American Woodmark Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Woodmark Bundle

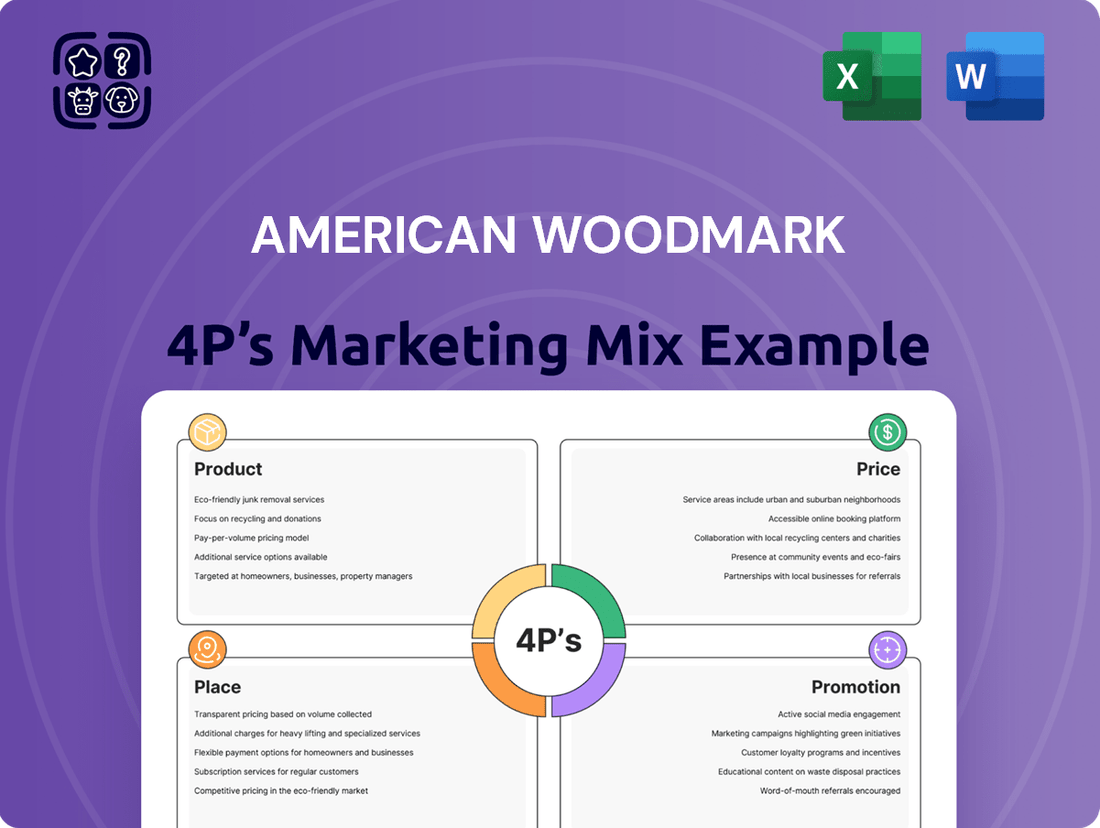

American Woodmark's marketing success is built on a carefully orchestrated blend of Product, Price, Place, and Promotion. Discover how their diverse product lines, strategic pricing, expansive distribution channels, and targeted promotions create a powerful market presence.

Go beyond this glimpse—get access to an in-depth, ready-made Marketing Mix Analysis covering American Woodmark's complete Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable insights and strategic direction.

Product

American Woodmark's diverse cabinetry portfolio is a cornerstone of its marketing strategy, encompassing a wide array of kitchen, bath, and home organization solutions. This breadth caters to a broad customer base, from those seeking budget-friendly stock options to individuals desiring more personalized semi-custom designs.

The company actively develops its product lines to align with current market trends and the dynamic demands of both the remodeling and new home construction sectors. For instance, in fiscal year 2023, American Woodmark reported net sales of $2.3 billion, reflecting strong demand for its varied cabinetry offerings.

