American Woodmark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Woodmark Bundle

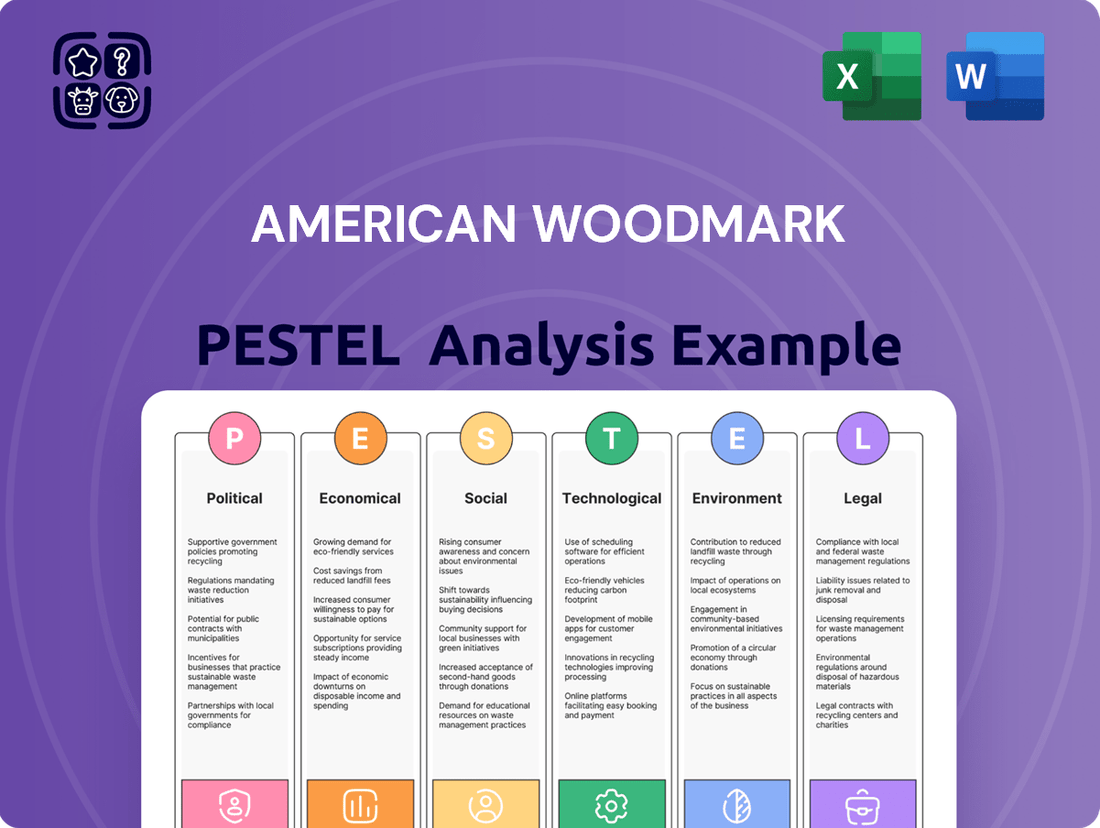

Navigate the complex external forces shaping American Woodmark's future with our comprehensive PESTEL analysis. Understand how political shifts, economic fluctuations, and technological advancements create both opportunities and challenges for the company. Gain a critical edge in your strategic planning by downloading the full analysis now, packed with actionable insights.

Political factors

American Woodmark faces potential political headwinds from renewed or increased tariffs on imported wood products, especially from Canada and China. While the industry has seen some stability, a return of a 25% tariff on Canadian lumber, for instance, could hurt competitiveness and increase costs for U.S. buyers.

Further complicating matters, the potential for new tariffs stemming from initiatives like Executive Order 14223, which aimed to expand American timber production and investigate foreign sources, could disrupt raw material costs and supply chains. For example, in 2018, the U.S. imposed a 20% tariff on Canadian softwood lumber, a move that significantly impacted pricing and availability.

Government policies significantly shape the construction and housing landscape, directly impacting demand for American Woodmark's products. For instance, while single-family housing starts are projected for modest growth in 2025, the broader residential construction sector and consumer confidence remain sensitive to potential policy shifts following the US elections.

Changes in building codes, permitting efficiency, or the introduction of incentives for new home construction and renovations can create either favorable market conditions or present operational challenges for American Woodmark. These regulatory environments are crucial considerations for strategic planning and market positioning.

Changes in labor laws, such as federal and state minimum wage hikes or evolving overtime rules, directly influence American Woodmark's operational expenses and how they manage their workforce. For instance, if the federal minimum wage were to increase to $15 per hour, it would significantly impact the company's labor costs, especially for entry-level positions.

