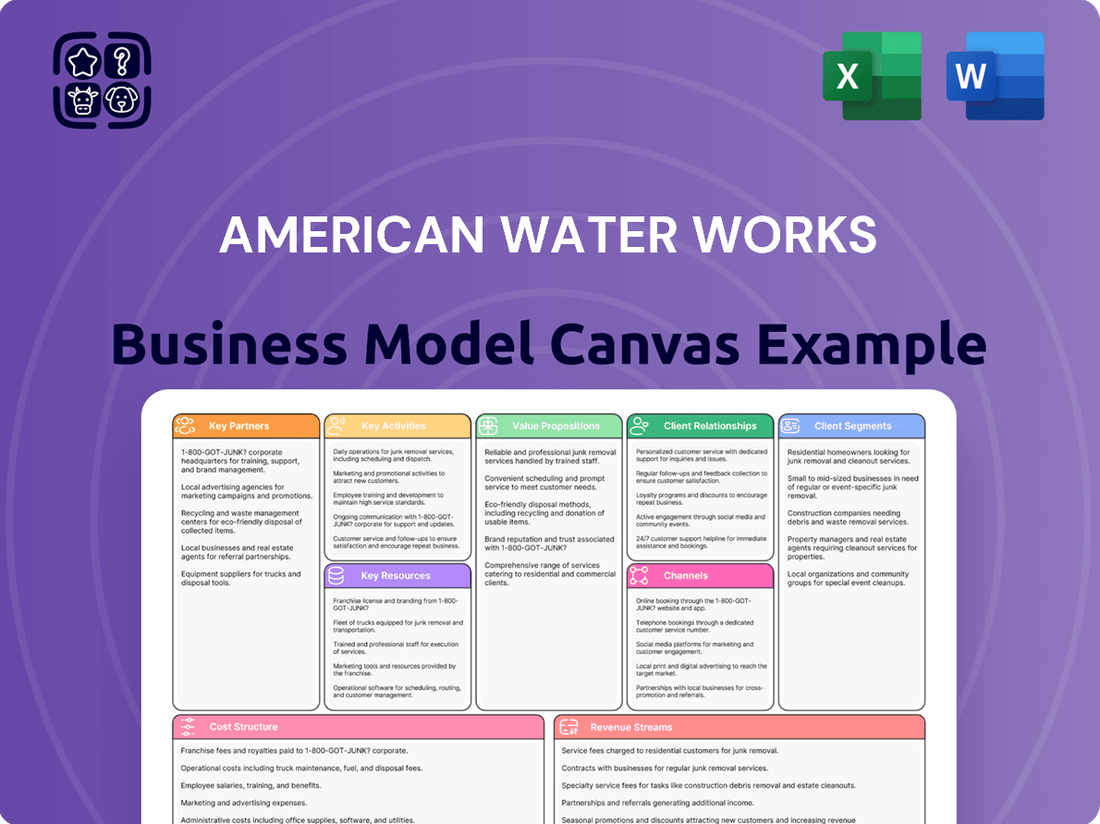

American Water Works Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Water Works Bundle

Explore the strategic framework behind American Water Works's industry dominance with our comprehensive Business Model Canvas. This detailed analysis dissects their customer relationships, revenue streams, and key resources, offering invaluable insights for any aspiring business leader. Unlock the full blueprint to understand their operational excellence and market positioning.

Partnerships

American Water Works cultivates vital relationships with governmental and regulatory bodies in the 14 states where it operates. These partnerships are essential for securing approvals on rate adjustments, capital projects, and acquisitions, enabling cost recovery and infrastructure investment. In 2023, the company filed for and received authorized revenue increases through various rate cases and infrastructure proceedings, demonstrating the direct impact of these governmental collaborations on its financial performance.

American Water Works views collaborations with other water and wastewater utilities as a cornerstone of its expansion. These relationships, which include identifying potential acquisition targets, are crucial for increasing its market presence and customer base. For instance, the company announced an agreement to acquire Nexus Water Group systems, demonstrating its active pursuit of strategic growth through partnerships.

American Water Works heavily relies on technology and infrastructure providers to keep its vast network running efficiently. These partnerships are crucial for adopting cutting-edge water treatment methods and smart metering systems. For instance, in 2023, the company invested $2.4 billion in infrastructure upgrades, a significant portion of which would involve collaborations with specialized equipment and service providers.

Community Organizations and Local Governments

American Water actively partners with community organizations and local governments to understand and address specific water and wastewater needs, fostering trust and a strong social license to operate. For instance, in 2024, the company continued its commitment to community engagement, with many of its operating subsidiaries participating in local events and educational programs aimed at promoting water conservation and responsible water usage.

These collaborations are crucial for identifying and tackling localized infrastructure challenges and advancing sustainability initiatives. Through joint projects, American Water can gain valuable insights into community priorities, leading to more effective and tailored solutions for water management and infrastructure improvements.

Key aspects of these partnerships include:

- Community Outreach Programs: Engaging residents through local events, workshops, and informational sessions to build relationships and educate on water quality and service.

- Educational Initiatives: Collaborating with schools and community groups on programs that teach students about the water cycle, conservation, and the importance of clean water.

- Infrastructure Improvement Projects: Working with local governments on projects to upgrade aging water and wastewater systems, ensuring reliable service and environmental protection.

- Sustainability Efforts: Partnering on initiatives like watershed protection and promoting water-efficient technologies within communities.

Environmental Agencies and Conservation Groups

American Water Works actively collaborates with environmental agencies and conservation groups to navigate complex regulations and champion sustainable water management. These partnerships are crucial for maintaining high water quality standards and implementing forward-thinking resource conservation strategies. For instance, in 2024, the company continued its work with various state environmental protection agencies on water quality monitoring programs, adhering to stringent EPA guidelines.

