American Water Works Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Water Works Bundle

American Water Works operates in a sector with moderate bargaining power from buyers, as water is an essential commodity. However, the threat of new entrants is generally low due to high capital requirements and regulatory hurdles. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping American Water Works’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for American Water Works is influenced by supplier concentration and the availability of critical inputs such as chemicals, pipes, and specialized equipment. If a significant portion of these essential materials comes from a limited number of providers, those suppliers gain considerable leverage, potentially driving up costs for American Water Works. For instance, in 2024, the water utility sector faced ongoing supply chain challenges for specialized infrastructure components, with some key manufacturers experiencing production backlogs.

American Water Works Company faces significant switching costs when dealing with its suppliers, particularly for specialized infrastructure components and regulatory compliance services. The need for extensive re-certification of equipment and retraining of personnel for new systems, should they switch providers, creates a substantial barrier. For instance, adopting new water treatment technologies might require months of testing and approval processes, adding to the overall expense and operational disruption.

The uniqueness of supplier inputs significantly impacts American Water Works' (AWK) bargaining power. If suppliers offer highly specialized or proprietary components, like advanced water purification technologies or unique pipe materials with limited alternatives, their ability to dictate terms increases. This is particularly relevant in a regulated industry where approved materials and technologies can be scarce.

For example, if a key supplier holds patents on essential water treatment chemicals or advanced metering infrastructure that AWK relies on, that supplier gains considerable leverage. In 2024, the infrastructure upgrade market for water utilities saw increased demand for specialized components, potentially giving suppliers of these unique items more pricing power.

Threat of forward integration by suppliers

The threat of suppliers moving into the water utility business themselves, for instance by directly providing water treatment solutions, is a key consideration. If suppliers can credibly signal their intent to compete with American Water Works, their leverage naturally grows.

However, in the heavily regulated environment of water utilities, this particular threat is generally quite low. The significant capital investment and stringent regulatory approvals required to operate as a utility create substantial barriers for potential new entrants, including suppliers.

- Low Likelihood of Supplier Forward Integration: Suppliers in the water sector typically face high barriers to entry for direct utility operations.

- Regulatory Hurdles: The extensive regulatory framework and capital requirements make it difficult for suppliers to replicate utility services.

- Impact on Bargaining Power: The low threat of forward integration limits suppliers' ability to exert significant bargaining power over American Water Works.

Importance of American Water Works Company to suppliers

American Water Works Company's (AWK) significant scale and diversified operational needs mean that individual suppliers often represent a smaller fraction of their overall revenue. For instance, in 2023, AWK reported capital expenditures exceeding $2.5 billion, indicating substantial purchasing power across various categories like pipes, treatment chemicals, and specialized equipment. This broad supplier base generally limits the leverage any single supplier can exert, as AWK can often find alternative sources for essential goods and services.

The bargaining power of suppliers to American Water Works is further tempered by the industry's nature. Many suppliers in the water utility sector deal with standardized products or services, reducing the uniqueness of their offerings. While some specialized equipment might offer a supplier more leverage, the overall reliance of suppliers on AWK's consistent demand, especially for large infrastructure projects, often shifts the power dynamic. For example, a supplier of water treatment chemicals might see a considerable portion of their sales tied to AWK's operations, making them less likely to push for unfavorable terms.

- Supplier Dependence: The proportion of a supplier's total sales derived from American Water Works is a key indicator. If AWK constitutes a significant portion of a supplier's business, that supplier's bargaining power is reduced because they are more dependent on maintaining the relationship.

- Industry Concentration: A fragmented supplier market with many providers typically grants the buyer, like AWK, greater leverage. Conversely, a highly concentrated supplier market where few companies offer essential goods or services can empower those suppliers.

- Switching Costs: The difficulty and expense for American Water Works to switch from one supplier to another influence supplier power. High switching costs can give suppliers more pricing power.

- Availability of Substitutes: If there are readily available substitutes for a supplier's products or services, the supplier's bargaining power is diminished.

The bargaining power of suppliers for American Water Works is generally moderate, influenced by factors like supplier concentration and switching costs. While some specialized components might offer suppliers leverage, AWK's scale and diversified needs often limit individual supplier power. For instance, in 2024, the water utility sector saw continued demand for infrastructure upgrades, potentially increasing the bargaining power of suppliers providing specialized pipes and treatment equipment.

