AmTrust Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmTrust Financial Services Bundle

Unlock the critical external factors impacting AmTrust Financial Services with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, and technological advancements that are shaping its strategic direction. Gain a competitive advantage by leveraging these expert insights. Download the full PESTLE analysis now to make informed decisions and fortify your market position.

Political factors

The stability and evolving direction of government regulations are paramount to AmTrust Financial Services' operational framework. For instance, shifts in capital requirements and solvency rules, such as those implemented by the NAIC in the US or Solvency II in Europe, directly influence AmTrust's capacity to underwrite new business and pursue international market expansion. Political transitions can also lead to altered enforcement priorities for existing insurance mandates.

AmTrust Financial Services, operating globally, is significantly impacted by evolving trade policies and international relations. For instance, the ongoing trade discussions between the United States and China, which saw tariffs imposed on various goods in 2023, could indirectly affect market access and operational costs for financial services firms with cross-border investments or operations.

Geopolitical tensions, such as those witnessed in Eastern Europe in 2024, can disrupt global supply chains and create economic uncertainty, influencing investment strategies and the stability of international subsidiaries. These shifts can lead to increased compliance burdens or altered market dynamics for companies like AmTrust.

Furthermore, the signing of new trade agreements or the renegotiation of existing ones, like potential updates to agreements involving the European Union, can reshape market access and regulatory landscapes. AmTrust’s ability to navigate these changes will be crucial for its international growth and operational efficiency.

Government healthcare policies, especially in the United States, significantly shape the workers' compensation landscape, a core area for AmTrust Financial Services. For instance, the Affordable Care Act (ACA) and subsequent healthcare reform discussions can influence medical costs associated with claims. In 2024, ongoing debates around healthcare affordability and access continue to be a backdrop for how medical expenses are managed within the workers' compensation system.

Changes in medical cost containment strategies or occupational health and safety regulations directly impact the frequency and severity of workers' compensation claims. For example, stricter safety regulations could lead to fewer injuries, while shifts in medical billing practices could alter claim payouts. AmTrust must remain agile in its underwriting and claims management to adapt to these evolving regulatory environments.

Taxation Policies

Changes in taxation policies directly impact AmTrust Financial Services. For instance, fluctuations in corporate tax rates, like the US federal corporate tax rate which has been 21% since 2018, can significantly alter profitability. Premium taxes in various jurisdictions also add to operating costs.

Government fiscal policies, whether offering tax incentives or increasing tax burdens, influence AmTrust's strategic decisions regarding investments and capital allocation. For example, tax credits for certain types of insurance or investments could encourage specific business lines.

Anticipating these shifts is vital for effective financial planning and maintaining a competitive edge.

- Corporate Tax Rates: The US federal corporate tax rate stands at 21% (as of mid-2024), but state-level variations exist.

- Premium Taxes: These vary significantly by state and country, directly impacting the cost of doing business for insurers like AmTrust.

- Tax Incentives: Governments may offer incentives for specific insurance products or investments, influencing strategic direction.

- International Tax Laws: AmTrust's global operations mean navigating diverse and changing international tax regulations.

Political Stability and Geopolitical Risks

AmTrust Financial Services operates within a global landscape where political stability is paramount. Any significant political unrest or policy shifts in key markets, such as the United States or Europe, can directly influence its operational environment and investment strategies. For instance, the 2024 US presidential election cycle, with its potential for policy changes affecting financial regulations and international trade, represents a significant area of focus for risk assessment.

Geopolitical risks, including regional conflicts or trade disputes, can also have a tangible impact on AmTrust. The ongoing geopolitical tensions in Eastern Europe, for example, have led to increased insurance premiums for political risk coverage and can disrupt supply chains, indirectly affecting the business operations of AmTrust's clients and potentially leading to higher claims. In 2024, the global insurance market has seen a notable increase in demand for political risk insurance, with premiums for certain regions rising by as much as 15-20% compared to pre-2022 levels.

- Increased scrutiny on international trade policies: Potential shifts in tariffs and trade agreements in 2024-2025 could impact cross-border financial flows and investment opportunities for AmTrust.

- Regulatory divergence: Differing approaches to financial regulation across countries can create compliance challenges and affect market access.

- Impact of elections on economic policy: Upcoming elections in major economies could lead to changes in fiscal and monetary policies, influencing interest rates and economic growth, which are key drivers for the insurance sector.

- Heightened cyber-security threats linked to state actors: Geopolitical tensions can correlate with an increase in state-sponsored cyberattacks, posing risks to financial institutions like AmTrust.

