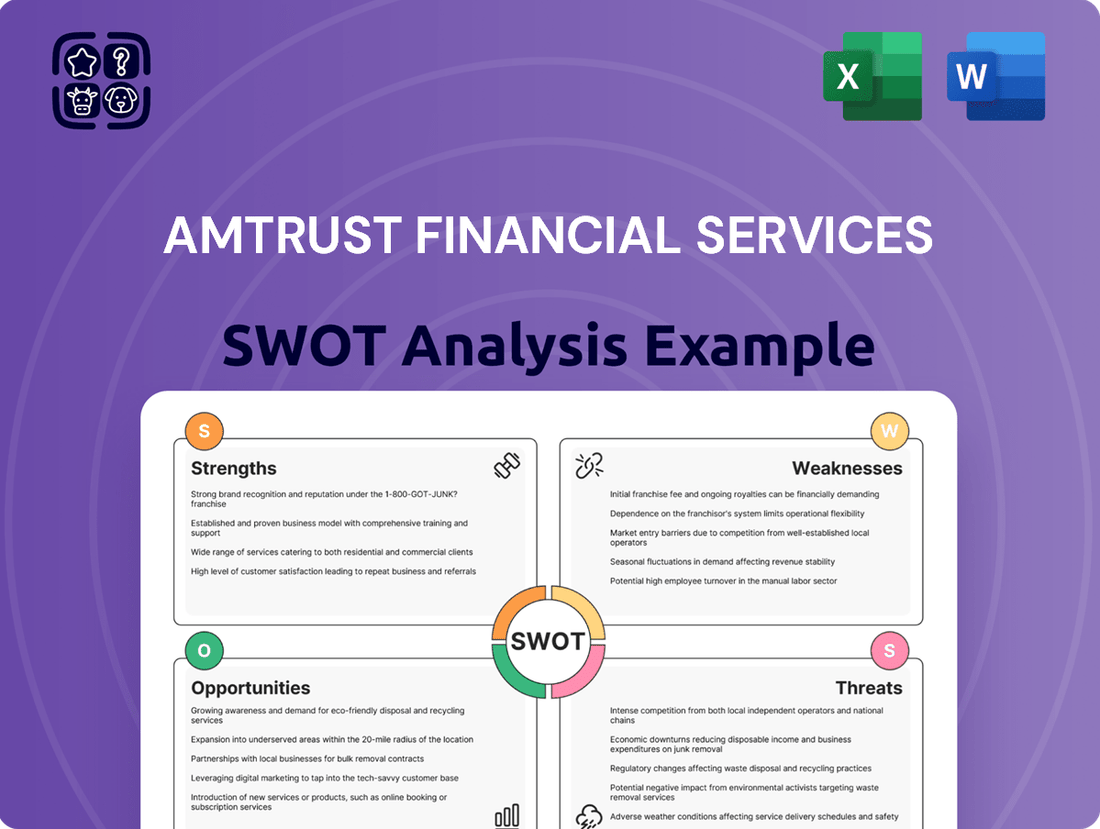

AmTrust Financial Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmTrust Financial Services Bundle

AmTrust Financial Services exhibits notable strengths in its diversified product lines and strong niche market presence, but faces challenges from regulatory scrutiny and competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within the insurance sector.

Want the full story behind AmTrust's competitive advantages, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AmTrust Financial Services boasts a robust and diversified product portfolio, spanning a wide array of property and casualty insurance. This includes essential offerings like workers' compensation, commercial package policies, and specialized coverages tailored to niche markets. Their reach also extends to consumer protection products such as extended warranty programs and specialty risk solutions.

This extensive product offering is a significant strength, as it reduces AmTrust's reliance on any single insurance line. By catering to a broad spectrum of market needs across various geographies, the company effectively diversifies its revenue streams and mitigates overall risk exposure. For instance, their significant presence in the small commercial market, a sector often underserved by larger insurers, further solidifies this diversification.

AmTrust Financial Services demonstrates a strong market position within specialized insurance sectors. For instance, it ranks among the top three providers of workers' compensation insurance in the United States, a testament to its established presence and expertise in this critical area.

Furthermore, the company maintains a robust market share in the Italian medical professional liability insurance (MPLI) segment. This focus on niche markets allows AmTrust to develop specialized underwriting capabilities and offer tailored solutions that resonate with specific customer needs, thereby fostering profitability.

