American Woodmark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Woodmark Bundle

Discover the strategic framework behind American Woodmark's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources. For those seeking to understand market leaders, this is an essential tool.

Partnerships

American Woodmark's relationship with home centers like Home Depot and Lowe's is a cornerstone of its business. These retailers are not just sales channels; they are strategic partners that facilitate the distribution of Woodmark's cabinetry and other products directly to consumers undertaking remodeling projects.

These alliances are vital, with fiscal year 2025 data indicating that these major home improvement retailers represented a substantial percentage of American Woodmark's overall net sales. This reliance highlights the importance of maintaining strong, collaborative ties with these industry giants to ensure continued market access and sales volume.

American Woodmark's key partnerships with builders and contractors are foundational to its business. The company directly collaborates with home builders, including a significant number of the top builders across the United States. This strategic alignment is particularly strong in regions experiencing high levels of new single-family home construction.

This builder channel is a critical revenue driver for American Woodmark, accounting for a substantial percentage of its total sales. For example, in fiscal year 2023, the company's new home segment, which heavily relies on these partnerships, generated approximately $1.1 billion in revenue, highlighting the importance of these relationships in their go-to-market strategy.

American Woodmark relies heavily on a robust network of independent dealers and distributors to get its products to market. This channel is crucial for reaching a broad customer base across the United States.

Through these partnerships, brands like Waypoint Living Spaces® and the newer 1951 Cabinetry™ find their way to consumers. In 2024, this distribution network remained a cornerstone of American Woodmark's sales strategy, facilitating significant market penetration.

Raw Material and Component Suppliers

American Woodmark’s ability to consistently deliver quality cabinetry hinges on robust relationships with its raw material and component suppliers. These partnerships are crucial for securing a steady flow of lumber, hardware, finishes, and other essential elements. By fostering strong ties, the company can better negotiate favorable pricing, ensuring cost management remains a priority. In 2023, American Woodmark reported its cost of goods sold was approximately $1.7 billion, underscoring the significant impact of supplier efficiency on its bottom line.

Maintaining these supplier relationships directly impacts operational excellence. Reliable suppliers mean fewer production delays and a more predictable manufacturing schedule. This stability is key to meeting customer demand efficiently. For instance, strong supplier partnerships can help mitigate the impact of supply chain disruptions, a challenge that many manufacturers faced in recent years. The company's commitment to supplier collaboration is a cornerstone of its strategy to maintain a competitive edge in the market.

Key aspects of these partnerships include:

- Ensuring consistent quality of incoming materials

- Negotiating competitive pricing for lumber and hardware

- Minimizing supply chain disruptions

- Collaborating on material innovation and sustainability

Logistics and Third-Party Logistics (3PL) Providers

American Woodmark relies heavily on its partnerships with logistics providers and a robust third-party logistics (3PL) network. These collaborations are critical for ensuring the efficient movement of cabinetry and countertops from their manufacturing plants to a wide array of customers throughout the United States.

This strategic approach to distribution allows American Woodmark to maintain what they refer to as a 'short supply chain'. This means products can reach their destinations quickly, minimizing transit times and associated costs. For instance, in 2024, the company continued to optimize its distribution routes, aiming to reduce delivery lead times and improve customer satisfaction, a key performance indicator in the home improvement sector.

The company's ability to meet demanding logistics criteria is directly supported by these partnerships. This includes timely deliveries, careful handling of goods, and the flexibility to adapt to fluctuating demand. Such capabilities are vital for a business operating in the competitive kitchen and bath industry, where customer expectations for product availability and delivery speed are consistently high.

- Distribution Network: Partnerships with national and regional carriers ensure broad U.S. coverage.

- Efficiency Gains: 3PL providers help manage warehousing, transportation, and last-mile delivery, reducing operational overhead.

- Customer Fulfillment: Meeting stringent delivery windows is paramount, with logistics partners playing a direct role in customer satisfaction.

- Supply Chain Agility: The network provides flexibility to scale operations up or down based on market demand and seasonal trends.

American Woodmark's key partnerships extend to a broad network of independent dealers and distributors, crucial for market reach. These alliances ensure brands like Waypoint Living Spaces and 1951 Cabinetry are accessible to a wide customer base across the United States. This distribution network remained a cornerstone of their sales strategy in 2024, facilitating significant market penetration.

The company also emphasizes strong relationships with raw material and component suppliers, vital for securing lumber, hardware, and finishes. These partnerships are essential for cost management and operational stability. In 2023, American Woodmark's cost of goods sold was approximately $1.7 billion, underscoring the impact of supplier efficiency.

Furthermore, robust partnerships with logistics providers and a third-party logistics (3PL) network are critical for efficient product movement. This optimizes their distribution, enabling a 'short supply chain' and quick delivery. In 2024, American Woodmark continued to refine distribution routes to reduce lead times and enhance customer satisfaction.

| Partner Type | Significance | 2024/2023 Data/Impact |

|---|---|---|

| Home Centers (e.g., Home Depot, Lowe's) | Primary sales channel, direct consumer access | Substantial percentage of net sales in FY25 |

| Builders & Contractors | Key revenue driver for new home segment | New home segment generated ~$1.1 billion in FY23 |

| Dealers & Distributors | Broad market penetration and brand accessibility | Cornerstone of sales strategy for market reach |

| Suppliers (Raw Materials/Components) | Ensures quality, cost management, operational stability | Cost of Goods Sold was ~$1.7 billion in 2023 |

| Logistics Providers (3PL) | Efficient product movement, short supply chain | Optimized delivery routes in 2024 for customer satisfaction |

What is included in the product

A strategic overview of American Woodmark's business model, detailing its focus on providing customized cabinetry solutions to diverse customer segments, primarily through wholesale channels.