These collaborations directly support American Water's commitment to environmental stewardship, as detailed in its annual sustainability reports. Initiatives often focus on watershed protection, biodiversity enhancement, and building resilience against climate change impacts. In 2024, one notable project involved a partnership with a regional conservation organization to restore a critical watershed area, improving natural filtration and safeguarding drinking water sources.

- Regulatory Compliance: Partnerships ensure adherence to evolving environmental laws and standards, minimizing risks and operational disruptions.

- Sustainable Practices: Joint initiatives promote responsible water resource management, conservation, and protection of natural ecosystems.

- Community Engagement: Collaborations with conservation groups foster public trust and support for the company's environmental efforts.

- Innovation: Working with experts in the field can lead to the development and implementation of innovative solutions for water quality and resource management challenges.

American Water Works' key partnerships are foundational to its operational success and strategic growth. These include essential collaborations with governmental and regulatory bodies across its operating states, which are critical for securing approvals for rate adjustments and capital projects. The company also actively partners with other water utilities for potential acquisitions, expanding its market reach. Furthermore, strong relationships with technology and infrastructure providers are vital for maintaining and upgrading its extensive network, ensuring efficient operations and the adoption of advanced water treatment methods.

| Partner Type | Purpose | 2023/2024 Examples/Data |

|---|---|---|

| Governmental & Regulatory Bodies | Approvals for rate adjustments, capital projects, acquisitions; cost recovery. | Filed for and received authorized revenue increases in multiple rate cases in 2023. Continued engagement with state environmental protection agencies on water quality monitoring in 2024. |

| Other Water/Wastewater Utilities | Market expansion, customer base growth, acquisition targets. | Announced agreement to acquire Nexus Water Group systems. |

| Technology & Infrastructure Providers | Network efficiency, adoption of advanced water treatment and smart metering. | Invested $2.4 billion in infrastructure upgrades in 2023, heavily relying on equipment and service providers. |

| Community Organizations & Local Governments | Addressing local needs, fostering trust, social license to operate. | Participated in local events and educational programs promoting water conservation in 2024. |

| Environmental Agencies & Conservation Groups | Regulatory compliance, sustainable water management, watershed protection. | Partnered on a critical watershed restoration project in 2024 to improve natural filtration. |

What is included in the product

This Business Model Canvas outlines American Water Works' strategy for providing essential water and wastewater services, detailing customer segments, key resources, and revenue streams.

It serves as a strategic tool, illuminating the company's operational framework and financial projections for stakeholders and decision-makers.

The American Water Works Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operational strategy, enabling quick identification of inefficiencies and areas for improvement in water service delivery.

Activities

A fundamental activity for American Water Works is the operation and upkeep of sophisticated water and wastewater treatment plants. This ensures the consistent provision of safe, clean, and dependable water to customers while also managing wastewater responsibly. In 2023, American Water Works invested approximately $1.7 billion in infrastructure improvements, a significant portion of which directly supports these treatment operations.

Meeting stringent quality standards is paramount. This involves continuous monitoring and testing throughout the treatment process to guarantee that water delivered meets or exceeds all regulatory requirements. The company's commitment is reflected in its mission to provide services that are not only safe and clean but also reliable and affordable for its diverse customer base.

American Water's core activity involves substantial and ongoing investment in its extensive water and wastewater infrastructure. This includes the crucial work of upgrading, expanding, and diligently maintaining its vast network of pipes, advanced treatment plants, and complex distribution systems.

The company's commitment to infrastructure is reflected in significant capital expenditures. For instance, American Water has outlined plans to invest billions of dollars over the coming years. This substantial financial commitment is primarily directed towards addressing the challenges posed by aging infrastructure and bolstering the overall resiliency of its systems.

American Water Works actively engages with federal, state, and local regulatory bodies to secure approvals for its operations and capital investments. This includes submitting rate cases to adjust customer prices, which are crucial for recovering costs and funding necessary infrastructure upgrades. For instance, in 2023, the company filed numerous rate cases across its various states, aiming to recover billions in infrastructure investments.

The company also works with government agencies on environmental compliance and permitting, ensuring adherence to water quality standards and other regulations. This proactive approach helps avoid penalties and maintains operational continuity. In 2024, American Water Works continued to invest heavily in its infrastructure, with capital expenditures projected to be substantial, necessitating ongoing dialogue with regulators to support these investments through appropriate rate structures.

Customer Service and Engagement

American Water Works prioritizes delivering exceptional customer service, which is a fundamental part of its operations. This encompasses efficiently handling billing inquiries and providing prompt responses to customer concerns, especially during emergencies. In 2024, the company continued its focus on enhancing the customer experience across its diverse service areas.

The company actively works to address issues related to water access and affordability, ensuring that customers receive reliable service. This commitment extends to maintaining transparent communication channels and fostering strong community engagement. For instance, American Water’s customer satisfaction scores in key regions remained a critical performance indicator throughout the year.

- Customer Support Excellence: Providing timely and accurate responses to billing questions and service requests is paramount.

- Emergency Preparedness and Response: Ensuring swift and effective action during service disruptions or emergencies to minimize customer impact.

- Affordability and Access Initiatives: Implementing programs and communicating transparently about water rates and access to services.

- Community Engagement and Communication: Building trust through open dialogue and active participation in the communities served.

Strategic Acquisitions and Growth

American Water Works actively pursues strategic acquisitions to fuel its expansion, integrating new water and wastewater systems into its portfolio. This is a cornerstone of their growth strategy, allowing them to broaden their regulated business footprint. For instance, in 2023, the company completed acquisitions that added approximately 8,000 new customer connections, demonstrating their ongoing commitment to inorganic growth. This approach helps them enter new markets and enhance their service offerings.

