American Water Works SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Water Works Bundle

American Water Works is a leader in the water utility sector, boasting strong brand recognition and a stable, regulated revenue stream. However, they face challenges from aging infrastructure and evolving regulatory landscapes.

Discover the complete picture behind American Water Works' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

American Water Works stands as the largest publicly traded water and wastewater utility in the U.S., a significant advantage in a sector often characterized by fragmented local operations. This scale allows for operational efficiencies and a broader customer base, translating into robust market leadership.

Serving over 14 million people across 14 states and 18 military installations, American Water Works benefits from a dominant market position. This extensive reach ensures consistent demand for its essential services, underpinning its financial stability.

The company's largely regulated business model is a key strength, offering stable and predictable revenue streams. State authorities approve rates, providing a degree of insulation from market volatility and ensuring a reliable income flow for the company.

American Water Works has shown steady financial results, with earnings per share (EPS) reaching $5.39 in 2024, an increase from $4.90 in 2023. The company has also projected its 2025 EPS to be between $5.65 and $5.75, indicating continued positive momentum.

This consistent performance is underpinned by a long-term growth target for both earnings and dividends, aiming for a 7-9% increase annually. These ambitious goals are well-supported by the company's significant capital investment initiatives and its strategic approach to acquiring new businesses.

American Water Works is making substantial commitments to infrastructure upgrades. The company plans to invest around $3.3 billion in 2025 alone, demonstrating a strong focus on improving its systems.

Looking ahead, American Water has a robust long-term investment strategy, earmarking $40-$42 billion for infrastructure improvements between 2025 and 2034. This significant capital allocation directly addresses the widespread issue of aging water and wastewater systems across the United States.

These substantial investments are designed to boost service reliability and ensure higher water quality for its customers. By upgrading its extensive network, American Water is also enhancing the overall resiliency of its operations against potential disruptions.

Strategic Acquisitions and Customer Growth

American Water Works consistently strengthens its market position through strategic acquisitions. In 2024 alone, the company successfully integrated 13 acquisitions, bringing on board approximately 69,500 new customers. This aggressive inorganic growth, coupled with ongoing organic customer additions, directly fuels revenue expansion and solidifies its geographic reach.

The company’s acquisition pipeline remains robust, with several pending deals anticipated to add thousands more customers in the near future. This proactive approach to expanding its customer base is a key driver of American Water Works' sustained growth and market leadership in the utility sector.

- Acquisition Volume: 13 acquisitions completed in 2024.

- Customer Addition (2024): 69,500 new customers gained through acquisitions.

- Growth Strategy: Combination of inorganic (acquisitions) and organic customer growth.

- Impact: Direct contribution to revenue expansion and increased geographic footprint.

Strong Regulatory and Operational Execution

American Water Works consistently demonstrates robust regulatory and operational execution, a critical strength that allows it to secure necessary rate increases to recoup significant infrastructure investments. This disciplined approach is vital for maintaining both service reliability and financial health.

In 2023, for instance, American Water successfully completed 19 rate-based regulatory filings across its various state subsidiaries, securing approximately $500 million in annual revenue increases. This track record underscores its ability to navigate complex regulatory environments effectively, ensuring a stable financial footing for continued capital deployment.

- Proven Regulatory Success: Secured approximately $500 million in annual revenue increases through 19 rate-based filings in 2023.

- Operational Discipline: Efficiently manages operations and capital deployment, leading to reliable and affordable service delivery.

- Financial Stability: The consistent ability to recover investment costs through authorized rates underpins the company's financial resilience.

American Water Works' strength lies in its unparalleled scale as the largest U.S. water utility, serving over 14 million people across 14 states and 18 military installations. This market dominance, coupled with a regulated business model, ensures stable, predictable revenues, insulated from market volatility. The company's financial performance is robust, with projected 2025 EPS between $5.65 and $5.75, supported by a 7-9% annual earnings and dividend growth target.

Strategic acquisitions are a key growth driver, with 13 acquisitions in 2024 adding 69,500 customers. This inorganic expansion, combined with organic growth, fuels revenue and geographic reach. The company's commitment to infrastructure is substantial, with a planned $3.3 billion investment in 2025 and a long-term strategy to invest $40-$42 billion between 2025 and 2034, enhancing service reliability and operational resilience.