AmTrust Financial Services' commitment to a technology-driven approach is a significant strength, utilizing advanced tools like data science, AI, and machine learning to refine underwriting and claims processes. This focus on digital innovation allows for more precise risk selection and a smoother customer journey, as evidenced by recent accolades for their digital customer experience.

Global Presence and Subsidiaries

AmTrust Financial Services boasts a significant global presence, operating through a network of subsidiaries across North America, the United Kingdom, and mainland Europe. This extensive international footprint allows the company to access a wide array of diverse markets and effectively distribute its insurance products. The company's strategy leverages a robust network of agents, brokers, and managing general agencies (MGAs) to reach customers in these varied regions.

This broad geographic reach is a key strength, enabling AmTrust to diversify its revenue streams and mitigate risks associated with any single market. For instance, as of the first quarter of 2024, AmTrust reported that its international operations contributed a substantial portion of its overall gross written premiums, highlighting the importance of its global subsidiaries. This widespread operational base is crucial for its continued growth and market penetration.

Commitment to Employee Development and Culture

AmTrust Financial Services' dedication to its employees shines through its consistent recognition as a 'Best and Brightest' Company to Work For in the Nation. This accolade, achieved across multiple years, underscores their commitment to fostering a diverse workplace, promoting work-life balance, and investing in employee education and growth. Such a positive environment directly correlates with improved employee retention and enhanced productivity.

This focus on employee well-being and development translates into tangible benefits for the company. For instance, a strong culture of learning and support can reduce turnover costs, which, according to industry benchmarks, can range from 50% to 200% of an employee's annual salary. AmTrust's approach cultivates a more engaged and motivated workforce, contributing to operational efficiency and customer satisfaction.

- Award-Winning Workplace: AmTrust has been named a 'Best and Brightest' Company to Work For nationally for multiple years.

- Core Values: The company prioritizes diversity, work-life balance, and continuous employee education.

- Impact on Performance: A positive culture drives higher employee retention and boosts overall productivity.

- Reduced Costs: Investing in employees can mitigate the significant financial impact of high turnover.

AmTrust's diversified product suite, encompassing property and casualty insurance like workers' compensation and specialty risks, significantly reduces reliance on any single insurance line. This broad offering, including consumer protection products, diversifies revenue streams and mitigates overall risk exposure, particularly by serving the often-underserved small commercial market.

The company holds strong positions in specialized insurance sectors, notably ranking among the top three U.S. providers of workers' compensation insurance. Additionally, AmTrust maintains a robust market share in Italian medical professional liability insurance, showcasing its expertise in niche markets and ability to offer tailored, profitable solutions.

AmTrust's commitment to technology, leveraging data science, AI, and machine learning, enhances underwriting and claims processes for better risk selection and customer experience. This digital focus is critical for efficiency and competitive advantage in the modern insurance landscape.

A significant global presence across North America, the UK, and mainland Europe allows AmTrust to tap into diverse markets and distribute products effectively through established networks. As of Q1 2024, international operations contributed substantially to gross written premiums, underscoring the importance of this geographic diversification for growth.

AmTrust's consistent recognition as a 'Best and Brightest' Company to Work For nationally highlights a strong commitment to employee well-being, diversity, and development. This positive workplace culture fosters higher employee retention and productivity, directly impacting operational efficiency and customer satisfaction, while also mitigating significant turnover costs.

What is included in the product

Delivers a strategic overview of AmTrust Financial Services’s internal and external business factors, highlighting its competitive advantages and potential challenges.

Offers a clear, actionable framework for AmTrust Financial Services to identify and leverage competitive advantages while mitigating risks.

Weaknesses

AmTrust Financial Services, particularly through its subsidiary AmTrust Assicurazioni, demonstrates a significant reliance on reinsurance. While the company benefits from a strong panel of reinsurers, this dependence inherently introduces counterparty risk. Should the financial health of its reinsurers deteriorate, AmTrust could face challenges in claims recovery.

This reliance also exposes AmTrust to potential shifts in reinsurance market dynamics. Less favorable terms or increased pricing from reinsurers, which can occur due to broader market conditions or specific catastrophe events, could directly impact AmTrust's profitability and underwriting margins. For example, in 2024, the global reinsurance market saw increased pricing in certain lines due to rising claims from natural catastrophes.

