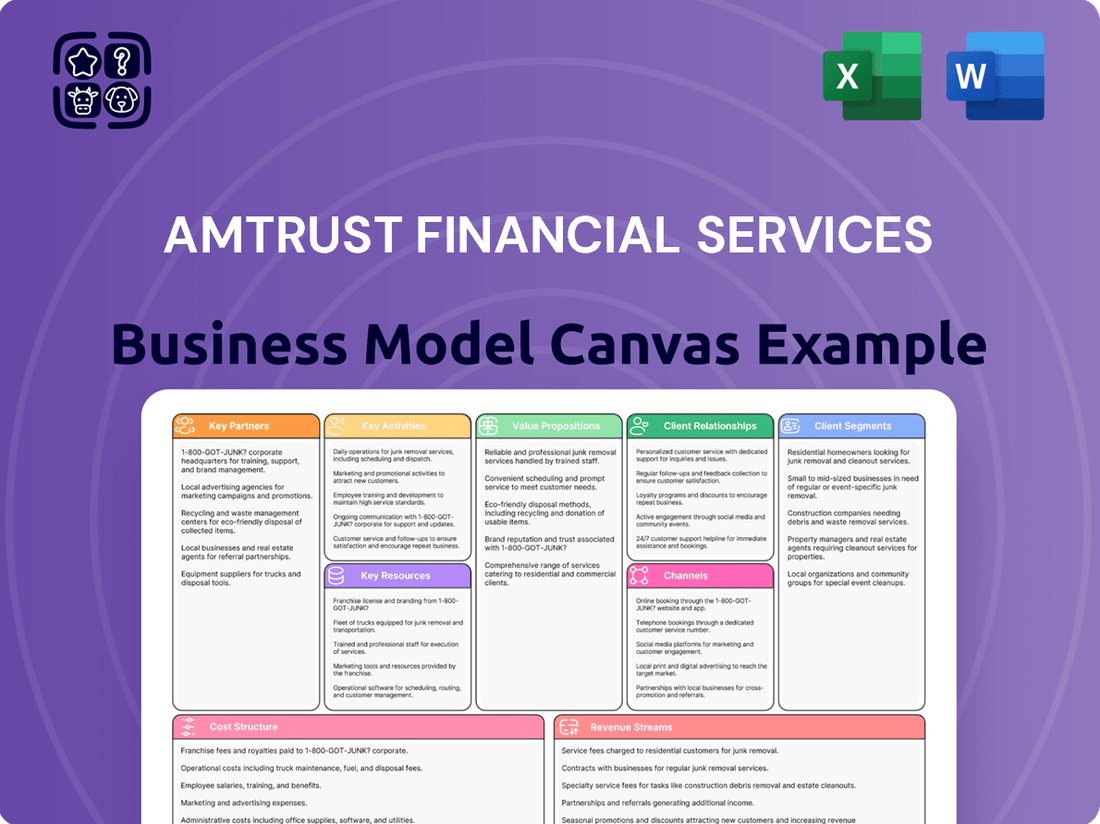

AmTrust Financial Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmTrust Financial Services Bundle

Unlock the strategic blueprint behind AmTrust Financial Services's success. This comprehensive Business Model Canvas details their approach to niche market specialization, strategic partnerships, and efficient claims management, revealing how they consistently deliver value.

Dive deeper into AmTrust Financial Services’s real-world strategy with the complete Business Model Canvas. From their target customer segments to revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

See how the pieces fit together in AmTrust Financial Services’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

AmTrust Financial Services heavily relies on a vast network of independent insurance brokers and agents as its primary distribution channel. These intermediaries are essential for connecting AmTrust with its core market: small to mid-sized businesses that often require specialized, localized insurance solutions.

In 2024, AmTrust continued to foster these vital relationships, recognizing that brokers and agents provide not only market access but also invaluable expertise in underwriting and customer service. This strategy allows AmTrust to efficiently reach a broad customer base and maintain strong policy retention rates, as these partners often build deep trust with their clients.

Reinsurance companies are crucial partners for AmTrust Financial Services, enabling the company to effectively manage its risk portfolio, particularly within its specialty property and casualty lines. These partnerships are fundamental to AmTrust's strategy, allowing it to transfer a portion of its underwriting risks to reinsurers. This not only bolsters its capital efficiency but also provides a critical buffer against potentially significant claims, ensuring financial resilience.

AmTrust Financial Services actively cultivates relationships with technology and Insurtech partners to drive innovation. In 2024, the company continued its significant investment in data science and digital solutions, recognizing these collaborations as crucial for refining underwriting accuracy and streamlining claims handling. These partnerships are key to AmTrust's strategy of leveraging cutting-edge technologies to improve operational efficiency and the overall customer journey.

Collaborations with Insurtech firms and specialized technology providers are fundamental to AmTrust's business model. For instance, by integrating advanced analytics platforms from tech partners, AmTrust aims to enhance its risk assessment capabilities. The company's commitment to exploring emerging technologies like artificial intelligence and machine learning, often through partnerships, allows for more sophisticated fraud detection and personalized customer interactions, contributing to a competitive edge in the market.

Third-Party Administrators (TPAs) and Program Managers

AmTrust Financial Services collaborates with Third-Party Administrators (TPAs) and Program Managers for specialized insurance products, including extended warranties. These alliances are crucial for AmTrust to broaden its product portfolio and access underserved, niche markets.

By leveraging the unique expertise and administrative strengths of these partners, AmTrust can effectively manage intricate insurance programs. This strategic approach allows for the delivery of customized solutions designed to meet the specific needs of diverse customer bases.

- Expanded Product Reach: Partnerships with TPAs allow AmTrust to offer a wider array of specialty coverages that might otherwise be challenging to develop and administer in-house.

- Niche Market Access: TPAs often possess deep knowledge and established networks within specific industries or customer segments, enabling AmTrust to penetrate these niche markets more effectively.

- Operational Efficiency: By outsourcing administrative functions to specialized TPAs, AmTrust can streamline operations, reduce overhead, and focus on its core competencies in underwriting and risk management.

