American Water Works Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Water Works Bundle

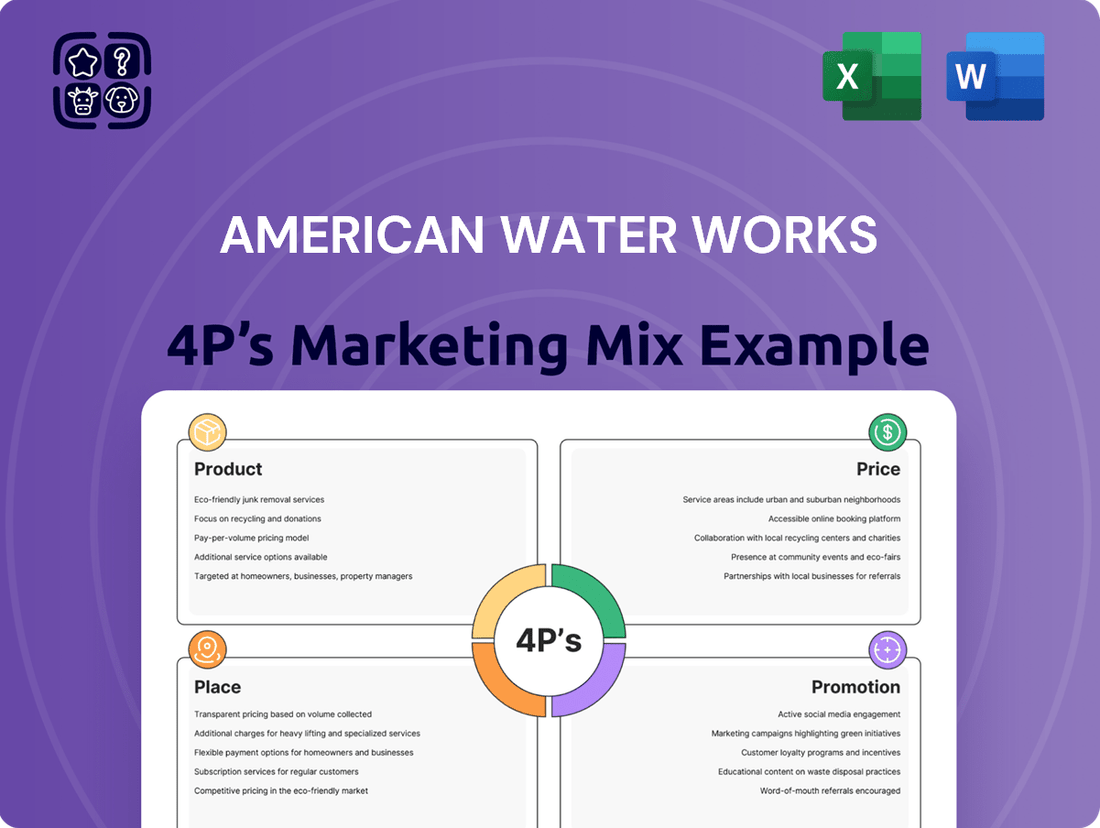

American Water Works expertly navigates the market by strategically aligning its Product, Price, Place, and Promotion. This comprehensive analysis delves into how their essential water services are positioned, priced competitively, delivered efficiently, and communicated effectively to customers. Discover the core elements driving their success and gain actionable insights for your own marketing endeavors.

Unlock the full potential of this analysis to understand American Water Works' market dominance. Our detailed report breaks down each of the 4Ps, offering a clear roadmap of their strategies. Get ready to elevate your own business planning with this ready-to-use, editable resource.

Product

American Water Works' core product is the regulated provision of essential water and wastewater services. This encompasses treating, distributing, and collecting water and wastewater for a diverse customer base, including residential, commercial, and industrial sectors, as well as military installations across 14 states. The company's commitment lies in delivering clean, safe, reliable, and affordable water, alongside efficient wastewater management. For instance, in 2023, American Water Works invested approximately $2.7 billion in infrastructure improvements, underscoring its dedication to product quality and service reliability.

American Water Works places a strong emphasis on infrastructure investment and modernization as a core element of its marketing mix. The company is committed to consistently upgrading its vast network of water and wastewater treatment plants, along with its distribution and collection systems. This focus ensures reliable service and addresses the critical need for system improvements.

Looking ahead, American Water has ambitious capital investment plans, projecting between $40 billion and $42 billion over the next ten years. A substantial portion of this capital will be directed towards replacing aging pipelines, enhancing system resilience against various threats, and elevating water quality to meet increasingly stringent regulatory requirements. This includes critical initiatives like addressing PFAS contamination and the replacement of lead service lines, demonstrating a proactive approach to public health and environmental stewardship.

