American Water Works Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Water Works Bundle

Curious about American Water Works' strategic positioning? This glimpse into their BCG Matrix reveals the potential of their offerings, highlighting which are poised for growth and which may require a closer look. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to drive your own strategic decisions.

Stars

American Water Works Company's regulated water and wastewater services are a definite Star in the BCG Matrix. This segment is the bedrock of their operations, benefiting from consistent demand and significant investment needs across the country.

As the largest publicly traded utility in the U.S., American Water Works commands a substantial market share in these essential services. The company reported approximately $4.7 billion in revenue for the fiscal year 2023, with a significant portion derived from these regulated operations, underscoring their Star status.

The ongoing necessity for infrastructure upgrades and expansion within the water and wastewater sector provides a strong tailwind for continued growth. This consistent demand, coupled with their dominant market position, solidifies the Star classification for these core services.

American Water Works consistently pursues strategic acquisitions of smaller, often aging, water and wastewater systems. This approach is a primary engine for customer expansion and strengthens their regulated rate base.

These acquisitions are crucial for transforming underperforming assets into areas with significant growth potential, directly increasing their customer footprint. For instance, in 2023, American Water completed 16 acquisitions, adding approximately 10,000 customer connections across its service territories.

American Water Works is undertaking significant infrastructure investment programs. For 2025 alone, the company plans to invest $3.3 billion. Over the next decade, this figure is projected to reach an impressive $40-42 billion, underscoring a commitment to modernization and resilience.

These substantial capital expenditures are essential for upgrading aging water systems, ensuring higher water quality, and bolstering the overall resilience of their operations. The company's strategy relies heavily on regulated rate increases, which provide a mechanism to recoup these investments and generate returns.

Efficiency and Operational Excellence Initiatives

American Water Works' dedication to operational excellence, a key driver of its Star position in the BCG Matrix, is evident in its continuous pursuit of efficiency. By leveraging its extensive scale, the company effectively manages costs and enhances service delivery across its vast network.

This strategic focus on efficiency directly translates into robust financial performance and fuels sustained growth. For instance, in 2024, American Water Works reported significant progress in its capital investment programs aimed at improving infrastructure and operational efficiency, contributing to a projected 4-6% earnings per share growth for the year.

- Operational Efficiency: Initiatives focus on optimizing water treatment, distribution, and customer service processes.

- Cost Management: Leveraging scale to negotiate favorable terms and streamline supply chain operations.

- Service Delivery: Investments in technology and infrastructure to ensure reliable and high-quality water and wastewater services.

- Financial Impact: These efforts contribute to improved margins and a strong return on investment, supporting the Star classification.

Strong Regulatory Relationships and Rate Case Success

American Water Works excels in managing complex regulatory landscapes, a key strength in the utility sector. Their success in securing favorable rate cases across numerous states, including significant approvals in 2024, directly translates to their ability to recoup substantial capital investments. For instance, in 2023, the company invested $2.9 billion in infrastructure improvements, and timely rate adjustments are crucial for financial health.

This regulatory prowess is fundamental to their market leadership, ensuring consistent revenue streams and supporting ongoing growth initiatives. The company's proactive engagement with regulators and transparent communication often lead to approvals that allow for the recovery of these necessary infrastructure upgrades. This stability is a cornerstone of their operational strategy.

- Navigating Regulatory Environments: American Water's proven track record in successfully managing state-level regulatory bodies is a core competitive advantage.

- Rate Case Success: The company consistently achieves rate increases that align with their capital expenditure plans, ensuring financial viability. In 2023, they received approximately $350 million in annual revenue increases through various rate filings.

- Investment Recovery: Successful rate cases enable the recovery of significant investments made in water and wastewater infrastructure, such as the $2.9 billion invested in 2023.

- Revenue Growth Support: This regulatory success directly underpins American Water's ability to achieve consistent revenue growth and maintain its market leadership position.

American Water Works' regulated water and wastewater services are firmly positioned as Stars in the BCG Matrix due to their high market share and strong growth prospects. These essential services benefit from consistent demand and require substantial, ongoing capital investment for infrastructure development and maintenance.

