported funding stream is expected to drive consistent demand for Arcosa's products and services through 2025 and beyond.

- Infrastructure Investment and Jobs Act (IIJA): $1.2 trillion total, with $550 billion in new federal spending allocated to infrastructure projects through 2026.

- Bipartisan Support: The IIJA passed with significant support from both major US political parties, indicating a degree of policy continuity.

- Impact on Arcosa: The IIJA is projected to boost demand for Arcosa's construction, energy, and transportation-related products, supporting revenue growth.

Government spending on infrastructure remains a primary political driver for Arcosa. The Infrastructure Investment and Jobs Act (IIJA) continues to be a significant source of funding, with substantial allocations expected through 2026. This sustained federal commitment directly translates into increased demand for Arcosa's construction products and engineered structures.

Regulatory shifts, such as the EPA's Buy Clean initiative, are pushing for domestically sourced and lower-carbon materials in federal projects. While still evolving, this trend could favor Arcosa's manufacturing capabilities and product development in the coming years, impacting sectors like steel and concrete.

Trade policies and tariffs, particularly on raw materials like steel, pose a potential risk to Arcosa's cost structure. However, the company's strategic sourcing of steel within the US and its production in Mexico under USMCA agreements offer a degree of protection against import duties, potentially enhancing its competitive position.

| Political Factor | Description | Impact on Arcosa | Data/Trend (2024-2025) |

| Infrastructure Spending | Government investment in public works projects. | Directly drives demand for Arcosa's products. | IIJA: ~$134 billion allocated for 2025, ~$136 billion for 2026. |

| Environmental Regulations | Policies promoting sustainable and low-carbon materials. | May increase demand for eco-friendly products; requires compliance adaptation. | EPA's 'Buy Clean' initiative developing labeling programs. |

| Trade Policies & Tariffs | Import duties on raw materials and finished goods. | Potential cost increases; US sourcing and USMCA compliance offer mitigation. | Steel tariffs can impact costs; USMCA compliance exempts Mexican production. |

What is included in the product

This Arcosa PESTLE analysis critically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic planning.

It provides actionable insights for Arcosa's leadership to navigate external challenges and capitalize on emerging opportunities.

A clear, actionable summary of Arcosa's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decisions.

Economic factors

Rising interest rates, exemplified by the Federal Reserve's continued monetary tightening throughout 2024, directly escalate financing expenses for Arcosa's construction projects. This increased cost of capital can dampen demand for both private non-residential and residential building, negatively affecting sales within the Construction Products segment.

While the immediate surge in material costs has somewhat abated, prices in mid-2024 remain elevated compared to pre-pandemic benchmarks. The potential for new tariffs or unforeseen supply chain disruptions looms, carrying the risk of reintroducing significant cost pressures for Arcosa's manufacturing and product delivery.

Arcosa's business is significantly influenced by the broader economic climate and, more directly, by how much is being spent on construction projects. While rising interest rates have cooled down the residential building sector, there's a silver lining. Increased government investment in infrastructure and a rebound in private non-residential construction are creating solid demand for Arcosa's offerings.

Looking ahead, the construction industry is projected to gain momentum. Experts anticipate a noticeable uptick in construction spending during 2025, driven by improving economic conditions. This positive outlook suggests a more favorable environment for Arcosa's key markets.

Input costs, especially for steel, are a critical economic consideration for Arcosa, particularly impacting its Engineered Structures segment. While steel availability was generally adequate in 2023, the company must remain vigilant regarding price volatility and potential supply chain disruptions that could affect its bottom line.

For instance, fluctuations in global steel prices, influenced by factors like geopolitical events and demand shifts, directly influence Arcosa's cost of goods sold. A significant increase in steel prices, as seen in some periods of 2022 and early 2023, can compress margins if not effectively passed on to customers.

Acquisition and Divestiture Strategy

Arcosa's acquisition strategy, notably the purchases of Stavola and Ameron in 2024, significantly bolstered its market presence. These moves expanded its aggregates business and enhanced its stake in more stable infrastructure sectors.

The company's strategic divestiture of its steel components segment in 2024 exemplifies its commitment to portfolio refinement. This action sharpened Arcosa's focus on its primary revenue-generating segments, improving operational efficiency.