Government stability and policy continuity are critical for AmTrust Financial Services. For instance, the 2024 US election cycle could introduce shifts in financial regulation and trade policy, impacting AmTrust's operational landscape and investment strategies. Political transitions in key markets can also alter enforcement priorities for existing insurance mandates, requiring agile adaptation.

What is included in the product

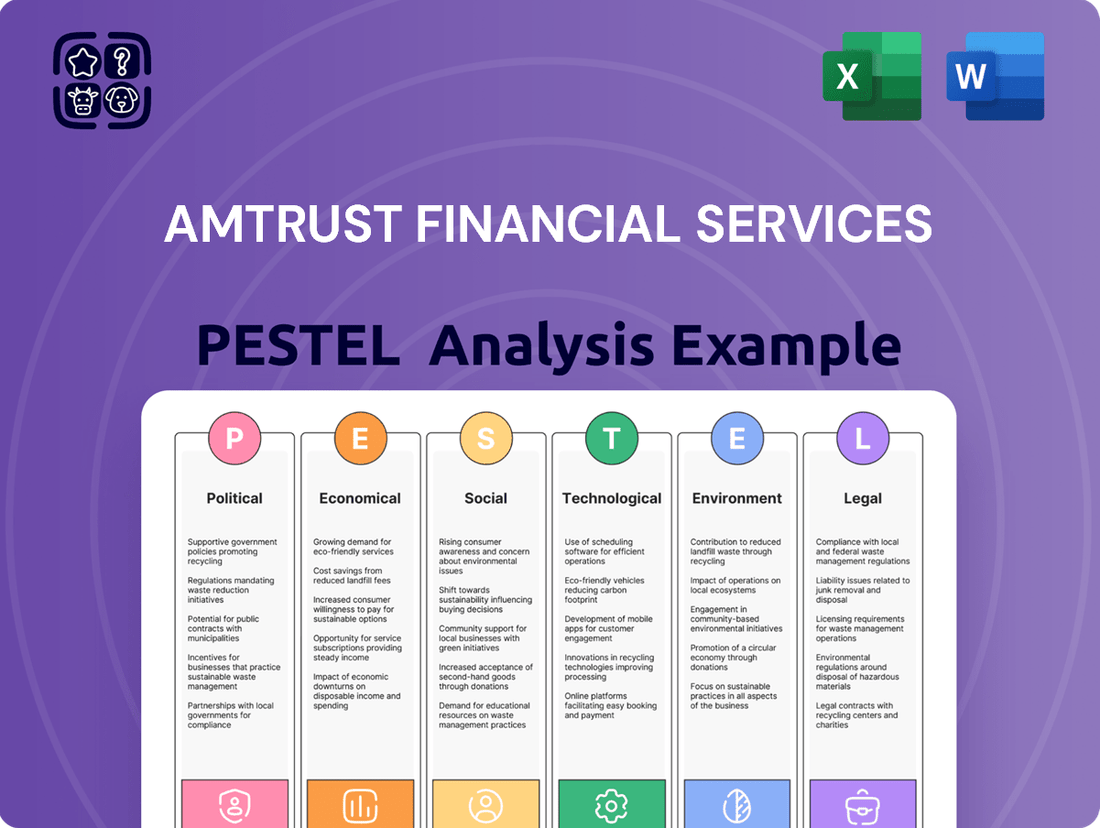

This PESTLE analysis examines the external macro-environmental factors influencing AmTrust Financial Services, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities stemming from these critical market forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of AmTrust's external environment to proactively address potential challenges.

Economic factors

Interest rate movements are a significant factor for AmTrust Financial Services. As an insurer, a substantial portion of their business involves investing premiums, and the returns generated from these investments directly impact profitability. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25% to 5.50%, a level that generally supports higher investment income for insurers compared to periods of near-zero rates.

Higher interest rates, such as those seen in the 2023-2024 period, can boost AmTrust's investment income, providing a cushion against potential underwriting volatility. Conversely, a sharp decline in rates, as experienced in prior years, would likely compress these returns, placing greater emphasis on the company's ability to generate profits from its core insurance operations. Central bank policies, like those from the Federal Reserve, are therefore closely watched by AmTrust.

Inflation significantly impacts AmTrust's claims costs, especially in property and casualty and workers' compensation. For instance, the US Producer Price Index for services, a key indicator of business costs, saw an increase of 3.1% year-over-year as of April 2024, signaling higher expenses for repairs and labor.

This rise in repair, medical, and labor expenses directly translates to larger claim payouts. If AmTrust doesn't adjust its premiums to keep pace with these escalating costs, its underwriting margins could shrink. For example, the average cost of auto physical damage claims rose by 10% in 2023 compared to 2022, according to industry reports.