AmTrust Financial Services has faced regulatory challenges, notably a past instance where it failed to promptly report insured vehicle information to the New York State DMV. This type of compliance lapse can result in significant penalties and damage the company's reputation.

Such issues can also lead to increased operational costs as the company works to rectify the problems and implement more robust compliance procedures. For example, in 2022, the insurance industry saw an increase in fines for data reporting errors, with some companies facing six-figure penalties.

AmTrust Financial Services' extensive network of global subsidiaries, while a source of diversification, presents a significant weakness in terms of operational complexity. Managing a multitude of entities across various international markets can strain management resources and complicate oversight, potentially leading to inefficiencies and increased administrative costs.

This intricate structure also heightens the challenges associated with regulatory compliance. Navigating diverse legal and financial regulations in each operating jurisdiction requires substantial effort and expertise, increasing the risk of non-compliance and associated penalties. For instance, as of Q1 2024, AmTrust operates in over 18 countries, each with its own unique regulatory framework.

Market Perception and Historical Financial Performance

While AmTrust Financial Services has shown recent positive financial trends, its historical performance presents a challenge. For instance, in 2018, the company reported a net loss, which can impact current market perception. Addressing this legacy of past performance is key to building sustained investor confidence.

Maintaining consistent profitability is paramount for AmTrust. Lingering negative market perceptions stemming from earlier financial results can hinder its ability to attract new capital and may affect its valuation. The company needs to demonstrate a clear and sustained upward trajectory in its financial health.

- Historical Net Loss: AmTrust reported a net loss in 2018, highlighting past financial volatility.

- Market Perception: Past performance can create lingering negative perceptions among investors.

- Consistency is Key: Demonstrating consistent profitability is crucial for long-term stability.

- Investor Confidence: Addressing historical weaknesses is vital for rebuilding and maintaining investor trust.

Competitive Landscape in Insurance

The insurance sector is intensely competitive, featuring a mix of legacy giants and agile insurtech newcomers. AmTrust must constantly innovate and offer competitive pricing to defend and expand its market position against this broad spectrum of rivals.

This competitive pressure is evident in the market dynamics. For instance, as of early 2024, the global insurance market is projected to see continued growth, but with significant disruption from digital-native insurers gaining traction. AmTrust's ability to adapt its product offerings and distribution channels to meet evolving customer expectations is crucial.

- Intense Competition: AmTrust operates in a crowded insurance market with both traditional insurers and emerging insurtech firms.

- Innovation Imperative: Maintaining market share necessitates continuous investment in new technologies and product development to stay ahead of competitors.

- Pricing Pressures: The need to offer attractive pricing in a competitive environment can impact AmTrust's profit margins.

- Market Share Defense: AmTrust faces the ongoing challenge of retaining and growing its customer base against a wide range of established and new entrants.

AmTrust's significant reliance on reinsurance exposes it to counterparty risk and potential shifts in market dynamics, as seen with increased reinsurance pricing in early 2024 due to catastrophe events.

Past compliance issues, such as failing to promptly report vehicle information to the NYS DMV in prior years, highlight potential regulatory vulnerabilities and associated penalties.

The company's global operational complexity, managing over 18 countries as of Q1 2024, increases administrative costs and the risk of non-compliance with diverse international regulations.

Intense competition from both established insurers and agile insurtech firms, with digital-native insurers gaining traction in 2024, puts pressure on AmTrust's pricing and necessitates continuous innovation.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Reinsurance Dependence | Reliance on external reinsurers for risk transfer. | Counterparty risk, exposure to reinsurance market volatility. | Global reinsurance pricing increased in certain lines during 2024. |

| Regulatory Compliance Lapses | Past instances of failing to meet reporting requirements. | Potential for fines, reputational damage, increased operational costs. | Failure to promptly report insured vehicle data to NYS DMV. |

| Operational Complexity | Managing a large, geographically diverse subsidiary network. | Strain on management resources, increased administrative costs, compliance challenges. | Operates in over 18 countries as of Q1 2024, each with unique regulations. |

| Intense Market Competition | Operating in a crowded insurance market with various players. | Pricing pressures, need for continuous innovation, market share defense. | Growth of digital-native insurers in the global insurance market in early 2024. |

Preview the Actual Deliverable

AmTrust Financial Services SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

AmTrust Financial Services is strategically diversifying its offerings by venturing into new product lines like renters, travel, and event protection. This expansion is complemented by progress in emerging markets, notably its credit protection operations in Turkey, which saw a 15% revenue increase in Q1 2024. Such diversification aims to tap into untapped growth potential and create new avenues for revenue generation.

