American Woodmark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Woodmark Bundle

American Woodmark, a leader in cabinet manufacturing, leverages strong brand recognition and a broad distribution network as key strengths. However, the company faces potential headwinds from rising raw material costs and intense competition within the home furnishings sector.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American Woodmark boasts an extensive product portfolio, offering a diverse range of kitchen, bath, and home organization solutions. This breadth allows them to cater to a wide spectrum of customer tastes and budgets, from entry-level to premium segments. For the fiscal year ending April 28, 2024, the company reported net sales of $2.2 billion, demonstrating the scale of their market reach.

The company's strategy of developing and marketing multiple brands, such as Timberlake, Shenandoah, and Cabinetry, further enhances its market penetration. This brand diversity enables American Woodmark to target different consumer demographics and preferences effectively, reducing the risk associated with over-reliance on a single product line or brand identity.

American Woodmark's strength lies in its diversified sales channels, encompassing home centers, independent dealers, and direct sales to builders. This multi-channel strategy offers significant resilience, buffering the company against downturns in any single sales avenue and broadening its overall market penetration.

This approach allows American Woodmark to cater effectively to both the do-it-yourself remodeling market through home centers and the new home construction sector via direct builder relationships. For the fiscal year ending January 28, 2024, approximately 48% of American Woodmark's net sales were generated through its direct-to-builder channel, highlighting the importance of this segment.

American Woodmark's strategic positioning across both the remodeling and new construction sectors offers a significant advantage. This dual market approach, which saw the company actively participating in both segments throughout 2024 and into early 2025, provides a robust and diversified revenue base. Such a balanced presence helps to insulate the company from the volatility inherent in either market alone, fostering greater financial stability and consistent growth potential across various economic conditions.

Established Market Leadership and Brand Recognition

American Woodmark's position as a leading manufacturer in the cabinetry sector translates into significant brand recognition and an established market reputation. This inherent trust fosters customer loyalty and repeat business, providing a distinct competitive edge in acquiring new clientele. The company's extensive history and varied portfolio of brands reinforce its authority within the industry.

For instance, as of its fiscal year ending April 28, 2024, American Woodmark reported net sales of $2.1 billion. This scale of operation underscores its market leadership. The company operates through several well-recognized brands, including American Woodmark, Timberlake Cabinetry, and Kitchenview, each catering to different market segments and consumer preferences. This multi-brand strategy is a key component of its market strength.

- Market Dominance: American Woodmark is a top-tier player in the North American cabinetry market, benefiting from economies of scale and established distribution networks.

- Brand Equity: The company's portfolio of brands, including Timberlake and American Woodmark, enjoys high consumer awareness and trust, facilitating sales and market penetration.

- Customer Loyalty: A strong brand reputation cultivated over years of operation leads to a loyal customer base, ensuring consistent demand and reduced customer acquisition costs.

- Industry Influence: Its leadership position allows American Woodmark to influence industry trends and standards, further solidifying its competitive standing.

Operational Scale and Manufacturing Capabilities

American Woodmark's operational scale and robust manufacturing capabilities are significant strengths, positioning it as a leader in the industry. This extensive infrastructure enables efficient production processes and the realization of economies of scale, which are vital for cost competitiveness. In fiscal year 2023, the company operated 17 manufacturing facilities across the United States, underscoring its substantial production capacity. This allows American Woodmark to effectively manage large-volume orders and maintain a consistent supply chain, crucial for meeting diverse customer demands in the competitive cabinetry market.

These capabilities translate into tangible benefits:

- Economies of Scale: Large-scale manufacturing allows for reduced per-unit production costs.

- Production Efficiency: Streamlined operations and advanced manufacturing techniques enhance output.

- Market Responsiveness: The ability to scale production helps meet fluctuating market demand and large orders.

- Cost Management: Efficient operations contribute to better cost control and pricing strategies.