However, AWK's significant purchasing volume, exceeding $2.5 billion in capital expenditures in 2023, allows it to negotiate favorable terms with many suppliers. The threat of suppliers integrating forward into utility operations remains low due to high regulatory and capital barriers. This balance suggests that while some suppliers can exert influence, AWK's overall position helps mitigate excessive supplier power.

| Factor | Impact on AWK | 2024/2023 Data/Trend |

| Supplier Concentration | Moderate | Ongoing supply chain challenges for specialized components in 2024. |

| Switching Costs | High for specialized equipment/services | Re-certification and retraining add significant expense. |

| Uniqueness of Inputs | Varies; higher for proprietary tech | Patented water treatment chemicals or advanced metering infrastructure can increase supplier leverage. |

| Supplier Forward Integration Threat | Low | High barriers to entry for utility operations limit this threat. |

| AWK's Purchasing Power | High | Over $2.5 billion in capital expenditures in 2023 indicates significant leverage. |

What is included in the product

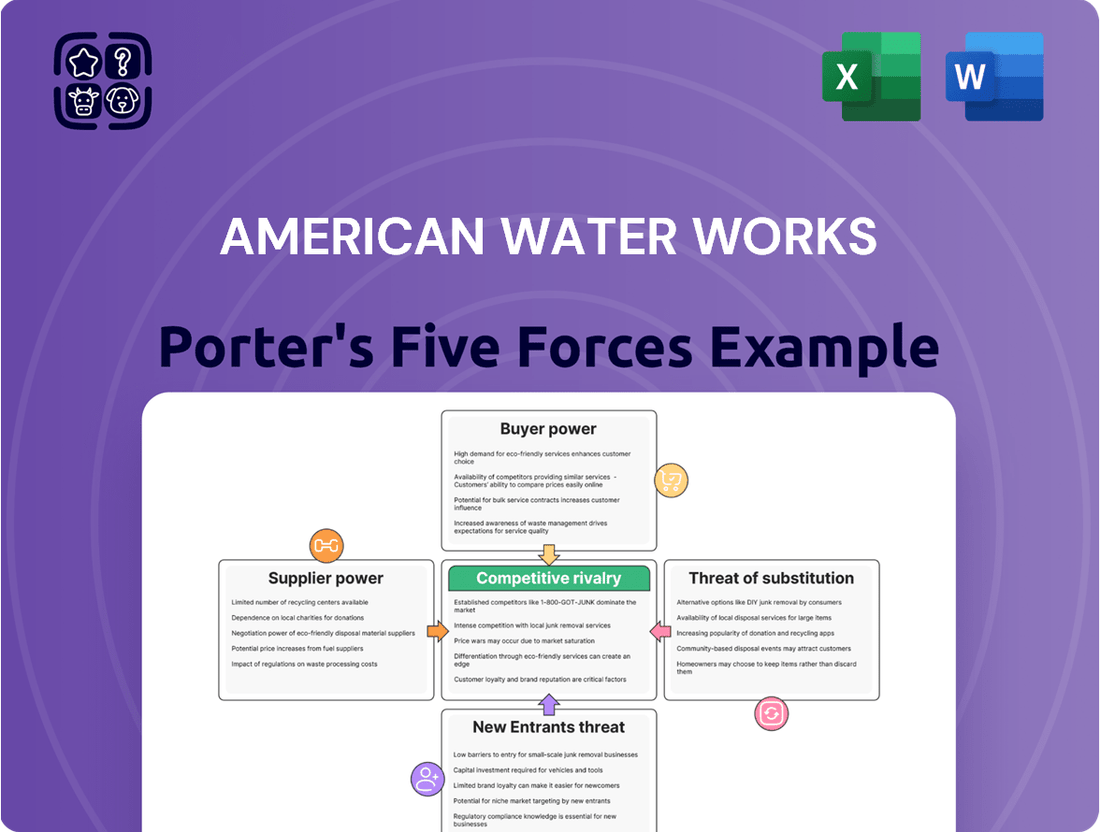

This analysis evaluates the competitive landscape for American Water Works by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the water utility industry.

Instantly understand competitive pressures with a clear, visual representation of each force, simplifying complex strategic analysis.