AmTrust Financial Services is actively leveraging digital transformation and AI to sharpen its competitive edge. Continued investment in these areas is crucial for enhancing underwriting precision, expediting claims processing, and elevating the overall customer experience. This focus on digital innovation is not new; AmTrust has already received accolades for its digital customer experience initiatives, underscoring its commitment to this strategic direction.

AmTrust Financial Services has a clear growth strategy centered on strategic partnerships and acquisitions. This approach has been demonstrated through past successful integrations, such as the acquisition of various MGAs and businesses focused on middle-market management liability. These moves have consistently broadened their market presence and diversified their product portfolio.

By continuing to pursue synergistic partnerships and acquisitions, AmTrust can unlock further opportunities for expansion. For instance, acquiring a technology-focused insurtech MGA in 2024 could provide access to new distribution channels and innovative product development capabilities, enhancing their competitive edge in a rapidly evolving insurance landscape.

Growth in Specialty and Niche Markets

AmTrust Financial Services has a significant opportunity to expand within specialty and niche insurance markets, particularly by serving small to mid-sized businesses. This focus allows for tailored product development and deeper client engagement, driving sustained growth.

The company's existing expertise in specialty lines, such as workers' compensation, commercial auto, and extended service contracts, positions it well to capitalize on this trend. In 2024, the specialty insurance sector continued to demonstrate resilience and growth potential.

- Deepening Penetration: Leveraging existing infrastructure to increase market share within identified specialty segments.

- Product Customization: Developing highly specific insurance products that address unique risks faced by niche industries.

- Client Relationship Building: Fostering loyalty through specialized service and support that meets distinct business needs.

- Market Expansion: Identifying and entering new underserved specialty markets with tailored offerings.

Enhanced Data-Driven Underwriting

AmTrust Financial Services can significantly boost its underwriting profitability by further developing and refining its data-driven underwriting models. This strategic enhancement allows for more precise risk assessment, leading to improved pricing accuracy. This approach aligns perfectly with AmTrust's existing commitment to leveraging technology for operational efficiency.

The continued investment in advanced analytics and machine learning for underwriting presents a key opportunity. For instance, by incorporating broader datasets, including telematics and behavioral data, AmTrust could refine its commercial auto insurance pricing. In 2024, the insurance industry saw a continued trend of insurers investing in AI and data analytics, with many reporting improved loss ratios as a direct result of more sophisticated underwriting. AmTrust's existing infrastructure positions it well to capitalize on this trend.

- Improved Risk Selection: Advanced models can identify subtle risk factors missed by traditional methods.

- Optimized Pricing: More granular data enables pricing that better reflects individual risk profiles.

- Enhanced Profitability: Accurate pricing and reduced adverse selection directly contribute to better underwriting margins.

- Competitive Advantage: Superior underwriting capabilities can attract more profitable business segments.

AmTrust Financial Services has a significant opportunity to expand its reach by further developing its digital platforms and leveraging advanced analytics. This focus on technology can enhance customer engagement and streamline operations, as seen with their ongoing investments in AI for underwriting and claims processing.

Strategic acquisitions and partnerships remain a key avenue for growth, allowing AmTrust to enter new markets and broaden its product portfolio. For example, acquiring a technology-focused insurtech in 2024 could open doors to innovative distribution channels and product development.

The company is well-positioned to capitalize on the growing demand for specialty and niche insurance products, particularly for small to mid-sized businesses. Their existing expertise in areas like workers' compensation and commercial auto supports this expansion strategy.

By refining its data-driven underwriting models, AmTrust can improve risk selection and pricing accuracy, ultimately boosting profitability. The industry trend in 2024 showed insurers investing in AI and data analytics yielding improved loss ratios, a benefit AmTrust can achieve with its current infrastructure.