Furthermore, American Water Works excels in regulatory execution, securing approximately $500 million in annual revenue increases through 19 rate-based filings in 2023. This consistent ability to recover investment costs through authorized rates underpins its financial resilience and operational discipline.

| Metric | 2023 | 2024 (Projected/Actual) | 2025 (Projected) |

|---|---|---|---|

| Earnings Per Share (EPS) | $4.90 | $5.39 | $5.65 - $5.75 |

| Acquisitions Completed | N/A | 13 | N/A |

| New Customers (Acquisitions) | N/A | 69,500 | N/A |

| Annual Revenue Increase (Rate Filings) | ~$500 million (19 filings) | N/A | N/A |

| Infrastructure Investment (Annual) | N/A | N/A | ~$3.3 billion |

What is included in the product

Offers a full breakdown of American Water Works’s strategic business environment, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing critical challenges in water infrastructure management.

Weaknesses

American Water Works faces a significant challenge with high capital expenditure requirements. The company must continuously invest in maintaining and upgrading its vast network of aging water and wastewater infrastructure. This ongoing need for investment is crucial for ensuring service reliability and meeting stringent regulatory standards.

These substantial capital outlays, estimated to be in the billions annually, can place a strain on the company's financial resources. For instance, in 2023, American Water Works reported capital expenditures of approximately $3.2 billion, a figure expected to remain robust in 2024 and beyond as they execute their multi-year capital investment plan.

While these investments are vital for long-term operational health and growth, they can lead to negative free cash flow in the short term. This dynamic requires careful financial management to balance necessary infrastructure spending with shareholder returns and debt obligations.

American Water Works' operations are significantly constrained by its status as a regulated utility, meaning pricing adjustments and operational shifts require approval from state regulatory bodies. This dependence creates a direct link between regulatory decisions and the company's financial performance, affecting how quickly it can adapt to changing market conditions or invest in new infrastructure.

The complexity of the regulatory environment can lead to considerable delays in crucial rate case outcomes, directly impacting revenue recognition and overall earnings. For instance, a prolonged rate case in a key state could defer expected revenue, as seen in past instances where regulatory lag affected financial projections. Unfavorable decisions can further limit profit margins and hinder growth strategies.

Despite its widespread presence across numerous states, American Water Works remains susceptible to localized risks. These can manifest as regional economic slowdowns, which might disproportionately affect certain service areas, or severe weather events, such as hurricanes or prolonged droughts, that can damage specific infrastructure and disrupt operations. For instance, in 2023, the company navigated significant weather challenges in various regions, highlighting the ongoing vulnerability to localized environmental impacts.

Increasing Operating and Financing Costs

American Water Works has been grappling with escalating operating expenses. These include higher employee-related costs and other operation and maintenance expenditures. For instance, in the first quarter of 2024, the company reported a notable increase in its operating expenses, which put pressure on margins despite revenue growth.

These rising costs, coupled with increased depreciation and financing costs, can significantly offset the positive impact of approved rate increases and strategic acquisitions. This dynamic directly affects the company's ability to translate top-line growth into bottom-line profitability, a key concern for investors in the utility sector.

- Increased Employee Costs: Higher wages and benefits contribute to elevated operating expenses.

- Rising O&M Expenses: General upkeep and maintenance costs are on the rise.

- Depreciation and Financing Costs: Investments in infrastructure and higher interest rates impact financial outlays.

- Margin Compression: The combination of these factors can dilute the benefits of revenue enhancements.

Cybersecurity Risks

American Water's extensive reliance on technology and interconnected critical infrastructure systems, including water treatment plants and distribution networks, inherently exposes the company to significant cybersecurity risks. A successful cyberattack could compromise sensitive customer data, disrupt essential water services, and lead to substantial financial losses.

The company has acknowledged these vulnerabilities, as evidenced by a resolved cybersecurity incident in October 2024. Such events can trigger immediate costs associated with prevention, mitigation, and recovery efforts, alongside potential long-term expenses related to regulatory fines and legal liabilities.

- Vulnerability to Cyber Threats: Critical infrastructure is a prime target for malicious actors seeking to cause widespread disruption.

- Operational Disruption: A breach could halt water supply or treatment processes, impacting millions of customers.

- Data Breach Impact: Compromised customer information, including personal and financial details, can lead to identity theft and reputational damage.

- Financial Repercussions: Costs include incident response, system restoration, potential ransomware payments, and legal settlements.

American Water Works' significant capital expenditure needs, projected to remain in the billions annually, can strain its financial resources and potentially lead to negative free cash flow in the short term, as seen with 2023 expenditures of approximately $3.2 billion. The company's regulated utility status creates a dependency on state regulatory bodies for pricing and operational changes, which can cause delays in rate case outcomes, impacting revenue recognition and profitability. Furthermore, the company is susceptible to localized risks, including economic downturns and severe weather events, which can disrupt operations and damage infrastructure, as highlighted by challenges faced in 2023.