Customers Bargaining Power

Customer price sensitivity for American Water Works is generally low for residential users because water is an essential service with few direct substitutes, meaning they are unlikely to drastically reduce consumption due to minor price increases. For instance, a typical residential water bill represents a small fraction of most household budgets, making significant price changes less impactful on overall spending.

However, industrial and commercial clients may exhibit higher price sensitivity, particularly those with substantial water usage as a key operational input. If water costs represent a larger percentage of their operating expenses, they might explore conservation measures or, in some cases, seek alternative water sources if economically viable, though this is often challenging for essential services.

The availability of substitutes for customers is a critical factor in assessing bargaining power. For American Water Works Company, a provider of regulated water and wastewater services, customers generally have very limited, if any, viable alternatives. Once connected to the existing water and sewer infrastructure, switching to another provider is typically not feasible or economically practical, effectively creating a captive customer base.

This lack of substitutes is a hallmark of utility monopolies, significantly diminishing the bargaining power of customers. In 2024, American Water Works operated in 14 states, serving millions of customers. The regulated nature of these services means that alternative water sources or treatment facilities are rarely an option for individual households or businesses, reinforcing the company's strong position in this regard.

Customer concentration and volume significantly influence bargaining power. American Water Works Company serves millions of customers across numerous states, from individual households to large industrial facilities. This broad customer base means that no single customer or small group of customers represents a substantial portion of the company's overall revenue.

For instance, in 2023, American Water Works reported total operating revenues of approximately $4.8 billion. This vast revenue stream, derived from a diverse customer portfolio, dilutes the impact any one customer could have on pricing or service terms. While large industrial clients might possess slightly more negotiation leverage due to their higher consumption volumes compared to residential customers, the sheer number of customers prevents any individual or small group from dictating terms.

Customer switching costs

Customer switching costs for American Water Works are exceptionally high, effectively rendering them negligible. For residential and commercial customers connected to American Water Works' infrastructure, the cost and complexity of switching to an alternative water or wastewater provider are prohibitive. This involves not just the logistical challenge of disconnecting from one system and connecting to another, but also the significant expense of installing entirely new plumbing and infrastructure to their properties.

This inherent lack of practical alternatives means customers have virtually no bargaining power derived from the ability to switch providers.

- Extreme Infrastructure Dependency: Residential and commercial properties are physically connected to a specific water and wastewater network.

- Prohibitive Switching Costs: Disconnecting from one utility and reconnecting to another would necessitate extensive and costly physical modifications to a customer's property.

- Regulatory Barriers: In many regulated territories, the establishment of duplicate utility infrastructure is restricted or impossible, further limiting customer choice.

- Negligible Switching Power: Due to these factors, customers face virtually insurmountable hurdles in switching, giving them minimal leverage over American Water Works.

Threat of backward integration by customers

The threat of backward integration by customers for American Water Works is generally low. This threat arises if customers could potentially provide their own water or wastewater services. While a few exceptionally large industrial or agricultural clients might explore developing independent water sources or treatment facilities, this is rarely a practical or economical option for the typical residential or commercial customer. For instance, the capital investment and ongoing operational complexity required for such self-sufficiency are prohibitive for most.

The feasibility of customers integrating backward is severely limited by the significant infrastructure and regulatory hurdles involved in water and wastewater management. Residential customers, comprising a substantial portion of American Water Works' revenue base, lack the technical expertise, capital, and regulatory approvals to operate their own water systems. Similarly, most commercial entities do not possess the scale or need to justify the immense cost and complexity of establishing independent water and wastewater treatment capabilities. This inherent difficulty significantly mitigates the bargaining power of customers in this regard.

For example, in 2024, American Water Works served approximately 15 million people across 14 states. The vast majority of these customers are individual households and small to medium-sized businesses, for whom developing their own water infrastructure would be financially and logistically impossible. The few large industrial users that might consider such a move are typically subject to long-term contracts and regulatory frameworks that further discourage or prevent backward integration.

- Low Feasibility for Most Customers: The high capital and operational costs make backward integration impractical for residential and most commercial clients.

- Infrastructure and Regulatory Barriers: Establishing independent water and wastewater services requires significant technical expertise and regulatory compliance.