New Occupational Safety and Health Administration (OSHA) regulations, like those effective January 2025 mandating better-fitting personal protective equipment (PPE) and expanded hazard communication, require American Woodmark to invest in compliance. This could mean increased spending on safety training and updated equipment to meet these enhanced standards, potentially adding to their cost of doing business.

Environmental Protection Agency (EPA) Regulations

The Environmental Protection Agency's (EPA) formaldehyde emission standards significantly impact American Woodmark. Specifically, regulations effective March 22, 2024, require producers of laminated composite wood products to meet stringent emission limits or use no-added formaldehyde (NAF) or phenolic (PF) resins. Compliance necessitates rigorous testing and certification, a crucial legal consideration for market access and avoiding penalties.

American Woodmark must navigate these evolving EPA regulations, which demand continuous monitoring and adaptation. Failure to comply with formaldehyde emission standards could lead to fines and restrict the company's ability to sell its products in the United States. The company's strategic approach to NAF or PF resin utilization, or robust testing protocols for compliant products, will be key to managing these environmental legal factors.

- EPA Formaldehyde Emission Standards: Critical for composite wood products, impacting laminated products from March 22, 2024.

- Compliance Requirements: Mandates testing and certification for products not using NAF or PF resins.

- Market Access: Adherence is essential to avoid penalties and maintain sales channels.

- Regulatory Monitoring: Ongoing updates necessitate continuous vigilance and adaptation by American Woodmark.

Political Stability and Consumer Confidence

Erratic U.S. trade policies and geopolitical uncertainties can significantly temper both business and consumer confidence. This uncertainty directly impacts demand for home improvement and new construction products, which are key to American Woodmark's sales. For instance, the ongoing trade disputes and tariffs introduced in 2018-2019, while evolving, have created a backdrop of caution for many businesses and consumers.

A stable political environment is crucial for fostering consumer spending on large purchases, such as home renovations and new home constructions. This stability directly benefits companies like American Woodmark, as it encourages investment in housing. In 2024, consumer confidence surveys, such as the University of Michigan Consumer Sentiment Index, have shown fluctuations tied to political developments, highlighting this correlation.

Conversely, political instability can breed consumer uncertainty, leading to a slowdown in market activity. This can manifest as delayed home buying decisions or postponed renovation projects. The U.S. national debt, which continues to grow, also presents a long-term political and economic risk that could influence consumer behavior and investment in the housing sector.

Key considerations for American Woodmark include:

- Trade Policy Impact: Fluctuations in tariffs or trade agreements can affect the cost of imported materials and finished goods, influencing pricing and profitability.

- Consumer Confidence Trends: Monitoring consumer sentiment, often linked to political stability and economic outlook, is vital for forecasting demand. For example, a 1% rise in consumer confidence has historically correlated with a noticeable uptick in housing starts.

- Government Spending and Deficits: The trajectory of government deficit spending can influence interest rates and the overall economic climate, indirectly impacting the housing market and consumer purchasing power.

- Regulatory Environment: Changes in housing regulations, building codes, or environmental policies can affect construction costs and market accessibility.

Political factors significantly influence American Woodmark's operational costs and market access through trade policies and environmental regulations. For instance, the EPA's formaldehyde emission standards, effective March 2024, mandate strict compliance for composite wood products, impacting manufacturing processes and material choices.

Changes in U.S. trade policies, such as potential tariffs on imported wood products from Canada or China, could increase raw material costs and disrupt supply chains, as seen with past tariffs like the 20% on Canadian softwood lumber in 2018. Government spending and national debt levels also indirectly affect consumer confidence and interest rates, influencing the housing market, a key driver for American Woodmark's sales.

Furthermore, shifts in labor laws, like potential federal minimum wage increases to $15 per hour, directly impact the company's operational expenses. New OSHA regulations for 2025 also necessitate investments in compliance, affecting workforce management and safety protocols.

| Political Factor | Impact on American Woodmark | Relevant Data/Example |

|---|---|---|

| Trade Tariffs | Increased raw material costs, reduced competitiveness | Past 20% tariff on Canadian softwood lumber (2018) |

| Environmental Regulations | Manufacturing process changes, compliance costs | EPA formaldehyde emission standards (effective March 2024) |

| Labor Laws | Increased operational expenses | Potential federal minimum wage increase to $15/hour |

| Consumer Confidence | Demand for housing and renovation products | Fluctuations tied to political developments in 2024 |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing American Woodmark, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within the cabinet and home furnishings industry.

A clear, actionable summary of American Woodmark's PESTLE factors, enabling teams to proactively address external challenges and capitalize on opportunities.

Economic factors

The U.S. housing market's vitality, covering new builds and renovations, directly impacts American Woodmark. Despite a projected modest expansion for the kitchen and bath sector in 2025 following two years of decline, the broader housing market faces headwinds from persistently high mortgage rates and increasing home prices.