Preview Before You Purchase

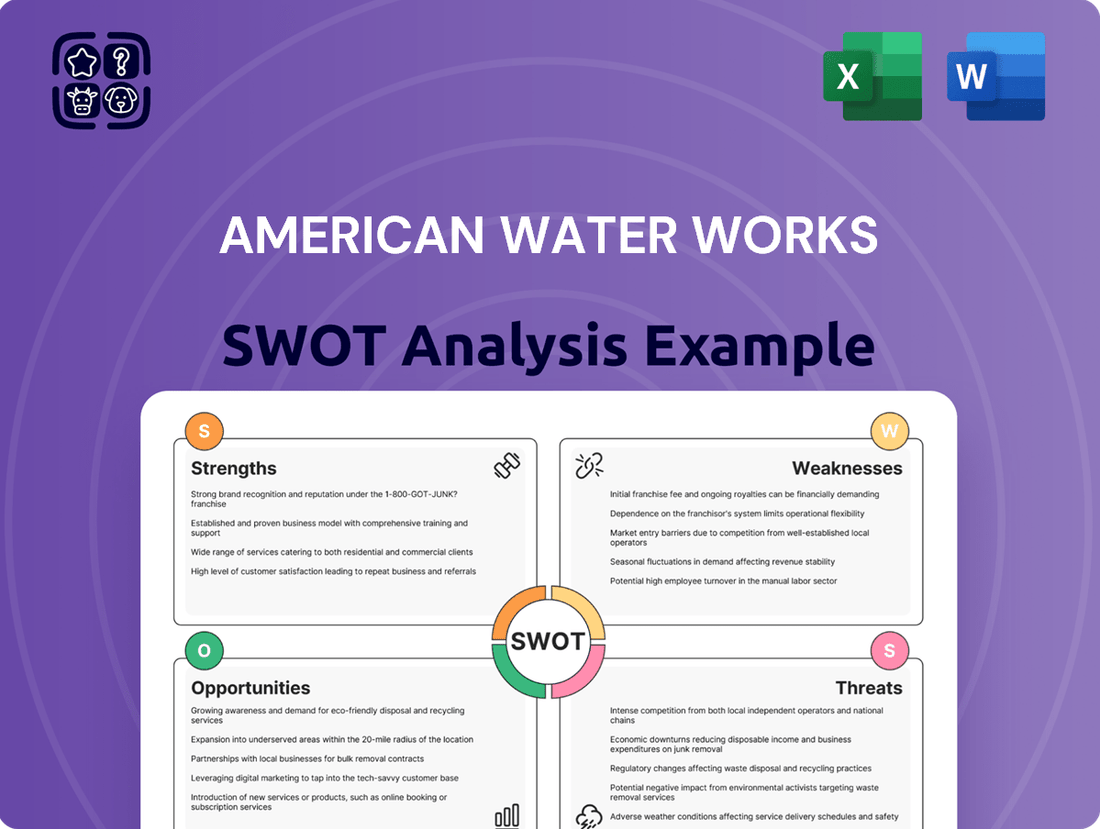

American Water Works SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at American Water Works' Strengths, Weaknesses, Opportunities, and Threats. Gain valuable insights to inform your strategic decisions.

Opportunities

The United States faces a critical need to upgrade its aging water infrastructure, with estimates suggesting trillions of dollars are required over the coming decades. This presents a substantial opportunity for American Water to leverage its expertise and financial capacity. For instance, the American Society of Civil Engineers (ASCE) consistently highlights the poor condition of water systems, with their 2021 report giving the drinking water infrastructure a D grade. This ongoing challenge creates a fertile ground for American Water’s strategic investments and acquisitions.

This widespread need for infrastructure renewal allows American Water to systematically invest in upgrades and expansions, thereby growing its rate base. Furthermore, industry consolidation is a key trend, with smaller, often financially strained municipal water systems looking for partners. American Water's ability to acquire these systems not only adds customer connections but also enhances its overall market position and revenue streams.

Recent legislative and regulatory shifts across several states are poised to enhance American Water Works' (AWK) profitability by allowing for better recoupment of infrastructure expenses. This positive trend is crucial for AWK's ongoing capital improvement projects.