This model highlights key partnerships with dealers and builders, supported by efficient manufacturing and distribution to deliver value through quality products and customer service.

American Woodmark's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operations, allowing for swift identification of inefficiencies and opportunities for improvement.

By condensing complex strategic elements into a single, digestible page, the Business Model Canvas helps American Woodmark alleviate the pain of information overload and facilitates focused problem-solving.

Activities

American Woodmark's manufacturing and production activities are central to its business, encompassing the design, creation, and assembly of cabinetry for kitchens, bathrooms, and home organization. This core function involves transforming raw materials into finished goods for their diverse product lines.

The company strategically operates a network of manufacturing facilities, with a significant presence in the United States and Mexico. This extensive footprint allows them to efficiently produce a broad spectrum of cabinetry, from readily available stock options to more customized semi-custom solutions, catering to varied customer needs and market demands.

American Woodmark's product design and development is a core activity, focused on creating new cabinet styles, finishes, and entire product lines. This constant innovation is crucial for keeping pace with changing consumer tastes and market demands. For instance, the company launched the 1951 Cabinetry™ brand, showcasing a variety of new designs.

American Woodmark manages its sales and distribution by overseeing a multi-channel approach. This includes direct sales to home builders, working with independent dealers, and supplying large home improvement retailers. In 2024, the company continued to leverage these diverse channels to reach a broad customer base.

Efficiently managing the company's extensive distribution network is a core activity. This ensures that cabinetry and related products are delivered to customers, whether they are large construction firms or individual homeowners, in a timely and cost-effective manner.

Supply Chain Management

American Woodmark's supply chain management focuses on the efficient flow from raw material procurement to final product delivery. This involves careful oversight of inventory levels and logistics to ensure timely fulfillment and cost-effectiveness. In 2024, the company continued to emphasize strong supplier relationships to secure consistent access to lumber and other essential components.

Key activities include:

- Sourcing and Procurement: Securing high-quality raw materials like lumber and hardware from reliable suppliers, managing supplier contracts and performance.

- Inventory Management: Optimizing stock levels of raw materials, work-in-progress, and finished goods to balance availability with carrying costs.

- Logistics and Distribution: Efficiently managing transportation of raw materials to manufacturing facilities and finished goods to distribution centers and customers, including fleet management and carrier negotiations.

- Supplier Relationship Management: Building and maintaining strong partnerships with key suppliers to ensure consistent supply, quality, and competitive pricing.

Digital Transformation and Operational Excellence Initiatives

American Woodmark is driving digital transformation by integrating cloud-based ERP and CRM systems. This initiative aims to streamline operations, boost data-driven decision-making, and foster stronger customer relationships, ultimately enhancing efficiency across the organization.

The company's commitment extends to continuous operational excellence. This involves actively seeking and implementing improvements to reduce complexity within its processes, leading to greater agility and cost-effectiveness.

- Digital Transformation: Implementation of cloud ERP and CRM solutions is a core activity.

- Operational Excellence: Focus on continuous improvement and complexity reduction.

- Efficiency Gains: Aiming to enhance operational efficiency and decision-making capabilities.

- Customer Focus: Strengthening customer loyalty through improved systems and processes.

American Woodmark's key activities revolve around its extensive manufacturing and production capabilities, transforming raw materials into a wide array of cabinetry solutions. The company also places a strong emphasis on product design and development to stay ahead of market trends. Furthermore, managing a multi-channel sales and distribution network is critical for reaching diverse customer segments, from home builders to retail consumers.

The company's operational focus includes digital transformation through integrated ERP and CRM systems, alongside a commitment to continuous operational excellence and complexity reduction. This strategic approach aims to enhance efficiency, improve decision-making, and ultimately strengthen customer relationships.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing & Production | Design, creation, and assembly of cabinetry. | Operates numerous manufacturing facilities across North America. |

| Product Design & Development | Creating new cabinet styles, finishes, and product lines. | Launched new designs and brands like 1951 Cabinetry™. |

| Sales & Distribution | Multi-channel sales to builders, dealers, and retailers. | Leveraged diverse channels to reach a broad customer base. |

| Supply Chain Management | Procurement of raw materials and logistics. | Emphasized strong supplier relationships for consistent access to lumber. |

| Digital Transformation | Implementing cloud-based ERP and CRM systems. | Streamlining operations and enhancing data-driven decision-making. |