Consequently, AmTrust needs to vigilantly track inflationary trends. This proactive monitoring is crucial for ensuring that pricing strategies and financial reserves accurately reflect the current economic environment and protect profitability.

The overall health of the economy and the rate of new business formation are critical drivers for AmTrust Financial Services. A strong economy with healthy GDP growth often translates to more businesses opening their doors and expanding, directly increasing the demand for commercial insurance products like workers' compensation and commercial package policies. For instance, the U.S. economy experienced a GDP growth of 2.5% in 2023, signaling a generally favorable environment for business expansion and, consequently, for insurers like AmTrust.

Unemployment Rates

Unemployment rates significantly influence AmTrust Financial Services' workers' compensation business. When unemployment rises, there can be an uptick in claims as individuals, facing job loss, may file for benefits. Conversely, a robust labor market with low unemployment often sees a reduction in claim frequency.

For instance, the U.S. unemployment rate stood at 3.9% in April 2024, a slight increase from March's 3.8%, indicating a stable but potentially shifting labor market. AmTrust must closely track these figures to forecast potential changes in claim volumes and associated costs.

- U.S. Unemployment Rate (April 2024): 3.9%

- U.S. Unemployment Rate (March 2024): 3.8%

- Impact on Claims: Higher unemployment can lead to more workers' compensation claims, while lower unemployment generally results in fewer claims.

- Strategic Monitoring: AmTrust needs to continuously analyze labor market dynamics to effectively manage its workers' compensation portfolio.

Global Economic Volatility and Recession Risks

Global economic volatility remains a significant concern, with many analysts forecasting a heightened risk of recessions in key markets throughout 2024 and into 2025. For AmTrust Financial Services, this translates to potential headwinds for premium growth as businesses scale back operations and consumer spending tightens. Investment portfolios could also face pressure from market downturns, impacting overall financial performance.

Economic downturns directly affect the insurance sector. Reduced business activity often means lower demand for commercial insurance products, AmTrust's core market. Furthermore, policyholders facing financial strain may increase lapse rates to cut costs or experience greater credit risk, impacting AmTrust's profitability and capital adequacy.

- Recession Probability: The IMF's October 2024 World Economic Outlook projected a global growth rate of 3.1% for 2024, with significant downside risks, suggesting a non-negligible probability of recession in several advanced economies.

- Impact on Insurance Demand: Historically, during economic slowdowns, commercial insurance renewals have seen premium moderation or even declines, as businesses prioritize essential spending.

- Credit Risk Exposure: Increased corporate defaults during recessions can lead to higher credit losses for insurers on their bond portfolios and from reinsurance counterparties.

- Geographic Diversification Benefit: AmTrust's presence in multiple international markets, including Europe and Latin America, can help offset localized economic downturns by leveraging stronger performance in other regions.

Interest rate stability, as seen with the Federal Reserve's rate holding steady around 5.25%-5.50% in early 2024, generally benefits insurers like AmTrust by boosting investment income. However, ongoing inflation, with service sector costs rising 3.1% year-over-year as of April 2024, directly increases claims expenses, particularly for property and casualty lines. A strong economy, evidenced by 2.5% GDP growth in 2023, typically fuels demand for commercial insurance.

The U.S. unemployment rate, hovering near 3.8%-3.9% in early 2024, has a direct correlation with workers' compensation claims frequency. Global economic volatility and recession risks in 2024-2025 present challenges for premium growth and investment portfolio stability. AmTrust's geographic diversification offers a buffer against localized economic downturns.

| Economic Factor | Indicator/Trend (Early 2024 - Mid 2025 Forecasts) | Impact on AmTrust Financial Services |

|---|---|---|

| Interest Rates | Federal Reserve Rate: 5.25%-5.50% (held steady) | Supports investment income; higher returns on premiums. |

| Inflation | US Producer Price Index (Services): +3.1% (April 2024) | Increases claims costs (repairs, labor); requires premium adjustments. |

| Economic Growth | US GDP Growth: +2.5% (2023) | Favorable for commercial insurance demand; increased business activity. |

| Unemployment | US Unemployment Rate: 3.8%-3.9% (Q1 2024) | Stable, but shifts can impact workers' compensation claims frequency. |

| Global Outlook | Recession Risk: Heightened in key markets (2024-2025 forecasts) | Potential headwinds for premium growth and investment portfolio performance. |

What You See Is What You Get

AmTrust Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of AmTrust Financial Services delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understand the critical external forces shaping AmTrust's future business landscape.

