AmTrust Financial Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AmTrust Financial Services Bundle

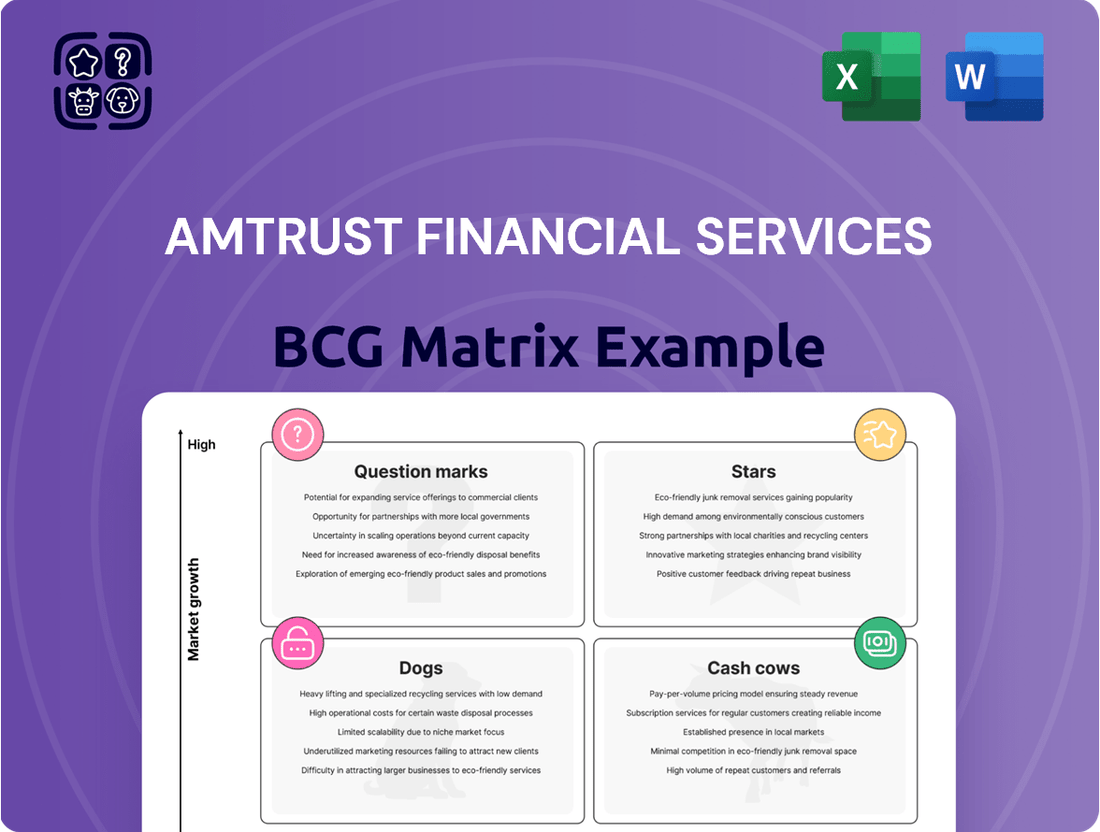

AmTrust Financial Services' BCG Matrix offers a strategic lens into its diverse product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements is crucial for informed resource allocation and future growth.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for AmTrust.

Stars

AmTrust Financial Services stands out as a major global player in extended warranties and specialty risk, a segment that's showing robust growth. The US extended warranty market, for instance, is projected to expand by a significant USD 5.84 billion between 2023 and 2028, indicating a strong upward trend.

This substantial market expansion, coupled with AmTrust's deep-rooted expertise and established reputation as a leading underwriter of service contracts and protection products, firmly places this business unit within the Stars category of the BCG Matrix. Their long-standing specialization in this area is a key differentiator.

AmTrust's Excess & Surplus (E&S) insurance division is a significant player, fueled by strategic technology investments. The company's partnership with TCS to integrate AI and automation has dramatically improved underwriting efficiency, shrinking response times for E&S policies from days to mere hours.