Full Document Unlocks After Purchase

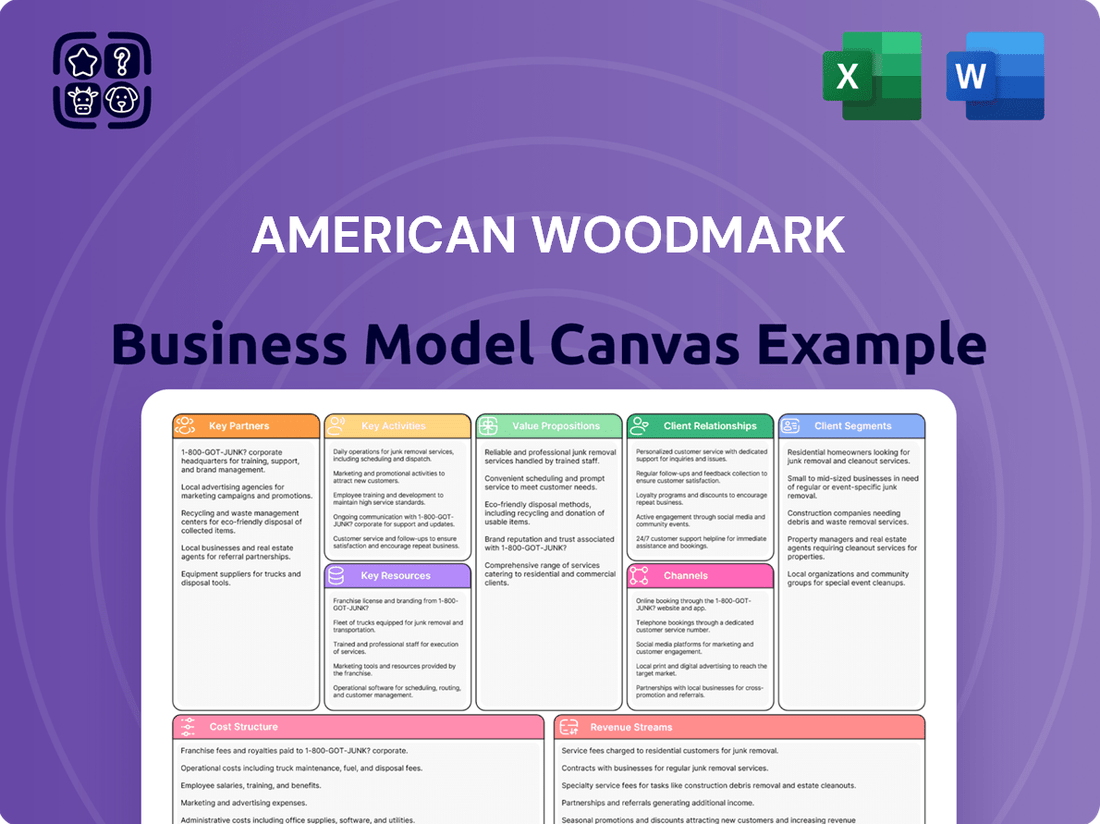

Business Model Canvas

The preview you are seeing is an authentic representation of the American Woodmark Business Model Canvas you will receive. This is not a sample or a mockup; it is a direct snapshot from the actual, complete document that will be yours upon purchase. You can be assured that the structure, content, and formatting are precisely what you will download, ready for immediate use.

Resources

American Woodmark operates a robust network of manufacturing facilities, strategically positioned throughout the United States and Mexico. This extensive footprint allows for efficient production and distribution across key markets. In 2023, the company reported having 16 manufacturing facilities.

The company's investment in modern machinery and equipment is crucial for its large-scale cabinetry production. This includes advanced woodworking tools and automated systems designed to enhance efficiency and product quality. These assets are central to maintaining their competitive edge in the industry.

These facilities and the associated equipment are fundamental to American Woodmark's ability to meet high production volumes. Their strategic location and operational capacity directly contribute to cost efficiencies, enabling them to offer competitive pricing and manage supply chain complexities effectively. This infrastructure supports their business model by ensuring timely delivery and consistent product output.

American Woodmark's brand portfolio, including American Woodmark, Timberlake, Shenandoah Cabinetry, Waypoint Living Spaces®, and 1951 Cabinetry™, represents significant intellectual property. These established brands allow the company to target diverse market segments and price points, thereby broadening its market reach and appeal.

American Woodmark's foundation rests on its extensive workforce of over 8,600 individuals. This team includes a substantial base of skilled manufacturing labor, crucial for producing their cabinetry.

The company also benefits from an experienced management team. Their collective expertise in the cabinetry and home improvement sectors is invaluable for guiding strategic decisions and ensuring smooth daily operations.

Distribution Network and Logistics Infrastructure

American Woodmark's distribution network is a cornerstone of its business model, enabling efficient product delivery across the United States. This extensive infrastructure includes numerous distribution centers and service centers, complemented by strategic partnerships with third-party logistics providers. This robust system ensures timely and cost-effective delivery to a diverse customer base, encompassing major home centers, builders, and independent dealers.

The company's logistical capabilities are vital for maintaining its competitive edge. By optimizing its supply chain, American Woodmark can meet the demands of various market segments, from large-scale construction projects to individual homeowner renovations. This operational efficiency directly impacts customer satisfaction and the company's ability to manage inventory effectively.

- Extensive Network: Operates a widespread network of distribution and service centers across the US.

- Third-Party Partnerships: Leverages relationships with third-party logistics providers to enhance reach and efficiency.

- Customer Reach: Facilitates product delivery to key channels including home centers, builders, and independent dealers.

- Operational Efficiency: Supports the company's ability to manage inventory and ensure timely product availability.

Technology and Digital Systems (ERP, CRM)

American Woodmark's commitment to technology is evident in its strategic investments in systems like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM). These digital infrastructures are foundational for streamlining operations, from manufacturing floor to customer interaction.

These advanced systems are crucial for managing the complexities of a large-scale manufacturing business. They enable better inventory control, production scheduling, and supply chain visibility, directly impacting efficiency and cost management. For instance, in 2024, companies across the manufacturing sector saw significant improvements in order fulfillment times and inventory accuracy by implementing robust ERP solutions.

Furthermore, CRM systems are indispensable for enhancing sales management and fostering stronger customer relationships. This includes tracking leads, managing customer interactions, and providing personalized service, which is vital for retaining business in a competitive market. By 2024, businesses leveraging CRM reported an average increase in customer retention rates of up to 20%.