- 2024 Acquisitions: Stavola and Ameron expanded Arcosa's aggregates footprint and infrastructure exposure.

- Portfolio Optimization: Divestiture of the steel components business in 2024 allowed for greater focus on core operations.

- Growth Driver: Strategic M&A activity is a key component of Arcosa's overall growth and market positioning strategy.

Capital Allocation and Financial Performance

Arcosa's financial performance, a critical economic factor, is directly tied to its capital allocation strategy. The company demonstrated strong momentum in its Q1 2025 results, with adjusted EBITDA and revenue both experiencing double-digit increases. This growth underscores the effectiveness of its operational execution and market positioning.

The company's capital allocation priorities are strategically focused on deleveraging its balance sheet and reinvesting in organic growth initiatives. This balanced approach aims to enhance shareholder value by improving financial flexibility and driving future expansion.

- Q1 2025 Adjusted EBITDA Growth: Double-digit increase reported, reflecting operational strength.

- Q1 2025 Revenue Growth: Also saw double-digit expansion, indicating healthy demand.

- Capital Allocation Priorities: Focus on debt reduction and supporting organic growth.

- Financial Health: Strategic capital deployment supports Arcosa's overall economic standing.

Economic factors significantly shape Arcosa's operational landscape. Rising interest rates, as seen with Federal Reserve actions in 2024, increase financing costs, potentially slowing construction demand. Despite some cost moderation, material prices in mid-2024 remained higher than pre-pandemic levels, with ongoing risks of tariffs and supply chain issues impacting Arcosa's manufacturing and product delivery.

However, increased government infrastructure spending and a rebound in private non-residential construction provide a counterbalancing demand for Arcosa's products. Projections for 2025 indicate a general uptick in construction spending, suggesting a more favorable market environment. Input costs, particularly steel prices, remain a critical consideration, directly affecting Arcosa's Engineered Structures segment, with price volatility and supply chain disruptions being key concerns.

Arcosa's strategic financial moves, including acquisitions like Stavola and Ameron in 2024, broadened its market reach, especially in aggregates and infrastructure. The 2024 divestiture of its steel components segment streamlined operations, sharpening its focus on core revenue drivers. The company reported strong Q1 2025 financial results, with double-digit growth in adjusted EBITDA and revenue, underscoring effective execution and market positioning.

| Key Economic Indicators Impacting Arcosa | 2024/2025 Data Points | Impact on Arcosa |

| Interest Rates (Federal Reserve Policy) | Continued monetary tightening in 2024, rates expected to remain elevated through mid-2025. | Increased financing costs for projects, potential dampening of construction demand. |

| Material Costs (e.g., Steel) | Mid-2024 prices elevated compared to pre-pandemic; steel price volatility a constant concern. | Directly impacts cost of goods sold, potentially compressing margins if not passed on. |

| Construction Spending Outlook | Projected uptick in spending during 2025, driven by infrastructure investment and non-residential rebound. | Creates solid demand for Arcosa's products and services. |

| Arcosa's Financial Performance (Q1 2025) | Double-digit growth in adjusted EBITDA and revenue. | Demonstrates operational strength and effective market positioning. |

Preview the Actual Deliverable

Arcosa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Arcosa PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Arcosa.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Arcosa's operating environment.

Sociological factors

The construction sector, a key market for Arcosa, is grappling with persistent labor shortages. An aging workforce coupled with insufficient new talent entering the trades means this challenge is set to grow. Projections for the coming years highlight a substantial deficit, requiring hundreds of thousands of additional skilled workers.

This scarcity directly impacts Arcosa by driving up labor costs through rising wages. Consequently, the company must strategically invest in robust upskilling and training programs to develop its existing workforce and attract new talent, ensuring it can meet project demands.

Arcosa's commitment to safety is a cornerstone of its operations, fostering a culture where employee well-being is paramount. Initiatives like ARC 100 have demonstrably improved safety metrics, leading to a notable decrease in lost workdays. For instance, Arcosa reported a significant reduction in recordable incidents, contributing to a safer work environment and enhanced employee confidence.

Demographic shifts, like a growing global population and increasing migration to cities, directly fuel the need for infrastructure. By 2050, the UN projects that 68% of the world’s population will live in urban areas, up from 55% in 2018. This trend creates a consistent demand for Arcosa's offerings in building and maintaining essential networks.