This digital transformation is a key driver for AmTrust's E&S business, directly contributing to a surge in quote submission volumes. In 2023, the E&S market saw robust growth, with premium volume exceeding $60 billion, underscoring the increasing demand for specialized coverage that AmTrust is well-positioned to meet.

AmTrust Financial Services is making significant strides in technology, particularly in underwriting and customer experience. The company is actively investing in AI and automation to streamline operations, such as revamping its E&S (Excess and Surplus) clearance process. This commitment to innovation is not going unnoticed; AmTrust received a Celent Model Insurer award for Digital Customer Experience and a 5-Star Claims Excellence Award in 2025, highlighting their success in creating efficient and engaging digital solutions for brokers and customers.

AmTrust International's Core Growth Products

AmTrust International's core growth products are thriving, with significant expansion noted in 2023 and continuing into 2024. The company's strategic focus on specialized international markets is yielding strong results across its key offerings.

These product lines are positioned as Stars within AmTrust Financial Services' BCG Matrix due to their high market share and robust growth potential. The company's commitment to expanding its global reach and distribution networks further solidifies their status.

- Warranty: Experiencing consistent growth, bolstered by an expanding international customer base and partnerships.

- Legal Expenses: Demonstrating strong uptake in key European markets, driven by increasing demand for accessible legal protection.

- Medical Malpractice: AmTrust International has seen a notable increase in this segment, particularly in markets with evolving healthcare regulations.

- Professional Lines: This category, including cyber and management liability, is a significant contributor to growth, reflecting heightened business risk awareness.

Cyber Insurance Offerings

Cyber insurance is a standout offering for AmTrust Financial Services, fitting perfectly into their small commercial business strategy and the new AmTrustONE quoting platform. This product directly addresses the growing need for digital protection as businesses increasingly rely on technology, a trend that has only accelerated. The market for cyber insurance is booming, with projections indicating continued strong growth through 2024 and beyond, making it a prime candidate for AmTrust’s Star quadrant in the BCG matrix.

The demand for cyber insurance is driven by a significant increase in cyber threats. For instance, the average cost of a data breach reached $4.45 million in 2024, a 15% increase over two years, according to IBM's Cost of a Data Breach Report. This escalating risk landscape makes cyber insurance a crucial investment for small and medium-sized businesses, a segment AmTrust actively serves. As AmTrust enhances its market reach with products like this, its position as a Star solidifies.

- Rapidly Expanding Market: The global cyber insurance market is projected to grow significantly, with some estimates suggesting it could reach over $20 billion by 2025.

- Critical Need for Protection: Businesses face an ever-increasing volume and sophistication of cyberattacks, making robust cyber insurance essential.

- Product Integration: AmTrust's cyber insurance is a core component of its small commercial offerings and is integrated into the user-friendly AmTrustONE quoting experience, facilitating easier adoption.

- Growth Potential: The product's alignment with a high-growth market and AmTrust's strategic focus on expanding market penetration positions it as a Star performer.

AmTrust Financial Services' extended warranty business is a prime example of a Star in the BCG Matrix. This segment benefits from a growing market, with the US extended warranty market alone projected to add $5.84 billion in value between 2023 and 2028. AmTrust's established expertise and reputation as a leading underwriter of service contracts and protection products solidify its high market share and strong growth potential in this area.

The company's Excess & Surplus (E&S) insurance division also demonstrates Star characteristics, driven by significant technology investments. By integrating AI and automation, AmTrust has drastically improved underwriting efficiency, reducing response times for E&S policies to hours from days. This digital transformation has fueled a surge in quote submissions, aligning with the robust growth seen in the E&S market, which exceeded $60 billion in premium volume in 2023.