American Woodmark's extensive product line, covering kitchen, bath, and home organization, allows it to serve a broad customer base across various price points. Its multi-brand strategy, featuring names like Timberlake and Shenandoah, further enhances market reach by targeting diverse consumer segments effectively. The company's robust sales channels, including home centers and direct builder relationships, provide significant market penetration and revenue diversification.

The company's dual focus on both the remodeling and new construction markets provides a stable revenue stream, mitigating risks associated with reliance on a single sector. For fiscal year 2024, the direct-to-builder channel accounted for approximately 48% of net sales, demonstrating its importance. American Woodmark's established brand reputation and market leadership foster customer loyalty, contributing to consistent demand and a competitive advantage.

American Woodmark's substantial manufacturing capacity, with 17 facilities operating in fiscal year 2023, enables economies of scale and efficient production. This operational strength supports cost competitiveness and the ability to meet large order volumes, reinforcing its position as an industry leader.

| Key Strength | Description | Supporting Data (FY2024 unless noted) |

| Diverse Product Portfolio | Offers a wide range of cabinetry and home organization solutions catering to various customer needs and budgets. | Net sales of $2.2 billion. |

| Multi-Brand Strategy | Markets multiple brands (e.g., Timberlake, Shenandoah) to target different consumer demographics and preferences. | Facilitates broad market penetration. |

| Diversified Sales Channels | Utilizes home centers, independent dealers, and direct builder sales for broad market access and resilience. | Direct-to-builder channel represented ~48% of net sales. |

| Dual Market Focus | Serves both remodeling and new construction sectors, providing revenue stability. | Active participation in both segments throughout 2024. |

| Brand Recognition & Loyalty | Strong market reputation and established brands foster customer trust and repeat business. | Operates recognized brands like American Woodmark and Timberlake. |

| Operational Scale & Efficiency | Large manufacturing footprint enables economies of scale and cost competitiveness. | Operated 17 manufacturing facilities in FY2023. |