Community Impact and Social Responsibility

Arcosa actively invests in the communities where it operates, with a notable focus on educational initiatives. For instance, in 2023, the company reported supporting various educational programs and scholarships, demonstrating a tangible commitment to social responsibility. This dedication not only bolsters Arcosa's public image but also plays a role in attracting and retaining skilled employees, fostering a more sustainable business environment.

The company's social responsibility efforts can translate into significant reputational advantages. By contributing to local development and educational advancement, Arcosa builds goodwill, which can be crucial in navigating regulatory landscapes and securing community support for its projects. This proactive approach to community engagement is increasingly valued by investors and stakeholders alike, aligning with broader ESG (Environmental, Social, and Governance) expectations.

Arcosa's commitment to social impact is further evidenced by specific community programs. In 2024, the company continued its partnerships with local schools and vocational training centers, aiming to develop a pipeline of future talent. Such initiatives are vital for long-term workforce development and can directly benefit Arcosa by ensuring a skilled labor pool.

- Community Investment: Arcosa's focus on supporting education in its operating regions enhances its social license to operate.

- Reputation Enhancement: Strong community ties and social responsibility programs positively influence Arcosa's brand image and stakeholder relations.

- Talent Attraction: A commitment to social impact makes Arcosa a more attractive employer, aiding in recruitment and retention efforts.

- Long-Term Sustainability: Investing in communities and education contributes to Arcosa's overall long-term viability and resilience.

Evolving Workplace Expectations

The influx of Gen Z into manufacturing is reshaping workplace dynamics. This generation, accustomed to digital environments, expects advanced technology, automation, and seamless digital platforms. For Arcosa, this means a strategic imperative to integrate smart factory solutions and invest in cutting-edge technology to attract and retain this crucial demographic.

Companies that fail to adapt risk a talent deficit. In 2024, reports indicated that over 60% of Gen Z workers prioritize employers with strong technological capabilities. Arcosa's ability to meet these evolving workplace expectations will be a key differentiator in securing a skilled, future-ready workforce, impacting innovation and operational efficiency.

- Gen Z's Tech Demands: Younger workers expect modern digital tools and automation in their roles.

- Smart Factory Adoption: Arcosa must invest in smart factory solutions to align with these expectations.

- Talent Attraction & Retention: Technological advancement is a critical factor for attracting and keeping a tech-savvy workforce.

- Industry Trend: By 2025, the manufacturing sector is seeing increased demand for digitally integrated workplaces.

Sociological factors significantly influence Arcosa's operational landscape, particularly concerning labor and community relations. The persistent shortage of skilled labor in the construction sector, exacerbated by an aging workforce and insufficient new talent, directly impacts Arcosa by driving up labor costs. For instance, in 2024, the demand for skilled tradespeople outstripped supply, leading to wage inflation across the industry.

Arcosa's proactive investment in community engagement and educational initiatives, such as supporting local schools and vocational training in 2023 and 2024, builds crucial social capital. This commitment not only enhances its reputation but also aids in talent attraction and retention, ensuring a pipeline of skilled workers. Furthermore, the influx of Gen Z into manufacturing necessitates Arcosa's adoption of advanced technology and automation, as over 60% of Gen Z workers prioritize technologically capable employers.

| Sociological Factor | Impact on Arcosa | 2024/2025 Data/Trend |

|---|---|---|

| Skilled Labor Shortage | Increased labor costs, project delays | Demand for skilled trades outstripped supply in 2024, driving wage increases. |

| Demographic Shifts (Urbanization) | Increased demand for infrastructure | UN projects 68% global urban population by 2050, up from 55% in 2018. |

| Community Investment | Enhanced reputation, social license to operate | Arcosa supported educational programs in 2023; continued partnerships in 2024. |

| Gen Z Workforce Expectations | Need for technological adoption, modern workplace | Over 60% of Gen Z prioritize employers with strong tech capabilities (2024 data). |

Technological factors

The construction and manufacturing sectors are increasingly turning to automation and robotics to combat labor shortages and boost efficiency. For instance, the global industrial robotics market was projected to reach $65.3 billion in 2024, highlighting significant investment in this area. This trend allows companies to improve operational precision and reduce dependency on manual labor.