Sociological factors

Demographic shifts profoundly influence the insurance landscape. By 2025, the U.S. is projected to see continued growth in its older population, impacting health and life insurance needs. Simultaneously, the gig economy's expansion, with an estimated 59 million Americans participating by 2025, introduces new occupational risk profiles for workers' compensation insurance, demanding adaptive underwriting and product design from AmTrust.

Modern consumers and small to mid-sized businesses now demand effortless, tech-powered experiences for everything from buying insurance to managing policies and filing claims. This shift means insurers must prioritize intuitive digital interfaces and robust online capabilities.

AmTrust's focus on technology is well-aligned with this trend, but ongoing investment in user-friendly digital platforms is essential. For instance, a 2024 survey indicated that 70% of consumers prefer digital channels for insurance interactions, highlighting the need for features like mobile accessibility and online self-service to ensure customer satisfaction and retention.

Public perception and trust are cornerstones for any insurance provider, directly impacting how many people choose and stay with AmTrust. A recent survey in late 2024 indicated that over 60% of consumers prioritize transparency and ethical dealings when selecting an insurer, highlighting the critical need for clear communication and fair claims processes.

AmTrust's ability to build and maintain trust, particularly during challenging periods like widespread natural disasters or economic downturns, is paramount. For instance, in the aftermath of the 2024 hurricane season, insurers demonstrating swift and equitable claim settlements saw a significant boost in customer retention, a benchmark AmTrust aims to meet and exceed to foster long-term brand loyalty.

Social Attitudes Towards Risk and Responsibility

Societal attitudes toward risk significantly influence the demand for insurance. As awareness of emerging threats like cyberattacks and climate-related events grows, there's a corresponding increase in the need for specialized coverage. For instance, a 2024 survey indicated that 65% of small businesses now consider cyber risk a top concern, driving demand for cyber liability insurance.

Shifts in perceptions of personal responsibility and liability also play a crucial role. If society increasingly expects individuals or entities to bear the brunt of unforeseen events, demand for certain insurance products might decline. Conversely, a greater emphasis on collective security and risk mitigation can bolster the market for comprehensive insurance solutions.

AmTrust Financial Services must remain attuned to these evolving social perspectives to effectively tailor its product portfolio. For example, the increasing frequency of natural disasters, with insured losses from severe weather events in the US alone projected to exceed $70 billion in 2024, necessitates adaptable and robust property and casualty offerings.

- Growing Cyber Threat Awareness: 65% of US small businesses identified cyber risk as a primary concern in 2024, boosting demand for cyber insurance.

- Climate Change Impact: Insured losses from severe weather in the US are expected to surpass $70 billion in 2024, highlighting the need for climate-resilient insurance products.

- Liability Perception Shifts: Evolving views on corporate and individual accountability for damages can alter claims trends and the overall demand for liability coverage.

- Demand for Specialty Coverages: Increased societal awareness of niche risks, such as supply chain disruptions or professional liability, drives the need for specialized insurance solutions.

Work-Life Balance and Employee Well-being Trends

Societal emphasis on employee well-being, mental health, and work-life balance directly impacts workplace safety and health. This shift can influence the frequency and severity of workers' compensation claims. For instance, a 2024 survey indicated that 65% of employees believe their employer should do more to support their mental health, a sentiment that correlates with potential safety lapses due to stress.

Companies that proactively invest in employee wellness programs often report fewer workers' compensation claims. Conversely, sectors experiencing high burnout rates, such as healthcare and technology, may see an uptick in claims related to stress-induced accidents or mental health issues. AmTrust Financial Services must closely monitor these evolving employee expectations and well-being metrics to accurately underwrite policies and provide relevant risk management advice to its clients.

Key trends influencing this area include:

- Growing Demand for Flexible Work Arrangements: Post-pandemic, a significant portion of the workforce, estimated at over 50% in many developed economies by early 2025, expects hybrid or remote work options, impacting how safety protocols are implemented and monitored.

- Increased Focus on Mental Health Support: Mental health is now a primary concern, with a notable rise in employer-sponsored mental health benefits and resources, aiming to mitigate the impact of psychological stress on job performance and safety.

- Emphasis on Preventative Health Measures: There's a greater societal push for preventative health, encouraging employers to implement wellness programs that address physical and mental health proactively, potentially reducing overall claim costs.

- Impact on Workers' Compensation Premiums: Industries demonstrating a strong commitment to employee well-being may eventually see more favorable workers' compensation insurance rates as their risk profiles improve.

