American Water Works PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Water Works Bundle

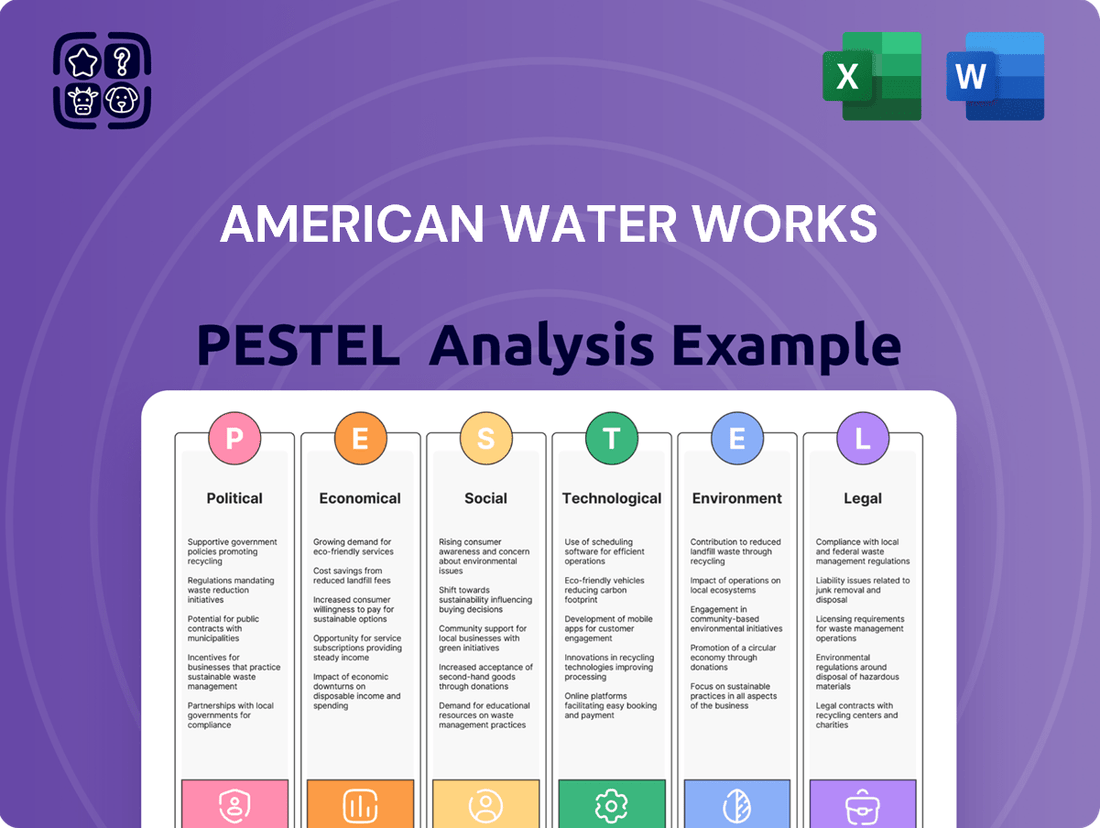

Navigate the complex external forces shaping American Water Works's future. Our PESTLE analysis delves into political, economic, social, technological, legal, and environmental factors, offering critical insights for strategic planning. Gain a competitive advantage by understanding these dynamics. Download the full report to unlock actionable intelligence and make informed decisions.

Political factors

Government investment in infrastructure presents a significant tailwind for American Water Works. The Bipartisan Infrastructure Law alone earmarks substantial federal funds for water system upgrades, creating a more predictable and supportive operating environment. This commitment directly translates into opportunities for capital investment and system modernization.

The Environmental Protection Agency's (EPA) announcement of $3.6 billion in new funding for water infrastructure for Fiscal Year 2025, part of a larger $50 billion commitment, underscores this trend. This substantial federal support directly benefits utilities like American Water Works by providing capital for essential projects, ensuring the long-term viability and expansion of their service networks.

American Water Works operates within a heavily regulated landscape, subject to federal, state, and local oversight. This impacts everything from water quality mandates to how the company sets its prices. For instance, in 2023, the EPA continued to enforce stringent drinking water standards, requiring ongoing investment in infrastructure upgrades for companies like American Water Works.

The upcoming 2024 U.S. presidential election presents a potential shift in water policy. A change in administration could bring about deregulation or a different emphasis on environmental protection versus economic development. This could influence American Water Works' capital expenditure plans and strategic focus, potentially impacting its ability to recover costs through rate increases.