American Water's product is fundamentally its commitment to delivering safe, high-quality water. This dedication is underscored by adherence to rigorous performance and water quality standards, a commitment frequently validated by national awards for their treatment facilities. For instance, in 2023, American Water continued its significant investments in infrastructure upgrades, including substantial progress on lead service line replacement projects across its service territories.

Beyond established standards, American Water actively invests in addressing emerging concerns. The company is making targeted investments to tackle contaminants like PFAS, ensuring that the drinking water provided meets and exceeds evolving safety benchmarks. This proactive approach to water quality is a cornerstone of their product offering, building trust and reliability with customers.

Reliability and Resiliency of Service

American Water Works places a premium on the reliability and resiliency of its water and wastewater services. This commitment is backed by substantial, strategic investments aimed at fortifying its infrastructure against the increasing challenges posed by climate change and weather volatility. For instance, in 2024, the company planned approximately $2.7 billion in capital expenditures to improve its systems, a significant portion of which directly addresses system hardening and modernization to ensure uninterrupted service delivery.

The company’s operational excellence, driven by a disciplined approach to capital deployment, underpins the dependability customers expect. This focus ensures that essential services remain consistent, even in the face of adverse conditions. American Water's proactive strategy includes upgrading aging infrastructure, implementing advanced leak detection technologies, and enhancing cybersecurity measures to safeguard its critical operations.

Key aspects of their reliability and resiliency efforts include:

- Infrastructure Hardening: Investments in upgrading pipes, treatment facilities, and distribution networks to withstand extreme weather events such as floods and droughts.

- System Redundancy: Developing backup systems and diverse water sources to maintain service continuity during emergencies or maintenance.

- Technological Integration: Utilizing smart grid technologies and data analytics to monitor system performance, predict potential failures, and optimize response times.

- Climate Adaptation Planning: Integrating climate projections into long-term capital planning to proactively address future environmental risks.

Market-Based and Military Services

American Water Works extends its reach beyond typical residential and commercial customers by offering specialized water and wastewater services to U.S. military bases. These contracts, often long-term, are structured similarly to regulated utility operations, providing a stable revenue stream and showcasing the company's adaptability. In 2023, American Water reported that its government contracts, including those with military installations, represented a significant, albeit smaller, portion of its overall revenue, highlighting its diversified service model.

These military services are crucial for maintaining essential infrastructure on government property, demonstrating American Water's capacity to manage complex operations under specific governmental requirements. This segment, while not as large as its regulated utility business, underscores the company's ability to serve a wide array of client needs, reinforcing its position as a comprehensive water solutions provider.

- Military Contracts: American Water serves numerous U.S. military installations, providing vital water and wastewater management.

- Revenue Contribution: While a smaller segment, these government contracts contribute to revenue diversification.

- Operational Expertise: These services highlight American Water's capability in managing critical infrastructure for government entities.

- Strategic Importance: Demonstrates a commitment to serving diverse customer needs, including national defense infrastructure.

American Water Works' product is the reliable delivery of safe, high-quality water and wastewater services. This is supported by significant infrastructure investments, with approximately $2.7 billion allocated in 2023 and planned capital expenditures of $40 billion to $42 billion over the next decade. These investments focus on modernization, addressing emerging contaminants like PFAS, and replacing aging infrastructure, including lead service lines.

| Product Aspect | Description | Key Investments/Data (2023-2025) |

|---|---|---|

| Core Service | Regulated provision of water and wastewater treatment and distribution. | Serves residential, commercial, industrial, and military customers across 14 states. |

| Quality & Safety | Commitment to clean, safe, and reliable water meeting stringent standards. | Invested in lead service line replacement and tackling PFAS contamination. Received national awards for treatment facilities in 2023. |

| Infrastructure & Reliability | Upgrading and modernizing water and wastewater systems for resilience. | Approximately $2.7 billion in capital expenditures planned for 2024 to improve systems and ensure uninterrupted service. |

| Service Diversity | Specialized services for U.S. military installations. | Government contracts, including military, represent a diversified revenue stream, highlighting operational expertise for government entities. |

What is included in the product

This analysis provides a comprehensive breakdown of American Water Works' marketing strategies, examining their Product offerings, Pricing structures, Place (distribution) of services, and Promotional activities.

Provides a clear, actionable framework for American Water Works to address customer concerns regarding water quality and service reliability, transforming potential complaints into opportunities for positive engagement.