- Tailored Solutions: These collaborations facilitate the creation and management of highly customized insurance programs, ensuring that the specific needs of particular customer groups are met with precision.

Service Providers and Vendors

AmTrust Financial Services relies on a diverse network of service providers and vendors to maintain efficient operations. These include crucial relationships with legal services, claims adjusters, IT support, and marketing agencies.

These partnerships are essential for day-to-day business, ensuring everything from expert handling of claims to effective outreach. For instance, in 2024, AmTrust continued to leverage specialized legal teams to navigate complex insurance regulations and litigation, a critical component of their risk management strategy.

- Legal Services: Essential for compliance and claims defense.

- Claims Adjusters: Crucial for efficient and fair claims processing.

- IT Service Providers: Support the technological infrastructure powering AmTrust's digital services.

- Marketing Agencies: Enhance brand visibility and customer acquisition.

AmTrust's key partnerships extend to reinsurance companies, which are vital for managing its risk exposure, particularly in specialty lines. These alliances allow AmTrust to transfer a portion of its underwriting risks, enhancing capital efficiency and providing a financial cushion against large claims.

In 2024, AmTrust continued to strengthen its collaborations with Insurtech firms and technology providers. These partnerships are instrumental in driving innovation, improving underwriting accuracy through advanced data analytics, and streamlining claims processing, thereby enhancing operational efficiency and the customer experience.

The company also partners with Third-Party Administrators (TPAs) and Program Managers, especially for specialized products like extended warranties. These relationships are crucial for expanding AmTrust's product offerings and accessing niche markets, leveraging the partners' expertise to deliver tailored insurance solutions.

AmTrust relies on a broad network of service providers, including legal counsel, claims adjusters, and IT support. These partnerships are fundamental to its daily operations, ensuring regulatory compliance, efficient claims handling, and robust technological infrastructure.

| Partner Type | Role in Business Model | 2024 Focus/Impact |

|---|---|---|

| Independent Brokers & Agents | Primary distribution channel, market access, underwriting expertise | Continued strong relationships for reaching SMBs and maintaining policy retention. |

| Reinsurance Companies | Risk management, capital efficiency, financial resilience | Strategic transfer of underwriting risks in specialty lines. |

| Insurtech & Technology Providers | Innovation, data analytics, operational efficiency, customer experience | Investment in AI, machine learning for underwriting accuracy and fraud detection. |

| TPAs & Program Managers | Product expansion, niche market access, operational efficiency for specialized products | Facilitating customized solutions for extended warranties and other niche areas. |

| Service Providers (Legal, Claims, IT) | Operational support, regulatory compliance, claims processing efficiency | Leveraging specialized legal teams for complex regulations and litigation. |

What is included in the product

This Business Model Canvas for AmTrust Financial Services details their strategy of providing specialized insurance and financial products to small and mid-sized businesses, leveraging a network of agents and brokers.

It outlines key resources like underwriting expertise and technology, along with revenue streams from premiums and fees, all designed to support their niche market focus.

AmTrust Financial Services' Business Model Canvas acts as a pain point reliever by offering a high-level, one-page snapshot of their core components, simplifying complex strategies for quick review and adaptation.

Activities

AmTrust Financial Services' core activity revolves around underwriting a diverse array of property and casualty insurance. This includes specialized areas like workers' compensation, commercial package policies, and other niche coverages. The company excels at assessing and pricing these risks, leveraging advanced technology and data analytics for its underwriting models.

A key aspect of AmTrust's strategy is its focus on niche markets and lower-hazard risks. This deliberate approach allows them to achieve their profitability objectives by managing risk effectively within these specific segments. For instance, in 2024, AmTrust continued to emphasize its expertise in small commercial business insurance, a segment known for its recurring revenue streams and predictable loss patterns.

AmTrust's claims management is a cornerstone of its operations, focused on delivering efficient and superior handling to foster customer satisfaction and retention. This commitment is underscored by their consistent recognition for strong claims performance.

The company maintains robust in-house claims management capabilities, a critical activity that ensures direct control over the entire process from initial receipt through investigation and fair settlement. This integrated approach allows for greater responsiveness and a more personalized customer experience.

AmTrust Financial Services' key activity is the continuous development of new and improved insurance products. This ensures they stay relevant and meet the ever-changing demands of the market. They are actively expanding their portfolio.

Their product development focuses on areas like commercial property and casualty, workers' compensation, and business owner's policies. They are also building out cyber insurance and extended warranty programs, demonstrating a commitment to a diverse and modern product suite.

Looking ahead, AmTrust is exploring new market opportunities, such as travel insurance and renters' protection. This forward-thinking approach to product innovation is vital for their sustained growth and competitive edge in the financial services sector.

Technology and Digital Transformation

AmTrust Financial Services actively invests in technology to drive digital transformation. This includes enhancing data analytics capabilities and adopting new technologies to improve operational efficiency and the customer experience. In 2024, AmTrust continued to focus on digital platforms to streamline workflows for their broker and agent partners.

Key activities in this area involve:

- Digitalization of Underwriting and Claims: Implementing AI and automation to speed up processing and reduce manual effort.

- Data Analytics and Insights: Leveraging data to better understand customer needs, identify risks, and personalize offerings.

- Cybersecurity Enhancements: Continuously updating security measures to protect sensitive customer and company data.

- Cloud Migration and Modernization: Moving to scalable cloud infrastructure to improve agility and reduce IT costs.

Sales and Distribution Management

AmTrust Financial Services actively manages its vast network of independent agents, brokers, and other distribution partners. This involves providing ongoing support, expanding the range of products available to these partners, and continually improving the quoting process. For instance, platforms like AmTrustONE are crucial for enabling faster and more efficient policy sales.

The company's sales and distribution management is a critical function, directly impacting its market reach and revenue generation. In 2024, AmTrust continued to invest in its distribution channels, recognizing the importance of these relationships for growth.