American Woodmark strategically leverages a diverse portfolio of brands, including popular names like Timberlake, Shenandoah, and Waypoint, to capture a wide market share. This multi-brand approach allows them to cater to various consumer preferences, price sensitivities, and design aesthetics, ensuring broad appeal across different customer segments.

American Woodmark's product strategy heavily emphasizes the remodeling market. Their offerings are specifically developed to cater to homeowners undertaking renovation projects, ensuring they meet the unique demands of this segment.

The remodeling sector often requires products that offer specific aesthetic appeal, high quality, and customization to seamlessly blend with existing home styles. American Woodmark's cabinetry and related products are designed with these consumer-driven renovation needs in mind.

In 2023, the U.S. home improvement and repair market was valued at approximately $485 billion, with remodeling making up a significant portion. American Woodmark's focus on this robust market positions them to capitalize on ongoing consumer investment in their homes.

Serving New Home Construction

American Woodmark is a significant player in the new home construction sector, supplying cabinetry to residential builders. This segment demands reliable delivery, unwavering quality, and the capacity to scale production to meet project demands. Their offerings are specifically tailored to align with the rigorous specifications and demanding schedules of large-scale construction projects.

In 2023, the U.S. saw approximately 1.02 million housing starts, a figure expected to see modest growth in 2024 and 2025, indicating a robust market for new home construction suppliers. American Woodmark's ability to provide consistent, high-volume cabinetry solutions directly supports this demand.

- Market Reach: Serves national and regional builders with scalable cabinetry solutions.

- Product Focus: Offers cabinetry designed for efficiency and aesthetic appeal in new homes.

- Operational Strength: Emphasizes timely delivery and consistent quality crucial for builder timelines.

Quality and Design Innovation

American Woodmark consistently pushes the boundaries of product innovation, focusing on both cutting-edge design and superior quality in their cabinetry and home organization solutions. This dedication ensures their products are not just practical but also visually appealing and built to last, meeting the evolving tastes of consumers.

Their commitment to quality is evident in their manufacturing processes and material selection, aiming for durability and a premium feel. This focus on excellence helps American Woodmark stand out in a crowded marketplace, appealing to customers who value both style and longevity in their home furnishings.

For instance, in fiscal year 2023, American Woodmark reported net sales of $2.3 billion, a testament to the market's reception of their product strategy. The company actively invests in research and development to introduce new designs and features, such as enhanced storage solutions and modern finishes, reflecting their drive for continuous improvement.

- Design Innovation: Introduction of new door styles and finishes, catering to current interior design trends.

- Quality Assurance: Rigorous testing and use of high-grade materials for enhanced product durability.

- Feature Enhancement: Development of functional improvements like soft-close hinges and integrated lighting.

- Customer Focus: Aligning product development with consumer feedback and market demand for aesthetic appeal and utility.

American Woodmark's product strategy centers on a diverse and evolving cabinetry portfolio, catering to both the remodeling and new home construction markets. Their offerings include a wide range of styles, from stock to semi-custom, designed to meet varying consumer preferences and price points. The company's commitment to innovation is reflected in the continuous introduction of new designs, finishes, and functional enhancements, ensuring their products remain relevant and appealing. This focus on quality and design, backed by substantial net sales of $2.3 billion in fiscal year 2023, underscores their strong market position.

| Product Aspect | Description | Market Relevance | Fiscal Year 2023 Data |

|---|---|---|---|

| Portfolio Breadth | Extensive range of kitchen, bath, and home organization cabinetry. | Serves diverse customer needs from budget-conscious to custom-seeking. | Net sales of $2.3 billion. |

| Market Focus | Caters to remodeling and new home construction sectors. | Addresses demand for aesthetic appeal, quality, and scalability in both markets. | U.S. home improvement market valued at ~$485 billion. |

| Innovation & Quality | Emphasis on new designs, finishes, and durable materials. | Meets evolving consumer tastes and ensures product longevity. | Investment in R&D for enhanced features like soft-close hinges. |

What is included in the product

This analysis offers a comprehensive examination of American Woodmark's marketing strategies, delving into their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a detailed understanding of American Woodmark's market positioning, providing a solid foundation for competitive benchmarking and strategic planning.