- Limited Scale of Potential Integrators: Only very large industrial or agricultural customers might consider this, but it's not a widespread threat.

- Contractual and Regulatory Safeguards: Existing agreements and regulations can further deter customers from pursuing self-sufficiency.

Customers of American Water Works possess very low bargaining power, primarily due to the essential nature of water and the lack of viable alternatives. The high costs and logistical complexities associated with switching providers, coupled with regulatory barriers, effectively lock customers into existing service agreements. This limited ability to switch or seek alternatives significantly reduces their leverage in price negotiations or service demands.

In 2024, American Water Works' extensive infrastructure, serving approximately 15 million people across 14 states, reinforces this low customer bargaining power. The company's diverse customer base, with total operating revenues around $4.8 billion in 2023, means no single customer segment can exert substantial influence. For instance, the prohibitive costs of developing independent water sources or treatment facilities prevent backward integration for most of its residential and commercial clients.

| Factor | Assessment | Impact on Bargaining Power |

| Price Sensitivity | Low for residential, moderate for industrial | Low |

| Availability of Substitutes | Virtually none | Very Low |

| Switching Costs | Extremely High | Very Low |

| Threat of Backward Integration | Low | Low |

What You See Is What You Get

American Water Works Porter's Five Forces Analysis

This preview displays the complete American Water Works Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're looking at the actual document, meaning the detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you'll receive. Once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

American Water Works operates in a sector characterized by significant fragmentation at the local level, with numerous municipal and smaller private water and wastewater utilities. Despite this, American Water Works stands as the largest publicly traded company in the U.S. water utility space, indicating a degree of consolidation within the sector, particularly through strategic acquisitions.

Direct competition for the same customer base within a specific geographic territory is generally limited due to the nature of regulated service areas, which often grant monopolies. Therefore, competitive rivalry for American Water Works primarily manifests through the pursuit of acquisition opportunities to expand its regulated asset base and market share, rather than direct head-to-head competition in established markets.

The water utility sector generally sees steady, modest growth, largely influenced by population increases and the ongoing need for infrastructure upgrades. In 2024, the U.S. population is projected to grow by approximately 0.8%, a factor that directly impacts demand for water services.

This slow growth environment can heighten competition among industry players as they vie for market share or seek to acquire other businesses. However, American Water Works Company's position within a regulated framework provides a degree of protection from intense price wars, a common characteristic of more rapidly expanding industries.

American Water Works, like other water utilities, faces significant competitive rivalry stemming from high fixed costs tied to its extensive infrastructure, including treatment plants and miles of pipes. These substantial investments necessitate high capacity utilization to achieve cost efficiencies, as underutilized assets become a major burden.

While high fixed costs can typically fuel intense rivalry as companies vie for market share to spread those costs, American Water Works' core business operates under a regulated monopoly structure. This regulatory framework significantly limits direct competition for its primary water and wastewater services in its service territories, thereby mitigating the intensity of rivalry in those segments.

In 2024, American Water Works reported capital expenditures of $2.7 billion, highlighting the ongoing need to invest in and maintain its vast infrastructure. This continuous investment underscores the importance of operational efficiency and effective management of these high fixed costs to ensure profitability and service quality.

Product differentiation and switching costs

Water and wastewater services are fundamentally undifferentiated commodities. Customers generally see little distinction between providers, and the significant investment required to connect to and utilize these essential services creates prohibitively high switching costs. This lack of differentiation and high switching costs would typically intensify rivalry, but the regulated monopoly structure within most service territories significantly curtails direct competition on service features or pricing.

The regulated nature of the industry means that American Water Works, like its peers, operates within defined service areas where it is often the sole provider. This structure inherently limits direct competitive rivalry based on product differentiation or price wars. Instead, competition often manifests in bidding for new service territories or franchises, where the ability to demonstrate operational efficiency and financial stability is paramount.

- Service Territory Dominance: In 2024, American Water Works served approximately 15 million people across 14 states, highlighting its substantial presence and the limited direct competition within these established territories.

- Infrastructure as a Barrier: The immense cost and complexity of replicating water and wastewater infrastructure, including pipes, treatment plants, and distribution networks, act as a significant deterrent to new entrants, effectively insulating existing players.