- Agent and Broker Network: Maintaining and growing relationships with a diverse base of independent agents and brokers is paramount.

- Product Expansion: Continuously developing and offering new and relevant insurance products through these channels is a key activity.

- Technology Enhancement: Investing in and optimizing digital platforms like AmTrustONE to streamline the sales and quoting process for partners.

- Partner Support: Providing training, resources, and responsive service to ensure distribution partners can effectively sell AmTrust products.

AmTrust Financial Services' key activities center on underwriting specialized property and casualty insurance, particularly in niche markets like small commercial businesses. They also focus on efficient claims management, product development, and leveraging technology for digital transformation. Crucially, they manage and support their extensive network of independent agents and brokers.

In 2024, AmTrust continued to refine its underwriting models, emphasizing data analytics and technology to assess risk in segments like workers' compensation and commercial package policies. Their commitment to niche markets, particularly small commercial insurance, remained a strategic pillar, aiming for consistent profitability through effective risk management.

The company's claims handling is a vital activity, designed for efficiency and customer satisfaction, supported by robust in-house capabilities. Product development is ongoing, with expansions into areas such as cyber insurance and extended warranties, alongside explorations into travel insurance and renters' protection.

Digitalization efforts continued in 2024, focusing on streamlining underwriting and claims through automation and AI, while enhancing data analytics. AmTrust also invested in its distribution channels, supporting its agent and broker network through platforms like AmTrustONE to improve sales efficiency.

| Key Activity | Focus Area | 2024 Emphasis/Data |

|---|---|---|

| Underwriting | Specialized P&C, Niche Markets | Continued focus on small commercial insurance; leveraging data analytics for risk assessment. |

| Claims Management | Efficiency & Customer Satisfaction | Maintaining in-house capabilities for direct control and responsive service. |

| Product Development | Portfolio Expansion | Growth in cyber insurance and extended warranties; exploring travel and renters' protection. |

| Technology & Digitalization | Operational Efficiency | Enhancing data analytics, AI in underwriting/claims, and digital platforms for partners. |

| Distribution Management | Agent & Broker Network Support | Investing in channels and platforms like AmTrustONE to streamline sales processes. |

What You See Is What You Get

Business Model Canvas

The AmTrust Financial Services Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will instantly download this same, fully detailed Business Model Canvas, ready for your strategic planning needs.

Resources

AmTrust Financial Services leverages its profound underwriting expertise, especially in less common insurance areas and specialized policies. This deep knowledge is a cornerstone of its business.

This expertise is powerfully supported by a vast repository of historical claims data. AmTrust uses this data to refine its underwriting models and make smarter decisions about which risks to accept, a critical element for profitability.

For instance, AmTrust's focus on small commercial business lines, where it holds a significant market share, demonstrates this specialized underwriting strength. In 2024, the company continued to highlight its ability to profitably underwrite these often overlooked segments.

This combination of specialized knowledge and robust data analytics forms a significant competitive advantage, allowing AmTrust to identify and manage risks more effectively than many competitors.

AmTrust Financial Services relies heavily on its proprietary technology and IT infrastructure, a critical resource that underpins its operations. This robust system is continuously enhanced through significant investment, enabling technology-driven underwriting processes and highly efficient claims handling. For example, in 2024, AmTrust continued to prioritize digital transformation, aiming to further optimize its IT expense ratio through these advanced platforms.

The company's IT infrastructure is designed to support a range of digital tools, catering to both partners and customers. This digital accessibility streamlines interactions and enhances the overall user experience. By leveraging these proprietary technologies, AmTrust can offer seamless integration and responsive service, a key differentiator in the competitive insurance market.

AmTrust Financial Services, a global insurance provider, relies heavily on its robust financial capital and reserves to operate effectively. This substantial financial foundation is absolutely essential for underwriting a wide array of insurance policies, ensuring timely payment of claims, and crucially, maintaining overall financial stability in a dynamic market. Their strong financial position is underscored by an A- (Excellent) rating from A.M. Best, a testament to their sound capital management and operational resilience.

Skilled Workforce and Talent

AmTrust Financial Services relies on its global team of over 6,500 employees, a critical asset for its operations. This workforce includes seasoned underwriters, adept claims professionals, and specialized technology experts, all contributing to the company's capabilities.

The company actively invests in employee development, fostering a culture that values diversity, equity, and inclusion. This commitment stems from the understanding that its people are the primary drivers of its success and innovation.

- Global Workforce: Over 6,500 employees worldwide.

- Key Expertise: Experienced underwriters, claims professionals, and technology specialists.

- Strategic Focus: Emphasis on employee development, diversity, equity, and inclusion.

Global Network of Subsidiaries and Licenses

AmTrust Financial Services leverages a vast global network, operating through numerous subsidiaries and holding licenses in more than 60 countries. This extensive reach is a cornerstone of its business model, allowing it to navigate diverse regulatory landscapes and cater to a wide array of international markets.

This expansive operational footprint, covering over 60 countries, is crucial for AmTrust's ability to offer a comprehensive suite of insurance and financial products tailored to local needs and regulations. For instance, in 2023, AmTrust continued to expand its presence in key European markets, solidifying its position as a significant global insurer.

- Global Presence: Operates in over 60 countries, demonstrating a significant international reach.

- Subsidiary Structure: Utilizes a network of subsidiaries to manage diverse operations and regulatory compliance.

- Product Diversification: Enables the offering of a broad range of insurance and financial solutions across different geographies.

- Regulatory Adaptability: Facilitates compliance and operation within varied international legal and financial frameworks.

AmTrust's key resources include its deep underwriting expertise, particularly in specialty insurance lines, and a vast historical claims data repository that informs risk assessment. This is augmented by proprietary technology and robust IT infrastructure, enabling efficient operations and digital customer engagement. The company's substantial financial capital and reserves, backed by an A- rating from A.M. Best, provide stability and capacity for growth.

