AmTrust Financial Services Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmTrust Financial Services Bundle

Uncover AmTrust Financial Services' strategic approach to its offerings, pricing, distribution, and promotional efforts. This analysis delves into how these core elements are integrated to achieve market penetration and customer loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into AmTrust Financial Services.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking on AmTrust Financial Services—perfect for reports, benchmarking, or business planning.

Product

Workers' compensation insurance stands as a cornerstone of AmTrust Financial Services' product offering, specifically tailored to meet the needs of small and medium-sized businesses. This vital coverage ensures that employees injured or made ill on the job receive necessary medical care and wage replacement, protecting both the workforce and the employer.

AmTrust's commitment to this sector is substantial, evidenced by its impressive market position. In 2024, the company reported gross written premiums for workers' compensation reaching approximately $2.5 billion. This figure solidifies AmTrust's standing as a leading provider, ranking among the top three in the United States for this essential insurance product.

AmTrust Financial Services provides Business Owner's Policies (BOPs), a bundled insurance solution combining liability and property coverage. This simplifies risk management for small businesses, typically those with under 50 employees.

The BOP market demonstrated robust growth, with premiums reaching $28 billion in 2024, reflecting a 6% increase. This surge highlights the strong market appetite for consolidated insurance offerings.

AmTrust's specialty coverages extend beyond standard offerings, catering to the middle market with solutions for complex risks. This includes crucial areas like commercial auto, cyber liability to safeguard against digital threats, and employment practices liability insurance (EPLI) for employer protection.

The company's commitment to these specialized areas is evident in its performance. In 2024, AmTrust saw a significant 12% surge in premiums written specifically for these specialty programs, demonstrating a strategic focus and market demand for their tailored risk management solutions.

Extended Warranty and Protection s

AmTrust Financial Services is a significant underwriter of extended warranties and protection plans, covering a wide array of industries. Their product suite extends to automotive, powersports, and heavy equipment, providing crucial post-purchase security for consumers and businesses alike. In 2024, the extended warranty market in the US alone was projected to reach over $50 billion, highlighting the substantial demand AmTrust addresses.

These protection products are designed to mitigate unexpected repair costs and enhance customer satisfaction. AmTrust's reach also includes specialized offerings for consumer goods, ensuring durability and peace of mind for purchasers of electronics and appliances. Their commitment to this sector is underscored by a global presence, serving diverse markets with tailored risk management solutions.

Furthermore, AmTrust provides essential lender and debt protection products to financial institutions. These services safeguard lenders against borrower defaults and offer financial security to consumers. This dual focus on product protection and financial risk management showcases AmTrust's comprehensive approach to specialty insurance.

Key aspects of AmTrust's extended warranty and protection offerings include:

- Broad Market Coverage: Serving automotive, powersports, heavy equipment, and consumer goods sectors.

- Financial Institution Support: Providing lender and debt protection products.

- Global Reach: Offering specialty risk solutions across international markets.

- Customer Centricity: Aiming to enhance satisfaction through post-purchase security.

Technology-Driven Insurance Solutions

AmTrust Financial Services' product strategy heavily emphasizes technology-driven insurance solutions. They utilize proprietary technology and data-driven underwriting models to create innovative insurance products. This focus on technology allows them to enhance risk selection and improve the overall customer experience.

Their in-house claims management further streamlines operations, contributing to their ability to bring leading-edge products to market efficiently. For instance, AmTrust reported a combined ratio of 92.1% in Q1 2024, reflecting the operational efficiencies gained through these technological advancements.

The company is actively expanding its product portfolio into new markets, including renters, travel, events, and shipping. This expansion is fueled by continuous innovation and strategic digital partnerships, ensuring their offerings remain competitive and relevant in evolving market landscapes.

- Proprietary Technology: AmTrust leverages its own tech for product development and underwriting.

- Data-Driven Underwriting: Advanced models improve risk assessment and pricing accuracy.

- In-House Claims Management: Enhances efficiency and customer service throughout the claims process.

- Market Expansion: Targeting new segments like renters, travel, events, and shipping with digital-first solutions.

AmTrust's product strategy centers on specialized insurance solutions, particularly for small to medium-sized businesses. Their core offerings include workers' compensation, Business Owner's Policies (BOPs), and a range of specialty coverages like commercial auto and cyber liability.

The company also underwrites extended warranties and protection plans across various sectors, from automotive to consumer goods, and provides lender and debt protection products to financial institutions. This diversified product portfolio addresses niche market needs.