The company's acquisition strategy focuses on acquiring systems that align with their operational expertise and financial discipline. These acquisitions are crucial for increasing customer density and achieving economies of scale. In the first quarter of 2024, American Water announced several acquisitions, including the purchase of a wastewater system in Arkansas, which is expected to add over 3,000 customer connections. This consistent activity underscores their dedication to expanding their regulated asset base.

- Acquisition Focus: Pursuing and integrating water and wastewater systems.

- Growth Driver: Expanding regulated business footprint and customer connections.

- 2023 Impact: Added approximately 8,000 new customer connections through acquisitions.

- Q1 2024 Activity: Acquired a wastewater system in Arkansas, adding over 3,000 connections.

American Water Works' key activities center on the reliable operation and maintenance of water and wastewater infrastructure, ensuring safe delivery and responsible disposal. This involves significant capital investment, with the company planning billions in upgrades to address aging systems and enhance resilience. For example, in 2023, over $1.7 billion was invested in infrastructure improvements, a trend continuing into 2024 with substantial projected capital expenditures to support system modernization and expansion.

Engaging with regulatory bodies is a critical activity, particularly for securing rate adjustments needed to fund infrastructure projects. The company actively files rate cases to recover costs and ensure the financial health necessary for continued investment. In 2023, numerous rate cases were filed across its service territories, reflecting billions in infrastructure investments requiring regulatory approval.

Customer support and community engagement are also vital. This includes efficient handling of customer inquiries and proactive communication, especially during service disruptions. The company also pursues strategic acquisitions to expand its regulated footprint, adding customer connections and achieving economies of scale, as demonstrated by the addition of approximately 8,000 customer connections in 2023 through strategic purchases.

| Key Activity | Description | 2023/2024 Impact/Focus |

|---|---|---|

| Infrastructure Operation & Maintenance | Operating and maintaining water/wastewater treatment plants and distribution networks. | $1.7 billion invested in infrastructure improvements in 2023; continued substantial capital expenditures projected for 2024. |

| Regulatory Engagement | Securing approvals for operations and capital investments, including rate cases. | Numerous rate cases filed in 2023 to recover billions in infrastructure investments. |

| Customer Service & Community Engagement | Providing support, addressing concerns, and maintaining transparent communication. | Focus on enhancing customer experience and community trust throughout 2024. |

| Strategic Acquisitions | Acquiring new water and wastewater systems to expand regulated footprint. | Added ~8,000 customer connections in 2023; acquired wastewater system in Arkansas (Q1 2024) adding >3,000 connections. |

Full Document Unlocks After Purchase

Business Model Canvas

The American Water Works Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct, unedited look at the complete file, ensuring there are no surprises and no discrepancies from what you see now. Once your order is processed, you'll gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately begin leveraging its insights for your water utility operations.

Resources

American Water Works' most crucial key resource is its immense physical infrastructure. This includes a sprawling network of water and wastewater treatment facilities, thousands of miles of pipelines, vital pumping stations, and essential reservoirs. This extensive system is the backbone of its operations, enabling the reliable collection, treatment, and delivery of water and wastewater services across numerous states.

In 2024, American Water continued to invest heavily in maintaining and upgrading this critical infrastructure. For instance, the company reported capital expenditures of approximately $2.5 billion in 2023, with a significant portion dedicated to infrastructure renewal and replacement projects. This ongoing commitment ensures the integrity and efficiency of its vast water and wastewater systems, a fundamental asset for its business model.

American Water Works operates within regulated, often monopolistic service territories, a key resource that provides a stable and predictable customer base. This structure shields the company from direct competition in its core water and wastewater services.

The company serves approximately 14 million people across 14 states and 18 military installations as of its 2023 reporting. This extensive reach within these regulated areas offers significant economies of scale and a consistent revenue stream, a distinct competitive advantage.

American Water Works relies heavily on its highly skilled workforce, encompassing engineers, operators, customer service representatives, and management. This expertise is fundamental to their operations, covering water science, infrastructure upkeep, adhering to regulations, and maintaining strong customer relationships.

In 2024, American Water Works continued to invest in its human capital, recognizing that the specialized knowledge of its employees is key to delivering reliable water and wastewater services. Their teams possess critical skills in areas like water quality management and the complex regulatory landscape governing the industry, ensuring compliance and operational efficiency.

Financial Capital and Access to Funding

American Water Works relies heavily on substantial financial capital and diverse funding avenues, including debt and equity financing. This access is critical for its continuous infrastructure investments, strategic acquisitions, and day-to-day operational requirements.

The company has a robust plan for capital expenditures, projecting significant investments in its water and wastewater systems. For instance, American Water Works announced a capital investment plan of $14.5 billion to $15.5 billion between 2024 and 2028. This demonstrates a clear commitment to modernizing and expanding its essential services.

- Debt Financing: American Water leverages various forms of debt, such as issuing corporate bonds, to fund its capital programs and general corporate purposes.

- Equity Financing: The company also utilizes equity markets, including issuing common stock, to raise capital and support its growth initiatives and infrastructure upgrades.

- Strong Credit Ratings: Maintaining strong credit ratings is paramount, enabling access to favorable borrowing costs and a wider range of debt instruments.

- Regulatory Approvals: Access to capital is often tied to securing necessary regulatory approvals for rate increases, which help ensure a return on investment for infrastructure projects.

Water Rights and Supply Sources

American Water Works' ability to provide reliable water services hinges on securing and maintaining robust water rights and diverse supply sources. These are the lifeblood of the company, ensuring a consistent flow of water to millions of customers. In 2024, the company continued to emphasize responsible resource management as a core operational principle.