A global workforce of over 6,500 employees, comprising skilled underwriters, claims professionals, and tech experts, is vital. Furthermore, AmTrust's extensive global network, spanning over 60 countries through numerous subsidiaries, allows for localized product offerings and regulatory navigation.

| Key Resource | Description | 2024 Relevance/Data Point |

| Underwriting Expertise | Specialized knowledge in niche insurance markets. | Continued focus on profitable underwriting in small commercial segments. |

| Data Repository | Extensive historical claims data. | Used to refine underwriting models and enhance decision-making. |

| Proprietary Technology | Advanced IT infrastructure and digital tools. | Prioritization of digital transformation to optimize IT expense ratio. |

| Financial Capital | Strong capital base and reserves. | A- (Excellent) rating from A.M. Best signifies sound capital management. |

| Global Workforce | Over 6,500 employees worldwide. | Includes experienced underwriters, claims professionals, and tech specialists. |

| Global Network | Operations in over 60 countries. | Facilitates diverse product offerings and regulatory compliance. |

Value Propositions

AmTrust Financial Services excels by providing highly specialized property and casualty insurance products, particularly for niche markets. Their focus on workers' compensation and commercial packages caters to the unique demands of small to mid-sized businesses across various industries.

This strategic specialization allows AmTrust to offer tailored protection, addressing specific risks and operational complexities that larger, more generalized insurers might overlook. For instance, in 2024, AmTrust continued its strong presence in sectors like small commercial lines, where specialized underwriting is crucial for profitability.

The company's philosophy centers on niche diversity and a concentration on low-hazard risks, which enables them to develop deep expertise and efficient claims management within these targeted segments. This approach ensures that policyholders receive coverage that accurately reflects their specific operational profiles and risk exposures.

AmTrust leverages technology to streamline underwriting and claims processing, offering partners and clients faster turnaround times and a more intuitive digital experience. In 2024, the company continued to invest in its digital infrastructure, aiming to reduce operational costs and improve service efficiency.

This technological focus translates into tangible benefits, such as quicker quote generation and more responsive claims handling, enhancing overall customer satisfaction. AmTrust's commitment to innovation in 2024 was evident in its ongoing development of advanced analytics and AI-powered tools to support these processes.

AmTrust Financial Services goes beyond standard insurance, offering comprehensive risk solutions like extended warranty programs and specialized coverage across the globe. This expansive approach equips clients with robust tools to manage their exposures effectively.

These integrated solutions not only enhance client protection but also unlock opportunities for new revenue generation. By minimizing potential financial fallout, AmTrust empowers businesses to operate with greater confidence and strategic foresight.

In 2024, AmTrust's specialty risk segment demonstrated significant growth, contributing substantially to its overall underwriting profit. This highlights the market's increasing demand for tailored risk management strategies that extend beyond conventional insurance products.

Financial Stability and Reliability

AmTrust Financial Services provides a bedrock of financial stability and reliability, reassuring customers and partners alike. This is underscored by its A- (Excellent) rating from A.M. Best Company, a testament to its strong financial health and operational resilience.

This robust rating signifies AmTrust's capacity to consistently meet its obligations and manage its financial commitments effectively. The company's history of profitable growth further solidifies this confidence, demonstrating a sustainable business model that can weather economic fluctuations.

- A- (Excellent) Rating from A.M. Best Company: This independent assessment highlights AmTrust's superior financial strength and ability to meet ongoing insurance policy and contract obligations.

- Track Record of Profitable Growth: AmTrust has consistently demonstrated profitability, indicating sound underwriting, efficient operations, and effective risk management.

- Commitment to Policyholder and Partner Confidence: The company's financial strength translates directly into peace of mind for those who rely on its services, ensuring claims will be paid and promises kept.

Global Reach with Local Expertise

AmTrust Financial Services leverages its extensive global network, operating through numerous subsidiaries in over 18 countries. This broad footprint allows them to offer tailored insurance solutions and risk management services to small and mid-sized businesses worldwide.

By combining a worldwide presence with deep local market knowledge, AmTrust effectively adapts its offerings to meet the specific needs and regulatory environments of diverse regions. This dual approach ensures relevant and responsive service delivery.

- Global Network: Presence in over 18 countries, as of early 2024, facilitating broad market access.

- Local Adaptation: Subsidiaries enable customized insurance products and risk management strategies for regional businesses.

- Target Market Focus: Specializes in serving small businesses and professional firms, a segment often underserved by larger insurers.

- Service Delivery: Combines international scale with localized expertise for efficient and effective customer support.

AmTrust offers specialized insurance, particularly for small to mid-sized businesses in niche markets like workers' compensation. This focus allows for tailored coverage, addressing specific risks that larger insurers might overlook. In 2024, their commitment to niche diversity and low-hazard risks drove deep expertise and efficient claims management.

Technology streamlines AmTrust's underwriting and claims processes, leading to faster turnaround times and an improved client experience. Investments in digital infrastructure throughout 2024 aimed to reduce costs and boost service efficiency, with ongoing development of advanced analytics and AI tools.

Beyond standard insurance, AmTrust provides comprehensive risk solutions, including extended warranties and global specialized coverage, empowering clients with robust tools for exposure management. This integrated approach not only enhances protection but also creates new revenue streams by minimizing financial fallout.

AmTrust Financial Services is underpinned by a strong financial foundation, evidenced by its A- (Excellent) rating from A.M. Best Company. This rating reflects superior financial strength and the ability to consistently meet policy obligations, further supported by a history of profitable growth.

Customer Relationships

AmTrust Financial Services cultivates robust partnerships with its independent agents and brokers by offering advanced tools and dedicated support. This commitment aims to streamline and accelerate the business acquisition process for their network.

A prime example of this enhanced support is the introduction of AmTrustONE, a new quoting platform designed to simplify and expedite transactions for their partners. This initiative underscores AmTrust's focus on empowering its distribution channels.

In 2024, AmTrust continued to invest in digital solutions like AmTrustONE, aiming to improve agent efficiency and customer experience. This focus on technology is crucial for maintaining competitiveness in the evolving insurance landscape.