- Regulatory Oversight: While rivalry is dampened by monopoly structures, companies like American Water Works face intense scrutiny from regulatory bodies regarding pricing, service quality, and capital investments, which influences operational strategies and profitability.

Exit barriers for competitors

American Water Works, like other utilities, faces substantial exit barriers. The sheer scale of investment in water infrastructure, including pipes, treatment plants, and distribution networks, makes it incredibly difficult for any company to divest or cease operations without incurring massive financial losses. For instance, American Water Works reported capital expenditures of $2.5 billion in 2023, highlighting the ongoing commitment required.

Furthermore, the essential nature of water services means that regulatory bodies heavily scrutinize any attempts to exit a market. Companies are often obligated to ensure continuity of service, which can involve finding a buyer or maintaining operations even when unprofitable. This regulatory oversight, coupled with the sunk costs in specialized infrastructure, effectively locks companies into their service areas for the long term.

These high exit barriers mean that even struggling competitors are less likely to leave the market quickly. This can lead to a situation where less efficient players remain, potentially impacting overall industry profitability and competitive intensity, though it's more a factor of market stability than direct competitive rivalry.

- High Capital Investment: American Water Works' extensive infrastructure represents significant sunk costs, making divestment financially prohibitive.

- Regulatory Hurdles: Exit requires regulatory approval, often contingent on ensuring uninterrupted service, adding complexity and cost.

- Essential Service Obligation: The non-discretionary nature of water means companies cannot easily walk away from their service commitments.

- Long-Term Commitment: These factors create a market where players are committed for the long haul, influencing strategic decisions.

Competitive rivalry for American Water Works is generally low due to the regulated monopoly nature of its core water and wastewater services in most of its operating territories. Direct competition on price or service features is minimal because customers have limited or no alternative providers within these areas. For example, in 2024, American Water Works served approximately 15 million people across 14 states, underscoring its dominant position in many regions.

Instead of direct rivalry, competition often occurs in the acquisition of other utilities or in bidding for new service franchises. The high fixed costs associated with maintaining extensive infrastructure, such as treatment plants and distribution networks, necessitate efficient operations. In 2024, American Water Works reported capital expenditures of $2.7 billion, demonstrating the ongoing investment required to manage these assets effectively.

The undifferentiated nature of water as a commodity and the high switching costs for customers further reduce direct competitive pressure. While this would typically intensify rivalry, the regulatory framework effectively limits head-to-head competition. Companies are more focused on operational efficiency and regulatory compliance than on aggressive market share battles within established territories.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Nature of Service | Water and wastewater are essential, undifferentiated commodities. | Lowers rivalry as differentiation is difficult. |

| Regulatory Structure | Operates as a regulated monopoly in most service areas. | Significantly limits direct competitive rivalry. |

| Customer Switching Costs | High costs and infrastructure dependencies for customers. | Reduces customer-driven rivalry. |

| Acquisition Focus | Competition often centers on acquiring other utilities. | Indirect rivalry through M&A activity. |

| Infrastructure Costs | High fixed costs require efficient utilization. | Drives operational focus rather than price wars. |

SSubstitutes Threaten

The threat of substitutes for American Water Works is relatively low for core water utility services. While alternatives like private wells or rainwater harvesting exist, they are often not practical or cost-effective for most residential and commercial customers requiring consistent, high-volume water supply. In 2024, the vast majority of households and businesses rely on municipal water systems for their daily needs.

Bottled water serves as a substitute for drinking water, but it's not a viable alternative for the extensive water usage in homes and businesses, such as for sanitation, irrigation, or industrial processes. The infrastructure and sheer volume required make bottled water an impractical substitute for overall water provision.

The cost-effectiveness of substitutes for American Water Works' services presents a moderate threat. While private wells are a theoretical alternative in some rural settings, their high initial setup costs, ongoing maintenance, and potential for water quality issues make them economically less viable for most consumers compared to the reliable and regulated utility service.

Bottled water, another substitute, is considerably more expensive for everyday consumption. For instance, the average cost of tap water in the U.S. is around $0.004 per gallon, while even budget-friendly bottled water can cost upwards of $1.00 per gallon, representing a significant price disparity that limits its appeal as a widespread substitute for essential water needs.