AmTrust leverages proprietary technology and data-driven underwriting to enhance product development and risk assessment, aiming for operational efficiency. Their focus on innovation fuels expansion into new markets like renters and travel insurance.

| Product Category | 2024 Premium (USD Billions) | Growth Rate (YoY) | Key Features |

|---|---|---|---|

| Workers' Compensation | $2.5 | N/A (Leading Provider) | Tailored for SMBs, medical & wage replacement |

| Business Owner's Policies (BOPs) | $28.0 | 6% | Bundled liability & property for small businesses |

| Specialty Coverages | N/A (Significant Growth) | 12% | Commercial auto, cyber liability, EPLI |

| Extended Warranties & Protection Plans | >$50.0 (US Market) | N/A (Large Market) | Automotive, powersports, consumer goods, financial institutions |

What is included in the product

This analysis provides a comprehensive overview of AmTrust Financial Services' marketing strategies, detailing their product offerings, pricing models, distribution channels, and promotional activities.

It's designed for professionals seeking a clear understanding of AmTrust's market positioning and competitive approach.

This analysis distills AmTrust's 4Ps into actionable insights, simplifying complex marketing strategies for swift decision-making and alleviating the burden of in-depth research.

Place

AmTrust Financial Services leverages a powerful distribution strategy centered on its extensive network of independent agents and brokers. This approach is key to reaching a wide array of small businesses and specialized markets, both domestically and internationally.

By prioritizing support for these crucial distribution partners, AmTrust has seen tangible results. The company reported a significant 15% increase in agent retention rates by the first quarter of 2025, underscoring the effectiveness of this relationship-focused element of their marketing mix.

AmTrust Financial Services leverages Managing General Agents (MGAs) as a key component of its distribution strategy. This allows them to tap into specialized markets and efficiently deliver their insurance products to targeted customer groups.

The MGA model has proven instrumental in AmTrust's growth, contributing significantly to their gross written premiums in 2024. This strategic utilization of MGAs is projected to remain a vital driver for achieving AmTrust's market penetration objectives throughout 2025.

AmTrust Financial Services leverages its extensive global subsidiary network, operating in over 60 countries, to provide widespread access to its specialized insurance products. This international reach is bolstered by a deep understanding of local markets and regulatory environments, allowing for tailored product delivery and customer service.

The company's international operations are strategically focused on high-demand areas such as warranty, legal expenses, and medical malpractice insurance. For instance, AmTrust's European Warranty segment saw significant growth in 2024, with gross written premiums increasing by 12% year-over-year, reflecting strong demand for extended protection plans.

Digital Distribution Channels

AmTrust Financial Services is significantly bolstering its digital distribution by investing in accessible and efficient online platforms for its agents. This strategic push includes user-friendly submission portals and over 400 bind-online classes, simplifying the policy underwriting process.

The company's commitment to advanced technology is evident in its leading API capabilities, which facilitate seamless integration with partner systems. A prime example is the November 2024 integration of Qualia Atlas with AmTrust's Advanced Search and Production Software (ASAP), directly enhancing agent productivity and policy underwriting.

- Digital Investment: Continued investment in digital channels to improve agent accessibility and operational efficiency.

- Agent Tools: User-friendly online submission portals and over 400 bind-online classes are available for agents.

- API Integration: Leading API technology enables smooth data exchange and workflow automation.

- ASAP Enhancement: Integration with Qualia Atlas in November 2024 streamlines underwriting via the ASAP platform.

Strategic Partnerships and Affiliations

AmTrust Financial Services actively cultivates strategic partnerships to enhance its market presence and product offerings. A prime example is their collaboration with InsurePay, focusing on workers' compensation solutions that utilize a pay-as-you-go model. This initiative provides clients with real-time data visibility and adaptable payment structures, streamlining the insurance process.

These alliances are crucial for AmTrust's growth strategy, enabling them to tap into new customer segments and deliver more integrated business insurance solutions. By teaming up with specialized providers, AmTrust can offer a broader spectrum of services, reinforcing its position as a comprehensive insurance provider.

- InsurePay Partnership: Facilitates pay-as-you-go workers' compensation, improving cash flow for businesses.

- Expanded Reach: These collaborations allow AmTrust to access a wider array of small and medium-sized businesses.

- Product Enhancement: Integrates advanced technology and flexible payment options into their insurance products.

AmTrust Financial Services utilizes a multi-faceted approach to distribution, prioritizing independent agents and brokers who serve niche markets. This strategy is further enhanced by a robust network of Managing General Agents (MGAs), allowing for efficient access to specialized customer segments. The company's global presence, spanning over 60 countries, ensures broad product accessibility, with a particular focus on high-demand areas like warranty and medical malpractice insurance.