Provides a clear, actionable framework to address customer pain points by optimizing product, price, place, and promotion strategies for American Woodmark.

Simplifies complex marketing decisions by offering a structured approach to identify and alleviate customer frustrations at each stage of the marketing mix.

Place

American Woodmark's distribution strategy heavily relies on major home centers, ensuring widespread accessibility for both DIY homeowners and professional contractors. This approach, often referred to as "Home Center Distribution," is key to their market penetration.

In 2023, American Woodmark reported that its cabinets were available in over 1,500 Home Depot and Lowe's locations across the United States, highlighting the significant reach of this channel. These partnerships are vital for providing convenient, on-demand cabinetry solutions to a broad customer base.

The company's success in this segment is directly tied to maintaining robust relationships with these national retailers. This ensures prime shelf space and continued product placement, crucial for driving sales volume and brand visibility in a competitive market.

American Woodmark utilizes an independent dealer network to connect with customers who value personalized sales and design assistance. This approach allows for tailored customer experiences, including in-depth design consultations and professional installation services.

This distribution channel is particularly effective for reaching consumers who prioritize a higher degree of customization and dedicated service for their cabinetry needs.

American Woodmark's direct-to-builder sales strategy is a cornerstone of its marketing mix, focusing on supplying large-scale home builders for new construction. This approach streamlines the supply chain, enabling efficient delivery of bulk orders and tailored product solutions to meet builder specifications. For example, in fiscal year 2023, American Woodmark reported that approximately 68% of its revenue was generated from sales to builders, highlighting the significance of these partnerships.

Optimized Supply Chain Logistics

American Woodmark's place strategy centers on optimizing its supply chain for maximum efficiency. This means carefully managing inventory levels and logistics to ensure their cabinetry and components are readily available across various distribution points, from big-box retailers to independent dealers.

Their approach involves strategic warehousing and robust transportation networks. This infrastructure is designed to facilitate timely deliveries, a critical factor for customer satisfaction and maintaining competitive lead times in the home building and remodeling sectors. For example, in fiscal year 2023, the company continued to invest in its distribution capabilities to enhance service levels.

Maximizing logistical efficiency directly impacts both customer satisfaction and cost management. By streamlining operations, American Woodmark aims to reduce transit times and associated expenses, ultimately benefiting their bottom line and their customers.

- Strategic Warehousing: Maintaining a network of distribution centers to ensure product availability closer to key markets.

- Transportation Optimization: Utilizing efficient freight management to control costs and ensure timely deliveries across diverse channels.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive carrying costs, a key focus in their 2024 planning.

- Distribution Channel Support: Providing reliable product flow to a wide range of customers, including large national retailers and smaller independent dealers.

Geographic Market Coverage

American Woodmark prioritizes extensive geographic market coverage to ensure its cabinetry and vanities are readily available where customers need them. This strategy involves a deliberate placement of distribution centers and sales representatives in areas with high activity in both home remodeling and new home construction. As of the first quarter of fiscal year 2025, the company reported serving customers across approximately 48 states in the U.S., demonstrating a robust national footprint.

This widespread presence is crucial for capturing a significant share of the market by offering convenience and accessibility to a broad customer base. By strategically targeting key metropolitan areas and emerging construction zones, American Woodmark aims to maximize sales opportunities and solidify its position as a leading provider in the industry. Their network is designed to efficiently reach builders, remodelers, and ultimately, homeowners.

- Extensive U.S. Presence: Operates in approximately 48 states as of Q1 FY2025.

- Strategic Distribution: Focuses on key remodeling and new construction hubs.

- Market Accessibility: Enhances customer convenience and drives sales growth.

- National Reach: Supports a broad customer base of builders and remodelers.

American Woodmark's place strategy is built on broad accessibility and efficient logistics. They leverage a multi-channel approach, reaching customers through major home centers, independent dealers, and direct sales to builders. This ensures their products are available where and how consumers prefer to shop for cabinetry and vanities.