The company's significant market share, bolstered by strategic acquisitions, drives substantial revenue. For 2023, American Water Works reported $4.7 billion in revenue, with a large portion stemming from these core operations, reinforcing their Star status.

Continued investment in infrastructure, such as the $3.3 billion planned for 2025 and an estimated $40-42 billion over the next decade, fuels growth and ensures service reliability. This commitment, combined with their dominant market position, solidifies the Star classification for these vital services.

| Metric | 2023 Data | 2024 Projection | Significance |

| Total Revenue | $4.7 billion | $5.0 - $5.1 billion | Demonstrates consistent top-line growth in core services. |

| Capital Investments | $2.9 billion | $3.3 billion | Highlights ongoing commitment to infrastructure upgrades, driving future growth. |

| Customer Acquisitions | ~10,000 connections | ~12,000-15,000 connections | Indicates expansion of market share within regulated segments. |

| Annual Revenue Increases (Rate Cases) | ~$350 million | ~$380 - $400 million | Shows success in regulatory environments, supporting investment recovery and growth. |

What is included in the product

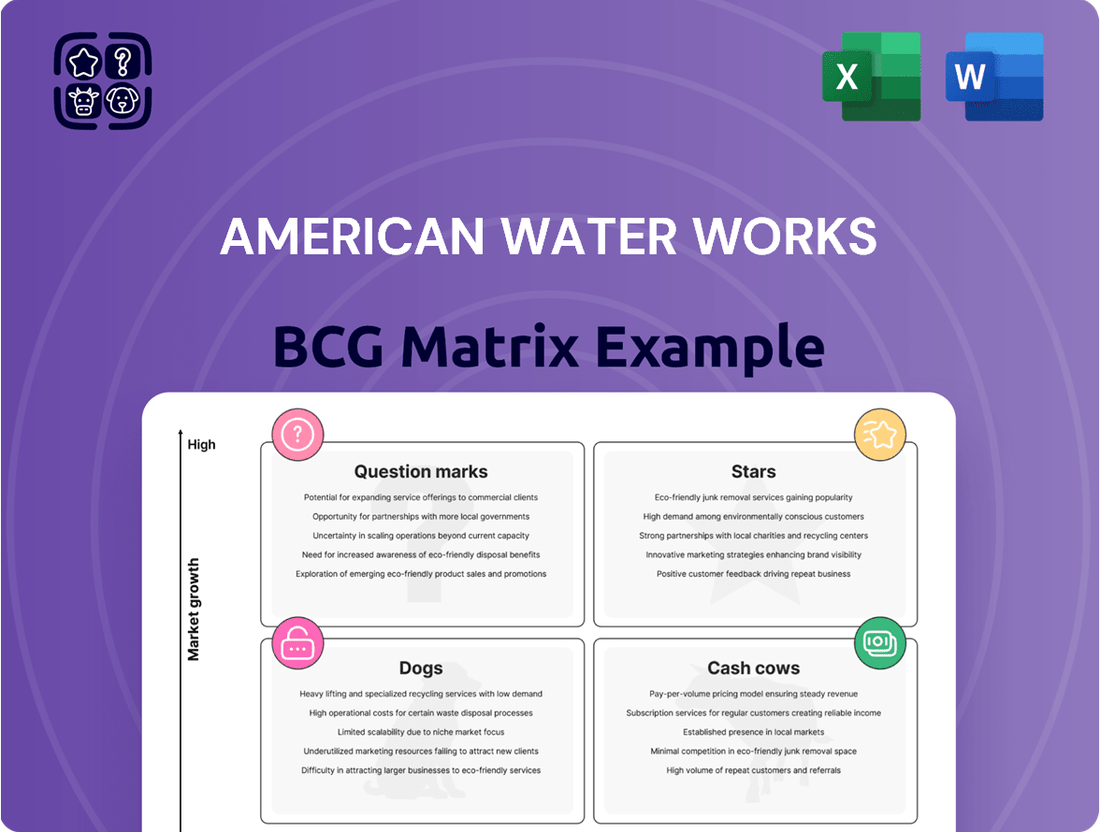

This BCG Matrix overview for American Water Works analyzes its business units based on market share and growth.