For instance, the average 30-year fixed mortgage rate hovered around 6.5% in early 2024, a significant increase from previous years, impacting affordability. This environment means remodeling spending on kitchen and bath products is anticipated to grow faster than new construction spending in 2025, potentially offering a stronger avenue for American Woodmark's repair and remodel business.

Higher-for-longer interest rates and elevated mortgage rates continue to discourage potential homebuyers, impacting homeownership affordability and renovation project financing. J.P. Morgan Research forecasts mortgage rates to only slightly decrease to 6.7% by the end of 2025, which will likely continue to suppress new home sales and influence homeowners' decisions on major remodeling.

These sustained higher borrowing costs directly affect consumer financing options for significant home improvement projects, such as kitchen and bath upgrades, potentially leading to delayed or scaled-back spending.

Consumer spending on home improvement, particularly for items like kitchen and bath cabinetry, is heavily influenced by how much discretionary income households have and their overall confidence in the economy. When people feel secure about their financial future, they are more likely to spend on larger purchases for their homes.

Looking ahead to 2025, economic forecasts point towards a potentially difficult and unpredictable environment for businesses. This uncertainty could make consumers hesitant to commit to major home renovation projects, which often involve significant upfront costs.

A key segment of consumers, often referred to as the 'missing middle' income group, relies on home equity to fund renovations. This demographic is especially sensitive to changes in interest rates; higher rates can make borrowing against home equity less attractive, thereby dampening spending on home improvements.

Raw Material Costs and Inflation

American Woodmark, like many manufacturers, continues to grapple with elevated raw material costs. Despite a general slowdown in inflation, the price of essential inputs such as lumber has remained stubbornly high, a trend expected to persist. For instance, lumber prices, which surged significantly post-pandemic, are projected to see further increases in 2025 due to anticipated demand growth.

These persistent cost pressures directly impact profitability. Without strategic price adjustments or significant operational efficiencies, these rising material expenses can compress American Woodmark's profit margins. This necessitates a careful balancing act between passing costs to consumers and maintaining competitive pricing.

- Lumber Price Volatility: Lumber prices saw a substantial increase following the pandemic, and while inflation has cooled, the cost of building materials remains elevated.

- Projected 2025 Demand: An anticipated rise in demand for lumber in 2025 is expected to further contribute to price increases, adding to manufacturers' input cost challenges.

- Margin Compression Risk: Higher raw material costs pose a direct threat to profit margins for companies like American Woodmark, requiring proactive management through pricing and efficiency measures.

Labor Market Dynamics and Wages

The manufacturing sector, including companies like American Woodmark, continues to grapple with labor market dynamics. While some indicators suggest a slight easing of labor market tightness in 2024, attracting and retaining skilled workers remains a significant hurdle, with close to 60% of manufacturers identifying it as a primary challenge.

This persistent difficulty in staffing directly impacts operational costs. The Employment Cost Index for total compensation in manufacturing has shown a consistent upward trend, reflecting increasing wage and benefit expenses for employers.

These rising labor costs can exert pressure on American Woodmark's manufacturing efficiency and overall operational expenditures, potentially affecting profit margins.

- Nearly 60% of manufacturers cite employee attraction and retention as a top challenge.

- The Employment Cost Index for total compensation in manufacturing continues to climb.

- Rising labor costs directly impact manufacturing efficiency and operational expenses.

The U.S. housing market's health significantly influences American Woodmark, with high mortgage rates and home prices impacting affordability and renovation decisions. While remodeling spending is expected to outpace new construction in 2025, persistent high borrowing costs continue to dampen consumer enthusiasm for large home improvement projects.

Elevated raw material costs, particularly for lumber, remain a challenge, with prices projected to increase in 2025 due to demand. This puts pressure on profit margins, requiring strategic pricing and efficiency improvements. Similarly, the manufacturing sector faces ongoing labor shortages, with nearly 60% of manufacturers citing attraction and retention as a key issue, leading to rising compensation costs.

Consumer confidence and discretionary income are crucial for American Woodmark's sales, especially for higher-ticket items like kitchen and bath cabinetry. Economic uncertainty in 2025 may lead consumers to postpone or scale back renovations, impacting demand for the company's products.

| Economic Factor | 2024/2025 Outlook | Impact on American Woodmark |

|---|---|---|

| Mortgage Rates | Expected to remain elevated, around 6.7% by end of 2025 (J.P. Morgan) | Reduces affordability for new homes and refinancing for renovations, potentially slowing new construction and remodeling demand. |

| Home Prices | Continuing to rise, impacting affordability | Further limits consumer purchasing power for homes and renovations. |

| Lumber Prices | Projected to increase in 2025 due to demand | Increases input costs, potentially compressing profit margins if not passed on to consumers. |

| Labor Market | Tightness persists, with ~60% of manufacturers citing attraction/retention as a challenge | Drives up labor costs (rising Employment Cost Index), impacting operational expenses and efficiency. |

Full Version Awaits

American Woodmark PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of American Woodmark delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into the strategic landscape for informed decision-making.