Arcosa, with its diverse operations spanning infrastructure, energy, and transportation, stands to gain considerably from adopting these advanced technologies. Integrating robotics in manufacturing processes can lead to optimized production, fewer errors, and potentially lower costs. This strategic move aligns with industry-wide efforts to enhance productivity in challenging labor markets.

Technologies like Building Information Modeling (BIM), 3D printing, and artificial intelligence are significantly reshaping the construction and manufacturing sectors. These innovations offer Arcosa the potential to streamline project management, refine product designs, and improve the allocation of resources. For instance, BIM can reduce design errors by an estimated 10-20% in large projects, directly impacting efficiency.

AI-powered analytics can optimize supply chains and predict maintenance needs for manufacturing equipment, thereby reducing downtime and operational costs. In 2024, the global construction technology market was valued at over $15 billion and is projected to grow substantially, indicating a strong trend towards adopting these advanced methods.

The increasing integration of real-time data tracking, artificial intelligence (AI), and machine learning is revolutionizing industries. These technologies enable sophisticated predictive analysis, more accurate cost estimations, and robust risk management strategies.

Arcosa can harness these digital advancements to streamline its operational processes, leading to enhanced efficiency and better resource allocation. For instance, by implementing AI-driven analytics, Arcosa could potentially reduce project overruns, a common challenge in infrastructure projects.

The adoption of advanced data analytics allows for deeper insights into market trends and customer behavior, empowering Arcosa to make more informed strategic decisions. In 2024, companies that effectively leverage data analytics are seeing significant improvements in operational agility and competitive positioning.

Sustainable Technologies and Materials Innovation

The construction sector is seeing a significant shift towards sustainable technologies and materials. This trend is driven by increasing environmental awareness and regulatory pressures, creating new opportunities for companies like Arcosa. The demand for low-carbon construction materials, such as those incorporating recycled content or produced with lower embodied energy, is on the rise.

Arcosa is well-positioned to benefit from this transition, given its existing product lines that support infrastructure development and its increasing focus on sustainability. For instance, the company's involvement in renewable energy projects, like wind towers, directly aligns with the growth in green energy infrastructure. The global green building materials market was valued at approximately $240 billion in 2023 and is projected to grow substantially in the coming years, with a compound annual growth rate (CAGR) of around 9% through 2030.

Key areas of innovation include:

- Development of eco-friendly and recycled materials: Companies are investing in materials that reduce waste and environmental impact.

- Advancements in renewable energy integration: Technologies enabling easier incorporation of solar, wind, and other renewables into building designs are gaining traction.

- Energy-efficient building systems: Innovations in insulation, HVAC, and smart building technologies are becoming standard.

- Circular economy principles in construction: Focus on designing for deconstruction and material reuse is increasing.

Connectivity and Smart Infrastructure

The ongoing expansion of new transmission, distribution, and telecommunications infrastructure presents a significant technological opportunity for Arcosa's Engineered Structures segment. This growth is directly tied to the need for more robust and widespread connectivity solutions.

Furthermore, the exploration and adoption of smart-grid technologies are creating new avenues for Arcosa. These advancements require sophisticated infrastructure components that Arcosa is well-positioned to provide. For instance, the U.S. Energy Information Administration reported that in 2023, investments in grid modernization and smart grid technologies were projected to reach tens of billions of dollars, highlighting the scale of this opportunity.

Seamless connectivity across Arcosa's manufacturing sites and the increasing reliance on real-time communications among smart devices are becoming critical operational imperatives. This technological shift demands advanced infrastructure that supports efficient data flow and operational coordination.

- Infrastructure Expansion: Growth in new transmission, distribution, and telecommunications networks fuels demand for Arcosa's engineered structures.

- Smart Grid Adoption: The development of smart-grid technologies creates opportunities for specialized infrastructure components.

- Connectivity Needs: Enhanced site connectivity and real-time device communication are becoming essential for operational efficiency.

Technological advancements like AI and automation are transforming construction and manufacturing, driving efficiency and addressing labor shortages. The global industrial robotics market was projected to reach $65.3 billion in 2024, reflecting significant investment in these areas.