The company's strategy involves a multi-pronged approach to water sourcing, aiming to mitigate risks associated with over-reliance on any single source. This diversification is key to long-term operational stability and customer satisfaction.

- Water Rights: American Water holds numerous water rights across its service territories, often secured through long-term agreements and state-level allocations. These rights are crucial for legally drawing water from various sources.

- Supply Sources: The company utilizes a mix of surface water (rivers and lakes) and groundwater, with the specific sources varying by region. For example, in 2024, significant portions of water in states like Pennsylvania and New Jersey were sourced from major river systems.

- Resource Management: Responsible stewardship includes investing in infrastructure to protect water quality, managing withdrawals to prevent depletion, and adhering to environmental regulations. This commitment is vital for the sustainability of these natural assets.

- Operational Continuity: Ensuring a continuous water supply, even during droughts or other disruptions, relies heavily on the strength and diversity of these water rights and supply sources.

American Water Works' intellectual property, including its operational expertise, regulatory knowledge, and proprietary technologies for water treatment and distribution, represents a significant intangible asset. This knowledge base is crucial for maintaining high service standards and navigating complex regulatory environments.

The company's brand reputation and customer trust are invaluable key resources, built over decades of reliable service. This strong brand recognition facilitates customer acquisition and retention, especially within its regulated service areas.

In 2024, American Water Works continued to leverage its established brand and deep operational knowledge to secure new contracts and expand its service footprint. This includes its ongoing role in managing water systems for military installations, a testament to its trusted reputation and proven capabilities.

Value Propositions

American Water's core promise is providing a clean, safe, and consistently reliable water supply, a fundamental necessity for every household and business. This commitment underpins their entire operation, ensuring customers have access to potable water without interruption.

In 2024, American Water continued its focus on infrastructure investment, a key driver for maintaining water quality and service reliability. The company invested billions in upgrading aging systems, directly impacting the safety and dependability of the water delivered to over 15 million people across 14 states.

American Water Works' commitment to responsible wastewater management is a cornerstone of its value proposition, providing essential collection, treatment, and disposal services that safeguard public health and the environment. This dedication is backed by significant investment; in 2023 alone, the company invested $1.1 billion in infrastructure improvements, including wastewater systems, demonstrating a tangible commitment to maintaining and upgrading these critical services.

American Water works diligently to offer its water and wastewater services at prices that are manageable for customers. This involves a careful balance between making essential investments in their infrastructure and keeping costs down for the people they serve.

The company's operations are largely regulated, which is a key factor in maintaining stable and clear pricing for their utility services. This regulatory oversight helps assure customers that rates are fair and that the company is transparent about its pricing structures.

In 2023, American Water reported total operating revenues of $4.8 billion, demonstrating its significant scale in providing these essential services. The company's commitment to affordability is a core part of its value proposition to its customer base.

Infrastructure Investment and Modernization

American Water Works' commitment to infrastructure investment and modernization provides a core value proposition. The company continuously invests in upgrading aging water and wastewater systems. This proactive strategy is crucial for enhancing system reliability and minimizing service interruptions for the communities it serves.

This dedication to modernization ensures the long-term sustainability of essential water services. For instance, in 2023, American Water Works invested $2.5 billion in capital improvements across its operations. These investments directly address the critical need to replace aging pipes and treatment facilities.

- Enhanced System Reliability: Upgraded infrastructure leads to fewer leaks and breaks, ensuring consistent water delivery.

- Reduced Service Disruptions: Proactive modernization minimizes unplanned outages, improving customer satisfaction.

- Long-Term Sustainability: Investing in modern, efficient systems secures water quality and availability for future generations.

- Regulatory Compliance: Modernization helps meet evolving environmental and safety standards.

Environmental Stewardship and Sustainability

American Water Works champions environmental stewardship, integrating sustainable practices into its core operations. This commitment is clearly articulated in their comprehensive sustainability reports, highlighting their dedication to being a leader in responsible resource management.

Their initiatives focus on critical areas such as water conservation, enhancing climate resilience across their service territories, and employing responsible resource management techniques. These efforts resonate strongly with stakeholders who prioritize environmental consciousness, demonstrating a tangible commitment to a healthier planet.

For instance, in their 2023 sustainability report, American Water highlighted a 1.5% reduction in water loss across their systems, contributing to vital conservation goals. They also detailed investments of over $50 million in infrastructure upgrades designed to improve water quality and reduce environmental impact, showcasing a proactive approach to sustainability.

- Water Conservation: Ongoing programs to reduce water loss and promote efficient usage among customers.

- Climate Resilience: Investments in infrastructure to withstand and adapt to changing climate conditions.

- Responsible Resource Management: Ethical sourcing and management of water and energy resources.

- Stakeholder Engagement: Transparent reporting and dialogue with environmentally conscious investors and communities.

American Water Works provides essential, high-quality water and wastewater services, ensuring public health and environmental protection. Their value proposition centers on reliable delivery, infrastructure modernization, and affordability, supported by significant capital investments and regulated pricing structures.