The company is also heavily investing in digital channels to streamline the agent experience, offering user-friendly portals and extensive online training. Key technological advancements, such as API integrations and the enhancement of their ASAP platform, are designed to boost agent productivity and simplify underwriting. Strategic partnerships, like the one with InsurePay for pay-as-you-go workers' compensation, further expand AmTrust's market reach and product integration capabilities.

| Distribution Channel | Key Initiatives/Data (2024-2025) | Impact/Projection |

|---|---|---|

| Independent Agents/Brokers | 15% increase in agent retention (Q1 2025) | Strengthened market access and client relationships |

| Managing General Agents (MGAs) | Significant contribution to gross written premiums (2024) | Drives market penetration in specialized sectors |

| Digital Platforms | User-friendly portals, 400+ bind-online classes | Improved agent efficiency and accessibility |

| Global Subsidiaries | Operations in 60+ countries; 12% YoY growth in European Warranty (2024) | Widespread product availability and tailored local offerings |

| Strategic Partnerships (e.g., InsurePay) | Pay-as-you-go workers' compensation | Enhanced customer value and expanded service offerings |

Same Document Delivered

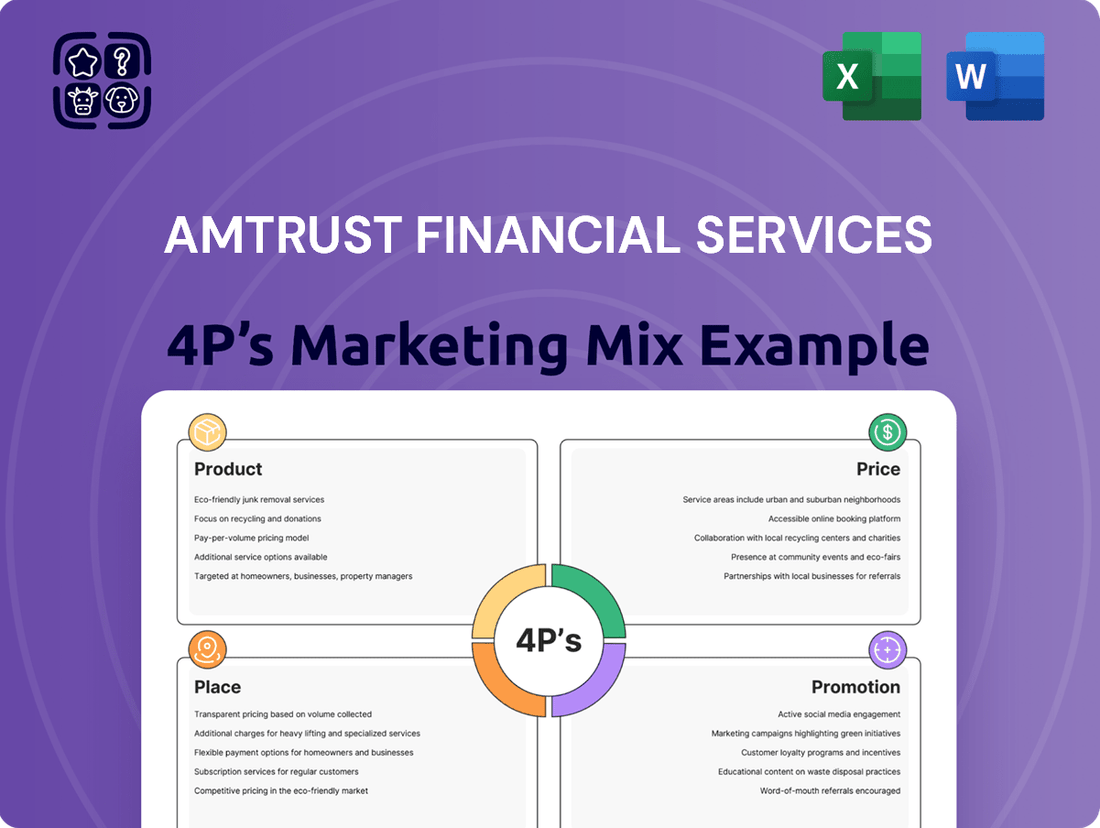

AmTrust Financial Services 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive AmTrust Financial Services 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You can trust that the insights and strategies presented are exactly what you'll get to guide your business decisions.

Promotion

AmTrust Financial Services excels by tailoring its marketing to specific industries, showcasing a profound grasp of each sector's distinct requirements. This focused strategy aids in standing out from rivals and boosting lead generation, with an estimated 15% rise in lead conversion rates within specialized markets observed by late 2024.