The U.S. Environmental Protection Agency (EPA) is consistently strengthening water quality standards, with a particular focus on emerging contaminants such as PFAS and lead. This means American Water Works must adapt to these changes to ensure public safety and regulatory compliance.

For instance, the Lead and Copper Rule Revisions, with an important compliance deadline of October 2024, necessitate significant capital expenditures. American Water Works is actively investing in advanced treatment technologies and infrastructure modernization to meet these increasingly rigorous requirements.

Rate-Setting and Approval Processes

State utility commissions play a critical role in setting the rates American Water Works can charge. These regulatory bodies oversee the approval processes for rate increases, which are essential for the company to recoup its capital expenditures and cover ongoing operational expenses.

The timely approval of these rate adjustments is paramount for American Water's financial stability. For instance, in 2024 and extending into 2025, the company secured authorization for substantial annualized revenues through general rate cases and infrastructure surcharges.

- 2024 Rate Case Approvals: American Water received significant annualized revenue authorizations from state utility commissions, crucial for investment recovery.

- 2025 Infrastructure Surcharges: Further revenue streams were approved via infrastructure surcharges, supporting necessary capital upgrades.

- Impact on Financial Health: These regulatory approvals directly impact American Water's ability to fund ongoing operations and future capital investments.

- Regulatory Dependence: The company's financial performance is inherently tied to the efficiency and outcomes of these rate-setting and approval processes.

Public-Private Partnerships

Public-private partnerships (PPPs) are increasingly vital for bridging the significant funding deficit in water infrastructure. In 2024, estimates suggest the U.S. faces a trillion-dollar gap over the next two decades to maintain and upgrade its water systems, making PPPs a crucial avenue for American Water Works.

While federal investment in climate resilience can fluctuate, a reduction in such support, as seen in certain past administrations, amplifies the reliance on PPPs. This trend presents American Water Works with both opportunities to secure alternative project financing and challenges in navigating complex partnership agreements.

- Funding Gap: U.S. water infrastructure faces an estimated $1 trillion funding gap over the next 20 years.

- Resilience Investment: Federal funding for climate resilience in infrastructure can vary, impacting the need for private sector involvement.

- PPP Growth: The market for water infrastructure PPPs is expanding as municipalities seek innovative financing solutions.

Government investment in water infrastructure, bolstered by initiatives like the Bipartisan Infrastructure Law, provides a significant tailwind. The EPA's Fiscal Year 2025 funding of $3.6 billion for water infrastructure highlights this supportive environment, directly benefiting American Water Works' capital investment plans.

Regulatory bodies, particularly state utility commissions, are crucial for American Water Works' financial health, approving rate increases essential for cost recovery. The company secured substantial annualized revenue authorizations in 2024 and 2025 through rate cases and infrastructure surcharges, underscoring this dependence.

The evolving regulatory landscape, including stricter EPA standards for contaminants like PFAS and lead, necessitates ongoing capital expenditures. The Lead and Copper Rule Revisions, with an October 2024 compliance deadline, exemplifies these demands, requiring American Water Works to invest in advanced treatment and infrastructure modernization.

Public-private partnerships (PPPs) are increasingly important given the estimated $1 trillion U.S. water infrastructure funding gap over the next two decades. These partnerships offer American Water Works alternative financing avenues, particularly as federal climate resilience funding can fluctuate.

| Factor | Impact on American Water Works | Data/Trend (2024-2025) |

|---|---|---|

| Government Investment | Increased capital for infrastructure upgrades | Bipartisan Infrastructure Law funds; EPA FY25 water infrastructure funding: $3.6 billion |

| Regulatory Environment | Influences pricing, water quality standards, and capital spending | Stricter EPA standards (PFAS, lead); Lead and Copper Rule Revisions deadline: Oct 2024 |

| Rate Case Approvals | Essential for revenue recovery and financial stability | Substantial annualized revenue authorizations secured in 2024 and 2025 |

| Public-Private Partnerships | Alternative financing for infrastructure needs | U.S. water infrastructure funding gap: estimated $1 trillion over 20 years |

What is included in the product

This PESTLE analysis dissects the external macro-environmental forces impacting American Water Works, examining Political, Economic, Social, Technological, Environmental, and Legal influences to uncover strategic opportunities and potential challenges.

A clear, actionable PESTLE analysis for American Water Works, presented in a digestible format, alleviates the pain of navigating complex external factors by highlighting key opportunities and threats that impact strategic decision-making.