Sociological factors

Consumers are increasingly prioritizing sustainable and eco-friendly furniture options, a trend expected to continue its upward trajectory through 2025. This shift is driven by a growing awareness of environmental impact and a desire for healthier living spaces. For instance, a 2024 survey indicated that over 60% of US consumers consider sustainability a key factor when purchasing home furnishings.

This preference extends to materials and finishes, with consumers actively seeking out cabinetry made from reclaimed wood, bamboo, or lumber certified by the Forest Stewardship Council (FSC). Furthermore, low-VOC (volatile organic compound) finishes are becoming a standard expectation, reflecting a concern for indoor air quality. By 2025, the market share for furniture with verifiable eco-certifications is projected to grow by an additional 15% year-over-year.

American Woodmark has a clear opportunity to align with these evolving consumer values. Highlighting its commitment to responsible forestry practices, the use of recycled or rapidly renewable materials, and the adoption of low-VOC manufacturing processes can significantly enhance brand appeal and market position. Demonstrating transparency in its supply chain and manufacturing, backed by certifications, will resonate strongly with this environmentally conscious demographic.

Homeowners are actively seeking to transform their living areas, particularly kitchens and bathrooms, into highly personalized and efficient spaces. This means a growing appetite for features that offer both aesthetic customization and practical utility, such as pull-out drawers for better organization, clever vertical storage solutions, and discreet hidden compartments. The demand for multifunctional appliances, capable of performing several tasks, also reflects this desire for optimized home environments.

This shift directly impacts the cabinetry industry, with consumers looking for solutions that go beyond standard offerings. They want cabinetry that can be adapted to their specific needs, whether it's maximizing storage in a small apartment or creating a highly functional workspace within a larger kitchen. For instance, a 2024 survey indicated that over 60% of homeowners prioritize smart storage solutions when renovating their kitchens, highlighting the importance of these personalized features.

American Woodmark, with its broad range of brands and capacity for semi-custom cabinetry, is well-positioned to meet these evolving consumer preferences. The company's ability to provide tailored solutions, from specialized drawer inserts to integrated shelving systems, allows them to cater to the desire for both unique design and enhanced functionality in home spaces. This adaptability is crucial in a market where personalization is becoming a key differentiator.

The sustained adoption of remote and hybrid work arrangements has significantly amplified homeowners' desire to enhance their living spaces, particularly kitchens, which are now central hubs for both work and life. This increased utilization fuels a demand for remodels that prioritize functionality, comfort, and aesthetic appeal. For instance, a 2024 Houzz survey indicated that 61% of homeowners planning renovations in the next year are focusing on improving their kitchens, with a notable emphasis on creating more versatile and integrated spaces.

This evolving lifestyle necessitates kitchen and bath designs that are not only visually pleasing but also highly efficient and adaptable. Homeowners are seeking solutions that support multitasking, from virtual meetings to family meals, driving demand for features like built-in workstations, improved lighting, and multi-functional cabinetry. American Woodmark is well-positioned to capitalize on this trend, as consumers increasingly invest in their homes as primary environments, boosting sales for cabinetry and related home improvement products.

Aging Population and Multigenerational Living

The United States is experiencing a significant demographic shift with an aging population, which directly impacts housing and renovation trends. By 2030, all Baby Boomers will be 65 and older, representing over 20% of the total population. This demographic trend, coupled with a resurgence in multigenerational living arrangements, is creating a strong demand for kitchens and bathrooms that are both accessible and inclusive.

This demand translates into a need for design features that cater to varying mobility levels. Think wider doorways, lower countertops, and easy-to-reach storage solutions. Smart home technology, such as voice-activated faucets and lighting, is also becoming increasingly important for enhancing convenience and future-proofing these spaces. For instance, the smart home market is projected to reach $150 billion by 2025, highlighting consumer interest in integrated technology.

- Aging Population Growth: The percentage of Americans aged 65 and older is projected to reach 21.7% by 2030, up from 16.9% in 2020.

- Multigenerational Households: In 2022, nearly 20% of Americans lived in multigenerational households, a trend that has been growing since 2010.

- Demand for Accessibility Features: Surveys indicate a growing preference for homes with features that support aging in place, including accessible bathrooms and kitchens.

Aesthetic and Design Trends in Cabinetry

Beyond mere utility, the way cabinets look plays a huge role in what people buy. For 2025, we're seeing a shift towards bolder colors like deep navy, forest greens, and sophisticated matte blacks. There's also a strong comeback for natural materials and softer, earth-toned palettes. Mixing different cabinet finishes and using statement pieces are also gaining traction.