What is included in the product

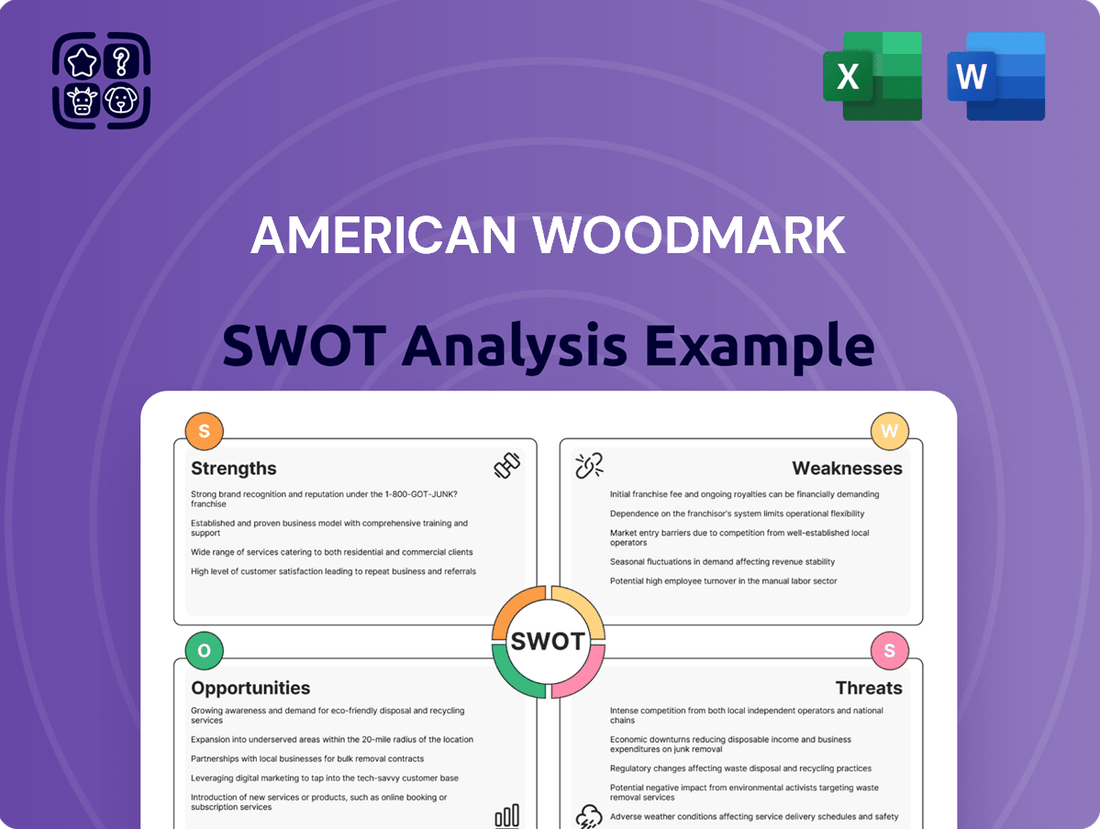

This SWOT analysis outlines American Woodmark’s internal strengths and weaknesses, alongside external opportunities and threats, to provide a comprehensive view of its strategic business environment.

Offers a clear, actionable framework to identify and address American Woodmark's strategic challenges and leverage its competitive advantages.

Weaknesses

American Woodmark's reliance on the housing sector makes it susceptible to market downturns. For instance, if new home construction slows due to factors like rising interest rates, demand for Woodmark's cabinetry and other products naturally decreases. This cyclicality can lead to volatile revenue streams.

In 2023, the U.S. housing market experienced a slowdown, with new housing starts declining compared to previous years. This trend directly impacts companies like American Woodmark, as fewer new homes being built translates to fewer opportunities for product sales. The company's performance is therefore closely tied to the broader economic conditions affecting housing affordability and construction activity.

American Woodmark's profitability is vulnerable to the unpredictable swings in the cost of essential raw materials like wood, composite materials, and hardware. For instance, lumber prices, a critical component, saw significant volatility in 2023 and early 2024, impacting manufacturers across the industry. These unpredictable increases in input costs can directly squeeze profit margins, especially if the company struggles to pass these higher expenses onto its customers through price adjustments.

American Woodmark operates in a crowded kitchen, bath, and home organization product market, facing a multitude of domestic and international competitors. This fierce rivalry often translates into significant pricing pressures, compelling the company to invest more heavily in marketing and sales efforts to stand out. Effectively differentiating its product offerings and services is paramount for American Woodmark to navigate this challenging landscape and sustain its market position.

Supply Chain Dependencies and Disruptions

American Woodmark's reliance on a complex supply chain for raw materials like lumber and manufactured components presents a significant weakness. Disruptions, whether from transportation issues, labor shortages impacting logistics, or even geopolitical events affecting global trade, can directly hinder production. For instance, a 2023 report highlighted that the construction materials sector experienced an average of 15% increase in shipping costs due to port congestion and driver scarcity, a factor that directly impacts companies like American Woodmark.

These supply chain vulnerabilities can lead to production delays, making it difficult to meet customer demand for cabinetry and other wood products. This inability to fulfill orders promptly can result in lost sales and damage customer relationships. In the competitive housing market, where timely delivery is crucial, such disruptions can significantly impact American Woodmark's market share and financial performance, as seen in past quarters where extended lead times were cited as a factor in revenue shortfalls.

- Logistical Challenges: Increased freight costs and delivery delays due to port congestion and driver shortages.

- Labor Shortages: Difficulty securing adequate staffing in manufacturing and distribution centers.

- Geopolitical Risks: Potential trade restrictions or tariffs impacting the import of key materials.

- Material Volatility: Fluctuations in lumber prices and availability can impact cost of goods sold.

Potential for Shifting Consumer Preferences and Design Trends

American Woodmark faces a significant challenge from the ever-changing landscape of consumer tastes in home design and cabinetry. This necessitates substantial and ongoing investment in product development and innovation to keep pace. For instance, the company's ability to quickly adapt to emerging styles or predict shifts in buyer preferences is crucial; otherwise, its product lines risk becoming dated. This dynamic environment demands continuous research and development, alongside thorough market analysis, to ensure continued relevance in a competitive market.