Place

American Water Works boasts an extensive geographic footprint, operating in 14 states across the United States. This broad reach allows them to serve a diverse customer base, encompassing residential, commercial, and industrial clients.

As the largest publicly traded water and wastewater utility in the U.S. by population served, American Water provides essential services to approximately 14 million people. This scale is a significant competitive advantage, enabling economies of scale and a robust operational network.

The primary 'place' for American Water Works' services is through its regulated utility subsidiaries. These operations are under the jurisdiction of state utility commissions, which oversee service areas and ensure water and wastewater services are accessible and delivered efficiently to customers within their designated territories. For instance, in 2023, American Water invested $2.7 billion in infrastructure improvements across its 14 states, a key aspect of fulfilling its 'place' obligation within regulated markets.

American Water directly provides essential water and wastewater services to millions of customers across the United States. This direct delivery model, managed through its extensive infrastructure of pipes, treatment facilities, and distribution networks, ensures reliable access to clean water and effective wastewater management for homes and businesses. For instance, in 2023, American Water served approximately 14.5 million people, highlighting the scale of its direct customer engagement.

Acquisition-Led Expansion

Acquisition-led expansion is a cornerstone of American Water Works' market strategy, enabling them to grow their customer base and geographic reach. This involves acquiring smaller, often municipally-owned, water and wastewater systems. This proactive approach solidifies their position in the utility sector.

The impact of this strategy is evident in their recent performance. In 2024 alone, American Water Works successfully integrated nearly 90,000 new customer connections. A significant portion of this growth, specifically 69,500 connections, was directly attributed to strategic acquisitions.

- Acquisition Strategy: Focus on acquiring smaller, often municipal, water and wastewater systems.

- Market Expansion: Increases customer base and geographic footprint.

- 2024 Performance: Added nearly 90,000 customer connections.

- Acquisition Contribution: 69,500 of the 2024 customer connections came from acquisitions.

Military Installation Partnerships

American Water's military installation partnerships represent a crucial, albeit specialized, aspect of its distribution strategy. These long-term contracts, often spanning 50 years, secure a stable and predictable revenue stream by providing essential water and wastewater services to U.S. military communities. This segment highlights American Water's ability to leverage its core competencies in diverse and often complex operational environments.

These partnerships go beyond simple service provision, often involving significant infrastructure upgrades and management. For instance, in 2023, American Water continued to invest in modernizing water systems at various bases, ensuring reliable service for tens of thousands of service members and their families. The company reported that its Military Partnerships segment contributed approximately $400 million in revenue in 2023, showcasing its substantial presence in this niche market.

- Long-term Contracts: Secures stable revenue through 50-year agreements with the U.S. Department of Defense.

- Essential Services: Provides critical water and wastewater management for military personnel and their families.

- Infrastructure Investment: Demonstrates commitment through ongoing upgrades and modernization projects on bases.

- Revenue Contribution: Military partnerships generated around $400 million in revenue for American Water in 2023.

American Water Works' 'place' is defined by its regulated utility operations across 14 states, serving approximately 14.5 million people as of 2023. This extensive network is managed through state utility commissions, ensuring service delivery within designated territories. The company's strategic acquisitions further expand this 'place,' as seen with the addition of nearly 90,000 customer connections in 2024, primarily through acquiring smaller systems.

| Market Segment | Geographic Reach | Customer Base (approx.) | Key Infrastructure |

|---|---|---|---|

| Regulated Utilities | 14 States | 14.5 Million People (2023) | Extensive pipe networks, treatment facilities |

| Acquisition Growth | Expanding across existing states | 90,000 new connections (2024) | Integration of acquired systems |

| Military Partnerships | U.S. Military Installations | Tens of thousands of personnel/families | On-base water/wastewater infrastructure |

Preview the Actual Deliverable

American Water Works 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive American Water Works 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use for your business insights.

Promotion

American Water Works prioritizes public relations and community engagement, fostering trust through active participation in the areas it serves. These efforts include significant investments in environmental sustainability grants and support for local initiatives, reinforcing their commitment to community well-being. In 2023, American Water provided over $1.7 million in grants and sponsorships, directly impacting communities across its footprint.

As a publicly traded entity, American Water Works prioritizes robust investor relations and financial communications. This commitment is evident in their regular earnings calls, which in the first quarter of 2024, provided insights into their strategic progress and financial health. They also issue comprehensive annual reports and proxy statements, ensuring transparency for shareholders and the broader financial community.