Furthermore, AmTrust actively cultivates thought leadership through the publication of industry-specific reports, such as the 2024 AmTrust Restaurant Risk Report. This initiative effectively demonstrates their expertise and fosters engagement with targeted customer segments.

AmTrust Financial Services actively cultivates its digital footprint through diverse online channels to boost brand awareness and foster customer interaction. This strategic approach incorporates robust search engine marketing (SEM) to enhance visibility and reach.

The company’s commitment to an superior digital customer experience was recognized with a Celent Model Insurer award in June 2025, underscoring their success in this area. This focus on digital engagement is a cornerstone of their marketing strategy, aiming to connect with and serve their audience effectively.

AmTrust Financial Services strategically leverages public relations to bolster its brand recognition. The company consistently disseminates news highlighting its accomplishments, key personnel changes, and accolades. For instance, AmTrust was honored with a 5-Star Claims Excellence Award by Insurance Business America in June 2025, underscoring its commitment to superior customer service.

Further solidifying its reputation, AmTrust was also recognized as one of the 2024 'Best and Brightest' Companies to Work For. These awards are not merely ceremonial; they directly contribute to increased brand equity and a stronger market presence by showcasing the company's strengths and positive corporate culture.

Agent and Broker Support Programs

AmTrust Financial Services actively supports its independent agents and brokers through robust programs designed to enhance their sales and marketing capabilities. This commitment ensures agents are well-equipped to articulate the distinct advantages of AmTrust's insurance offerings, particularly for the small business sector.

These initiatives provide agents with a wealth of marketing and sales collateral, simplifying the process of communicating AmTrust's value proposition to potential clients. Crucially, this support empowers agents to thoroughly understand and effectively convey the specific benefits embedded within AmTrust's small business insurance products, fostering stronger client relationships and driving sales growth.

- Comprehensive Marketing Collateral: AmTrust supplies agents with ready-to-use materials that highlight product features and benefits.

- Sales Training and Enablement: Programs are in place to ensure agents can confidently present and sell AmTrust solutions.

- Product Knowledge Resources: Agents receive in-depth information on small business insurance to better serve client needs.

- Digital Support Tools: Access to online platforms and resources aids agents in reaching and engaging clients effectively.

Corporate Social Responsibility and Internal Culture

AmTrust Financial Services actively cultivates a strong internal culture and demonstrates commitment to Corporate Social Responsibility (CSR) through its AmTrust Cares program. This initiative directly supports communities where its employees reside and operate, reinforcing the company's values.

The company’s dedication to fostering an inclusive workplace was recognized with the 2024 5-Star Diversity, Equity, and Inclusion (DEI) Award from Insurance Business America. This accolade not only enhances AmTrust's brand image but also significantly aids its talent acquisition efforts by attracting individuals who value a diverse and equitable environment.

- AmTrust Cares: Global charitable program supporting communities.

- 2024 DEI Award: 5-Star recognition from Insurance Business America.

- Brand Enhancement: CSR and inclusive culture positively impact brand perception.

- Talent Acquisition: DEI focus attracts and retains a diverse workforce.

AmTrust's promotional efforts are multi-faceted, focusing on industry specialization, thought leadership, and robust digital engagement. Their 2024 Restaurant Risk Report exemplifies their commitment to providing valuable insights, a strategy that has demonstrably boosted lead conversion by an estimated 15% in specialized markets by late 2024.

Public relations and awards further bolster their brand. Receiving the 5-Star Claims Excellence Award in June 2025 from Insurance Business America highlights their service quality, while recognition as a 2024 'Best and Brightest' Company to Work For strengthens their corporate image and market presence.

Support for agents is a key promotional pillar, equipping them with marketing collateral and product knowledge, particularly for the small business sector. This enablement is crucial for effectively communicating AmTrust's value proposition, fostering stronger client relationships and driving sales.

AmTrust also leverages its CSR initiatives and inclusive culture, as evidenced by the 2024 5-Star Diversity, Equity, and Inclusion Award from Insurance Business America, to enhance brand perception and attract top talent, reinforcing their commitment to community and workplace excellence.

Price

AmTrust Financial Services utilizes a competitive pricing strategy, carefully adjusting premiums based on factors like policy type, the client's industry, geographic location, and a thorough risk assessment. This allows them to remain competitive, especially when serving small businesses.

This value-driven approach is crucial for attracting and retaining clients in a crowded market. For instance, in 2024, AmTrust continued to focus on niche markets where their specialized underwriting and pricing models offer distinct advantages, helping them secure market share against larger, more generalized insurers.