The company's reliance on anticipating and responding to these evolving trends presents a notable weakness. A failure to accurately forecast or react swiftly to new design aesthetics could result in a portfolio of products that no longer resonate with the target market. This could impact sales and market share, as demonstrated by the company's net sales for the fiscal year ending April 28, 2024, which were $2.2 billion. Staying ahead of these shifts requires dedicated resources for market intelligence and rapid product iteration.

- Evolving Consumer Tastes: Home design and cabinetry preferences are not static, requiring constant adaptation.

- Innovation Investment: Continuous R&D is essential to develop and launch new, relevant product lines.

- Risk of Obsolescence: Slow adaptation to trends can lead to outdated products, impacting competitiveness.

- Market Research Necessity: Ongoing market analysis is vital to understand and anticipate consumer shifts.

American Woodmark's dependence on the housing market makes it vulnerable to economic slowdowns, as seen in the 2023 decline in new housing starts, directly impacting demand for its products. Profitability is also threatened by volatile raw material costs, with lumber prices experiencing significant fluctuations in late 2023 and early 2024, squeezing profit margins. Intense competition in the home organization market necessitates high marketing spend and constant product differentiation to maintain market share.

What You See Is What You Get

American Woodmark SWOT Analysis

The preview you see is the actual American Woodmark SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at the company's strategic position. Unlock the full, in-depth analysis by completing your purchase.

Opportunities

The robust homeowner interest in home renovation and remodeling is a prime opportunity for American Woodmark. This trend, driven by aging housing stock and evolving lifestyle needs, directly fuels demand for cabinetry and organization solutions. In 2024, the U.S. home improvement market was projected to reach over $500 billion, indicating substantial potential for Woodmark's offerings.

American Woodmark can broaden its reach by venturing into adjacent home improvement areas like custom closets or integrated smart home technology, moving beyond its core cabinetry. This diversification could tap into growing consumer demand for cohesive living spaces.

Exploring new geographic territories or focusing on underserved market niches presents another avenue for growth. For instance, expanding into regions with strong new home construction or renovation trends could yield significant returns.

In 2024, the home renovation market, a key sector for American Woodmark, was projected to see continued growth, with spending expected to increase by approximately 5-7% year-over-year, according to industry forecasts. This trend supports the strategic rationale for expansion.

American Woodmark can capitalize on technological advancements in manufacturing and design to boost efficiency and cut costs. For instance, adopting automation and AI-driven design tools can lead to quicker product development cycles and more precise manufacturing, potentially reducing waste. In 2023, the company reported a net sales increase, indicating a positive market reception that could be further amplified by these innovations.

Implementing digital tools for customer engagement, such as augmented reality for visualizing cabinetry in a home setting, can significantly enhance the buying experience and streamline the sales process. This approach not only improves customer satisfaction but also reduces the need for physical showrooms and associated overheads. Such digital integration is becoming a key differentiator in the home furnishings market.

By embracing advanced materials and smart manufacturing techniques, American Woodmark can also enhance product durability and customization options. This focus on innovation allows the company to offer higher-value products and maintain a competitive edge in an evolving market landscape. The industry's trend towards personalized and sustainable solutions makes these technological investments crucial for future growth.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships present a significant opportunity for American Woodmark to accelerate growth and enhance its competitive edge. By acquiring smaller, innovative companies, American Woodmark can rapidly broaden its product offerings, integrate cutting-edge technologies, and penetrate new geographic markets. For instance, in 2024, the kitchen and bath cabinet industry continued to see consolidation, with companies like Masco Corporation, a competitor, making strategic tuck-in acquisitions to bolster their specialized product lines.

Forming alliances can also unlock substantial benefits. These collaborations can fortify distribution channels, leading to wider market reach and improved customer access. Furthermore, strategic partnerships can bolster market positioning by leveraging complementary strengths, such as shared R&D capabilities or co-branded marketing initiatives. This inorganic growth approach is crucial for gaining market share swiftly in a dynamic industry.