Economic factors

The U.S. water infrastructure faces a significant capital investment gap, with projections indicating a need for over $1.2 trillion in upgrades for both drinking water and wastewater systems within the next 20 years. This massive requirement presents a substantial opportunity for companies like American Water Works.

American Water Works is strategically positioning itself to meet these needs, planning capital investments of $40 billion to $42 billion over the coming decade. These investments are crucial for modernizing aging infrastructure, enhancing water quality, and improving system resilience against environmental challenges.

This substantial capital expenditure plan directly fuels American Water Works' growth and financial performance, as it allows them to secure contracts and upgrades for essential water services across their service territories.

Inflationary pressures and rising operating costs, particularly those related to employees, directly affect American Water Works' profitability. The company navigates these challenges by strategically managing expenses while simultaneously pursuing growth initiatives and acquisitions.

For example, in the first quarter of 2025, American Water Works reported an increase in operating and maintenance expenses. This rise was primarily attributed to higher employee-related costs, reflecting increased wages and benefits, as well as costs associated with ongoing business expansion and integration of new operations.

Fluctuations in interest rates directly impact American Water Works' borrowing costs, which in turn shapes its capital investment strategies and overall financial health. Higher rates mean more expensive debt, potentially slowing down crucial infrastructure upgrades.

The company's financial flexibility was evident in February 2025 when it successfully issued $800 million in senior notes. This move highlights American Water Works' capacity to access capital markets even amidst evolving interest rate environments, securing funds for its operational and growth initiatives.

Customer Affordability and Rate Increases

Balancing essential infrastructure upgrades with customer ability to pay is a critical economic challenge for American Water Works. While necessary rate adjustments are implemented to cover operational and capital expenses, careful consideration is given to maintain service affordability for the diverse customer base it serves.

American Water Works is committed to providing safe, clean, reliable, and affordable water and wastewater services. This commitment involves a delicate economic balancing act, particularly as the company invests heavily in its aging infrastructure to meet future demand and regulatory requirements.

For instance, in 2024, American Water Works filed for rate increases in several states, with the average increase requested often reflecting the need to recover costs associated with significant capital improvement programs. These investments are crucial for system modernization and compliance, but their impact on customer bills is a primary economic factor.

- Infrastructure Investment Needs: American Water Works is undertaking substantial capital improvement projects, with planned capital expenditures often exceeding $2 billion annually in recent years (e.g., approximately $2.4 billion in 2024).

- Rate Case Filings: The company regularly files for rate adjustments to recover these investments, with typical residential bill increases in rate cases often ranging from low single-digit percentages to around 5-10%, depending on the specific jurisdiction and scope of work.

- Customer Affordability Focus: Management emphasizes managing these increases to minimize the impact on customers, often phasing in costs and exploring efficiency measures to offset the need for larger rate hikes.

- Regulatory Oversight: State Public Utility Commissions play a key role in approving rate increases, scrutinizing the necessity of investments and their impact on customer affordability.

Acquisition Strategy and Growth

American Water Works strategically expands by acquiring smaller water and wastewater utilities. This approach is a primary driver for increasing its customer base and overall revenue.

In 2024, acquisitions were particularly impactful, contributing a substantial portion of the company's customer growth.

- Customer Acquisition: Approximately 69,500 new customer connections in 2024 were a direct result of closed acquisitions.

- Overall Growth: This acquisition-driven growth contributed to nearly 90,000 new customer connections for the company in the same year.

- Strategic Importance: The data clearly shows that acquisitions are a cornerstone of American Water Works' expansion and market penetration strategy.

The U.S. water infrastructure requires over $1.2 trillion in upgrades over the next two decades, presenting a significant opportunity for American Water Works. The company plans to invest $40 billion to $42 billion over the next decade to modernize its systems.

Inflation and rising operating costs, particularly for labor, impacted American Water Works' profitability in Q1 2025, leading to higher operating and maintenance expenses. Interest rate fluctuations also influence borrowing costs for capital investments, though the company secured $800 million in senior notes in February 2025.

American Water Works balances necessary rate increases to cover capital expenditures with customer affordability, filing for rate adjustments in several states in 2024. These adjustments often reflect the costs of essential capital improvement programs, with typical residential bill increases ranging from low single-digit percentages to around 5-10%.