AmTrust International's core growth products, including Legal Expenses, Medical Malpractice, and Professional Lines, are performing exceptionally well. These segments are experiencing strong uptake in key European markets and notable increases in specific segments like medical malpractice, driven by evolving healthcare regulations and heightened business risk awareness. This strategic focus on specialized international markets yields strong results across key offerings, positioning them as Stars.

Cyber insurance is another clear Star for AmTrust, fitting seamlessly into their small commercial strategy and the AmTrustONE quoting platform. With cyber threats escalating, evidenced by the average cost of a data breach reaching $4.45 million in 2024, businesses increasingly need robust digital protection. The global cyber insurance market is expanding rapidly, projected to exceed $20 billion by 2025, making AmTrust's integrated cyber product a significant growth driver.

| Business Segment | Market Growth | AmTrust Market Share | BCG Classification |

|---|---|---|---|

| Extended Warranties | High (US market projected +$5.84B by 2028) | High (Leading underwriter) | Star |

| Excess & Surplus (E&S) | High (2023 premium volume >$60B) | High (Driven by tech efficiency) | Star |

| International Growth Products (Legal, Med Mal, Prof Lines) | High (Strong uptake in key markets) | High (Strategic focus on specialization) | Star |

| Cyber Insurance | Very High (Market projected >$20B by 2025) | High (Integrated into core offerings) | Star |

What is included in the product

AmTrust's BCG Matrix reveals a portfolio with established Cash Cows and emerging Stars, alongside Question Marks needing strategic evaluation and potential Dogs for divestment.

A clear AmTrust Financial Services BCG Matrix provides a visual roadmap, relieving the pain of strategic uncertainty by highlighting growth opportunities and areas needing divestment.

Cash Cows

AmTrust Financial Services' Workers' Compensation Insurance is a quintessential Cash Cow. As of 2024, AmTrust holds the 3rd largest market share in the U.S. for workers' compensation, commanding a substantial 5.87% of the market. This robust position in a mature industry allows for consistent cash generation.

Despite a slight dip in overall direct premiums written for the workers' compensation sector between 2023 and 2024, AmTrust's ability to implement rate increases demonstrates its pricing power. This strategic advantage ensures continued profitability and strong cash flow from this established business line, reinforcing its Cash Cow status.

AmTrust's Small Commercial Business Owner's Policy (BOP) is a strong Cash Cow. This policy is a foundational product for AmTrust, serving over 500,000 small to mid-sized businesses nationwide.

The BOP generates consistent and profitable revenue due to its widespread acceptance in a mature market segment. AmTrust benefits from high profit margins on this product, as it requires minimal additional investment to maintain its market share.

General liability insurance is a cornerstone for AmTrust Financial Services, acting as a reliable Cash Cow within their business portfolio. This coverage is a staple for countless small businesses, ensuring consistent premium generation.

In 2024, the small commercial insurance market, where general liability plays a significant role, continued to show resilience. AmTrust's established market share in this segment means they benefit from steady, predictable revenue streams, even if growth is modest.

Established Commercial Package Policies

AmTrust Financial Services' established commercial package policies are a prime example of a Cash Cow within their Business Growth Matrix. These policies are designed to offer a comprehensive suite of insurance coverages, bundled together for the convenience of small and medium-sized businesses.

These offerings have a long history and represent a substantial, stable portion of AmTrust's business. They generate consistent and predictable revenue, bolstering the company's financial stability. Importantly, these mature products require minimal new investment to maintain their market position and revenue generation.

For instance, AmTrust reported gross written premiums of $14.8 billion in 2023, with a significant portion attributed to its commercial lines, including these package policies. The predictable nature of these established policies allows AmTrust to allocate capital to other areas of the business, such as investing in new technologies or expanding into emerging markets.

- Stable Revenue: Commercial package policies provide a consistent and predictable income stream for AmTrust.

- Low Investment Needs: These established products require minimal capital infusion for growth or maintenance.