American Woodmark is well-positioned to capitalize on these shifts. Their wide range of brands means they can offer products that match these evolving consumer tastes. For instance, their brands might feature collections with rich, dark wood veneers or painted finishes in the trending bold hues, ensuring they stay relevant in a dynamic market.

- 2025 Color Trends: Deep navy, forest green, and matte black are projected to be top choices.

- Material Preferences: Natural materials and earth tones are experiencing a resurgence.

- Design Elements: Mix-and-match finishes and statement cabinets are increasingly popular.

- American Woodmark's Advantage: A diverse brand portfolio allows alignment with current aesthetic trends, supporting market relevance and sales.

Societal shifts toward sustainability and health consciousness are profoundly influencing consumer choices in home furnishings. By 2025, the demand for eco-friendly materials and low-VOC finishes in cabinetry is expected to surge, with a projected 15% year-over-year market share growth for certified products. This aligns with a broader consumer trend where over 60% of US buyers in 2024 considered sustainability a key purchasing factor.

Technological factors

American Woodmark is deeply invested in digital transformation, evidenced by its new customer relationship management (CRM) sales solution and ongoing enterprise resource planning (ERP) cloud implementation. This strategic shift is designed to unify the company's operations and drive significant efficiency improvements.

The company plans to roll out the next phase of its ERP implementation to its made-to-stock manufacturing facilities on the West Coast during fiscal year 2025. This expansion is a critical step in streamlining processes and enhancing data management across a broader segment of its operations.

These technological advancements are expected to yield substantial efficiency gains by integrating systems and improving how the company interacts with its customers, ultimately leading to more agile and responsive business practices.

American Woodmark is actively investing in automation across its manufacturing operations and new facilities. This strategic move aims to boost efficiency and achieve greater operational excellence. For instance, the company is expanding its Hamlet, North Carolina facility, and opening a new plant in Monterrey, Mexico, both designed to increase production capacity.

The integration of automation is expected to yield significant benefits, including lower production costs, improved product quality, and enhanced workplace safety. These advancements are crucial for American Woodmark to meet its long-term financial and operational targets, contributing to a more competitive market position.

Smart technology is increasingly influencing cabinetry design, with trends for 2025 including touch-to-open mechanisms, integrated lighting systems, and voice-activated storage solutions. These advancements aim to make kitchens more convenient and tailored to modern lifestyles, enhancing both functionality and energy efficiency. For instance, the smart home market, projected to reach $170 billion in 2024, signifies a strong consumer appetite for connected living solutions.

American Woodmark can capitalize on this by integrating these smart features into its product lines, directly addressing growing consumer demand for enhanced kitchen experiences. This integration offers a competitive edge, positioning the company to capture a larger share of a market where technological innovation is a key differentiator, especially as smart home adoption is expected to continue its upward trajectory through 2025.

Advanced Materials and Manufacturing Processes

The furniture sector is increasingly adopting innovations in material science and manufacturing. This includes research into sustainable alternatives like hemp fibers and mycelium-based composites, alongside smart materials that adapt to environmental changes.

The integration of 3D printing with these advanced materials holds significant potential for enhancing product customization and bolstering sustainability efforts. For American Woodmark, this could unlock novel avenues for product design and development, potentially leading to more efficient production cycles and unique offerings.

- Material Innovation: Exploration of eco-friendly materials like hemp-based fibers and mycelium composites is gaining traction.

- Smart Materials: Development of materials that can alter their properties based on external stimuli is an emerging trend.

- 3D Printing Integration: Combining 3D printing with advanced materials allows for greater product customization and reduced waste.

- Industry Adoption: The furniture manufacturing industry is actively exploring these technological advancements for competitive advantage.

E-commerce and Digital Sales Channels

While American Woodmark's core sales remain through traditional channels like home centers and independent dealers, the burgeoning e-commerce landscape for home furnishings presents a significant technological factor. The increasing consumer comfort with online purchasing for larger items, including cabinetry and home decor, necessitates a robust digital strategy. This trend is underscored by the growth in online retail sales, which are projected to continue their upward trajectory, impacting how consumers discover and acquire home improvement products.

Digital tools for design visualization, product configuration, and streamlined ordering are becoming crucial differentiators. Platforms that allow customers to virtually place cabinets in their homes or easily customize options enhance the buying experience and can drive sales across all of American Woodmark's distribution networks. For instance, the home furnishings e-commerce market in the U.S. saw substantial growth, with online sales accounting for a significant portion of the total market share, a trend expected to persist through 2025.

- Digital Sales Growth: E-commerce in home furnishings is a rapidly expanding sector, with projections indicating continued double-digit growth in the coming years.