AmTrust Financial Services employs a sophisticated risk-based underwriting approach, tailoring premiums to the unique risk profiles of various industries and geographic locations. This strategy ensures that pricing accurately reflects the perceived value of their insurance products and reinforces their market position.

This customization allows AmTrust to offer competitive yet appropriate rates, directly linking premium costs to the assessed risk. For instance, in the first quarter of 2024, AmTrust successfully implemented significant workers' compensation rate increases, a testament to their agile and data-driven pricing adjustments in response to evolving risk landscapes.

AmTrust Financial Services actively promotes cost savings for its clients through the strategic bundling of insurance policies. A prime example is their Business Owner's Policy (BOP), which conveniently packages essential coverages like general liability and property insurance into a single, more affordable plan. This approach not only makes AmTrust's offerings more attractive, potentially boosting sales, but also fosters greater customer loyalty by providing a streamlined and cost-effective solution.

Dynamic Market Adaptation

AmTrust Financial Services demonstrates dynamic market adaptation in its pricing, a crucial element of its marketing mix. Their strategies are built to flex with market demand, competitor actions, and the broader economic climate. This agility ensures their insurance products stay appealing and affordable for their customer base.

This adaptive approach is particularly relevant given recent economic shifts. For instance, S&P Global reported an average insurance price increase of 10% due to inflation in early 2024. AmTrust's ability to adjust its pricing in response to such pressures is key to maintaining its competitive edge and market relevance.

- Market Responsiveness: AmTrust adjusts pricing based on real-time market demand and competitor offerings.

- Economic Sensitivity: Pricing strategies account for macroeconomic factors like inflation, which saw average insurance prices rise by 10% in early 2024.

- Value Proposition: Flexibility in pricing helps maintain the attractiveness and accessibility of AmTrust's insurance solutions.

Pay-As-You-Go (PAYO) Options

AmTrust Financial Services' Pay-As-You-Go (PAYO) options are a key part of their product strategy, particularly for workers' compensation. These solutions offer businesses flexible premium payments tied directly to their actual payroll, making cash flow management significantly easier. This approach eliminates large upfront payments and adjusts premiums dynamically as payroll fluctuates.

The appeal of PAYO is its alignment with business realities. For instance, a small construction firm experiencing seasonal hiring can benefit immensely from paying premiums only on the wages they are actively disbursing. This real-time adjustment is a major advantage over traditional methods that rely on estimated annual payrolls, which can lead to over or underpayments.

Key benefits of AmTrust's PAYO for policyholders include:

- Improved Cash Flow: Premiums are paid based on current payroll, preventing large, fixed outflows.

- Accuracy and Fairness: Policyholders pay for what they use, aligning costs with actual risk exposure.

- Simplified Administration: Integration with payroll systems often automates the payment process.

- Enhanced Budgeting: Predictable, smaller payments make financial planning more manageable.

AmTrust's pricing strategy centers on value and competitiveness, adapting to market conditions and client needs. Their approach is dynamic, ensuring premiums reflect actual risk and market realities, a strategy crucial for their focus on small and medium-sized businesses.

This adaptability was evident in 2024, where AmTrust successfully navigated inflationary pressures, with industry-wide price increases averaging 10% according to S&P Global. Their ability to adjust rates while maintaining value for niche markets highlights a key strength.

By offering bundled policies, like the Business Owner's Policy, AmTrust enhances its value proposition, making insurance more accessible and affordable. This bundling strategy aims to boost sales and foster customer loyalty through cost-effective, streamlined solutions.

The Pay-As-You-Go (PAYO) model for workers' compensation is another significant pricing lever, directly linking premium payments to actual payroll. This offers improved cash flow and accuracy for businesses, especially those with fluctuating workforces.

| Pricing Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Competitive Pricing | Adjusting premiums based on policy type, industry, location, and risk assessment. | Key for small business segment, maintaining market share against larger competitors. |

| Risk-Based Underwriting | Tailoring premiums to specific industry and geographic risk profiles. | Ensures accurate pricing reflecting perceived value; Q1 2024 saw successful workers' comp rate increases. |

| Bundling (e.g., BOP) | Packaging multiple coverages into a single, more affordable plan. | Enhances value, attracts new clients, and fosters loyalty through cost savings. |

| Pay-As-You-Go (PAYO) | Flexible premium payments tied to actual payroll, particularly for workers' compensation. | Improves cash flow and accuracy for businesses with variable payrolls. |

| Market Responsiveness | Adapting pricing to demand, competitor actions, and economic climate. | Crucial for affordability amidst inflation; industry prices rose ~10% in early 2024. |

4P's Marketing Mix Analysis Data Sources

Our AmTrust Financial Services 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.