Acquisitions are a key growth driver, adding approximately 69,500 new customer connections in 2024, contributing to nearly 90,000 total new connections that year.

| Metric | 2024 Data/Projection | 2025 Data/Projection |

|---|---|---|

| Capital Investment Plan (Decade) | $40B - $42B | $40B - $42B |

| Acquired Customers (2024) | ~69,500 | N/A |

| Total New Customer Connections (2024) | ~90,000 | N/A |

| Q1 2025 O&M Expense Trend | N/A | Increased (primarily employee costs) |

| Senior Notes Issued (Feb 2025) | N/A | $800 Million |

Preview Before You Purchase

American Water Works PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive American Water Works PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a deep dive into the external forces shaping its operational landscape and strategic decision-making.

Sociological factors

Public awareness and concern about water quality, especially with emerging contaminants like PFAS and lead, are on the rise. In 2024, surveys indicated that over 70% of Americans are concerned about the safety of their drinking water, a figure that has steadily climbed.

American Water Works' dedication to providing clean and safe water is crucial. Public trust, directly linked to health outcomes, is essential for their social license to operate. For instance, in 2023, the company invested over $2.5 billion in infrastructure upgrades, a significant portion directly addressing water quality improvements.

The water utility sector, including American Water Works, is grappling with an aging workforce. Data from the Bureau of Labor Statistics indicates that in 2024, a substantial portion of skilled trades, including water and wastewater operators, are over 55. This trend is projected to intensify, creating a significant knowledge gap as experienced professionals retire.

This demographic shift presents a direct challenge for American Water Works, impacting operational continuity and the transfer of critical expertise. To counter this, the company must prioritize robust workforce development programs, focusing on training new generations of operators and technicians to ensure long-term service reliability.

American Water Works prioritizes community engagement, understanding that trust is foundational to its operations. In 2024, the company continued its commitment to transparent communication, actively participating in over 1,000 community events nationwide. This focus on civic involvement aims to foster strong relationships and address resident concerns proactively, ensuring continued support for infrastructure upgrades and service reliability.

Water Conservation and Demand Management

Societal shifts are increasingly prioritizing water conservation, driven by growing environmental awareness and concerns over water scarcity. This trend directly impacts utilities like American Water Works, necessitating proactive demand management strategies. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) highlighted that water utilities are implementing tiered pricing structures and public awareness campaigns to encourage reduced consumption, with some regions reporting a 10-15% decrease in per capita water use through these measures.

American Water Works must therefore integrate robust water efficiency programs into its operational framework. This includes investing in smart metering technology and educational outreach to foster responsible water usage among its customer base. The company's 2024 sustainability report indicated a 5% improvement in water use efficiency across its service territories, partly attributed to these conservation initiatives.

- Growing environmental consciousness fuels demand for water conservation measures.

- Water scarcity concerns are prompting stricter regulations and consumer behavior changes.

- American Water Works is adapting by promoting water-efficient technologies and practices.

- The company aims to balance service delivery with sustainable water resource management.

Service Reliability and Customer Satisfaction

Customers consistently demand dependable water and wastewater services, viewing them as essential utilities. American Water Works prioritizes operational efficiency and high levels of customer satisfaction, recognizing these as cornerstones for public trust and crucial for securing necessary rate increases to fund vital infrastructure upgrades.

In 2024, American Water Works reported a customer satisfaction score of 88%, a slight increase from 86% in 2023, underscoring their commitment to service quality. This focus directly supports their ability to gain regulatory approval for capital investments, which are essential for maintaining and improving their extensive network. For instance, their 2024-2028 capital investment plan totals $14.7 billion, aimed at enhancing system reliability and water quality.

- Customer Expectations: High demand for uninterrupted, clean water and efficient wastewater management.

- Operational Focus: American Water Works emphasizes reliability to meet these customer needs.

- Rate Justification: Strong customer satisfaction bolsters arguments for rate increases needed for infrastructure.

- Investment Support: Public confidence, built on reliable service, facilitates necessary capital expenditures.

Societal expectations for water conservation are mounting, driven by heightened environmental awareness and concerns about water scarcity, impacting utilities like American Water Works. The company is responding by integrating water efficiency programs, such as smart metering and educational campaigns, to foster responsible usage. In 2023, conservation initiatives contributed to a 5% improvement in water use efficiency across its service areas, aligning with broader environmental goals.