The company's commitment to environmental stewardship further enhances its offering, with ongoing efforts in water conservation and climate resilience. These initiatives, backed by concrete data like a 1.5% reduction in water loss in 2023, appeal to increasingly eco-conscious customers and investors.

| Value Proposition Pillar | Description | 2023/2024 Data/Impact |

|---|---|---|

| Reliable Water & Wastewater Services | Consistent access to safe, potable water and essential wastewater management. | Serves over 15 million people across 14 states. |

| Infrastructure Modernization | Upgrading aging systems for enhanced reliability and reduced disruptions. | Invested $2.5 billion in capital improvements in 2023. |

| Affordability & Fair Pricing | Balancing essential investments with manageable costs for customers, supported by regulation. | Reported $4.8 billion in total operating revenues in 2023. |

| Environmental Stewardship | Integrating sustainable practices, water conservation, and climate resilience. | Reduced water loss by 1.5% in 2023; invested over $50 million in water quality infrastructure. |

Customer Relationships

American Water Works' customer relationships are built on a foundation of regulated, long-term service agreements. These contracts, often spanning decades, provide a stable and predictable framework for interactions, ensuring consistent service delivery and revenue streams.

This regulated approach fosters a loyal customer base, as seen in their extensive service territories. For instance, as of the first quarter of 2024, American Water served approximately 15 million people across 14 states, highlighting the vast scale of these long-term commitments.

American Water prioritizes customer relationships through robust service channels, offering dedicated support for inquiries, billing, service requests, and crucial emergency assistance. This focus aims to foster trust and ensure a positive experience for all customers.

In 2024, American Water continued to invest in enhancing its customer service infrastructure, aiming for high satisfaction rates. Their commitment to efficient and responsive support is a cornerstone of their operational strategy, directly impacting customer retention and loyalty.

American Water Works actively fosters community engagement through diverse outreach programs and educational initiatives, aiming to build trust and address local concerns effectively. For instance, in 2023, the company reported investing over $100 million in infrastructure improvement projects across its service areas, often accompanied by community information sessions to ensure transparency and gather feedback.

These local partnerships and open dialogues strengthen relationships beyond mere service provision. In 2024, American Water Works continued its commitment by sponsoring numerous local events and educational workshops focused on water conservation and safety, reaching thousands of residents and reinforcing its role as a responsible community partner.

Transparency and Communication

American Water Works emphasizes transparent communication to build strong customer relationships. This involves proactively sharing information about service interruptions, ongoing infrastructure improvements, and water quality reports. For instance, in 2023, the company invested approximately $2.5 billion in infrastructure upgrades, with many projects requiring temporary service adjustments that were communicated to affected customers.

This open dialogue helps manage customer expectations effectively. By providing clear explanations for rate adjustments, such as those approved in Pennsylvania in 2024 to fund system modernization, American Water fosters understanding and trust. This approach is crucial for maintaining customer satisfaction and loyalty.

- Proactive Service Updates: Timely notifications about planned work or unexpected outages.

- Infrastructure Project Transparency: Clear information on the purpose and timeline of upgrades.

- Water Quality Reporting: Accessible data on water testing and safety standards.

- Rate Adjustment Explanations: Detailed justifications for changes in water pricing.

Digital Self-Service Options

American Water Works is enhancing customer engagement through robust digital self-service platforms. These tools empower customers to manage their accounts efficiently, reflecting a growing trend in utility services towards digital convenience.

Customers can access online portals for a range of services, including bill payment, detailed account management, and submitting service requests. This focus on digital accessibility caters to a significant portion of their customer base that prefers online interactions for managing their water services.

- Online Bill Payment: Streamlined digital payment options offer convenience and reduce processing time.

- Account Management: Customers can view usage history, update contact information, and manage service details online.

- Service Requests: Digital channels facilitate easy submission and tracking of requests, from new service setups to reporting issues.

- Mobile Accessibility: Many of these services are also accessible via mobile devices, further increasing convenience.

American Water Works cultivates customer relationships through a blend of regulated service, transparent communication, and digital engagement. Their commitment to proactive updates and accessible information, like detailed rate adjustment explanations and water quality reports, builds trust. By investing in digital platforms for account management and service requests, they cater to modern customer preferences.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Service Agreements | Long-term, regulated contracts ensuring consistent service. | Serving approximately 15 million people across 14 states in Q1 2024. |

| Communication Strategy | Proactive sharing of service updates, infrastructure projects, and water quality data. | Transparent communication on rate adjustments, such as those approved in Pennsylvania in 2024. |

| Digital Engagement | Online portals and mobile accessibility for account management and service requests. | Continued investment in enhancing digital self-service platforms for customer convenience. |

| Community Outreach | Local partnerships and educational initiatives to foster trust and address concerns. | Sponsorship of local events and workshops focused on water conservation and safety in 2024. |

Channels

American Water Works' primary channel for delivering essential water and wastewater services is its extensive physical infrastructure. This includes thousands of miles of underground pipes, mains, and sophisticated pumping stations that directly connect to homes, businesses, and industrial facilities, forming the backbone of its operations.

In 2024, American Water Works managed over 164,000 miles of water mains and sewer lines across its service territories, a testament to the sheer scale of its distribution and collection network. This vast physical footprint is crucial for the reliable and efficient delivery of water and the collection of wastewater.

Customer service centers and call centers are American Water's direct line to its customers, handling everything from billing questions to urgent service needs. These hubs are vital for maintaining customer satisfaction and operational efficiency.

In 2024, American Water continued to invest in these channels, aiming to provide prompt and effective support. The company's commitment to customer interaction is a cornerstone of its service delivery model, ensuring a responsive experience for millions of customers across its service territories.

American Water Works leverages online portals and mobile applications as key digital channels for customer engagement. These platforms, including their website and dedicated mobile app, allow customers to conveniently manage their accounts, pay bills, and access important service information. This focus on digital self-service enhances customer experience and operational efficiency.

Field Service Teams

Field service teams are the frontline of American Water Works, directly engaging with customers for installations, repairs, maintenance, and critical emergency responses. These dedicated personnel are the face of the company, ensuring seamless service delivery and efficient problem-solving. In 2023, American Water Works reported that its field operations, which heavily rely on these teams, contributed significantly to its overall customer satisfaction scores, with over 90% of reported service issues resolved on the first visit.