The threat of substitutes for American Water Works' treated water is generally low, primarily due to the high quality and reliability standards it adheres to. Regulated water utilities like American Water Works are bound by stringent government regulations ensuring consistent water quality and an on-demand supply, a level of assurance difficult for most substitutes to match.

While private wells exist as an alternative, they often present significant disadvantages in terms of reliability and quality. Users of private wells are solely responsible for testing, treating, and maintaining their water supply, which can be inconsistent and prone to contamination. For instance, in 2023, the EPA continued to highlight concerns about private well water quality across the US, with various studies indicating potential issues with bacteria, nitrates, and heavy metals in a significant percentage of tested wells.

Impact of water conservation technologies

The threat of substitutes for American Water Works Company is amplified by advancements in water conservation technologies. Devices such as low-flow fixtures, sophisticated irrigation systems, and industrial water recycling significantly decrease the overall volume of water consumed. These innovations act as substitutes for the purchased water that American Water Works supplies.

While these technologies don't replace the fundamental need for water services, they directly reduce the demand for American Water Works' primary offering, thereby affecting its revenue streams. For example, widespread adoption of water-efficient appliances can lead to a noticeable drop in per-household consumption.

In 2024, many utilities, including American Water Works, actively promote these conservation measures. This strategy is often employed not only to manage overall demand and ensure system sustainability but also to align with regulatory goals and customer expectations for responsible water use. For instance, American Water Works' own initiatives often highlight customer savings through efficient water use.

- Reduced Demand: Technologies like low-flow toilets can reduce water usage by up to 20 gallons per day per household.

- Revenue Impact: A 10% reduction in water consumption across a service area could translate to a significant revenue decrease for the utility.

- Sustainability Focus: Promoting conservation helps utilities manage infrastructure strain and meet environmental objectives.

- Customer Engagement: Offering rebates or educational programs for water-saving devices fosters customer loyalty and reduces peak demand.

Regulatory and legal hurdles for substitutes

The threat of substitutes for American Water Works Company is significantly mitigated by stringent regulatory and legal frameworks governing alternative water sources and wastewater disposal. For instance, the Safe Drinking Water Act in the United States imposes rigorous standards on water quality and treatment, making it exceptionally challenging and expensive for any substitute to meet these requirements. Similarly, wastewater discharge regulations, such as those under the Clean Water Act, necessitate extensive infrastructure and compliance measures, further complicating the viability of alternatives.

These governmental oversight and permitting processes create substantial barriers to entry for potential substitute providers. Customers looking to bypass American Water Works would face a complex web of federal, state, and local regulations, including obtaining permits for water abstraction, treatment, and discharge. The sheer cost and time involved in navigating these legal hurdles make it economically unfeasible for most customers to develop or adopt independent water solutions. For example, in 2024, the average cost for obtaining environmental permits for new water infrastructure projects can range from tens of thousands to millions of dollars, depending on the scale and complexity.

- Regulatory Compliance Costs: Significant investment is required to meet stringent water quality and discharge standards, deterring substitute providers.

- Permitting Complexity: Navigating federal, state, and local regulations for water and wastewater services is a time-consuming and costly process.

- Environmental Standards: Adherence to environmental protection laws necessitates advanced treatment technologies and ongoing monitoring, increasing operational expenses for alternatives.

- Infrastructure Investment: Developing independent water and wastewater systems demands substantial capital outlay, often exceeding the cost-effectiveness of using established utility services.

The threat of substitutes for American Water Works is low due to the essential nature of water and the high cost and regulatory hurdles associated with alternatives. While water conservation technologies reduce demand, they do not eliminate the need for a reliable water source. The significant capital investment and complex permitting required for independent water systems make them impractical for most customers, especially when compared to the regulated quality and accessibility provided by American Water Works.

Entrants Threaten

The threat of new entrants for American Water Works is significantly mitigated by high capital requirements. Establishing a new water and wastewater utility demands an enormous upfront investment in essential infrastructure, encompassing treatment facilities, vast pipe distribution systems, and pumping stations. For instance, in 2023, American Water Works reported capital expenditures of $2.9 billion, highlighting the scale of investment needed to maintain and expand operations.

This substantial financial barrier makes it exceedingly difficult for new companies to enter the market and compete effectively with established entities like American Water Works. The sheer cost of building out a comparable network from scratch presents a formidable obstacle, deterring potential new players from even attempting to enter the regulated utility space.