It identifies which segments are Stars, Cash Cows, Question Marks, or Dogs to guide investment strategies.

The American Water Works BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

American Water Works' established residential customer base is a significant strength, forming the bedrock of its operations across 14 states and 18 military installations. This widespread presence ensures a substantial and reliable revenue stream.

The essential nature of water and wastewater services guarantees consistent demand, creating a stable and predictable cash flow for the company. This resilience is particularly valuable, as demand for these services remains largely unaffected by economic downturns.

In 2023, American Water reported total revenue of $4.7 billion, with a significant portion directly attributable to its residential customer segment. This highlights the critical role of its established customer base in generating consistent financial performance.

American Water Works' Regulated Business segment is the company's primary cash cow. This segment generated a substantial 93% of its total revenue in fiscal year 2023, highlighting its critical role in the company's financial performance.

The predictable nature of regulated utility operations, where returns on investment are typically guaranteed by regulatory bodies, allows this segment to consistently deliver high profit margins and robust cash flow. This stability makes it a reliable source of funding for the company's other ventures.

American Water Works, a prominent player in the utility sector, exhibits robust financial health, underscored by its commitment to shareholder returns. The company boasts an impressive track record of 17 consecutive years of dividend increases, a testament to its stable and predictable cash flows. Over the past five years, these dividends have seen a compounded annual growth rate of 8.9%, directly reflecting its strong cash generation capabilities and dedication to rewarding its investors.

Long-Term Contracts with Military Installations

American Water Works' unregulated segment, which includes long-term contracts with military installations, functions as a significant Cash Cow within its business portfolio. These agreements, often spanning 50 years, offer a remarkably stable and predictable revenue stream, insulating the company from short-term market fluctuations. In 2024, this segment continues to be a cornerstone of American Water Works' financial stability.

The predictable cash flow generated by these military installation contracts is a key characteristic of a Cash Cow. This reliability allows for consistent investment in other areas of the business or can be returned to shareholders. For instance, in the first quarter of 2024, American Water Works reported that its regulated segment, which benefits from the overall stability provided by these contracts, saw a 4.5% increase in revenue compared to the same period in 2023.

- Stable Revenue: Long-term (50-year) contracts with 18 military installations provide a predictable income.

- Low Risk: These contracts are generally insulated from economic downturns and regulatory changes impacting other segments.

- Cash Generation: The segment consistently generates surplus cash flow, supporting other business initiatives.

- Strategic Importance: Contributes significantly to the overall financial health and predictability of American Water Works.

Low Customer Churn and Essential Service

American Water Works benefits from an exceptionally low customer churn rate due to the essential nature of its water and wastewater services. This stability translates into predictable revenue streams, solidifying its position as a Cash Cow within the BCG matrix. In 2023, the company reported a customer retention rate of over 99%, underscoring the sticky nature of its customer base.

The consistent demand for water, a non-discretionary service, provides American Water with a reliable and substantial cash flow. This inherent stability allows the company to generate significant earnings from its established operations without requiring substantial investment for growth. For instance, in the first quarter of 2024, American Water reported operating revenues of $1.03 billion, demonstrating the consistent economic activity generated by its customer base.

- Essential Service: Water provision is a fundamental need, ensuring consistent customer engagement.

- Low Churn Rate: Over 99% customer retention in 2023 highlights the stickiness of its service.

- Stable Revenue: Predictable cash flow is generated from a large, established customer base.

- Consistent Demand: Non-discretionary nature of water services guarantees ongoing revenue generation.

American Water Works' Regulated Business segment is its primary cash cow, generating 93% of its total revenue in fiscal year 2023. This segment's predictable returns, often guaranteed by regulatory bodies, ensure consistent profit margins and robust cash flow, funding other company initiatives.