- Customer Experience Enhancement: Advanced digital platforms can improve customer engagement, offering personalized design tools and virtual try-on features.

- Channel Integration: Optimizing digital capabilities supports and potentially expands reach for traditional sales channels by providing online resources and information.

- Market Reach Expansion: Investing in online sales channels and digital marketing can tap into new customer segments and geographical markets previously inaccessible.

American Woodmark's technological investments are focused on enhancing operational efficiency and customer engagement. The company is actively implementing new CRM and ERP cloud solutions, with the ERP rollout slated for West Coast manufacturing facilities in fiscal year 2025. Automation is also a key area of investment, with expansion projects in North Carolina and Mexico designed to boost production capacity and lower costs.

The company is also keeping pace with smart home trends, integrating features like touch-to-open mechanisms and voice-activated storage into cabinetry designs, tapping into a smart home market projected to reach $170 billion in 2024. Furthermore, American Woodmark is exploring material science innovations, including sustainable alternatives and smart materials, alongside 3D printing for enhanced customization and reduced waste.

The growing e-commerce landscape for home furnishings is another significant technological factor. American Woodmark is enhancing its digital strategy to meet increasing consumer comfort with online purchasing, investing in digital tools for design visualization and streamlined ordering to improve the customer experience and expand market reach.

Legal factors

The U.S. Environmental Protection Agency's (EPA) Formaldehyde Emission Standards for Composite Wood Products, under TSCA Title VI, set rigorous limits for formaldehyde emissions from products like particleboard and medium-density fiberboard. As of March 22, 2024, manufacturers of laminated products are now also classified as hardwood plywood producers and must adhere to these stringent testing and certification requirements.

American Woodmark must ensure that all its manufactured goods and any imported materials comply with these legal obligations. Failure to meet these TSCA Title VI standards could result in penalties and impact market access for their product lines.

The Occupational Safety and Health Administration (OSHA) is introducing significant updates to construction industry regulations, effective January 13, 2025. A key change requires employers to provide personal protective equipment (PPE) that properly fits all workers, addressing a long-standing issue in workplace safety. This mandate aims to improve the effectiveness of safety gear and reduce potential injuries.

Furthermore, OSHA is broadening its hazard communication standards, particularly concerning hazardous materials, and strengthening requirements for reporting workplace injuries and illnesses. For American Woodmark, a manufacturer, adherence to these evolving standards is paramount. This means implementing rigorous safety protocols, conducting frequent site inspections, ensuring the correct and well-fitting PPE is available, and maintaining meticulous records of all safety-related activities and incidents.

American Woodmark must comply with broad product safety and quality regulations for its kitchen, bath, and home organization items, beyond just environmental concerns. These rules ensure products are safe for consumers and perform as expected, crucial for maintaining trust and avoiding costly recalls.

For instance, in 2024, the Consumer Product Safety Commission (CPSC) continued its focus on lead content in furniture and cabinetry, a key area for Woodmark. Non-compliance can lead to significant fines, with penalties potentially reaching tens of thousands of dollars per violation.

Adherence to these standards is vital for brand reputation and mitigating liability risks. A strong safety record, supported by certifications and testing, directly impacts market acceptance and customer loyalty, especially as consumers become more discerning about product integrity.

Consumer Protection Laws

Consumer protection laws are a cornerstone for American Woodmark's operations, influencing everything from product warranties to how they market their cabinetry. These regulations ensure fair trade practices, which is crucial for maintaining trust across their diverse sales channels, including home centers, independent dealers, and direct-to-builder relationships. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive advertising and unfair business practices, with companies facing significant penalties for non-compliance. American Woodmark's commitment to adhering to these standards helps mitigate legal risks and fosters positive customer experiences.

Adherence to consumer protection statutes is not just about avoiding penalties; it's about building a sustainable business. Laws governing product labeling, for example, ensure that customers receive accurate information about materials and care, which is vital for a product like cabinetry where durability and aesthetics are key. In 2025, industry analysts anticipate increased scrutiny on supply chain transparency and product origin claims, further emphasizing the need for robust compliance. By proactively managing these legal factors, American Woodmark can strengthen its brand reputation and reduce the likelihood of costly consumer disputes.

Key areas of consumer protection relevant to American Woodmark include:

- Warranty Compliance: Ensuring all product warranties are clearly communicated and honored.

- Product Labeling Accuracy: Providing truthful and comprehensive information on product materials and specifications.

- Fair Advertising Practices: Avoiding misleading claims in marketing and sales materials.

- Data Privacy: Protecting customer information collected through sales and service interactions.

Trade Agreements and Import/Export Regulations

International trade agreements and import/export regulations significantly influence American Woodmark's operations. The United States-Mexico-Canada Agreement (USMCA) generally allows for tariff-free trade of compliant products between these North American countries, providing a stable sourcing channel. However, shifts in global trade policies, such as potential tariffs on wood products from countries like China, could impact the cost and availability of both raw materials and finished goods. For instance, in 2023, the U.S. continued to review trade relationships, with potential implications for supply chain costs.