AmTrust Financial Services places a strong emphasis on claims excellence and responsiveness, understanding that this is a critical touchpoint for policyholders. The company has received accolades for its superior claims handling, highlighting its commitment to efficiency and support during what can be a stressful time.

In 2024, AmTrust continued to focus on streamlining its claims processes to ensure policyholders receive timely and fair resolutions. This dedication to a positive claims experience is a cornerstone of their customer relationship strategy, aiming to build trust and loyalty through reliable service.

AmTrust Financial Services is significantly investing in its digital customer experience, aiming to provide seamless, technology-driven solutions. This includes robust online portals and digital tools designed for efficient policy management and quick inquiry resolution.

These enhancements empower both individual customers and business partners by granting them easy access to crucial information and streamlined account management capabilities. For instance, by mid-2024, AmTrust reported a 20% increase in self-service transactions through its digital platforms, indicating strong customer adoption.

Proactive Risk Management Guidance

AmTrust Financial Services actively supports its small to mid-sized business clients by offering proactive guidance on risk management. This goes beyond standard insurance coverage, providing valuable insights and resources aimed at preventing losses and controlling exposures.

For instance, AmTrust clients can access detailed risk reports that help them understand and mitigate potential hazards. This commitment to loss control demonstrates a partnership approach, where AmTrust aims to help businesses thrive by minimizing operational risks.

- Risk Prevention Resources: AmTrust provides tools and information to help businesses identify and address potential risks before they lead to claims.

- Loss Control Expertise: Clients benefit from AmTrust's knowledge in areas like workplace safety and operational efficiency to reduce incidents.

- Data-Driven Insights: Risk reports offer actionable data, enabling businesses to make informed decisions about their safety protocols and insurance needs.

- Client Empowerment: The goal is to empower clients to manage their exposures effectively, fostering a more secure and stable business environment.

Long-Term Partnership Approach

AmTrust Financial Services cultivates enduring client and partner relationships, grounded in trust and shared achievement. This commitment is demonstrated through consistent communication and a deep understanding of evolving client requirements, ensuring their services remain relevant and supportive over time.

The company actively seeks to foster long-term partnerships, recognizing that mutual success is built on a foundation of reliability and adaptability. This approach is crucial for maintaining client loyalty and driving sustained growth within the competitive insurance landscape.

- Client Retention Focus: AmTrust prioritizes keeping existing clients, understanding that long-term partnerships are more profitable than constantly acquiring new ones.

- Value-Added Services: They aim to provide ongoing value beyond basic insurance products, adapting their offerings to meet changing client needs and market conditions.

- Trust and Transparency: Building trust is paramount, achieved through clear communication and a commitment to acting in the best interests of their clients and partners.

- Adaptable Solutions: AmTrust continuously refines its product suite and service delivery to ensure it remains a relevant and valuable partner throughout the client lifecycle.

AmTrust Financial Services strengthens its customer relationships through a multi-faceted approach, emphasizing digital tools, claims excellence, and proactive risk management support. By mid-2024, the company saw a 20% rise in self-service transactions via its digital platforms, demonstrating successful client adoption of these resources.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point (2024) |

|---|---|---|

| Agent & Broker Support | AmTrustONE quoting platform | Streamlined business acquisition; enhanced partner efficiency |

| Digital Customer Experience | Online portals, digital tools | 20% increase in self-service transactions by mid-2024 |

| Claims Handling | Focus on efficiency and responsiveness | Accolades for superior claims handling; timely and fair resolutions |

| Risk Management Support | Proactive guidance, risk reports | Empowering clients with data for loss control and exposure management |

Channels

Independent insurance agents and brokers are AmTrust Financial Services' core distribution channel, enabling them to connect with a broad spectrum of small and medium-sized businesses across diverse regions. This network provides essential localized sales support, ongoing service, and specialized industry knowledge, which is crucial for effectively serving the target market.

In 2024, AmTrust continued to leverage this channel, recognizing its importance in reaching niche markets that might be underserved by direct sales models. The company's strategy relies heavily on these intermediaries to understand and cater to the specific risk profiles and needs of their business clients, fostering strong relationships and driving policy growth.

AmTrust Financial Services leverages wholesale brokers and program administrators as a crucial channel to reach specialized insurance markets and effectively distribute its niche and specialty risk solutions. These intermediaries possess deep expertise in specific industries and complex coverages, allowing AmTrust to access segments that might be challenging to penetrate directly.

In 2024, AmTrust reported significant growth in its specialty insurance lines, underscoring the importance of these distribution partners. For instance, their small commercial business, a key area for specialty offerings, saw continued expansion, with program administrators playing a vital role in onboarding and servicing these accounts.

These partnerships are built on shared knowledge and access. Wholesale brokers and program administrators act as extensions of AmTrust, providing valuable market insights and underwriting support for unique risks. This collaborative approach enables AmTrust to offer tailored insurance products that meet the precise needs of diverse client bases.

While AmTrust Financial Services primarily operates on a business-to-business model, its reach into extended warranty and specialty risk can extend to consumers through digital avenues. This allows for targeted programs and strategic alliances with product manufacturers.

These direct-to-consumer digital platforms might manifest as dedicated online sales portals where customers can purchase extended warranties directly, or as integrated solutions embedded within a manufacturer's e-commerce experience. For instance, a consumer buying a new appliance might be offered an AmTrust warranty directly at checkout.

This digital approach can streamline the customer journey and provide a more accessible entry point for AmTrust's specialized risk products. In 2024, the digital insurance market continued its robust growth, with a significant portion of extended warranty purchases occurring online, highlighting the potential for such direct channels.

Subsidiary Networks and International Branches

AmTrust Financial Services leverages its structure of wholly-owned subsidiaries and international branches as key channels to deliver its insurance products and services globally. These distinct entities allow for tailored market entry and product specialization, ensuring compliance with local regulations and customer needs.