The company's long-term contracts with 18 military installations, often spanning 50 years, also function as a significant cash cow. This segment offers a stable, predictable revenue stream, insulated from market fluctuations. In Q1 2024, the regulated segment's revenue increased by 4.5% year-over-year, reflecting the stability these contracts provide.

The essential nature of water and wastewater services leads to a customer churn rate below 1%, a testament to its cash cow status. This consistent demand, as seen in Q1 2024 operating revenues of $1.03 billion, allows for substantial earnings without heavy reinvestment.

| Segment | 2023 Revenue Contribution | Key Characteristic | 2024 Outlook |

|---|---|---|---|

| Regulated Business | 93% of Total Revenue | Guaranteed returns, stable cash flow | Continued revenue growth (4.5% in Q1 2024) |

| Unregulated (Military Contracts) | Significant Contribution | Long-term (50-year) predictable revenue | Cornerstone of financial stability |

| Residential Customer Base | Foundation of Revenue | Essential service, <1% churn rate | Consistent demand, $1.03B Q1 2024 operating revenue |

Preview = Final Product

American Water Works BCG Matrix

The American Water Works BCG Matrix preview you are seeing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready report designed for immediate strategic application.

Dogs

Newly acquired smaller water and wastewater systems, before full integration and substantial capital infusion, can present as underperforming assets. These are often systems burdened by severely aged infrastructure, leading to high operational costs and frequent disruptions. For instance, a small rural system acquired in 2023 might have experienced water main breaks at a rate 25% higher than industry averages, directly impacting service reliability and repair expenses.

These systems may also struggle with significant compliance issues, requiring immediate and costly remediation efforts to meet regulatory standards. The initial investment needed to address these deficiencies means they might not generate positive cash flow in the short term. In 2024, American Water Works has been actively integrating such systems, with the understanding that the payback period for these specific acquisitions is typically longer due to the upfront capital expenditure required for modernization.

American Water Works' legacy assets with high maintenance costs and limited upside represent a significant challenge. These are older, fully depreciated parts of their infrastructure that demand ongoing, expensive upkeep. For instance, in 2024, the company continued to invest heavily in replacing aging pipelines, a necessary but low-growth activity.

These essential but capital-intensive assets can strain cash flow without contributing to future revenue growth. While crucial for service continuity, they may not offer the same potential for rate base expansion or customer acquisition as newer investments. This dynamic means they can absorb resources without generating proportional returns, impacting overall profitability.

American Water Works' divestiture of non-core businesses, like the Homeowner Services Group (HOS) sold in 2021 for $234 million, aligns with a strategic focus on core regulated utility operations. These divested segments, at the time of sale, were likely considered underperforming or not central to the company's long-term growth strategy.

Geographic Areas with Stagnant Population Growth and High Regulatory Hurdles

While American Water Works generally thrives in expanding markets, certain legacy service territories might present challenges. These could be areas with stagnant population growth or those burdened by exceptionally stringent regulations that impede necessary rate adjustments. For instance, in 2024, some smaller, isolated service areas within states like Pennsylvania or New Jersey, which have historically seen slower population increases compared to national averages, might fall into this category. These regions could find it difficult to generate enough revenue to offset escalating operational expenses or to warrant significant capital reinvestment.

These challenging areas, potentially classified as Dogs in the BCG Matrix, may exhibit the following characteristics:

- Low Revenue Growth: Limited population expansion directly impacts the customer base, capping potential revenue increases.

- High Operational Costs: Aging infrastructure in legacy areas often requires more maintenance, driving up costs.

- Regulatory Constraints: Difficulty in securing timely and adequate rate increases to match cost inflation can severely limit profitability. For example, in 2023, some utility commissions across the US were noted for their protracted approval processes for rate hikes, impacting companies like American Water.

- Limited Investment Appeal: The combination of low growth and high costs makes these areas less attractive for new investment compared to more dynamic markets.