Societal attitudes towards risk and responsibility are evolving, directly influencing insurance demand. Increased awareness of cyber threats, with 65% of US small businesses citing it as a top concern in 2024, fuels the need for specialized cyber liability coverage. Similarly, the escalating impact of climate change, evidenced by projected US insured losses from severe weather exceeding $70 billion in 2024, necessitates adaptable property and casualty products.

Technological factors

AmTrust Financial Services is actively integrating AI and machine learning to sharpen its underwriting processes and combat fraud. This tech-forward strategy aims to accelerate risk evaluation, refine pricing models, and expedite claims handling. For instance, by mid-2024, insurers using AI for claims processing reported an average reduction in processing times by 20-30%, directly boosting efficiency.

These advancements translate into tangible benefits like enhanced profitability and a smoother customer journey. The ability to analyze vast datasets quickly allows AmTrust to identify subtle risk patterns that might be missed by traditional methods. By Q1 2025, companies with mature AI underwriting capabilities are expected to see a 5-10% improvement in loss ratios.

Maintaining a competitive advantage in the insurance sector hinges on sustained investment in these AI capabilities. As of late 2024, the global AI in insurance market is projected to reach over $10 billion, underscoring the significant financial commitment and strategic importance of this technology for companies like AmTrust.

AmTrust Financial Services, like all insurers, handles a massive volume of sensitive customer information, making it a prime target for cyberattacks. The company must invest heavily in advanced cybersecurity measures to safeguard this data. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk involved in data breaches.

Failure to protect this data not only violates stringent regulations such as GDPR and CCPA but also erodes customer confidence, which is critical for AmTrust's reputation and long-term success. The reputational damage from a significant breach can be devastating, leading to a loss of business and increased customer churn.

Maintaining a robust cybersecurity infrastructure, including regular security audits, employee training, and sophisticated threat detection systems, is therefore non-negotiable for AmTrust. This proactive approach is crucial to counter the constantly evolving landscape of cyber threats and ensure the integrity and privacy of the data entrusted to them.

The Insurtech landscape is rapidly evolving, presenting both challenges and avenues for growth for established players like AmTrust. These nimble startups are increasingly utilizing advanced technologies to disrupt traditional insurance models, offering innovative products and streamlined customer journeys. For instance, the global Insurtech market was valued at approximately $11.4 billion in 2023 and is projected to reach over $30 billion by 2028, showcasing significant investment and expansion.

AmTrust needs to actively monitor these advancements. This could involve developing its own Insurtech capabilities, perhaps focusing on areas like AI-driven claims processing or personalized policy offerings, or forging strategic partnerships with existing Insurtech firms. Such collaborations can provide access to new technologies and customer segments, allowing AmTrust to enhance its competitive edge and expand its market penetration in the dynamic insurance sector.

Automation in Operations and Customer Service

Automation is rapidly transforming how AmTrust Financial Services operates, particularly in routine tasks like policy administration and handling customer inquiries. Chatbots and AI-powered systems are increasingly managing these functions, leading to significant improvements in efficiency and cost reduction. For instance, a study by McKinsey in late 2023 indicated that businesses can achieve up to a 30% reduction in operational costs through automation.

By automating these repetitive processes, AmTrust can reallocate its valuable human resources to more complex and strategic initiatives. This shift not only enhances service speed and accuracy but also enables 24/7 customer support, a critical factor for customer satisfaction in today's market. The reduction in human error is another key benefit, directly impacting the quality and reliability of services offered.

The impact of automation on the financial services sector is substantial, with significant investments being made. For example, global spending on AI in financial services was projected to reach over $30 billion by 2024, highlighting the industry's commitment to these technologies. This trend suggests a future where automated systems are integral to AmTrust's competitive advantage.

- Improved Operational Efficiency: Automation streamlines policy administration and claims processing.

- Cost Reduction: Automating routine tasks can lower operational expenses by up to 30%.

- Enhanced Customer Service: Chatbots and AI provide 24/7 support and faster query resolution.

- Reduced Human Error: Automated systems minimize mistakes in data entry and processing.

Data Analytics for Risk Assessment and Product Development

AmTrust Financial Services leverages advanced data analytics to refine its risk assessment and product development, a critical technological factor. This allows for a more granular understanding of risk patterns, enabling more accurate prediction of future claims and the creation of highly tailored insurance products. For instance, by analyzing vast datasets, AmTrust can proactively identify emerging risks and adjust pricing strategies accordingly, ensuring competitive yet profitable offerings.