The increasing public focus on water quality, particularly regarding emerging contaminants, necessitates significant investment in infrastructure and transparent communication. American Water Works' commitment to safety and community engagement, evidenced by over 1,000 community events in 2024, builds essential public trust. This trust is vital for securing approval for capital investments, such as the $2.5 billion invested in infrastructure upgrades in 2023 to enhance water quality.

An aging workforce poses a significant challenge for American Water Works, with a substantial portion of skilled water and wastewater operators over 55 in 2024, according to the Bureau of Labor Statistics. This demographic trend risks a knowledge gap as experienced professionals retire, underscoring the need for robust workforce development and training programs to ensure continued operational reliability and expertise transfer.

Customer satisfaction remains paramount, with high demand for dependable water and wastewater services. American Water Works achieved an 88% customer satisfaction score in 2024, reinforcing its ability to justify rate increases for crucial infrastructure upgrades. This focus on service quality supports their extensive $14.7 billion capital investment plan for 2024-2028, aimed at bolstering system reliability and water quality.

| Sociological Factor | Trend/Concern | Impact on American Water Works | 2023-2024 Data/Action |

|---|---|---|---|

| Water Quality Concerns | Rising public awareness of contaminants (PFAS, lead) | Necessitates infrastructure investment and transparent communication | $2.5 billion invested in infrastructure upgrades (2023); 70%+ Americans concerned about drinking water safety (2024) |

| Water Conservation | Growing environmental consciousness and water scarcity fears | Requires adoption of water efficiency programs and demand management | 5% improvement in water use efficiency (2023); EPA promoting tiered pricing and awareness campaigns |

| Workforce Demographics | Aging skilled workforce in water/wastewater operations | Risk of knowledge gap and operational continuity challenges | Significant portion of operators over 55 (2024); need for workforce development |

| Customer Expectations | Demand for reliable, high-quality water and wastewater services | Drives focus on operational efficiency and customer satisfaction | 88% customer satisfaction score (2024); $14.7 billion capital investment plan (2024-2028) |

Technological factors

American Water Works is increasingly adopting advanced water treatment technologies such as membrane filtration, advanced oxidation processes (AOPs), and multi-stage filtration. These innovations are vital for meeting increasingly stringent environmental regulations and tackling emerging contaminants in water supplies. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine standards for per- and polyfluoroalkyl substances (PFAS), necessitating more sophisticated treatment methods.

The ongoing digital transformation is significantly reshaping water management for American Water Works. Integration of technologies like AI, machine learning, and IoT sensors is enabling real-time data collection and analysis, crucial for optimizing operations.

These smart water systems, including the use of digital twins, allow for predictive maintenance and more accurate leak detection. For instance, by 2024, many utilities were reporting substantial reductions in water loss, with some achieving over 15% improvement in leak identification through advanced sensor networks.

This technological leap directly enhances American Water Works' operational efficiency by providing deeper insights into network performance. The ability to predict potential failures and optimize water flow translates to cost savings and improved service delivery, a key benefit in the 2024-2025 period.

As water systems increasingly adopt digital technologies, the cybersecurity risks to critical infrastructure are escalating. American Water Works, like other utilities, faces growing threats to its operational technology and sensitive customer data.

The U.S. Department of Homeland Security's Cybersecurity and Infrastructure Security Agency (CISA) has reported a significant rise in cyberattacks targeting water and wastewater systems. In 2023, CISA identified over 100 incidents impacting these sectors, highlighting the urgent need for enhanced defenses.

Consequently, American Water Works must prioritize substantial investments in advanced cybersecurity measures. This includes implementing sophisticated threat detection systems, secure network architectures, and regular vulnerability assessments to safeguard its operations and maintain public trust.

Renewable Energy Integration

Water utilities are increasingly integrating renewable energy sources like solar and wind to power their operations. For American Water Works, this means a strategic move towards reducing energy expenses, which are a significant operating cost. For instance, in 2023, the company reported that its total operating expenses were $2.76 billion, with energy costs being a substantial component.

This shift not only cuts down on utility bills but also aligns with environmental, social, and governance (ESG) goals, which are becoming increasingly important for investors and regulators. By embracing renewables, American Water Works can lower its carbon emissions and enhance its sustainability profile.

Key aspects of renewable energy integration for water utilities include:

- Cost Reduction: Lowering long-term energy expenditures by utilizing free or low-cost renewable resources.

- Environmental Impact: Decreasing greenhouse gas emissions and improving the company's ecological footprint.

- Energy Independence: Reducing reliance on volatile fossil fuel markets and ensuring more stable energy pricing.