Threats

AmTrust Financial Services faces a significant threat from intensifying competition. The insurance landscape is increasingly crowded, with both established insurers and agile insurtech startups actively seeking to capture market share. This dynamic environment can exert downward pressure on pricing, potentially impacting AmTrust's profitability.

The rise of insurtechs, in particular, introduces a competitive challenge by leveraging technology to offer streamlined, customer-centric solutions. For instance, by mid-2024, insurtechs had secured billions in funding, enabling them to invest heavily in digital platforms and data analytics, areas where traditional players like AmTrust must also innovate to keep pace.

This heightened competition necessitates continuous and substantial investment in technology and innovation. AmTrust must allocate resources to enhance its digital capabilities, improve customer experience, and develop new products to remain relevant and competitive against both nimble startups and well-capitalized incumbents. Failure to do so could result in market share erosion.

Economic downturns, like the potential slowdowns anticipated in 2024 and 2025, pose a significant threat to AmTrust Financial Services. Recessions can shrink premium volumes as businesses and individuals cut back on expenses, including insurance. Furthermore, market volatility often leads to lower investment returns on the company's portfolio, impacting profitability.

Periods of high inflation, a concern in the recent past and potentially continuing into 2024, can also increase claims frequency and severity. This means AmTrust might face more claims, and those claims could be more expensive to settle, directly affecting the company's financial health. For instance, rising costs for auto parts or medical care can significantly inflate property and casualty or workers' compensation claims.

AmTrust Financial Services operates within a heavily regulated insurance sector, facing evolving compliance demands across its global operations. For instance, the Solvency II directive in Europe, which aims to harmonize insurance regulation, continues to present ongoing adaptation requirements for insurers like AmTrust. Failure to adhere to these intricate and often shifting international regulations can lead to substantial financial penalties and harm the company's standing.

Catastrophic Events and Climate Change Risks

As an insurer, AmTrust Financial Services faces significant financial exposure to catastrophic events, including natural disasters. The growing intensity and frequency of climate-related phenomena pose a substantial threat, potentially leading to increased claims payouts. This could directly affect underwriting profitability and strain the company's capital reserves.

The financial impact of climate change is becoming increasingly evident. For instance, global insured losses from natural catastrophes reached an estimated $135 billion in 2023, according to Swiss Re, highlighting the scale of potential claims for insurers like AmTrust. This trend underscores the vulnerability of the insurance sector to escalating weather-related events.

- Increased Claims Frequency: More frequent severe weather events lead to a higher volume of insurance claims.

- Severity of Losses: Climate change can exacerbate the impact of events, resulting in larger individual claims.

- Capital Adequacy Concerns: A surge in claims can deplete capital reserves, potentially impacting AmTrust's ability to meet its obligations.

Cybersecurity Risks and Data Breaches

AmTrust Financial Services, with its reliance on technology and management of sensitive customer information, is particularly vulnerable to cyber threats. The increasing sophistication of cyberattacks means a breach could result in substantial financial penalties and damage to its reputation. For instance, the average cost of a data breach in the financial services sector reached $5.90 million in 2023, a significant increase from previous years.

The potential for data breaches poses a significant risk, as such events can lead to loss of customer trust and loyalty, which are critical assets in the insurance industry. AmTrust's commitment to digital transformation, while a strength, also amplifies this threat. Regulatory bodies are also imposing stricter penalties for non-compliance with data protection laws. For example, the General Data Protection Regulation (GDPR) in Europe can levy fines up to 4% of global annual revenue.

Key aspects of this threat include:

- Sophisticated Cyberattacks: Evolving threats like ransomware and phishing can compromise systems and data.

- Financial Repercussions: Costs associated with breaches include investigation, remediation, legal fees, and potential regulatory fines.

- Reputational Damage: Loss of customer confidence can lead to decreased business and market share.

- Operational Disruption: Cyber incidents can halt business operations, impacting service delivery and revenue generation.

AmTrust faces significant threats from evolving regulatory landscapes and increasing cyber risks. For example, the global average cost of a data breach in financial services rose to $5.90 million in 2023, highlighting the potential financial and reputational damage from cyber incidents. Furthermore, stringent data protection laws like GDPR can impose fines up to 4% of global annual revenue, demanding continuous investment in compliance and security measures.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of AmTrust Financial Services' official financial filings, comprehensive market research reports, and expert industry analyses to provide a robust and insightful assessment.