The company's commitment to a data-driven strategy is evident in its ability to optimize operations and foster innovation. This analytical prowess is not just about understanding existing markets but also about anticipating future needs. By processing extensive information, AmTrust can pinpoint opportunities for new specialty coverages, directly addressing specific market demands and enhancing its competitive edge. This focus on data analytics is a foundational element of their business model, contributing significantly to both profitability and market relevance.

- Enhanced Risk Prediction: AmTrust’s data analytics capabilities allow for more precise forecasting of claim frequencies and severity, reducing unexpected losses.

- Product Customization: The analysis of customer data enables the development of insurance products that more closely align with specific needs and risk profiles.

- Market Responsiveness: Identifying emerging trends and risks through data allows AmTrust to quickly adapt its product portfolio and pricing strategies.

- Operational Efficiency: Data-driven insights optimize underwriting processes, claims management, and overall business operations, leading to cost savings.

AmTrust Financial Services is heavily invested in Artificial Intelligence (AI) and machine learning to refine its underwriting and fraud detection capabilities. This strategic adoption aims to speed up risk assessment, improve pricing, and streamline claims processing. By mid-2024, insurers utilizing AI for claims processing saw processing times decrease by an average of 20-30%, boosting overall efficiency.

These technological advancements directly contribute to enhanced profitability and a more positive customer experience. The ability to rapidly analyze large datasets allows AmTrust to identify subtle risk patterns that traditional methods might overlook. By the first quarter of 2025, companies with mature AI underwriting are projected to experience a 5-10% improvement in their loss ratios.

Maintaining a competitive edge in the insurance industry requires continuous investment in AI. As of late 2024, the global AI in insurance market is expected to surpass $10 billion, highlighting the significant financial commitment and strategic importance of this technology for firms like AmTrust.

| Technology Area | Key Applications for AmTrust | Projected Impact/Market Data |

|---|---|---|

| AI & Machine Learning | Underwriting, Fraud Detection, Risk Assessment | 20-30% reduction in claims processing time (mid-2024); 5-10% improvement in loss ratios (Q1 2025); Global AI in Insurance market > $10 billion (late 2024) |

| Cybersecurity | Data Protection, Threat Prevention | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025 |

| Insurtech | Innovative Products, Streamlined Customer Journeys | Global Insurtech market valued at ~$11.4 billion (2023), projected to exceed $30 billion by 2028 |

| Automation | Policy Administration, Customer Inquiries | Up to 30% reduction in operational costs (late 2023 study); Global spending on AI in financial services > $30 billion (2024) |

| Data Analytics | Risk Prediction, Product Development, Market Analysis | Enables more accurate forecasting of claims and customized product offerings. |

Legal factors

AmTrust Financial Services navigates a landscape heavily shaped by insurance regulatory compliance. In the U.S. alone, this means adhering to the distinct rules set by 50 state insurance departments, each with its own licensing, solvency, and market conduct requirements. Globally, AmTrust must also comply with national regulators, adding layers of complexity. For instance, solvency standards, like the Risk-Based Capital (RBC) framework, are crucial for maintaining financial stability and operational licenses.

Staying abreast of these evolving regulations is paramount. In 2024, for example, discussions around data privacy and cybersecurity in insurance are intensifying, impacting how companies like AmTrust handle sensitive customer information. Failure to comply with these intricate rules can lead to significant financial penalties, damage to brand reputation, and even the revocation of operating licenses, underscoring the critical need for robust compliance programs.

AmTrust Financial Services operates within a complex web of data privacy and security laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations, which continue to evolve globally, mandate strict protocols for the collection, storage, processing, and protection of customer information. Failure to adhere to these legal frameworks can lead to substantial fines; for instance, GDPR violations can incur penalties of up to 4% of global annual revenue or €20 million, whichever is greater. Consequently, robust data governance and cybersecurity measures are not just best practices but legal necessities for AmTrust to mitigate risk and maintain customer trust.

AmTrust Financial Services, as a significant player in the insurance market, must meticulously adhere to anti-trust and competition laws. These regulations are designed to foster a level playing field by preventing monopolistic practices and ensuring fair competition across the industry. For instance, the U.S. Department of Justice and the Federal Trade Commission actively scrutinize mergers and acquisitions to maintain market competition.

Navigating these legal frameworks is crucial for AmTrust's strategic initiatives, particularly concerning any potential mergers or acquisitions. Failure to comply could result in substantial fines and legal disputes, potentially hindering the company's growth trajectory and market position. In 2024, regulatory bodies globally continued to emphasize robust enforcement of these laws, with significant penalties levied against companies found in violation of anti-competitive behavior.