- ERP systems optimize production planning, inventory management, and financial reporting.

- CRM systems enhance sales pipeline management, customer service, and marketing efforts.

- Investments in these digital tools directly contribute to operational efficiency and improved customer engagement.

- Data from 2024 indicates a strong correlation between technology adoption and improved profitability in the building products industry.

American Woodmark's key resources include its 16 manufacturing facilities as of 2023, advanced machinery, a portfolio of strong brands like Timberlake and Shenandoah Cabinetry, and a dedicated workforce of over 8,600 employees. These tangible and intangible assets, along with an experienced management team, form the backbone of their production and market presence.

The company's technological infrastructure, featuring ERP and CRM systems, is critical for operational efficiency and customer engagement. In 2024, the manufacturing sector saw significant gains in order fulfillment and inventory accuracy through robust ERP implementation, while CRM adoption led to up to a 20% increase in customer retention by the same year.

| Key Resource | Description | 2023/2024 Data Point |

| Manufacturing Facilities | Strategically located production sites | 16 facilities |

| Technology Systems | ERP and CRM for operational efficiency | Industry saw improved fulfillment times (ERP) and retention (CRM) in 2024 |

| Brand Portfolio | Intellectual property targeting diverse markets | Includes Timberlake, Shenandoah Cabinetry, Waypoint Living Spaces® |

| Workforce | Skilled labor and experienced management | Over 8,600 employees |

Value Propositions

American Woodmark offers a broad selection of kitchen, bath, and home organization products, encompassing both ready-to-ship and customizable cabinetry options. This extensive variety ensures they can meet diverse consumer preferences in terms of design, materials, finishes, and budget.

For instance, in fiscal year 2023, American Woodmark reported net sales of $2.2 billion, reflecting the significant market demand for their wide array of product offerings. This breadth allows them to serve a broad spectrum of customers, from those seeking quick, budget-friendly solutions to those desiring more tailored, high-end designs.

American Woodmark’s commitment to quality and craftsmanship is a cornerstone of its value proposition. They meticulously select high-quality materials and employ robust construction techniques, ensuring their cabinetry is not only aesthetically pleasing but also built to last. This dedication to durability and fine workmanship has cultivated a strong reputation, making their products a preferred choice for both homeowners and industry professionals seeking reliable and well-made cabinetry solutions.

American Woodmark effectively reaches both the remodeling and new home construction sectors, demonstrating a dual-pronged market strategy. This allows them to capture demand from homeowners looking to upgrade existing spaces as well as those building new residences.

Their distribution network is equally broad, encompassing major home centers, independent dealers, and direct relationships with builders. This multi-channel approach ensures product availability and caters to the distinct purchasing habits and preferences of each segment. For instance, in 2023, the new residential construction market saw a significant uptick, with housing starts reaching over 1.4 million units, a key indicator of demand American Woodmark is positioned to meet.

Affordability and Value

American Woodmark focuses on delivering excellent value by offering well-crafted cabinetry at accessible price points. This strategy is evident in product lines like 1951 Foundations™ and 1951 Progressions™, which are designed to provide quality craftsmanship without a premium cost. This approach directly addresses a key customer need: achieving a desirable home aesthetic without breaking the bank.

The company's commitment to affordability ensures that a broader range of consumers can access stylish and durable kitchen and bath solutions. For instance, in fiscal year 2023, American Woodmark reported net sales of $2.2 billion, indicating significant market penetration achieved through its value-oriented offerings. This broad appeal underscores their success in balancing quality with cost-effectiveness.

- Value Pricing: Offering high-quality products at competitive prices.

- Product Lines: Featuring collections like 1951 Foundations™ and 1951 Progressions™ that emphasize craftsmanship and affordability.

- Customer Appeal: Attracting budget-conscious consumers seeking both quality and style.

- Market Reach: Achieving substantial sales, like $2.2 billion in FY2023, through accessible product offerings.

Reliable Supply Chain and Service

American Woodmark's strategically positioned manufacturing and distribution centers create a short supply chain, ensuring dependable product delivery to their customers. This logistical advantage is a key reason why partners and clients trust their service.

The company's commitment to service excellence and efficient logistics translates into tangible benefits for their business partners. For example, in fiscal year 2023, American Woodmark reported net sales of $2.3 billion, reflecting the scale of their operations and the demand for their reliable supply chain.

- Proximity to Customers: Manufacturing facilities are located to minimize transit times.

- Efficient Distribution Network: A robust system ensures timely order fulfillment.

- Service Reliability: Consistent delivery performance builds partner trust.

- Operational Scale: Over $2.3 billion in net sales in FY2023 underscores their capacity.

American Woodmark provides a wide selection of cabinetry, from ready-to-ship options to fully customizable designs, catering to diverse tastes and budgets. Their commitment to quality is reflected in the use of superior materials and robust construction, ensuring lasting appeal and durability. This focus on both variety and craftsmanship makes them a preferred choice for homeowners and professionals alike.

| Value Proposition Aspect | Description | Supporting Data/Example |

|---|---|---|

| Product Breadth and Customization | Offers extensive ready-to-ship and customizable kitchen, bath, and home organization cabinetry. | Met diverse consumer preferences with a wide array of designs, materials, and finishes. |

| Quality and Durability | Emphasizes high-quality materials and construction for long-lasting, aesthetically pleasing products. | Cultivated a strong reputation for reliability and fine workmanship. |

| Value for Money | Delivers well-crafted cabinetry at accessible price points, balancing quality with cost-effectiveness. | Product lines like 1951 Foundations™ and 1951 Progressions™ appeal to budget-conscious consumers. |

| Market Reach and Accessibility | Serves both remodeling and new home construction sectors through a broad distribution network. | Net sales of $2.2 billion in fiscal year 2023 highlight significant market penetration. |

Customer Relationships

American Woodmark's success is deeply intertwined with its long-standing relationships with major retailers, particularly home improvement giants like Home Depot and Lowe's. These aren't fleeting connections; the company boasts an average relationship of over two decades with its top ten retail partners.