For instance, in 2023, AWK reported that regulatory decisions in states like Pennsylvania and New Jersey provided opportunities for improved recovery of infrastructure investments, contributing to a higher allowed return on equity. This favorable environment directly supports AWK's strategy to invest billions in upgrading its water and wastewater systems.

American Water Works is actively embracing technological advancements to boost its operations. By adopting new technologies and further digitalizing its processes, the company aims to become more efficient, deliver better services, and manage its resources more effectively. This focus on innovation is crucial for staying competitive in the evolving utility landscape.

Significant investments are being channeled into areas like smart water networks, advanced data analytics, and automation. These initiatives are projected to yield substantial operational cost savings for American Water Works. For instance, smart metering can reduce manual meter reading costs and improve billing accuracy, contributing to overall financial health.

The digitalization drive is also expected to significantly enhance customer service. By leveraging data analytics, American Water Works can gain deeper insights into customer usage patterns and potential issues, allowing for proactive problem-solving and more personalized service delivery. This customer-centric approach is a key differentiator.

Expansion of Market-Based Businesses

American Water Works can enhance revenue streams by strategically expanding its market-based businesses, moving beyond its core regulated operations. This diversification allows for growth in areas with less regulatory oversight, tapping into new markets and service offerings.

The company has already made strides in this area. For example, its Homeowner Services division, which offers services like water line repair and maintenance, has shown consistent growth. In 2023, this segment contributed to the company's overall performance, demonstrating the potential of non-regulated revenue. Further expansion into adjacent services or new geographic regions where regulatory hurdles are lower presents a significant opportunity for American Water Works to capture additional market share and bolster its financial results.

- Diversification into non-regulated services offers a pathway to increased revenue beyond traditional utility operations.

- Targeting areas with less stringent regulation can unlock new growth avenues and reduce reliance on rate case approvals.

- Leveraging existing infrastructure and expertise in water management can support expansion into related market-based offerings.

- The Homeowner Services segment provides a proven model for successful market-based business expansion.

Growing Demand for Water and Wastewater Services

The essential nature of water and wastewater services guarantees robust and consistent demand. This is further bolstered by ongoing population increases and economic expansion across its service territories, creating a stable bedrock for American Water's sustained growth and profitability.

The company's operations are inherently resilient, as access to clean water and effective wastewater management are non-negotiable utilities. For instance, American Water's regulated operations provide a predictable revenue stream, contributing to its financial stability.

- Consistent Demand: Water and wastewater services are essential, ensuring a baseline of customer need regardless of economic fluctuations.

- Population Growth: As populations grow, so does the demand for water infrastructure and services, directly benefiting American Water.

- Economic Development: Increased economic activity often leads to greater water consumption and the need for expanded wastewater treatment capabilities.

- Regulatory Stability: The regulated nature of many of its operations provides a predictable revenue environment, supporting long-term investment and planning.

American Water Works is well-positioned to capitalize on significant opportunities stemming from the nation's aging water infrastructure. The company can leverage its financial strength and expertise to undertake critical upgrades, as highlighted by the American Society of Civil Engineers' consistent D grade for drinking water infrastructure. This ongoing need creates fertile ground for strategic investments and acquisitions, particularly as smaller, financially challenged municipal systems seek partners.

Favorable regulatory shifts in states like Pennsylvania and New Jersey are allowing for better recoupment of infrastructure expenses, directly supporting American Water's capital improvement projects and enhancing its allowed return on equity. The company's commitment to technological advancement, including smart water networks and data analytics, promises increased operational efficiency and improved customer service, further solidifying its competitive edge in the evolving utility landscape.

Diversifying into non-regulated market-based businesses, such as its Homeowner Services division, offers a proven pathway for revenue growth beyond traditional utility operations. This strategy allows American Water to tap into new markets and service offerings with less regulatory oversight, as demonstrated by the consistent growth in its homeowner services segment in 2023.

The essential nature of water and wastewater services, coupled with population growth and economic development across its service territories, guarantees robust and consistent demand. This inherent resilience provides a stable foundation for American Water's sustained growth and profitability, ensuring predictable revenue streams that support long-term investment and planning.

Threats

American Water faces significant threats from increasingly stringent environmental regulations. For instance, new rules concerning per- and polyfluoroalkyl substances (PFAS) require substantial investments in advanced treatment technologies, potentially increasing capital expenditures by hundreds of millions of dollars over the next decade. Failure to comply with these evolving standards, such as those mandated by the EPA, could lead to substantial fines and damage the company's reputation.

Economic slowdowns present a significant threat to American Water Works by potentially reducing customer affordability and, consequently, demand for water and wastewater services. This could lead to slower revenue growth than anticipated.