- Market Maturity: They cater to a well-defined and stable market segment of small to mid-sized businesses.

- Financial Strength: Their consistent profitability contributes significantly to AmTrust's overall financial health and capacity for investment elsewhere.

Profitable Underwriting Practices

AmTrust Financial Services showcases robust underwriting profitability, a key characteristic of a Cash Cow. In 2024, the company reported a combined ratio of 96.7%, indicating that for every dollar of premium earned, less than a dollar was paid out in claims and expenses. This strong performance is further supported by $8.8 billion in gross written premium for the same year.

This disciplined approach to underwriting across AmTrust's established product lines consistently generates substantial profit margins. These healthy margins translate into reliable and significant cash flow. This consistent cash generation is vital, providing the financial flexibility needed to support other areas of the business, such as investments in growth or innovation, while simultaneously ensuring the company's overall financial health.

- Strong Combined Ratio: AmTrust's 2024 combined ratio of 96.7% highlights efficient claims and expense management.

- Significant Premium Volume: Gross written premium reached $8.8 billion in 2024, demonstrating market presence and trust.

- Consistent Profitability: Mature product lines yield high profit margins, a hallmark of a Cash Cow.

- Cash Flow Generation: Robust underwriting profits provide ample cash to fund strategic initiatives and maintain stability.

AmTrust's consistent underwriting profitability, evidenced by a 96.7% combined ratio in 2024, solidifies its Cash Cow status. This efficiency, coupled with $8.8 billion in gross written premiums for the year, showcases strong profit margins across its established product lines. These healthy margins translate into reliable cash flow, fueling strategic investments and overall financial stability.

| Business Segment | BCG Category | 2024 Data Point | Significance |

|---|---|---|---|

| Workers' Compensation | Cash Cow | 3rd largest market share (5.87%) in U.S. | Consistent cash generation in a mature market. |

| Small Commercial BOP | Cash Cow | Serves over 500,000 businesses | High profit margins with minimal investment. |

| General Liability | Cash Cow | Resilient small commercial market | Steady, predictable revenue streams. |

| Commercial Package Policies | Cash Cow | Part of $14.8 billion gross written premiums (2023) | Stable revenue, low investment needs, market maturity. |

| Underwriting Profitability | Cash Cow Characteristic | 96.7% combined ratio, $8.8 billion GWP (2024) | Strong profit margins, reliable cash flow. |

Preview = Final Product

AmTrust Financial Services BCG Matrix

The AmTrust Financial Services BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, offers a clear strategic overview of AmTrust's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. You can confidently use this preview as an accurate representation of the high-quality, actionable insights contained within the final downloadable report, ready for immediate integration into your strategic planning processes.

Dogs

AmTrust Financial Services, like many established insurers, likely manages legacy insurance programs that are showing signs of underperformance. These older or niche offerings may struggle to compete in today's dynamic market, exhibiting low growth and a reduced market share. For instance, in 2024, the insurance industry saw increased competition in specialized lines, potentially impacting older, less adaptable programs.

Such underperforming programs often require substantial administrative resources but yield minimal returns, presenting a drain on profitability. The cost of maintaining these lines, coupled with their inability to capture significant market share, makes them prime candidates for strategic review. Consider that administrative expenses in the insurance sector can represent a significant portion of premiums, especially for less efficient legacy systems.

These situations often lead companies like AmTrust to consider divestiture or a run-off strategy. Divesting allows the company to shed these underperforming assets, freeing up capital and management focus for more promising ventures. A run-off approach, on the other hand, involves managing the existing policies to their natural conclusion without actively seeking new business, thereby minimizing ongoing costs.

AmTrust Financial Services might identify certain niche commercial insurance products in highly saturated regions, like specialized liability coverage in the aging manufacturing sector of the Midwest, as falling into this category. These segments, despite past marketing efforts, may continue to exhibit low market share, potentially hovering around break-even profitability.