These strategic partnerships are the bedrock of American Woodmark's distribution network, ensuring their cabinetry and related products reach a vast customer base. For instance, in fiscal year 2023, sales to these key accounts represented a significant portion of their overall revenue, underscoring the vital role these relationships play in market penetration and sales volume.

American Woodmark prioritizes building strong relationships with its builder partners by offering dedicated support. This commitment is evident in their strategically located service centers, designed to be close to major metropolitan areas, ensuring efficient assistance for new construction projects.

This proximity allows for direct engagement, fostering robust and collaborative relationships within the crucial builder channel. In 2024, American Woodmark continued to invest in this network, recognizing that exceptional service is a cornerstone of their business model, driving repeat business and loyalty.

American Woodmark actively cultivates strong relationships with its independent dealers and distributors, recognizing them as crucial partners in reaching the market. This commitment translates into providing them with dedicated resources and tailored brand offerings, such as the distinct 1951 Cabinetry™ line, designed to enhance their sales capabilities and customer satisfaction.

Customer Satisfaction and Digital Engagement

American Woodmark is dedicated to surpassing customer expectations by delivering superior quality products and outstanding service. This commitment is evident in their consistently high customer satisfaction ratings, with recent data from 2024 indicating strong performance in this area.

The company actively invests in digital tools and online resources to enhance the overall customer journey. These digital initiatives are designed to streamline interactions and provide customers with greater convenience and access to information.

- High Customer Satisfaction: American Woodmark achieved a notable customer satisfaction rating in 2024, underscoring their focus on product quality and service excellence.

- Digital Investment: Significant investments have been made in digital platforms and online resources to improve customer engagement and support.

- Enhanced Experience: These digital advancements aim to provide a more seamless and satisfying experience for all customers interacting with the brand.

Integrity and Trust-Building

Integrity is a foundational element for American Woodmark, underpinning all interactions. This means operating with complete transparency, honesty, and unwavering ethical standards in every business transaction. This dedication is crucial for fostering deep trust with all stakeholders, especially customers, and significantly bolsters the company's overall reputation.

This commitment to integrity translates into tangible benefits, as evidenced by customer loyalty and positive market perception. For instance, in fiscal year 2024, American Woodmark continued to emphasize these values in its customer service initiatives, aiming to solidify its standing as a dependable partner in the home building and remodeling sectors.

- Transparency: Open communication regarding product availability, pricing, and manufacturing processes.

- Honesty: Accurate representation of product quality and performance.

- Ethical Conduct: Adherence to fair business practices and responsible sourcing.

- Trust Building: Cultivating long-term relationships through consistent reliability and accountability.

American Woodmark's customer relationships are built on long-term partnerships, with an average of over two decades with its top ten retail partners, ensuring broad market reach. Their commitment extends to builders through strategically located service centers, fostering collaboration and efficient support for new construction projects, a strategy reinforced by 2024 investments.

The company also strengthens ties with independent dealers by providing dedicated resources and tailored product lines, like 1951 Cabinetry™, to boost their sales. This focus on customer satisfaction, evidenced by strong 2024 ratings, is further enhanced by significant investments in digital tools for a smoother customer journey.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Focus |

|---|---|---|---|

| Major Retailers (e.g., Home Depot, Lowe's) | Long-term Partnership (avg. 20+ years) | Ensuring broad distribution and market penetration | Continued strategic alignment |

| Builder Partners | Collaborative Support | Proximity via service centers for efficient assistance | Network investment for enhanced service |

| Independent Dealers/Distributors | Resource Provision | Tailored brand offerings (e.g., 1951 Cabinetry™) | Empowering sales capabilities |

Channels

American Woodmark leverages major home centers like Home Depot and Lowe's as a critical sales channel, primarily for its stock cabinetry catering to the repair and remodel market. This strategy ensures widespread consumer access and visibility.

In 2023, the home improvement retail sector, which includes these large home centers, experienced robust sales, with companies like Home Depot reporting net sales of approximately $152.7 billion. This underscores the significant volume and reach these channels provide for American Woodmark's products.

These partnerships are essential for American Woodmark's business model, allowing them to tap into a vast customer base actively seeking renovation and repair solutions, thereby driving substantial product distribution.

American Woodmark's direct-to-builder channel is a cornerstone of its business, particularly within the dynamic new home construction sector. This strategic approach allows them to cultivate strong relationships with a significant number of top U.S. homebuilders, ensuring a consistent demand for their cabinetry and other wood products.

In 2024, the single-family housing market has shown resilience, and American Woodmark's direct sales to builders in these robust markets are a key driver of their revenue. This channel is not just about sales; it's about integrating their offerings early in the construction process, often leading to larger order volumes and more predictable revenue streams.

American Woodmark leverages a robust network of independent dealers and regional distributors to get its products to market. This strategy allows for broad reach across diverse geographic areas.