- Acquisition of innovative startups: Allows for rapid expansion of product lines and access to new technologies.

- Strategic partnerships: Can enhance distribution networks and strengthen overall market position.

- Inorganic growth: Accelerates market share gains and diversifies revenue streams.

Increasing Demand for Sustainable and Eco-Friendly Products

The increasing consumer focus on sustainability presents a significant opportunity for American Woodmark. As more buyers prioritize eco-friendly and responsibly sourced building materials, the company can leverage this trend for product differentiation. For instance, a growing number of consumers are actively seeking out products with environmental certifications, a segment that is projected to expand further in the coming years. This demand aligns perfectly with the company's potential to enhance its corporate social responsibility profile and capture a larger market share.

American Woodmark can capitalize on this by investing in sustainable sourcing practices and eco-friendly manufacturing processes. Offering products that meet recognized environmental standards, such as those from the Forest Stewardship Council (FSC), can directly appeal to this expanding consumer base. This strategic move not only meets current market demands but also positions the company for future growth in a sector increasingly driven by environmental consciousness. The global market for green building materials is expected to reach over $200 billion by 2025, indicating substantial growth potential.

- Growing Consumer Preference: A significant portion of consumers, particularly millennials and Gen Z, show a strong preference for sustainable products, influencing purchasing decisions in the home improvement sector.

- Market Differentiation: Eco-friendly product lines can set American Woodmark apart from competitors, attracting a dedicated customer segment willing to pay a premium for environmental attributes.

- Regulatory Tailwinds: Increasingly stringent environmental regulations in various regions may favor companies already invested in sustainable practices, creating a competitive advantage.

- Brand Reputation Enhancement: Demonstrating a commitment to sustainability can bolster American Woodmark's brand image, fostering customer loyalty and attracting environmentally conscious talent.

American Woodmark has a solid opportunity to expand its product portfolio by integrating smart home technology into its cabinetry solutions. This aligns with the growing consumer demand for connected living spaces, a trend projected to see continued adoption through 2025. Furthermore, the company can explore strategic acquisitions of smaller, innovative firms to quickly broaden its product offerings and gain access to new technologies, mirroring industry consolidation trends observed in 2024.

Threats

Economic downturns and recessions pose a significant threat to American Woodmark. A substantial economic slowdown, like the one experienced in 2008, directly impacts consumer confidence and discretionary spending. This means fewer people will be undertaking home renovations or purchasing new homes, which are key drivers for cabinet and flooring sales.

For instance, during the Great Recession, housing starts plummeted, directly affecting demand for building materials. While the economy has shown resilience, the Federal Reserve's interest rate hikes in 2022-2023 to combat inflation have increased recessionary risks. Should a recession materialize in 2024 or 2025, American Woodmark could see a sharp decline in sales volumes and profitability as consumers cut back on big-ticket home improvement projects.

The Federal Reserve's aggressive interest rate hikes throughout 2023 and continuing into 2024 have significantly increased mortgage costs. For instance, average 30-year fixed mortgage rates, which hovered around 3% in early 2022, have frequently surpassed 7% in 2023 and 2024, making homeownership less attainable for many.

This decline in housing affordability directly impacts the construction sector, leading to a slowdown in new home builds. According to the U.S. Census Bureau, housing starts saw a notable decrease in late 2023 and early 2024 compared to previous periods, signaling reduced demand for foundational building materials and finishes.

Furthermore, homeowners' ability to leverage home equity lines of credit (HELOCs) for renovations, a key driver for cabinetry demand, is diminished by higher interest rates. This dual pressure of fewer new homes and reduced renovation spending presents a significant threat to American Woodmark's sales volume.

American Woodmark faces significant pressure from low-cost manufacturers, including international competitors, who can offer cabinetry at more aggressive price points. This intensifies the challenge of maintaining market share without eroding profit margins through price reductions. For instance, in 2023, the overall cabinetry market saw continued import activity, particularly from Asia, impacting domestic producers' pricing power.