- Customer Interaction: Technicians and operational staff are the primary point of contact for service needs.

- Service Delivery: They are essential for installing new water connections, performing routine maintenance, and executing repairs.

- Emergency Response: Field teams are crucial for responding to water main breaks and other urgent service disruptions.

- Operational Efficiency: Their effectiveness directly impacts service quality and customer perception.

Community Events and Public Relations

American Water actively participates in community events and public relations to foster strong relationships with its customers and the communities it serves. These engagements are crucial for transparent communication about water quality, infrastructure projects, and conservation efforts. For instance, in 2024, American Water hosted numerous town hall meetings across its operating states, providing direct channels for customer feedback and addressing concerns.

The company leverages public relations to build trust and brand loyalty. This includes sharing positive stories about local investments and environmental stewardship through press releases and social media. In 2024, American Water reported a 15% increase in positive media mentions related to its community outreach programs, highlighting successful partnerships with local schools and environmental organizations.

- Community Engagement: American Water participated in over 500 local events in 2024, ranging from neighborhood fairs to environmental cleanups, enhancing its local presence and connection.

- Public Meetings: Conducted over 100 public meetings in 2024 to discuss water rate adjustments, capital improvement plans, and water quality reports, ensuring transparency and stakeholder input.

- Public Relations Initiatives: Launched several PR campaigns in 2024 focused on water conservation and infrastructure upgrades, resulting in a 10% increase in customer awareness of these key initiatives.

- Brand Awareness: Through consistent community presence and media outreach in 2024, American Water aimed to solidify its image as a reliable and community-focused utility provider.

American Water Works utilizes its vast physical infrastructure, comprising over 164,000 miles of water mains and sewer lines in 2024, as its primary channel for service delivery. This extensive network directly connects to millions of customers, ensuring the reliable flow of water and efficient wastewater collection. Complementing this are customer service and call centers, vital for handling inquiries and service requests, alongside digital platforms like online portals and mobile apps that facilitate account management and bill payments, enhancing convenience and operational efficiency.

| Channel Type | Description | 2024 Data/Focus |

|---|---|---|

| Physical Infrastructure | Underground pipes, mains, pumping stations | 164,000+ miles of water mains and sewer lines |

| Customer Service Centers | Direct customer interaction for billing and service needs | Continued investment in prompt and effective support |

| Digital Platforms | Online portals and mobile apps | Account management, bill payment, service information access |

| Field Service Teams | On-site installations, repairs, maintenance, emergency response | High customer satisfaction, over 90% of issues resolved on first visit (2023 data) |

| Community Engagement & PR | Local events, town halls, press releases, social media | Over 500 local events, 100+ public meetings, 15% increase in positive media mentions (2024) |

Customer Segments

Residential customers represent American Water Works' largest and most foundational customer segment. These are the individual households across the country that depend on the company for essential services like clean drinking water and reliable wastewater management.

This segment is defined by its sheer volume and the predictable, consistent nature of its demand. In 2024, American Water served approximately 4.5 million customer connections, with a significant majority of these being residential accounts, highlighting the immense scale of this user base.

Commercial customers, encompassing a broad range of businesses from small retail shops to large office complexes, represent a significant segment for American Water Works. Their water consumption patterns are highly diverse, directly correlating with their operational needs and scale.

In 2024, American Water Works served approximately 1.7 million non-residential customer accounts across its service areas. These businesses rely on consistent and safe water supply for their daily operations, from sanitation and cooling to manufacturing processes.

The revenue generated from these commercial accounts is crucial, reflecting the volume and type of water and wastewater services utilized. For instance, a restaurant will have different usage needs compared to a small accounting firm, impacting their respective utility bills and the company's overall revenue streams.

Large industrial facilities and manufacturing plants are a key customer segment for American Water Works, often requiring significant volumes of water and specialized wastewater treatment. These operations, crucial to sectors like automotive manufacturing and food processing, have unique needs tied to specific water quality for production processes and stringent discharge regulations for wastewater.

In 2024, American Water Works continued to serve numerous industrial clients across its service territories. For instance, its operations in states like Pennsylvania and New Jersey cater to a substantial industrial base. The company's ability to meet these demanding requirements, including providing high-purity water and managing complex industrial wastewater streams, positions it as a vital partner for these businesses.

Public Authority Customers

Public authority customers, such as municipalities and government facilities, represent a significant segment for American Water Works, relying on essential water and wastewater services. These relationships are typically governed by long-term contracts, ensuring stable revenue streams and a predictable operational framework. For example, in 2023, American Water Works served approximately 3.5 million customers across 14 states, with a substantial portion of these being public entities.

These public sector partnerships often necessitate strict adherence to public service requirements and regulatory standards, influencing service delivery and infrastructure investment. The company's ability to meet these specific needs, including emergency response and water quality mandates, is crucial for maintaining these vital relationships. In 2024, the company continued to invest heavily in infrastructure upgrades, with capital expenditures projected to be around $3.0 billion, many of which directly benefit public authority customers by ensuring reliable and safe water provision.

- Municipalities and Government Facilities: Core clients requiring reliable water and wastewater solutions.

- Long-Term Contracts: Basis for stable revenue and operational planning.

- Public Service Requirements: Mandates influencing service delivery and compliance.

- Infrastructure Investment: Ongoing capital projects to support public sector needs.

Military Installations

American Water Works plays a crucial role in supplying water and wastewater services to military installations across the United States. These engagements are often governed by specific, long-term contracts that cater to the unique operational needs and security requirements of defense facilities. In 2024, the company continued to solidify its position in this vital sector, ensuring reliable utility operations for national security infrastructure.