This channel is crucial for brands like Waypoint Living Spaces®, which cater to a wide range of customer needs. The recently introduced 1951 Cabinetry™ also relies heavily on these established relationships for distribution.

In 2024, American Woodmark continued to focus on strengthening these partnerships, recognizing their vital role in sales volume and market penetration. These independent channels are key to accessing both professional builders and individual homeowners.

Online Capabilities and Digital Properties

American Woodmark is enhancing its online capabilities and digital properties to complement its primarily physical sales channels. This strategic move is designed to attract more customers and improve conversion rates by making their digital presence more engaging and informative.

The company is focusing on content improvements across its websites and digital platforms. For instance, in fiscal year 2024, American Woodmark continued to invest in its digital infrastructure and marketing efforts to bolster its online sales pipeline.

- Digital Investment: Continued investment in online capabilities and content improvements across digital properties.

- Objective: Drive traffic and conversion through an enhanced digital presence.

- Fiscal Year 2024 Focus: Strengthening digital infrastructure and marketing for online sales.

Company Service and Distribution Centers

American Woodmark leverages a multi-faceted distribution network to ensure efficient product delivery. This includes dedicated, stand-alone distribution centers and facilities integrated within their manufacturing plants. They also utilize third-party logistics providers to reach all customer segments effectively.

In 2024, the company's strategic use of these varied distribution points is crucial for managing inventory and meeting demand across its diverse customer base, which includes homebuilders, remodelers, and dealers. This approach aims to minimize lead times and optimize shipping costs.

- Distribution Network: Own stand-alone centers, manufacturing facility centers, and third-party locations.

- Objective: Maximize efficiency in product distribution to all customer segments.

- Customer Reach: Serves homebuilders, remodelers, and dealers.

- 2024 Focus: Optimizing inventory management and reducing lead times.

American Woodmark utilizes a diverse channel strategy, including major home centers, direct sales to builders, independent dealers, and an expanding digital presence. These channels collectively ensure broad market access, from DIY consumers to large-scale construction projects.

The company's engagement with home centers like Home Depot and Lowe's is vital, tapping into the significant consumer traffic in the repair and remodel market. In 2023, Home Depot's net sales reached approximately $152.7 billion, highlighting the immense sales potential within these retail partnerships.

Direct sales to homebuilders form another crucial pillar, especially in the robust new home construction sector. In 2024, the single-family housing market's resilience means these direct relationships provide consistent demand and larger order volumes for American Woodmark.

Furthermore, a network of independent dealers and distributors extends American Woodmark's reach geographically, serving a wide array of customers including professional builders and individual homeowners. The company's ongoing focus in 2024 has been on strengthening these relationships to maximize sales and market penetration.

| Channel | Primary Market | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Home Centers (e.g., Home Depot) | Repair & Remodel | Widespread Consumer Access | Home Depot's $152.7B net sales in 2023 underscore channel strength. |

| Direct-to-Builder | New Home Construction | Predictable Demand, Larger Volumes | Resilient 2024 housing market supports this key revenue driver. |

| Independent Dealers/Distributors | Diverse Geographic Areas | Broad Market Penetration | Strengthening partnerships in 2024 for increased sales and reach. |

| Digital/Online | E-commerce & Brand Engagement | Enhanced Customer Interaction | Continued investment in 2024 to improve online sales pipeline. |

Customer Segments

Homeowners and professional remodelers are key customers for American Woodmark, particularly those involved in kitchen, bath, and home organization upgrades. These individuals typically purchase cabinetry and related products through large home improvement retailers, valuing a broad selection of styles, consistent quality, and competitive pricing to meet their renovation budgets.

New home builders, both single-family and multi-family, represent a cornerstone of American Woodmark's customer base. In 2024, this segment is crucial, demanding reliable and high-volume supply chains to meet the pace of construction projects. Builders rely on Woodmark for a broad range of cabinetry and millwork solutions, often needing customization and timely delivery to keep their developments on schedule and within budget.

Independent dealers and distributors are a key customer segment for American Woodmark, representing regional and local businesses that supply building materials. These entities cater to a diverse clientele, including small to mid-sized builders and contractors, as well as directly to homeowners. Their primary needs revolve around a flexible and comprehensive product offering that meets various project requirements, coupled with robust support from their manufacturing partners.

These independent channels are crucial for reaching fragmented markets. In 2024, the U.S. housing market saw continued demand for renovations and new construction, with the National Association of Home Builders reporting a Housing Market Index that, while fluctuating, generally indicated a positive outlook for single-family starts. This environment benefits independent dealers by driving consistent sales of cabinetry and other building components.

Designers and Architects

Designers and architects are key specifiers for American Woodmark, influencing cabinetry choices in residential projects. They seek extensive customization, superior craftsmanship, and a broad range of brands like Timberlake Cabinetry and Cabinets by Design to cater to diverse client preferences and project scopes. In 2024, the residential construction sector saw continued demand, with new housing starts projected to remain robust, creating significant opportunities for cabinetry suppliers who can meet the aesthetic and functional demands of these design professionals.

These professionals rely on American Woodmark for:

- Extensive Customization: Offering a wide array of door styles, finishes, and hardware to match unique design visions.

- Quality and Durability: Ensuring cabinetry meets high standards for longevity and aesthetic appeal in client homes.

- Brand Diversity: Providing multiple brands under the American Woodmark umbrella to serve different market segments and price points.

- Support and Resources: Access to design tools, samples, and responsive customer service to facilitate project specification.