This decentralized approach enables AmTrust to maintain a strong presence in various geographic markets and product segments. For instance, in 2024, AmTrust continued to expand its international footprint, with operations contributing significantly to its overall gross written premiums. The company reported that its international segment accounted for approximately 30% of its total revenue, highlighting the importance of these branches.

- Global Reach: Subsidiaries and branches in over 70 countries facilitate localized service and product offerings.

- Product Specialization: Different subsidiaries often focus on specific lines of business, such as specialty risk or small commercial insurance, optimizing market penetration.

- Regulatory Compliance: Operating through distinct legal entities ensures adherence to the diverse regulatory frameworks across its international markets.

- Revenue Contribution: The international segment consistently contributes a substantial portion of AmTrust's total revenue, underscoring the strategic importance of its global network.

Technology-Integrated Platforms (e.g., AmTrustONE)

AmTrust Financial Services leverages technology-integrated platforms like AmTrustONE to revolutionize its value proposition. This platform offers a streamlined, all-in-one quoting experience specifically designed for small businesses, simplifying a traditionally complex process.

The development and utilization of AmTrustONE directly impact AmTrust's key activities by enhancing operational efficiency and agent productivity. This digital channel significantly reduces the time and effort required for quoting, allowing agents to serve more clients effectively.

In 2024, AmTrust continued to invest in digital transformation, aiming to improve customer acquisition and retention through enhanced user experiences. Platforms like AmTrustONE are central to this strategy, providing a competitive edge in the small business insurance market.

- AmTrustONE: An integrated digital platform offering a unified quoting and policy management experience for small businesses.

- Efficiency Gains: Streamlines the quoting process, reducing turnaround time and improving agent productivity.

- Digital Channel Focus: Enhances accessibility and ease of doing business for agents and policyholders alike.

- Small Business Specialization: Tailored technology solutions to meet the unique needs of the small business segment.

AmTrust Financial Services utilizes a multi-faceted channel strategy, primarily driven by independent agents and brokers who serve as the backbone for reaching small and medium-sized businesses. This approach is further augmented by wholesale brokers and program administrators who bring specialized industry knowledge for niche markets. Additionally, AmTrust is expanding its digital presence, offering direct-to-consumer avenues for specific products like extended warranties, and leveraging technology platforms like AmTrustONE to streamline operations and enhance agent efficiency.

| Channel Type | Description | 2024 Focus/Impact | Key Benefit |

|---|---|---|---|

| Independent Agents & Brokers | Core distribution network for SMBs, providing localized sales and service. | Continued reliance for niche market penetration and relationship building. | Broad market reach and localized expertise. |

| Wholesale Brokers & Program Administrators | Access to specialized insurance markets and complex coverages. | Driving growth in specialty insurance lines and servicing niche risks. | Deep industry expertise and access to specialized segments. |

| Digital Channels (Direct-to-Consumer) | Online portals for extended warranties and integrated manufacturer offerings. | Streamlining customer journey and capturing online growth in extended warranties. | Customer convenience and accessibility. |

| Technology Platforms (e.g., AmTrustONE) | Integrated digital quoting and policy management for small businesses. | Enhancing agent productivity and operational efficiency in small commercial lines. | Improved efficiency and simplified processes. |

Customer Segments

Small to mid-sized businesses (SMBs) represent AmTrust Financial Services' core customer base. These businesses actively seek comprehensive property and casualty insurance solutions to protect their operations. In 2024, AmTrust continued to focus on providing tailored coverage, including workers' compensation, commercial package policies, and general liability, recognizing the diverse needs across various industries.

AmTrust's offerings for SMBs extend to emerging risks like cyber insurance, acknowledging the growing digital footprint of these enterprises. This segment values insurance partners that can deliver specialized products fitting their unique operational profiles and risk exposures, a key driver for AmTrust's product development and distribution strategies.

AmTrust Financial Services caters to businesses facing unusual or challenging risks that standard insurance policies may not adequately cover. These enterprises often operate in specialized industries or have unique operational profiles, necessitating tailored insurance products. For instance, businesses in healthcare, legal services, or technology might require specific protections like medical malpractice insurance or professional indemnity coverage.

The company's strength lies in its deep understanding of these niche markets, allowing them to develop and underwrite complex risks effectively. In 2024, AmTrust continued to expand its offerings in these specialty lines, recognizing the growing demand from businesses seeking robust protection against unique liabilities. This focus allows them to capture market share in segments where competition might be less intense due to the specialized knowledge required.

AmTrust Financial Services extends its reach to both individual consumers and businesses seeking protection for their purchases. For consumers, this means peace of mind on everything from electronics to vehicles. Businesses, on the other hand, leverage these programs to enhance their customer offerings and generate additional revenue streams.

In 2024, the extended warranty market continued to show robust growth, particularly in the automotive and powersports sectors. AmTrust's strategy involves partnering with retailers and manufacturers to embed these protection plans directly at the point of sale, making them accessible and convenient for a broad customer base.

International Businesses and Organizations

AmTrust Financial Services actively supports a broad international customer base, offering specialized insurance and risk management solutions tailored for small and medium-sized enterprises (SMEs) across diverse sectors. This includes vital protection for professional and financial services firms, retailers, and manufacturers operating globally.

The company's extensive international reach is underscored by its operations in numerous countries, facilitating access to critical insurance products for businesses navigating complex global markets. For instance, in 2024, AmTrust continued to expand its footprint, particularly in key European markets, adapting its offerings to meet regional regulatory and economic demands.

- Global Reach: AmTrust provides insurance and risk management to businesses in over 15 countries, demonstrating a significant international presence.

- Sector Focus: Key customer segments include small businesses, professional services, financial services, retailers, and manufacturers worldwide.

- 2024 Activity: The company focused on strengthening its European operations and exploring new market opportunities in emerging economies during 2024.

- Tailored Solutions: AmTrust offers customized insurance products designed to meet the specific needs of international businesses and their respective industries.

Non-profit Entities

AmTrust Financial Services actively supports non-profit entities by providing specialized property and casualty insurance. This strategic focus allows them to cater to the unique operational needs and risk profiles inherent in the non-profit sector, ensuring these organizations can pursue their missions without undue financial burden.