Innovations such as BIM and 3D printing are streamlining project management and product design, with BIM potentially reducing design errors by 10-20% in large projects. Arcosa can leverage these tools to optimize operations and reduce costs.

The adoption of smart-grid technologies and the expansion of telecommunications infrastructure present significant opportunities for Arcosa's Engineered Structures segment. U.S. grid modernization investments were projected to reach tens of billions of dollars in 2023.

The increasing demand for sustainable construction materials, with the global green building materials market valued at approximately $240 billion in 2023, aligns with Arcosa's focus on renewable energy projects.

| Technology Trend | Impact on Arcosa | Market Data (2024/2025 Estimates) |

|---|---|---|

| Automation & Robotics | Increased efficiency, reduced labor dependency | Global industrial robotics market: $65.3 billion (projected 2024) |

| BIM & 3D Printing | Streamlined project management, design optimization | BIM error reduction: 10-20% in large projects |

| Smart Grid & Connectivity | Demand for specialized infrastructure components | U.S. grid modernization investments: Tens of billions (projected 2023) |

| Sustainable Materials | Growth in green building opportunities | Global green building materials market: ~$240 billion (2023) |

Legal factors

The Infrastructure Investment and Jobs Act (IIJA), enacted in 2021, and the Inflation Reduction Act (IRA), passed in 2022, represent significant legislative drivers for Arcosa. These acts collectively allocate hundreds of billions of dollars towards upgrading America's infrastructure, directly benefiting Arcosa's core markets in construction and transportation through increased project opportunities.

Specifically, the IIJA earmarks approximately $550 billion in new federal investment for roads, bridges, public transit, and water infrastructure, while the IRA includes substantial tax credits and incentives for clean energy projects, which can spur demand for Arcosa's wind energy components and other related infrastructure. This sustained federal commitment is projected to create a robust pipeline of projects throughout 2024 and into 2025 and beyond.

Increasingly stringent environmental regulations, particularly concerning greenhouse gas emissions and the embodied carbon within construction materials, are a significant factor for Arcosa. These rules directly influence how Arcosa operates and what types of products it can develop.

Initiatives like the EPA's Buy Clean program and new European Union regulations for construction products are pushing manufacturers, including Arcosa, to actively provide data on the environmental sustainability of their offerings. This means Arcosa needs to be transparent about its environmental footprint.

Changes in labor laws, such as potential increases in the federal minimum wage or evolving overtime rules, directly affect Arcosa's operational expenses and how it manages its workforce. For instance, a significant shift in minimum wage could necessitate adjustments in pricing for Arcosa's manufactured goods or impact project bids in its construction segments.

Worker safety regulations, enforced by bodies like OSHA, are critical for Arcosa, particularly in its manufacturing and construction operations. Compliance with these laws, including reporting requirements and safety training mandates, is essential to prevent accidents and avoid costly penalties, ensuring operational continuity.

The influence of union regulations and collective bargaining agreements can shape Arcosa's labor relations and compensation structures. As of early 2024, unionization efforts across various sectors continue to be a notable trend, potentially impacting Arcosa's labor costs and negotiation strategies if its workforce becomes more unionized.

Arcosa's strategies for workforce development and addressing labor shortages are intrinsically linked to legal frameworks governing employment. Laws promoting apprenticeships or impacting the availability of skilled labor can influence Arcosa's ability to staff its projects and manufacturing facilities effectively, especially in specialized fields.

Product Standards and Certifications

Compliance with evolving product standards and the pursuit of certifications for sustainable or high-performance materials are crucial legal considerations for Arcosa. For example, the increasing emphasis on green building certifications, such as LEED, and zero-carbon initiatives are becoming dominant factors in new construction projects, directly impacting demand for Arcosa's building products and infrastructure solutions.

These legal mandates and voluntary certifications often dictate material specifications, manufacturing processes, and end-of-life management, influencing Arcosa's product development and operational strategies. Failure to adhere to these standards can result in fines, market access restrictions, and reputational damage.

- Green Building Standards: Arcosa's products must meet increasingly stringent environmental performance criteria for projects seeking certifications like LEED or BREEAM.

- Zero-Carbon Initiatives: Evolving regulations and targets for reducing embodied carbon in construction materials will necessitate innovation and potentially new product lines.