Contractors and Remodeling Professionals

Contractors and remodeling professionals are a core customer segment for American Woodmark. These are the individuals and businesses that actually perform the kitchen and bath cabinet installations in homes. They typically source their materials through independent dealers or sometimes directly from the manufacturer itself. Their purchasing decisions are heavily influenced by factors like consistent product availability, the reliability of the products they receive, and how straightforward the installation process is. In 2024, the residential remodeling market continued to show resilience, with projects often focused on kitchen and bath upgrades, directly benefiting cabinet suppliers like American Woodmark.

These professionals rely on American Woodmark for cabinets that meet specific project timelines and quality expectations. Ease of installation is paramount to their efficiency and profitability. A study in late 2023 indicated that over 60% of contractors prioritize products that reduce labor time on-site. Therefore, features like pre-assembled components or clear installation guides are highly valued. American Woodmark's ability to deliver these attributes directly impacts their repeat business and reputation within the contractor community.

- Key Needs: Product availability, installation ease, reliability.

- Purchasing Channels: Independent dealers, direct from manufacturer.

- Market Influence: Residential remodeling market growth, focus on kitchen/bath upgrades.

- Value Proposition: Efficient installation, consistent quality for project success.

American Woodmark serves a diverse customer base, including homeowners undertaking renovations and new home builders. The company also partners with independent dealers, designers, architects, and contractors. In 2024, the U.S. housing market continued to see demand for both new construction and remodeling, with the National Association of Home Builders reporting a Housing Market Index that generally indicated a positive outlook for single-family starts.

New home builders are a critical segment, requiring high-volume supply chains and timely delivery to manage construction schedules. Designers and architects influence purchasing decisions by specifying cabinetry for residential projects, valuing extensive customization and quality craftsmanship. Contractors and remodelers prioritize product availability and ease of installation to ensure project efficiency and profitability, with a significant portion of contractors favoring products that reduce on-site labor time.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Homeowners & Remodelers | Variety, quality, pricing | Resilient remodeling market, focus on kitchen/bath upgrades |

| New Home Builders | Reliable supply, timely delivery | Robust single-family housing starts |

| Independent Dealers | Flexible product offering, support | Fragmented market reach |

| Designers & Architects | Customization, craftsmanship | Strong residential construction demand |

| Contractors & Remodelers | Availability, installation ease, reliability | Focus on labor-saving products |

Cost Structure

Raw material and component costs represent a substantial part of American Woodmark's expenses. This includes the purchase of lumber, engineered wood products, and various hardware like hinges and drawer slides, all essential for cabinet production.

In 2024, the company, like many in the building products sector, likely navigated volatile commodity prices. For instance, lumber prices, a key input, experienced significant swings throughout 2023 and into 2024, directly affecting manufacturing costs and, consequently, profitability if not managed effectively through pricing strategies or hedging.

American Woodmark's manufacturing and labor costs are significant, encompassing direct wages for factory workers, the expenses of running production facilities, and costs tied to the actual manufacturing processes. In 2023, the company reported Cost of Sales, which includes these manufacturing expenses, at $2.1 billion.

The company actively pursues operational efficiencies and invests in automation to streamline production and manage these costs effectively. For example, in their 2023 fiscal year, American Woodmark reported capital expenditures of $138.6 million, a portion of which was directed towards enhancing manufacturing capabilities and automation to improve cost structures.

Distribution and logistics costs are a significant component of American Woodmark's operations, encompassing the expenses tied to moving finished cabinetry from their manufacturing facilities to various distribution hubs and ultimately to their end customers. This includes the cost of freight, warehousing, and the personnel required to manage these complex supply chains.

In 2024, companies in the building materials sector, similar to American Woodmark, often face rising transportation expenses due to fluctuating fuel prices and carrier availability. These logistics are crucial for ensuring timely delivery to a broad network of dealers and builders, directly impacting customer satisfaction and operational efficiency.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for American Woodmark encompass a broad range of operational costs. These include significant investments in sales and marketing to drive brand awareness and product adoption, as well as the essential administrative functions that keep the business running smoothly. Corporate overhead, covering executive management and support services, also falls under this category.

Furthermore, American Woodmark is actively investing in its future through digital transformation. This involves substantial outlays for implementing and maintaining enterprise resource planning (ERP) and customer relationship management (CRM) systems. These technologies are crucial for streamlining operations, enhancing customer engagement, and improving overall efficiency.

- Sales and Marketing: Costs associated with advertising, promotions, and sales force compensation.

- General and Administrative: Expenses related to accounting, legal, human resources, and executive management.

- Digital Transformation: Investments in ERP, CRM, and other technology infrastructure.

- Corporate Overhead: Costs for central functions supporting the entire organization.

Capital Expenditures and Investments

American Woodmark's capital expenditures are significant, reflecting a commitment to expanding its manufacturing footprint and enhancing operational capabilities. In fiscal year 2023, the company reported capital expenditures of $119.6 million, a notable increase from $74.7 million in fiscal year 2022, demonstrating a ramp-up in strategic investments.

These investments are primarily directed towards building new facilities, expanding existing ones, and crucially, upgrading technology and automation. For instance, the company has been investing in advanced manufacturing equipment to boost production efficiency and product quality.

- Capital Expenditures: $119.6 million in FY2023, up from $74.7 million in FY2022.

- Focus Areas: New manufacturing plants, existing plant expansions, and technology/automation upgrades.

- Strategic Goal: To support long-term growth and improve operational efficiency through modern infrastructure.