The water utility sector faces formidable regulatory hurdles that act as a significant deterrent to new entrants. Federal, state, and local governments impose a complex web of permits, licenses, and stringent compliance standards, such as those set by the Environmental Protection Agency (EPA) and various public utility commissions. For instance, in 2024, water infrastructure projects often require extensive environmental impact assessments and approvals, a process that can take years and substantial capital to navigate.

Existing utilities like American Water Works Company benefit from significant economies of scale in operations, purchasing, and maintenance due to their vast infrastructure and customer base. For instance, in 2023, American Water Works reported operating revenues of $4.8 billion, reflecting the scale of their operations.

New entrants would struggle to achieve similar cost efficiencies without a large initial investment and customer base, putting them at a competitive disadvantage. Building a comparable network of water treatment plants and distribution systems would require billions of dollars, a substantial barrier for any new player.

Customer loyalty and switching costs

Customer loyalty for American Water Works is exceptionally high, largely because customers are effectively captive within their designated service territories. This is due to the essential, physical infrastructure that connects them directly to the existing water utility, making it nearly impossible to switch providers.

The prohibitive cost and sheer logistical complexity involved in establishing new water infrastructure mean that potential new entrants face an almost insurmountable barrier to entry. They simply cannot attract customers away from established companies like American Water Works with relative ease.

- High Capital Investment: Building new water treatment plants and distribution networks requires billions of dollars, deterring most potential competitors.

- Regulatory Hurdles: Obtaining permits and approvals for water services is a lengthy and complex process, often favoring incumbent utilities.

- Essential Service Nature: Water is a non-discretionary service, meaning customers have little incentive to switch if the current provider is reliable, regardless of minor price differences.

- Limited Geographic Overlap: Water utilities typically operate within exclusive service territories granted by local governments, preventing direct competition within the same area.

Access to distribution channels and essential resources

New entrants face substantial hurdles in securing access to critical distribution channels and essential resources. For a company like American Water Works, this means that new players would need to acquire rights to water sources, secure land for treatment plants and infrastructure, and obtain rights-of-way for pipeline networks. These assets are often already controlled by established utilities or are subject to stringent governmental regulations, making them difficult and costly for newcomers to obtain.

The scarcity and control of these foundational elements significantly deter potential new entrants. For instance, in many regions, water rights are a complex legal and regulatory matter, often already allocated. Similarly, obtaining permits for extensive pipeline construction can be a lengthy and politically charged process. These barriers effectively limit the threat of new entrants, providing a degree of protection for existing, well-established companies in the water utility sector.

- Limited Access to Water Sources: New entrants must navigate complex water rights and allocation systems, often already secured by incumbents.

- Infrastructure and Land Acquisition Challenges: Securing land for treatment facilities and rights-of-way for pipelines involves significant regulatory hurdles and costs.

- Governmental and Regulatory Barriers: Permits and approvals for water infrastructure are often difficult to obtain, favoring established players with existing relationships and expertise.

The threat of new entrants for American Water Works is very low. The immense capital required to build water infrastructure, coupled with stringent regulatory approvals and exclusive service territories, creates significant barriers. For example, American Water Works invested $2.9 billion in capital expenditures in 2023, demonstrating the scale of investment needed.

New companies face difficulties in acquiring necessary resources like water rights and rights-of-way, which are often already controlled by established players or heavily regulated. These factors, combined with the essential nature of water services and lack of customer switching incentives, effectively shield American Water Works from significant new competition.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Building water treatment and distribution infrastructure costs billions. | Extremely High |

| Regulatory Hurdles | Complex permits, licenses, and compliance standards (e.g., EPA). | Very High |

| Economies of Scale | Incumbents benefit from lower costs due to large operations. | High |

| Customer Loyalty/Captivity | Essential service, physical infrastructure locks in customers. | Very High |

| Access to Resources | Water rights and rights-of-way are scarce and regulated. | High |

Porter's Five Forces Analysis Data Sources

Our analysis of American Water Works leverages data from SEC filings, annual reports, and investor presentations to understand the company's financial health and strategic positioning. We also incorporate industry-specific reports from organizations like the EPA and AWWA, alongside macroeconomic data, to assess external pressures.