- Safety and Performance Certifications: Ongoing compliance with industry-specific safety and performance standards, such as those for structural steel or transportation components, remains a legal imperative.

- Material Traceability: Legal frameworks may increasingly require transparent sourcing and traceability of materials used in construction and manufacturing.

Trade and Tariff Regulations

Arcosa's position within international trade agreements, particularly the United States-Mexico-Canada Agreement (USMCA), offers significant protection against many tariff-related disruptions. Given that Arcosa primarily sources its steel domestically within the U.S. and its manufactured goods in Mexico adhere to USMCA compliance, the company is largely insulated from the direct impact of tariffs on imported raw materials or finished products that might affect competitors.

However, broader trade policy shifts or retaliatory tariffs targeting specific industries could still indirectly influence Arcosa's operations. For instance, if tariffs were imposed on components used in the production of its wind towers or other infrastructure products, even if sourced domestically, the cost of those components could rise. The global trade landscape remains dynamic, and Arcosa, like all businesses, must monitor evolving regulations.

The USMCA, which replaced NAFTA, has been in effect since July 1, 2020, and continues to shape trade flows between the three North American nations. Arcosa's strategic sourcing and manufacturing alignment with this agreement underscore its proactive approach to navigating these legal and economic factors.

While Arcosa's primary steel sourcing is U.S.-based, and its Mexican production meets USMCA standards, it’s important to note that the company also operates in segments like energy, where international supply chains for specialized components can exist. Any disruption to these could present challenges, though the core business model appears robust against direct tariff impacts on its primary inputs.

Arcosa's legal landscape is significantly shaped by infrastructure spending laws like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA). These acts, with billions allocated to infrastructure and clean energy, create substantial project opportunities for Arcosa through 2024 and 2025.

Environmental regulations, particularly those targeting greenhouse gas emissions and embodied carbon, are increasingly influencing Arcosa's operations and product development. Compliance with mandates like the EPA's Buy Clean program requires transparency in environmental footprints.

Labor laws, including minimum wage and overtime regulations, directly impact Arcosa's operational costs and workforce management. Worker safety regulations from bodies like OSHA are critical for preventing accidents and avoiding penalties in manufacturing and construction.

Trade agreements, such as the USMCA, provide Arcosa with tariff protection, especially given its domestic steel sourcing and USMCA-compliant Mexican manufacturing, insulating it from many competitor disadvantages.

Environmental factors

Climate change is increasingly driving more frequent and intense weather events, which directly impacts Arcosa's operations. These events can disrupt construction timelines, complicate the logistics of transporting essential materials, and necessitate higher durability standards for the infrastructure products Arcosa manufactures. For instance, the increasing frequency of severe storms in 2024 and projected for 2025 means that projects requiring Arcosa's components might face delays or require more robust designs to withstand harsher conditions.

Arcosa is strategically positioned to benefit from these environmental shifts due to its emphasis on resilient infrastructure solutions. The company's portfolio, which includes products designed for harsh environments and long-term durability, directly addresses the growing need for infrastructure that can withstand the impacts of climate change and extreme weather. This focus allows Arcosa to offer solutions that are not only functional but also sustainable and long-lasting in the face of evolving environmental challenges.

The availability and pricing of essential raw materials like aggregates and steel are directly impacted by environmental regulations and how effectively resources are managed globally. Fluctuations in these supplies can significantly affect Arcosa's production costs and project timelines.

Arcosa's proactive approach to water efficiency, aiming to reduce consumption and waste, reflects a growing understanding of resource conservation. This focus on minimizing material loss also contributes to operational efficiency and can mitigate the impact of scarcity-driven cost increases.

The construction industry faces mounting pressure to cut its environmental impact, particularly concerning embodied carbon in materials. Arcosa has proactively addressed this by achieving a 23% reduction in its Scope 1 and 2 greenhouse gas emissions intensity by the end of 2023, exceeding its initial 2026 target of 15% reduction. This accomplishment demonstrates a strong commitment to sustainability, aligning with evolving regulatory landscapes and increasing customer demand for eco-friendly solutions.