American Woodmark's cost structure is heavily influenced by its raw materials, primarily lumber and engineered wood products, alongside hardware components. The company also incurs substantial manufacturing and labor costs, encompassing factory wages and operational expenses for its production facilities. Distribution and logistics are significant, covering freight, warehousing, and supply chain management to reach its customer base.

Selling, General, and Administrative (SG&A) expenses include marketing, sales force, and corporate overhead, with notable investments in digital transformation initiatives like ERP and CRM systems. Capital expenditures, such as the $119.6 million in FY2023, are dedicated to expanding manufacturing capacity and enhancing automation, reflecting a strategic focus on efficiency and growth.

| Cost Category | Description | FY2023 Data/Context |

|---|---|---|

| Raw Materials & Components | Lumber, engineered wood, hardware | Volatile commodity prices impacting input costs. |

| Manufacturing & Labor | Factory wages, facility operations | Cost of Sales was $2.1 billion in FY2023. |

| Distribution & Logistics | Freight, warehousing, supply chain | Rising transportation expenses in 2024 due to fuel and carrier availability. |

| SG&A | Sales, marketing, admin, digital transformation | Investments in ERP/CRM systems for efficiency. |

| Capital Expenditures | Facility expansion, automation upgrades | $119.6 million in FY2023, up from $74.7 million in FY2022. |

Revenue Streams

The core revenue for American Woodmark comes from selling kitchen cabinets. This is a significant part of their business, serving both builders putting up new homes and homeowners looking to renovate. They offer a broad selection of cabinet styles and price ranges to meet diverse customer needs.

In fiscal year 2023, American Woodmark reported net sales of $2.3 billion, with cabinetry sales forming the bulk of this figure. The company's focus on both the new home construction market and the remodeling sector provides a stable, albeit cyclical, revenue base.

Revenue is also generated from the sale of bath cabinetry and vanities, catering to similar market segments as kitchen cabinets. These products are frequently integral to broader home renovation projects or new construction builds, reflecting a consistent demand in the residential market.

American Woodmark's revenue isn't limited to just kitchens and bathrooms. They also bring in income by selling cabinetry for other home spaces, like custom office setups and smart home organization systems. This diversification broadens their market appeal.

Stock and Semi-Custom Cabinetry Sales

American Woodmark generates revenue primarily through the sale of stock and semi-custom cabinetry. This dual approach allows them to cater to a broad customer base, from those seeking readily available, budget-friendly options to individuals desiring more personalized solutions. The stock cabinetry offers pre-designed, ready-to-assemble units, while semi-custom options provide a greater degree of modification, impacting both price and delivery time.

For the fiscal year ending April 28, 2024, American Woodmark reported net sales of $2.2 billion. This figure reflects the combined sales from their diverse product lines, including both stock and semi-custom offerings. The company's ability to serve different market segments through these product tiers is a key driver of its consistent revenue generation.

- Stock Cabinetry: Offers standardized designs for quicker production and lower price points.

- Semi-Custom Cabinetry: Provides options for personalization, such as different door styles, finishes, and dimensions, commanding higher prices.

- Market Reach: Appeals to a wide range of consumers, from DIY enthusiasts to those working with contractors and designers.

- Sales Performance: The company's net sales of $2.2 billion in FY2024 underscore the significant demand for its cabinetry solutions.

Sales through Home Centers, Builders, and Independent Channels

American Woodmark generates revenue by selling its cabinetry and other wood products through several key distribution channels. A substantial portion of its sales comes from partnerships with major home improvement retailers, often referred to as home centers. These relationships allow for broad market reach and consistent order volumes.

The company also engages in direct sales to builders and contractors. This channel is crucial for large-scale projects and custom home developments, providing a steady stream of business and allowing for tailored product offerings. In fiscal year 2024, American Woodmark reported that its dealer and builder channel represented a significant portion of its net sales.

Furthermore, American Woodmark utilizes independent dealers and distributors to reach a wider customer base, including smaller builders and remodelers. These independent channels often provide specialized service and cater to specific regional markets. The company’s diversified approach across these channels helps mitigate risks and capture opportunities in various segments of the housing and remodeling market.

- Home Centers: Direct sales to large home improvement retailers.

- Builders: Direct sales to residential and commercial construction companies.

- Independent Channels: Sales through a network of independent dealers and distributors.

American Woodmark's revenue streams are primarily built around the sale of kitchen and bath cabinetry, serving both the new home construction and remodeling markets. They offer a mix of stock and semi-custom options to appeal to a broad customer base, from budget-conscious buyers to those seeking more personalized solutions.

In fiscal year 2024, the company reported net sales of $2.2 billion, with cabinetry sales forming the core of this revenue. This figure highlights the consistent demand for their products across various residential segments.

Additional revenue is generated from cabinetry for other home areas, such as offices and storage solutions, further diversifying their product offerings and market reach.

| Revenue Source | Description | FY2024 Net Sales Contribution (Approximate) |

| Kitchen Cabinetry | Core product line for new builds and renovations. | Significant majority of total sales |

| Bath Cabinetry & Vanities | Products for bathrooms in new construction and remodels. | Substantial portion of total sales |

| Other Cabinetry | Solutions for offices, storage, and other home spaces. | Smaller, but growing, segment |

Business Model Canvas Data Sources

The American Woodmark Business Model Canvas is informed by a blend of internal financial reports, market research on consumer preferences in home renovation, and competitive analysis of cabinetry manufacturers. This comprehensive data ensures each component of the canvas accurately reflects the company's operational realities and market position.