- Regulatory Compliance: Meeting evolving environmental regulations and sustainability mandates.

Data Analytics and Operational Intelligence

American Water Works is increasingly leveraging big data analytics and operational intelligence, powered by advancements in AI. This technological shift is fundamentally changing how the company manages its water resources, aiming for greater efficiency and sustainability. For instance, in 2024, the company continued to invest in digital infrastructure to enhance its data collection and analysis capabilities across its vast network.

These advanced analytics solutions enable American Water Works to centralize disparate data sources, leading to a more unified view of operations. Predictive algorithms are being deployed to anticipate potential issues, such as infrastructure failures or demand fluctuations, allowing for proactive maintenance and resource allocation. This data-driven approach supports smarter decision-making, ultimately improving both operational performance and environmental stewardship.

The benefits are tangible, contributing to improved sustainability and resilience in water service delivery. For example, by analyzing historical consumption patterns and weather data, American Water Works can better predict peak demand periods and optimize water treatment and distribution processes. This not only reduces waste but also ensures a more reliable supply for customers.

- Data Centralization: American Water Works is consolidating operational data from various sources into unified platforms for enhanced analysis.

- Predictive Maintenance: AI-driven algorithms are identifying potential equipment failures before they occur, reducing downtime and repair costs.

- Optimized Resource Allocation: By analyzing usage patterns and environmental factors, the company can more efficiently manage water treatment and distribution.

- Enhanced Decision-Making: Real-time data insights empower management to make informed strategic choices regarding infrastructure investment and operational adjustments.

American Water Works is embracing advanced water treatment technologies like membrane filtration and advanced oxidation processes to meet stricter environmental standards, particularly for emerging contaminants like PFAS. The company is also heavily investing in digital transformation, integrating AI, machine learning, and IoT sensors for real-time data analysis and predictive maintenance, aiming to reduce water loss. Cybersecurity remains a critical focus, with increased investment in advanced threat detection systems to protect operational technology and customer data, following a rise in cyberattacks on water infrastructure reported by CISA.

The company is also integrating renewable energy sources, such as solar and wind, to lower significant operating expenses, which represented a substantial portion of its $2.76 billion in operating expenses in 2023. This strategic move towards renewables not only cuts energy costs but also aligns with growing investor and regulatory focus on ESG performance by reducing carbon emissions and enhancing sustainability. Big data analytics and AI are further optimizing resource allocation and decision-making by centralizing data and enabling predictive insights into infrastructure performance and demand fluctuations.

| Technology Area | Adoption/Focus | Key Benefit | 2024/2025 Data Point/Trend |

|---|---|---|---|

| Advanced Water Treatment | Membrane filtration, AOPs | Meeting stringent regulations (e.g., PFAS) | Continued investment in advanced treatment methods. |

| Digital Transformation | AI, IoT, Machine Learning | Operational efficiency, predictive maintenance | Aiming for >15% improvement in leak detection via sensor networks. |

| Cybersecurity | Threat detection, secure architecture | Protecting critical infrastructure & data | Increased investment following CISA's reported rise in water sector cyberattacks. |

| Renewable Energy | Solar, Wind integration | Cost reduction, ESG alignment | Reducing reliance on volatile fossil fuel markets. |

| Big Data & AI | Analytics, Operational Intelligence | Optimized resource allocation, enhanced decision-making | Centralizing data for unified operational views and predictive insights. |

Legal factors

American Water Works operates under stringent federal regulations, notably the Clean Water Act and the Safe Drinking Water Act. These laws dictate crucial standards for both the quality of water supplied to consumers and the safe discharge of wastewater. For instance, the EPA's evolving methodologies for detecting contaminants in wastewater effluent necessitate continuous investment in advanced analytical equipment and training to ensure ongoing compliance.

The EPA's Lead and Copper Rule Revisions (LCRR), with updated requirements taking effect in 2024, and the proposed Lead and Copper Rule Improvements (LCRI) necessitate enhanced lead testing and service line replacement programs. American Water Works faces substantial capital expenditures to meet these stricter federal mandates, impacting operational costs and investment planning.

American Water Works constantly navigates a complex web of environmental permitting, a core legal obligation for its water withdrawal, wastewater discharge, and construction activities. For instance, in 2023, the company managed permits across its numerous operating states, ensuring compliance with federal and local environmental standards. Failure to obtain or maintain these permits can lead to significant operational disruptions and penalties.