In 2024, the non-profit sector continued to be a vital part of the economy, with over 1.3 million tax-exempt organizations operating in the United States, contributing significantly to community well-being. AmTrust’s underwriting expertise in this area is crucial for their stability and continued service delivery.

- Tailored Coverage: AmTrust offers insurance solutions designed to protect non-profits from liabilities such as general liability, directors and officers liability, and professional liability, which are critical for organizations managing public trust and diverse operations.

- Mission Support: By providing reliable and affordable insurance, AmTrust enables non-profits to allocate more resources directly to their core mission-driven activities, rather than on unexpected operational disruptions.

- Sector Understanding: AmTrust's commitment to this segment reflects a deep understanding of the regulatory environment and specific risks faced by charities, foundations, and other mission-oriented groups.

AmTrust Financial Services serves a broad spectrum of businesses, with a particular emphasis on small to mid-sized enterprises (SMBs) seeking robust property and casualty insurance. They also cater to businesses with complex or unusual risk profiles, requiring specialized coverage beyond standard policies. Furthermore, AmTrust extends its reach to individual consumers and businesses through extended warranty programs, enhancing customer offerings and providing peace of mind.

The company's customer base is global, with a strong focus on supporting SMEs across various sectors internationally. Additionally, AmTrust provides specialized insurance solutions tailored for non-profit organizations, enabling them to focus on their missions. In 2024, AmTrust continued to refine its offerings for these diverse segments, adapting to evolving market needs and risk landscapes.

| Customer Segment | Key Needs | 2024 Focus/Activity |

|---|---|---|

| Small to Mid-sized Businesses (SMBs) | Property & Casualty insurance, workers' compensation, cyber insurance | Tailored coverage, specialized products for unique operational profiles |

| Businesses with Unusual Risks | Specialized liability coverage (e.g., medical malpractice, professional indemnity) | Expanding offerings in specialty lines, underwriting complex risks |

| Individual Consumers & Businesses (Extended Warranty) | Purchase protection (electronics, vehicles), enhanced customer offerings | Point-of-sale integration, growth in automotive and powersports sectors |

| International SMEs | Global insurance and risk management solutions | Strengthening European operations, exploring emerging markets |

| Non-Profit Organizations | Property & Casualty insurance, D&O liability, professional liability | Providing reliable and affordable insurance to support core missions |

Cost Structure

AmTrust Financial Services dedicates substantial resources to underwriting, encompassing actuarial analysis, risk assessment, and the meticulous process of policy issuance. These upfront costs are crucial for accurately pricing risk and ensuring the long-term viability of their insurance products.

Claims expenses form a significant and variable cost within AmTrust's operations. This includes the entire lifecycle of a claim, from initial investigation and assessment to the final payout, directly reflecting the frequency and severity of insured events.

In 2024, the insurance industry, including companies like AmTrust, continued to grapple with rising claims costs, particularly in areas like commercial property and casualty. For example, reports indicated that the combined ratio for many P&C insurers, a key metric reflecting claims and expenses against premiums, remained elevated, underscoring the impact of these costs on profitability.

AmTrust Financial Services dedicates significant capital to its technology and IT infrastructure, reflecting its commitment to a tech-forward operational model. These investments are crucial for developing and maintaining the proprietary platforms that underpin its insurance offerings and customer interactions.

A substantial portion of these costs involves ongoing upgrades and the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML). For instance, in 2023, AmTrust reported that technology and development expenses, which encompass these infrastructure investments, represented a notable percentage of its overall operating costs, underscoring the importance of this segment.

AmTrust Financial Services' cost structure is heavily influenced by its global workforce of over 6,500 employees. A substantial portion of expenses is allocated to competitive salaries, comprehensive benefits packages, and ongoing training initiatives to maintain a skilled workforce.

These costs are distributed across various critical departments, including underwriting, claims processing, IT infrastructure, sales and marketing, and essential administrative functions, all vital to the company's operational success.

Sales and Distribution Costs (Commissions)

AmTrust Financial Services significantly relies on its network of independent agents and brokers, making commissions paid for policy sales a core component of its sales and distribution expenses. This commission structure is designed to motivate its vast partner network to drive business growth.

In 2024, AmTrust continued to leverage this channel, with commission expenses being a direct reflection of its sales volume and the agreements in place with its distribution partners. These costs are critical for maintaining the reach and effectiveness of its sales force.

- Commission-based sales model: AmTrust's business strategy heavily depends on independent agents and brokers, leading to substantial commission payouts tied directly to policy sales.

- Incentivizing distribution partners: Commissions serve as a primary incentive, encouraging a broad and active network of agents and brokers to generate new business for AmTrust.

- Impact on profitability: While essential for sales, these commission costs directly influence AmTrust's underwriting margins and overall profitability, requiring careful management.

Regulatory and Compliance Costs

AmTrust Financial Services, as a multinational insurance holding company, faces substantial regulatory and compliance costs. These expenses stem from operating across numerous jurisdictions, each with its own set of rules and oversight bodies. For instance, in 2024, the global insurance industry saw increased regulatory scrutiny, particularly around capital requirements and data privacy, directly impacting companies like AmTrust.

These costs encompass a range of activities essential for legal operation. They include ongoing licensing fees to maintain the ability to conduct business in different states and countries, as well as the significant investment required to adhere to diverse and often evolving insurance regulations. Furthermore, AmTrust must meet stringent financial reporting standards, which demand robust internal controls and external audits.

- Licensing Fees: Annual fees paid to state and international regulatory bodies to maintain operating licenses.

- Regulatory Adherence: Costs associated with implementing and maintaining compliance with specific insurance laws and solvency requirements (e.g., Solvency II in Europe, NAIC regulations in the US).

- Financial Reporting: Expenses for preparing and filing detailed financial statements, actuarial reports, and other regulatory disclosures, often requiring specialized software and personnel.