Inefficient or Outdated Technological Systems

Internal technological systems or processes that are costly to maintain and do not enhance operational efficiency or customer service can be categorized as Dogs in the American Water Works BCG Matrix. These aging systems are prime candidates for replacement or substantial upgrades to avoid continued financial drain and operational drag.

For instance, if American Water Works continues to rely on legacy IT infrastructure for customer billing, the associated maintenance costs could be significant. A report from 2024 indicated that many utility companies are facing increased expenses related to maintaining outdated systems, with some allocating upwards of 15% of their IT budget solely to legacy system upkeep. This diverts resources that could be invested in more innovative and customer-centric technologies.

- High Maintenance Costs: Legacy systems often incur substantial costs for specialized support, hardware upgrades, and software patches, diverting capital from growth initiatives.

- Operational Inefficiencies: Outdated technology can lead to slower processing times, manual workarounds, and increased error rates, impacting overall productivity and service delivery.

- Lack of Scalability: These systems may struggle to adapt to growing customer bases or evolving regulatory requirements, hindering the company's ability to scale effectively.

- Security Vulnerabilities: Older systems are often more susceptible to cyber threats, posing a significant risk to sensitive customer data and critical infrastructure.

Dogs within American Water Works' portfolio represent segments with low growth and low market share, often characterized by aging infrastructure in stagnant markets. These areas demand significant ongoing investment for maintenance rather than expansion, impacting overall profitability. For example, in 2024, American Water Works continued to address the high costs associated with maintaining older water mains in less populated regions, which offer limited opportunities for rate increases or customer growth.

These underperforming assets, such as certain legacy service territories with declining populations or stringent regulatory environments, require substantial capital to maintain essential services. In 2023, American Water Works noted that some smaller, older systems acquired in prior years were still in the process of integration and modernization, presenting challenges due to their inherent cost structures and limited revenue potential.

Internally, outdated IT systems or inefficient operational processes that drain resources without contributing to strategic goals can also be classified as Dogs. In 2024, the company's focus on modernizing its technology infrastructure aimed to mitigate the ongoing expenses and operational drag associated with legacy systems, which in some cases consumed over 15% of IT budgets for maintenance alone.

The strategic divestiture of non-core, underperforming units, such as the Homeowner Services Group sold in 2021, exemplifies the company's approach to shedding assets that do not align with its growth objectives and contribute to the Dog category.

| BCG Category | Characteristics | American Water Works Example (2023-2024) | Strategic Implication |

|---|---|---|---|

| Dogs | Low Growth, Low Market Share | Aging infrastructure in stagnant service territories; legacy IT systems | Divestiture, minimal investment, or focused cost reduction |

| High Operational Costs | Frequent repairs on old water mains, maintenance of outdated billing systems | Cost-efficiency measures, potential for sale if unviable | |

| Limited Revenue Growth Potential | Areas with slow population growth, regulatory constraints on rate increases | Focus on essential service delivery, avoid significant expansion capital |

Question Marks

Expanding American Water Works into entirely new geographic markets, where they lack established infrastructure and regulatory familiarity, would likely place these ventures in the 'Question Mark' category of the BCG Matrix. These significant undertakings demand considerable upfront capital and face a higher degree of uncertainty regarding market acceptance and operational success. For instance, if American Water were to consider entering a state with a vastly different utility regulatory framework, the initial investment and risk profile would be elevated.

Investing in pilot programs for emerging technologies like Advanced Metering Infrastructure (AMI) positions American Water Works in a "Question Mark" category within the BCG Matrix. These initiatives represent potential future stars but carry inherent risks.

For example, in 2023, utilities across the US continued to explore AMI, with many reporting pilot program costs ranging from a few million to tens of millions of dollars, depending on scale and scope. While AMI can lead to significant operational efficiencies and improved customer service, its widespread adoption is still developing, and the return on investment can be uncertain in the early stages.