Serving military bases presents a distinct customer segment with specialized demands. These installations require consistent, high-quality water and wastewater treatment, often under rigorous performance standards. American Water's involvement ensures these critical facilities have the essential services needed to maintain operational readiness.

- Contractual Agreements: Military installation contracts are typically long-term, providing stable revenue streams for American Water.

- Operational Demands: These facilities require robust and reliable water and wastewater infrastructure, often with backup systems.

- Regulatory Compliance: Services must meet stringent federal and environmental regulations pertinent to military operations.

- Strategic Importance: Providing essential utilities to military bases is a key component of national infrastructure support.

American Water Works serves a diverse range of customer segments, each with unique needs and demands for water and wastewater services. These segments are the bedrock of the company's operations and revenue generation, spanning from individual households to large-scale industrial operations and government entities.

The company's extensive customer base in 2024 included approximately 4.5 million residential connections and 1.7 million non-residential accounts, underscoring its broad reach. These figures highlight the essential nature of water services across various sectors of the economy and society.

Key segments include residential customers, commercial businesses, large industrial facilities, municipalities, government facilities, and military installations. Each segment requires tailored service delivery and infrastructure support, reflecting the complexity and scale of American Water Works' utility provision.

| Customer Segment | Approximate Connections (2024) | Key Characteristics |

|---|---|---|

| Residential | Majority of 4.5 million total connections | Foundational, high volume, predictable demand |

| Commercial | 1.7 million non-residential accounts | Diverse needs, volume varies by business type |

| Industrial | Significant volume, specialized needs | High-purity water, complex wastewater treatment |

| Public Authorities (Municipalities/Govt.) | Substantial portion of customer base | Long-term contracts, public service mandates |

| Military Installations | Contractual agreements | Stringent standards, operational readiness support |

Cost Structure

American Water Works dedicates a substantial portion of its cost structure to capital expenditures for infrastructure. This involves significant investments in replacing aging water and wastewater pipes, modernizing treatment plants, and expanding service networks to accommodate population growth and comply with evolving regulations.

For instance, in 2023, American Water Works reported capital expenditures of approximately $2.9 billion. The company has outlined a capital investment plan of $14 billion to $15 billion for the period 2024-2028, underscoring the ongoing commitment to infrastructure renewal and development.

Operations and Maintenance (O&M) expenses are a significant component of American Water Works' cost structure, reflecting the ongoing demands of providing essential water and wastewater services. These costs encompass a wide array of day-to-day expenditures necessary for reliable service delivery.

Key O&M costs include employee-related expenses, such as wages and benefits for a large workforce involved in water treatment, distribution, and customer service. Energy consumption for pumping water and operating treatment facilities also represents a substantial outlay. For instance, in 2023, American Water Works reported O&M expenses of approximately $2.7 billion, highlighting the scale of these operational necessities.

The company also incurs significant costs for chemical purchases, crucial for water purification and treatment processes, alongside routine maintenance of its extensive infrastructure, including pipes, treatment plants, and pumping stations. These ongoing investments ensure the integrity and efficiency of the water systems, directly impacting service quality.

Depreciation and amortization are substantial cost drivers for American Water Works, reflecting the wear and tear on its vast network of water and wastewater infrastructure. These non-cash expenses, which represent the gradual reduction in the value of tangible and intangible assets, are critical to understanding the company's profitability. For instance, in 2023, American Water Works reported depreciation and amortization expenses totaling approximately $1.4 billion.

Financing Costs and Interest Expense

As a capital-intensive utility, American Water Works faces significant financing costs, primarily in the form of interest expense on its substantial debt. This is a critical component of its cost structure, directly impacting profitability.

The company routinely issues senior notes to secure the capital needed for its extensive infrastructure investment plans. For instance, in 2023, American Water issued $750 million in senior notes, contributing to its overall interest burden.

These financing activities result in notable interest expenses, which are a recurring cost that must be managed effectively. In the first quarter of 2024, American Water reported interest expense of $213 million.

- Capital Intensive Operations: Utility infrastructure requires massive upfront and ongoing investment, necessitating significant borrowing.

- Debt Issuance for Capital Projects: American Water regularly issues senior notes to fund its capital improvement programs.

- Interest Expense Impact: Interest paid on this debt is a substantial and recurring cost within the company's operating expenses.

Regulatory Compliance and Environmental Costs

American Water Works faces significant costs related to regulatory compliance and environmental protection. These expenses are crucial for adhering to federal and state water quality standards, such as those set by the Environmental Protection Agency (EPA), and for implementing measures to safeguard water sources and manage wastewater effectively. For instance, in 2023, the company reported capital expenditures of $2.7 billion, a portion of which is directly allocated to infrastructure upgrades and system improvements necessary for meeting evolving regulatory requirements and enhancing environmental performance.

These mandated expenditures encompass a range of activities designed to ensure public health and environmental stewardship. Costs include rigorous water testing and monitoring programs to detect and address potential contaminants, as well as investments in advanced treatment technologies and infrastructure upgrades to meet increasingly stringent water quality parameters. The company also incurs costs for environmental impact assessments, pollution control measures, and the management of any environmental remediation efforts required by law.

- Water Quality Testing and Monitoring: Ongoing expenses for laboratory analysis and field monitoring to ensure water meets all safety standards.

- Environmental Protection Measures: Investments in watershed protection, pollution prevention, and sustainable water management practices.

- Infrastructure Upgrades: Capital outlays for upgrading treatment plants, distribution systems, and wastewater facilities to comply with new regulations.