Litigation Trends and Class Action Lawsuits

The insurance sector, including AmTrust Financial Services, is inherently exposed to significant litigation risks. These range from individual policy disputes to more complex class action lawsuits, often stemming from claims handling or coverage interpretations. In 2024, the ongoing evolution of legal precedents, particularly concerning workers' compensation and commercial liability, continues to shape the landscape of potential jury awards and the associated legal defense expenses for insurers like AmTrust.

Effective management of these legal challenges is paramount for AmTrust's financial health. Key areas of focus often include:

- Claims Disputes: Individual policyholder disagreements over claim validity or payout amounts.

- Bad Faith Lawsuits: Allegations that an insurer acted improperly in handling a claim.

- Class Action Lawsuits: Consolidated legal actions representing a large group of policyholders with similar grievances.

- Regulatory Scrutiny: Increased oversight and potential penalties from state and federal insurance regulators.

The financial impact of litigation can be substantial, affecting profitability through increased claims reserves and legal fees. For instance, a significant adverse jury verdict in a class action case could lead to millions in payouts and further legal costs, directly impacting AmTrust's bottom line.

Contract Law and Policy Wording

Insurance policies are essentially legally binding contracts, and how the wording of these policies is interpreted under contract law is absolutely critical for handling claims and resolving any disagreements. If there are unclear parts or specific clauses that can be read in different ways, it often leads to legal battles.

AmTrust Financial Services needs to make sure that the language used in its policies is crystal clear, legally robust, and fully compliant with all relevant laws. This diligence is key to reducing the likelihood of disputes and the associated risk of litigation, ultimately safeguarding both the company and its policyholders.

For instance, in 2023, the U.S. insurance industry saw a significant number of contract disputes, with legal costs for insurers rising. Clear policy wording is a direct defense against such increases. AmTrust's commitment to precise contractual language helps mitigate these financial and reputational risks.

- Contractual Clarity: Policy wording must be unambiguous to prevent misinterpretation and subsequent legal challenges.

- Dispute Mitigation: Clear, legally sound language reduces the frequency and cost of claims disputes and litigation.

- Regulatory Compliance: Adherence to contract law ensures AmTrust operates within legal frameworks, avoiding penalties.

- Policyholder Protection: Well-defined terms protect policyholders by setting clear expectations and obligations.

AmTrust Financial Services operates under a stringent regulatory environment, requiring adherence to state-specific insurance laws in the U.S. and national regulations globally. These rules govern everything from licensing and solvency, such as Risk-Based Capital (RBC) requirements, to market conduct. Failure to comply can result in severe penalties, reputational damage, and loss of operating licenses, making robust compliance programs essential for business continuity.

Environmental factors

The escalating frequency and intensity of climate-driven natural disasters pose a significant threat to AmTrust's property and casualty insurance segments. Events such as major hurricanes, widespread wildfires, and severe flooding directly translate into increased claims payouts and heightened unpredictability in underwriting performance.

For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, causing over $92.9 billion in damages, according to NOAA. This trend necessitates that AmTrust continuously enhance its catastrophe modeling capabilities, adapt premium pricing structures, and strategically manage its exposure in vulnerable geographical areas to effectively counter these expanding environmental challenges.

AmTrust Financial Services, like other insurers, faces increasing scrutiny from investors and regulators regarding its Environmental, Social, and Governance (ESG) performance. This pressure is driving a demand for transparency and tangible action in areas like climate risk management and ethical business practices. For instance, by the end of 2023, global sustainable investment assets reached an estimated $37.7 trillion, a significant increase that underscores investor appetite for ESG-aligned companies.

As a result, AmTrust is increasingly expected to embed ESG principles into its core operations, from investment portfolio allocation to underwriting criteria and internal policies. This integration is crucial for maintaining investor confidence and securing capital. In 2024, many institutional investors are prioritizing ESG integration, with a growing number of asset managers linking executive compensation to ESG targets.

Failure to adequately address ESG expectations can have material consequences for AmTrust, potentially impacting its ability to attract capital, its standing with stakeholders, and its overall brand reputation. A 2025 survey indicated that over 60% of investors would divest from companies with poor ESG scores, highlighting the financial implications of neglecting these factors.

AmTrust Financial Services, like many global companies, faces environmental pressures related to resource scarcity and the need for operational efficiency. This includes managing energy consumption, waste generation, and the use of raw materials across its worldwide offices. For instance, in 2024, many financial institutions are investing in digital transformation to reduce paper usage, a trend AmTrust is likely participating in to streamline operations.