AmTrust Financial Services likely categorizes its non-strategic run-off business as Dogs within the BCG Matrix. These are segments, like the run-off block mentioned by AmTrust Specialty Limited, that are no longer actively pursued for growth. They represent areas with low market share and minimal future potential, managed primarily for a controlled wind-down or to minimize further investment.

Inefficient Manual Processes Not Yet Digitalized

While AmTrust Financial Services is making significant strides in technology adoption, pockets of manual processes that haven't yet undergone digitalization represent a potential drag on efficiency and profitability. These areas, often characterized by paper-based workflows or legacy systems, can lead to higher operational costs and slower turnaround times compared to their digitally optimized counterparts.

In a rapidly evolving insurance landscape, such inefficiencies can hinder scalability and competitiveness. For instance, a 2024 industry report indicated that companies with a high degree of manual underwriting processes experienced an average of 15% higher administrative costs per policy compared to those with automated systems. This directly impacts AmTrust's ability to compete on price and service delivery.

- High Operational Costs: Manual processes often require more human intervention, increasing labor expenses and the potential for errors.

- Limited Scalability: Inefficient workflows struggle to keep pace with growing business volumes, impacting growth potential.

- Competitive Disadvantage: Peers leveraging digital solutions can offer faster service and potentially lower premiums.

- Risk of Errors: Manual data handling increases the likelihood of mistakes, leading to compliance issues or customer dissatisfaction.

Outdated IT Infrastructure in Acquired Entities

AmTrust Financial Services might face challenges integrating IT infrastructure from acquired entities. Outdated systems can be costly to maintain and may not align with AmTrust's existing technological framework, potentially hindering operational efficiency and future growth initiatives. This situation often places acquired entities in the question mark category of the BCG matrix, requiring careful strategic evaluation.

The integration of legacy IT systems can divert capital and human resources that could otherwise be invested in more profitable ventures or innovation. For instance, a significant portion of IT budgets in financial services companies is often allocated to maintaining these older systems, a trend that continued into 2024, with many firms reporting substantial spending on legacy modernization or replacement projects.

- Resource Drain: Maintaining and integrating disparate, outdated IT systems from acquired companies can consume significant financial and personnel resources.

- Efficiency Hindrance: Legacy infrastructure often lacks the speed, flexibility, and security of modern systems, impeding operational efficiency and innovation.

- Cost of Modernization: The expense associated with upgrading or replacing these outdated systems can be substantial, impacting profitability without a guaranteed return on investment.

- Strategic Mismatch: Incompatible IT architectures can create barriers to seamless data flow and system integration, potentially limiting the realization of acquisition synergies.

AmTrust Financial Services likely identifies certain legacy insurance products or niche segments with declining market relevance as Dogs. These are business lines characterized by low market share and low growth prospects, often requiring significant resources for maintenance without generating substantial returns. For example, specific types of commercial property insurance in regions experiencing economic downturns might fit this description.

These "Dog" segments, such as certain run-off blocks of business that are no longer actively marketed, demand resources for administration but offer minimal future growth potential. Companies like AmTrust manage these to minimize further investment and extract remaining value, a strategy consistent with BCG Matrix principles for low-performing units.

The presence of these Dogs necessitates careful strategic consideration, often leading to decisions about divestiture or managed run-off to reallocate capital and management attention to more promising areas of the business. This focus on optimizing the portfolio is crucial for sustained profitability.

In 2024, the financial services industry continued to see a trend of insurers divesting non-core or underperforming lines of business to streamline operations and enhance focus on growth areas. This strategic pruning is a common response to market pressures and the need for capital efficiency.

Question Marks

AmTrustONE, launched in 2024, represents AmTrust Financial Services' strategic move into the high-growth small business insurance sector, specifically targeting Business Owner's Policy (BOP), Workers' Compensation, and Cyber insurance. This platform is designed to revolutionize the quoting process, making it faster and simpler for agents. Its introduction positions AmTrust to capture a larger share of the small business market, a segment experiencing significant digital transformation and demand for efficient solutions.