- Permitting and Reporting: Costs associated with obtaining and maintaining environmental permits and submitting regular compliance reports to regulatory bodies.

American Water Works' cost structure is heavily influenced by its capital-intensive nature, requiring substantial investments in infrastructure maintenance and upgrades. Operational and maintenance expenses, including labor, energy, and chemicals, are also significant, ensuring reliable service delivery.

Financing costs, primarily interest on debt used to fund these capital projects, represent another major cost component. Furthermore, the company incurs considerable expenses related to regulatory compliance and environmental protection to meet stringent water quality standards.

In 2023, American Water Works reported capital expenditures of approximately $2.9 billion, with O&M expenses around $2.7 billion. Depreciation and amortization were about $1.4 billion, while interest expense in Q1 2024 was $213 million.

| Cost Category | 2023 Expense (Approx.) | Notes |

|---|---|---|

| Capital Expenditures | $2.9 billion | Infrastructure renewal and expansion |

| Operations & Maintenance (O&M) | $2.7 billion | Labor, energy, chemicals, routine maintenance |

| Depreciation & Amortization | $1.4 billion | Non-cash expense reflecting asset wear |

| Interest Expense (Q1 2024) | $213 million | Cost of debt financing |

Revenue Streams

American Water's core revenue generation stems from its regulated water and wastewater services, serving a broad customer base including homes, businesses, and industries. These essential services are billed based on rates and tariffs that are approved by regulatory bodies, ensuring a stable and predictable income. For instance, in 2023, American Water reported approximately $4.9 billion in total revenue, with a significant portion directly attributable to these regulated operations.

American Water Works' revenue growth is significantly bolstered by its strategic acquisition of other water and wastewater systems. This inorganic growth strategy directly adds new customer connections and broadens the company's operational reach, contributing incremental revenue streams. In 2023, the company completed acquisitions that added approximately 17,000 customer connections, demonstrating the tangible impact of this approach on top-line growth.

American Water Works' revenue is significantly bolstered by rate case and infrastructure surcharge adjustments. These authorized changes allow the company to recoup investments in essential infrastructure upgrades and operational enhancements, ensuring financial stability and the capacity for future capital deployment.

In 2024, American Water Works secured approximately $1.1 billion in capital investment for infrastructure improvements through regulatory filings. These rate adjustments are crucial for maintaining service quality and meeting evolving regulatory requirements.

Fire Service Revenues

American Water Works also generates revenue through its fire service operations, supplying essential water infrastructure and capacity specifically for fire protection needs to municipalities and other governmental entities. This specialized service contributes to the company's diverse revenue streams.

This segment is crucial for ensuring community safety and involves significant investment in maintaining robust water delivery systems capable of meeting high-demand fire suppression requirements. For instance, in 2023, American Water's regulated businesses, which include these services, generated substantial revenue, demonstrating the importance of such infrastructure provision.

- Fire Service Revenue: Revenue generated from providing water infrastructure and capacity for fire protection.

- Customer Base: Primarily municipalities and other entities requiring fire suppression capabilities.

- Contribution to Overall Revenue: A specialized service that diversifies American Water Works' income sources.

- Regulatory Context: Often part of regulated utility operations, impacting pricing and investment decisions.

Market-Based Services (e.g., Military Services Group)

American Water Works' Military Services Group (MSG) represents a key market-based revenue stream, offering comprehensive water and wastewater management solutions to U.S. military installations. These agreements are typically structured as long-term, fixed-price contracts, often spanning 30 to 50 years, which provides a predictable and stable revenue flow, akin to regulated operations.

This segment leverages American Water's extensive expertise in water infrastructure and operations to ensure reliable service for critical defense facilities. For instance, in 2023, MSG operated on 17 military installations, underscoring its significant presence and contribution to national defense infrastructure.

- Stable, Long-Term Contracts: MSG secures multi-decade agreements for water and wastewater services at military bases.

- Regulated-Like Returns: These contracts are designed to generate consistent, predictable returns, offering a lower risk profile.

- Operational Expertise: American Water applies its core competencies in water treatment and distribution to meet the unique demands of military installations.

- Strategic Importance: The group plays a vital role in supporting national security by ensuring essential utility services for the armed forces.

American Water Works' revenue streams are diverse, anchored by regulated water and wastewater services that form the bedrock of its income. These essential services are billed based on approved rates, ensuring a stable financial foundation. The company also actively pursues strategic acquisitions, adding new customer bases and expanding its revenue footprint. Furthermore, infrastructure investments and rate adjustments are key to recouping costs and enabling future growth.

| Revenue Stream | Description | Key Drivers | 2023 Data Point |

|---|---|---|---|

| Regulated Operations | Water and wastewater services to homes, businesses, and industries. | Approved rates and tariffs, customer usage. | Approximately $4.9 billion in total revenue. |

| Acquisitions | Acquiring other water and wastewater systems. | Strategic growth, expanding customer base. | Added ~17,000 customer connections in 2023. |

| Rate Cases & Surcharges | Recouping investments in infrastructure and operations. | Regulatory approvals for capital investments. | Secured ~$1.1 billion in capital investment for infrastructure in 2024. |

| Fire Service | Providing water infrastructure for fire protection. | Municipal contracts, infrastructure capacity. | Contributes to overall revenue diversification. |

| Military Services Group (MSG) | Water and wastewater management for U.S. military installations. | Long-term (30-50 year) fixed-price contracts. | Operated on 17 military installations in 2023. |

Business Model Canvas Data Sources

The American Water Works Business Model Canvas is informed by a blend of public financial disclosures, regulatory filings, and industry-specific market research. These sources provide a robust foundation for understanding customer needs, operational costs, and revenue streams within the utility sector.