American Woodmark's reliance on imported lumber and wood components makes it susceptible to changes in trade dynamics. For example, a 2024 report indicated that the value of imported wood furniture into the U.S. reached billions of dollars, highlighting the importance of favorable trade terms. Adapting to these evolving regulations is critical for maintaining competitive pricing and ensuring a consistent supply chain for their cabinetry and home building products.

- USMCA Benefits: Continued tariff-free access for compliant wood products from Canada and Mexico.

- Tariff Risks: Potential for new or reinstated tariffs on imported wood products, particularly from non-USMCA countries, impacting costs.

- Supply Chain Stability: The need for agility in sourcing and distribution to mitigate disruptions caused by trade policy changes.

- Market Impact: Fluctuations in import costs can directly affect the pricing and competitiveness of American Woodmark's product offerings.

American Woodmark navigates a complex legal landscape, particularly concerning environmental regulations like the EPA's Formaldehyde Emission Standards. As of March 2024, new classifications for laminated products mean increased compliance burdens. Furthermore, OSHA's updated construction safety rules, effective January 2025, mandate better-fitting Personal Protective Equipment (PPE) and enhanced hazard communication, directly impacting workplace safety protocols and record-keeping for the company.

Product safety and consumer protection laws are also paramount. The CPSC's ongoing focus on lead content in cabinetry, with potential fines in the tens of thousands of dollars per violation in 2024, underscores the need for meticulous adherence. Proactive compliance with warranty, labeling, advertising, and data privacy regulations, as emphasized by the FTC's stance on fair practices, is crucial for mitigating legal risks and fostering customer trust, especially with anticipated 2025 scrutiny on supply chain transparency.

International trade agreements, like the USMCA, offer tariff-free access for compliant products, supporting American Woodmark's sourcing. However, the company remains exposed to risks from potential tariffs on imported wood products, which could affect costs and availability. Given that the value of imported wood furniture into the U.S. was in the billions in 2024, maintaining supply chain stability through agile sourcing is vital for competitive pricing.

Environmental factors

The rising consumer preference for environmentally conscious products is pushing American Woodmark to emphasize sourcing wood from responsibly managed forests and incorporating recycled or renewable materials. For instance, the global sustainable furniture market is projected to reach $25.7 billion by 2027, growing at a CAGR of 7.1% from 2020, indicating a significant shift towards eco-friendly options.

Green certifications like the Forest Stewardship Council (FSC) are increasingly valued by customers, with studies showing that consumers are willing to pay a premium for certified sustainable products. American Woodmark's commitment to these certifications directly addresses this demand, enhancing brand reputation and market appeal.

By adopting and openly communicating its sustainable sourcing strategies, American Woodmark can effectively meet evolving consumer expectations and actively lower its environmental impact, a critical factor in today's market.

Minimizing waste is a major environmental push for American Woodmark heading into 2025. This involves refining production to cut down on excess materials and adopting circular design ideas. The aim is to make products that can be reused, repaired, or recycled when they're no longer needed.

By focusing on product longevity and reducing what goes to landfills, American Woodmark can improve its environmental footprint. For example, the company's commitment to sustainability could lead to innovations in material sourcing and end-of-life product management, aligning with growing consumer demand for eco-friendly options. In 2023, the building materials industry saw a significant increase in demand for sustainable products, with reports indicating a 15% year-over-year growth in consumer preference for recycled content.

Furniture manufacturers like American Woodmark face growing pressure to minimize their environmental impact, particularly concerning energy consumption and carbon emissions. Many brands are actively pursuing carbon neutrality, with significant investments in renewable energy for both manufacturing and logistics operations. This trend reflects a broader industry shift towards sustainability and meeting evolving consumer and regulatory expectations.

For American Woodmark, enhancing energy efficiency across its facilities and exploring on-site renewable energy generation are crucial strategies to align with net-zero objectives. Optimizing energy usage can lead to substantial cost savings while also demonstrating a commitment to environmental stewardship. For instance, by 2023, the U.S. manufacturing sector saw a 2.5% increase in energy efficiency compared to 2022 levels, indicating a growing focus on this area.

Management of Emissions and VOCs

American Woodmark must navigate stringent environmental regulations, particularly concerning formaldehyde emissions in composite wood products, as mandated by the EPA. For instance, the EPA's Formaldehyde Emission Standards for Composite Wood Products, implemented in 2018 and with ongoing compliance checks, sets strict limits that manufacturers like American Woodmark must meet. Failure to comply can result in significant penalties.