By maintaining a strong presence in key geographic markets, particularly those with high construction and remodeling activity, American Woodmark effectively captures market share. Their network is designed to facilitate timely deliveries and support a diverse customer base, from large home builders to individual homeowners seeking personalized service.

The company's commitment to optimizing its supply chain, including strategic warehousing and transportation, is crucial for meeting demand and controlling costs. This operational efficiency underpins their ability to serve a wide array of customers across approximately 48 states as of Q1 FY2025.

| Distribution Channel | Key Characteristics | FY2023 Impact | Q1 FY2025 Reach |

|---|---|---|---|

| Major Home Centers | Widespread availability, DIY and contractor focus | Key for market penetration | 1,500+ Home Depot & Lowe's locations |

| Independent Dealers | Personalized service, customization focus | Tailored customer experiences | National network |

| Direct-to-Builder | Bulk orders, new construction focus | 68% of revenue | Serving large home builders |

Full Version Awaits

American Woodmark 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This detailed analysis of American Woodmark's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring transparency and confidence in your purchase.

Promotion

American Woodmark actively participates in key industry trade shows, such as the Kitchen & Bath Industry Show (KBIS), to display its newest cabinetry and surfacing innovations. These events are crucial for networking with builders, dealers, and designers, facilitating lead generation and direct product demonstrations. For instance, in 2023, KBIS saw over 600 exhibitors and attracted more than 100,000 attendees, highlighting the significant reach of such platforms.

American Woodmark leverages a robust digital marketing strategy to connect with consumers and professionals. Its corporate and brand-specific websites serve as digital showrooms, featuring extensive product galleries, inspirational design ideas, and compelling customer testimonials. This online engagement aims to capture interest and guide potential buyers toward their sales channels.

The company's social media presence is actively used to foster engagement, share visual content, and build brand loyalty. By showcasing the versatility and aesthetic appeal of their cabinetry, American Woodmark utilizes these platforms to reinforce their brand message and reach a broad audience. This digital outreach is essential for staying relevant in today's market.

In 2024, the home improvement sector continued to see significant online engagement, with digital channels playing a pivotal role in purchasing decisions. While specific 2024 digital marketing spend for American Woodmark isn't publicly detailed, industry trends show a consistent increase in digital advertising budgets for manufacturers seeking to enhance their online visibility and customer reach.

American Woodmark actively cultivates its sales channels through targeted Builder and Dealer Programs. These initiatives are designed to incentivize partners, offering benefits like co-marketing assistance and volume-based discounts to boost product adoption.

For instance, in fiscal year 2023, American Woodmark reported net sales of $2.3 billion, with a significant portion driven by these channel partnerships. The company's investment in these programs, including training and promotional support, directly translates into stronger indirect sales performance.

Public Relations and Industry Recognition

American Woodmark actively pursues public relations to cultivate a strong brand image and secure favorable media attention. This includes strategic announcements regarding new product introductions, such as their 2024 innovations in kitchen and bath cabinetry, and highlighting their commitment to sustainable manufacturing practices, a key differentiator in the current market.

Industry recognition serves as a powerful validation of American Woodmark's quality and market leadership. For instance, receiving accolades like the 2023 Manufacturer of the Year award from the Cabinet Makers Association significantly boosts consumer trust and reinforces their competitive standing. Such awards are often tied to operational excellence and product innovation.

These efforts contribute directly to enhanced brand credibility and market visibility. By consistently communicating their achievements and values, American Woodmark aims to build lasting relationships with customers, partners, and investors. This proactive approach to PR is crucial in a competitive landscape where trust and reputation are paramount.

- Brand Reputation: Public relations activities aim to build and maintain a positive brand image.

- Media Coverage: Announcements of new products and sustainability initiatives generate positive press.

- Industry Awards: Recognition from industry bodies validates product quality and market position.

- Credibility and Visibility: PR and awards enhance trust and make the brand more recognizable.