Inflationary pressures are a direct concern, as they can significantly increase the operating costs for materials, labor, and energy, impacting the company's profit margins. For instance, the Producer Price Index for Industrial Commodities saw a notable increase in late 2023 and early 2024, indicating rising input costs across various sectors.

Furthermore, rising interest rates, a common response to inflation, directly affect American Water Works' ability to finance its substantial infrastructure upgrades and expansions. Higher borrowing costs can make crucial capital investments more expensive, potentially delaying or scaling back necessary improvements to their extensive network.

American Water Works, despite being the largest publicly traded water utility, encounters significant competition from a multitude of local and municipal water providers. These public entities often operate with different cost structures and may benefit from tax advantages or direct public funding, creating a competitive landscape that can influence American Water's growth strategies and acquisition opportunities.

For instance, in 2023, the municipalization trend saw several smaller water systems being taken over by local governments, a factor that could limit American Water's organic growth through acquisitions. These public entities can sometimes offer services at a lower price point due to their non-profit status and access to municipal bonds, posing a challenge to American Water's market share in certain regions.

Public and Political Opposition to Rate Hikes

Public and political opposition to rate hikes presents a notable threat to American Water Works. While regulatory bodies approve necessary increases for infrastructure upgrades, these can still spark backlash from consumers and elected officials. This opposition can translate into delayed approvals or pressure to cap rate increases, directly affecting the company's ability to recoup its substantial investments and hindering revenue growth.

For instance, in 2023, many utility companies faced scrutiny over rate increases aimed at funding grid modernization and water system improvements. In states like Pennsylvania, where American Water Works operates significantly, proposed rate adjustments often trigger public hearings and legislative review, highlighting the sensitivity of these financial decisions. The company's 2024 capital investment plan, projected to be in the billions, underscores the ongoing need for rate adjustments to support these critical infrastructure projects.

- Regulatory Hurdles: Public and political pressure can lead to protracted approval processes for rate increases, potentially delaying crucial revenue recovery.

- Revenue Impact: Opposition may force lower-than-requested rate hikes, directly impacting the company's financial performance and ability to fund essential infrastructure.

- Investment Recovery: Significant capital expenditures, such as those planned for 2024 and beyond, rely on timely rate adjustments to ensure a return on investment.

Climate Change and Water Scarcity

Climate change poses a significant long-term threat, with prolonged droughts potentially leading to severe water scarcity in areas American Water Works serves. For instance, the Western United States has experienced increasingly severe drought conditions in recent years, impacting water availability. The company must anticipate and budget for potential investments in new water sources or enhanced conservation technologies to mitigate these risks.

Furthermore, the increasing frequency of extreme weather events, such as hurricanes and floods, presents a direct threat to American Water Works' existing infrastructure. Damage to treatment plants, pipelines, and pumping stations can lead to service disruptions and necessitate costly repairs and upgrades. For example, the aftermath of Hurricane Ida in 2021 caused significant damage to utility infrastructure in affected regions, highlighting the vulnerability of such assets.

- Increased Drought Frequency: Regions may face prolonged periods of low water availability, straining existing supplies.

- Infrastructure Vulnerability: Extreme weather events can cause substantial damage to water treatment and distribution systems.

- Unforeseen Capital Expenditures: Climate-related impacts may require significant, unplanned investments in resilience and adaptation measures.

- Operational Challenges: Water scarcity and infrastructure damage can lead to complex operational adjustments and potential service interruptions.

Intensifying competition from municipal entities, often benefiting from tax advantages and direct public funding, poses a challenge to American Water Works' market share and growth through acquisitions. The trend of municipalization, observed in 2023 with smaller systems being taken over by local governments, exemplifies this threat. These public providers can sometimes offer services at a lower price point, impacting American Water's ability to compete effectively and secure new service areas.

Public and political resistance to rate increases is a significant hurdle, potentially delaying revenue recovery needed for critical infrastructure investments. For instance, proposed rate adjustments in states like Pennsylvania, where American Water has substantial operations, often face public hearings and legislative review. This opposition can limit the company's ability to recoup its capital expenditures, such as the billions planned for 2024 and beyond, impacting financial performance.

Climate change presents substantial long-term threats, including water scarcity due to increased drought frequency, as seen in the Western United States, and infrastructure damage from extreme weather events like hurricanes and floods. These factors necessitate significant, unplanned investments in resilience and adaptation measures, potentially leading to complex operational adjustments and service interruptions.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from American Water Works' official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.