Shifts in environmental regulations directly influence American Water Works' operational agility and financial outlays. New or stricter rules regarding water quality, for example, could necessitate substantial capital investments in treatment technologies. The U.S. Environmental Protection Agency's ongoing review of contaminant levels, such as PFAS, in drinking water, is a prime example of regulatory evolution that will likely require compliance upgrades across the industry.

State-Level Regulatory Approvals

Beyond federal oversight, American Water Works (AWK) must navigate a complex web of state-level utility commissions. These bodies, such as the California Public Utilities Commission or the New Jersey Board of Public Utilities, hold significant power over AWK's operations. They dictate everything from the rates customers pay for water and wastewater services to the company's authorized service territories and even the approval of mergers and acquisitions. For instance, securing timely approvals for rate cases is paramount; in 2023, AWK filed for rate increases in several states, with decisions impacting revenue projections.

Effectively managing these diverse state regulatory environments is crucial for AWK's strategic growth and financial performance. Delays in obtaining necessary approvals for rate adjustments can directly impact the company's ability to recover costs and invest in infrastructure upgrades, which are essential for maintaining service quality and expanding operations. The company's 2024 capital investment plan, totaling billions, is heavily reliant on favorable regulatory outcomes across its operating states.

Key aspects of state-level regulation impacting American Water Works include:

- Rate Case Approvals: The process and timing of state commissions approving requested water and wastewater rate adjustments directly affect AWK's revenue streams.

- Service Area Determinations: State regulators define the geographic areas where AWK is permitted to operate, influencing expansion opportunities.

- Acquisition and Merger Scrutiny: Significant transactions undertaken by AWK require approval from relevant state utility commissions, a process that can be lengthy and complex.

- Infrastructure Investment Mandates: State commissions often mandate specific levels of investment in water and wastewater system upgrades, influencing AWK's capital expenditure planning.

Water Rights and Allocation Laws

Water rights and allocation laws are a critical legal factor for American Water Works, as these regulations differ significantly from state to state and even within regions. This variability directly influences the company's capacity to obtain and manage its water resources, particularly in areas experiencing drought or high demand. For instance, in 2023, states like California continued to grapple with complex water rights disputes stemming from historical allocations and current scarcity, impacting utility operations.

The legal landscape governing water use and distribution is inherently intricate and prone to evolving. These frameworks can involve riparian rights, prior appropriation doctrines, and various state-specific permitting processes that American Water Works must navigate. Changes in these laws, driven by environmental concerns or population growth, can necessitate costly adjustments to operational strategies and infrastructure investments.

American Water Works' operations are subject to a patchwork of federal, state, and local regulations concerning water quality, treatment standards, and infrastructure development. Compliance with the Safe Drinking Water Act, for example, requires continuous monitoring and investment in treatment technologies. In 2024, the EPA continued to emphasize stricter enforcement of lead and copper rule revisions, impacting capital expenditure plans for many water utilities.

- State-specific water rights: Laws vary, affecting supply acquisition and management, especially in water-scarce regions.

- Evolving legal frameworks: Water use and distribution regulations are complex and subject to change, requiring constant adaptation.

- Regulatory compliance: Adherence to water quality and infrastructure standards, like those under the Safe Drinking Water Act, is paramount.

American Water Works (AWK) operates within a stringent legal framework, heavily influenced by federal mandates like the Clean Water Act and Safe Drinking Water Act, dictating water quality and wastewater discharge standards. The EPA's ongoing revisions to the Lead and Copper Rule, with updated requirements in 2024 and proposed improvements, necessitate significant capital outlays for lead testing and service line replacements, impacting AWK's financial planning for 2024 and beyond.

Environmental factors

Increasing water scarcity and more frequent droughts, especially in the Western U.S., present major environmental hurdles for water utilities like American Water Works. For instance, the Colorado River, a vital water source for millions, is experiencing unprecedented low levels, impacting water availability across several states.

To combat these challenges, American Water Works is actively pursuing strategies such as diversifying water sources through recycled water initiatives and desalination projects. They are also investing in expanding water storage capacity and implementing advanced technologies to enhance drought resilience across their service areas.

Climate change is intensifying extreme weather events like storms and floods, which directly threaten water quality and the durability of water infrastructure. For instance, in 2023, the US experienced 28 separate billion-dollar weather and climate disasters, many of which involved heavy rainfall and flooding, impacting water systems nationwide.