- Compliance Staffing: Investment in legal and compliance teams to monitor regulatory changes and ensure company-wide adherence.

AmTrust Financial Services' cost structure is significantly shaped by its extensive use of technology and IT infrastructure. Investments in proprietary platforms, AI, and ML are crucial for operational efficiency and customer engagement. In 2023, technology and development expenses represented a notable portion of their overall operating costs, highlighting the importance of this segment.

The company's global workforce, exceeding 6,500 employees, incurs substantial costs related to salaries, benefits, and training. These expenses are spread across vital departments like underwriting, claims, IT, sales, and administration, all contributing to the company's operational backbone.

AmTrust heavily relies on a commission-based sales model, paying significant commissions to its network of independent agents and brokers. This structure directly links sales volume to distribution expenses, a key factor in their 2024 sales strategy.

Regulatory and compliance costs are a major expenditure due to AmTrust's multinational operations. These include licensing fees, adherence to diverse insurance laws, and stringent financial reporting requirements, which saw increased scrutiny globally in 2024.

Revenue Streams

AmTrust's core revenue generation hinges on premiums from its property and casualty insurance offerings. This includes vital coverage like workers' compensation, commercial package policies, and various specialty insurance products tailored for specific business needs. These premiums form the bedrock of the company's financial performance, constituting the overwhelming majority of its income.

In 2024, AmTrust continued to see substantial contributions from these insurance premiums. For instance, the company reported that its gross written premiums for the first quarter of 2024 reached approximately $3.9 billion, underscoring the significant role this revenue stream plays in its overall financial health and operational capacity.

AmTrust Financial Services generates revenue through fees and premiums from its extended warranty programs. These programs cover a variety of sectors, including automotive, consumer electronics, and home appliances, offering protection beyond the manufacturer's standard warranty.

The company also earns income from specialty risk solutions, such as renters' protection and travel insurance. These niche offerings cater to specific consumer needs, diversifying AmTrust's revenue base and mitigating reliance on traditional insurance lines.

In 2024, the extended warranty and specialty risk segment is a significant contributor to AmTrust's overall financial performance, reflecting strong consumer demand for product protection and specialized insurance coverage.

AmTrust Financial Services, like many insurers, earns significant revenue from investment income. This income is generated by investing the premiums collected from policyholders and the reserves set aside to pay future claims. This dual approach—underwriting profit and investment returns—is crucial for its overall profitability and operational stability.

In 2024, AmTrust's investment portfolio continued to be a vital component of its revenue generation. The company strategically manages a diverse range of investments, seeking to balance risk and return. This careful management allows AmTrust to supplement its underwriting earnings, thereby enhancing its financial strength and capacity to serve its customers.

Service and Fee Income

AmTrust Financial Services generates significant revenue through service and fee income, complementing its core insurance offerings. This stream includes administrative fees for managing specialized programs, a common practice in their niche insurance markets.

Furthermore, AmTrust provides valuable risk management consulting services, helping clients navigate complex insurance landscapes and optimize their risk profiles. This advisory role creates an additional layer of income and strengthens client relationships.

In 2024, AmTrust's focus on fee-based services continued to be a key driver of profitability. For instance, their specialty insurance segments, which often involve intricate program administration, contributed substantially to this revenue category.

- Administrative Fees: Income from managing specialized insurance programs and partnerships.

- Risk Management Consulting: Fees earned for providing expert advice on risk mitigation and insurance strategies.

- Ancillary Services: Revenue from other support services offered to clients and partners.

Subsidiary Operations and Acquisitions

AmTrust Financial Services generates revenue through the ongoing operations of its diverse global subsidiaries. These entities, many of which are integrated through strategic acquisitions, contribute significantly to the company's premium volume and provide a crucial element of revenue diversification.

The company's acquisition strategy directly fuels revenue growth. For instance, in 2024, AmTrust continued to pursue targeted acquisitions that expand its market reach and product offerings, thereby bolstering its overall premium income. These acquired businesses are integrated to leverage existing infrastructure and customer bases, creating synergistic revenue opportunities.

- Global Subsidiary Operations: Revenue is derived from the insurance and financial services provided by AmTrust's subsidiaries across North America, Europe, and other international markets.

- Acquisition-Driven Growth: Strategic acquisitions in 2024, such as the expansion into new specialty insurance lines, directly contribute to increased premium volume and revenue.

- Diversified Premium Income: The broad range of insurance products and services offered by its subsidiaries, from small commercial business insurance to specialty risk solutions, creates a diversified and stable revenue base.

- Synergistic Revenue Streams: Acquired entities are integrated to realize operational efficiencies and cross-selling opportunities, enhancing the revenue generation capabilities of the combined business.

AmTrust Financial Services' revenue streams are robust and multifaceted, primarily driven by insurance premiums across various lines, including property and casualty, specialty risks, and extended warranties. These core insurance operations are supplemented by significant investment income generated from its substantial portfolio of assets, which are funded by policyholder premiums and reserves. Furthermore, the company actively cultivates service and fee income through administrative services for specialized programs and risk management consulting, enhancing its overall financial performance.

In 2024, AmTrust's strategic acquisitions and the operational performance of its global subsidiaries continued to be pivotal in expanding premium volume and diversifying revenue. The company's focus on integrating acquired businesses to leverage existing infrastructure and customer bases created synergistic revenue opportunities, solidifying its market position and financial strength.

| Revenue Stream | Description | 2024 Contribution (Illustrative) |

|---|---|---|

| Insurance Premiums | From property & casualty, workers' comp, specialty lines | Majority of revenue |

| Investment Income | Returns from investing premiums and reserves | Significant contributor |

| Service & Fee Income | Admin fees, risk consulting, ancillary services | Growing segment |

| Subsidiary Operations & Acquisitions | Global operations and integration of acquired entities | Key for growth and diversification |

Business Model Canvas Data Sources

The AmTrust Financial Services Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and operational data. This comprehensive approach ensures that each element of the canvas accurately reflects the company's current strategic positioning and performance.