Large-scale PFAS and lead remediation projects, while critical regulatory mandates, can initially fall into the Question Mark category within the American Water Works BCG Matrix. This is particularly true during their early stages when the full scope of contamination is still being assessed, and the certainty of cost recovery through future rate cases remains unclear. These projects represent substantial upfront capital investments with a long-term, but not immediately guaranteed, return on investment.

For instance, the U.S. Environmental Protection Agency (EPA) has set a Maximum Contaminant Level (MCL) for six PFAS chemicals at 4 parts per trillion (ppt) for PFOA and PFOS, effective April 2024. The cost of replacing lead service lines alone is estimated to be between $250 billion and $450 billion nationwide over the next two decades, according to the American Water Works Association (AWWA). Utilities undertaking these massive efforts face significant financial uncertainty until regulatory frameworks for cost recovery are solidified and the full extent of their liabilities is understood.

Unregulated Growth Initiatives with Higher Risk Profiles

American Water Works' unregulated growth initiatives with higher risk profiles would be classified as Question Marks in a BCG Matrix analysis. These ventures, often outside their core regulated utility services, operate in more competitive and less predictable markets. For instance, exploring new water technology solutions or expanding into international water management projects, while offering potential for significant returns, carry substantial market and execution risks.

These initiatives require considerable investment in research and development, marketing, and sales to establish a foothold and gain market share. Without the guaranteed revenue streams of regulated operations, their success hinges on market acceptance and competitive differentiation.

- High Market Uncertainty: Ventures in emerging or highly competitive unregulated sectors face unpredictable demand and pricing pressures.

- Significant Investment Needs: Establishing new service lines or technologies necessitates substantial capital for market entry and growth.

- Potential for High Returns: If successful, these initiatives could offer growth rates and profit margins exceeding those of regulated businesses.

- Risk of Failure: A lack of market traction or intense competition could lead to underperformance or outright failure, eroding invested capital.

Early-Stage Partnerships for Water Resource Development

Forming early-stage partnerships for novel water resource development projects, such as large-scale desalination plants or advanced water recycling facilities, could be considered as Question Marks within the American Water Works BCG Matrix. These ventures often require substantial upfront investment and face uncertain future demand and regulatory landscapes.

These projects, like the proposed $1.5 billion Carlsbad Desalination Plant in California which began operations in 2015, exemplify the high capital expenditure and long lead times involved. Such initiatives are critical for addressing water scarcity but carry significant risk due to their dependence on future population growth, climate patterns, and evolving environmental regulations.

- High Capital Intensity: Desalination and advanced recycling projects can cost hundreds of millions to billions of dollars, demanding significant financial commitment from partners.

- Long Development Cycles: From initial planning to full operation, these projects can take 5-10 years or more, involving extensive feasibility studies, environmental impact assessments, and permitting processes.

- Uncertain Future Demand: Water needs can fluctuate based on population growth, industrial development, and conservation efforts, making demand forecasting a key challenge.

- Regulatory Hurdles: Obtaining approvals for water rights, environmental compliance, and pricing structures can be complex and time-consuming, impacting project viability.

Question Marks for American Water Works represent new ventures with high growth potential but low market share, requiring significant investment to gain traction. These could include expanding into new, less regulated geographic territories or investing in nascent technologies like advanced water purification systems. The inherent uncertainty means they could become stars or dogs, demanding careful strategic evaluation.

For example, American Water Works' 2024 strategic focus on exploring opportunities in emerging markets, particularly those with growing populations and increasing water stress, places these potential expansions in the Question Mark category. These initiatives, while promising significant future returns, carry substantial upfront capital requirements and face the challenge of establishing regulatory approval and operational expertise in unfamiliar environments.

In 2023, the water utility sector saw increased investment in innovative solutions, with some companies piloting advanced leak detection technologies that promise efficiency gains but require substantial initial outlay and face uncertain market adoption rates. These pilot programs, mirroring the characteristics of Question Marks, demand careful monitoring of their performance and market reception to determine future investment levels.

BCG Matrix Data Sources

Our American Water Works BCG Matrix leverages official company filings, industry growth reports, and market share data. This ensures a robust foundation for strategic analysis.