The company actively engages with analysts and investors through detailed presentations, offering a clear view of their financial performance and future strategic direction. For instance, their 2023 annual report highlighted a 6.1% increase in revenue to $4.8 billion, demonstrating consistent growth and operational efficiency, which is crucial for stakeholder confidence.

American Water Works (AWK) leverages its website, amwater.com, and social media channels like LinkedIn, Facebook, X, and Instagram to connect with customers and investors. This digital strategy ensures widespread and prompt delivery of crucial information, including financial updates and sustainability initiatives.

In 2024, AWK continued to emphasize its digital footprint. For instance, their investor relations section on amwater.com provides easy access to quarterly earnings reports and SEC filings, facilitating transparency. Their social media presence aims to foster community engagement and share company news, reflecting a commitment to accessible communication.

Sustainability Reporting and ESG Initiatives

American Water Works actively engages in sustainability reporting, publishing annual reports that detail its environmental, social, and governance (ESG) performance. This commitment to transparency showcases their dedication to responsible operations, resonating with investors and the public who increasingly prioritize sustainability. For instance, in their 2023 report, they detailed significant progress in reducing greenhouse gas emissions and investing in water infrastructure resilience, demonstrating tangible ESG advancements.

Their ESG initiatives are a core component of their marketing mix, particularly under the Promotion element, as they communicate their values and operational integrity. This proactive approach helps build trust and brand loyalty among stakeholders who are environmentally and socially conscious. The company's focus on these areas is not just about compliance but a strategic effort to align with evolving market expectations and investor sentiment, which is crucial in the current financial landscape.

Key aspects of their sustainability promotion include:

- Annual Sustainability Reports: Providing detailed data on ESG performance, including environmental metrics and social impact.

- Stakeholder Engagement: Actively communicating their sustainability efforts to investors, customers, and communities.

- ESG Integration: Embedding ESG principles into their business strategy and operations, as evidenced by their 2024-2028 ESG goals.

- Transparency and Accountability: Offering clear insights into their progress and challenges in achieving sustainability targets.

Regulatory Advocacy and Industry Participation

American Water actively engages with regulatory bodies and industry associations, such as the American Water Works Association (AWWA). This participation is crucial for advocating for policies that support sustainable water management and infrastructure investment, aligning with their commitment to reliable service. For instance, in 2024, American Water continued its engagement in numerous state regulatory proceedings, influencing rate cases and operational standards to ensure fair cost recovery and service quality.

Their involvement in industry groups allows them to share best practices and contribute to the development of water quality and management standards. This collaborative approach helps shape the future of the water utility sector, ensuring that advancements in technology and operational efficiency are adopted industry-wide. In 2024, American Water's representatives contributed to AWWA's committees focused on cybersecurity and lead service line replacement strategies.

- Regulatory Influence: American Water participates in state-level regulatory proceedings to advocate for favorable rate structures and operational policies.

- Industry Best Practices: Engagement with associations like AWWA facilitates the sharing and adoption of leading operational and quality standards.

- Policy Advocacy: The company actively lobbies for constructive policies that promote infrastructure investment and sustainable water resource management.

- Sector Advancement: Contributions to industry discussions help drive innovation and improvement across the broader water utility landscape.

American Water Works' promotional strategy heavily relies on robust investor relations and transparent financial communication. Their commitment to keeping stakeholders informed is evident in their regular earnings calls and detailed annual reports, which in 2023, highlighted a 6.1% revenue increase to $4.8 billion.

The company also emphasizes its digital presence, utilizing its website and social media platforms to disseminate crucial information about financial performance and sustainability initiatives, ensuring broad accessibility. This digital outreach is vital for maintaining trust and engagement with customers and investors alike.

Furthermore, American Water Works actively promotes its environmental, social, and governance (ESG) performance through annual sustainability reports, detailing progress in areas like greenhouse gas emission reduction and infrastructure resilience. Their 2023 sustainability report underscored significant ESG advancements, aligning with growing investor and public demand for responsible operations.