Waste Management and Circular Economy

The increasing global emphasis on circular economy principles is significantly influencing the construction sector, driving demand for sustainable practices and materials. Arcosa's commitment to incorporating recycled aggregates and optimizing material usage directly addresses this trend, positioning the company favorably within an environmentally conscious market. This strategic focus on resource efficiency is not just an environmental imperative but also a growing economic advantage.

Arcosa’s operations, particularly in its Construction Products segment, are actively contributing to waste reduction. For instance, in 2023, the company reported a significant portion of its aggregate production utilized recycled materials, demonstrating a tangible commitment to circularity. This approach helps mitigate landfill waste and lowers the carbon footprint associated with virgin material extraction and processing.

- Growing Demand for Recycled Content: Environmental regulations and consumer preferences are increasingly favoring construction projects that incorporate recycled materials.

- Resource Optimization: Arcosa's focus on efficient material use minimizes waste throughout its production processes, aligning with circular economy goals.

- Reduced Environmental Impact: By utilizing recycled aggregates, Arcosa contributes to lower greenhouse gas emissions and reduced demand for natural resources in infrastructure development.

- Market Differentiation: A strong sustainability profile, driven by circular economy practices, offers a competitive edge in securing contracts and attracting environmentally conscious clients.

Water Management and Conservation

Water scarcity is a growing concern for manufacturing, pushing companies like Arcosa to prioritize efficient water usage. Arcosa has made notable strides in this area, with its water intensity seeing a significant reduction. This improvement is a direct result of ongoing, dedicated conservation initiatives across its operations.

Arcosa's commitment to water management is reflected in tangible results. For instance, in 2023, the company reported a substantial decrease in water intensity, a key metric for operational efficiency. This focus on conservation is crucial given the increasing regulatory scrutiny and potential operational disruptions associated with water availability.

- Water Intensity Reduction: Arcosa achieved a notable reduction in water intensity in 2023, showcasing progress in conservation efforts.

- Operational Efficiency: Improved water management directly contributes to operational cost savings and resource optimization.

- Risk Mitigation: Proactive water conservation helps mitigate risks associated with water scarcity and potential regulatory changes.

- Sustainability Commitment: Demonstrates Arcosa's dedication to environmental stewardship and sustainable manufacturing practices.

Environmental factors are increasingly shaping Arcosa's operational landscape, from the direct impacts of climate change on construction projects to the growing demand for sustainable materials. The company's proactive stance on reducing its carbon footprint, evidenced by a 23% decrease in Scope 1 and 2 greenhouse gas emissions intensity by the end of 2023, positions it favorably. Furthermore, Arcosa's commitment to water conservation, demonstrated by a significant reduction in water intensity in 2023, addresses critical resource management concerns and aligns with evolving regulatory expectations.

Arcosa's strategic integration of recycled aggregates into its production processes highlights a commitment to circular economy principles, contributing to reduced waste and a lower demand for virgin resources. This focus on resource optimization not only mitigates environmental impact but also enhances market differentiation by meeting the growing preference for eco-friendly construction solutions.

The company's efforts in waste reduction, particularly within its Construction Products segment, are tangible. For example, a notable portion of aggregate production in 2023 utilized recycled materials, directly addressing landfill diversion and the carbon footprint associated with new material extraction.

Arcosa's water management initiatives have yielded measurable results, with a substantial reduction in water intensity reported in 2023. This focus on conservation is paramount given increasing regulatory scrutiny and the potential for operational disruptions due to water scarcity.

| Environmental Factor | Arcosa's Response/Impact | Key Data/Metric (as of 2023/2024) |

|---|---|---|

| Climate Change & Extreme Weather | Disruptions to construction, need for durable products | Increased frequency of severe storms projected for 2024-2025 |

| Greenhouse Gas Emissions | Commitment to reduction | 23% reduction in Scope 1 & 2 GHG emissions intensity (exceeded 2026 target of 15%) |

| Circular Economy & Recycled Content | Use of recycled aggregates, resource optimization | Significant portion of aggregate production in 2023 used recycled materials |

| Water Scarcity & Conservation | Focus on efficient water usage | Substantial reduction in water intensity in 2023 |

PESTLE Analysis Data Sources

Arcosa's PESTLE Analysis is built on a foundation of data from reputable sources including government publications, industry-specific market research, and international economic reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.