Disruptions in Global Supply Chains and Trade Policies

Geopolitical tensions and trade disputes can severely disrupt American Woodmark's supply chain, leading to increased costs and delivery delays. For instance, ongoing trade friction between major economies could result in higher tariffs on imported lumber or components, directly impacting manufacturing expenses. Natural disasters, such as extreme weather events affecting timber-producing regions, also pose a significant threat by limiting raw material availability.

Changes in trade policies, including new import restrictions or quotas, can force the company to seek alternative, potentially more expensive, sourcing options. This impacts operational efficiency and can lead to scarcity of critical materials needed for production. These external factors are largely outside of American Woodmark's direct control, making proactive risk mitigation crucial.

- Supply Chain Vulnerability: Events like the Suez Canal blockage in 2021, which halted global shipping for days, highlight the fragility of international logistics networks.

- Tariff Impact: The imposition of tariffs on steel, for example, has previously increased costs for manufacturers across various sectors, a risk applicable to wood product components.

- Natural Disaster Risk: Extreme weather events, such as wildfires in North America or hurricanes in the Gulf Coast, can disrupt timber harvesting and transportation, affecting raw material supply.

Shifts in Consumer Spending Habits and Housing Trends

Long-term shifts in consumer preferences, such as a move away from traditional homeownership or a preference for smaller living spaces that require less cabinetry, represent a significant threat. For instance, the increasing popularity of minimalist lifestyles could directly impact the volume of cabinetry demand.

Changes in housing trends, like a growing preference for multi-family units over single-family homes, could also disrupt demand patterns for American Woodmark's primary product offerings. In 2024, the U.S. Census Bureau reported a continued trend towards multi-family construction starts, which often feature different cabinetry needs compared to single-family dwellings.

Adapting to these overarching macro trends is crucial for American Woodmark's sustained success and market position. Failure to align product development and marketing with evolving consumer and housing market dynamics could lead to reduced market share.

The company faces intense competition from low-cost manufacturers, particularly international ones, impacting its pricing power and market share. Furthermore, supply chain disruptions, exacerbated by geopolitical tensions, trade disputes, and natural disasters, can lead to increased costs and material shortages. Shifts in consumer preferences, such as a move towards smaller living spaces or multi-family housing, also pose a threat by altering demand patterns for cabinetry.

The increasing cost of borrowing, with average 30-year fixed mortgage rates frequently exceeding 7% in 2023-2024, directly reduces housing affordability and new construction starts. This trend, coupled with diminished homeowner capacity for renovation financing via HELOCs, significantly curtails demand for American Woodmark's core products. For instance, housing starts saw a notable decrease in late 2023 and early 2024 compared to prior periods.

| Threat Category | Description | Impact on American Woodmark | Relevant Data/Examples |

|---|---|---|---|

| Economic Downturns | Recessions reduce consumer confidence and discretionary spending. | Decreased demand for new homes and renovations, impacting sales volume and profitability. | Federal Reserve interest rate hikes in 2022-2023 increased recessionary risks; housing starts declined late 2023/early 2024. |

| Competition | Pressure from low-cost domestic and international manufacturers. | Erosion of profit margins if forced to lower prices to maintain market share. | Continued import activity, especially from Asia, impacting domestic producers' pricing power in 2023. |

| Supply Chain Vulnerability | Disruptions from trade disputes, tariffs, and natural disasters. | Increased manufacturing costs, delivery delays, and raw material scarcity. | Tariffs on components can raise expenses; extreme weather can disrupt timber harvesting and transportation. |

| Shifting Consumer Preferences | Changes in housing trends and lifestyle choices. | Reduced demand for traditional cabinetry due to smaller living spaces or multi-family housing focus. | Growing popularity of minimalist lifestyles; trend towards multi-family construction starts reported in 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including American Woodmark's official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust and accurate strategic overview.