Targeted Advertising Campaigns

American Woodmark likely leverages targeted advertising campaigns to reach specific customer segments. These efforts probably span industry trade publications, digital advertising on home improvement sites, and possibly placements on television channels catering to homeowners. The goal is to build brand recognition and highlight key product attributes like durability and aesthetic appeal to both professional builders and end consumers.

In 2024, digital advertising spend in the home improvement sector saw significant growth, with many companies allocating substantial portions of their marketing budgets online. For instance, a significant portion of American Woodmark's advertising likely focuses on platforms where potential buyers research renovations and new home purchases. This strategic placement ensures their message reaches an engaged audience.

The messaging within these campaigns consistently emphasizes core product strengths. Key selling points often include:

- Superior Quality Materials: Highlighting the durability and longevity of their cabinetry and other wood products.

- Innovative Design: Showcasing modern and classic styles to suit diverse consumer tastes and project requirements.

- Functional Benefits: Detailing features that enhance usability and storage solutions within kitchens and bathrooms.

American Woodmark's promotional strategy encompasses participation in major industry events like KBIS, where they showcase new products and connect with trade professionals. Their digital marketing efforts include robust websites and active social media engagement to reach consumers and build brand loyalty. Targeted advertising campaigns, likely across digital and print media, highlight product quality, design, and functionality to both consumers and builders.

Public relations and industry awards bolster brand credibility. For example, receiving accolades such as the 2023 Manufacturer of the Year award validates their commitment to quality and innovation. These efforts collectively aim to enhance brand recognition and trust within the competitive home improvement market.

| Promotional Activity | Key Focus | Impact |

| Industry Trade Shows (e.g., KBIS) | New product displays, networking, lead generation | Direct engagement with builders, dealers, designers |

| Digital Marketing (Websites, Social Media) | Product galleries, design inspiration, customer engagement | Broad consumer reach, brand loyalty building |

| Targeted Advertising | Product quality, design, functional benefits | Brand recognition, reaching specific customer segments |

| Public Relations & Industry Awards | New product announcements, sustainability, quality validation | Enhanced brand credibility, market trust |

Price

American Woodmark utilizes a tiered pricing strategy, offering a spectrum of products to appeal to various customer needs and budgets. This approach ensures they can serve both value-seeking consumers and those desiring more premium cabinetry solutions.

This tiered structure directly supports their diverse brand portfolio, with brands like Timberlake and Dura Supreme positioned at different price points to capture distinct market segments. For instance, in 2024, the company reported net sales of $2.2 billion, reflecting the broad market reach enabled by their pricing flexibility.

American Woodmark's competitive market pricing strategy involves a keen eye on what rivals are charging and the broader economic climate. This ensures their cabinetry and related products stay appealing to consumers. For instance, in 2024, the housing market saw fluctuating demand, and American Woodmark had to adjust its pricing to remain competitive amidst rising lumber costs, which averaged around $400 per thousand board feet for certain species through much of the year, impacting overall production expenses.

The company actively tracks market demand and the cost of essential raw materials, like engineered wood and hardware, to inform its pricing decisions. Simultaneously, they closely analyze competitor pricing strategies to avoid being priced out of the market. This dynamic approach is crucial for maintaining market share in a sector where price sensitivity can be high.

Striking the right balance between offering competitive prices and ensuring healthy profitability is a continuous challenge. For 2025, projections indicate continued volatility in raw material costs, potentially requiring further pricing adjustments to maintain margins while still presenting value to customers in a market that is expected to see moderate growth in new home construction starts, estimated at around 1.5 million units.

American Woodmark likely employs value-based pricing for its semi-custom and premium cabinet lines. This strategy aligns with the elevated quality, intricate designs, and extensive customization choices offered, allowing the company to capture a higher price point based on the perceived value to the customer.

Consumers in this segment are typically willing to invest more for superior craftsmanship, enhanced durability, and sophisticated aesthetic appeal that complements their living spaces. This approach focuses on the enduring benefits and satisfaction derived from higher-end products.

For instance, in the fiscal year 2023, American Woodmark reported a net sales increase of 4.5% to $2.3 billion, with growth in their higher-margin product segments indicating successful premium positioning.