As a Question Mark in the BCG matrix, AmTrustONE exhibits high potential but uncertain market adoption. While AmTrust Financial Services reported a 12% increase in gross written premiums for its small commercial segment in 2023, reaching $5.1 billion, the precise impact of AmTrustONE on this growth trajectory is still unfolding. The platform's success hinges on its ability to truly streamline agent workflows and deliver competitive quotes, which will ultimately determine its market penetration and contribution to AmTrust's overall market share.

AmTrust Financial Services signaled a strategic push in 2024, aiming to capture new market segments including renters, travel, events, and shipping insurance. These areas represent promising growth opportunities within the insurance landscape.

While these niches are expanding, AmTrust's initial market share is expected to be minimal. Substantial capital allocation will be necessary to elevate these ventures to Star status.

Without successful market penetration, these new initiatives could potentially stagnate as Dogs in AmTrust's portfolio, underscoring the critical need for effective execution and market adoption strategies.

AmTrust Title, AmTrust Financial Services' title insurance arm, is actively broadening its reach. In 2025, this expansion includes new leadership appointments and operational growth, particularly in Texas and the Southeast/Carolinas. This strategic push aims to capture a larger share of these regional markets.

While the title insurance sector is robust, AmTrust's market share in these expanding territories may still be modest compared to long-standing competitors. For instance, the U.S. title insurance market generated approximately $18.5 billion in premiums in 2023, according to industry reports, indicating significant revenue potential but also intense competition. Continued investment will be crucial for AmTrust to solidify its position and drive substantial growth in these newer areas.

Specialized New Product Launches (e.g., PropanePro™)

AmTrust Financial Services, in partnership with NIP Group, introduced PropanePro™ in July 2024. This specialized insurance product is designed for propane gas distributors, a segment that often requires tailored coverage. Such niche products are typical of a 'Question Mark' in the BCG matrix, indicating high growth potential within their specific markets but often starting with a relatively small market share.

The success of PropanePro™ will depend on AmTrust's ability to capture market share within the propane distribution industry. This requires strategic marketing and sales efforts to build awareness and trust among potential clients. The company will need to invest in understanding the unique risks and needs of propane distributors to effectively position and price this offering.

- Niche Market Focus: PropanePro™ targets a specific industry segment, aiming for high growth within that niche.

- Investment Requirement: As a 'Question Mark', it necessitates targeted investment to gain market traction and build share.

- Growth Potential: The product is positioned to capitalize on the growth opportunities within the propane distribution sector.

- Market Adoption Strategy: Success hinges on effective strategies to drive adoption and establish a strong market presence.

Advanced AI-Driven Product Development

AmTrust Financial Services is exploring entirely new insurance products and services, driven by advanced AI and data analytics, moving beyond mere process enhancements.

These ventures, while holding potential for significant market disruption, represent high-risk, high-reward initiatives demanding considerable investment for market penetration and share growth.

For instance, AmTrust might leverage AI to develop hyper-personalized cyber insurance policies, dynamically adjusting premiums based on real-time threat intelligence and a business's evolving digital footprint, a stark contrast to traditional static offerings.

- AI-powered predictive underwriting for niche commercial risks

- Development of usage-based insurance products leveraging IoT data

- Creation of automated claims processing with AI-driven fraud detection

- Personalized insurance bundles based on individual customer behavior analytics

AmTrust Financial Services' new ventures, such as AmTrustONE and PropanePro™, are positioned as Question Marks in the BCG matrix. These initiatives target high-growth niche markets but require substantial investment to gain market share and achieve success. The company's expansion into new insurance segments like renters and travel insurance also falls into this category, with significant capital needed to move them towards Star status.

BCG Matrix Data Sources

Our AmTrust Financial Services BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.