Beyond regulatory adherence, there's a growing market preference for products that enhance indoor air quality. This trend is driving the adoption of low-VOC finishes and water-based adhesives. For example, many industry reports from 2023 and early 2024 highlight a consumer willingness to pay a premium for "green" building materials, directly impacting purchasing decisions.

American Woodmark has an opportunity to gain a competitive edge by proactively embracing and marketing these healthier material choices. This includes:

- Formaldehyde Emission Compliance: Adhering to EPA TSCA Title VI standards for composite wood products.

- Low-VOC Product Development: Investing in and promoting cabinetry and wood products with reduced volatile organic compound emissions.

- Sustainable Adhesive Use: Transitioning to water-based or low-emission adhesive technologies in manufacturing processes.

Climate Change Impact and Resource Availability

Climate change presents significant long-term environmental risks for American Woodmark, potentially impacting timber availability and forest health. Extreme weather events, such as increased wildfire frequency or intensity, could disrupt supply chains and affect the quality and quantity of wood resources. For instance, the U.S. Forest Service reported in 2023 that wildfire seasons are becoming more severe, leading to increased timber loss in affected regions.

To navigate these challenges, American Woodmark can focus on strategic diversification of its timber sourcing. Investing in resilient supply chain infrastructure, including advanced logistics and warehousing, will be crucial to buffer against weather-related disruptions. Furthermore, actively promoting and investing in sustainable forestry practices, such as responsible harvesting and reforestation efforts, can ensure a consistent and reliable supply of essential raw materials for the company's operations.

- Timber Availability: Climate change can lead to reduced timber yields and quality due to drought, pests, and extreme weather.

- Forest Health: Increased frequency of wildfires and disease outbreaks negatively impacts forest ecosystems, a key resource for the industry.

- Supply Chain Disruptions: Extreme weather events can damage transportation networks, halting or delaying the delivery of raw materials.

- Mitigation Strategies: Diversifying sourcing, investing in resilient infrastructure, and promoting sustainable forestry are key to managing these risks.

Environmental factors are increasingly shaping consumer choices and regulatory landscapes for American Woodmark. The company is responding to a growing demand for sustainable products, with the global sustainable furniture market expected to reach $25.7 billion by 2027. This shift necessitates a focus on responsibly sourced timber and the use of recycled or renewable materials. Green certifications, such as Forest Stewardship Council (FSC), are becoming key differentiators, as consumers are willing to pay more for eco-friendly options.

Minimizing waste and enhancing energy efficiency are critical operational goals for American Woodmark. By adopting circular design principles and improving production processes, the company aims to reduce material waste and promote product longevity. Energy efficiency improvements are also a priority, with the U.S. manufacturing sector showing a 2.5% increase in energy efficiency in 2023. This focus on sustainability not only lowers environmental impact but also offers potential cost savings.

American Woodmark must also navigate strict environmental regulations, particularly concerning formaldehyde emissions in composite wood products, as mandated by the EPA. Beyond compliance, there's a market trend towards products that improve indoor air quality, driving the adoption of low-VOC finishes and water-based adhesives. Reports from 2023-2024 indicate consumers are willing to pay a premium for such healthier building materials.

Climate change poses long-term risks to timber availability and forest health, potentially disrupting supply chains. Severe weather events and increased wildfire frequency, as noted by the U.S. Forest Service in 2023, can impact wood resources. To mitigate these risks, American Woodmark is exploring diversified timber sourcing, resilient supply chain infrastructure, and promoting sustainable forestry practices.

| Environmental Factor | Impact on American Woodmark | Key Data/Trend (2023-2025) | Company Response/Strategy |

|---|---|---|---|

| Consumer Demand for Sustainability | Drives product development and sourcing strategies | Global sustainable furniture market projected to reach $25.7B by 2027 | Emphasis on responsibly sourced wood, recycled materials, green certifications (FSC) |

| Waste Reduction & Circularity | Operational efficiency and resource management | Focus on minimizing production waste and adopting circular design | Refining production, exploring reusable/repairable product designs |

| Energy Efficiency & Emissions | Operational costs and environmental footprint | U.S. manufacturing sector energy efficiency up 2.5% in 2023 | Enhancing facility energy efficiency, exploring renewable energy |

| Environmental Regulations (e.g., Formaldehyde) | Compliance costs and product design constraints | EPA TSCA Title VI standards for composite wood products | Adherence to emission standards, development of low-VOC products |

| Climate Change Impacts | Supply chain stability and resource availability | Increased wildfire frequency impacting timber yields (U.S. Forest Service 2023) | Diversifying timber sourcing, investing in resilient supply chains |

PESTLE Analysis Data Sources

Our American Woodmark PESTLE Analysis is built on a robust foundation of data from U.S. government agencies, leading economic research firms, and industry-specific market reports. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive view.