Discounts and Incentives for Channels

American Woodmark strategically deploys discounts, rebates, and attractive financing options to its diverse network of partners. These incentives are designed to motivate higher volume orders from home centers, independent dealers, and direct builders alike. For instance, in fiscal year 2024, the company reported a net sales increase of 3.3%, partly driven by efforts to strengthen channel relationships through such programs.

These financial enticements play a critical role in cultivating channel loyalty and accelerating sales. They provide a tangible benefit for partners who commit to larger purchase volumes, thereby ensuring a consistent flow of business for American Woodmark. This approach directly supports sales velocity and market penetration.

- Volume Discounts: Tiered pricing structures encourage partners to reach specific purchase thresholds for reduced unit costs.

- Rebate Programs: Performance-based rebates reward dealers and builders for achieving sales targets or promoting specific product lines.

- Financing Options: Flexible payment terms and financing solutions ease the purchasing burden for channel partners, facilitating larger commitments.

- Channel Partner Support: These incentives are fundamental to maintaining strong, mutually beneficial relationships within the distribution network.

Economic Condition Adjustments

American Woodmark's pricing is closely tied to the economic climate. When the housing market is strong and consumer spending is high, the company can maintain or even increase its prices. Conversely, during economic downturns, characterized by rising inflation and reduced purchasing power, American Woodmark might implement price adjustments or promotional offers to stimulate demand and protect its market share.

For instance, in 2023, the U.S. housing market experienced a slowdown due to higher mortgage rates, impacting demand for new homes and, consequently, cabinetry. This environment likely pressured American Woodmark to be more competitive with its pricing. Inflationary pressures throughout 2023 and into early 2024 also meant that the cost of raw materials like lumber and labor increased, forcing companies like American Woodmark to carefully balance price increases with maintaining sales volume.

- Housing Market Sensitivity: A downturn in housing starts, like the projected slight decrease in new single-family home completions for 2024 compared to 2023, directly influences demand for American Woodmark's products.

- Inflationary Impact: Rising costs for lumber, transportation, and labor, which were significant factors in 2023, necessitate careful price management to avoid alienating customers.

- Consumer Spending Power: Shifts in consumer confidence and disposable income, influenced by broader economic conditions, directly affect the willingness of homeowners to undertake renovation projects or purchase new cabinetry.

- Promotional Strategies: The company's ability to offer promotions or tiered pricing structures becomes crucial during periods of economic uncertainty to capture sales from price-sensitive buyers.

American Woodmark's pricing strategy is multifaceted, balancing competitive market positioning with value-based approaches for premium offerings. They adjust prices based on raw material costs, like lumber, which saw averages around $400 per thousand board feet in 2024, and competitor pricing to remain appealing in a dynamic housing market.

For 2025, projections suggest continued material cost volatility, necessitating price adjustments to maintain margins amid anticipated moderate growth in new home construction starts, estimated at 1.5 million units.

The company also employs discounts and financing options for channel partners, contributing to sales growth. For instance, fiscal year 2024 saw a 3.3% net sales increase, partly due to these partner incentives.

| Pricing Tactic | Rationale | Example/Context |

| Tiered Pricing | Appeals to diverse customer needs and budgets, supporting brand portfolio (e.g., Timberlake, Dura Supreme). | Net sales of $2.2 billion in 2024 reflect broad market reach. |

| Competitive Pricing | Keeps products appealing by monitoring rival pricing and economic conditions. | Adjustments made in 2024 due to rising lumber costs and fluctuating housing demand. |

| Value-Based Pricing | Captures higher price points for semi-custom/premium lines based on quality, design, and customization. | Fiscal year 2023 saw growth in higher-margin segments, indicating successful premium positioning. |

4P's Marketing Mix Analysis Data Sources

Our American Woodmark 4P's Marketing Mix Analysis is built upon a foundation of verified, up-to-date information. We meticulously review company financial disclosures, investor presentations, product catalogs, and official brand websites to capture their strategic actions across all four Ps.