These shifts in precipitation patterns and increased storm severity necessitate significant investment in climate adaptation for companies like American Water Works. By 2025, it's estimated that water utilities will need to spend billions on infrastructure upgrades to cope with these changing conditions and maintain reliable service delivery to customers.

The increasing detection of emerging contaminants, particularly PFAS, in water supplies presents a significant environmental challenge for American Water Works. These "forever chemicals" are persistent and can pose health risks, necessitating proactive management.

American Water Works is actively engaged in research to better understand and address PFAS contamination. This commitment requires substantial investment in advanced treatment solutions, such as granular activated carbon or ion exchange resins, to effectively remove these substances and comply with increasingly stringent environmental regulations. For instance, as of early 2024, several states have already enacted or are considering PFAS maximum contaminant levels (MCLs) for drinking water, underscoring the urgency of these investments.

Water Quality Degradation

Water quality degradation is a significant environmental challenge impacting American Water Works. Factors like rising water temperatures, increased nutrient runoff leading to eutrophication, and higher sediment loads from extreme weather events all contribute to a decline in source water quality. For instance, the EPA reported in 2023 that over 30% of assessed river and stream miles nationwide showed signs of degradation, a trend exacerbated by climate change-driven precipitation patterns.

To counter these issues and ensure safe drinking water, American Water Works must implement robust strategies. These include developing and executing targeted watershed management plans, which involve working with stakeholders to reduce pollution at its source. Additionally, the company needs to invest in and utilize advanced water treatment technologies capable of effectively removing emerging contaminants and addressing the impacts of degraded source water.

- Warming Waters: Increased average water temperatures, particularly in surface reservoirs, can foster the growth of harmful algal blooms and affect the efficacy of certain treatment processes.

- Eutrophication Risks: Nutrient enrichment, often from agricultural and urban runoff, leads to eutrophication, depleting oxygen levels and impacting aquatic ecosystems, which in turn affects raw water quality.

- Stormwater Impacts: Extreme storm events, becoming more frequent, carry higher volumes of sediment, chemicals, and pathogens into water sources, necessitating more intensive treatment.

- Regulatory Compliance: Maintaining compliance with stringent drinking water standards, such as those set by the EPA, requires continuous monitoring and adaptation to evolving water quality challenges.

Sustainability and Environmental Leadership

American Water Works is actively pursuing environmental leadership and sustainability, focusing on reducing its carbon footprint and championing water reuse initiatives. This commitment is underscored by ambitious targets to decrease absolute scope 1 and scope 2 emissions, with a clear objective of achieving net-zero emissions by 2050.

In line with these goals, the company reported a 3.5% reduction in its absolute scope 1 and 2 greenhouse gas emissions in 2023 compared to its 2021 baseline, demonstrating tangible progress. Their sustainability strategy also includes investing in renewable energy sources and enhancing water efficiency across their systems.

- Emissions Reduction: Aiming to cut absolute scope 1 and 2 emissions, targeting net-zero by 2050.

- Water Reuse: Implementing programs to increase water reuse and conservation efforts.

- Renewable Energy: Increasing the use of renewable energy sources in operations.

- 2023 Performance: Achieved a 3.5% reduction in absolute scope 1 and 2 GHG emissions against a 2021 baseline.

Water scarcity, particularly in regions like the Western U.S. reliant on sources such as the Colorado River, poses a significant operational challenge, driving American Water Works to invest in diversified water sources and enhanced storage. Climate change exacerbates this by increasing the frequency of extreme weather events, such as the 28 billion-dollar weather disasters recorded in the US in 2023, which threaten infrastructure and necessitate substantial upgrades estimated in the billions by 2025.

The presence of emerging contaminants like PFAS in water supplies requires substantial investment in advanced treatment technologies, as evidenced by several states enacting or considering maximum contaminant levels for these chemicals as of early 2024. Furthermore, increasing water quality degradation, with over 30% of assessed river and stream miles showing degradation in 2023 according to the EPA, demands proactive watershed management and sophisticated treatment solutions.

American Water Works is committed to sustainability, aiming for net-zero emissions by 2050 and reporting a 3.5% reduction in absolute scope 1 and 2 greenhouse gas emissions in 2023 against a 2021 baseline, while also increasing water reuse and renewable energy adoption.

PESTLE Analysis Data Sources

Our PESTLE analysis for American Water Works is built on a robust foundation of data from federal and state regulatory bodies, industry-specific market research reports, and economic indicators from reputable financial institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the water utility sector.