Their engagement with regulatory bodies and industry associations, such as the AWWA, also serves a promotional purpose by advocating for policies that support sustainable water management and infrastructure investment. In 2024, their participation in state regulatory proceedings and contributions to AWWA committees on critical issues like lead service line replacement demonstrate this proactive approach.

| Promotional Activity | Key Focus Areas | Recent Data/Examples |

|---|---|---|

| Investor Relations | Financial transparency, growth, strategic direction | Q1 2024 earnings calls, 2023 Annual Report (6.1% revenue growth to $4.8B) |

| Digital Communication | Customer and investor engagement, information dissemination | amwater.com investor section, active social media presence (LinkedIn, Facebook, X, Instagram) |

| Sustainability Reporting | ESG performance, environmental and social impact | 2023 Sustainability Report (GHG emission reduction, infrastructure resilience initiatives) |

| Regulatory & Industry Engagement | Policy advocacy, best practice sharing, sector advancement | 2024 state regulatory proceedings, AWWA committee participation (cybersecurity, lead service line replacement) |

Price

American Water Works' pricing for its essential water and wastewater services is largely dictated by state utility commissions. This regulated rate-setting process ensures that the prices customers pay are fair and cover the company's operational expenses and investments. For instance, in 2023, American Water's regulated jurisdictions generated approximately $4.6 billion in revenue from these core services, reflecting the direct impact of these commission-approved rates.

American Water Works justifies rate increases by highlighting substantial capital investments in infrastructure upgrades, including replacing aging pipes and enhancing water quality. These investments are crucial for maintaining system reliability and resilience. For instance, in 2023, the company invested $2.7 billion in infrastructure improvements, a key factor in their rate case filings.

Regulatory bodies permit American Water Works to recover these significant capital expenditures through authorized revenue adjustments. This recovery mechanism is typically pursued via general rate cases and specific infrastructure investment proceedings, ensuring that necessary system modernizations can be funded. The company's 2024-2027 capital investment plan totals $14.4 billion, demonstrating the ongoing need for rate adjustments to support these projects.

American Water Works actively considers customer affordability when requesting rate adjustments, working with regulators to balance necessary investments with the financial well-being of its customers. For instance, in 2023, the company implemented or proposed affordability programs across various states, including a tiered discount structure in Pennsylvania designed to help low-income households manage rising water costs.

Competitive Landscape and Market-Based Pricing

American Water Works' approach to pricing in its market-based businesses, which include services for military installations, is heavily influenced by competitive dynamics. Pricing is established through multi-year contracts and rigorous competitive bidding, reflecting a market-driven strategy rather than direct regulatory mandates for these specific services.

These contracts, while offering a stable, regulated-like revenue stream, operate outside the direct oversight of state-level utility commissions that govern its core regulated operations. This distinction allows for market forces to play a more significant role in setting prices for these specialized services.

- Competitive Bidding: Pricing for services like those provided to military bases is determined through competitive bidding processes, ensuring market alignment.

- Long-Term Contracts: These arrangements, often spanning several years, provide predictable revenue streams for American Water Works.

- Market-Based Earnings: While resembling regulated earnings, these revenue streams are not subject to the same direct state commission oversight as the company's primary utility operations.

- Strategic Service Areas: Services to military installations represent a segment where American Water Works leverages its expertise in a competitive, non-regulated market context.

Operational Efficiency and Cost Control

American Water Works places a strong emphasis on operational efficiency and cost control as a cornerstone of its strategy. This focus directly impacts the rates it can propose to regulatory bodies, ensuring affordability for customers. By diligently managing operations and maintenance expenses, the company aims to keep costs down.

Leveraging new technologies is a key driver for achieving these efficiencies. For instance, in 2023, American Water reported that its investment in infrastructure upgrades, including advanced leak detection and smart metering technologies, contributed to a 2% reduction in water loss compared to the previous year. This not only controls costs but also enhances service reliability.

- Operational Efficiency: The company's commitment to streamlining operations helps manage its cost base.

- Cost Control: Diligent management of operations and maintenance expenses is crucial for rate setting.

- Technology Adoption: Investments in new technologies, like smart meters, are key to reducing water loss and operational costs.

- Profitability and Affordability: Balancing cost control with technological investment allows American Water to maintain profitability while offering affordable services.

American Water Works' pricing strategy is primarily shaped by regulatory frameworks, with state utility commissions setting rates for essential water and wastewater services. These approved rates directly influence the company's revenue, as seen in the approximately $4.6 billion generated from regulated operations in 2023. The company justifies rate adjustments by demonstrating significant investments in infrastructure, such as the $2.7 billion spent in 2023 on upgrades like pipe replacement, which are critical for system reliability and are recovered through authorized revenue adjustments.

| Service Segment | Pricing Mechanism | Key Considerations |

|---|---|---|

| Regulated Water & Wastewater | State Utility Commission Approval | Infrastructure investment needs, operational costs, customer affordability |

| Military Installations (Market-Based) | Competitive Bidding & Long-Term Contracts | Market dynamics, service scope, contract terms |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for American Water Works is grounded in a comprehensive review of their official investor relations materials, including annual reports and SEC filings. We also incorporate data from industry publications and news articles detailing their operational strategies and market presence.