By focusing on reducing its energy footprint and adopting paperless workflows, AmTrust can achieve tangible cost savings. These initiatives not only contribute to environmental sustainability but also bolster the company's reputation as a responsible corporate citizen. For example, a 10% reduction in office energy consumption could translate to millions in annual savings for a company of AmTrust's scale.

Environmental Liability Insurance Demand

The increasing stringency of environmental regulations globally, coupled with a heightened focus on corporate responsibility for pollution, is significantly boosting the demand for environmental liability insurance. This trend presents a prime opportunity for AmTrust Financial Services, given its specialization in niche insurance markets, to broaden its product portfolio in this rapidly growing sector. For instance, the global environmental insurance market was valued at approximately USD 9.5 billion in 2023 and is projected to reach USD 15.2 billion by 2030, exhibiting a compound annual growth rate of 7.0%.

Effectively assessing and underwriting these intricate environmental risks necessitates a deep reservoir of specialized expertise and a forward-thinking strategy attuned to evolving market demands. AmTrust can leverage its existing underwriting capabilities to develop tailored solutions for businesses facing environmental exposures, such as those in manufacturing, construction, and energy sectors.

- Growing Market Size: The global environmental insurance market is expanding, with projections indicating continued robust growth through 2030.

- Regulatory Drivers: Stricter environmental laws and increased corporate accountability are key factors driving demand for these specialized policies.

- Specialty Insurance Opportunity: AmTrust's focus on specialty coverages positions it well to capitalize on the demand for environmental liability insurance.

- Expertise Requirement: Successful underwriting in this area requires specialized knowledge of environmental risks and regulatory landscapes.

Sustainability Initiatives and Corporate Responsibility

AmTrust Financial Services' dedication to sustainability and corporate responsibility is a growing factor in its market positioning. By investing in eco-friendly technologies and promoting sustainable supply chains, AmTrust aims to bolster its brand reputation and attract a wider range of clients, particularly those prioritizing environmental impact. This commitment can also be a draw for talent seeking to work for socially conscious organizations.

For instance, many financial institutions are increasingly reporting on their Environmental, Social, and Governance (ESG) performance. AmTrust's engagement in these areas can lead to enhanced stakeholder trust and potentially better access to capital from ESG-focused investors. This focus on long-term value creation beyond immediate profits is becoming a key differentiator in the financial services sector.

- Brand Enhancement: Demonstrating commitment to sustainability can improve AmTrust's public image and appeal to environmentally aware consumers and businesses.

- Talent Acquisition: A strong corporate responsibility record can attract and retain employees who value working for ethical and sustainable companies.

- Client Base Expansion: Appealing to clients who prioritize ESG factors can broaden AmTrust's market reach and customer loyalty.

- Stakeholder Value: Investing in green initiatives and responsible practices can foster long-term relationships with stakeholders, contributing to sustained financial performance.

The increasing frequency of natural disasters directly impacts AmTrust's property and casualty insurance, leading to higher claims and underwriting volatility. With 28 billion-dollar weather events in the U.S. in 2023 causing over $92.9 billion in damages, AmTrust must adapt its models and pricing.

Growing investor and regulatory focus on ESG means AmTrust must demonstrate strong environmental stewardship. Global sustainable investment assets reached $37.7 trillion by the end of 2023, highlighting the financial importance of ESG alignment for capital access.

AmTrust can capitalize on the expanding environmental liability insurance market, projected to grow from $9.5 billion in 2023 to $15.2 billion by 2030, by leveraging its specialty insurance expertise.

By embracing sustainability, AmTrust enhances its brand, attracts talent, and appeals to a growing client base that prioritizes environmental responsibility, fostering long-term stakeholder value.

| Environmental Factor | Impact on AmTrust | Supporting Data (2023-2025) |

|---|---|---|

| Climate Change & Natural Disasters | Increased claims, underwriting risk | 28 U.S. billion-dollar disasters in 2023 ($92.9B damages) |

| ESG Scrutiny | Need for transparency, capital access | $37.7T global sustainable investment assets (end of 2023) |

| Environmental Regulations & Liability | Opportunity for specialty insurance | Global environmental insurance market: $9.5B (2023) to $15.2B (2030) |

| Sustainability & Corporate Responsibility | Brand enhancement, talent acquisition | Growing investor preference for ESG-aligned companies (2024-2025 trend) |

PESTLE Analysis Data Sources

Our PESTLE analysis for AmTrust Financial Services is built on a robust foundation of data from reputable financial news outlets, government regulatory filings, and industry-specific market research reports. We meticulously gather insights on political stability, economic indicators, technological advancements, and legal frameworks relevant to the insurance sector.